Aliphatic Hydrocarbon Solvents and Thinners Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Aliphatic Hydrocarbon Solvents and Thinners Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

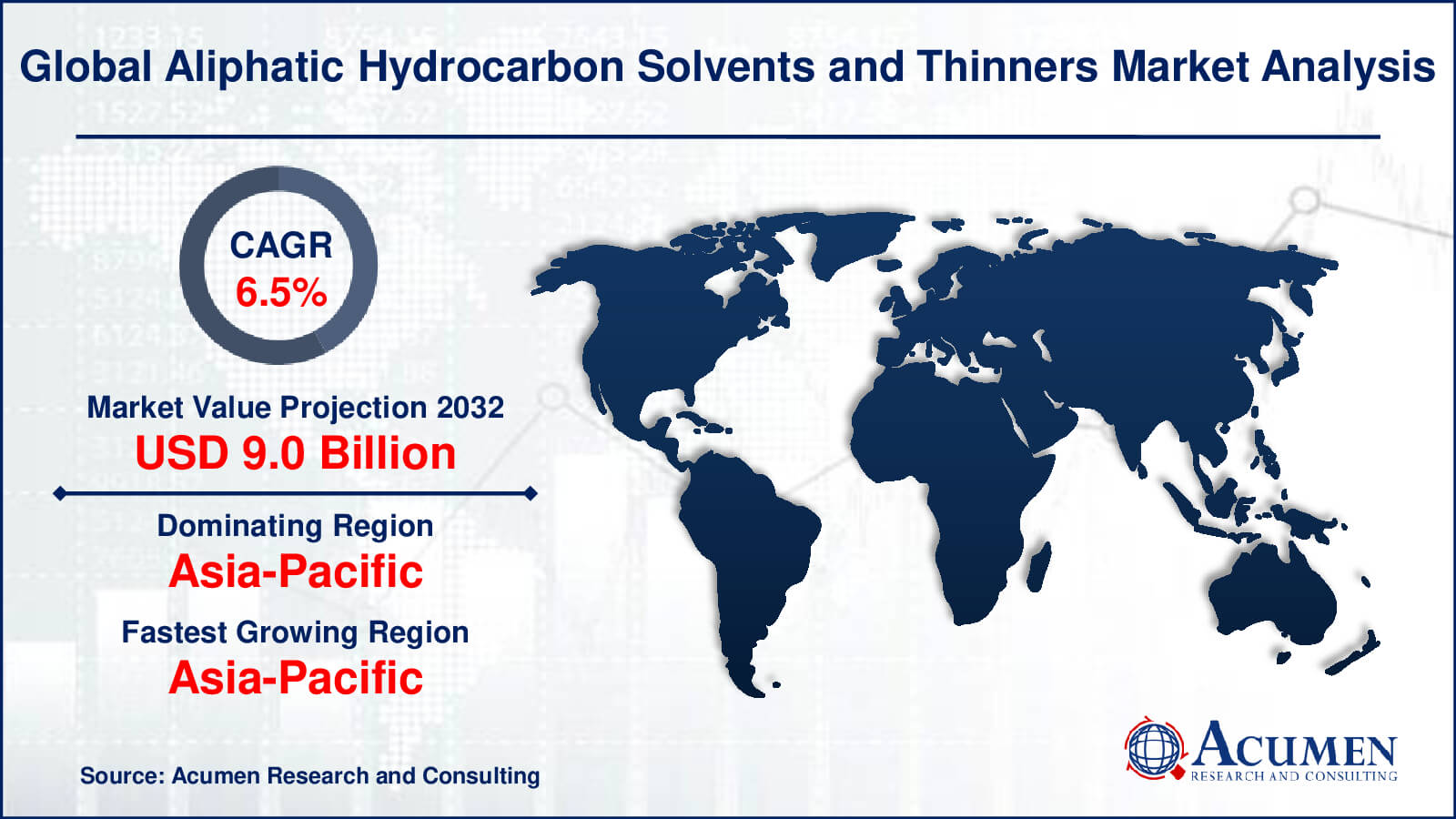

Request Sample Report

