Oilfield Services Market | Acumen Research and Consulting

Oilfield Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

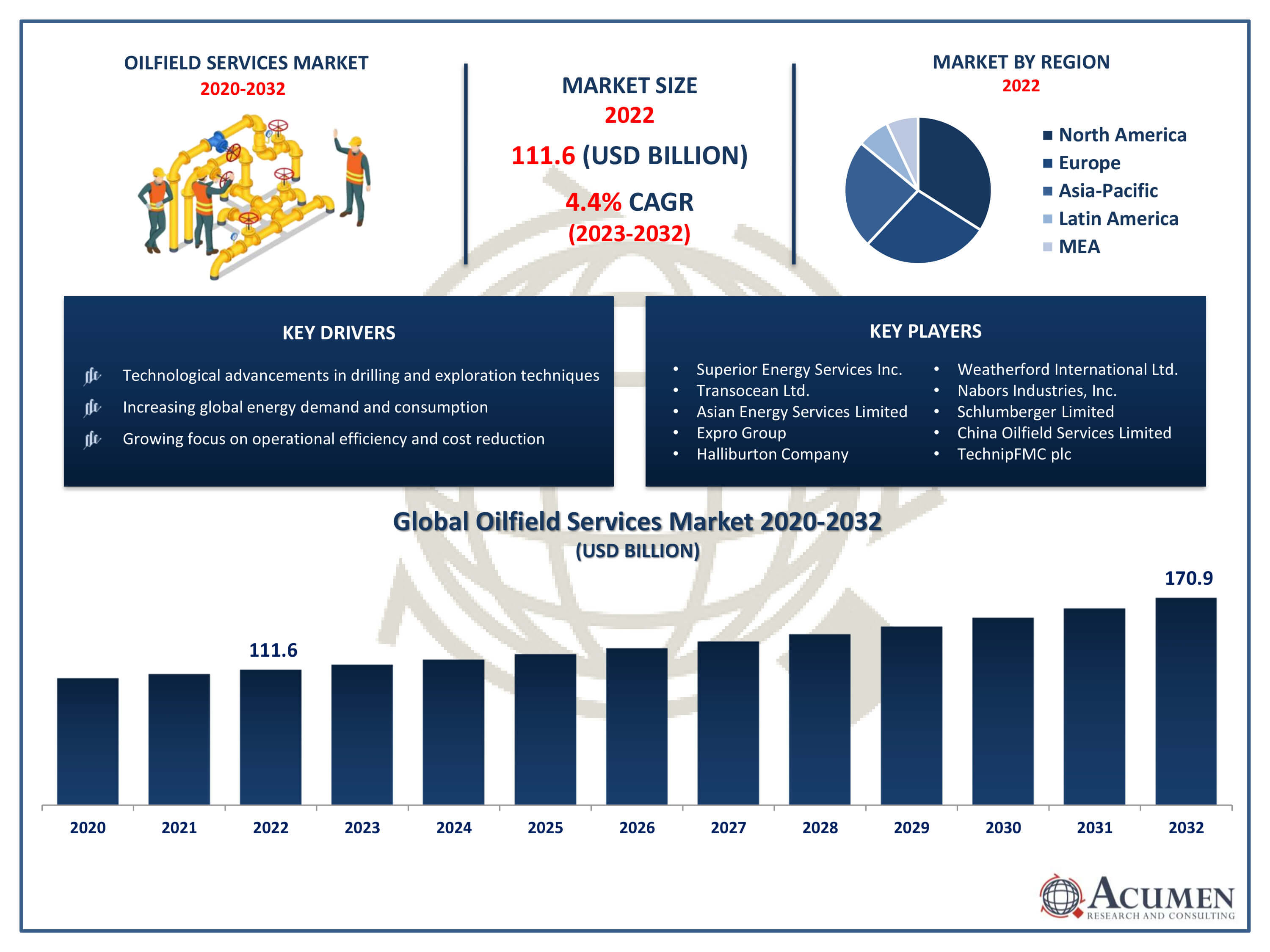

The Oilfield Services Market Size accounted for USD 111.6 Billion in 2022 and is projected to achieve a market size of USD 170.9 Billion by 2032 growing at a CAGR of 4.4% from 2023 to 2032.

