Microdisplays Market | Acumen Research and Consulting

Microdisplays Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

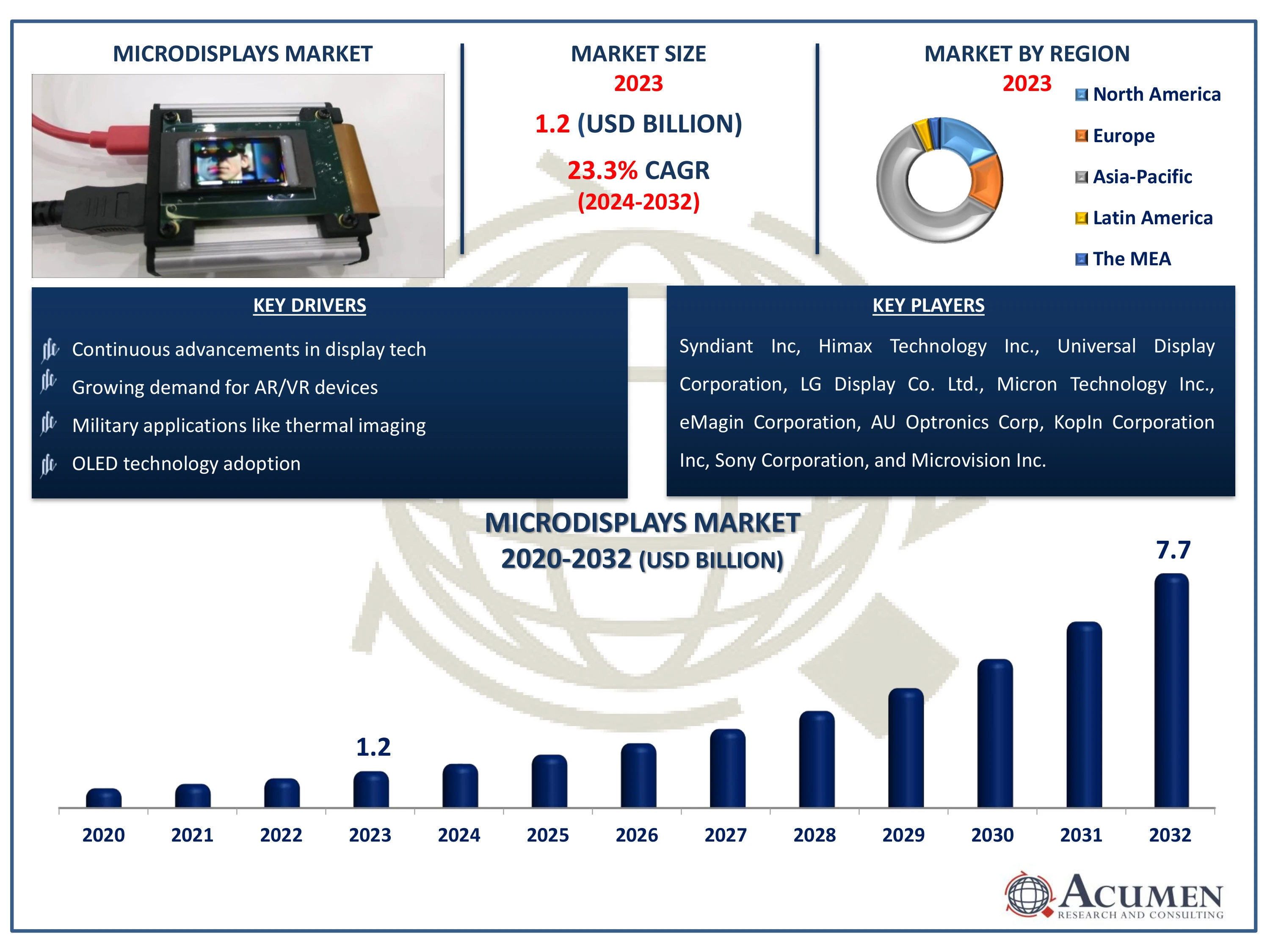

The Global Microdisplays Market Size accounted for USD 1.2 Billion in 2023 and is estimated to achieve a market size of USD 7.7 Billion by 2032 growing at a CAGR of 23.3% from 2024 to 2032.

