Supply Chain Analytics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

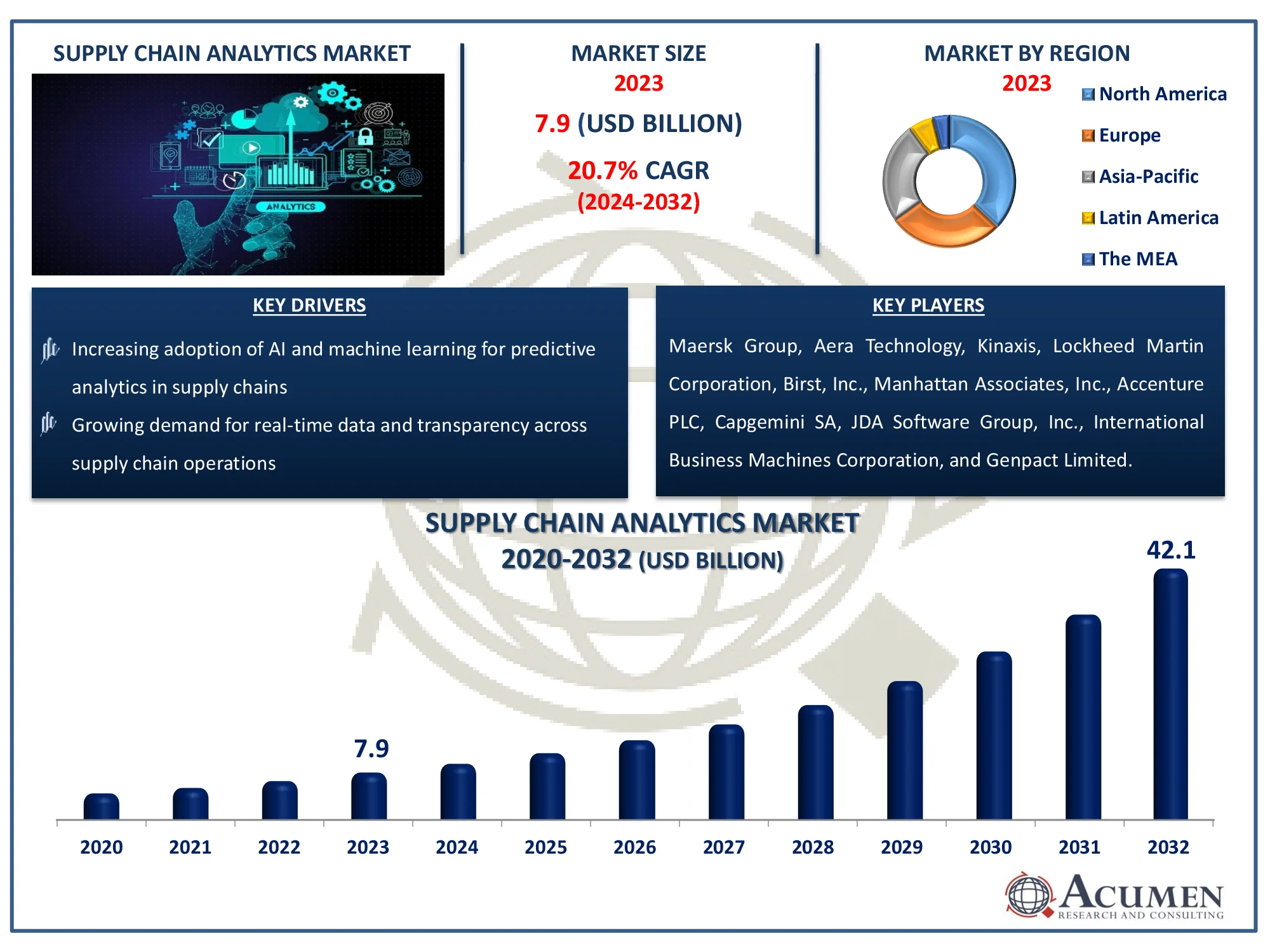

The Global Supply Chain Analytics Market Size accounted for USD 7.9 Billion in 2023 and is estimated to achieve a market size of USD 42.1 Billion by 2032 growing at a CAGR of 20.7% from 2024 to 2032

Supply Chain Analytics Market Highlights

- Global supply chain analytics market revenue is poised to garner USD 42.1 billion by 2032 with a CAGR of 20.7% from 2024 to 2032

- North America supply chain analytics market value occupied around USD 2.9 billion in 2023

- Asia-Pacific supply chain analytics market growth will record a CAGR of more than 22% from 2024 to 2032

