Payment Gateway Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Payment Gateway Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

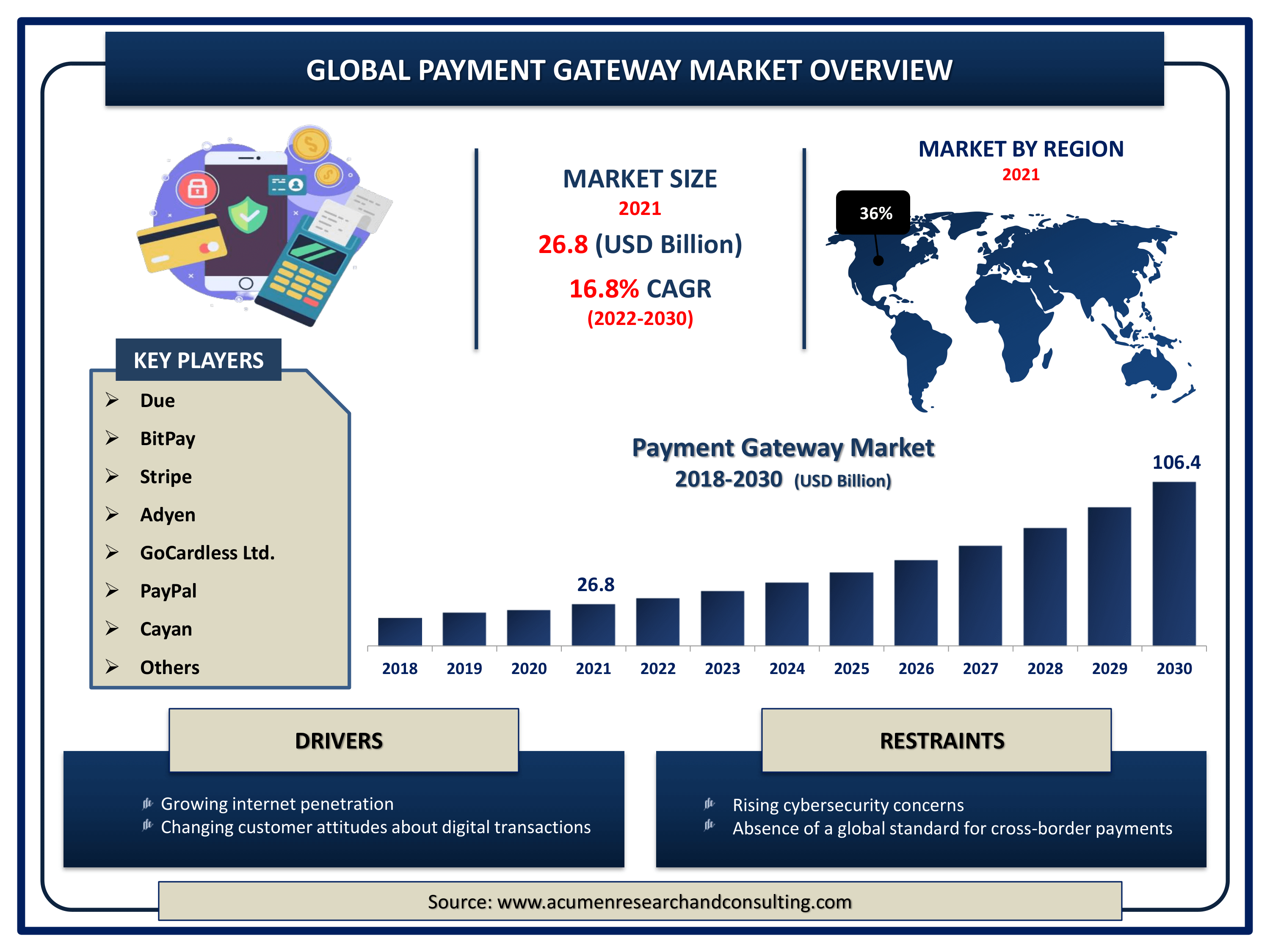

The Global Payment Gateway Market Size accounted for USD 26.8 Billion in 2021 and is estimated to achieve a market size of USD 106.4 Billion by 2030 growing at a CAGR of 16.8% from 2022 to 2030. Rising e-commerce transactions and global digital penetration are two additional important aspects expected to drive the payment gateway market value. Moreover, the transition in merchants and consumers predilection to the online platform for enabling online electronic payments is expected to boost the payment gateway market growth in the future years.