Microdisplays Market Highlights

- Global microdisplays market revenue is poised to garner USD 7.7 billion by 2032 with a CAGR of 23.3% from 2024 to 2032

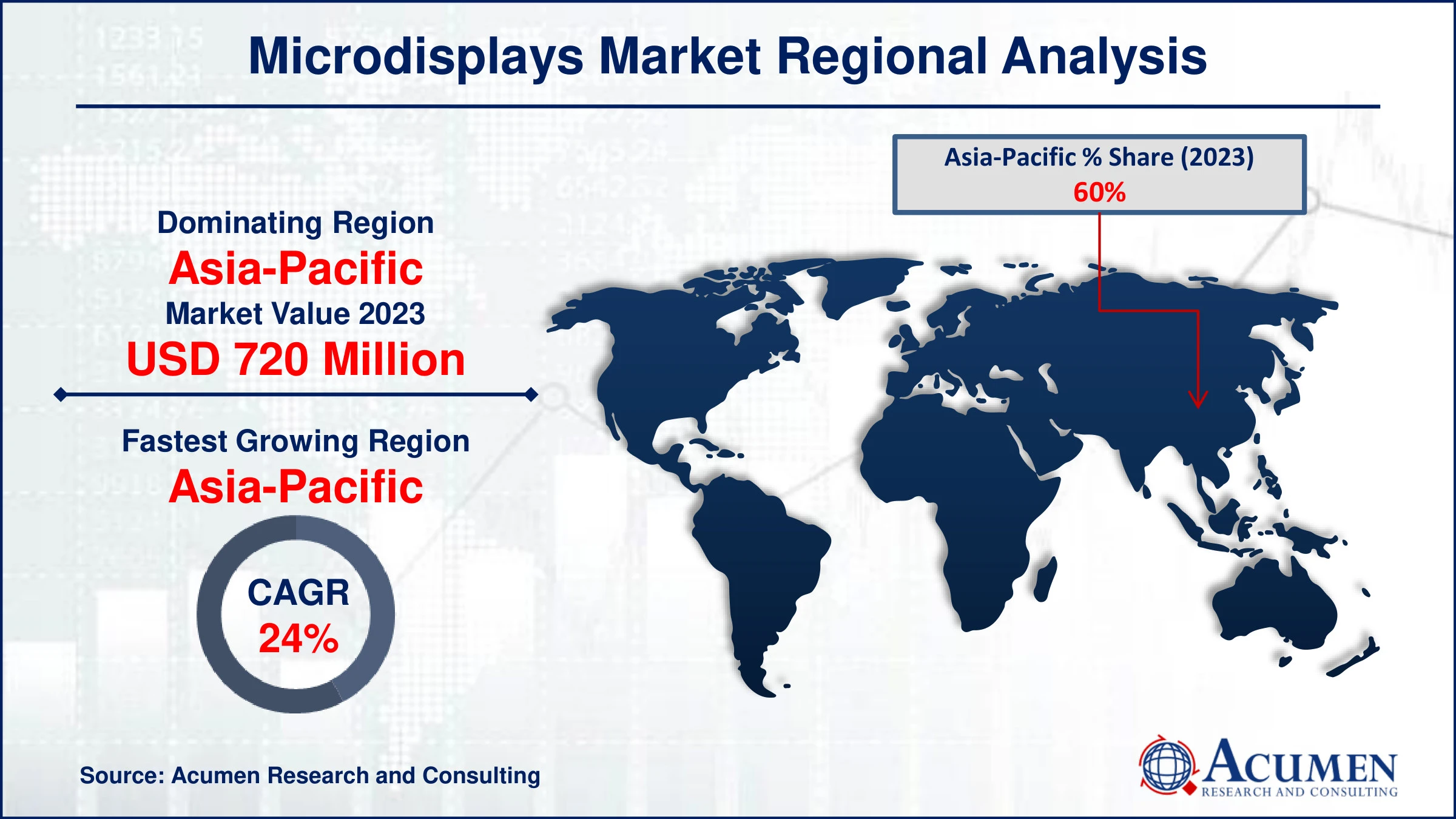

- Asia-Pacific microdisplays market value occupied around USD 720 million in 2023

- Asia-Pacific microdisplays market growth will record a CAGR of more than 24% from 2024 to 2032

- Among technology, the LCD sub-segment generated notable revenue in 2023

- Based on application, the consumer electronics sub-segment generated significant market share in 2023

