Plastic Packaging Market | Acumen Research and Consulting

Plastic Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

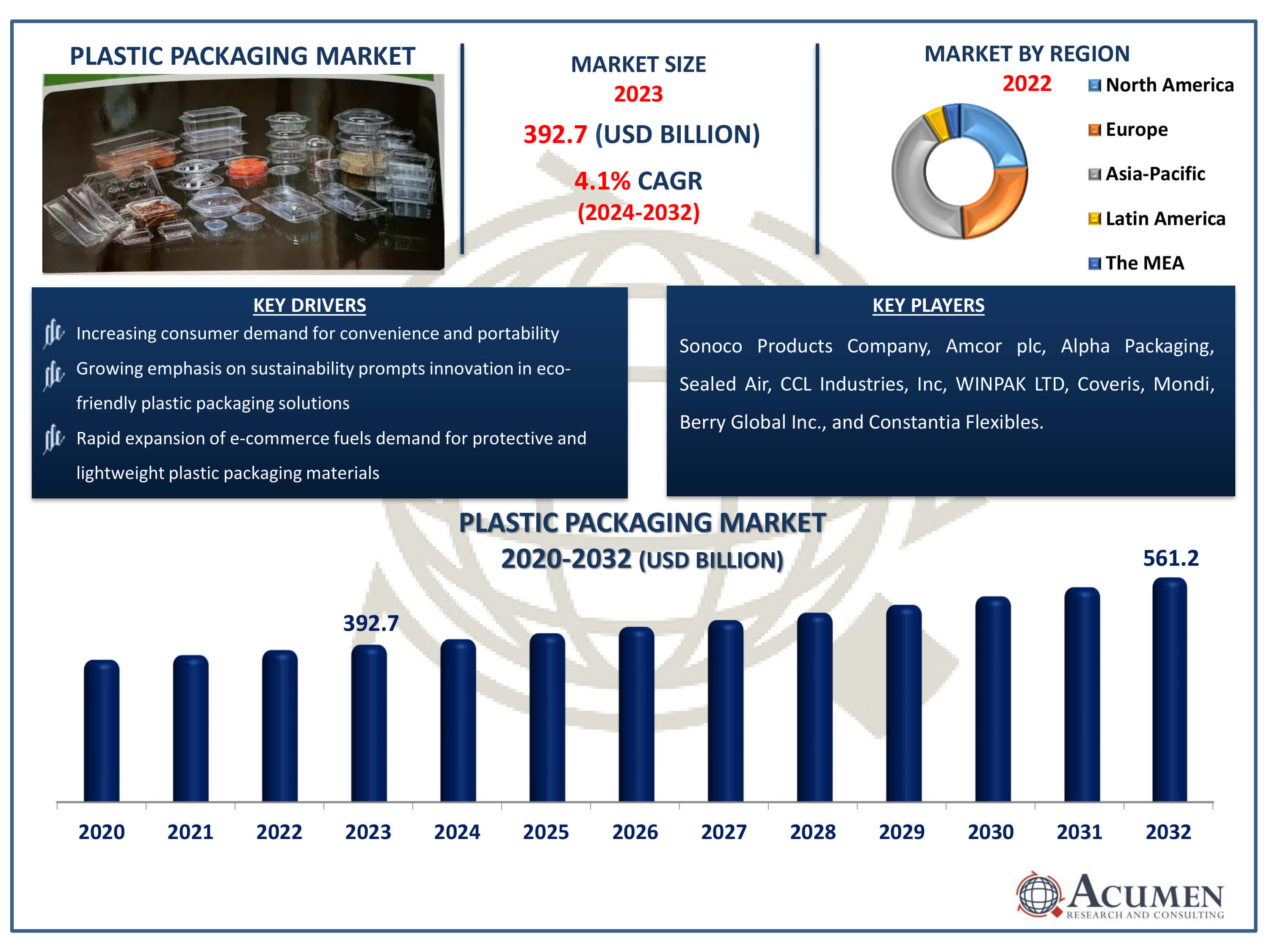

The Plastic Packaging Market Size accounted for USD 392.7 Billion in 2023 and is estimated to achieve a market size of USD 561.2 Billion by 2032 growing at a CAGR of 4.1% from 2024 to 2032.

