Urban Farming Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Urban Farming Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

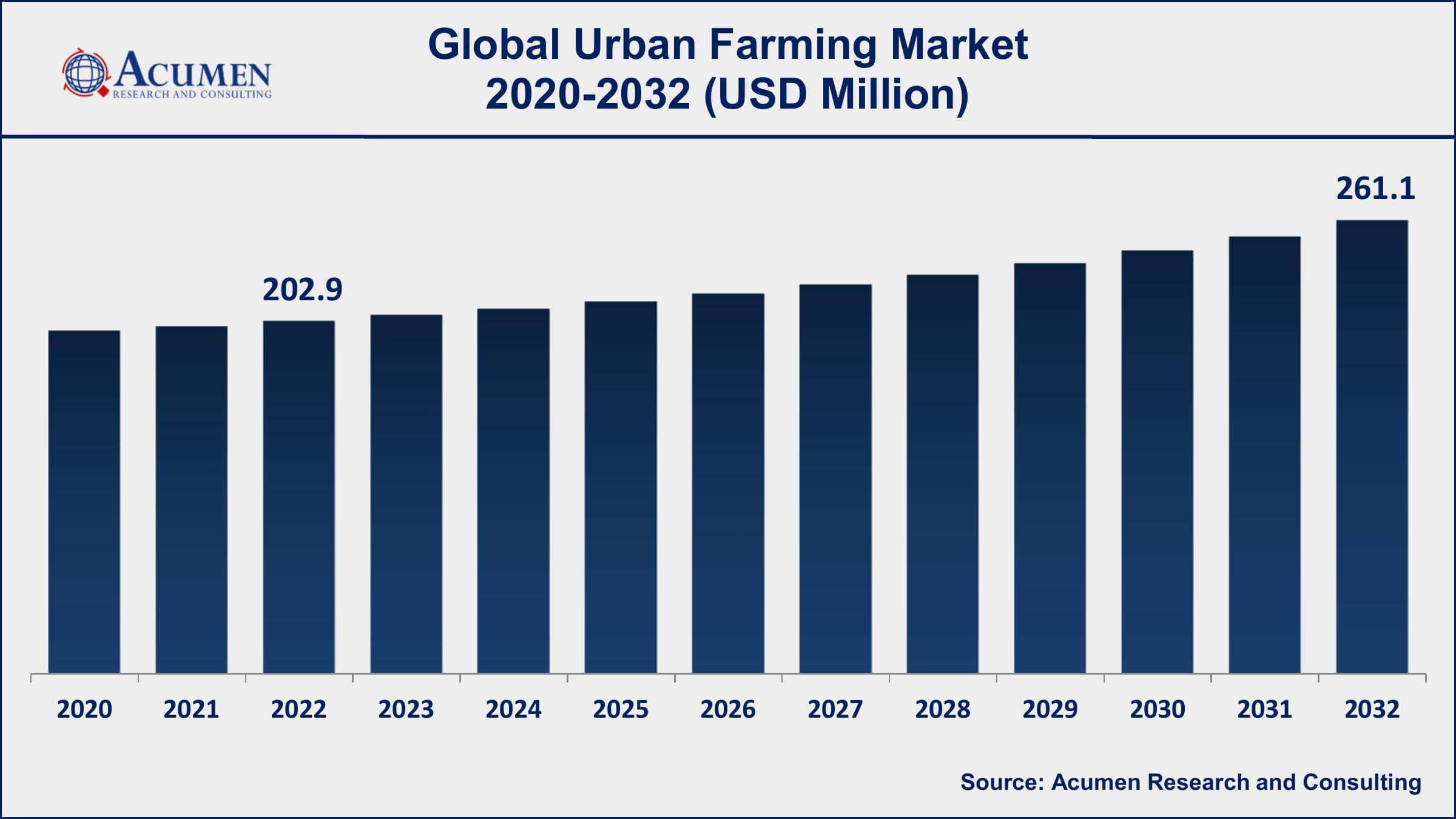

The Global Urban Farming Market Size accounted for USD 202.9 Million in 2022 and is projected to achieve a market size of USD 261.1 Million by 2032 growing at a CAGR of 2.7% from 2023 to 2032.

