Plant-Based Seafood Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Plant-Based Seafood Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

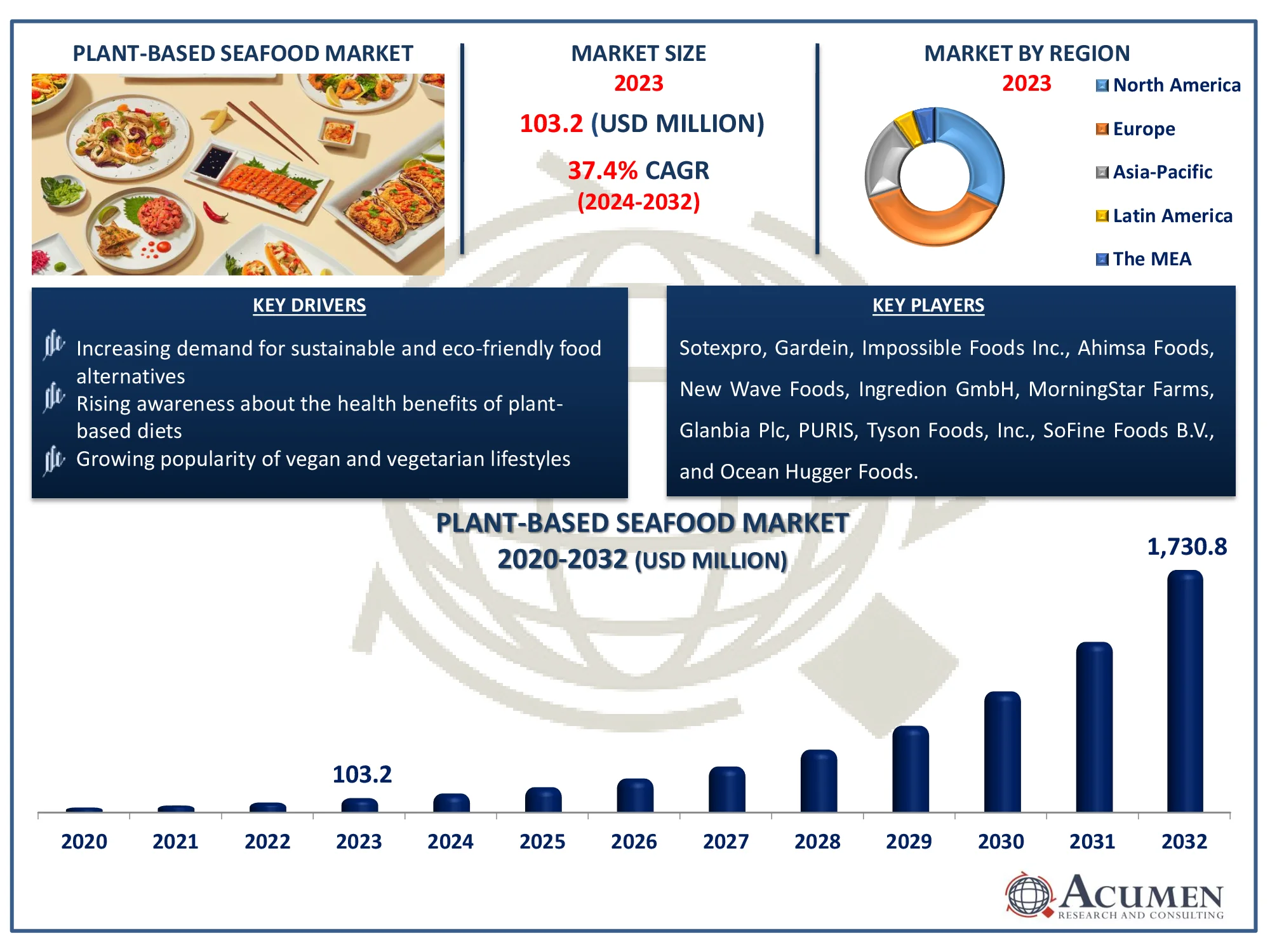

Request Sample Report

The Global Plant-Based Seafood Market Size accounted for USD 103.2 Million in 2023 and is estimated to achieve a market size of USD 1,730.8 Million by 2032 growing at a CAGR of 37.4% from 2024 to 2032.

Plant-Based Seafood Market Highlights

- Global plant-based seafood market revenue is poised to garner USD 1,730.8 million by 2032 with a CAGR of 37.4% from 2024 to 2032

- Europe plant-based seafood market value occupied around USD 39.2 million in 2023

- North America plant-based seafood market growth will record a CAGR of more than 39% from 2024 to 2032

- Among product, the fish products sub-segment generated 61% of the market share in 2023

- Based on source, the soy sub-segment generated 36% market share in 2023

- Expanding consumer interest in flexitarian and vegan diets is the plant-based seafood market trend that fuels the industry demand

Plant-based seafood refers to culinary products that have the same taste, texture, and look as traditional seafood but are created from plant-based materials. These substitutes are often made with plant proteins like soy, peas, or seaweed, as well as other natural components, to mimic the nutritional profile of seafood. Plant-based seafood products, such as fish fillets, shrimp, and tuna, attempt to give an environmentally sustainable alternative to seafood consumption.

