Pharmaceutical Excipients Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Pharmaceutical Excipients Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

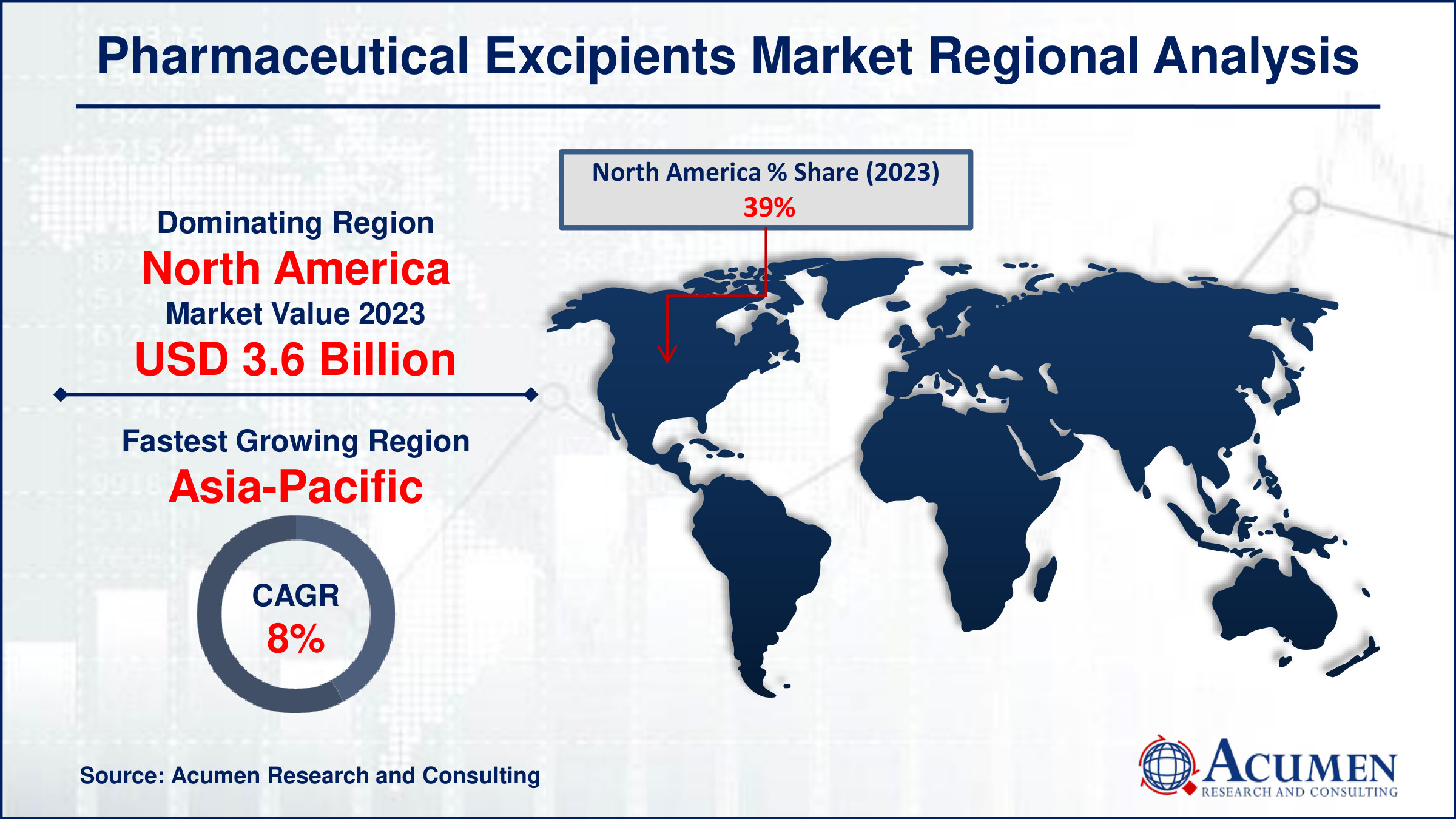

Request Sample Report

The Pharmaceutical Excipients Market Size accounted for USD 9.3 Billion in 2023 and is estimated to achieve a market size of USD 17.2 Billion by 2032 growing at a CAGR of 7.2% from 2024 to 2032.

