Thermoplastic Elastomer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Thermoplastic Elastomer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

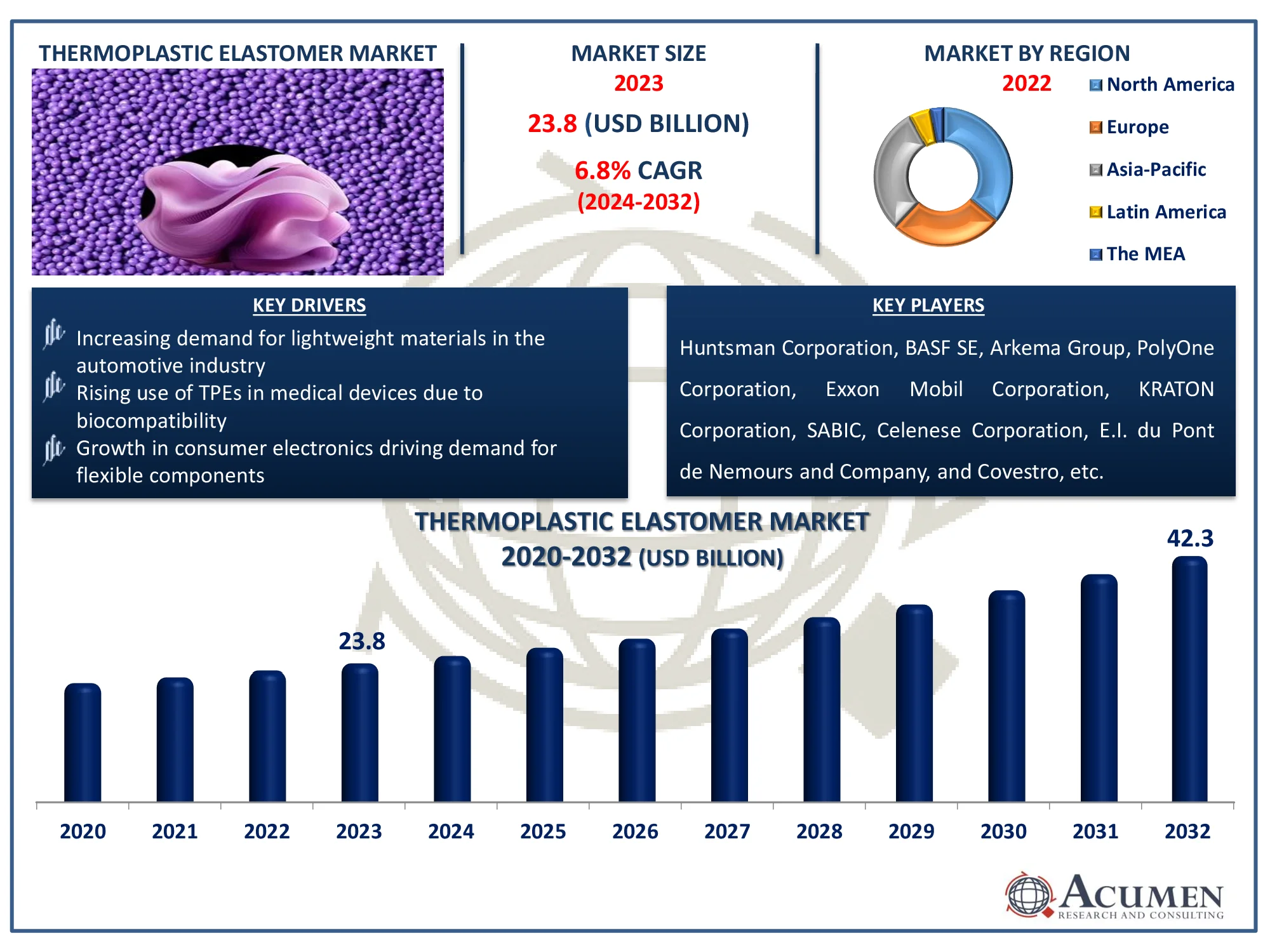

The Global Thermoplastic Elastomer Market Size accounted for USD 23.8 Billion in 2023 and is estimated to achieve a market size of USD 42.3 Billion by 2032 growing at a CAGR of 6.8% from 2024 to 2032.