Food and Agriculture Organization of the United Nations states that as more plant-based seafood producers explore the use of seaweed and algae in their products, the plant-based sector could create new market opportunities for aquatic plant farmers. This development could support the growth of environmentally sustainable aquaculture practices. The increased consumption of plant-based seafood has the potential to significantly reduce environmental impact, particularly by lowering carbon emissions associated with transportation, thus further driving the growth of the plant-based seafood market.

Global Plant-Based Seafood Market Dynamics

Market Drivers

- Increasing demand for sustainable and eco-friendly food alternatives

- Rising awareness about the health benefits of plant-based diets

- Growing popularity of vegan and vegetarian lifestyles

Market Restraints

- High production costs of plant-based seafood alternatives

- Limited availability of ingredients and technologies

- Consumer skepticism about taste and texture compared to traditional seafood

Market Opportunities

- Expansion in emerging markets with rising plant-based consumer demand

- Innovation in flavors and textures to improve product appeal

- Collaboration with restaurants and food service chains to promote plant-based options

Plant-Based Seafood Market Report Coverage

|

Market |

Plant-Based Seafood Market |

|

Plant-Based Seafood Market Size 2023 |

USD 103.2 Million |

|

Plant-Based Seafood Market Forecast 2032 |

USD 1,730.8 Million |

|

Plant-Based Seafood Market CAGR During 2024 - 2032 |

37.4% |

|

Plant-Based Seafood Market Analysis Period |

2020 - 2032 |

|

Plant-Based Seafood Market Base Year |

2023 |

|

Plant-Based Seafood Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Source, By Consumer, By Distribution Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Sotexpro, Gardein, Impossible Foods Inc., Ahimsa Foods, New Wave Foods, Ingredion GmbH, MorningStar Farms, Glanbia Plc, PURIS, Tyson Foods, Inc., SoFine Foods B.V., and Ocean Hugger Foods. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Plant-Based Seafood Market Insights

Consumers are becoming more aware of the environmental impact of traditional animal-based food production, resulting in a boom in demand for plant-based alternatives. Federal Programs like the Supplemental Nutrition Assistance Program and the Dietary Guidelines for Americans generally encourage the consumption of unprocessed plant-based foods while providing little to no information on sustainability and the negative environmental impact of animal-based foods. Plant-based seafood provides a sustainable alternative to overfishing while lowering the carbon footprint associated with seafood harvesting. The increased demand for environmentally friendly alternatives is propelling the plant-based seafood business.

The production of plant-based seafood often involves advanced technologies and sourcing of specialized ingredients, which can drive up costs. These high production costs are passed onto consumers, making plant-based seafood products more expensive than traditional seafood. This price disparity can limit widespread consumer adoption, especially in price-sensitive markets.

Emerging markets, especially in Asia and Latin America, are witnessing increasing interest in plant-based diets due to health and environmental concerns. According to Assocham India, plant-based diets are becoming more popular in India due to health concerns and consumer demand for healthier options. Plant-based diets are a safe and ethical alternative to meat, eggs, and dairy, addressing nutritional shortfalls. The proposed convention aims to promote plant-based diets as an alternative to animal agriculture, addressing environmental and ethical concerns. As a result, as these regions grow more conscious of the benefits of plant-based alternatives, there is a significant opportunity for the plant-based seafood market to expand.

To enhance consumer acceptance, plant-based seafood companies are investing in developing products with textures and flavors that closely resemble traditional seafood. For instance, According to the India Brand Equity Foundation, numerous SMEs and FMCGs have ventured into India's growing plant-based food sector, offering alternatives to meat, poultry, seafood, dairy and even vegan meals for pets. With over 50 start-ups already operating in this space, the industry is experiencing significant growth. The expansion of the plant-based foods market presents a remarkable opportunity for farmers to boost their incomes while addressing critical issues such as food poverty, climate change, hunger, and public health challenges.

Advances in food technology, such as the use of seaweed and plant proteins, allow for more realistic replicas of seafood's taste and texture, increasing the appeal of these alternatives to a wider audience. For instance, The CMFRI Repository highlights a growing interest in seaweeds and their use in aquafeeds. Studies show that seaweed-based supplements boost immune response, antioxidant levels, and disease resistance in fish, due to bioactive compounds like polysaccharides that improve nutrient digestion and support gut health. Additionally, seaweed proteins are gaining traction for applications in food, supplements, and biotechnology, making them a key innovation in promoting plant-based options for seafood enthusiasts.