Urban Farming Market Highlights

- Global urban farming market revenue is expected to increase by USD 261.1 Million by 2032, with a 2.7% CAGR from 2023 to 2032

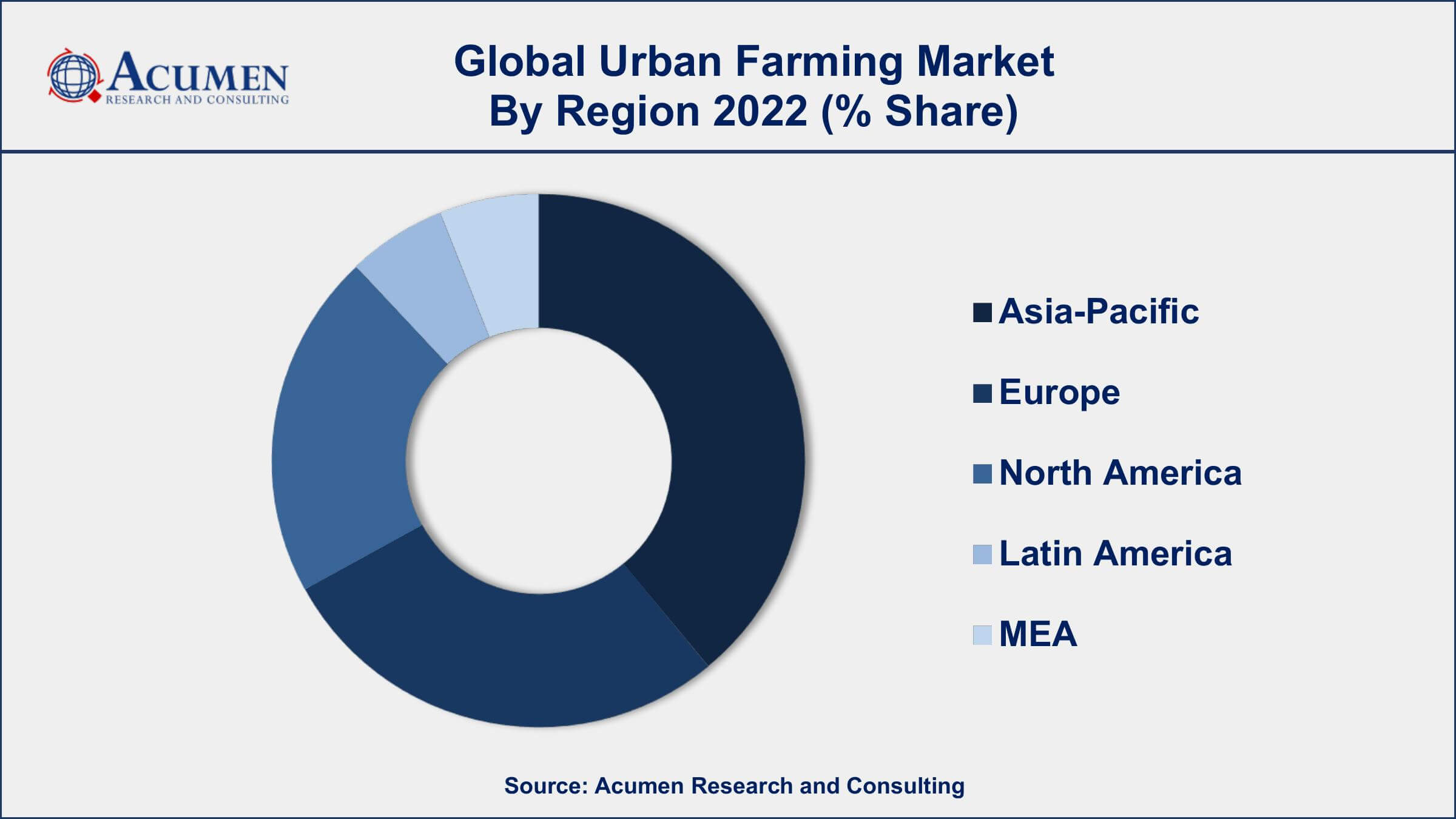

- Asia-Pacific region led with more than 42% of urban farming market share in 2022

- Europe region is expected to expand at the highest CAGR between 2023 and 2032

- By 2050, it is estimated that 68% of the global population will live in urban areas, emphasizing the need for urban agriculture

- Urban farming can provide up to 15% of the global food supply, contributing to food security

- Increasing demand for locally sourced, fresh, and nutritious produce, drives the urban farming market value

Urban farming refers to the practice of growing and cultivating food and other agricultural products within urban or suburban areas. It involves the utilization of limited space, such as rooftops, balconies, vacant lots, or vertical structures, to create productive green spaces for growing crops, raising animals, and even producing fish or honey. Urban farming aims to increase local food production, reduce the environmental impact of traditional agriculture, improve food security, and promote sustainable living in densely populated areas.

