Needles Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Needles Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

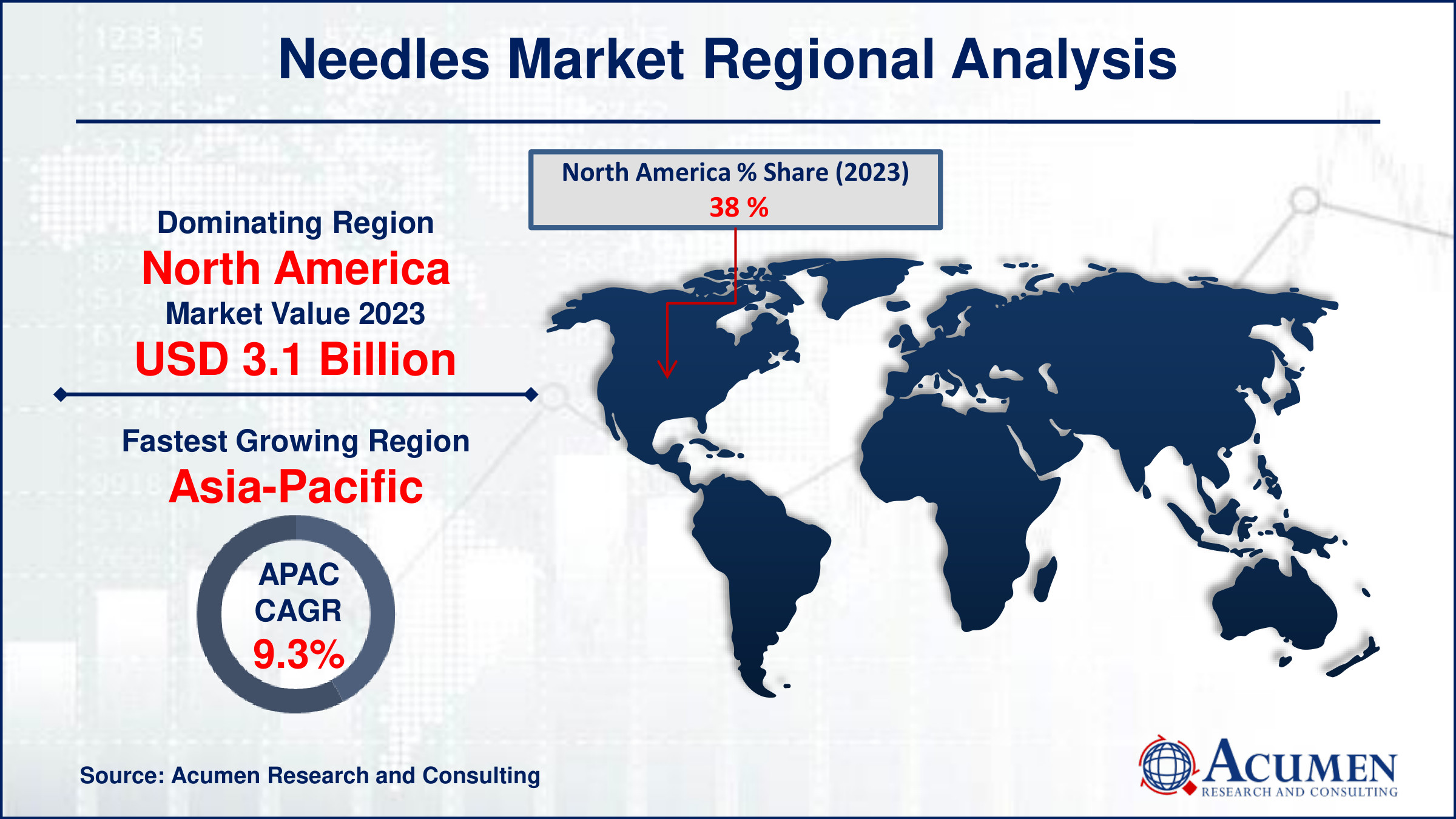

The Global Needles Market Size accounted for USD 8.1 Billion in 2023 and is estimated to achieve a market size of USD 16.8 Billion by 2032 growing at a CAGR of 8.5%from 2024 to 2032

Needles Market Highlights

- Global needles market revenue is poised to garner USD 16.8 billion by 2032 with a CAGR of 8.5% from 2024 to 2032