Plant-Based Seafood Market Segmentation

The worldwide market for plant-based seafood is split based on product, source, consumer, distribution channel, and geography.

Plant-Based Seafood Market By Product

- Fish Products

- Prawn and Shrimp Products

- Crab Products

- Others

According to the plant-based seafood industry analysis, fish products dominate industry due to their widespread popularity and cultural significance in many cuisines. Consumers are increasingly seeking plant-based alternatives to fish, such as plant-based fish fillets, sticks, and tuna, to meet the growing demand for sustainable and ethical food options. The texture and flavor profiles of fish are more easily replicated with plant-based ingredients like soy, pea protein, and seaweed, making it a primary focus for product development. As the awareness of environmental issues and health benefits rises, plant-based fish products are likely to lead the market in terms of sales and consumer adoption.

Plant-Based Seafood Market By Source

- Wheat

- Pea

- Soy

- Lentil

- Canola

- Others

According to the plant-based seafood industry analysis, soy source dominates industry due to its versatile, high-protein content and ability to mimic the texture of traditional seafood. Soy protein is widely used in creating plant-based fish, shrimp, and other seafood alternatives because of its neutral flavor, which allows it to absorb various seasonings and flavorings. Additionally, soy is a cost-effective ingredient that provides a sustainable and nutritious option for consumers. This has led to its prominent role in the production of plant-based seafood products worldwide.

Plant-Based Seafood Market By Consumer

- Vegetarian

- Omnivore

- Vegan

- Flexitarian

According to the plant-based seafood market forecast, omnivore consumers are expected to dominate market as they seek healthier, more sustainable alternatives without completely giving up familiar flavors and textures. These consumers are driven by environmental concerns, health benefits, and the desire to reduce their carbon footprint while still enjoying seafood-like dishes. The plant-based seafood offerings cater to this group by replicating the taste and texture of traditional seafood, making the transition easier for those who aren't strictly vegan or vegetarian. As awareness grows, omnivores are expected to remain a key driver of growth in the plant-based seafood sector.

Plant-Based Seafood Market By Distribution Channel

- HoReCa

- Supermarkets and Hypermarkets

- Online Sales

- Specialty Stores

- Convenience Stores

According to the plant-based seafood market forecast, online sales are expected to see the largest growth in industry due to the convenience and increasing popularity of e-commerce platforms. Consumers are increasingly shopping for specialty products like plant-based seafood from the comfort of their homes, often seeking niche or hard-to-find items. The rise of direct-to-consumer brands and online grocery delivery services has made plant-based seafood more accessible, reaching a broader audience. Additionally, online platforms provide detailed product information and customer reviews, enhancing consumer confidence in trying new plant-based alternatives.