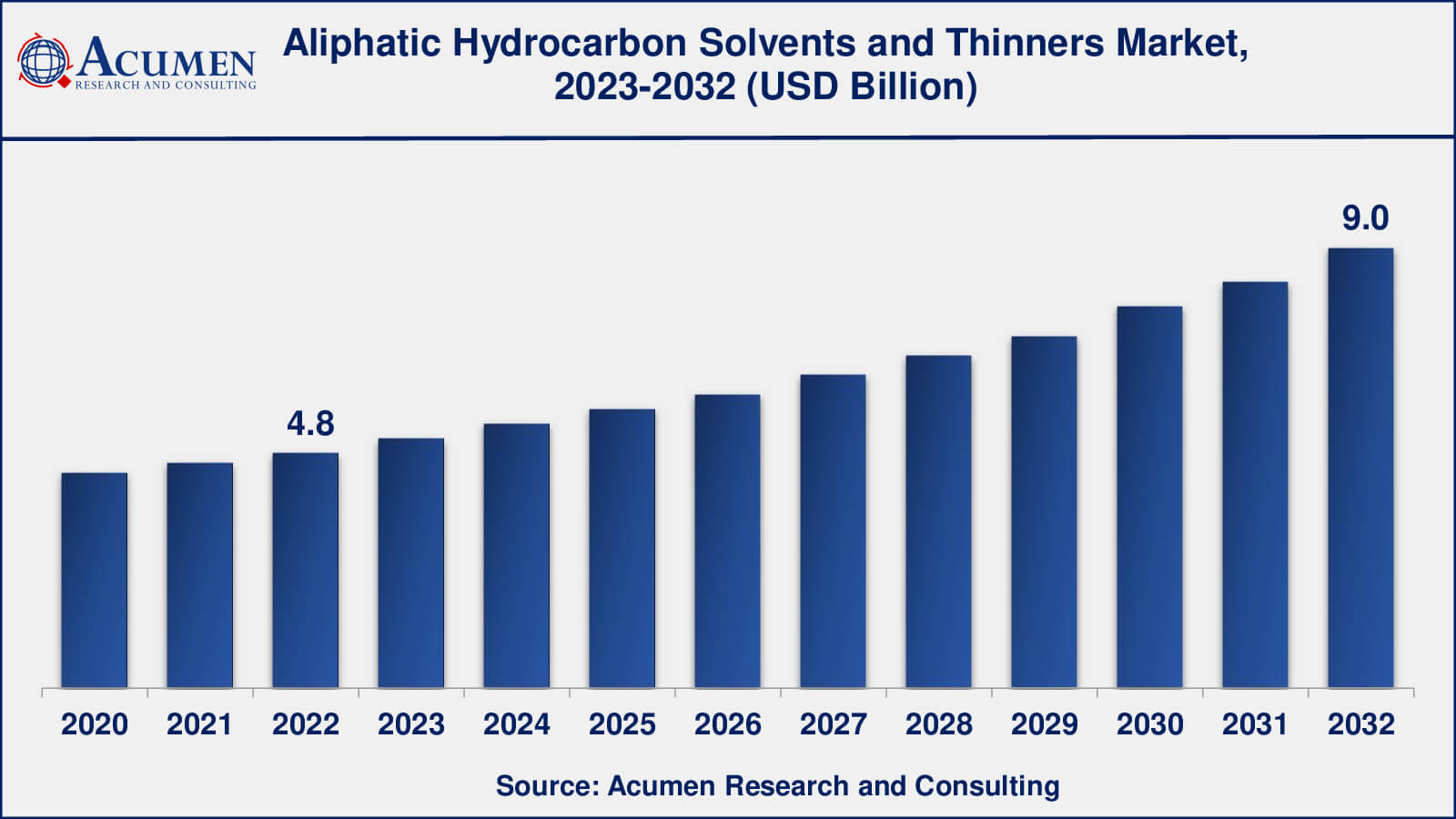

The Global Aliphatic Hydrocarbon Solvents and Thinners Market Size collected USD 4.8 Billion in 2022 and is set to achieve a market size of USD 9.0 Billion in 2032 growing at a CAGR of 6.5% from 2023 to 2032.

