Oil and Gas Subsea Power Grid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Oil and Gas Subsea Power Grid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

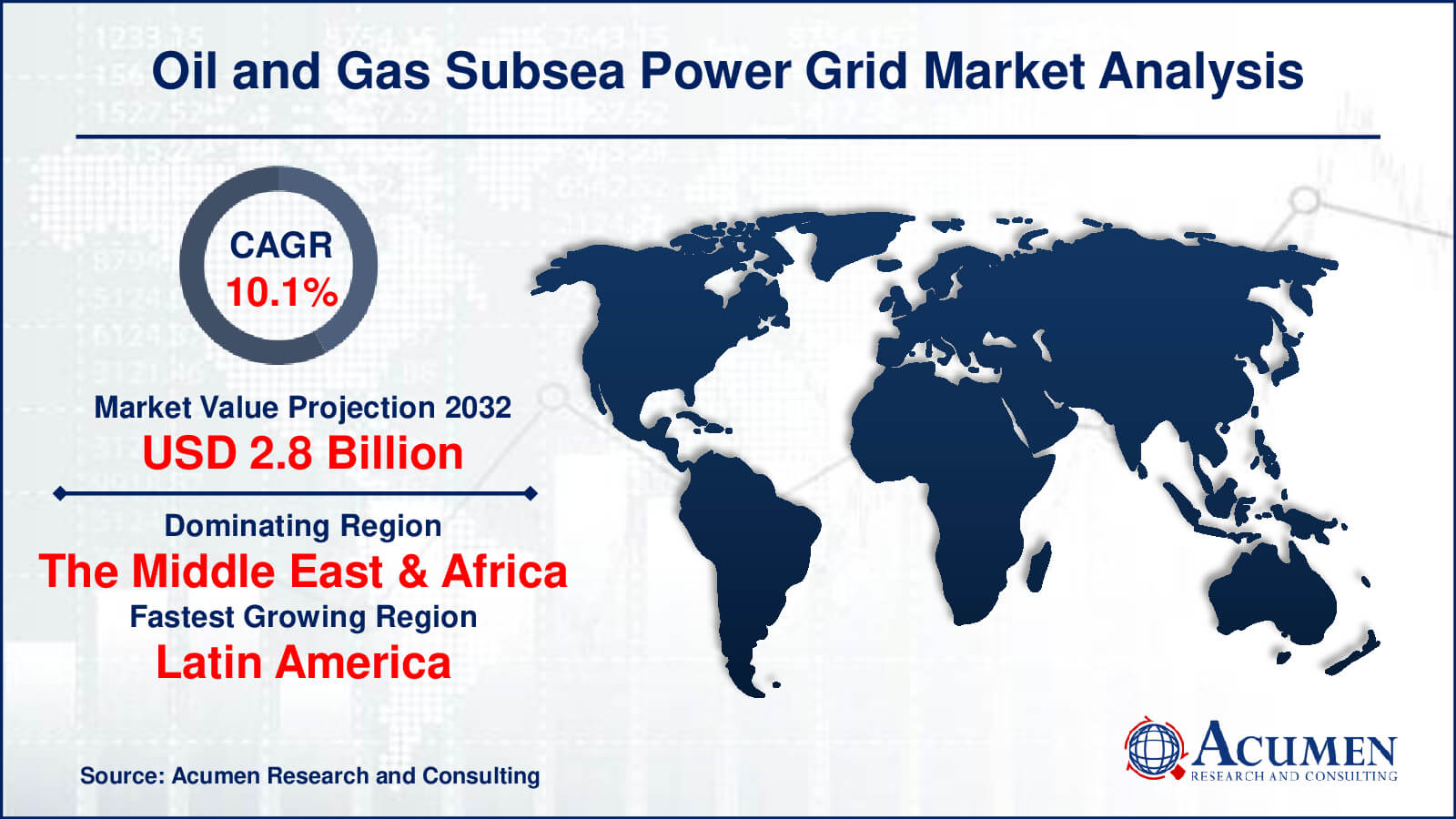