Flexible microdisplay tech development opens new device possibilities is a popular microdisplays market trend that fuels the industry demand

Microdisplays are miniature display panels typically measuring less than one inch diagonally. They utilize technologies like OLED, LCD, or LCoS (Liquid Crystal on Silicon) to render images. Despite their small size, microdisplays offer high resolution and brightness, making them suitable for applications requiring compact, lightweight displays with high visual clarity. They are commonly used in electronic viewfinders for cameras, head-mounted displays (HMDs) in virtual and augmented reality systems, and as viewfinders in digital cameras and camcorders. Their compact size and efficient performance make microdisplays integral components in a variety of consumer electronics, medical devices, and military applications where space and weight are critical considerations.

Global Microdisplays Market Dynamics

Market Drivers

- Growing demand for AR/VR devices boosts microdisplay market

- OLED technology adoption drives microdisplay demand

- Military applications like thermal imaging drive microdisplay use

- Continuous advancements in display tech expand microdisplay applications

Market Restraints

- High initial and production costs limit microdisplay adoption

- Integration complexities hinder widespread microdisplay use

- Regulatory compliance poses challenges in healthcare and military sectors

Market Opportunities

- Automotive demand grows for ADAS and AR displays

- Wearables like smart glasses expand microdisplay applications

- Healthcare explores microdisplays for medical devices

Microdisplays Market Report Coverage

|

Market |

Microdisplays Market |

|

Microdisplays Market Size 2023 |

USD 1.2 Billion |

|

Microdisplays Market Forecast 2032 |

USD 7.7 Billion |

|

Microdisplays Market CAGR During 2024 - 2032 |

23.3% |

|

Microdisplays Market Analysis Period |

2020 - 2032 |

|

Microdisplays Market Base Year |

2023 |

|

Microdisplays Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Technology, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Syndiant Inc, Himax Technology Inc., Universal Display Corporation, LG Display Co. Ltd., Micron Technology Inc., eMagin Corporation, AU Optronics Corp, KopIn Corporation Inc, Sony Corporation, and Microvision Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Microdisplays Market Insights

The global microdisplay market is poised for significant growth driven by expanding applications across various sectors. Microdisplays are increasingly being integrated into consumer electronics, defense, aerospace, automotive sectors, and emerging technologies like holographic displays. Consumer electronics, particularly fitness trackers and smartwatches, are driving demand due to their applications in fitness monitoring, health tracking, entertainment, and lifestyle enhancements. The increasing popularity of these devices among consumers is expected to bolster the industry in the microdisplays market forecast period.

Another growth factor is the development of microdisplay-based holographic displays. These advanced displays offer immersive experiences and are finding applications in entertainment, gaming, and professional sectors, thereby contributing to market expansion. The adoption of Virtual Reality (VR) headsets, especially those compatible with smartphones, is also contributing significantly to market growth. VR headsets are increasingly favored by younger demographics for enhanced gaming experiences, with smartphone manufacturers like HTC and Samsung bundling VR headsets with new smartphones. This trend not only boosts the sales of microdisplays but also widens their application scope beyond traditional uses.

In addition to consumer electronics and entertainment, microdisplays are gaining traction in critical sectors such as defense and aerospace. They are integral components in applications like head-up displays (HUDs), thermal imaging devices, and wearable technology used by defense personnel and pilots, further driving market expansion. Looking ahead, the microdisplay market is expected to benefit from ongoing technological advancements, including improvements in display resolution, energy efficiency, and integration capabilities. These advancements will cater to growing demand across multiple sectors, reinforcing the steady momentum anticipated in the market in the microdisplays industry forecast period.

Microdisplays Market Segmentation

The worldwide market for microdisplays is split based on type, technology, application, and geography.

Microdisplay Market By Type

- Near-to-Eye

- Projection

- Others

According to microdisplays industry analysis, the near-to-eye segment holds the largest share primarily due to its widespread adoption in applications such as augmented reality (AR), virtual reality (VR), and heads-up displays (HUDs). Near-to-eye microdisplays are crucial for these technologies as they provide compact, high-resolution displays that are essential for immersive user experiences and real-time data overlay. The increasing demand for AR glasses, VR headsets, and HUDs across various sectors including gaming, healthcare, automotive, and defense is driving the growth of this segment. Technological advancements in near-to-eye microdisplays, such as improved resolution, field of view, and energy efficiency, further enhance their appeal. As these applications continue to expand, the near-to-eye segment is expected to maintain its dominance in the microdisplays market.