Plastic Packaging Market Highlights

- Global plastic packaging market revenue is poised to garner USD 561.2 billion by 2032 with a CAGR of 4.1% from 2024 to 2032

- Asia Pacific plastic packaging market value occupied around USD 164.9 billion in 2023

- Asia Pacific plastic packaging market growth will record a CAGR of more than 4.6% from 2024 to 2032

- Among material, the polyethylene terephthalate (PET) sub-segment generated 34% of the market share in 2023

- Based on product, the rigid sub-segment generated 61% market share in 2023

- Shifting towards sustainability and recyclability is the plastic packaging market trend that fuels the industry demand

Plastic packaging refers to a wide range of materials made from polymers used to enclose, protect, and preserve products. This type of packaging is highly versatile and includes items like bottles, containers, wraps, and films, which are employed across numerous industries due to their durability, lightweight nature, and cost-effectiveness. Applications of plastic packaging span from food and beverage containers that maintain product freshness and prevent contamination, to medical and pharmaceutical packaging that ensures sterility and safe transport, to industrial packaging for protecting machinery and components during shipping. The adaptability of plastic packaging also makes it a preferred choice for custom and innovative packaging solutions.

Global Plastic Packaging Market Dynamics

Market Drivers

- Increasing consumer demand for convenience and portability

- Growing emphasis on sustainability prompts innovation in eco-friendly plastic packaging solutions

- Rapid expansion of e-commerce fuels demand for protective and lightweight plastic packaging materials

Market Restraints

- Heightened environmental concerns lead to regulatory pressure against single-use plastics

- Rising awareness about plastic pollution

- Escalating costs of raw materials and production

Market Opportunities

- Technological advancements offer opportunities for the development of biodegradable plastic packaging solutions

- Growing focus on circular economy models

- Expansion into emerging markets

Plastic Packaging Market Report Coverage

| Market | Plastic Packaging Market |

| Plastic Packaging Market Size 2022 | USD 392.7 Billion |

| Plastic Packaging Market Forecast 2032 |

USD 561.2 Billion |

| Plastic Packaging Market CAGR During 2024 - 2032 | 4.1% |

| Plastic Packaging Market Analysis Period | 2020 - 2032 |

| Plastic Packaging Market Base Year |

2022 |

| Plastic Packaging Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Material, By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sonoco Products Company, Amcor plc, Alpha Packaging, Sealed Air, CCL Industries, Inc, WINPAK LTD, Coveris, Mondi, Berry Global Inc., and Constantia Flexibles. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Plastic Packaging Market Insights

The rapid expansion of e-commerce fuels demand for protective and lightweight plastic packaging materials market. As online shopping grows, the need for durable packaging that can withstand the precision of shipping while remaining cost-effective and environmentally sustainable becomes paramount. For instance, the Indian e-commerce industry has been expanding rapidly. In FY 2022-23, the Government e-marketplace (GeM) had its highest ever Gross Merchandise Value of $2011 billion. Plastic packaging materials, known for their strength, flexibility, and lightweight properties, are ideal for protecting a wide range of products during transportation. Their ability to provide enough protection while reducing shipping costs due to their light weight makes them an attractive choice for e-commerce businesses. Moreover, growing emphasis on sustainability prompts innovation in eco-friendly plastic packaging solutions.

The rising awareness about plastic pollution impedes growth of plastic packaging market. Consumers and businesses are becoming more conscious of the environmental impact of plastic waste, leading to heightened demand for sustainable alternatives. Governments are implementing stricter regulations and policies to reduce plastic usage and promote recycling. For instance, according to U.S. Department of Interior, Secretary's Order 3407 (SO 3407), issued on June 8, 2022, aims to minimize the procurement, sale, and distribution of single-use plastic items and packaging. The goal is to phase out all single-use plastic products on Department-managed lands by 2032. As a result, manufacturers are under pressure to innovate and shift towards eco-friendly packaging solutions, which can be more costly and complex. This shift is gradually reducing the market share of traditional plastic packaging, slowing its overall growth.

Technological advancements have significantly boosted the development of biodegradable plastic packaging solutions, addressing the growing environmental concerns associated with traditional plastics. Innovations in material science have led to the creation of bioplastics derived from renewable sources like corn starch, sugarcane, and cellulose, which can decompose more efficiently and safely in natural environments. Advanced manufacturing techniques and the incorporation of microbial enzymes are further enhancing the degradation process, making these alternatives increasingly viable for commercial use. These advancements not only reduce the carbon footprint but also help mitigate plastic pollution, offering a sustainable path forward in packaging technology.

Plastic Packaging Market Segmentation

The worldwide market for plastic packaging is split based on technology, product, application, and geography.

Plastic Packaging Materials

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Expanded Polystyrene (EPS)

- Polyvinyl Chloride (PVC)

- Bio-based plastics

- Others

According to the plastic packaging industry analysis, polyethylene terephthalate (PET) dominates the plastic packaging market due to its excellent combination of properties. PET is lightweight, durable, and highly resistant to impact, making it ideal for protecting products during transportation and handling. Its clarity and ability to retain carbonation make it particularly popular for beverage bottles. Additionally, PET is recyclable, which aligns with increasing consumer and regulatory demands for sustainable packaging solutions. Moreover, key manufacturers focusing on new innovations and advancements in PET further contribute’s to its growth. For instance, in January 2024, Coca-Cola India and Reliance Retail, the retail arm of India-based giant Reliance Industries Limited (RIL), launched a new PET collecting and recycling project. The campaign, dubbed 'Bhool na Jana, Plastic Bottles Lautana, would feature reverse vending machines and collecting bins in Coca-Cola India and Reliance Retail outlets in Mumbai and Delhi, with ambitions to roll it out nationwide.As a result, its versatility and cost-effectiveness further solidify its position as the leading material in the plastic packaging industry.