Oilfield Services Market Highlights

- Global oilfield services market revenue is expected to increase by USD 170.9 Billion by 2032, with a 4.4% CAGR from 2023 to 2032

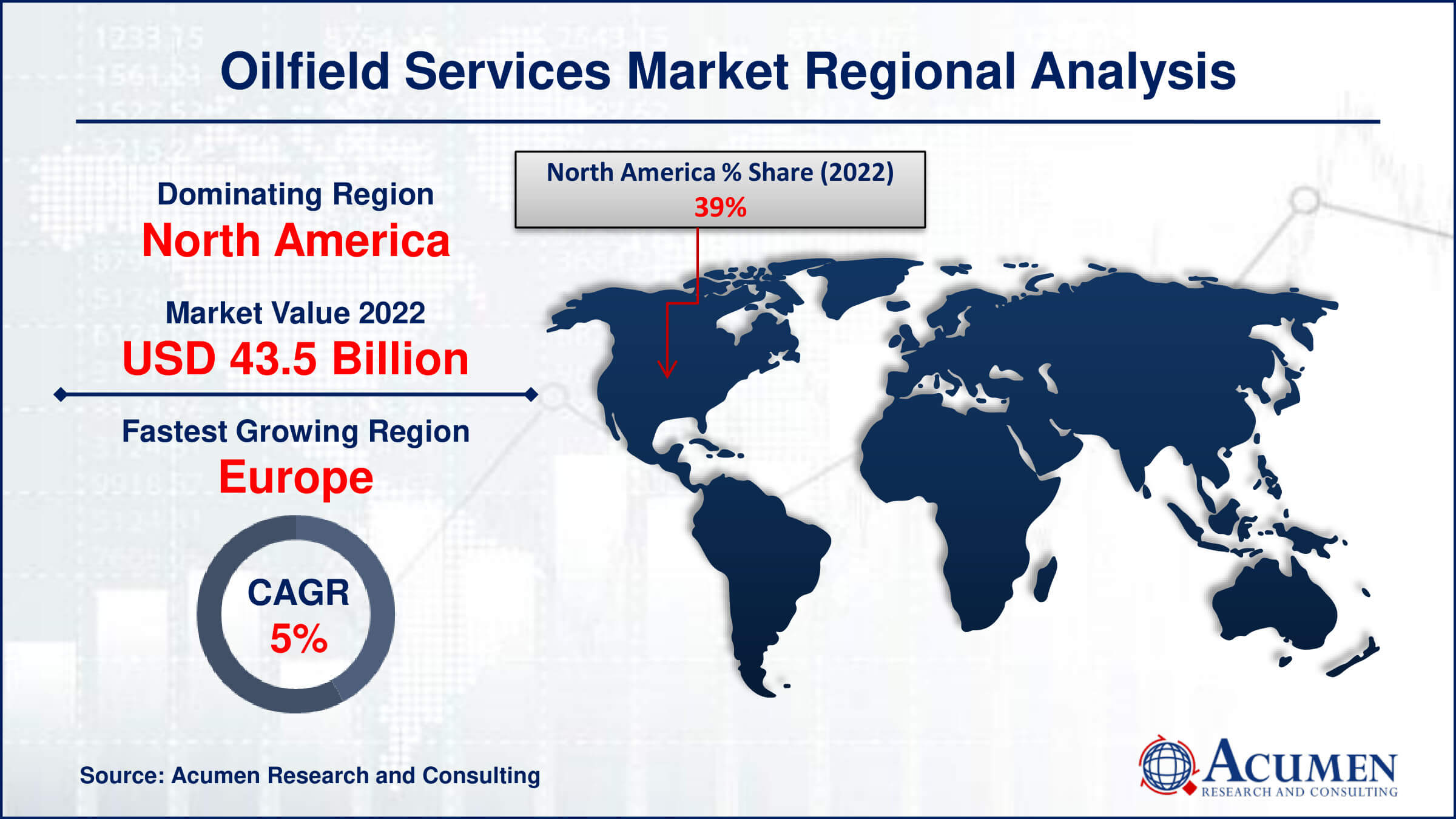

- North America region led with more than 39% of oilfield services market share in 2022

- Europe oilfield services market growth will record a CAGR of more than 4.9% from 2023 to 2032

- By service, the production services segment captured more than 31% of revenue share in 2022.