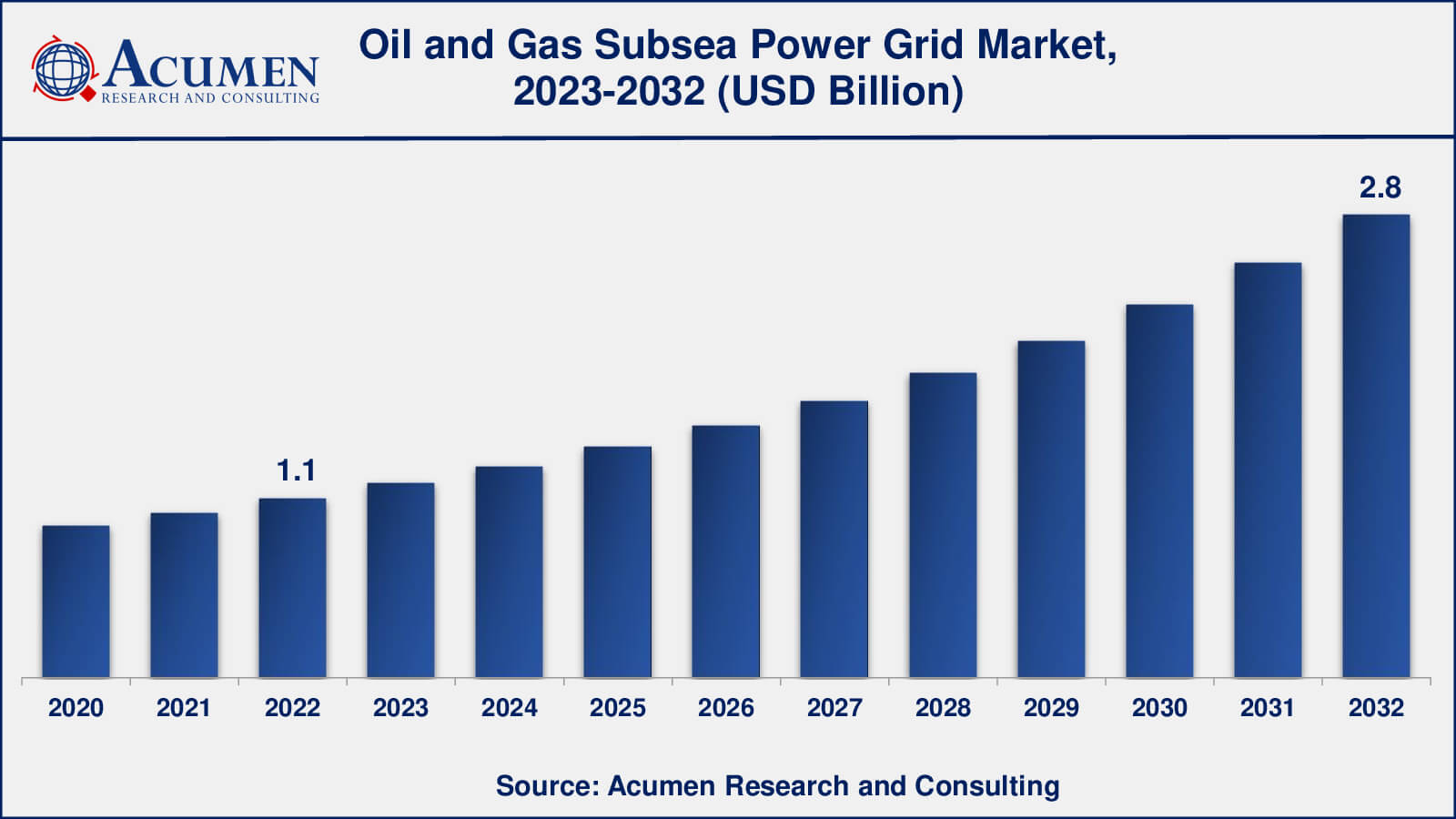

The Global Oil and Gas Subsea Power Grid Market Size accounted for USD 1.1 Billion in 2022 and is estimated to achieve a market size of USD 2.8 Billion by 2032 growing at a CAGR of 10.1% from 2023 to 2032.