- Among solution, the sales & operations analytics sub-segment generated USD 2.2 billion revenue in 2023

- Based on deployment, the cloud sub-segment generated 63% supply chain analytics market share in 2023

- Emerging markets increasing investment in digital supply chain transformation is a popular supply chain analytics market trend that fuels the industry demand

Supply chain analytics involves using data analysis and advanced techniques to enhance supply chain operations and decision making. It encompasses the collection, processing, and interpretation of data from various sources within the supply chain, including procurement, production, inventory management, and distribution. Leveraging technologies like artificial intelligence, machine learning, and big data, it provides insights into trends, patterns, and potential issues. This enables businesses to streamline processes, cut costs, and improve customer satisfaction. Key applications include demand forecasting, risk management, and performance monitoring, contributing to a more resilient and agile supply chain. Additionally, supply chain analytics supports sustainability initiatives, helping companies minimize waste, reduce carbon footprints, and ensure ethical sourcing practices.

Global Supply Chain Analytics Market Dynamics

Market Drivers

- Increasing adoption of AI and machine learning for predictive analytics in supply chains

- Growing demand for real-time data and transparency across supply chain operations

- Rising e-commerce activities driving the need for efficient supply chain management

- Enhanced focus on cost reduction and operational efficiency by businesses

Market Restraints

- High implementation costs of advanced supply chain analytics solutions

- Data security and privacy concerns limiting widespread adoption

- Complexity in integrating analytics with existing legacy systems

Market Opportunities

- Expansion of cloud-based analytics solutions offering scalability and flexibility

- Growing emphasis on sustainability and ethical supply chains driving analytics adoption

- Rising interest in IoT-enabled supply chain analytics for improved decision-making

Supply Chain Analytics Market Report Coverage

| Market | Supply Chain Analytics Market |

| Supply Chain Analytics Market Size 2022 |

USD 7.9 Billion |

| Supply Chain Analytics Market Forecast 2032 | USD 42.1 Billion |

| Supply Chain Analytics Market CAGR During 2023 - 2032 | 20.7% |

| Supply Chain Analytics Market Analysis Period | 2020 - 2032 |

| Supply Chain Analytics Market Base Year |

2023 |

| Supply Chain Analytics Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Solution, By Service, By Deployment, By Enterprise Size, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Maersk Group, Aera Technology, Kinaxis, Lockheed Martin Corporation, Birst, Inc., Manhattan Associates, Inc., Accenture PLC, Capgemini SA, JDA Software Group, Inc., International Business Machines Corporation, and Genpact Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Supply Chain Analytics Market Insights

A significant driver in the supply chain analytics market is the growing adoption of artificial intelligence (AI) and machine learning (ML). These technologies empower businesses to process large volumes of data swiftly and extract valuable insights, leading to more informed decision-making. AI and ML enhance demand forecasting, streamline inventory management, and anticipate supply chain disruptions, ultimately improving efficiency and reducing costs. As companies face increasing pressure to remain competitive in a rapidly evolving market, the integration of AI and ML into supply chain analytics becomes indispensable for optimizing operations and sustaining a competitive advantage.

One of the main restraints hindering the growth of the supply chain analytics market is the high cost of implementing advanced analytics solutions. These costs encompass not only the purchase of software and technology but also the expenses related to system integration, employee training, and ongoing maintenance. For small and medium-sized enterprises (SMEs), these financial demands can be particularly prohibitive, restricting their ability to adopt such technologies and potentially slowing market growth.

The rise of cloud-based analytics solutions presents a promising opportunity in the supply chain analytics market. Cloud platforms offer significant advantages such as scalability, flexibility, and reduced costs, making advanced analytics more accessible to a wider range of businesses. By lowering the need for significant upfront investments, cloud-based solutions enable companies, particularly SMEs, to implement and scale their analytics capabilities more easily. This trend is expected to accelerate the adoption of supply chain analytics, particularly in emerging markets.

Supply Chain Analytics Market Segmentation

The worldwide market for supply chain analytics is split based on solution, service, deployment, enterprise size, end-users, and geography.

Supply Chain Analytics Market By Solutions

- Logistics Analytics

- Manufacturing Analytics

- Planning & Procurement

- Sales & Operations Analytics

- Visualization & Reporting

According to supply chain analytics industry analysis, the sales & operations analytics segment holds the largest share due to its critical role in aligning a company's sales and operational planning processes. This segment helps businesses optimize their demand forecasting, inventory management, and production scheduling by providing insights that balance supply with customer demand. By integrating data from sales, marketing, and operations, companies can make informed decisions that enhance efficiency, reduce costs, and improve customer satisfaction. The growing complexity of global supply chains and the need for real-time decision-making further drive the demand for robust sales & operations analytics solutions, making this segment the market leader.

