Pheochromocytoma Market | Acumen Research and Consulting

Pheochromocytoma Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

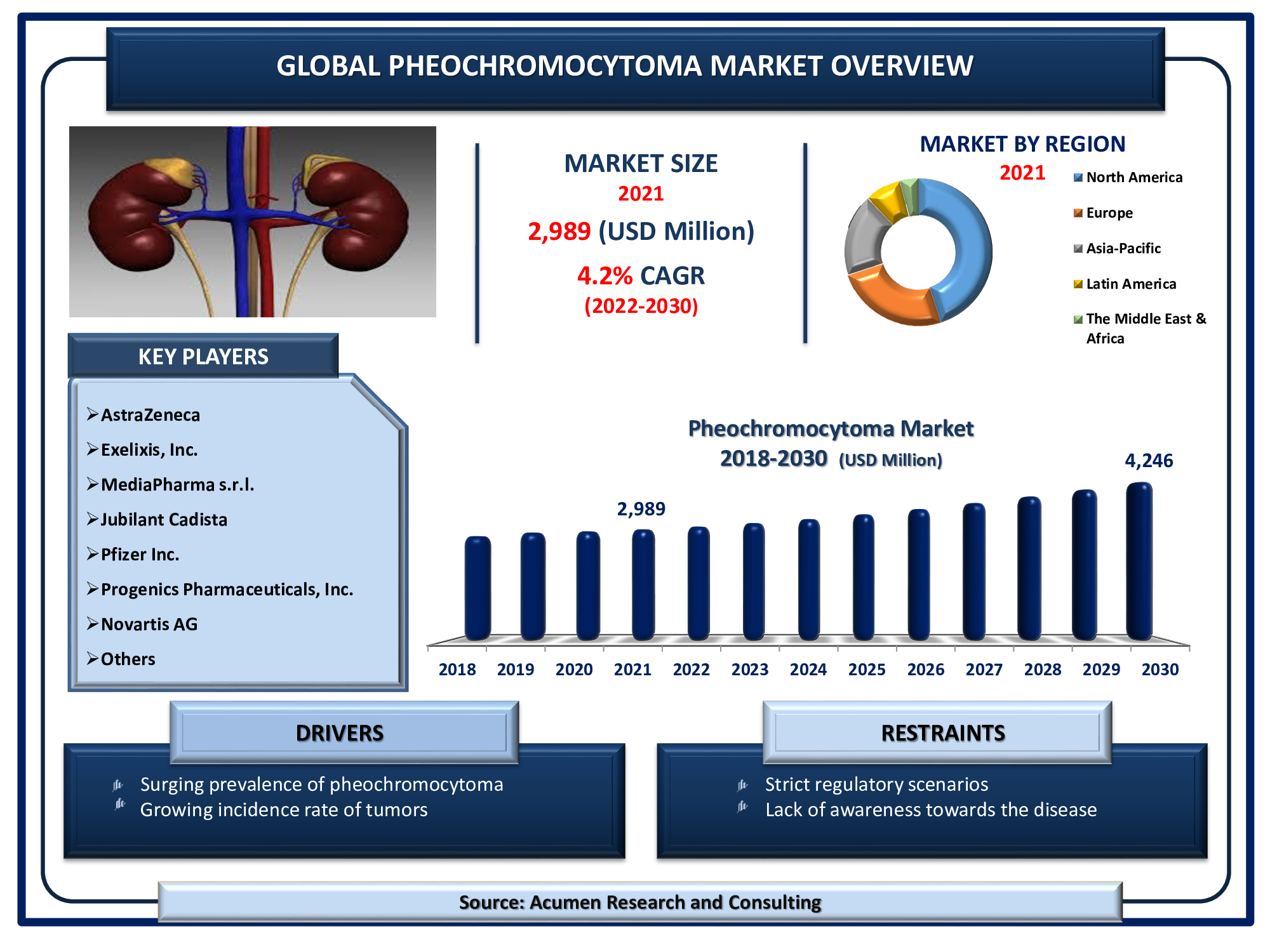

The Global Pheochromocytoma Market Size accounted for USD 2,989 Million in 2021 and will achieve a market size of USD 4,246 Million by 2030, budding at a CAGR of 4.2%.

High blood pressure, headache, heavy sweating, rapid heartbeat, etc are some major symptoms of the pheochromocytoma. Pheochromocytoma is noncancerous tumor that develops in specialized cells, called chromaffin cells, located in the center of an adrenal gland.