Oil and Gas Subsea Power Grid Market Highlights

- Global oil and gas subsea power grid market revenue is poised to garner USD 2.8 billion by 2032 with a CAGR of 10.1% from 2023 to 2032

- The MEA oil and gas subsea power grid market value occupied around USD 450 million in 2022

- Latin America oil and gas subsea power grid market growth will record a CAGR of more than 11% from 2023 to 2032

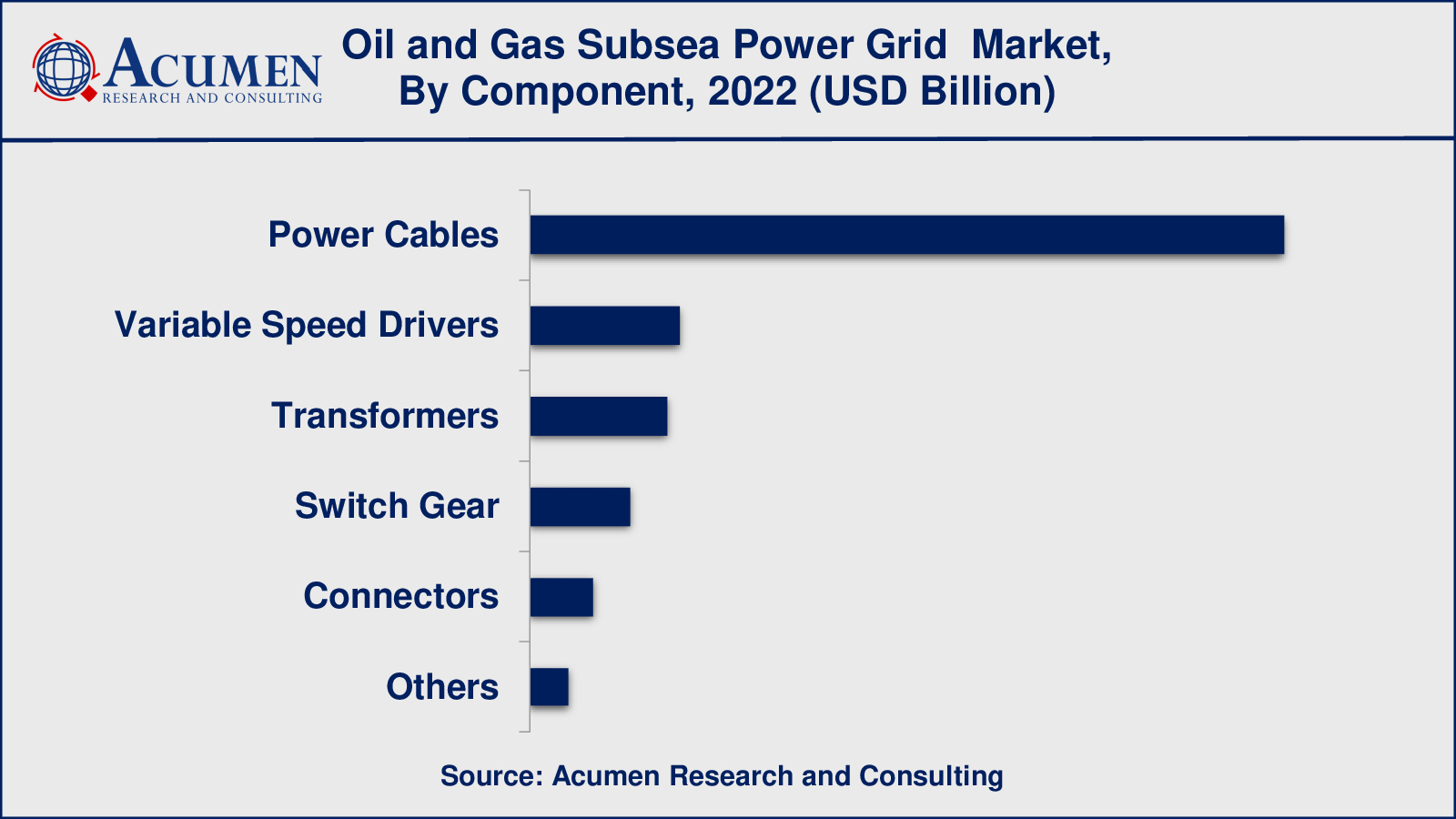

- Among components, the power cables sub-segment generated over US$ 671 million in revenue in 2022