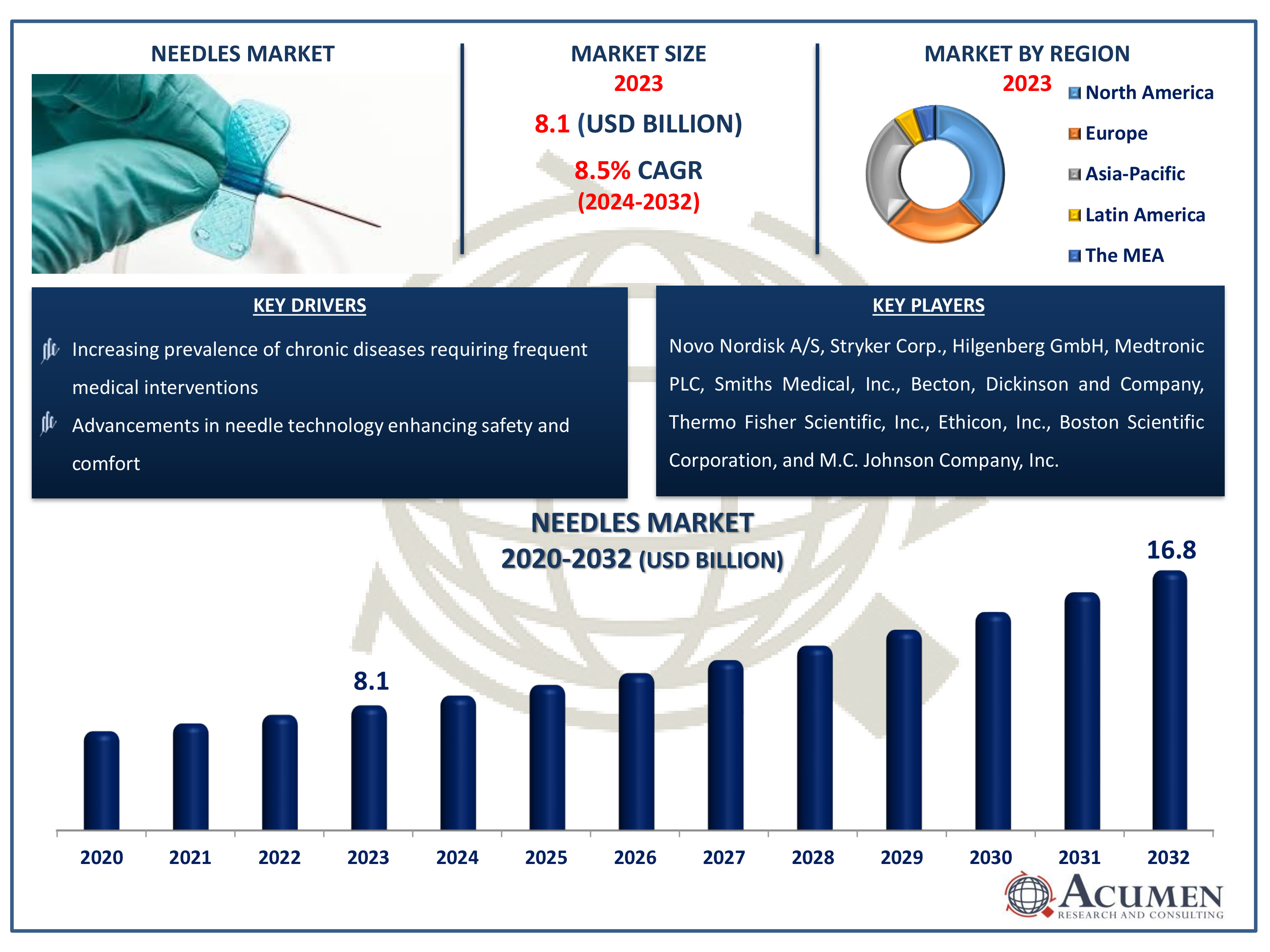

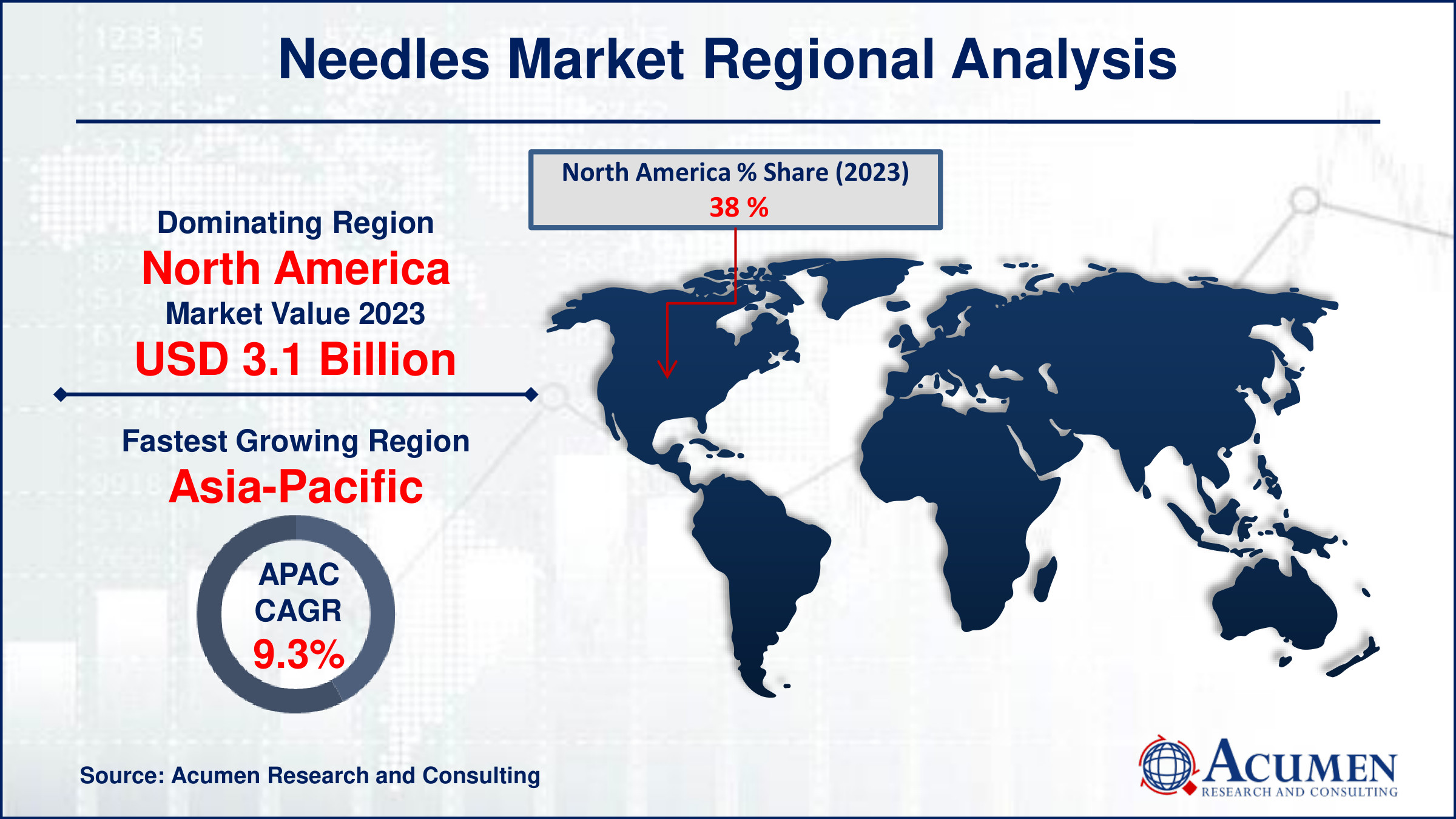

- North America needles market value occupied around USD 3.1 billion in 2023

- Asia-Pacific needles market growth will record a CAGR of more than 9.3% from 2024 to 2032

- Among product, the suture sub-segment generated noteworthy revenue in 2023

- Based on raw material, the stainless steel sub-segment generated significant needles market share in 2023

- Increasing investments in research and development for needle safety is a popular needles market trend that fuels the industry demand

The needles market encompasses a wide range of needle types used across various medical applications, including surgical procedures, diagnostics, and drug delivery. This market is driven by the increasing prevalence of chronic diseases, the rising number of surgical procedures, and advancements in needle technology. Additionally, the growing demand for minimally invasive procedures and the expansion of healthcare infrastructure in emerging economies contribute to market growth. Key players in the market focus on innovation, safety features, and improving patient comfort. With the continuous evolution of medical practices and the increasing emphasis on preventive healthcare, the industry is poised for significant growth and development in the needles market forecast period.