Aliphatic Hydrocarbon Solvents and Thinners Market Report Statistics

- Global aliphatic hydrocarbon solvents and thinners market revenue is estimated to reach USD 9.0 Billion by 2032 with a CAGR of 6.5% from 2023 to 2032

- Asia-Pacific aliphatic hydrocarbon solvents and thinners market value occupied more than USD 1.7 billion in 2022

- Asia-Pacific aliphatic hydrocarbon solvents and thinners market growth will record a CAGR of around 7% from 2023 to 2032

- Among type, the mineral spirits sub-segment generated around 30% share in 2022

- Based on application, the paints and coatings generated more than US $ 2 billion revenue in 2022

- Shift towards water-based coatings is a popular aliphatic hydrocarbon solvents and thinners market trend that fuels the industry demand

Aliphatic hydrocarbon solvents and thinners are such chemicals that are mostly preferred in varnishes and paints and the most common use is mineral spirits which are also known as paint thinners. In addition to this, the rising growth in the global automotive and construction industries is one of the key factors said to further bolster the demand for aliphatic hydrocarbon solvents and thinners, thus driving the growth of the global aliphatic hydrocarbon solvents and thinners market in the foreseeable years. On the other hand, the increasing growth of the construction industry has resulted in an increase in demand for aliphatic hydrocarbon solvents and thinners, thus fueling the growth of the market across the globe. The aliphatic hydrocarbon solvents and thinners market especially in Asia-Pacific and Latin America is anticipated to showcase and tender some lucratively sound opportunities owing to higher disposable incomes, increasing population, growing automotive and construction industry, increasing consumer spending capabilities and replacement of turpentine by mineral spirits among others.

Global Aliphatic Hydrocarbon Solvents and Thinners Market Dynamics

Market Drivers

- Increasing demand from end-use industries

- Rising demand for low-VOC solvents

- Growing construction industry

- Increasing demand from the automotive industry

Market Restraints

- Volatility in crude oil prices

- Health and environmental concerns

- Fluctuations in demand from end-use industries

Market Opportunities

- Growing demand for bio-based solvents

- Development of high-performance solvents

- Increasing demand from the Asia-Pacific region

Aliphatic Hydrocarbon Solvents and Thinners Market Report Coverage

| Market | Aliphatic Hydrocarbon Solvents and Thinners Market |

| Aliphatic Hydrocarbon Solvents and Thinners Market Size 2022 | USD 4.8 Billion |

| Aliphatic Hydrocarbon Solvents and Thinners Market Forecast 2032 | USD 9.0 Billion |

| Aliphatic Hydrocarbon Solvents and Thinners Market CAGR During 2023 - 2032 | 6.5% |

| Aliphatic Hydrocarbon Solvents and Thinners Market Analysis Period | 2020 - 2032 |

| Aliphatic Hydrocarbon Solvents and Thinners Market Base Year | 2022 |

| Aliphatic Hydrocarbon Solvents and Thinners Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Calumet Specialty Products Partners, CPC Corporation, ExxonMobil, Gotham Industries, Gulf Chemicals & Industries, Haltermann Carless, IHI Ionbond AG, Royal Dutch Shell PLC, Shell Global, and SK Global Chemical Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aliphatic Hydrocarbon Solvents and Thinners Market Growth Factors

Some of the major factors which are accelerating the growth of global aliphatic hydrocarbon solvents and thinners market include rise in demand for aliphatic hydrocarbon solvents and thinners in developing regions such as Asia-Pacific and Latin America. Moreover, replacement of turpentine by alternatives such as mineral spirits coupled with high growth in paint and coating industry is another factor fueling the growth of global aliphatic hydrocarbon solvents and thinners market. As far as regions are concerned, the Asia-Pacific aliphatic hydrocarbon solvents and thinners market is anticipated to witness significant growth at an impressive pace over the forecast period owing to up gradations in technology in countries like India and China. In addition, increasing levels of income along with changing lifestyles of consumers in developing economies of Asia-Pacific and Latin America are further expected to fuel the growth of the global aliphatic hydrocarbon solvents and thinners market.

Aliphatic Hydrocarbon Solvents and Thinners Market Segmentation

The worldwide aliphatic hydrocarbon solvents and thinners market is categorized based on type, application, and geography.