Supply Chain Analytics Market By Services

- Professional

- Support & Maintenance

In the supply chain analytics market, the professional services category leads due to its critical role in helping businesses implement and customize analytics solutions. These services include consulting, system integration, and training, which are essential for organizations to effectively leverage advanced analytics tools. Professional services providers guide companies through the complex process of deploying analytics solutions, ensuring they are tailored to specific business needs and aligned with strategic goals. As businesses increasingly rely on data-driven decision-making, the demand for expert guidance and specialized knowledge has grown, making Professional services the dominant category in this market.

Supply Chain Analytics Market By Deployments

- Cloud

- On-Premise

Cloud deployment has emerged as the largest segment and it is expected to increase over the supply chain analytics market forecast period due to its numerous advantages over on-premise solutions. Cloud-based analytics platforms offer scalability, flexibility, and cost efficiency, allowing businesses to easily adjust resources based on their needs without heavy upfront investments. These platforms facilitate real-time data access and collaboration across multiple locations, enhancing decision making and operational efficiency. Additionally, cloud solutions typically feature lower maintenance costs and faster implementation times compared to on-premise systems. As organizations seek to streamline their supply chain operations and leverage advanced analytics capabilities without significant capital expenditure, the preference for cloud deployment continues to grow, solidifying its position as the leading choice in the market.

Supply Chain Analytics Market By Enterprise Sizes

- Large Enterprise

- Small & Medium Enterprises

Large enterprises hold the dominant position within enterprise size the due to their extensive resources and complex supply chain networks. These organizations benefit from advanced analytics to manage and optimize their vast and intricate operations, which include global sourcing, production, and distribution. Large enterprises have the financial capacity to invest in sophisticated analytics solutions and integrate them across their entire supply chain. They also have the data volume and complexity that justify the need for advanced tools that can provide detailed insights and forecasts. Consequently, the ability to handle large-scale data and drive strategic decision-making makes large enterprises the leading users of supply chain analytics solutions.

Supply Chain Analytics Market By End-Users

- Retail & Consumer Goods

- Healthcare

- Manufacturing

- Transportation

- Aerospace & Defense

- High Technology Products

- Others

The manufacturing sector is anticipated to be the major category due to its reliance on efficient and precise supply chain management. Manufacturers face complex logistics, inventory control, and production planning challenges, which require sophisticated analytics to optimize operations. Advanced analytics help manufacturers forecast demand, streamline procurement, manage production schedules, and reduce waste. The need for real-time data and analytics to ensure the smooth flow of materials and goods throughout the production process drives the high adoption of these solutions in the manufacturing industry. As a result, manufacturing is expected to lead in the utilization of supply chain analytics, reflecting its critical role in enhancing operational efficiency and competitiveness.

Supply Chain Analytics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Supply Chain Analytics Market Regional Analysis

