Over the Counter (OTC) Drugs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Over the Counter (OTC) Drugs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

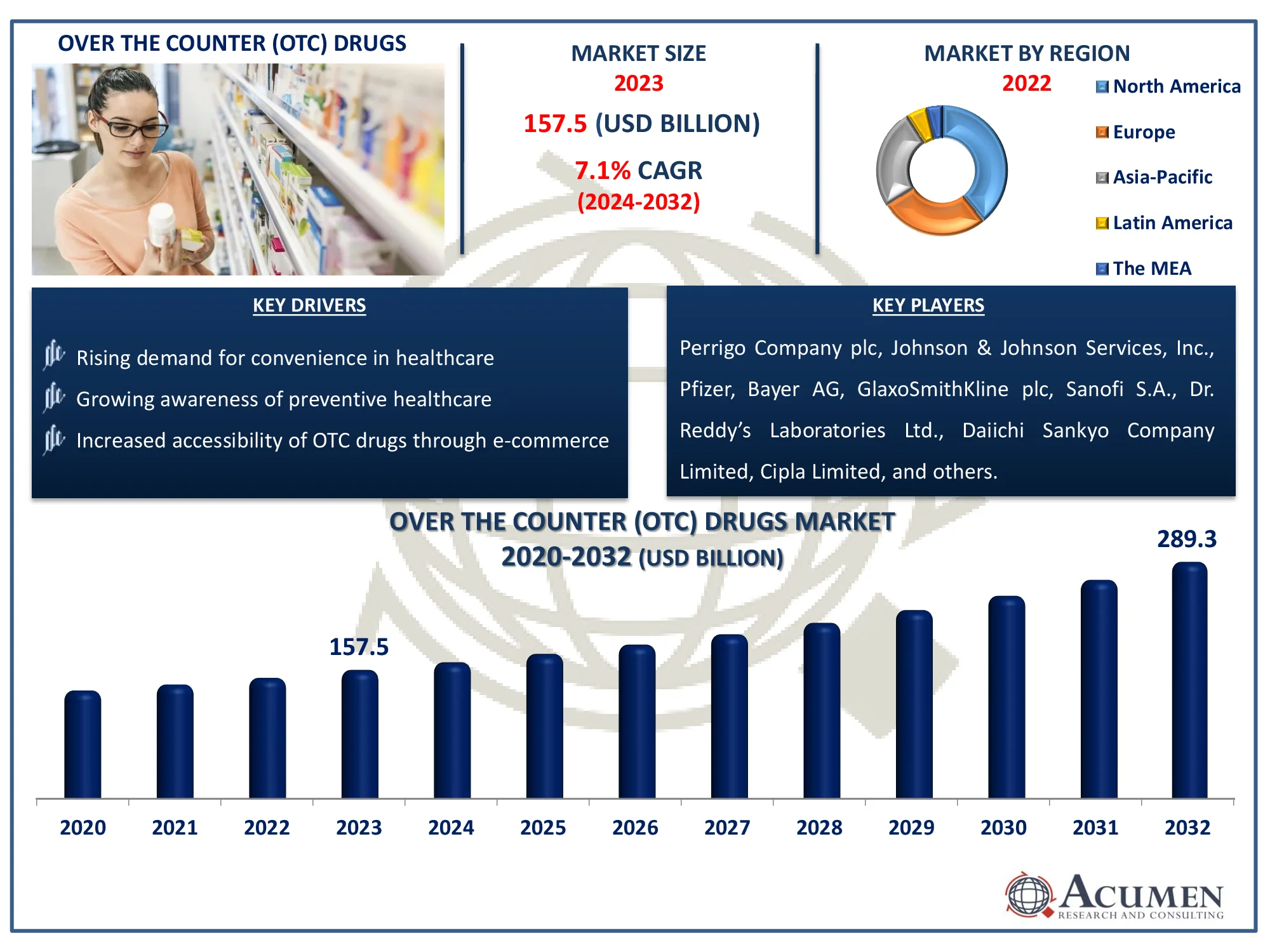

The Global Over the Counter (OTC) Drugs Market Size accounted for USD 157.5 Billion in 2023 and is estimated to achieve a market size of USD 289.3 Billion by 2032 growing at a CAGR of 7.1% from 2024 to 2032.