Aliphatic Hydrocarbon Solvents and Thinners Market By Type

- Varnish Makers & Painter’s Naphtha

- Hexane

- Mineral Spirits

- Heptane

- Others

According to the aliphatic hydrocarbon solvents and thinners market forecast, mineral spirits are the most widely used aliphatic hydrocarbon solvents and thinners and therefore account for the largest share in the market. Mineral spirits are versatile solvents that are commonly used in applications such as paints and coatings, cleaning agents, and inks. The other types of aliphatic hydrocarbon solvents and thinners such as varnish makers & painter's naphtha, hexane, heptane, and others also have significant market shares, but they are comparatively lower than mineral spirits.

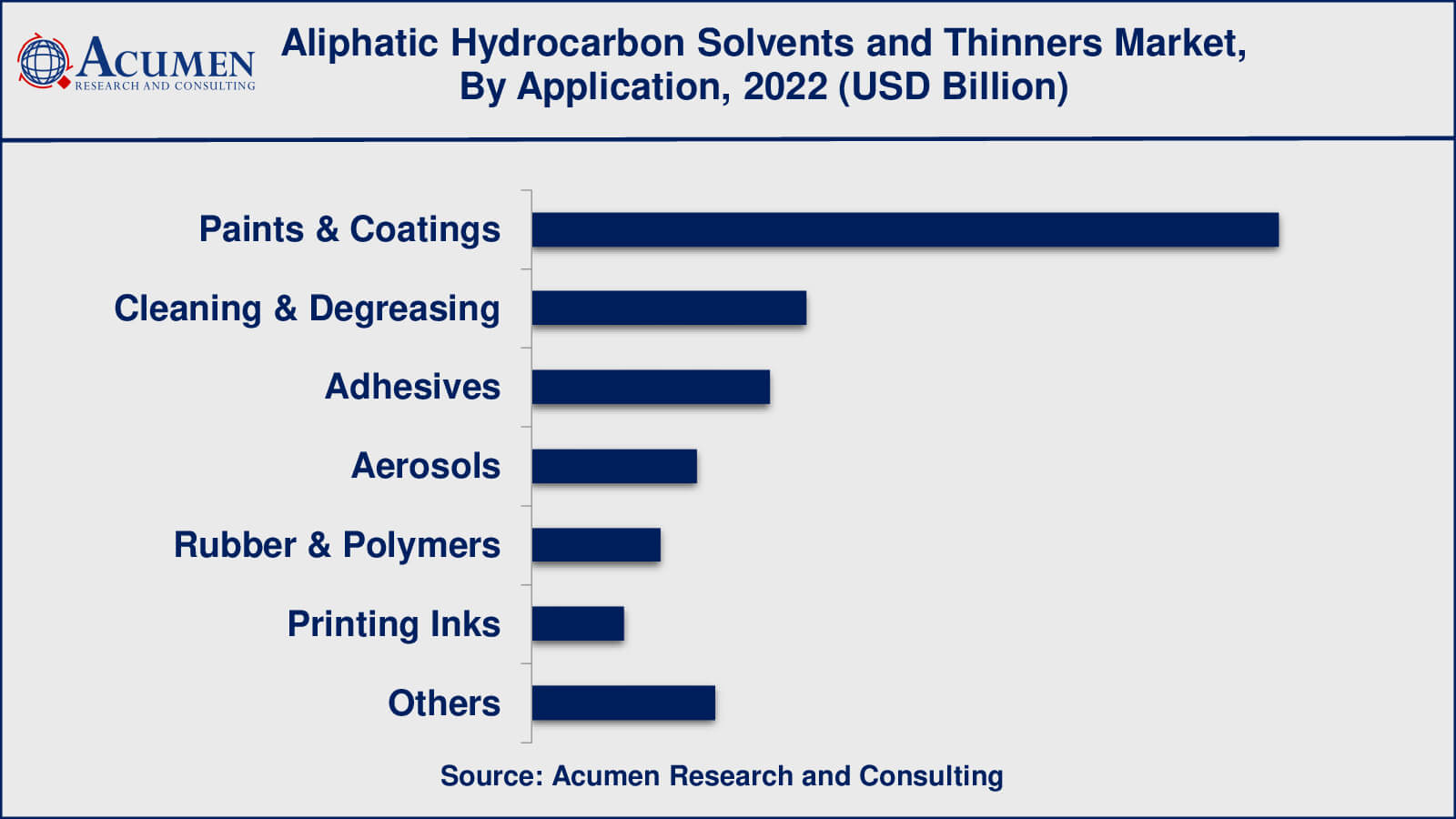

Aliphatic Hydrocarbon Solvents and Thinners Market By Application

- Paints & Coatings

- Cleaning & Degreasing

- Adhesives

- Aerosols

- Rubber & Polymers

- Printing Inks

- Others (Agrochemicals, Automotive, and Pharmaceuticals)

According to an aliphatic hydrocarbon solvents and thinners industry analysis, paints and coatings applications dominated the market with largest share. Aliphatic hydrocarbon solvents and thinners are widespread used as diluents and solvents for resins, binders, and pigments in the paints and coatings industry. The paints and coatings industry's demand for aliphatic hydrocarbon solvents and thinners is being driven by factors such as construction industry growth, increased demand for high-performance coatings, and a shift toward low-VOC coatings. Another important application of aliphatic hydrocarbon solvents and thinners is cleaning and degreasing, particularly in the automotive and industrial sectors. Adhesives, aerosols, rubber and polymers, and printing inks are also important applications for aliphatic hydrocarbon solvents and thinners, but their market shares are smaller than those of paints and coatings. Agrochemicals, automotive, and pharmaceuticals are some of the other industries that use aliphatic hydrocarbon solvents and thinners.

Aliphatic Hydrocarbon Solvents and Thinners Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