Plant-Based Seafood Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

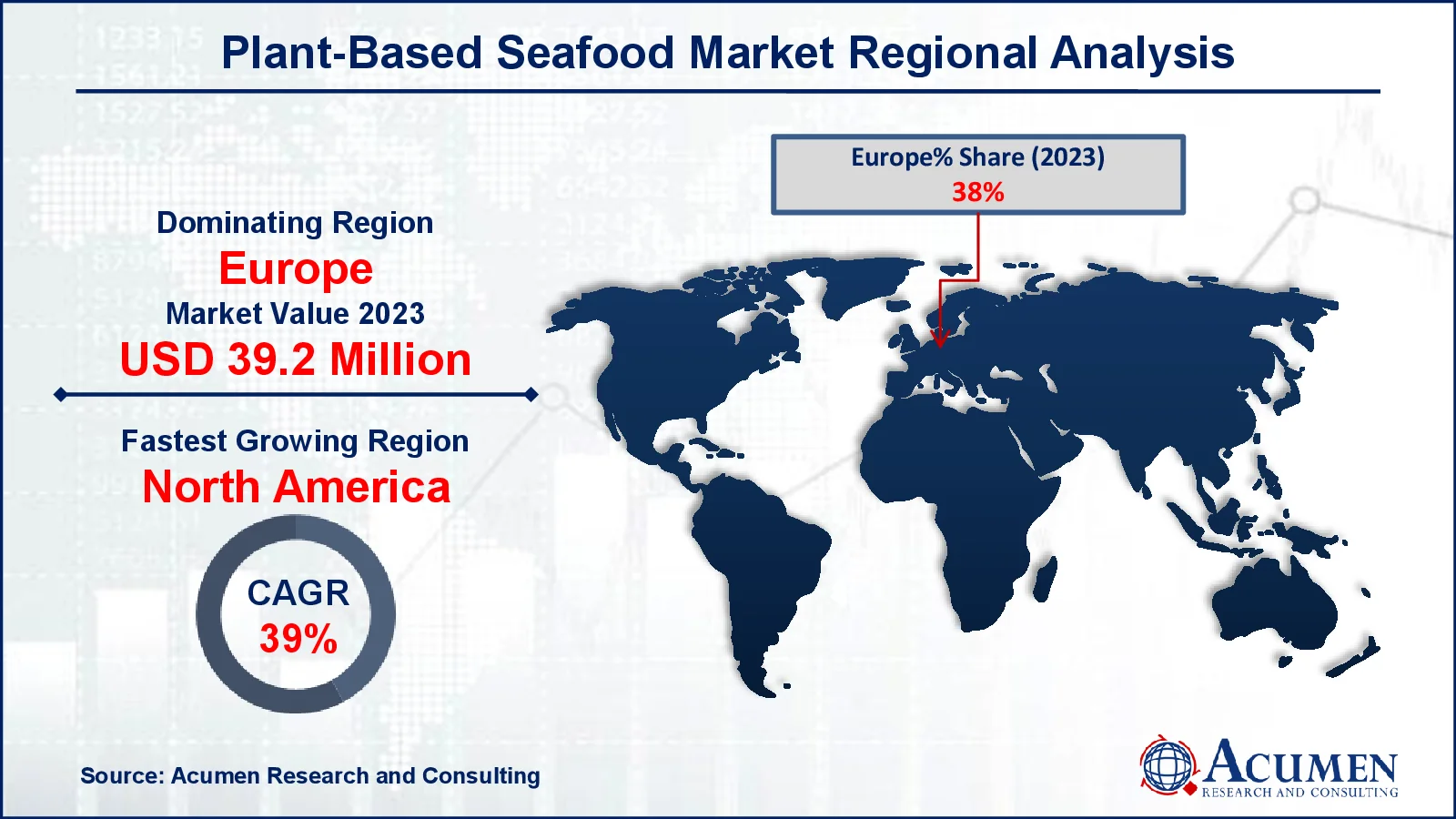

Plant-Based Seafood Market Regional Analysis

For several reasons, Europe dominates in the plant-based seafood market, driven by rising environmental consciousness and a shift toward sustainable food choices. For instance, the European Sustainable Food Coalition (ESFC) is a pre-competition collaboration that stimulates the transition to a sustainable food system. The ESF Coalition ensures that they can feed 10 billion people a healthy diet while staying within the planet's environmental limits, requiring urgent and collective action from all sectors. This collective effort is driving the growth of the plant-based seafood market in Europe, as consumers and businesses increasingly seek sustainable, eco-friendly food alternatives in line with these global goals. Additionally, the region's focus on reducing the carbon footprint aligns well with the expansion of plant-based options in the food industry.

North America region is expected to grow significantly in the plant-based seafood market due to high consumer awareness of health, sustainability, and environmental concerns. The region has seen strong demand for plant-based alternatives driven by a large base of vegan, vegetarian, and flexitarian consumers. According to National Institute of Health, consumers in the U.S. increasingly prefer plant-based milk alternative beverages (abbreviated “plant milk”) to conventional milk. Increased availability of plant-based seafood products in major retail chains and restaurants further fuels market growth. As per The Good Food Institute, 95% of households that purchased plant-based meat and seafood in 2023 also bought animal-based meat, highlighting the increasing integration of plant-based options into traditional diets. The most engaged households are allocating up to one-third of their total meat spending to plant-based alternatives, signaling significant growth in the plant-based seafood market.

Plant-Based Seafood Market Players

Some of the top plant-based seafood companies offered in our report include Sotexpro, Gardein, Impossible Foods Inc., Ahimsa Foods, New Wave Foods, Ingredion GmbH, MorningStar Farms, Glanbia Plc, PURIS, Tyson Foods, Inc., SoFine Foods B.V., and Ocean Hugger Foods.

Frequently Asked Questions

How big is the plant-based seafood market?

The plant-based seafood market size was valued at USD 103.2 million in 2023.

What is the CAGR of the global plant-based seafood market from 2024 to 2032?

The CAGR of plant-based seafood is 37.4% during the analysis period of 2024 to 2032.

Which are the key players in the plant-based seafood market?

The key players operating in the global market are including Sotexpro, Gardein, Impossible Foods Inc., Ahimsa Foods, New Wave Foods, Ingredion GmbH, MorningStar Farms, Glanbia Plc, PURIS, Tyson Foods, Inc., SoFine Foods B.V., and Ocean Hugger Foods.

Which region dominated the global plant-based seafood market share?

Europe held the dominating position in plant-based seafood industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of plant-based seafood during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global plant-based seafood industry?

The current trends and dynamics in the plant-based seafood industry include increasing demand for sustainable and eco-friendly food alternatives, rising awareness about the health benefits of plant-based diets, and growing popularity of vegan and vegetarian lifestyles.

Which product held the maximum share in 2023?

The fish products product held the maximum share of the plant-based seafood industry.