Pharmaceutical Excipients Market Highlights

- Global pharmaceutical excipients market revenue is poised to garner USD 17.2 billion by 2032 with a CAGR of 7.2% from 2024 to 2032

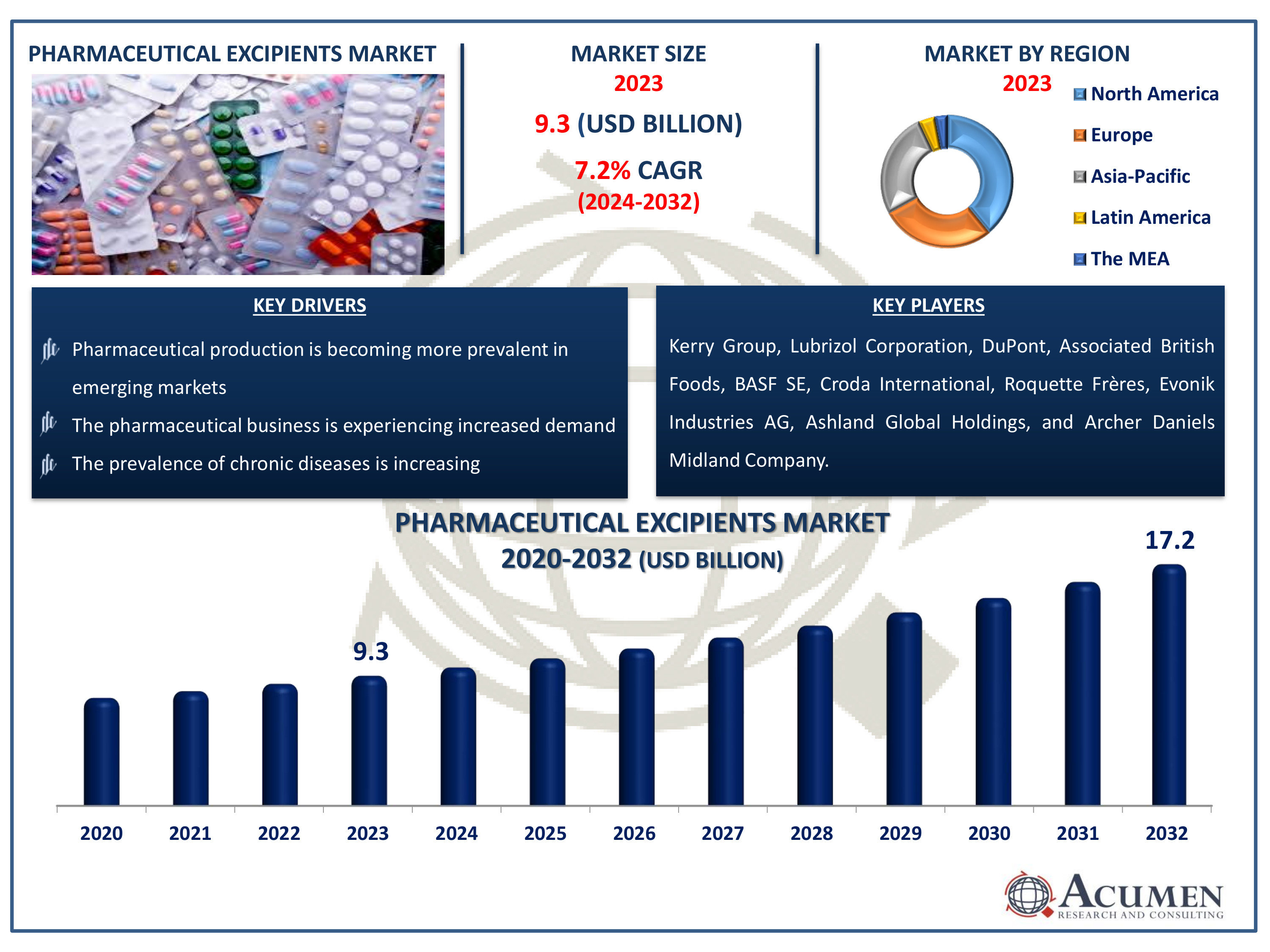

- North America pharmaceutical excipients market value occupied around USD 3.6 billion in 2023

- Asia-Pacific pharmaceutical excipients market growth will record a CAGR of more than 8% from 2024 to 2032

- Among function, the binders sub-segment generated more than USD 1.7 billion revenue in 2023