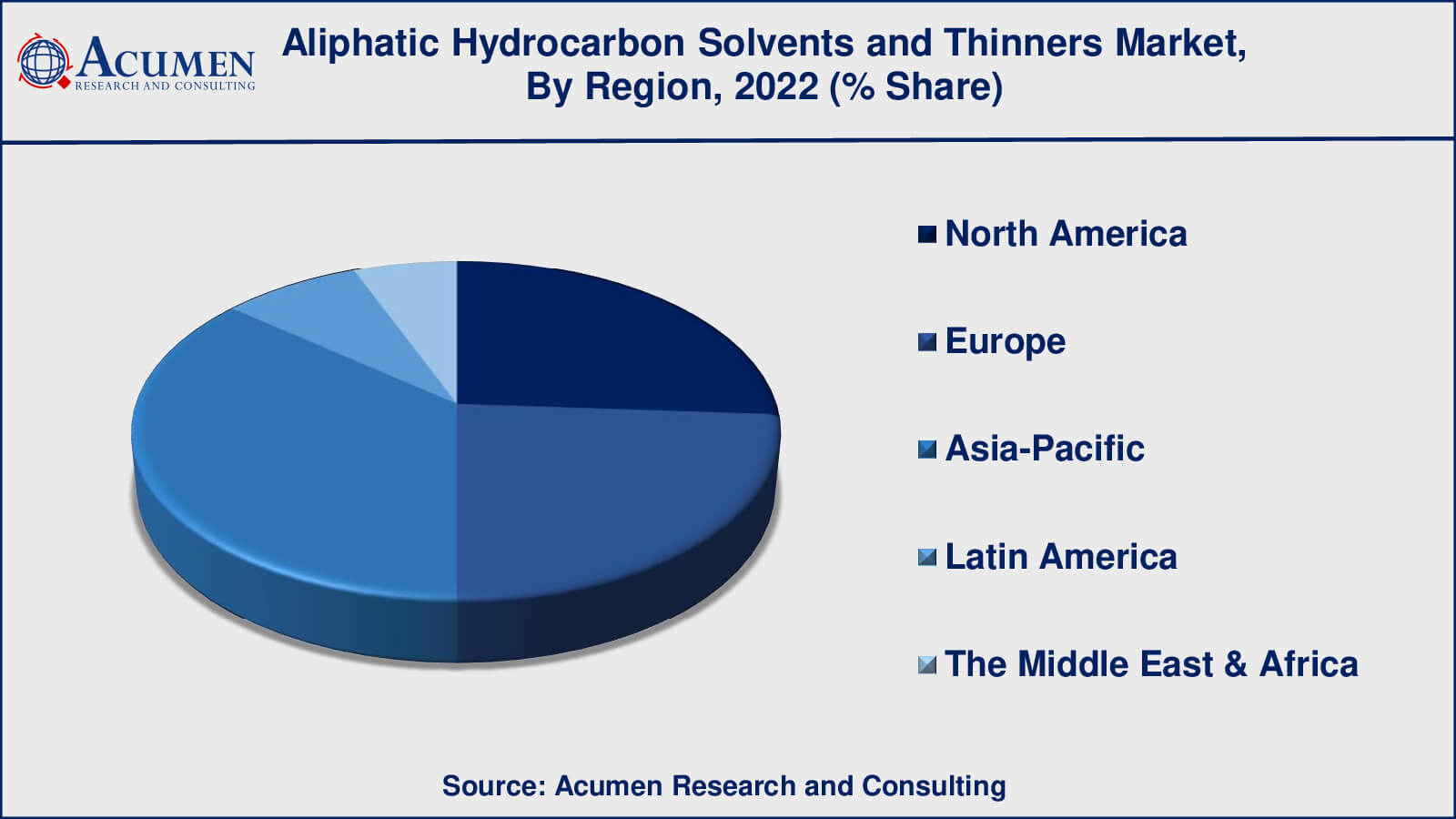

Aliphatic Hydrocarbon Solvents and Thinners Market Regional Analysis

On the basis of region, the global aliphatic hydrocarbon solvents and thinners market can be segmented into North America, Latin America, Europe, Middle East & Africa and Asia-Pacific. The strong growth in Asia-Pacific is anticipated to be the key driving factor for the growth of the market. China is anticipated to account for the largest share and lead the overall demand for aliphatic hydrocarbon solvents and thinners owing to increasing industrial production over the last few years. The market in other developing countries such as Brazil, Russia, Poland, Indonesia, New Zealand, Argentina and India is also anticipated to grow rapidly throughout the forecast period.

Aliphatic Hydrocarbon Solvents and Thinners Market Players

Major players operating in the global aliphatic hydrocarbon solvents and thinners market are focusing on some key market strategies such as mergers and acquisitions to keep hold in the ever competitive market.

Moreover, they are concentrating on collaborating with local players to increase their market reach as well as strengthen their goodwill in the global market.

Some of the global aliphatic hydrocarbon solvents and thinners companies profiled in the report include Calumet Specialty Products Partners, CPC Corporation, ExxonMobil, Gotham Industries, Gulf Chemicals & Industries, Haltermann Carless, IHI Ionbond AG, Royal Dutch Shell PLC, Shell Global, and SK Global Chemical Co. Ltd.