Global Needles Market Dynamics

Market Drivers

- Increasing prevalence of chronic diseases requiring frequent medical interventions

- Rising number of surgical procedures globally

- Advancements in needle technology enhancing safety and comfort

- Growing demand for minimally invasive procedures

Market Restraints

- High risk of needlestick injuries to healthcare workers

- Strict regulatory requirements and compliance costs

- Availability of alternative drug delivery methods

Market Opportunities

- Expanding healthcare infrastructure in emerging markets

- Technological innovations in needle design and materials

- Growing focus on home healthcare and self-administration of medications

NeedlesMarket Report Coverage

| Market | Needles Market |

| Needles Market Size 2022 | USD 8.1 Billion |

| Needles Market Forecast 2032 | USD 16.8 Billion |

| Needles Market CAGR During 2023 - 2032 | 8.5% |

| Needles Market Analysis Period | 2020 - 2032 |

| Needles Market Base Year |

2022 |

| Needles Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Product, By Delivery Mode, By Raw Material, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Novo Nordisk A/S, Stryker Corp., Hilgenberg GmbH, Medtronic PLC, Smiths Medical, Inc., Becton, Dickinson and Company, Thermo Fisher Scientific, Inc., Ethicon, Inc., Boston Scientific Corporation, and M.C. Johnson Company, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Needles Market Insights

The rising awareness and consciousness about blood donation are significantly driving the needles market. Campaigns and initiatives to encourage blood donation have heightened, resulting in an increased number of donors. This surge in blood donation activities necessitates a steady and reliable supply of needles, thereby boosting market demand. Continuous research and development efforts to produce advanced needle technology with enhanced safety and accuracy are pivotal to market growth. Innovations in needle design and manufacturing processes aim to reduce pain, prevent needlestick injuries, and improve overall safety for both patients and healthcare providers. These advancements not only improve patient outcomes but also increase the adoption of new needle technologies.

The global increase in the geriatric population is another major driver. Older adults often require more medical attention, including regular injections and blood tests, due to the higher prevalence of chronic diseases among this age group. This demographic trend is expected to sustain the demand for various types of needles, thereby supporting market growth. The growing need for vaccines, particularly in the wake of global health challenges like the COVID-19 pandemic, is a crucial driver for the needles market. Vaccination campaigns require massive quantities of needles for administering doses, significantly boosting market demand.

The high risk of needlestick injuries to healthcare workers remains a significant restraint. Such injuries pose health risks and add to healthcare costs, which may deter the use of needles. The stringent regulatory requirements and compliance costs associated with needle manufacturing and approval processes can hinder market growth. These regulations ensure safety and efficacy but can also delay the introduction of new products to the market.

The expansion of healthcare infrastructure in developing nations presents significant opportunities for the needles market. Increased investment in healthcare facilities and services leads to higher demand for medical supplies, including needles. The continuous advancements in needle technology offer substantial growth opportunities. Research focused on developing needles that are safer, more comfortable, and more effective is likely to drive market growth. The growing focus on home healthcare and self-administration of medications is creating new opportunities for needle manufacturers. Products designed for ease of use by patients at home can cater to this expanding market segment. The increasing number of hospitals and clinics, particularly in developing regions, is expected to expand the needles market. More healthcare facilities mean higher demand for medical supplies, including various types of needles necessary for routine procedures and treatments.

Needles Market Segmentation

The worldwide market for needles is split based on type, product, delivery mode, raw material, end users, and geography.

Needle Market Types

- Conventional

- Safety

According to needles industry analysis, the conventional needles segment holds the largest share due to its widespread usage, cost-effectiveness, and familiarity among healthcare professionals. These needles are commonly used in various medical procedures, including injections, blood draws, and intravenous therapies. Their extensive application in hospitals, clinics, and other healthcare settings contributes significantly to their market dominance. Despite advancements in safety needle technology, the simplicity, availability, and lower costs of conventional needles ensure their continued preference, particularly in resource-constrained environments, thus maintaining their leading position in the global needles market.