Thermoplastic Elastomer Market (By Type: Thermoplastic Polyurethane (TPU), Styrenic Block Copolymer (TPE-S), Thermoplastic Vulcanizates, Thermoplastic Copolyester, Elastomeric Alloys (TPE-V or TPV), and Others; By Material: Poly Styrenes, Poly Olefins, Poly Ether Imides, Poly Urethanes, Poly Esters, and Poly Amides; By Application: Automotive, Industrial, Electrical & Electronics, Consumer Goods, and Others and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Thermoplastic Elastomer Market Highlights

- Global thermoplastic elastomer market revenue is poised to garner USD 42.3 billion by 2032 with a CAGR of 6.8% from 2024 to 2032

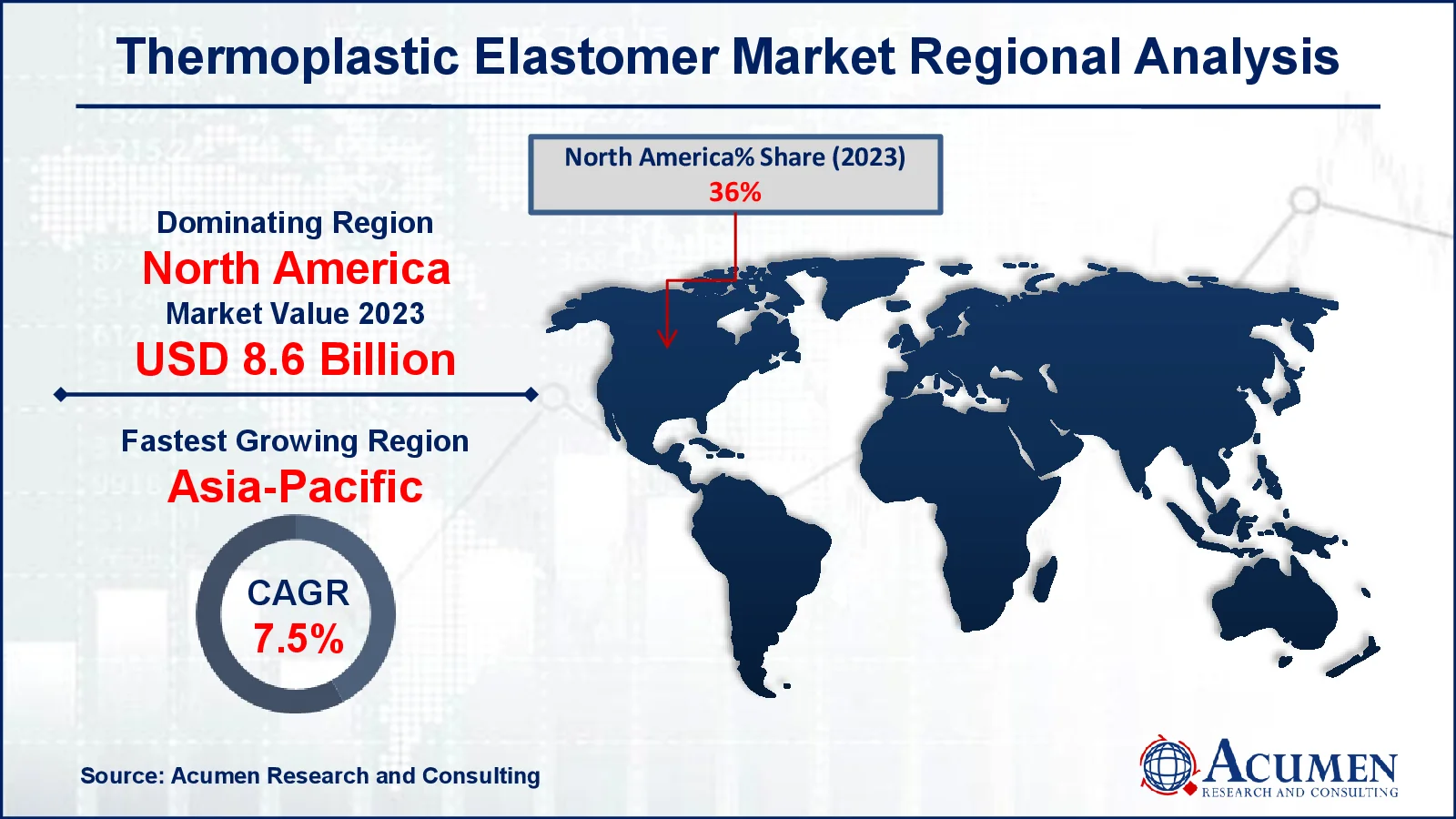

- North America thermoplastic elastomer market value occupied around USD 8.6 billion in 2023