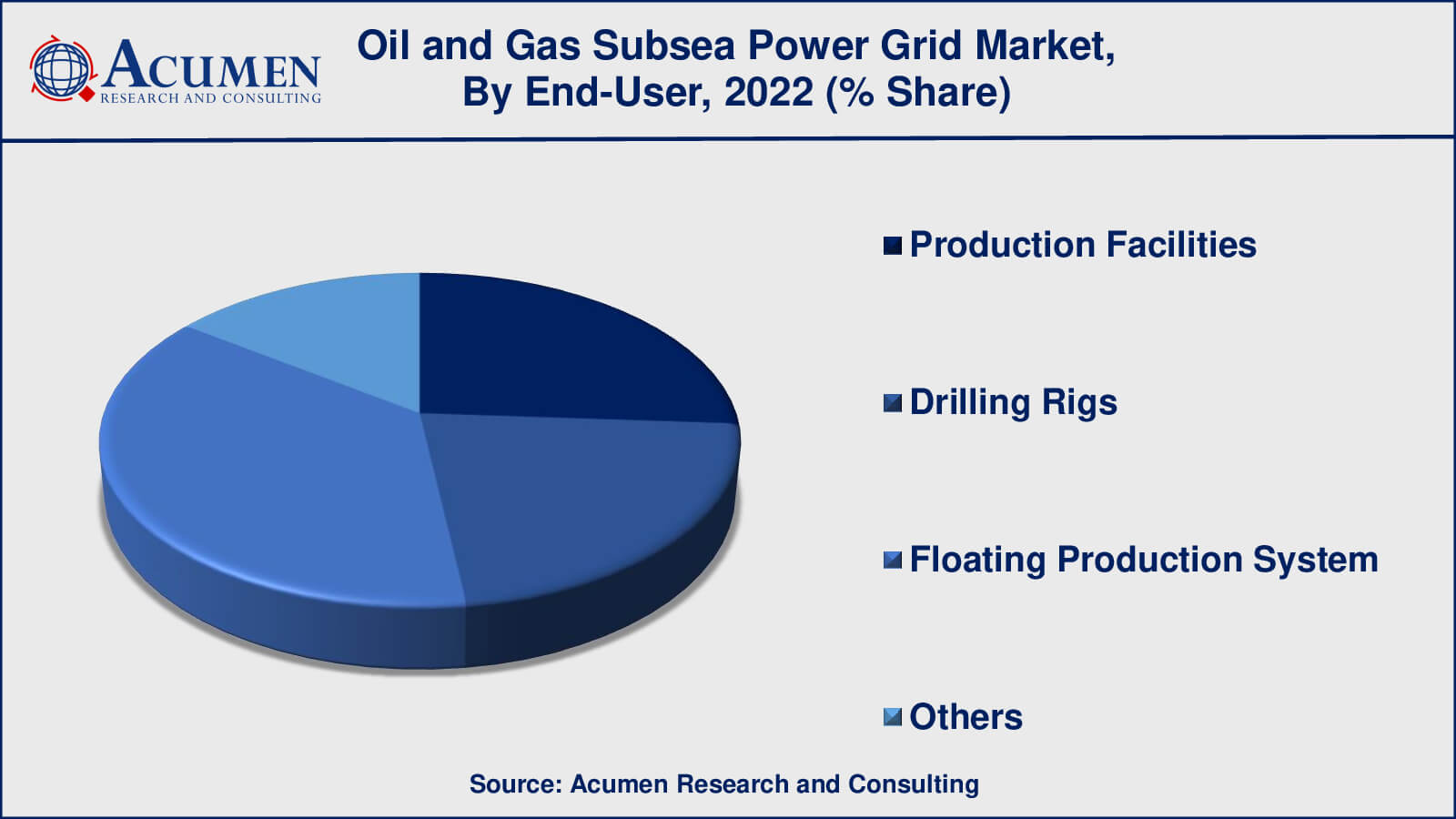

- Based on end-user, the floating production system sub-segment generated around 35% share in 2022

- The development of advanced subsea monitoring and control systems is a popular market trend that fuels the industry demand

An oil and gas subsea power grid is a sophisticated network of electrical infrastructure intended to power numerous undersea components and equipment used in offshore oil and gas activities. This infrastructure is critical to the efficient and dependable operation of equipment located in the difficult subsea environment.

