Polyphenylene Ether Alloy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Polyphenylene Ether Alloy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Polyphenylene Ether Alloy Market Size accounted for USD 1.6 Billion in 2023 and is estimated to achieve a market size of USD 3.1 Billion by 2032 growing at a CAGR of 7.3% from 2024 to 2032.

Polyphenylene Ether Alloy Market Highlights

- Global polyphenylene ether alloy market revenue is poised to garner USD 3.1 billion by 2032 with a CAGR of 7.3% from 2024 to 2032

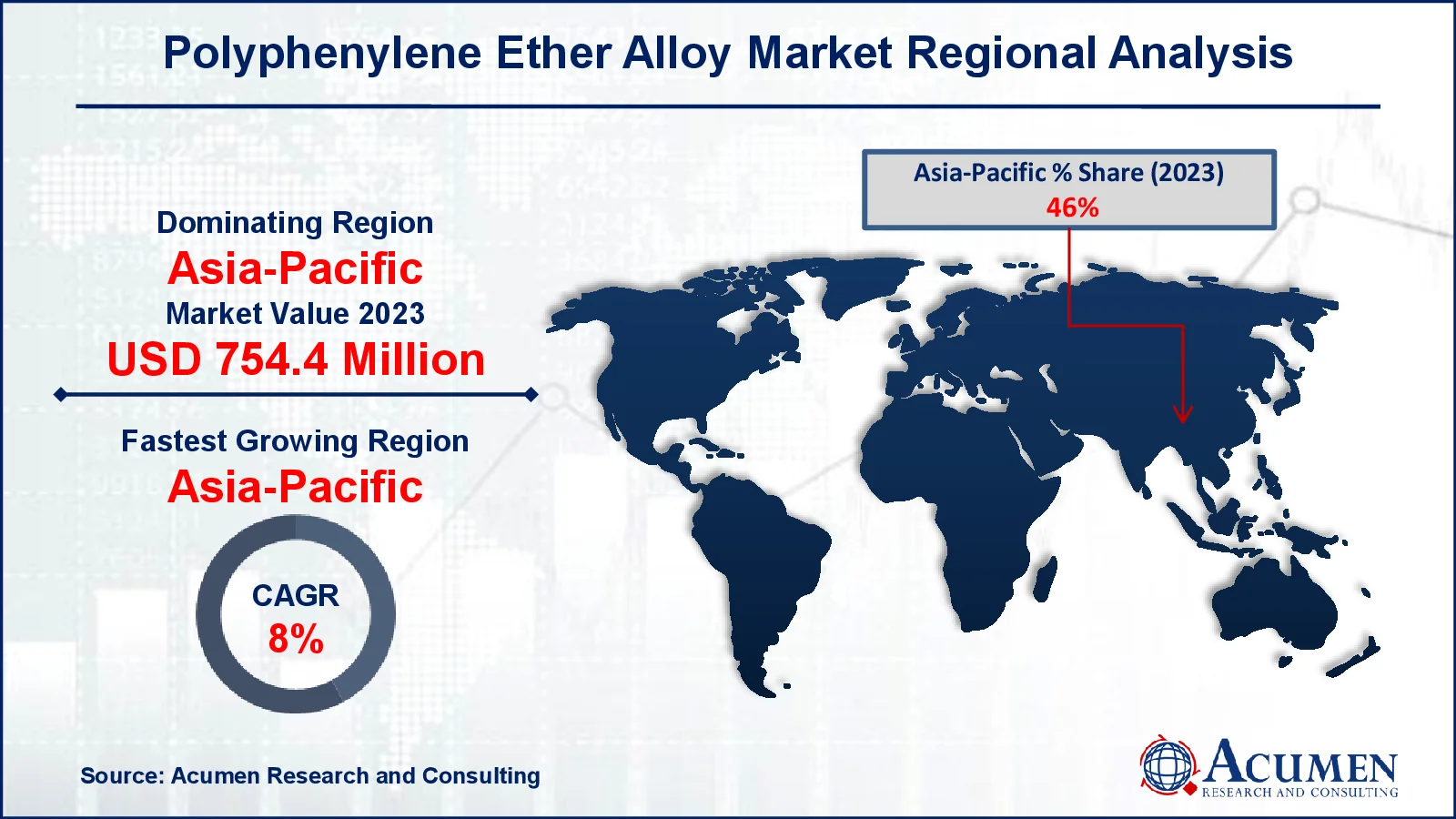

- Asia-Pacific polyphenylene ether alloy market value occupied around USD 754.4 million in 2023

