Nitrile Butadiene Rubber Latex Market | Acumen Research and Consulting

Nitrile Butadiene Rubber Latex Market Analysis - Global Industry Size, Share, Trends and Forecast 2021 - 2028

Published :

Report ID:

Pages :

Format :

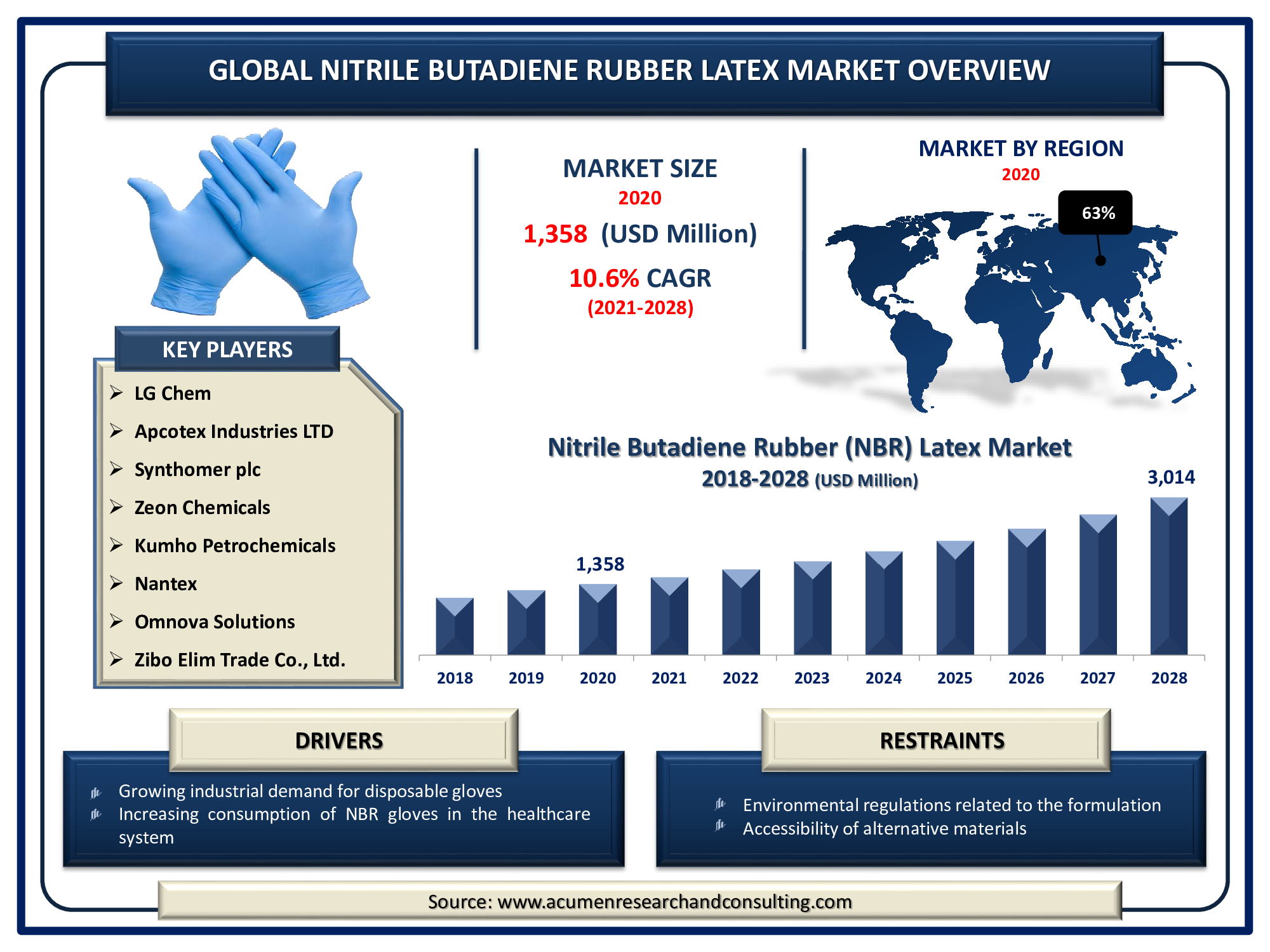

The Global Nitrile Butadiene Rubber (NBR) Latex Market Size was valued at USD 1,358 Million in 2020 and is predicted to be worth USD 3,014 Million by 2028, with a CAGR of 10.6% from 2021 to 2028.

