Network Automation Market

Published :

Report ID:

Pages :

Format :

Network Automation Market

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

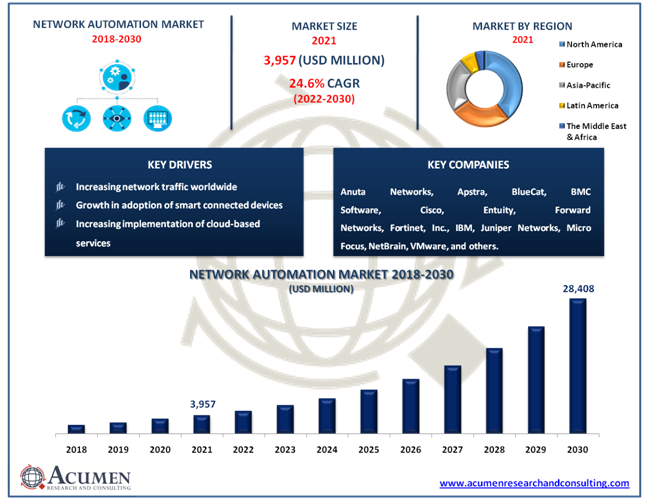

Request Sample Report

The Global Network Automation Market accounted for US$ 3,957 Mn in 2021 and is estimated to reach US$ 28,408 Mn by 2030, with a significant CAGR of 24.6% from 2022 to 2030.

Network automation is the combination of software and process to automate the configuration, provision, management, testing, maintenance, and operation of physical and virtual devices within an organization’s network. These are primarily manual processes, which are error-prone and time-consuming. Automating them saves time, minimizes errors, lowers operational costs, and improves network performance for businesses. Network automation has a wide range of applications. It decreases expenses by reducing human error, increasing efficiency, and lowering costs. Employees will be connected to the network when they need to be and faster, without having to contact IT, to boost an organization's overall productivity levels. These advanced automation solutions can be set up to take corrective action on their own, allowing for closed-loop network issue resolution even before they occur. As a result, network automation boosts operational efficiency, lowers the risk of human mistake, boosts network service availability, and improves customer satisfaction.

Market Growth Drivers:

· Increasing network traffic worldwide

· Growth in adoption of smart connected devices

· Emergence of automation technologies such as AI and machine learning

· Increasing implementation of cloud-based services

Market Restraints:

- Availability of open-source automation tools

- Increasing privacy and security threats

Market Opportunities:

· Surging investments in automation solutions

· Rising implementation of virtual and solutions-defined infrastructure

Report Coverage

| Market | Network Automation Market |

| Market Size 2021 | US$ 3,957 Mn |

| Market Forecast 2030 | US$ 28,408 Mn |

| CAGR | 24.6% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Component, By Network Type, By Deployment Mode, By Organization Size, By End-User, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Anuta Networks, Apstra, BlueCat, BMC Software, Cisco, Entuity, Forward Networks, Fortinet, Inc., IBM, Juniper Networks, Micro Focus, NetBrain, Riverbed, SolarWinds, Veriflow, and VMware. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Market Dynamics

There is an exponential rise in network traffic due to the increasing number of smartphones, computers, laptops, and other many devices. Automations requirement to detect old devices, data leak, compliance issues, and storage issues has proliferated the network automation industry. The majority of the detection process is carried out by the adoption of AI and machine learning. These technologies are used to troubleshoot network issues through real-time data monitoring. With the advent of artificial intelligence and machine learning, sophisticated network automation solutions explore meta-data and control model-driven network programmability to discover network behaviors, provide predictive analysis, and give recommendations to network operations teams.

A few of the benefits that automating network offers are a reduction in several issues, increased network resiliency, lower costs, increased strategic workforce, and reduction in network downtime. With more devices, users, and applications relying on the network for crucial access to a wide range of endpoints, enterprise networks are currently under strain. As a result, businesses are becoming more interested in advanced management tools and innovative network architectures that use machine learning and artificial intelligence to build self-driving or autonomous networks.

However, the market growth is limited by certain factors such as the availability of open-source automation tools and the lack of skilled network engineers. There is widespread usage of open-source tools in the market as they are free, and many SMEs have budget constraints, so they opt for open source automation solutions. In addition, several open-source technology developers have created cost-effective open-source network monitoring solutions that are regarded as superior to their commercial counterparts. Thus, the market is expected to witness a downturn due to these factors.

On the other hand, growing investments in R&D and key players' focus on developing new automation solutions are some of the aspects that can recover the market growth and will create numerous growth opportunities in the coming years. Companies that provide networking solutions are substantially investing in research and development, with an emphasis on long-term value creation.