- Asia-Pacific polyphenylene ether alloy market growth will record a CAGR of more than 8% from 2024 to 2032

- Among product, the PPE/PS sub-segment generated USD 836.4 million revenue in 2023

- Based on end use industry, the automotive sub-segment generated 45% polyphenylene ether alloy market share in 2023

- Innovations in manufacturing processes reducing production costs and improving efficiency is a popular polyphenylene ether alloy market trend that fuels the industry demand

Polyphenylene ether alloys are a class of polymers made from phenolic monomers that yield a variety of homopolymers and copolymers using different polymerization processes. PPE forms single-phase alloys when blended with polystyrene, which differs from usual polymer blends in that they are completely miscible. This unique synergy allows for the development of opaque thermoplastic resins with a wide range of chemical, thermal, and mechanical properties by altering the PPE-to-impact-modified polystyrene ratios. These alloys are well-known in the industry for their versatility and performance, making them suitable for a wide range of applications requiring strong material properties. The market provides a diverse range of PPE classes targeted to individual needs in areas ranging from the electrical and automotive industries to consumer goods and beyond. This demonstrates their extensive use and applicability in modern manufacturing and technical applications.

Global Polyphenylene Ether Alloy Market Dynamics

Market Drivers

- Increasing demand for lightweight and high-performance materials in the automotive industry

- Growing use in the electrical and electronics sector for its excellent insulating properties

- Rising adoption in consumer goods due to its durability and versatility

- Advancements in polymer blending technologies enhancing product performance

Market Restraints

- High production costs limiting widespread adoption

- Availability of alternative materials with similar properties at lower costs

- Environmental concerns regarding the recyclability and disposal of PPE alloys

Market Opportunities

- Expansion in emerging markets with rising industrialization and consumer demand

- Development of eco-friendly and recyclable PPE alloy variants

- Increasing application in medical devices due to its biocompatibility

Polyphenylene Ether Alloy Market Report Coverage

|

Market |

Polyphenylene Ether Alloy Market |

|

Polyphenylene Ether Alloy Market Size 2023 |

USD 1.6 Billion |

|

Polyphenylene Ether Alloy Market Forecast 2032 |

USD 3.1 Billion |

|

Polyphenylene Ether Alloy Market CAGR During 2024 - 2032 |

7.3% |

|

Polyphenylene Ether Alloy Market Analysis Period |

2020 - 2032 |

|

Polyphenylene Ether Alloy Market Base Year |

2023 |

|

Polyphenylene Ether Alloy Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By End Use Industry, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Sumitomo Chemical Company, Mitsubishi Engineering-plastics Corporation, Ashley Polymers, Saudi Basic Industries Corporation, Ensinger GmbH, RTP Company, Asahi Kasei Chemicals Corporation, Tokai Rika Create, LG Chem Ltd., and Formulated Polymers Limited (FPL). |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polyphenylene Ether Alloy Market Insights

Growing demand from the automotive industry is one of the drivers. As automakers attempt to produce more fuel-efficient vehicles, they are turning to lightweight materials such as PPE/PA (polyphenylene ether/polyamide) alloys. These alloys are valued for their great toughness and resistance to chemicals and organic solvents, making them excellent for automobile components that must be both robust and lightweight. The emphasis on fuel efficiency has raised demand for such materials, as lighter vehicles require less petroleum.

Another key reason is the expanding electronic manufacturing industry. As technology improves, there is an increasing demand for high-performance materials that can endure the demands of modern electronic equipment. PPE's outstanding thermal stability and electrical insulating characteristics make it the chosen material in this industry. Furthermore, rising demand for recycled plastics in the electrical and electronics industries is propelling market growth in line with global sustainability goals and regulatory regulations.

Despite the encouraging growth trends, the PPE industry confronts some significant difficulties. The high cost of PPE materials is a significant impediment to their widespread use, especially in price-sensitive applications. Furthermore, environmental issues about the production and disposal of PPE provide additional obstacles. These concerns include the environmental impact of manufacturing methods as well as the difficulty of recycling certain PPE goods, both of which may hinder market expansion if not addressed. The increased emphasis on sustainability creates significant prospects for the PPE sector.

The increased need for recycled plastic materials in a variety of industries presents a significant opportunity for expansion. Companies can improve market penetration by developing more cost-effective and environmentally friendly production processes. Furthermore, continual innovation in PPE formulations and processing techniques can lead to the creation of new applications, hence fueling market growth.

Polyphenylene Ether Alloy Market Segmentation

The worldwide market for polyphenylene ether alloy market is split based on product, end use industry, and geography.