- Based on formulation, the oral sub-segment generated around 41% pharmaceutical excipients market share in 2023

- Advancements in nanotechnology and drug delivery technologies is a popular pharmaceutical excipients market trend that fuels the industry demand

Pharmaceutical excipients are pharmaceutically inactive substances in the final formulation. Standard purposes of using excipients along with the active ingredients are streamlining the manufacturing of formulation and facilitate physiological absorption of drugs and support or enhance the stability of formulation. Various excipients are used in the single formulation and account for about 90% of the product. However, they cost about 0.5% to 1.0% of the total product. Emerging multifunctional excipients, growing pharmaceutical industry, and surge in the demand of generics are the key growth factors of the market.

Flavoring agents & sweeteners and coloring agents are used to enhance the aesthetic nature of formulation and improve the ease of administration among patients. Fillers and diluents accounted for the largest share of the market as they are used to provide bulk to the formulation. Hence, the requirement of fillers is more in the final formulation. Organic chemicals and inorganic chemicals are the key pharmaceutical excipients.

Global Pharmaceutical Excipients Market Dynamics

Market Drivers

- Rising prevalence of chronic diseases

- Multifunctional excipients are becoming increasingly popular

- Pharmaceutical production is becoming more prevalent in emerging markets

Market Restraints

- Stringent regulatory standards

- Production costs are high in developed regions

- Disruptions in the supply chain impair raw material availability

Market Opportunities

- Growth in developing markets such as Asia Pacific and Latin America

- Excipients that are both novel and sustainable will be developed

- Biologics and specialized pharmaceuticals have seen increased investment

Pharmaceutical Excipients Market Report Coverage

| Market | Pharmaceutical Excipients Market |

| Pharmaceutical Excipients Market Size 2022 | USD 9.3 Billion |

| Pharmaceutical Excipients Market Forecast 2032 | USD 17.2 Billion |

| Pharmaceutical Excipients Market CAGR During 2023 - 2032 | 7.2% |

| Pharmaceutical Excipients Market Analysis Period | 2020 - 2032 |

| Pharmaceutical Excipients Market Base Year |

2022 |

| Pharmaceutical Excipients Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Function, By Formulation, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Kerry Group, Lubrizol Corporation, DuPont, Associated British Foods, BASF SE, Croda International, Roquette Frères, Evonik Industries AG, Ashland Global Holdings, and Archer Daniels Midland Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pharmaceutical Excipients Market Insights

Several factors drive the pharmaceutical excipients market, including the expansion of the pharmaceutical industry, the rising usage of multifunctional excipients, and the availability of high-quality raw materials and excipients. Rising drug demand, particularly in response to the increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular problems, is propelling the pharmaceutical business forward. As the demand for effective and efficient drug delivery systems rises, so does the need for multifunctional excipients that improve the performance of active pharmaceutical ingredients. Furthermore, the availability of high-quality raw materials and excipients ensures that pharmaceutical products are consistently manufactured.

Furthermore, the entry of pharmaceutical behemoths into emerging countries such as Asia-Pacific and Latin America is a major driver of market growth. These regions are experiencing a growth in disposable income and healthcare awareness, which is increasing demand for pharmaceutical products and, consequently, excipients. Pharmaceutical use is growing over the world as a result of enhanced healthcare infrastructure, advantageous reimbursement schemes, and technological advancements. Telehealth facilities also play an important role in providing healthcare services and expert consultations to rural and isolated areas, hence improving pharmaceutical availability. However, market expansion is limited by high production costs in industrialized countries and severe regulatory controls. These issues present obstacles to manufacturers, potentially limiting the overall growth of the pharmaceutical excipients market.

Pharmaceutical Excipients Market Segmentation

The worldwide market for pharmaceutical excipients is split based on product, function, formulation, and geography.

Pharmaceutical Excipients Market By Product

- Organic Chemicals

- Oleochemicals

- Carbohydrates

- Petrochemicals

- Proteins

- Others

- Inorganic Chemicals

- Calcium Phosphate

- Metal Oxides

- Halites

- Calcium Carbonate

- Calcium Sulphate

- Others

- Others

According to pharmaceutical excipients industry analysis, based on the product, the pharmaceutical excipients are divided into organic chemicals, inorganic chemicals, and others. The organic chemicals segment dominated the pharmaceutical excipients market in 2023. This can be attributed to high demand from the pharmaceutical industry as organic chemicals such as proteins, carbohydrates, oleochemicals, and petrochemicals are majorly used in pharmaceutical formulations.

