Palletizing Robot Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Palletizing Robot Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

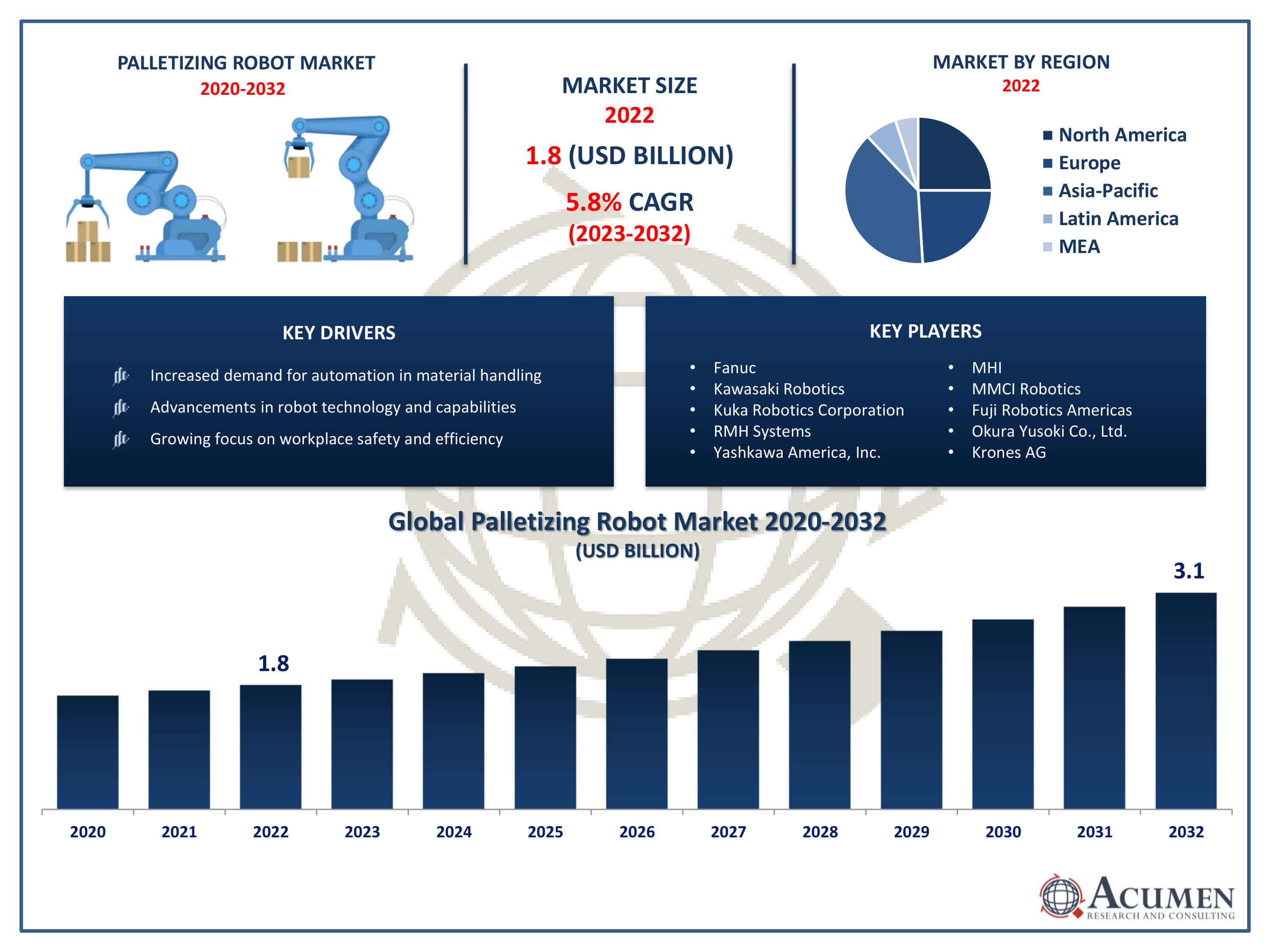

Request Sample Report

The Palletizing Robot Market Size accounted for USD 1.8 Billion in 2022 and is projected to achieve a market size of USD 3.1 Billion by 2032 growing at a CAGR of 5.8% from 2023 to 2032.