Global Pheochromocytoma Market DROs:

Drivers

- Surging prevalence of pheochromocytoma

- The growing incidence rate of tumors

- The rapid change in lifestyles

Restraints

- Strict regulatory scenarios

- Lack of awareness of the disease

- Scarcity of specific medications

Opportunities

- Increasing healthcare expenditure

- Rising number of clinical trials to develop new drugs

- Growing investments by leading players

Report Coverage

| Market | Pheochromocytoma Market |

| Market Size 2021 | USD 2,989 Million |

| Market Forecast 2030 | USD 4,246 Million |

| CAGR During 2022 - 2030 | 4.2% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Diagnosis, By Treatment, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AstraZeneca, Exelixis, Inc., Jubilant Cadista, MediaPharma s.r.l., Novartis AG, Pfizer Inc., Progenics Pharmaceuticals, Inc., Teva Pharmaceutical Company Limited, Valeant Pharmaceuticals International, Inc., and Zydus Cadila. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Prevalence of Pheochromocytoma tumor is witnessed across the globe. It is a rare type of tumor that originates from the chromaffin cells that are responsible for the production of necessary hormones for the body function properly. Pheochromocytoma generally is witnessed on the adrenal gland which is located above the kidney. Adrenal medulla contains major amount of chromaffin cells they can be seen in the adrenal glands inner layer. Approximately 90 percent of pheochromocytomas occur in the adrenal medulla. Approximately 10 percent occur outside of this area. Rise in number of patients suffering from chronic tumor across the globe and rapid advancements in the healthcare sector are major factors expected to drive the growth of global pheochromocytoma market. In the United States, about 2 to 8 people per every 1 million people are diagnosed with these tumors each year. Around 100 to 200 of these cases are malignant. In Europe a total of 239 patients with pheochromocytoma or paraganglioma (collectively with 251 tumors) were identified from a population of 5,196,368 people over a period of 7 years. The overall incidence of pheochromocytoma or paraganglioma was 0.66 cases per 100,000 people per year.

Drugs manufacturers are investing high for the development of new drugs, high flow of clinical trials and favorable policies by the government are factors expected to augment the growth of pheochromocytoma market.

Major players approach towards enhancing the business in emerging economies through partnerships and shift the manufacturing units to developing countries due to easy availability of raw material and low cost labor these factors are expected to boost the growth of target market. Factors such as high cost associated to drug development and lack of developed infrastructure for R&D activities in developing countries are expected to hamper the growth of global pheochromocytoma market. In addition, strict regulation by the government for product approval is expected to challenge the growth of target market. However, increasing investment for R&D activities and collaborative work approach for drug development are factors expected to create new opportunities for players operating in the pheochromocytoma market over the forecast period. In addition, increasing acquisition activities by major players in order to strengthen its customer base and enhance the product offerings is expected to support the revenue transaction of the target market.