Over the Counter (OTC) Drugs Market Highlights

- Global over the counter (OTC) drugs market revenue is poised to garner USD 289.3 billion by 2032 with a CAGR of 7.1% from 2024 to 2032

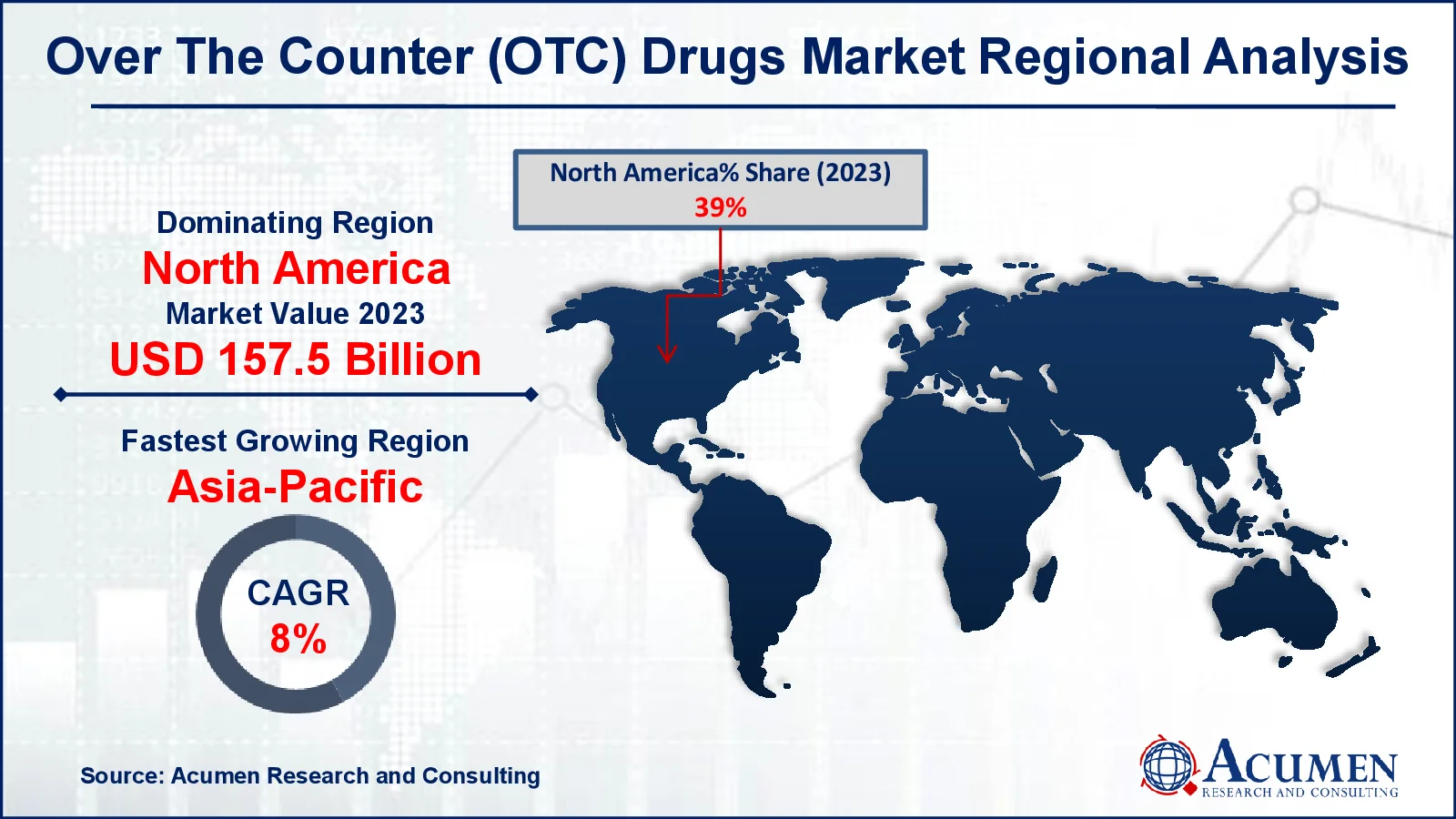

- North America over the counter (OTC) drugs market value occupied around USD 61.4 billion in 2023

- Asia-Pacific over the counter (OTC) drugs market growth will record a CAGR of more than 8% from 2024 to 2032

- Among product type, the cough, cold, and flu products sub-segment generated 26% market share in 2023

- Based on route of administration, the oral sub-segment generated 39% market share in 2023

- Among distribution channel, the retail pharmacies sub-segment generated 49% market share in 2023

- Greater focus on preventive healthcare and wellness boosts demand for OTC medications is the over the counter (OTC) drugs market trend that fuels the industry demand

Over-the-counter (OTC) medicine, commonly known as OTC or non-prescription medicine refers to medications that can be purchased without a prescription. They are safe and effective when used in accordance with the instructions on the label or as prescribed by a healthcare practitioner. OTC medications typically include a variety of products for the treatment of aches, pains, and itching. Some prevent or treat ailments, such as tooth decay and athlete's foot. Other medications help with persistent issues, such as migraines and allergies. In the United States, the Food and Drug Administration (FDA) determines whether a medicine is safe and effective to sell over the counter.