Payment Gateway Market Report Key Highlights

- Global payment gateway market revenue is expected to increase by USD 106.4 billion by 2030, with a 16.8% CAGR from 2022 to 2030

- North America region dominates with more than 36% payment gateway market share in 2021

- According to the GSMA, mobile internet penetration in Asia-Pacific is expected to reach 62% in 2025, up from 45% in 2018

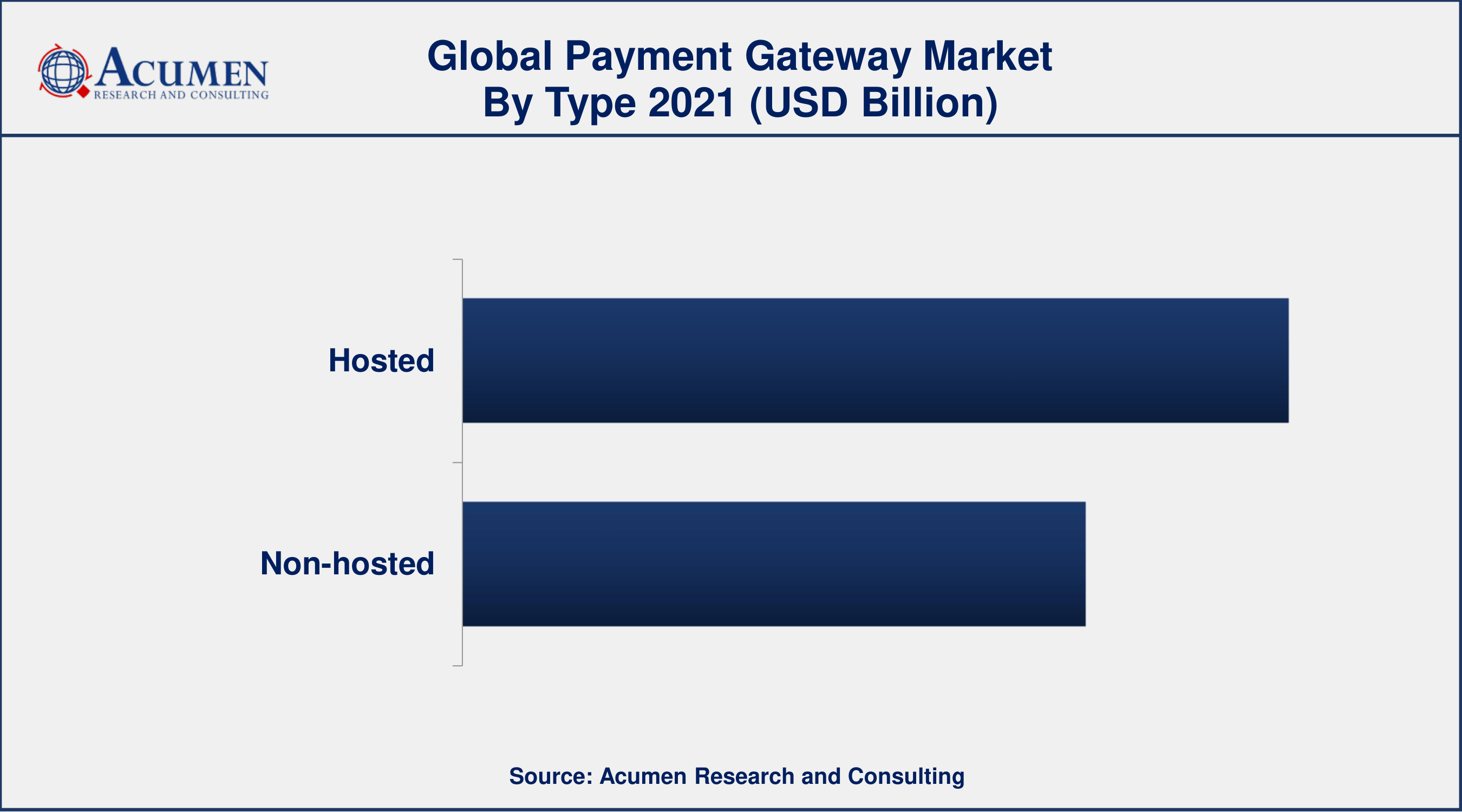

- By type, the hosted segment has accounted market share of over 57% in 2021

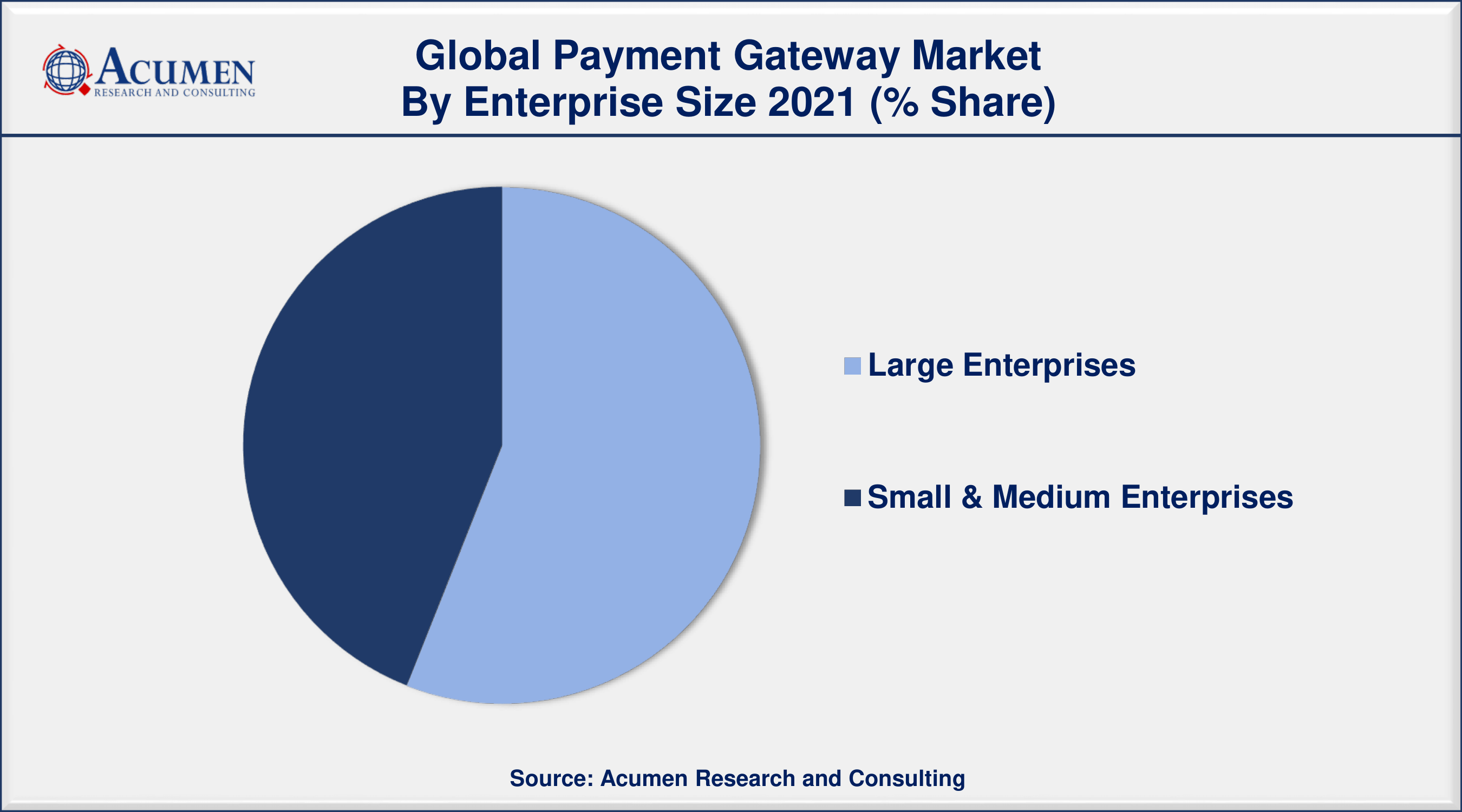

- By enterprise size, large enterprise segment engaged more than 55% of the total market share in 2021