Market Segmentation

Component, network type, deployment mode, organization size, end-user, industry vertical, and region are all used to segment the worldwide network automation market.

Market by Component

· Solutions

o Intent-Based Networking

o Network Automation Tools

· Services

o Training and Support

o Advisory and Consulting

o Deployment and Integration

Based on our analysis the solution segment is likely to achieve a considerable market share in 2021. Some of the factors that are boosting the solutions segment include the increasing investment in R&D activities, the presence of prevalent network automation solution providers, and a surge in varying connectivity load by communication service providers. In addition, network automation is a must for businesses to establish a networking solution that gets smarter, more responsive, and persistently adopts and protects the network.

Market by Network Type

- Physical Network

- Hybrid Network

- Virtual Network

The physical network is one of the noteworthy elements of the network type segment. Automated physical network deployment reduces installation personnel's skill requirements and allows for faster deployment of campus networks. The physical network configuration enables businesses to deploy physical network equipment to fulfill core business operations within their organizations. Moreover, the growth in large-scale investments by organizations in hardware networks due to reluctance to shift towards virtual networks is also propelling the segment growth.

Market by Deployment Mode

- On-Premise

- Cloud

During the forecasted timeframe, the cloud-based segment is anticipated to grow with the fastest CAGR. Cloud-based computing is becoming more popular among small & medium businesses. The advantages of cloud infrastructure, such as easiness of adoption, scalability, low in-house infrastructure requirements, and simple network automation solution installation, are driving this segment's quickest development.