In recent years, the market for urban farming has experienced significant growth as more people recognize its numerous benefits. The increasing demand for locally sourced, fresh, and organic produce has driven the expansion of urban farming initiatives. Consumers are becoming more conscious of the environmental impact of conventional agriculture, the distance food travels, and the use of pesticides and fertilizers. Urban farming offers a solution by bringing food production closer to consumers, reducing transportation costs and emissions, and providing access to healthy, sustainable food options. The market growth of urban farming is also driven by technological advancements and innovations. Vertical farming systems, hydroponics, aquaponics, and other advanced cultivation techniques enable year-round production, efficient use of resources like water and energy, and higher crop yields.

Global Urban Farming Market Trends

Market Drivers

- Increasing demand for locally sourced, fresh, and nutritious produce

- Growing concerns about food security and the vulnerability of global food supply chains

- Advances in agricultural technologies, such as vertical farming systems and hydroponics

- Rising consumer demand for organic and local produce

Market Restraints

- High initial investment costs

- Limited scale of production

Market Opportunities

- Increased awareness about the benefits of urban farming, coupled with educational initiatives and community outreach

Urban Farming Market Report Coverage

| Market | Urban Farming Market |

| Urban Farming Market Size 2022 | USD 202.9 Million |

| Urban Farming Market Forecast 2032 | USD 261.1 Million |

| Urban Farming Market CAGR During 2023 - 2032 | 2.7% |

| Urban Farming Market Analysis Period | 2020 - 2032 |

| Urban Farming Market Base Year | 2022 |

| Urban Farming Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Growth Type, By Structure Type, By Crop Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AeroFarms, BrightFarms, Gotham Greens, Plenty, Square Roots, Bowery Farming, Farm.One, Infarm, LocalGarden, and Freight Farms. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Urban farming is a sustainable approach to food production that utilizes innovative techniques and technologies to maximize yields in small spaces. Urban farming can take various forms, including rooftop gardens, vertical farms, hydroponics, aquaponics, and community gardens. It offers numerous benefits such as increased access to fresh, nutritious produce, reduced transportation emissions, improved food security, and the promotion of local economies and community engagement.

The application of urban farming is vast and diverse. One of the primary applications is the production of fresh, locally-grown produce for urban communities. Urban farms can supply fresh vegetables, fruits, herbs, and even fish or poultry products to nearby residents, reducing the reliance on long-distance transportation and improving access to healthy food. Additionally, urban farming can contribute to greening cities, as rooftop gardens and vertical farms help mitigate the urban heat island effect, improve air quality, and provide habitat for pollinators and other urban wildlife.

The market for urban farming has witnessed significant growth in recent years and is projected to continue expanding in the coming years. The increasing global population, rapid urbanization, and growing demand for sustainable and locally sourced food are key factors driving the market growth of urban farming. Urban farming offers a solution to the challenges posed by limited agricultural land in urban areas. By utilizing innovative techniques such as vertical farming, hydroponics, and aquaponics, urban farmers can maximize yield in limited spaces and bring food production closer to urban populations. This localized approach to food production reduces the carbon footprint associated with long-distance transportation and addresses concerns about food security. Additionally, supportive government initiatives and policies promoting sustainable farming practices have provided a boost to the urban farming market growth.

Urban Farming Market Segmentation

The global urban farming market segmentation is based on growth type, structure type, crop type, and geography.