- Among end use, retail and e-commerce sector is growing at a strongest CAGR over the forecast period

A payment gateway is an online platform service that works in tandem with an e-commerce platform to serve as a middleman for sending and receiving payments. An online payment gateway's primary function is to approve the transaction between the merchant and the customer. Furthermore, any business that collects money online needs a payment gateway. It has grown in popularity in the global market due to its numerous advantages, such as quick payment settlement and hassle-free transaction flow.

COVID-19 impact on the global payment gateway market

COVID-19 has had a positive impact on the global payment gateway market trend. COVID-19 triggered the expansion of e-commerce/online transactions with a focus on new firms, customer-centric approaches, and product types. Consumers now have access to a wide range of products at their leisure and safety from the comfort of their own homes, thanks to the growth of online transactions. According to an OECD report, sales in grocery stores and non-store retailers (primarily e-commerce providers) in the United States have reached new highs of nearly 16% and 14.8%, respectively. Furthermore, in the EU, retail sales from mail-order houses or the internet increased by 30% in April 2020 compared to April 2019. Furthermore, in the United Kingdom, the share of e-commerce in retail increased from 17.3% to 20.3% between the first quarter of 2018 and the first quarter of 2020, resulting in an exponential rise of 31.3% for the first and second quarters of 2020.

Global Payment Gateway Market Dynamics

Market Drivers

- Growing e-commerce transactions as well as internet penetration

- Changing customer attitudes about digital transactions

- Increasing financial literacy in impoverished countries

- Catalyzed investments in the financial industry

Market Restraints

- Rising cybersecurity concerns

- Absence of a global standard for cross-border payments

Market Opportunities

- Supportive governmental policies

- Digitalization in the retail sector

Payment Gateway Market Report Coverage

| Market | Payment Gateway Market |

| Payment Gateway Market Size 2021 | USD 26.8 Billion |

| Payment Gateway Market Forecast 2030 | USD 106.4 Billion |

| Payment Gateway Market CAGR During 2022 - 2030 | 16.8% |

| Payment Gateway Market Analysis Period | 2018 - 2030 |

| Payment Gateway Market Base Year | 2021 |

| Payment Gateway Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Enterprise Size, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Due, BitPay, Stripe, Square Capital, LLC, Payline Data Services LLC, Adyen, Flagship Merchant Services, GoCardless Ltd., PayPal, and Cayan. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

High Internet Utility And Smartphone Adoption Stimulate The Growth Of Global Payment Gateway Market Size

The current increase in digital literacy has resulted in an influx of investment in e-commerce firms, leveraging the market for new players to establish their base globally by churning out innovative patterns that disrupt old functioning. E-commerce has become an essential component of the global retail framework in recent years, propelling the payment gateway market. Furthermore, the widespread adoption of smartphones, the launch of 4G network services, rising consumer wealth, and the consumer shift toward online purchases have grown exponentially, resulting in a rapid expansion of the global payment gateway market. Furthermore, according to the Indian Brand Equity Foundation (IBEF) in India, smart phone shipments reached 150 million units and 5G smartphone shipments crossed 4 million in 2020, driven by high consumer demand following the lockdown. The retail sector, like many other industries, has undergone a drastic transformation as a result of the increasing prevalence of the internet and the ongoing digitalization of modern life, with consumers shifting to a virtual mode, resulting in profit marking by payment gateways in every country. As internet access and adoption grow at a rapid pace around the world, the number of digital buyers grows year after year.

Startups Are Witnessing High Brink In Global Payment Gateway Market

According to the ORF report, start-ups and a number of young entrepreneurs are driving digital innovation. As of 2020, the Indo-Pacific region is home to 55,200 start-ups. Digital start-ups are growing regionally as a result of intra-ASEAN investments and mergers and acquisitions. Furthermore, with a primary focus on innovation, digital e-commerce, and the operation of major players, intraregional investments and connectivity is significantly strengthening. Apart from that, major players with large consumer bases are expanding their service portfolio on their platforms by entering new sectors. Grab, for example, has expanded its financial services. Similarly, Gojek, an Indonesia-based ride-hailing unicorn, operates in Singapore, Vietnam, and Thailand and provides more than 18 financial and lifestyle services.