- Asia-Pacific thermoplastic elastomer market growth will record a CAGR of more than 7.5% from 2024 to 2032

- Among material, the poly styrenes sub-segment generated 35% of the market share in 2023

- Based on application, the automotive sub-segment generated 40% of market share in 2023

- Innovation in bio-based TPEs and enhanced processing techniques is the thermoplastic elastomer market trend that fuels the industry demand

Thermoplastic elastomers (TPEs) are polymers that have the flexibility of rubber and the processability of plastics. TPEs, unlike typical elastomers, may be melted, molded, and reformed, making them extremely adaptable and recyclable. They have outstanding flexibility, robustness, and durability, making them suitable for a variety of applications. TPEs are widely utilized in automobile parts including as seals, gaskets, and electrical insulation, as well as consumer products such as Industrial and grips. They are utilized in the healthcare business for medical tubing and devices because they are biocompatible. Furthermore, TPEs are used in industrial applications like hoses, belts, and coatings.

Global Thermoplastic Elastomer Market Dynamics

Market Drivers

- Increasing demand for lightweight materials in the automotive industry

- Rising use of TPEs in medical devices due to biocompatibility

- Growth in consumer electronics driving demand for flexible components

Market Restraints

- High cost of raw materials compared to traditional elastomers

- Limited thermal stability in high-temperature applications

- Competition from other elastomer types like thermoset rubber

Market Opportunities

- Growing adoption of sustainable and recyclable materials in various industries

- Expanding applications of TPEs in renewable energy sectors like solar and wind

- Increasing demand in emerging markets, especially in Asia-Pacific for automotive and consumer goods

Thermoplastic Elastomer Market Report Coverage

| Market | Thermoplastic Elastomer Market |

| Thermoplastic Elastomer Market Size 2022 |

USD 23.8 Billion |

| Thermoplastic Elastomer Market Forecast 2032 | USD 42.3 Billion |

| Thermoplastic Elastomer Market CAGR During 2023 - 2032 | 6.8% |

| Thermoplastic Elastomer Market Analysis Period | 2020 - 2032 |

| Thermoplastic Elastomer Market Base Year |

2022 |

| Thermoplastic Elastomer Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Material, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Huntsman Corporation, BASF SE, Arkema Group, PolyOne Corporation, Exxon Mobil Corporation, KRATON Corporation, SABIC, Celenese Corporation, E.I. du Pont de Nemours and Company, and Covestro, etc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Thermoplastic Elastomer Market Insights

Governments across the globe are gradually spending on material research and development activities to expand their product offerings. The rising innovation of thermoplastic elastomers by manufacturers on plastics in the automotive industry is one of the major factors driving the demand in the global Thermoplastic Elastomer Market. The thermoplastic elastomers are most widely used in the automotive sector as most of the automotive components are manufactured using thermoplastic elastomers that consist of airbags, anti-slip mats, window trims, control elements, seals, air duct, and other components.

The demand for thermoplastic elastomers is highly in demand in the Consumer Goods sector as well and is expected to grow at a rapid pace in the near future. The thermoplastic elastomers need shorter processing time and offer higher design flexibility as compared to conventional elastomers. The need for thermoplastic elastomers is expected to increase in the automotive, medical, and building and construction industries due to its excellent dimensional stability, chemical inertness, vapor and gas transfer qualities, and flexibility.

Manufacturer’s' investments in increasing production capacity help to drive the growth of the Thermoplastic elastomer market by satisfying rising global demand in industries such as automotive, medical, and consumer goods. For instance, in January 2022, Arkema announced a 25% increase in global Pebax elastomer production capacity through an investment in Serquigny, France. The investment allowed for increased manufacturing of the bio-circular Pebax Rnew and classic Pebax lines. This expanded production capacity also fosters innovation, allowing businesses to create specialized TPE compositions for new applications.

Thermoplastic Elastomer Market Segmentation

The worldwide market for thermoplastic elastomer is split based on type, material, application, and geography.