Palletizing Robot Market Key Highlights

- Global Palletizing Robot Market revenue is expected to increase by USD 3.1 Billion by 2032, with a 5.8% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 34% of Palletizing Robot Market share in 2022

- Europe Palletizing Robot Market growth will record a CAGR of more than 6.3% from 2023 to 2032

- By robot type, the articulated robot segment contributed over 55% of revenue share in 2022

- By end-use, the food and beverage segment captured more than 36% of revenue share in 2022

- Increased demand for automation in material handling, drives the Palletizing Robot Market value

A palletizing robot is a type of industrial robot designed to handle the task of loading or unloading items onto pallets in a warehouse or manufacturing setting. These robots are equipped with specialized end-of-arm tools, such as grippers or suction cups, to pick up and place products onto pallets with precision and efficiency. Palletizing robots automate a process that was traditionally manual, leading to increased productivity, reduced labor costs, and improved overall efficiency in material handling operations.

The market for palletizing robots has experienced significant growth in recent years, driven by the increasing demand for automation in various industries. Companies across sectors such as manufacturing, logistics, and e-commerce are adopting palletizing robots to streamline their operations and stay competitive in a rapidly changing business landscape. The market growth is attributed to factors such as advancements in robot technology, improvements in robotic capabilities, and the need for enhanced speed and accuracy in palletizing tasks. Additionally, the rising focus on workplace safety and the optimization of supply chain processes contribute to the growing adoption of palletizing robots globally. As industries continue to embrace automation, the palletizing robot market is expected to see sustained expansion in the coming years.

Global Palletizing Robot Market Trends

Market Drivers

- Increased demand for automation in material handling

- Advancements in robot technology and capabilities of robotic process automation

- Growing focus on workplace safety and efficiency

- Increasing e-commerce activities

Market Restraints

- High initial investment costs for robotic systems

- Limited adaptability to handle diverse product types

Market Opportunities

- Emerging markets and industries seeking automation solutions

- Integration of artificial intelligence for enhanced robot intelligence

Palletizing Robot Market Report Coverage

| Market | Palletizing Robot Market |

| Palletizing Robot Market Size 2022 | USD 1.8 Billion |

| Palletizing Robot Market Forecast 2032 | USD 3.1 Billion |

| Palletizing Robot Market CAGR During 2023 - 2032 | 5.8% |

| Palletizing Robot Market Analysis Period | 2020 - 2032 |

| Palletizing Robot Market Base Year |

2022 |

| Palletizing Robot Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Range, By Payload, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Fanuc, Kawasaki Robotics, Kuka Robotics Corporation, RMH Systems, Yashkawa America, Inc., MHI, MMCI Robotics, Fuji Robotics Americas, Okura Yusoki Co., Ltd., Schneider Packaging Equipment Co. Inc., Krones AG, and Concetti S.P.A. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Palletizing robots are equipped with specialized end-of-arm tools, such as grippers, suction cups, or clamps, which enable them to pick up products from a conveyor belt or another source and accurately place them onto pallets in a predetermined pattern. Palletizing robots streamline and automate the palletization process, offering increased efficiency, precision, and speed compared to traditional manual methods. The applications of palletizing robots are widespread across various industries, including manufacturing, logistics, and distribution. In manufacturing, these robots are employed to palletize finished products for storage or shipment. In warehouses and distribution centers, palletizing robots play a crucial role in organizing and preparing products for transportation, contributing to faster order fulfillment and reduced labor costs.

The palletizing robot market has witnessed robust growth in recent years, driven by the increasing adoption of automation solutions across industries. As businesses strive for greater efficiency and cost-effectiveness in their material handling processes, palletizing robots have become a key enabler. The market growth is fueled by advancements in robotic technology, leading to improved capabilities, greater precision, and enhanced flexibility in handling various types of products. These robots offer significant advantages, such as increased productivity, reduced labor costs, and the ability to operate in diverse environments. The global palletizing robot market is poised for continued expansion, with key factors contributing to its growth. The rise of e-commerce and the need for efficient order fulfillment processes have spurred the demand for palletizing robots in warehouses and distribution centers.

Palletizing Robot Market Segmentation

The global Palletizing Robot Market segmentation is based on component, range, payload, application, end-use, and geography.

Palletizing Robot Market By Component

- SCARA

- Articulated Robot

- Deltas

- Cobots

- Gantry Robot

According to palletizing robot industry analysis, the articulated robot segment held the largest market share in 2022. Articulated robots, characterized by their multi-joint design resembling a human arm, offer unparalleled flexibility and precision in palletizing tasks. This segment's growth is driven by the increasing demand for sophisticated robotic solutions that can handle a diverse range of products and adapt to changing production needs. One of the key factors contributing to the growth of articulated palletizing robots is their ability to efficiently navigate complex environments and accommodate varied palletizing patterns. These robots excel in applications where a high degree of dexterity is required, allowing them to pick, place, and stack items with precision. Industries such as manufacturing, logistics, and food and beverage have particularly embraced articulated palletizing robots due to their versatility in handling different shapes, sizes, and weights of products.