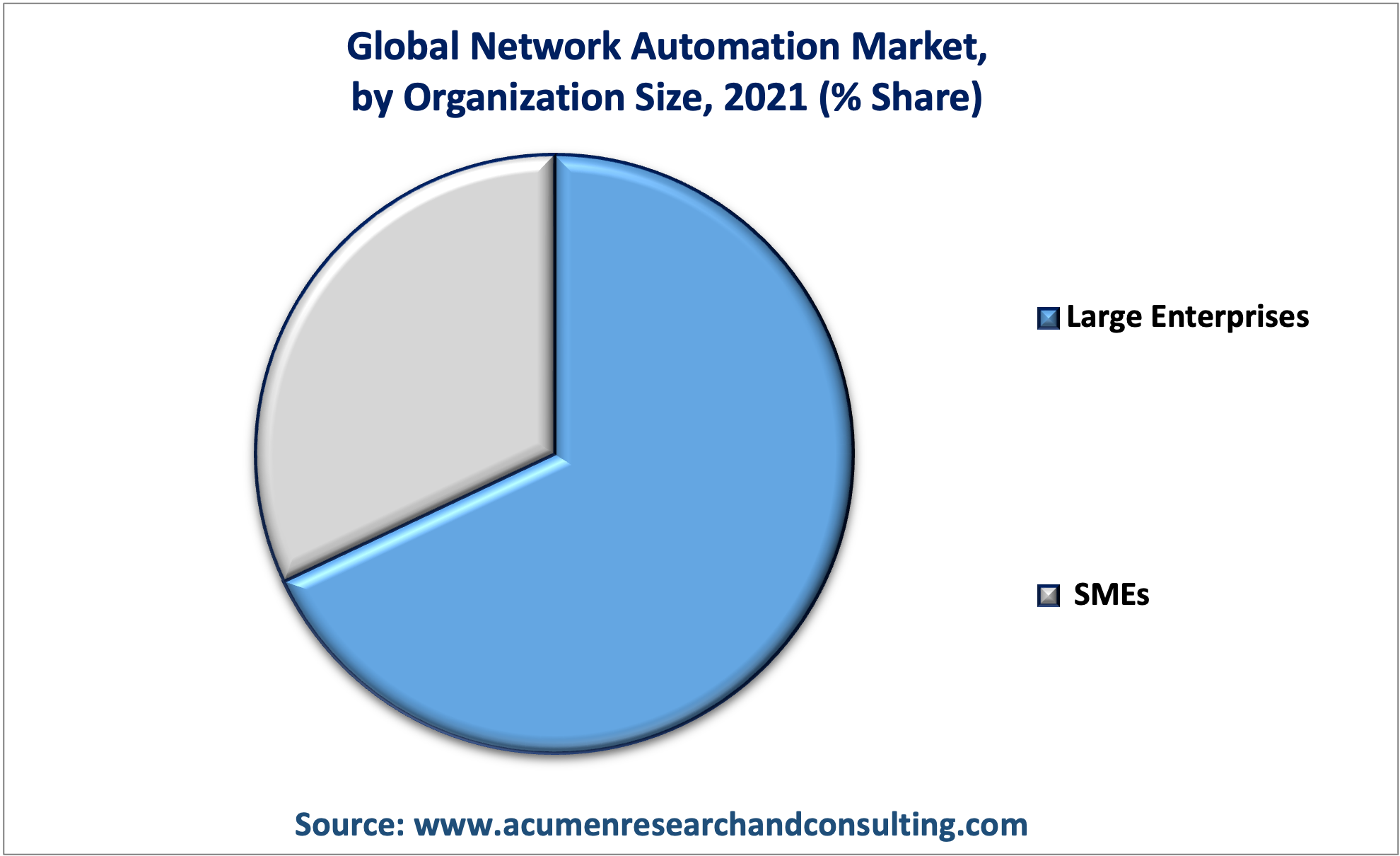

Market by Organization Size

- Large Enterprises

- SMEs

Among the organization size, the large enterprises segment generated a significant market share in 2021. However, the SMEs segment is anticipated to attain the fastest growth rate throughout the forecast period 2022 – 2030. The high growth in the segment is credited to the growing adoption of cloud technology that has driven the application of SDN technology among SMEs. In addition to that, due to budget constraints, SMEs prefer cloud-based network automation tools available in the market, thereby fueling the market demand.

Market by End-User

- Enterprise Vertical

- Service Providers

The pandemic has compelled organizations all over the world to reconsider how they should operate in the new normal. Organizations rely on digital services more than ever before as physical separation has become the norm. More regularly launched applications and services will need to be reliable and secure. Many have automated computing and storage provisioning, but most have not addressed network and security operations, which has only partially alleviated business speed and productivity concerns. Network automation is essential for enterprises to fully automate the IT delivery process from beginning to end.

Market by Industry Vertical

- IT

- Retail

- BFSI

- Healthcare

- Manufacturing

- Energy and Utilities

- Others (Retail, Government and Defense, and Media and Entertainment)

Among all the industry verticals, the IT segment generated significant revenue in 2021 as data centers have several compute, storage, and network devices. Several government digitalization initiatives have resulted in an increase in the IT and telecom industries to meet end-user demand. Furthermore, the introduction of 5G technologies is expected to bring sophisticated networking solutions to the market, thereby boosting the segment growth.

Network Automation MarketRegional Overview

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· India

· Japan

· China

· Australia

· South Korea

· Rest of Asia-Pacific

The Middle East & Africa

· GCC

· South Africa

· Rest of the Middle East & Africa

The presence of key players in the North America region fuels the regional market growth

Based on the regional segmentation, the North American region generated the maximum revenue in 2021. The dominance of the region is credited to the growth of internet penetration and technology use. According to the Cisco Annual Internet Report (2018-2023), by 2023, over 92 percent of the area population will be online. Meanwhile, the Asia-Pacific region is expected to attain the fastest GAGR throughout the forecast timeframe 2022 – 2030. The rising deployments of NFV and SDN by Asia-Pacific organizations are driving this region's rapid growth.

Major Players

Some of the top vendors offered in the professional report include Anuta Networks, Apstra, BlueCat, BMC Software, Cisco, Entuity, Forward Networks, Fortinet, Inc., IBM, Juniper Networks, Micro Focus, NetBrain, Riverbed, SolarWinds, Veriflow, and VMware.

Frequently Asked Questions

How much was the estimated value of the global network automation market in 2021?

The estimated value of global network automation market in 2021 was accounted to be US$3,957 Mn.

What will be the projected CAGR for global network automation market during forecast period of 2022 to 2030?

The projected CAGR of network automation market during the analysis period of 2022 to 2030is 24.6%.

Which are the prominent competitors operating in the market?

The prominent players of the global network automation marketinvolve Anuta Networks, Apstra, BlueCat, BMC Software, Cisco, Entuity, Forward Networks, Fortinet, Inc., IBM, Juniper Networks, Micro Focus, NetBrain, Riverbed, SolarWinds, Veriflow, and VMware.

Which region held the dominating position in the global network automation market?

North America held the dominating share for network automation during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for network automation during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global network automation market?

Increasing network traffic worldwide, growth in adoption of smart connected devices, and emergence of automation technologies such as AI and machine learning drives the growth of global network automation market.

By segment component, which sub-segment held the maximum share?

Based on component, solutions segment held the maximum share for network automation market in 2021.