Pharmaceutical Excipients Market By Functions

- Coating Agents

- Fillers & Diluents

- Suspending & Viscosity Agents

- Binders

- Flavoring Agents & Sweeteners

- Disintegrants

- Colorants

- Emulsifying agents

- Lubricants & Glidants

- Preservatives

- Others

On the basis of function, the market has been segmented into coating agents, filers & diluents, suspending & viscosity agents, binders, flavoring agents & sweeteners, disintegrants, colorants, emulsifying agents, lubricants & glidants, and preservatives. Binders sub segment is the generate largest revenue in the market and the fillers & diluents segment has the notable share. These excipients are important in tablet and capsule formulations because they help produce the proper size and shape, making the product easier to handle and administer. Fillers and diluents also play an important role in ensuring appropriate dose of active pharmaceutical ingredients (APIs) by adding bulk. Their widespread use in a variety of dosage forms, as well as the increased production of solid oral pharmaceuticals, contribute to their market domination, making them an essential component in pharmaceutical manufacturing.

Pharmaceutical Excipients Market By Formulations

- Oral

- Tablet

- Capsule

- Hard Gelatin

- Soft Gelatin

- Liquid

- Other Oral Formulations

- Parenteral

- Topical

- Other Formulations

The oral formulation sector is estimated to account for a sizable percentage in the pharmaceutical excipients market forecast period due to rising demand for oral drug delivery methods such as tablets, capsules, and liquids. Oral formulations are favored for their ease of usage, patient compliance, and cost effectiveness. They are also adaptable, supporting controlled-release, immediate-release, and sustained-release characteristics. The rising prevalence of chronic diseases, as well as the growing demand for generic pharmaceuticals, drive up the manufacturing of oral dosage forms. As a result, the demand for excipients in these formulations is likely to stay high, boosting market growth.

Pharmaceutical Excipients Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Pharmaceutical Excipients Market Regional Analysis

North America dominated the market in 2023. However, Asia-Pacific is anticipated to propel the market growth with the fastest rate during the pharmaceutical excipient industry forecast period. Presence of pharmaceutical giants in the region, emphasis on high quality pharmaceutical products, and high consumption & demand for novel excipients are the key driving factors for the dominance of North America in the global market. The increasing number of pharmaceutical product manufacturers in Asia Pacific is expected to increase the demand for excipients in the coming years. Furthermore, extensive R&D in healthcare, rising disposable income, and increasing treatment rate are other factors to boost the pharmaceutical excipients market in Asia Pacific. Low cost raw materials and workforce and availability of resources for manufacturing facility are attracting several pharmaceutical companies in Asia Pacific. Japan, China, India, Singapore, and Australia are some of the major contributing countries in the region.

Pharmaceutical Excipients Market Players

Some of the top pharmaceutical excipients companies offered in our report includes Kerry Group, Lubrizol Corporation, DuPont, Associated British Foods, BASF SE, Croda International, Roquette Frères, Evonik Industries AG, Ashland Global Holdings, and Archer Daniels Midland Company.

Frequently Asked Questions

How big is the pharmaceutical excipients market?

The pharmaceutical excipients market size was valued at USD 9.3 Billion in 2023.

What is the CAGR of the global pharmaceutical excipients market from 2024 to 2032?

The CAGR of pharmaceutical excipients is 7.2% during the analysis period of 2024 to 2032.

Which are the key players in the pharmaceutical excipients market?

The key players operating in the global market are including Kerry Group, Lubrizol Corporation, DuPont, Associated British Foods, BASF SE, Croda International, Roquette Frères, Evonik Industries AG, Ashland Global Holdings, and Archer Daniels Midland Company.

Which region dominated the global pharmaceutical excipients market share?

North America held the dominating position in pharmaceutical excipients industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of pharmaceutical excipients during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global pharmaceutical excipients industry?

The current trends and dynamics in the pharmaceutical excipients industry include the pharmaceutical business is experiencing increased demand, the prevalence of chronic diseases is increasing, multifunctional excipients are becoming increasingly popular, and pharmaceutical production is becoming more prevalent in emerging markets.

Which function held the maximum share in 2023?

The oral function held the maximum share of the pharmaceutical excipients industry.