Nitrile butadiene rubber (NBR) latex is a type of synthetic latex in liquid form with milky color. It’s a part of unsaturated acrylonitrile and butadiene copolymers family. NBR latex properties include excellent tensile strength and good resistance to various oils including mineral & vegetable oils, benzene/petrol, ordinary diluted acids, and alkalines. It is used as the key part of medical and industrial applications, where oil, fuel and chemical resistance is required. Nitrile butadiene rubber (NBR) is used for manufacturing fuel and oil hoses, seals and grommets and water handling applications in automotive industry. Also, used for making laboratory and other gloves including disposable lab, cleaning, and examination gloves.

Report Coverage

| Market | Nitrile Butadiene Rubber Latex Market |

| Market Size 2020 | USD 1,358 Million |

| Market Forecast 2028 | USD 3,014 Million |

| CAGR During 2021 - 2028 | 10.6% |

| Analysis Period | 2018 - 2028 |

| Base Year | 2020 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | LG Chem, Apcotex Industries Limited, Synthomer plc, Zeon Chemicals, Kumho Petrochemicals, Nantex, Omnova Solutions, and Zibo Elim Trade Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

The increasing demand for NBR gloves in the medical sector owing to increasing investment in the healthcare industry is driving the market growth. The gloves are used in examinations and surgeries to restrict microorganisms’ transmission in the patient. The increasing demand for disposable gloves in the industrial sector, particularly in the food industry is also accelerating the market value. The increasing concern for the safety of employees working in hazardous conditions is further propelling the demand for gloves in the market. For instance, the Occupational Safety and Health Administration (OSHA) imposed a mandatory regulation on industrial and manufacturing firms to provide high-quality safety equipment to the workers operating under unsafe conditions.

The, environmental regulations associated with the formulation and use of rubber owing to the increasing environmental concern is likely to hamper the market growth. Additionally, the availability of substitute materials in the market is further expected to limit market growth. Whereas, increasing end-user industries in developing economies across the globe is projected to create potential opportunities over the estimated period 2021-2028.

Nitrile Butadiene Rubber (NBR) Latex Market Segmentation

The global nitrile butadiene rubber (NBR) latex market is segmented into type and application.