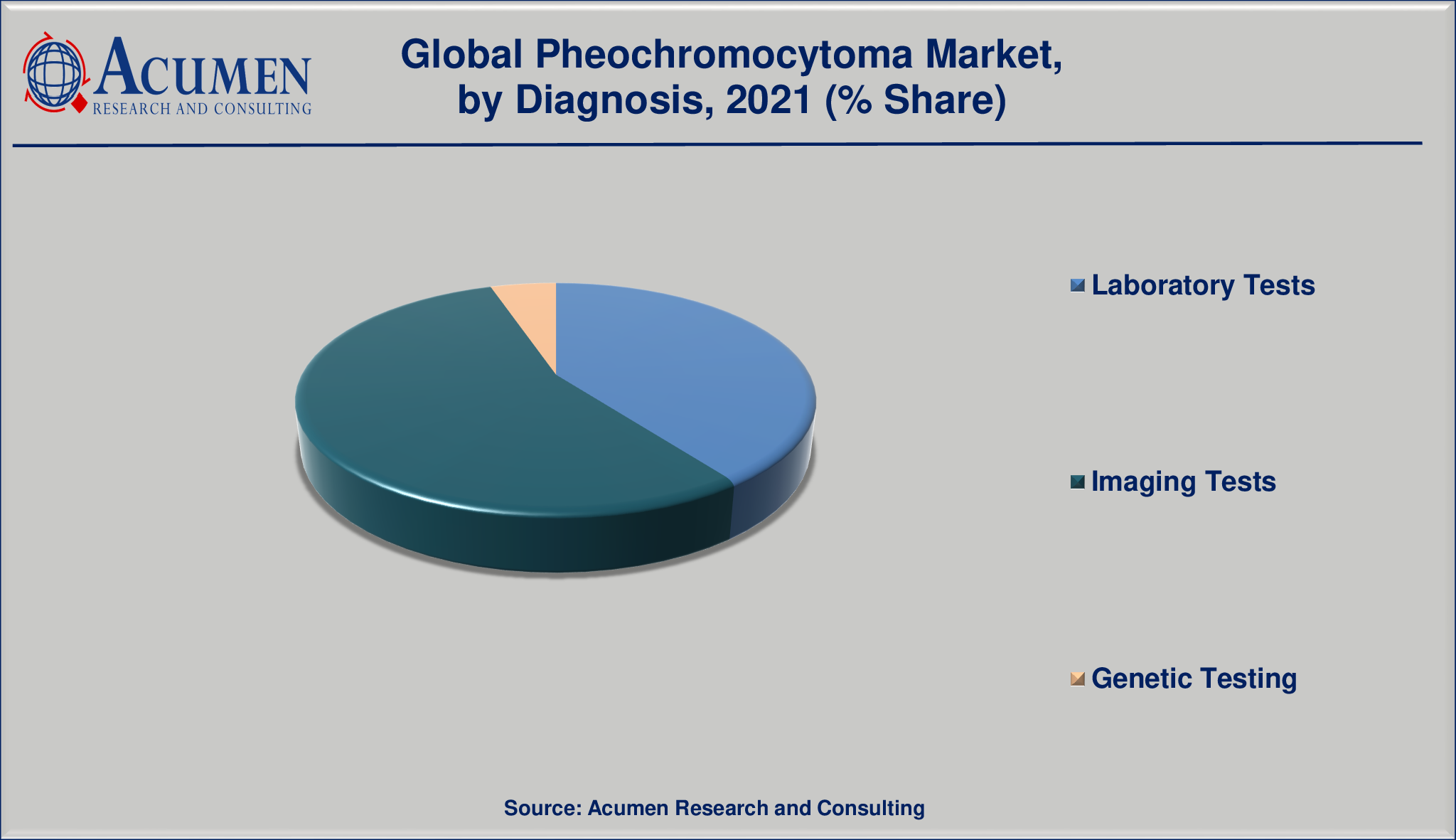

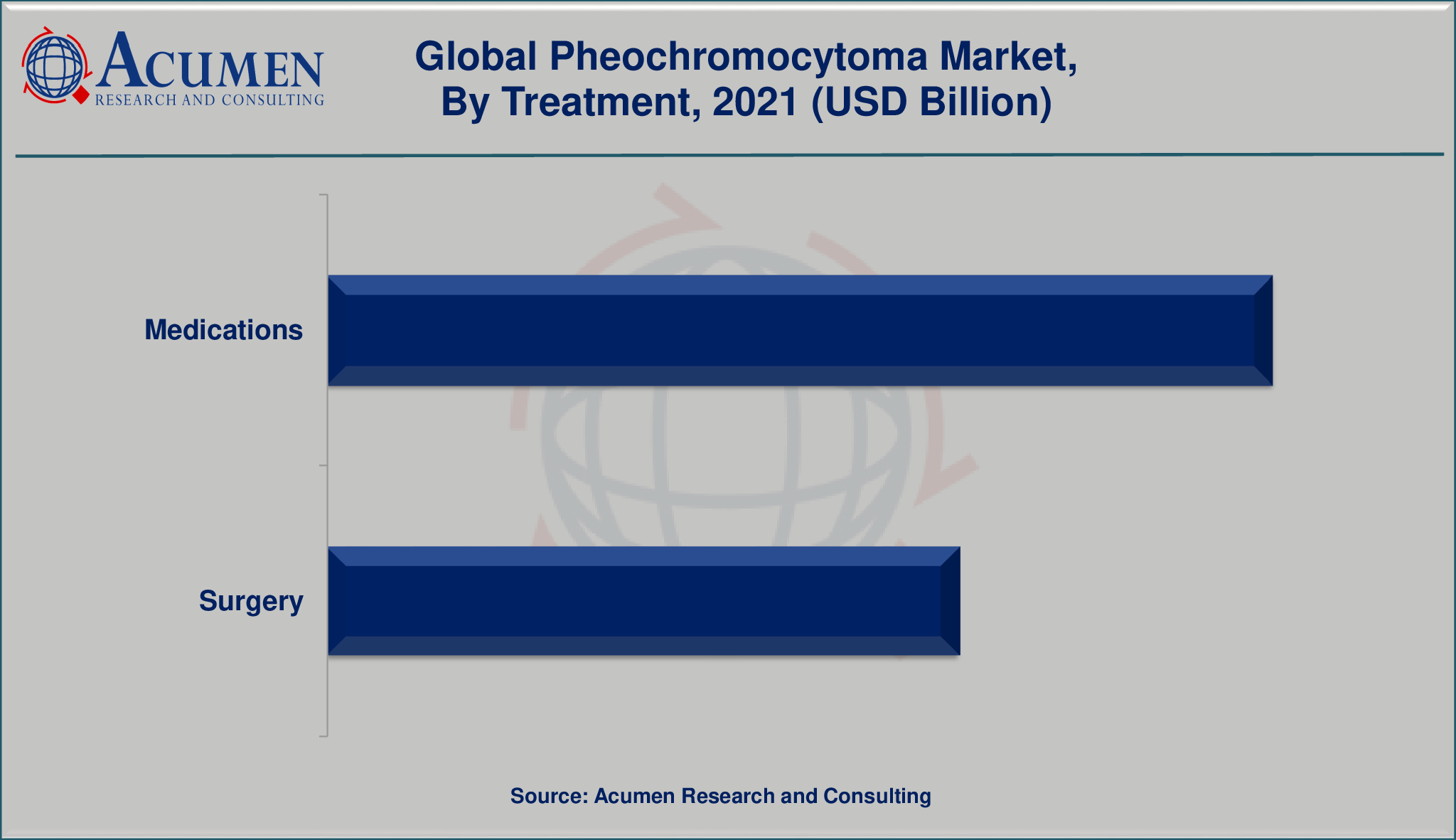

Pheochromocytoma Market Segmentation

The global pheochromocytoma market is segmented into diagnosis and treatment. The diagnosis segment is divided into laboratory tests, imaging tests, and genetic testing. The treatment segment is bifurcated into medications and surgery. Among treatment the medication segment is expected to account for major revenue share in the global pheochromocytoma market.

Market by Diagnosis

- Laboratory Tests

- Imaging Tests

- Genetic Testing

Market by Treatment

- Medications

- Surgery

Pheochromocytoma Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Presence of large number of players in North America region, fuels the regional market growth

The market in North America is expected to account for major revenue share in the global pheochromocytoma market due to high patient pool suffering from chronic diseases. Presence of large number of players operating in the country and introduction of new drugs is expected to augment the growth of pheochromocytoma market. Increasing acquisition activities by major players in order to enhance the business and increase the product portfolio is expected to support the region market growth.

Pheochromocytoma Market Players

Some of the top pheochromocytoma companies offered in the professional report include AstraZeneca, Exelixis, Inc., Jubilant Cadista, MediaPharma s.r.l., Novartis AG, Pfizer Inc., Progenics Pharmaceuticals, Inc., Teva Pharmaceutical Company Limited, Valeant Pharmaceuticals International, Inc., and Zydus Cadila.

In 2019, Ono Pharmaceutical Co. Ltd., a global drug manufacturer launched “Demser” Capsule 250 mg a tyrosine hydroxylase inhibitor for the improvement of status of catecholamine excess secretion in pheochromocytoma in Japan market. This product launch is expected to help the company to enhance the business and increase the revenue share.