Palletizing Robot Market By Range

- Below 1,000 mm

- 1,000-3,000 mm

- Above 3,000 mm

In terms of range, the 1,000-3,000 mm segment dominates the market in 2022. This segment represents the size range of the robot's arm reach, and the 1,000-3,000 mm category strikes a balance between versatility and efficiency. Companies across manufacturing, logistics, and distribution sectors have increasingly adopted palletizing robots within this size range to accommodate varying pallet configurations and optimize their material handling processes. The growth of the 1,000-3,000 mm segment can be attributed to the adaptability of robots within this range to handle both small and large payloads, making them suitable for applications with diverse product sizes.

Palletizing Robot Market By Payload

- Less than 100 kg

- 100-300 kg

- 300-500 Kg

- Above 500 Kg

According to the palletizing robot market forecast, the 100-300 kg segment is expected to witness significant growth in the coming years. This segment caters to industries with requirements for robust and powerful robots, such as manufacturing and logistics, where there's a need to lift and stack larger and heavier products efficiently. The growth in this segment is indicative of the increasing trend toward automating tasks that involve substantial payloads, offering companies the advantages of improved productivity and streamlined operations. The versatility of palletizing robots within the 100-300 kg payload range makes them well-suited for handling a diverse range of products, from bulky items in manufacturing facilities to heavy packages in distribution centers.

Palletizing Robot Market By Application

- Cases and Boxes Palletizing

- Bundles Palletizing

- Bags and Sacks Palletizing

- Others

Based on the application, the cases and boxes palletizing segment is expected to witness significant growth in the coming years. With the rise of e-commerce and the need for efficient order fulfillment, the demand for palletizing robots specializing in cases and boxes has surged. These robots are designed to handle a variety of packaging shapes and sizes, making them crucial in warehouses and distribution centers where diverse products need to be palletized with speed and precision. The growth of the cases and boxes palletizing segment is driven by the advantages these robots offer in terms of accuracy, consistency, and throughput. Palletizing robots can be programmed to arrange cases and boxes in specific patterns, optimizing pallet density and ensuring stable and secure loads for transportation. The segment's expansion is also attributed to advancements in vision systems and sensing technologies, enabling robots to adapt to variations in product dimensions and configurations.

Palletizing Robot Market By End-use

- Discrete Manufacturing

- Electrical & Electronics

- Chemicals & Materials

- Food and Beverage

- Transportation & Warehousing

- Pharmaceutical & Healthcare

- Others

In terms of end-use, the food and beverage segment has been experiencing significant growth in recent years. Palletizing robots play a pivotal role in the food and beverage sector by streamlining the palletization of packaged goods, including boxes, cartons, and containers of various shapes and sizes. The demand for these robots is fueled by the need for improved efficiency, hygiene, and compliance with stringent quality standards in food handling and packaging. One of the key factors contributing to the growth of palletizing robots in the food and beverage segment is their ability to maintain a high level of cleanliness and adherence to safety regulations. Many palletizing robots in this sector are designed with materials and coatings that meet food-grade standards, ensuring that they can operate in environments where sanitation is paramount.