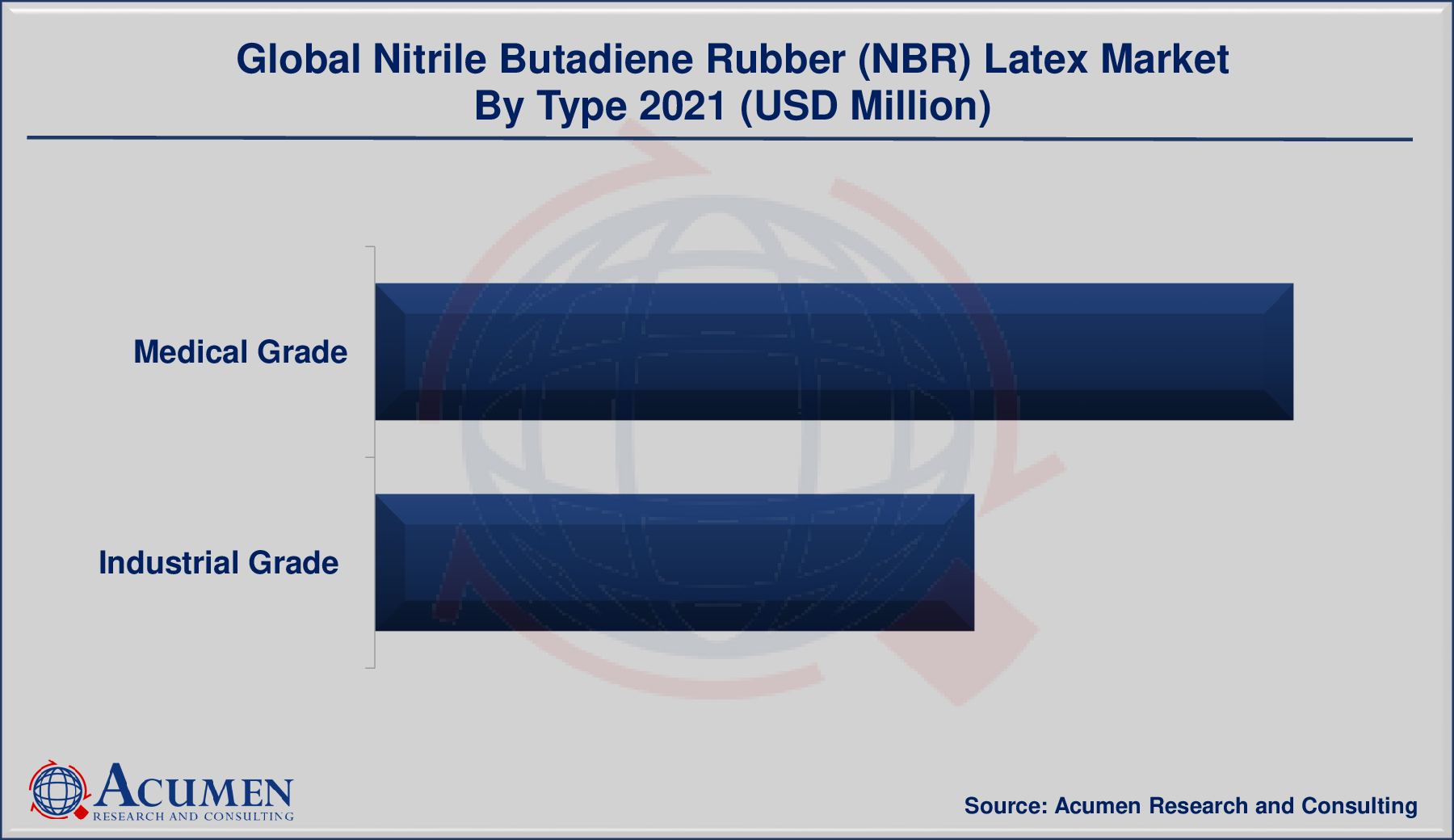

Market by Type

- Industrial Grade

- Medical Grade

The industrial-grade NBR latex is expected to holds the significant market share in the coming years. The rapid industrialization in the developing economies is primarily driving the market growth. The increasing demand for disposable gloves because of less maintenance cost is also propelling the market growth. The increasing demand from clean rooms is further supporting the segment growth.

Market by Application

- Healthcare

- Industrial

- Food

On the basis of application, industrial segment is predicted to grow appreciably in the market owing to the availability of a wide range of products in the market for industrial use. The increasing demand for gloves from chemicals, automotive, and electronics industry for workers' safety is also supporting the market value. Along with these, rapid industrialization is pushing the demand for NBR latex in innovative products is further propelling the market growth.

Nitrile Butadiene Rubber (NBR) Latex Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