An interconnected network of transformers, power cables, variable speed drives, and switchgear forms a subsea power grid system. The future growth of complex reserves holds the key to the development of the oil and gas industry. In oil and gas production, subsea processing systems in offshore wells provide a cost-effective solution. The oil and gas subsea power grid is quintessential for powering subsea processing equipment such as pumps, subsea compressors, and motors, among others. This power grid not only ensures a consistent power supply to subsea processing facilities but also contributes to the growing power requirements.

Subsea equipment used in offshore oil and gas production includes wellheads, pumps, compressors, and sensors. To function properly, these components require a consistent source of electrical power. A subsea power grid, which addresses this demand, is an integrated system of electrical cables, connections, and distribution mechanisms that transport electricity from the source to the undersea equipment.

Power generation for subsea activities can take place either on the offshore platform or on land before being transported via specialized underwater cables. These cables are specially engineered to withstand the harsh circumstances of the underwater environment, such as high pressures, corrosive substances, and fluctuating temperatures.

Global Oil and Gas Subsea Power Grid Market Dynamics

Market Drivers

- Increasing demand for deepwater oil and gas exploration

- Growing need for efficient and remote subsea operations

- Advancements in subsea technology, enabling complex projects

- Cost savings and operational benefits of subsea processing

Market Restraints

- High upfront investment and installation costs

- Technological challenges in extreme subsea conditions

- Regulatory and environmental constraints

- Volatility in oil and gas prices affecting project viability

Market Opportunities

- Expansion into untapped offshore reserves.

- Integration of renewable energy sources in subsea power generation

- Collaborative efforts to address technical and financial barriers

Oil and Gas Subsea Power Grid Market Report Coverage

| Market | Oil and Gas Subsea Power Grid Market |

| Oil and Gas Subsea Power Grid Market Size 2022 | USD 1.1 Billion |

| Oil and Gas Subsea Power Grid Market Forecast 2032 | USD 2.8 Billion |

| Oil and Gas Subsea Power Grid Market CAGR During 2023 - 2032 | 10.1% |

| Oil and Gas Subsea Power Grid Market Analysis Period | 2020 - 2032 |

| Oil and Gas Subsea Power Grid Market Base Year | 2022 |

| Oil and Gas Subsea Power Grid Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Configuration, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Expro International Group Holdings Limited, Subsea Technology Group AS, General Electric, Aker Solutions, Drill-Quip Inc., Siemens, Cameron International Corporation, FMC Technology, ABB, Schneider Electric, Subsea 7, OneSubsea (a Schlumberger company), Prysmian Group, and Nexans SA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Oil and Gas Subsea Power Grid Market Insights

Factors such as the rise in subsea power load, high reliability, minimum maintenance costs, increasing energy demand, and the expansion of deep-sea oil and gas operations are driving the growth of this market. However, low investments by countries in the oil and gas sector and volatile oil and gas prices are restraining market growth. Marinization of existing equipment and technology, along with the increasing CAPEX on subsea oil and gas facilities, are ongoing trends in this market. Additionally, the growing utilization of subsea processing systems in oil and gas production represents a significant trend driving market growth.

The progress of seabed power grids and the development of power system components capable of operating at great sea depths are expected to offer future growth opportunities for the oil and gas subsea power grid market. Rising global energy demand due to population growth, particularly in developing countries like China and India, is anticipated to contribute to market expansion in the coming years. Conversely, environmental concerns are also crucial factors influencing market growth. Compared to other traditional extraction methods, subsea power grids are more environmentally friendly.

Oil and Gas Subsea Power Grid Market Segmentation

The worldwide market for oil and gas subsea power grid is split based on component, configuration, end-user, and geography.

Oil and Gas Subsea Power Grid Components

- Variable Speed Drivers

- Transformers

- Switch Gear

- Power Cables

- Connectors

- Others

According to the market, the component segment is divided into variable speed drivers, transformers, switchgear, power cables, connectors, and other components. Within the component segment, the power cables category emerged as the leader in terms of revenue share in previous years, and it is expected to grow at the highest CAGR throughout the forecast period. This segment is used for underwater operations with high pressure, high temperature, and corrosive water conditions. These cables are capable of transmitting electricity on oil and gas platforms, thus driving market growth in this segment. Moreover, the variable speed drivers segment significantly holds the second-largest market share. This segment will help reduce the cost of cables in oil and gas platforms where equipment is placed, and it will also be utilized for booster and injection pumps.