Frequently Asked Questions

What was the market size of the global aliphatic hydrocarbon solvents and thinners in 2022?

The market size of aliphatic hydrocarbon solvents and thinners was USD 4.8 Billion in 2022.

What is the CAGR of the global aliphatic hydrocarbon solvents and thinners market during forecast period of 2023 to 2032?

The CAGR of aliphatic hydrocarbon solvents and thinners market is 6.5% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global market are Calumet Specialty Products Partners, CPC Corporation, ExxonMobil, Gotham Industries, Gulf Chemicals & Industries, Haltermann Carless, IHI Ionbond AG, Royal Dutch Shell PLC, Shell Global, and SK Global Chemical Co. Ltd.

Which region held the dominating position in the global aliphatic hydrocarbon solvents and thinners market?

North America held the dominating position in aliphatic hydrocarbon solvents and thinners market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for aliphatic hydrocarbon solvents and thinners market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global aliphatic hydrocarbon solvents and thinners market?

The current trends and dynamics in the aliphatic hydrocarbon solvents and thinners industry include increasing demand from end-use industries, rising demand for low-VOC solvents, and growing construction industry.

Which Type held the maximum share in 2022?

The varnish makers & painter�s naphtha type held the maximum share of the aliphatic hydrocarbon solvents and thinners market.?