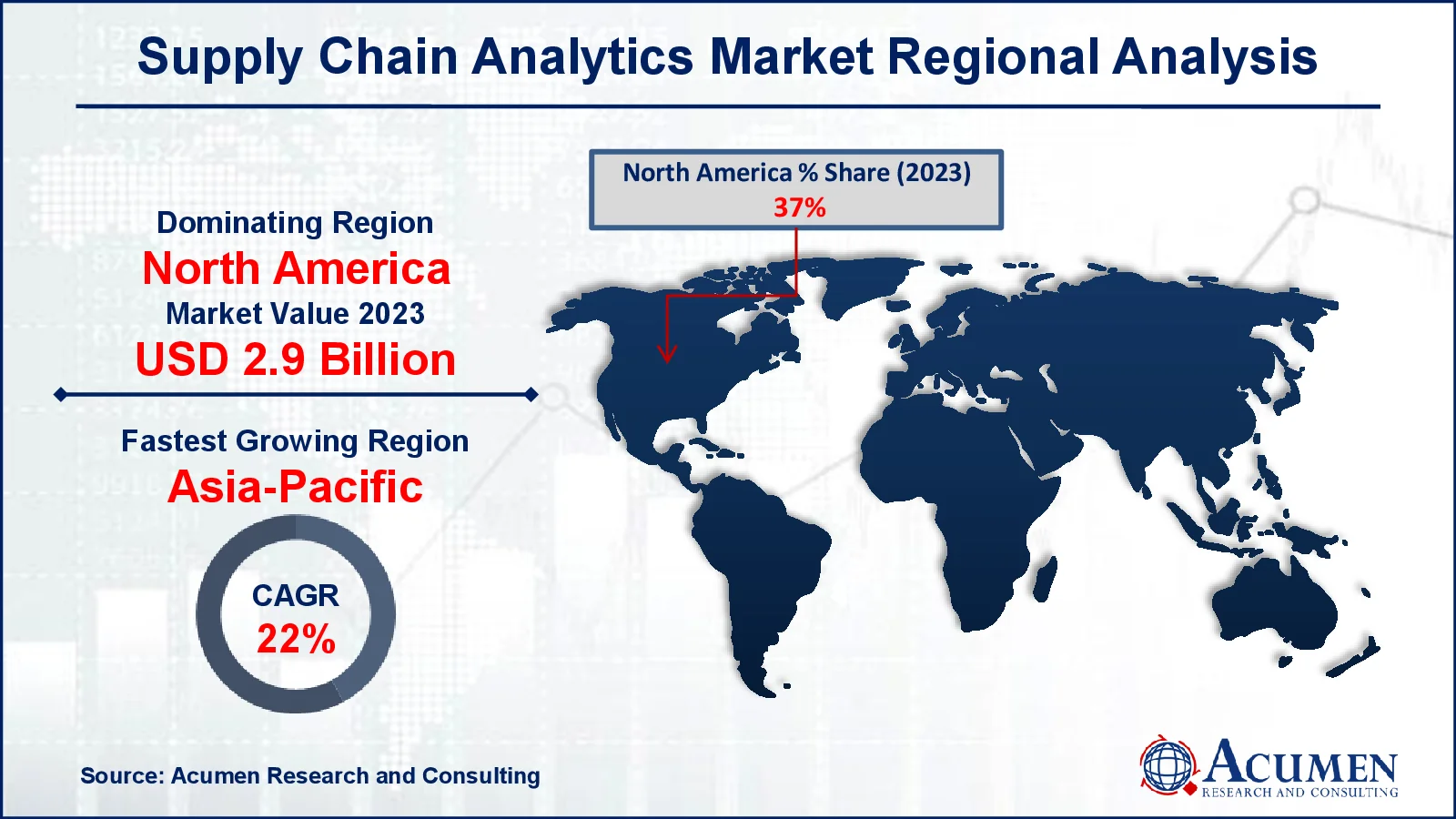

In terms of supply chain analytics market analysis, North America led the industry in terms of revenue in 2023, valued at USD 2.9 billion. Several suppliers of supply chain analytics solutions are headquartered in the region, giving it an edge over other areas. Additionally, as business operations continue to grow in complexity; manufacturing companies are increasingly favoring visual representations of supply chain data to analyze the current state of their supply chains, thereby driving demand for supply chain analytics solutions in the region.

Conversely, the Asia-Pacific region is expected to experience significant growth during the supply chain analytics industry forecast period. This growth can be attributed to increased awareness among enterprises about the benefits of analytics solutions. Moreover, the rapidly growing number of small and mid-sized businesses (SMBs) and their adoption of advanced technologies to expand their operations are likely to provide a substantial boost during the forecast period.

Supply Chain Analytics Market Players

Some of the top supply chain analytics companies offered in our report includes Maersk Group, Aera Technology, Kinaxis, Lockheed Martin Corporation, Birst, Inc., Manhattan Associates, Inc., Accenture PLC, Capgemini SA, JDA Software Group, Inc., International Business Machines Corporation, and Genpact Limited.

Frequently Asked Questions

How big is the supply chain analytics market?

The supply chain analytics market size was valued at USD 7.9 billion in 2023.

What is the CAGR of the global supply chain analytics market from 2024 to 2032?

The CAGR of supply chain analytics is 20.7% during the analysis period of 2024 to 2032.

Which are the key players in the supply chain analytics market?

The key players operating in the global market are including Maersk Group, Aera Technology, Kinaxis, Lockheed Martin Corporation, Birst, Inc., Manhattan Associates, Inc., Accenture PLC, Capgemini SA, JDA Software Group, Inc., International Business Machines Corporation, and Genpact Limited.

Which region dominated the global supply chain analytics market share?

North America held the dominating position in supply chain analytics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of supply chain analytics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global supply chain analytics industry?

The current trends and dynamics in the supply chain analytics industry include increasing adoption of AI and machine learning for predictive analytics in supply chains, growing demand for real-time data and transparency across supply chain operations, rising e-commerce activities driving the need for efficient supply chain management, and enhanced focus on cost reduction and operational efficiency by businesses.

Which solution held the maximum share in 2023?

The sales & operations analytics held the maximum share of the supply chain analytics industry.