Thermoplastic Elastomer Types

- Thermoplastic Polyurethane (TPU)

- Styrenic Block Copolymer (TPE-S)

- Thermoplastic Vulcanizates

- Thermoplastic Copolyester

- Elastomeric Alloys (TPE-V or TPV)

- Others

According to the thermoplastic elastomer industry analysis, thermoplastic vulcanizates (TPVs) are predicted to dominate the thermoplastic elastomer (TPE) market due to their superior mix of rubber-like elasticity and plastic-like processability. TPVs are highly resistant to chemicals, heat, and age, making them perfect for automotive applications such as seals and hoses. Their recyclability and lightweight qualities complement sustainability trends in areas including as building and consumer goods. The increased demand for high-performance materials in these industries continues to fuel the preference for TPVs over other types of TPE.

Thermoplastic Elastomer Materials

- Poly Styrenes

- Poly Olefins

- Poly Ether Imides

- Poly Urethanes

- Poly Esters

- Poly Amides

Polystyrene is expected to have a large market share in 2023. These polystyrene elastomers are designed to perform better in a variety of applications. The properties of thermoplastic materials in styrene block copolymers are used in a range of end-use industries to replace ethylene propylene diene monomer (EPDM) and ethylene-propylene (EP) rubber. Furthermore, the polystyrene segment dominated the market because to rising client demands in a variety of industries, including automotive, medical, construction, electrical and electronics, Industrial, and many more. Furthermore, the shift toward passenger cars and light commercials is expected to fuel the segment's further expansion.

Thermoplastic Elastomer Applications

- Automotive

- Industrial

- Electrical & Electronics

- Consumer Goods

- Medical

- Others

According to the thermoplastic elastomer market forecast, the automotive category is predicted to grow significantly in the thermoplastic elastomer (TPE) market over the next several years. This growth is due to the increasing global demand for lightweight automobiles. Thermoplastic elastomers are widely used in the automotive industry for exterior and interior body elements such as bodywork seals, external filler panels, automotive sealants, door and window grips, wipers, rocker sheets, and vibration damping pads. The automotive thermoplastic elastomers market is expected to expand due to increased competition among market participants to produce lighter weights, rising demand for electric and hybrid automobiles, the expansion of transportation systems, supportive government regulations, robust automotive parts, and rapid economic growth.

Thermoplastic Elastomer Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Thermoplastic Elastomer Market Regional Analysis

For several reasons, North America dominates thermoplastic elastomer (TPE) market due to increased use of thermoplastic elastomers in the consumer goods industry. Increasing automotive sales in developing nations such as U.S., and Canada as well as the large presence of automakers are expected to fuel demand for thermoplastic elastomers in the North American region throughout the forecast period. Thermoplastic elastomers enhance automotive fuel efficiency; hence they are widely utilized around the world.

The Asia-Pacific region is expected to have significant market growth in the next years. This is due to the region's growing end-use sectors, which include automobiles, electronics, electricity, and construction. Another element driving demand growth in the Asia-Pacific area is raising population per capita income in emerging countries like as India and China, paired with expanding industrialization. India and China are the region's fastest-growing economies, and they are also among the world's largest manufacturers. Furthermore, the growing manufacturing industry will increase demand for thermoplastic elastomers compounds in the transportation, industrial equipment, container, electronics, and electrical sectors.

Thermoplastic Elastomer Market Players

Some of the top thermoplastic elastomer companies offered in our report include Huntsman Corporation, BASF SE, Arkema Group, PolyOne Corporation, Exxon Mobil Corporation, KRATON Corporation, SABIC, Celenese Corporation, E.I. du Pont de Nemours and Company, and Covestro, etc.

Frequently Asked Questions

How big is the thermoplastic elastomer market?

The thermoplastic elastomer market size was valued at USD 23.8 billion in 2023.

What is the CAGR of the global thermoplastic elastomer market from 2024 to 2032?

The CAGR of thermoplastic elastomer is 6.8% during the analysis period of 2024 to 2032.

Which are the key players in the thermoplastic elastomer market?

The key players operating in the global market are including Huntsman Corporation, BASF SE, Arkema Group, PolyOne Corporation, Exxon Mobil Corporation, KRATON Corporation, SABIC, Celenese Corporation, E.I. du Pont de Nemours and Company, and Covestro, etc.

Which region dominated the global thermoplastic elastomer market share?

North America held the dominating position in thermoplastic elastomer industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of thermoplastic elastomer during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global thermoplastic elastomer industry?

The current trends and dynamics in the thermoplastic elastomer industry include increasing demand for lightweight materials in the automotive industry, rising use of TPEs in medical devices due to biocompatibility, and growth in consumer electronics driving demand for flexible components.

Which material held the maximum share in 2023?

The poly styrenes held the maximum share of the thermoplastic elastomer industry.