Plastic Packaging Products

- Rigid

- Flexibles

The rigid segment is the largest product category in the plastic packaging market and it is expected to increase over the industry due to its durability, protection capabilities, and extended shelf life for products. Unlike flexible packaging, rigid plastic containers offer superior strength and are less prone to damage, making them ideal for a wide range of applications, including food, beverages, healthcare, and personal care products. Additionally, advancements in manufacturing technologies and the growing demand for recyclable and sustainable packaging solutions have further bolstered the popularity of rigid plastic packaging.

Plastic Packaging Applications

- Food and Beverages

- Healthcare

- Cosmetics and Personal Care

- Industrial Packaging

- Others

According to the plastic packaging industry forecast, food and beverages segment expected to dominates the the plastic packaging market. This industry requires packaging solutions that offer durability, versatility, and protection to ensure the safety and freshness of products. Plastic packaging excels in providing these attributes with its lightweight nature, cost-effectiveness, and ability to be molded into various shapes and sizes. Additionally, the increasing demand for convenience foods and ready-to-drink beverages has further driven the need for innovative plastic packaging solutions. These trends, combined with the ongoing advancements in sustainable and recyclable plastic materials, maintain the prominence of the food and beverages segment in the plastic packaging market.

Plastic Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Plastic Packaging Market Regional Analysis

For several reasons, the Asia-Pacific region dominates as well as fastest-growing region in the plastic packaging market. The Asia Pacific region leads the global plastic packaging market due to several key factors. Rapid industrialization and urbanization in countries like China and India have significantly boosted demand for plastic packaging. This is driven by the growing e-commerce sector, expanding food and beverage industry, and increased consumer spending. Additionally, the regions benefits from a robust manufacturing base which attract multinational companies. For instance, on May 8, 2024, Amcor plc and AVON launched the AmPrima Plus refill pouch in China. When recycled, the recycle-ready packaging reduces its carbon footprint by 83%, as well as 88% and 79% reductions in water use and renewable energy. Moreover, advancements in packaging technology and a shift towards sustainable packaging solutions further bolster the market's growth in this region. As a result, the Asia Pacific remains a pivotal player in the global plastic packaging landscape.

Europe is the second largest region in the plastic packaging market. This rapid growth is driven by several factors, including increasing urbanization, and rising consumer demand for packaged goods. Additionally, the region's expanding food and beverage industry, coupled with the growth of e-commerce, significantly boosts the need for plastic packaging. For instance, on March 10, 2023, ALPLA-Werke Alwin Lehner GmbH & Co. KG established a joint venture with INDEN Pharma. The companies formed a long-term relationship to produce certified bottles, containers, and closures in clean rooms. Furthermore, countries like U.K., Germany, France, Spain, are key contributors to this growth, benefiting from both local consumption and their roles as major manufacturers in this market fueling growth in forecast year.

Plastic Packaging Market Players

Some of the top plastic packaging companies offered in our report include Sonoco Products Company, Amcor plc, Alpha Packaging, Sealed Air, CCL Industries, Inc, WINPAK LTD, Coveris, Mondi, Berry Global Inc., and Constantia Flexibles.

Frequently Asked Questions

How big is the plastic packaging market?

The plastic packaging market size was valued at USD 392.7 billion in 2023.

What is the CAGR of the global plastic packaging market from 2024 to 2032?

The CAGR of plastic packaging is 4.1% during the analysis period of 2024 to 2032.

Which are the key players in the plastic packaging market?

The key players operating in the global market are including Sonoco Products Company, Amcor plc, Alpha Packaging, Sealed Air, CCL Industries, Inc, WINPAK LTD, Coveris, Mondi, Berry Global Inc., and Constantia Flexibles

Which region dominated the global plastic packaging market share?

Asia Pacific held the dominating position in plastic packaging industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia Pacific region exhibited fastest growing CAGR for market of plastic packaging during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global plastic packaging industry?

The current trends and dynamics in the plastic packaging industry include increasing consumer demand for convenience and portability drives the growth of plastic packaging, growing emphasis on sustainability prompts innovation in eco-friendly plastic packaging solutions, and rapid expansion of e-commerce fuels demand for protective and lightweight plastic packaging materials.

Which technology held the maximum share in 2023?

The polyethylene terephthalate (PET) technology held the maximum share of the plastic packaging industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date