Needle Market Products

- Pen

- Suture

- Blood Collection

- Dental

- Ophthalmic

- Others

The suture segment generate a significant share in the needles market due to its crucial role in wound closure and surgical procedures. Suturing is a fundamental medical practice employed extensively in hospitals, clinics, and outpatient centers to repair tissue and close incisions. The high frequency of surgical interventions, coupled with the necessity for effective wound management, drives the demand for suture needles. Additionally, the development of specialized suture needles for various types of surgeries further bolsters their widespread adoption, ensuring the suture segment's prominent position in the global needles market.

Needle Market Delivery Modes

- Hypodermic

- Subcutaneous

- Intravenous

- Intramuscular

- Others

In the needles market, the hypodermic needles segment is expected to be the largest due to their widespread use in medical procedures. Hypodermic needles are essential for injecting medications, drawing blood, and administering vaccines. Their versatility, ease of use, and effectiveness in various medical settings contribute to their dominance in the market. With advancements in needle technology and increasing healthcare demands, the hypodermic segment is poised to continue its leading position, driven by their critical role in both routine and complex medical applications.

Needle Market Raw Materials

- Stainless Steel

- Glass

- Others

Stainless steel dominates the market and it is expected to increase during the needles industry forecast period, due to its superior properties, including strength, corrosion resistance, and biocompatibility. This material is highly favored in the production of needles because it ensures durability and precision during medical procedures. Its resistance to rust and staining makes it ideal for both disposable and reusable needles, contributing to its widespread use. Additionally, stainless steel's ability to maintain sharpness and integrity under various conditions enhances its reliability in medical settings, solidifying its position as the preferred raw material for needle manufacturing.

Needle Market End Users

- Hospitals and Clinics

- Diagnostic Centers

- Home

- Others

Based on the end user category, the segment of hospitals and clinics leads the needles market due to their high volume of procedures requiring needle use. These healthcare facilities regularly perform a range of treatments, including injections, blood draws, and intravenous therapies, which drives significant needle consumption. The extensive array of medical activities performed in hospitals and clinics necessitates a constant supply of various types of needles. Their centralized role in patient care, combined with rigorous standards for medical equipment, underscores their dominant position in the market, making them the primary end users of needles.

Needles Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

NeedlesMarket Regional Analysis

In the terms of needles market analysis, North America holds the largest share due to its advanced healthcare infrastructure, high demand for medical procedures, and substantial investments in healthcare technology. The region benefits from a well-established distribution network, a high prevalence of chronic diseases, and a strong presence of leading market players.

Conversely, the Asia-Pacific region is experiencing the fastest growth. This surge is driven by increasing healthcare spending, rising population, and expanding healthcare access across developing countries. Rapid urbanization and improving economic conditions in countries like China and India contribute significantly to the market's expansion. The growing emphasis on improving healthcare infrastructure and increasing awareness of healthcare practices further fuel the demand for needles in this region. As a result, while North America remains the largest market, Asia-Pacific dynamic growth presents significant opportunities for market players.

Needles Market Players

Some of the top needles companies offered in our report includes Novo Nordisk A/S, Stryker Corp., Hilgenberg GmbH, Medtronic PLC, Smiths Medical, Inc., Becton, Dickinson and Company, Thermo Fisher Scientific, Inc., Ethicon, Inc., Boston Scientific Corporation, and M.C. Johnson Company, Inc.

Frequently Asked Questions

How big is the needles market?

The needles market size was valued at USD 8.1 billion in 2023.

What is the CAGR of the global needles market from 2024 to 2032?

The CAGR of needles is 8.5% during the analysis period of 2024 to 2032.

Which are the key players in the needles market?

The key players operating in the global market are including Novo Nordisk A/S, Stryker Corp., Hilgenberg GmbH, Medtronic PLC, Smiths Medical, Inc., Becton, Dickinson and Company, Thermo Fisher Scientific, Inc., Ethicon, Inc., Boston Scientific Corporation, and M.C. Johnson Company, Inc.

Which region dominated the global needles market share?

North America held the dominating position in needles industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of needles during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global needles industry?

The current trends and dynamics in the needles industry include increasing prevalence of chronic diseases requiring frequent medical interventions, rising number of surgical procedures globally, advancements in needle technology enhancing safety and comfort, and growing demand for minimally invasive procedures.

Which type held the maximum share in 2023?

The conventional held the notable share of the needles industry.