Payment Gateway Market Segmentation

The global payment gateway market segmentation is based on type, enterprise size, end use, and geography.

Payment Gateway Market By Type

- Hosted

- Non-hosted

According to a payment gateway industry analysis, the hosted segment will account for a sizable portion of the global market. As a hosted payment gateway tapped with more security purposes for merchants' secure transactions, it has gained prominence in the global market. Furthermore, all hosted payments are conducted in accordance with the PCI-DSS standards, which meet the compliance requirement, which increases the utility of hosted medium and ultimately contributes to the growth of the global payment gateway market.

Payment Gateway Market By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

In terms of enterprise size, the large enterprise category held the largest market share in 2021. Large enterprises typically have more clients visit their websites, necessitating the adoption of efficient services for their consumers during the purchase process. Payment gateway systems can make the checkout process more convenient for clients by supporting multiple methods of digital payment such as online banking and debit or credit cards. Furthermore, these businesses require a very secure and safe manner of the transaction, which payment gateways allow.

Payment Gateway Market By End Use

- BFSI

- Retail & E-commerce

- Media & Entertainment

- Travel & Hospitality

- Others

According to the payment gateway market forecast, the retail and e-commerce segment is predicted to increase significantly in the market over the next few years. The shift in consumer purchasing habits toward online purchases has resulted in the expansion of the retail sector. This is one of the most important factors influencing the growth of the global payment gateway market. Furthermore, as a result of the advent of digitalization and increasing smartphone utility, large enterprises have completely shifted their focus to selling products through online retail platforms in order to capture the lion's share of the market. This contributes to the retail sector's growth.

Payment Gateway Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America dominates; Asia Pacific fastest records fastest growth for payment gateway market

North America has dominated the payment gateway market in the past and will continue to do so during the forecast period. The revenue generated in North America is due to the large consumer base's accelerated shift to digital channels. This has received a lot of attention because of the increased influx of credit cards, which are considered to be the largest source of payment in the region by about 44%.

The Asia-Pacific, on the other hand, is expected to have the fastest-growing CAGR in the payment gateway market. Rising consumerism, a high influx of digital economy and adoption, and an influx of startups are the major factors driving the region's phenomenal growth. According to the ORF report, digital economies, specifically India and South East Asia (SEA), are on the rise as a result of e-commerce, ride-hailing, food delivery, and the hyper-local service sector. E-commerce is the largest sector in SEA, with a projected value of US$123 Bn by 2025. Furthermore, startups fuel digital innovations. India is home to 72% of startups, with the SEA region accounting for 24% and Australia accounting for a meager 4%.

Payment Gateway Market Players

Some of the top payment gateway market companies offered in the professional report includes Due, BitPay, Stripe, Square Capital, LLC, Payline Data Services LLC, Adyen, Flagship Merchant Services, GoCardless Ltd., PayPal, and Cayan.

Frequently Asked Questions

What is the size of global payment gateway market in 2021?

The estimated value of global payment gateway market in 2021 was accounted to be USD 26.8 Billion.

What is the CAGR of global payment gateway market during forecast period of 2022 to 2030?

The projected CAGR payment gateway market during the analysis period of 2022 to 2030 is 16.8%.

Which are the key players operating in the market?

The prominent players of the global payment gateway market are Due, BitPay, Stripe, Square Capital, LLC, Payline Data Services LLC, Adyen, Flagship Merchant Services, GoCardless Ltd., PayPal, and Cayan.

Which region held the dominating position in the global Payment Gateway market?

North America held the dominating payment gateway during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for payment gateway during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global payment gateway market?

Growing e-commerce transactions as well as internet penetration, and changing customer attitudes about digital transactions, drives the growth of global payment gateway market.

By Enterprise Size segment, which sub-segment held the maximum share?

Based on enterprise size, large enterprises segment is expected to hold the maximum share of the payment gateway market.