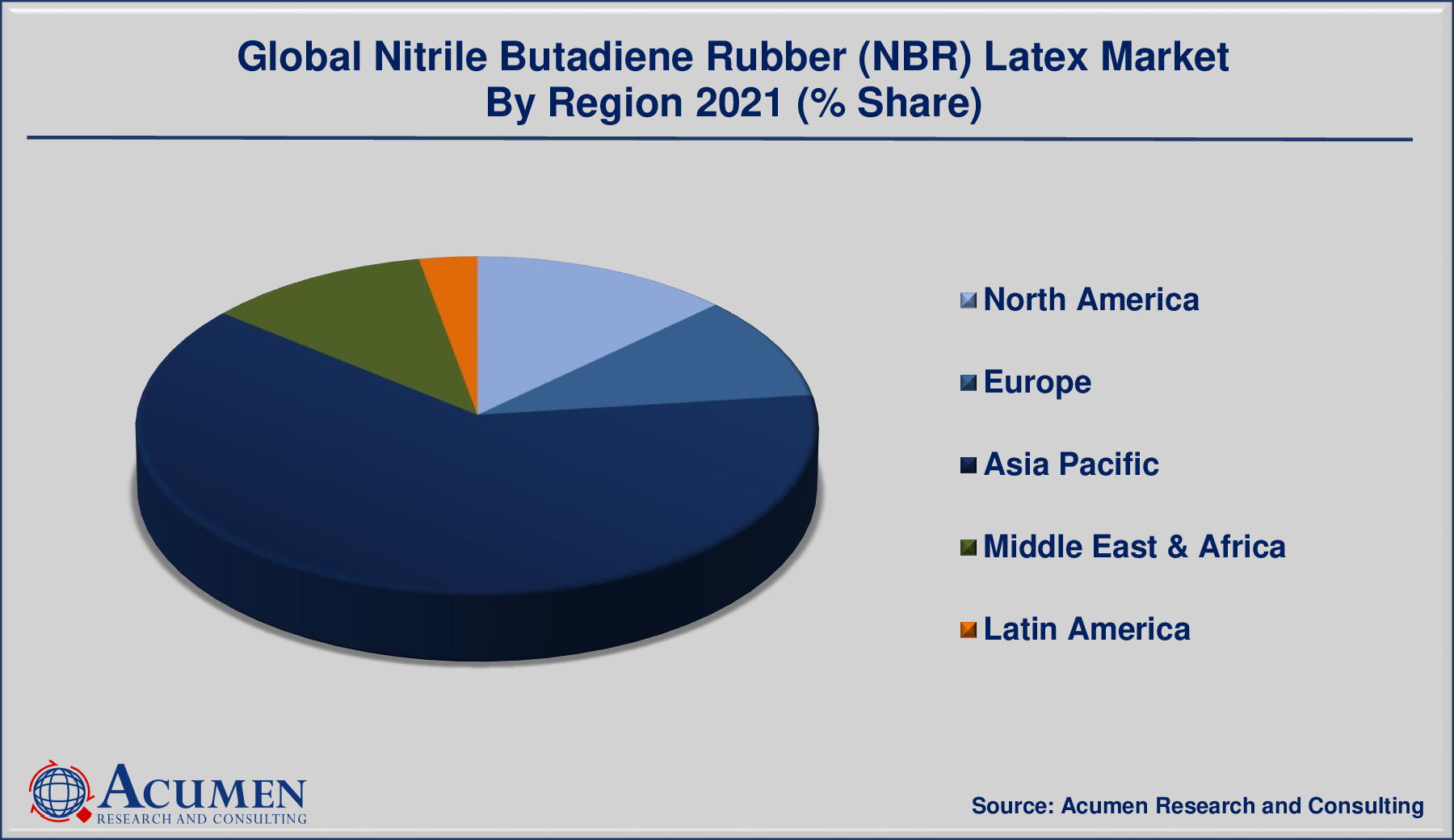

Asia Pacific dominated the global NBR latex market in 2020

Geographically, Asia Pacific held the maximum market share of the NBR latex market and the segment is expected to maintain its dominance over the forecast period. The developed countries in the region, Japan and South Korea is developing industrial robots for electronics and semiconductor industry is driving the regional market growth. Also, the developing economies of the region including China & India are further supporting the regional market growth.

Nitrile Butadiene Rubber (NBR) Latex Market Players

Some of the prominent global Nitrile Butadiene Rubber (NBR) Latex market companies are LG Chem, Apcotex Industries Limited, Synthomer plc, Zeon Chemicals, Kumho Petrochemicals, Nantex, Omnova Solutions, and Zibo Elim Trade Co., Ltd.

Frequently Asked Questions

How much was the global nitrile butadiene rubber (NBR) latex market size in 2021?

The global nitrile butadiene rubber (NBR) latex market size in 2020 was accounted to be USD 1,358 Million.

What will be the projected CAGR for global nitrile butadiene rubber (NBR) latex market during forecast period of 2021 to 2028?

The projected CAGR of nitrile butadiene rubber (NBR) latex during the analysis period of 2021 to 2028 is 10.6%.

Which are the prominent competitors operating in the market?

The prominent players of the global nitrile butadiene rubber (NBR) latex market involve LG Chem, Apcotex Industries Limited, Synthomer plc, Zeon Chemicals, Kumho Petrochemicals, Nantex, Omnova Solutions, and Zibo Elim Trade Co., Ltd.

Which region held the dominating position in the global nitrile butadiene rubber (NBR) latex market?

Asia-Pacific held the dominating share for nitrile butadiene rubber (NBR) latex during the analysis period of 2021 to 2028.

Which region exhibited the fastest growing CAGR for the forecast period of 2021 to 2028?

North America region exhibited fastest growing CAGR for nitrile butadiene rubber (NBR) latex during the analysis period of 2021 to 2028.

What are the current trends and dynamics in the global nitrile butadiene rubber (NBR) latex market?

Increased usages of NBR gloves, particularly in the healthcare industry are the prominent factors that fuel the growth of global nitrile butadiene rubber (NBR) latex market.

By segment type, which sub-segment held the maximum share?

Based on type, medical grade segment held the maximum share for nitrile butadiene rubber (NBR) latex market in 2020.