- By application, the onshore segment has held the largest market share of 89% in 2022

- Growing focus on operational efficiency and cost reduction in oil and gas sector, drives the oilfield services market value

Oilfield services refer to a broad range of services and products provided to the oil and gas industry to facilitate exploration, drilling, production, and transportation of hydrocarbons. These services encompass everything from seismic testing and well construction to maintenance, logistics, and equipment rental. Oilfield service companies play a crucial role in the oil and gas value chain, offering specialized expertise and technology to enhance operational efficiency, safety, and productivity in the extraction and processing of petroleum resources.

The oilfield services market has experienced significant growth over the years, driven by the expansion of global energy demand and the increasing complexity of oil and gas operations. Technological advancements, such as hydraulic fracturing and horizontal drilling techniques, have unlocked previously inaccessible hydrocarbon reserves, leading to a surge in exploration and production activities. Moreover, the rise of unconventional resources, such as shale oil and gas, has created new opportunities for oilfield service providers to deploy innovative solutions tailored to the unique challenges of these reservoirs. As a result, the oilfield services industry has become increasingly competitive, with companies continuously investing in research and development to develop cutting-edge technologies and gain a competitive edge in the industry.

Global Oilfield Services Market Trends

Market Drivers

- Technological advancements in drilling and exploration techniques

- Increasing global energy demand and consumption

- Expansion of unconventional resource development (e.g., shale oil and gas)

- Growing focus on operational efficiency and cost reduction

- Adoption of digital oilfieldand data analytics for improved decision-making

Market Restraints

- Fluctuations in oil prices and market volatility

- Regulatory challenges and environmental concerns

Market Opportunities

- Integration of renewable energy solutions with traditional oilfield operations

- Expansion into emerging markets with untapped hydrocarbon reserves

Oilfield Services Market Report Coverage

| Market | Oilfield Services Market |

| Oilfield Services Market Size 2022 | USD 111.6 Billion |

| Oilfield Services Market Forecast 2032 | USD 170.9 Billion |

| Oilfield Services Market CAGR During 2023 - 2032 | 4.4% |

| Oilfield Services Market Analysis Period | 2020 - 2032 |

| Oilfield Services Market Base Year |

2022 |

| Oilfield Services Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Service, By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Superior Energy Services Inc., Transocean Ltd., Asian Energy Services Limited, Expro Group, Halliburton Company, Weatherford International Ltd., Nabors Industries, Inc., Schlumberger Limited, China Oilfield Services Limited, TechnipFMC plc, Baker Hughes Inc., and National Oilwell Varco, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Oilfield services encompass a wide range of activities and support functions crucial to the exploration, extraction, and production of oil and gas resources. These services are provided by specialized companies that offer expertise, oilfield equipment, and technology tailored to the unique challenges of the oil and gas industry. Oilfield services can include everything from seismic surveys and drilling operations to well maintenance, production optimization, and logistics support. These services are essential for maximizing the efficiency and productivity of oil and gas operations while ensuring safety and environmental compliance. One of the primary applications of oilfield services is in drilling operations. Oilfield service companies provide various drilling services, including directional drilling, horizontal drilling, and deepwater drilling, to access oil and gas reservoirs located beneath the Earth's surface.

The oilfield services market has witnessed steady growth over the past few years, driven by several key factors. One primary driver is the increasing global demand for energy, particularly from emerging economies experiencing rapid industrialization and urbanization. This demand has fueled heightened exploration and production activities, necessitating the use of advanced technologies and specialized services provided by oilfield service companies. Moreover, the rise of unconventional resources, such as shale oil and gas, has further propelled market growth, as companies seek innovative solutions to extract hydrocarbons from previously inaccessible reservoirs. Additionally, technological advancements play a crucial role in driving the growth of the oilfield services industry. Innovations in drilling techniques, reservoir imaging, and well stimulation technologies have enabled operators to improve efficiency, optimize production, and reduce costs.

Oilfield Services Market Segmentation

The global oilfield services market segmentation is based on service, type, application, and geography.

Oilfield Services Market By Service

- Workover & completion services

- Drilling services

- Production services

- Seismic services

- Subsea services

- Processing & separation services

According to the oilfield services industry analysis, the production services segment accounted for the largest market share in 2022. One significant factor is the increasing focus on optimizing production from existing wells as operators seek to maximize recovery rates and extend the lifespan of mature fields. Production services encompass a range of activities aimed at enhancing well performance, such as artificial lift systems, well intervention, and production optimization techniques. As oil and gas fields age, the demand for these services grows, creating opportunities for service providers to offer tailored solutions that improve operational efficiency and boost output. Moreover, technological advancements have played a crucial role in driving the growth of the production services segment. Innovations in downhole monitoring, control systems, and data analytics have enabled operators to better understand reservoir behavior and optimize production strategies in real-time.