Oil and Gas Subsea Power Grid Configurations

- Topside/Shore

- Seabed

In a topside/shore setup, either an offshore platform or an onshore facility houses the equipment for power production and delivery. Underwater cables transport power to subsea devices. This layout can make maintenance and access easier, but cable lengths and the accompanying issues must be addressed.

Seabed configuration entails locating power generating and distribution equipment directly on the seabed, closer to the subsea equipment. This can shorten underwater lines and alleviate some of the difficulties involved with transferring electricity over larger distances.

Oil and Gas Subsea Power Grid End-Users

- Production Facilities

- Drilling Rigs

- Floating Production System

- Others

The oil and gas subsea power grid market is divided into end-user segments such as production facilities, drilling rigs, floating production systems, and others. According to the oil and gas subsea power grid market forecast, floating production system (FPS) often played a significant role in dominating the oil and gas subsea power grid market. Platforms, FPSOs (floating production, storage, and offloading vessels), and other floating structures used to produce and process oil and gas in offshore settings are examples of floating production systems.

To support diverse subsea activities including as drilling, wellheads, pumps, compressors, and other equipment, FPS units require efficient and dependable subsea power networks. These systems are primarily used in deepwater situations, where greater distances and difficult circumstances make subsea power distribution critical.

Subsea junction boxes, subsea power distribution networks, subsea umbilical, subsea transformers, subsea power systems, and subsea cables are among the options available in the production facilities market. These technologies comprise the backbone of the subsea power grid, transmitting electricity to deep-water producing plants. Subsea cables are used to carry power from the source to the drilling rig, as well as to monitor and regulate the power supply control system.

Oil and Gas Subsea Power Grid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Oil and Gas Subsea Power Grid Market Regional Analysis

Geographically, the Middle East Africa (MEA) region has historically dominated the oil and gas subsea power grid market. The presence of large-scale subsea plans in Africa is expected to drive the evolution of this market during the forecast period. In the past year, South America, followed by the Middle East & Africa (MEA), represented the second-largest market segment. Notably, Brazil, with its extensive involvement in subsea operations, has emerged as a hub for subsea advancements in the South American region.

The evolution of long step-out power grid configurations has driven the demand for subsea power cables. The oil and gas industry is increasingly adopting beneficial subsea processing systems to enhance production. Furthermore, the development of power grid components capable of withstanding the extreme pressures of the water column is propelling the growth of the seabed power grid segment.

Oil and Gas Subsea Power Grid Market Players

Some of the top oil and gas subsea power grid companies offered in our report include Expro International Group Holdings Limited, Subsea Technology Group AS, General Electric, Aker Solutions, Drill-Quip Inc., Siemens, Cameron International Corporation, FMC Technology, ABB, Schneider Electric, Subsea 7, OneSubsea (a Schlumberger company), Prysmian Group, and Nexans SA.

Frequently Asked Questions

What was the market size of the global oil and gas subsea power grid in 2022?

The market size of oil and gas subsea power grid was USD 1.1 billion in 2022.

What is the CAGR of the global oil and gas subsea power grid market from 2023 to 2032?

The CAGR of oil and gas subsea power grid is 10.1% during the analysis period of 2023 to 2032.

Which are the key players in the oil and gas subsea power grid market?

The key players operating in the global market are including Expro International Group Holdings Limited, Subsea Technology Group AS, General Electric, Aker Solutions, Drill-Quip Inc., Siemens, Cameron International Corporation, FMC Technology, ABB, Schneider Electric, Subsea 7, OneSubsea (a Schlumberger company), Prysmian Group, and Nexans SA.

Which region dominated the global oil and gas subsea power grid market share?

North America held the dominating position in oil and gas subsea power grid industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of oil and gas subsea power grid during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global oil and gas subsea power grid industry?

The current trends and dynamics in the oil and gas subsea power grid industry include increasing demand for deepwater oil and gas exploration, growing need for efficient and remote subsea operations, and advancements in subsea technology, enabling complex projects.

Which component held the maximum share in 2022?

The power cables component held the maximum share of the oil and gas subsea power grid industry.