Urban Farming Market By Growth Type

- Aquaponics

- Hydroponics

- Aeroponics

According to the urban farming industry analysis, the hydroponics segment accounted for the largest market share in 2022. Hydroponics is a soil-less cultivation technique that involves growing plants in nutrient-rich water solutions, providing an efficient and controlled environment for plant growth. This method offers several advantages for urban farming, making it a preferred choice for many farmers and entrepreneurs. One of the key drivers of the growth in the hydroponics segment is the ability to maximize yield in limited urban spaces. Hydroponic systems can be set up vertically, allowing for the cultivation of crops in stacked layers, and optimizing the use of vertical space in urban environments. This vertical farming approach helps increase productivity per square meter of land, making hydroponics an ideal solution for urban areas with space constraints.

Urban Farming Market By Structure Type

- Indoor

- Outdoor

In terms of structure types, the indoor segment is expected to witness significant growth in the coming years. Indoor farming refers to the practice of cultivating crops in controlled environments, such as warehouses, greenhouses, or converted indoor spaces. This method allows for year-round production, independent of external climate conditions, and offers precise control over various environmental factors, including light, temperature, humidity, and nutrient delivery. One of the key drivers of the growth in the indoor segment is the ability to overcome the limitations of traditional outdoor farming. Urban areas often face challenges such as limited available land, seasonal constraints, and exposure to environmental factors that can affect crop growth. Indoor farming provides a solution by creating optimized growing conditions, enabling farmers to cultivate crops consistently throughout the year. This continuous production not only helps meet the demand for fresh produce but also reduces the vulnerability to external factors such as weather fluctuations and pests.

Urban Farming Market By Crop Type

- Food Crops

- Grains & Cereals

- Fruits

- Vegetables

- Others

- Non-Food Crops

- Medicinal Herbs

- Aromatic Herbs

- Ornamental Plants

- Others

According to the urban farming market forecast, the food crops segment is expected to witness significant growth in the coming years. Food crops refer to the cultivation of various edible plants and vegetables in urban farming systems. This segment plays a vital role in addressing the growing demand for fresh, locally sourced, and nutritious food in urban areas. One of the key drivers of the growth in the food crops segment is the increasing awareness and demand for healthier food choices. Urban consumers are becoming more conscious of the nutritional value and safety of their food. By growing food crops locally, urban farmers can provide fresh produce that is free from long-distance transportation, reducing the time from harvest to the consumer's plate. This ensures that consumers have access to nutrient-rich food that is harvested at its peak freshness, offering enhanced taste and nutritional value. Additionally, the emphasis on sustainable and environmentally friendly agricultural practices has fueled the growth of food crops in urban farming.

Urban Farming Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Urban Farming Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the urban farming market due to several factors that contribute to its growth and success in this field. The high population density and rapid urbanization in many countries across the Asia-Pacific region have created a strong demand for local food production. The need to feed densely populated urban areas with limited available land has led to the adoption of innovative farming practices, including urban farming. Urban farming allows for efficient use of space by utilizing rooftops, vertical structures, and indoor environments, making it a practical solution for addressing the food demands of densely populated cities. Moreover, the Asia-Pacific region has been at the forefront of technological advancements in urban farming. Countries like Japan, Singapore, and South Korea have made significant investments in research and development, leading to the development of advanced systems and techniques in vertical farming, hydroponics, and indoor farming. These technological advancements have improved productivity, reduced resource consumption, and increased the profitability of urban farming operations.

Urban Farming Market Player

Some of the top urban farming market companies offered in the professional report include AeroFarms, BrightFarms, Gotham Greens, Plenty, Square Roots, Bowery Farming, Farm.One, Infarm, LocalGarden, and Freight Farms.

Frequently Asked Questions

What was the market size of the global urban farming in 2022?

The market size of urban farming was USD 202.9 Million in 2022.

What is the CAGR of the global urban farming market from 2023 to 2032?

The CAGR of urban farming is 2.7% during the analysis period of 2023 to 2032.

Which are the key players in the urban farming market?

The key players operating in the global market are including AeroFarms, BrightFarms, Gotham Greens, Plenty, Square Roots, Bowery Farming, Farm.One, Infarm, LocalGarden, and Freight Farms.

Which region dominated the global urban farming market share?

Asia-Pacific held the dominating position in urban farming industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of urban farming during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global urban farming industry?

The current trends and dynamics in the urban farming industry include increasing demand for locally sourced, fresh, and nutritious produce, and growing concerns about food security and the vulnerability of global food supply chains.

Which structure type held the maximum share in 2022?

The indoor structure type held the maximum share of the urban farming industry.