Polyphenylene Ether Alloy Products

- PPE/PS

- PPE/PA

- PPE/PP

- Others

According to polyphenylene ether alloy industry analysis, the PPE/PS segment is the largest in the market. Also the PPE/PA (polyphenylene ether/polyamide) category has the grow significantly. This dominance is owing to its excellent properties, which include increased toughness, chemical resistance, and thermal stability. PPE/PA alloys are well-suited for high-stress applications in the automotive and electronics industries. PPE/PA alloys are commonly used in the automotive sector to create lightweight, long-lasting components that increase fuel efficiency. Similarly, in electronics, the material's outstanding performance properties ensure component dependability and durability. Furthermore, rising demand for better and more durable materials in these industries hastens the adoption of PPE/PA alloys, cementing their market leadership. The widespread use and long-standing preference for PPE/PA over other PPE alloys highlights its significance in driving market growth.

Polyphenylene Ether Alloy End Use Industry

- Automotive

- Construction

- Electrical & Electronics

- Industrial

- Others

The automotive industry has the highest share and will increase significantly over the polyphenylene ether alloy business projection period. This supremacy stems mostly from the industry's need for lightweight, high-performance materials that improve fuel efficiency and lower emissions. PPE alloys, especially those containing polyamides, have high toughness, chemical resistance, and heat stability, making them perfect for automotive applications. These materials are widely employed in the production of different automobile components, including under-the-hood elements, exterior panels, and interior trim, which benefit from the weight reduction and durability afforded by PPE alloys.

Furthermore, the automobile industry's ongoing quest for sustainability, as well as regulatory requirements to satisfy severe emission regulations, are driving the adoption of these sophisticated materials. The automotive industry's position as the major end-use segment in the PPE alloy market is strengthened by PPE alloys' vital role in increasing vehicle performance and efficiency.

Polyphenylene Ether Alloy Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Polyphenylene Ether Alloy Market Regional Analysis

The Asia-Pacific area is the largest and fastest-growing market for polyphenylene ethers. Several factors contribute to this expansion, including lower production costs, expanded applications across multiple sectors, and increased output in developing countries. Furthermore, strong government backing and a large number of manufacturers in the region help to drive market growth.

Europe has the second-largest market share and is expanding quickly throughout the polyphenylene ether alloy market projection period. This trend is fueled by the desire for superior materials, attractive reimbursement rules, and substantial financing for R&D. European countries make considerable investments in modern technology, and the region's well-developed automotive sector helps to drive market growth.

North America holds a sizable part of the worldwide industry during the polyphenylene ether alloy market forecast period, owing to the presence of major firms and the availability of investment. However, growth has been gradual rather than rapid, affected by reasons such as increased demand for cheaper alternatives and changing government rules, as well as safety concerns about personal protective equipment.

Polyphenylene Ether Alloy Market Players

Some of the top polyphenylene ether alloy market companies offered in our report include Sumitomo Chemical Company, Mitsubishi Engineering-plastics Corporation, Ashley Polymers, Saudi Basic Industries Corporation, Ensinger GmbH, RTP Company, Asahi Kasei Chemicals Corporation, Tokai Rika Create, LG Chem Ltd., and Formulated Polymers Limited (FPL).

Frequently Asked Questions

How big is the polyphenylene ether alloy market?

The polyphenylene ether alloy market size was valued at USD 1.6 billion in 2023.

What is the CAGR of the global polyphenylene ether alloy market from 2024 to 2032?

The CAGR of polyphenylene ether alloy is 7.3% during the analysis period of 2024 to 2032.

Which are the key players in the polyphenylene ether alloy market?

The key players operating in the global market are including Sumitomo Chemical Company, Mitsubishi Engineering-plastics Corporation, Ashley Polymers, Saudi Basic Industries Corporation, Ensinger GmbH, RTP Company, Asahi Kasei Chemicals Corporation, Tokai Rika Create, LG Chem Ltd., and Formulated Polymers Limited (FPL).

Which region dominated the global polyphenylene ether alloy market share?

Asia-Pacific held the dominating position in polyphenylene ether alloy industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of polyphenylene ether alloy during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global polyphenylene ether alloy industry?

The current trends and dynamics in the polyphenylene ether alloy industry include increasing demand for lightweight and high-performance materials in the automotive industry, and growing use in the electrical and electronics sector for its excellent insulating properties.

Which end use industry held the maximum share in 2023?

The automotive end use industry held the maximum share of the polyphenylene ether alloy industry.