Oilfield Services Market By Type

- Field operation

- Equipment rental

- Analytical & consulting services

In terms of types, the field operation segment is expected to witness significant growth in the coming years. Field operations encompass a wide range of activities including well-site preparation, drilling support, maintenance, logistics, and personnel management. One significant driver of growth in this segment is the increasing complexity of oil and gas operations, particularly in remote or challenging environments. As operators expand into new frontiers and unconventional resource plays, there is a growing demand for specialized field services to support exploration, drilling, and production activities. Field operations companies provide essential services and expertise to ensure the smooth and efficient execution of oilfield projects, thereby enabling operators to maximize productivity and minimize downtime. Technological advancements have also played a pivotal role in driving growth in the field operations segment.

Oilfield Services Market By Application

- Onshore

- Offshore

According to the oilfield services market forecast, the onshore segment is expected to witness significant growth in the coming years. One primary driver is the increasing focus on unconventional resource development, particularly in regions such as North America where shale oil and gas plays have become prolific. The abundant availability of onshore reserves, coupled with advancements in hydraulic fracturing and horizontal drilling technologies, has led to a surge in onshore drilling and production activities. As operators seek to maximize the potential of these resources, there is a growing demand for onshore oilfield services to support exploration, drilling, completion, and production operations. Moreover, the onshore segment benefits from its relative cost-effectiveness and accessibility compared to offshore and deepwater projects. Onshore drilling operations typically involve lower capital expenditure and shorter lead times, making them an attractive option for operators, especially in the current volatile oil price environment.

Oilfield Services Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Oilfield Services Market Regional Analysis

North America has emerged as a dominating region in the oilfield services market due to several key factors. One significant reason is the abundance of hydrocarbon resources, particularly unconventional reserves such as shale oil and gas. The United States, in particular, has experienced a shale revolution in recent years, driven by technological advancements in hydraulic fracturing and horizontal drilling techniques. This has led to a surge in domestic oil and gas production, making North America one of the largest producers of hydrocarbons globally. The vast reserves and extensive infrastructure in the region have created a robust market for oilfield services, with companies offering a wide range of specialized expertise and technologies to support exploration, drilling, production, and transportation activities. Moreover, North America benefits from a mature oilfield services industry with a long history of innovation and entrepreneurship. The region is home to numerous leading oilfield service companies that have developed cutting-edge technologies and solutions to address the unique challenges of onshore and offshore operations. These companies leverage their expertise and experience to provide customized services tailored to the specific needs of operators, thereby maintaining a competitive edge in the market.

Oilfield Services Market Player

Some of the top oilfield services market companies offered in the professional report include Superior Energy Services Inc., Transocean Ltd., Asian Energy Services Limited, Expro Group, Halliburton Company, Weatherford International Ltd., Nabors Industries, Inc., Schlumberger Limited, China Oilfield Services Limited, TechnipFMC plc, Baker Hughes Inc., and National Oilwell Varco, Inc.

Frequently Asked Questions

How big is the oilfield services market?

The oilfield services market size was USD 111.6 Billion in 2022.

What is the CAGR of the global oilfield services market from 2023 to 2032?

The CAGR of oilfield services is 4.4% during the analysis period of 2023 to 2032.

Which are the key players in the oilfield services market?

The key players operating in the global market are including Superior Energy Services Inc., Transocean Ltd., Asian Energy Services Limited, Expro Group, Halliburton Company, Weatherford International Ltd., Nabors Industries, Inc., Schlumberger Limited, China Oilfield Services Limited, TechnipFMC plc, Baker Hughes Inc., and National Oilwell Varco, Inc.

Which region dominated the global oilfield services market share?

North America held the dominating position in oilfield services industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of oilfield services during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global oilfield services industry?

The current trends and dynamics in the oilfield services industry include technological advancements in drilling and exploration techniques, increasing global energy demand and consumption, and expansion of unconventional resource development.

Which type held the maximum share in 2022?

The field operation type held the maximum share of the oilfield services industry.