Global Over the Counter (OTC) Drugs Market Dynamics

Market Drivers

- Rising demand for convenience in healthcare

- Growing awareness of preventive healthcare

- Increased accessibility of OTC drugs through e-commerce

Market Restraints

- Regulatory challenges and stringent approval processes

- Potential for misuse or overuse

- Competition from prescription drugs and alternative treatments

Market Opportunities

- Expansion in developing regions with increasing healthcare access

- Introduction of personalized OTC products

- Advancements in drug delivery technologies

Over the Counter (OTC) Drugs Market Report Coverage

|

Market |

Over the Counter (OTC) Drugs Market |

|

Over the Counter (OTC) Drugs Market Size 2023 |

USD 157.5 Billion |

|

Over the Counter (OTC) Drugs Market Forecast 2032 |

USD 289.3 Billion |

|

Over the Counter (OTC) Drugs Market CAGR During 2024 - 2032 |

7.1% |

|

Over the Counter (OTC) Drugs Market Analysis Period |

2020 - 2032 |

|

Over the Counter (OTC) Drugs Market Base Year |

2023 |

|

Over the Counter (OTC) Drugs Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product Type, By Dosage Form, By Route Of Administration, By Distribution Channel, And By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Perrigo Company plc, Johnson & Johnson Services, Inc., Pfizer, Bayer AG, GlaxoSmithKline plc, Sanofi S.A., Dr. Reddy’s Laboratories Ltd., Daiichi Sankyo Company Limited, Cipla Limited, and others. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Over the Counter (OTC) Drugs Market Insights

As more prescription allergy medications have been converted to over-the-counter versions, a more accessible and affordable choice has emerged for the rising population which led to increase the OTC drugs market. According to the Consumer Healthcare Products Association (CHPA), allergy symptoms can have a physical and emotional impact on those who experience them. In fact, 28 percent indicate that allergies impair their ability to exercise, 23 percent say it affects their employment, and 23 percent say it affects their emotional health. Furthermore, according to information released by Consumer Healthcare Products Association (CHPA), US households spent an average of $338 per year on OTC products.

OTC medications offer cost-effective treatment choices for both patients and the healthcare system. The availability of OTC drugs adds enormous value to the US healthcare system, saving around US$146 billion per year compared to alternatives. These savings amount to $94.8 billion in clinical costs (excluding doctor's office visits and diagnostic testing) and $51.6 billion in drug costs (lower priced OTCs versus higher expensive prescription drugs). Furthermore, 86% of US adults agree that judicious use of OTC medications helps to reduce overall population expenses.

The over the counter drugs market has increased considerably in recent years. Several governments have permitted new distribution methods such as the internet and mail-order. In addition, the OTC drugs market has expanded to include sellers other than traditional pharmacies. The purchase of OTC drugs via the internet or mail-order does not pose any unique challenges for Special Health Authority (SHA) compliants as long as it is simply an extra distribution channel for established traditional pharmaceutical suppliers. Aside from that, the FDA has controlled most over-the-counter (OTC) medications, which are available without a prescription, using the OTC monograph process.

Over the Counter (OTC) Drugs Market Segmentation

The worldwide market for over-the-counter (OTC) drugs is split based on product type, dosage form, route of administration, distribution channel, and geography.

OTC Drugs Market By Product Type

- Cough, Cold, and Flu products

- Analgesics

- Dermatology Products

- Gastrointestinal Products

- Vitamins

- Mineral, and Supplements (VMS)

- Weight-loss/dietary products

- Ophthalmic Products

- Sleeping Aids

- Others

According to the over the counter (OTC) drugs industry analysis, cough, cold, and flu products dominate over industry due to the high occurrence of respiratory infections and seasonal diseases. These products are widely available and frequently the first line of defense for customers looking for symptom treatment without a prescription. Demand surges during flu seasons, resulting in significant market growth. Consumer trust in established brands is a key aspect, as is the growing inclination for self-medication.