In 2018, U.S. Food and Drug Administration approved “Azedra” an injection made by Progenics Pharmaceuticals, Inc. in the US market. The injection is for intravenous use for the treatment of adults and adolescents age 12 and older with rare tumors of the adrenal gland. This is expected to help the company to enhance the business and increase the revenue share in the market.

Frequently Asked Questions

How much was the global pheochromocytoma market size in 2021?

The global pheochromocytoma market size in 2021 was accounted to be USD 2,989 Million.

What will be the projected CAGR for global pheochromocytoma market during forecast period of 2022 to 2030?

The projected CAGR pheochromocytoma market during the analysis period of 2022 to 2030 is 4.2%.

Which are the prominent competitors operating in the market?

The prominent players of the global pheochromocytoma market are AstraZeneca, Exelixis, Inc., Jubilant Cadista, MediaPharma s.r.l., Novartis AG, Pfizer Inc., Progenics Pharmaceuticals, Inc., Teva Pharmaceutical Company Limited, Valeant Pharmaceuticals International, Inc., and Zydus Cadila.

Which region held the dominating position in the global pheochromocytoma market?

North America held the dominating pheochromocytoma during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for pheochromocytoma during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global pheochromocytoma market?

Surging prevalence of pheochromocytoma, growing incidence rate of tumors and rapid change in lifestyles drives the growth of global pheochromocytoma market.

By segment diagnosis, which sub-segment held the maximum share?

Based on diagnosis, imaging tests segment held the maximum share pheochromocytoma market in 2021.