Palletizing Robot Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

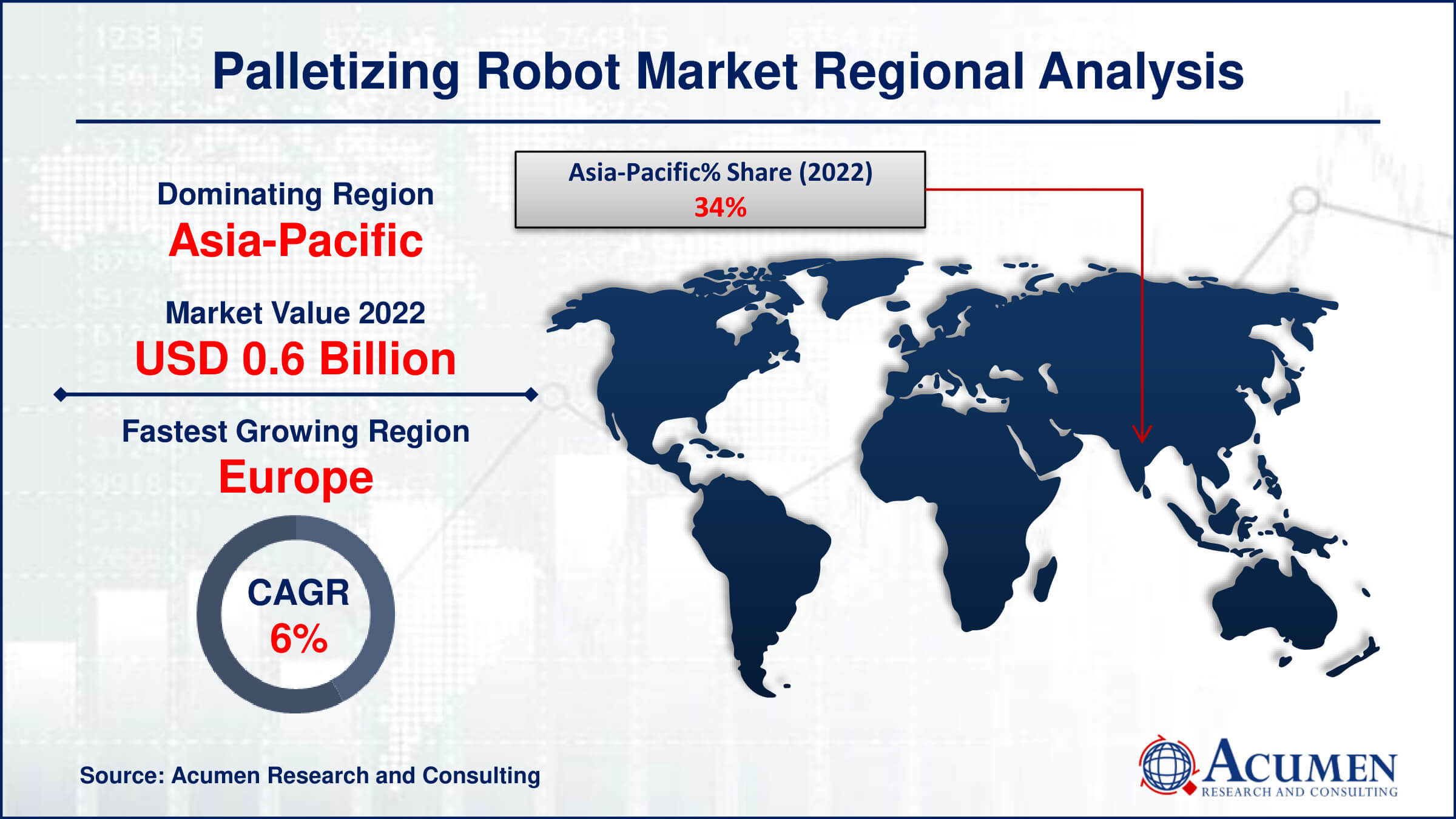

Palletizing Robot Market Regional Analysis

The Asia-Pacific region has emerged as a dominant force in the palletizing robot market, showcasing remarkable growth and playing a pivotal role in the global adoption of robotic solutions for material handling. Several factors contribute to the region's dominance, including the rapid industrialization, a burgeoning manufacturing sector, and the continuous drive for operational efficiency across diverse industries. Countries such as China, Japan, South Korea, and India have witnessed substantial investments in automation technologies, with a particular emphasis on palletizing robots to enhance supply chain and logistics operations. China, in particular, has played a central role in the dominance of the Asia-Pacific region in the palletizing robot market. The country's manufacturing boom and the increased focus on smart manufacturing practices have led to widespread adoption of palletizing robots across various industries. Moreover, the region benefits from a strong ecosystem of robotics manufacturers and suppliers, coupled with government initiatives supporting the development and integration of automation technologies.

Palletizing Robot Market Player

Some of the top palletizing robot market companies offered in the professional report include Fanuc, Kawasaki Robotics, Kuka Robotics Corporation, RMH Systems, Yashkawa America, Inc., MHI, MMCI Robotics, Fuji Robotics Americas, Okura Yusoki Co., Ltd., Schneider Packaging Equipment Co. Inc., Krones AG, and Concetti S.P.A.

Frequently Asked Questions

How big is the palletizing robot market?

The palletizing robot market size was USD 1.8 Billion in 2022.

What is the CAGR of the global palletizing robot market from 2023 to 2032?

The CAGR of palletizing robot is 5.8% during the analysis period of 2023 to 2032.

Which are the key players in the palletizing robot market?

The key players operating in the global market are including Fanuc, Kawasaki Robotics, Kuka Robotics Corporation, RMH Systems, Yashkawa America, Inc., MHI, MMCI Robotics, Fuji Robotics Americas, Okura Yusoki Co., Ltd., Schneider Packaging Equipment Co. Inc., Krones AG, and Concetti S.P.A.

Which region dominated the global palletizing robot market share?

Asia-Pacific held the dominating position in palletizing robot industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of palletizing robot during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global palletizing robot industry?

The current trends and dynamics in the palletizing robot industry include increased demand for automation in material handling, advancements in robot technology and capabilities, and growing focus on workplace safety and efficiency.

Which robot type held the maximum share in 2022?

The articulated robot type held the maximum share of the palletizing robot industry.