OTC Drugs Market By Dosage Form

- Tablets

- Hard Capsules

- Powders

- Ointments

- Soft Capsules

- Liquids

- Others

According to the over the counter (OTC) drugs industry analysis, tablets dominate the market due to their convenience, extended shelf life, and ease of mass production. They are portable, simple to administer, and can be coated to cover undesirable flavors, increasing user preference. Furthermore, tablets can hold a large range of active substances, making them suitable for a variety of treatments. Their stability and cost-effectiveness reinforce their position as the top dosage form in the OTC market.

OTC Drugs Market By Route of Administration

- Oral

- Parenteral

- Topical

- Others

According to the over the counter (OTC) drugs market forecast, the oral method of administration dominates market due to its convenience, ease of use, and widespread acceptance by consumers. Tablets, capsules, and liquid formulations are frequently offered in this format, allowing for self-administration without medical supervision. This method is effective for treating common ailments such as pain, colds, and allergies, making them a popular choice among customers.

Over the Counter (OTC) Drugs Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacy

- Others

According to the over the counter (OTC) drugs market forecast, retail pharmacies dominate because of their extensive availability and consumer trust. They provide a convenient point of purchase, with most offering a wide range of OTC products that treat common health concerns. Pharmacists in these contexts also provide professional guidance, which increases customer confidence in product selection, and it will increased sales volumes in the over-the-counter drugs market.

Over the Counter (OTC) Drugs Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Over the Counter (OTC) Drugs Market Regional Analysis

For several reasons, the North America leads the worldwide over the counter drugs market. One of the key drivers driving the global OTC pharmaceuticals industry is proper streamlining and necessary rules for over-the-counter drug items. The majority of over-the-counter (OTC) pharmaceuticals are not subject to the same regulations as prescription medicines. Manufacturers of prescription pharmaceuticals submit clinical data to the FDA to demonstrate the safety and efficacy of OTC treatments. Furthermore, the majority of OTCs use a "monograph" system, which involves analyzing the safety and effectiveness of the product's active chemicals rather than the actual product. The monograph for each category includes the active ingredient, dosage form, dosages or concentration, and mandatory labeling. It is published as a final rule in the federal register and codified in the code of federal regulations.

On the other hand, Asia-Pacific is an emerging as fastest-growing in over-the-counter (OTC) drugs market for the worldwide over-the-counter medicine. This is greatly encouraged due to the growing healthcare industry and the government's increased investment in healthcare development. According to estimates released by Invest India, India's hospital industry represents for 80% of the overall healthcare market. Over-the-counter (OTC) pharmaceutical medications serve an important role in the healthcare sector. According to statistics published in the International Journal of Recent Technology and Engineering (IJRTE), the adult population in India prefers over-the-counter drugs by over 76%. 71% of the population lives in rural India. Additionally, the presence of large players in the OTC drugs market in India adds to the growth of the worldwide over the counter drugs market.

Over the Counter (OTC) Drugs Market Players

Some of the top over-the-counter (OTC) drugs companies offered in our report include Perrigo Company plc, Johnson & Johnson Services, Inc., Pfizer, Bayer AG, GlaxoSmithKline plc, Sanofi S.A., Dr. Reddy’s Laboratories Ltd., Daiichi Sankyo Company Limited, Cipla Limited, and others.

Frequently Asked Questions

How big is the over the counter (OTC) drugs market?

The over the counter (OTC) drugs market size was valued at USD 157.5 billion in 2023.

What is the CAGR of the global over the counter (OTC) drugs market from 2024 to 2032?

The CAGR of over the counter (OTC) drugs market is 7.1% during the analysis period of 2024 to 2032.

Which are the key players in the over the counter (OTC) drugs market?

The key players operating in the global market are including Perrigo Company plc, Johnson & Johnson Services, Inc., Pfizer, Bayer AG, GlaxoSmithKline plc, Sanofi S.A., Dr. Reddy�s Laboratories Ltd., Daiichi Sankyo Company Limited, Cipla Limited, and others.

Which region dominated the global over the counter (OTC) drugs market share?

North America held the dominating position in over-the-counter (OTC) drugs industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of over-the-counter (OTC) drugs during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global over the counter (OTC) drugs market industry?

The current trends and dynamics in the over-the-counter (OTC) drugs industry include rising demand for convenience in healthcare, growing awareness of preventive healthcare, and increased accessibility of OTC drugs through e-commerce.

Which product type held the maximum share in 2023?

The cough, cold, and flu products product type held the maximum share of the over-the-counter (OTC) drugs industry.