Microdisplay Market By Technology

- OLED

- LCD

- DLP

- LCoS

The LCD technology segment commands the largest share in the microdisplay market due to its versatile applications across various industries. LCD microdisplays offer cost-effective solutions with good color reproduction and brightness, making them suitable for a wide range of devices including consumer electronics, automotive displays, and industrial equipment. Their established presence in products like digital cameras, camcorders, and head-mounted displays (HMDs) further solidifies their market dominance. LCD microdisplays also benefit from mature manufacturing processes and extensive industry adoption, which contribute to their competitive pricing and scalability. Continuous advancements in LCD technology, such as improved pixel density and energy efficiency, ensure that they remain a preferred choice for applications requiring high-quality visual output. As demand grows in sectors like healthcare, automotive HUDs, and entertainment, the LCD segment is poised to maintain its leading position in the microdisplays market.

Microdisplay Market By Application

- Consumer Electronics

- Military & Defense

- Medical

- Industrial

- Automotive

- Others

Consumer electronics constitute the notable segment in the microdisplays market, driven by widespread adoption in devices like augmented reality (AR) glasses, virtual reality (VR) headsets, and smartwatches. These applications benefit from microdisplays ability to deliver high-resolution visuals in compact form factors, enhancing user experiences in gaming, entertainment, and personal health monitoring. The consumer electronics sector continues to innovate with new product launches incorporating microdisplays, attracting a growing customer base interested in immersive technologies and wearable devices. Moreover, advancements in display technologies such as OLED and LCD further fuel the adoption of microdisplays in consumer electronics, ensuring sharper image quality and energy efficiency. As consumer demand for enhanced digital experiences grows, particularly among younger demographics, the consumer electronics segment is expected to maintain its prominence in driving the expansion of the microdisplays market globally.

Microdisplays Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Microdisplays Market Regional Analysis

In terms of microdisplays market analysis, the Asia-Pacific region is the largest and fastest-growing, driven by several key factors. This region is home to some of the world's leading manufacturers of consumer electronics, such as Samsung, LG, Sony, and Panasonic, which extensively incorporate microdisplays into their products. The robust demand for advanced consumer electronics, including smartphones, VR headsets, and wearable devices, propels the market in this region. Additionally, the Asia-Pacific region has a significant presence in the automotive and defense sectors, which are increasingly adopting microdisplay technology for applications such as heads-up displays (HUDs) and night vision equipment. Countries like China, Japan, and South Korea are investing heavily in these technologies, further boosting market growth.

The region also benefits from a strong manufacturing infrastructure and favorable government policies supporting technological advancements and innovation. Investments in research and development by key players and collaborations with technology firms enhance the development of new and improved microdisplay products. Moreover, the growing middle-class population and increasing disposable incomes in the Asia-Pacific region drive consumer demand for high-tech gadgets and immersive experiences, further fuel the market. As a result, the Asia-Pacific region is not only the largest but also the fastest-growing microdisplay market, with significant potential for continued expansion in the coming years.

Microdisplays Market Players

Some of the top microdisplays companies offered in our report includes Syndiant Inc, Himax Technology Inc., Universal Display Corporation, LG Display Co. Ltd., Micron Technology Inc., eMagin Corporation, AU Optronics Corp, KopIn Corporation Inc, Sony Corporation, and Microvision Inc.

Frequently Asked Questions

How big is the microdisplays market?

The microdisplays market size was valued at USD 1.2 billion in 2023.

What is the CAGR of the global microdisplays market from 2024 to 2032?

The CAGR of microdisplays is 23.3% during the analysis period of 2024 to 2032.

Which are the key players in the microdisplays market?

The key players operating in the global market are including Syndiant Inc, Himax Technology Inc., Universal Display Corporation, LG Display Co. Ltd., Micron Technology Inc., eMagin Corporation, AU Optronics Corp, KopIn Corporation Inc, Sony Corporation, and Microvision Inc.

Which region dominated the global microdisplays market share?

Asia-Pacific held the dominating position in microdisplays industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of microdisplays during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global microdisplays industry?

The current trends and dynamics in the microdisplays industry include growing demand for AR/VR devices, OLED technology adoption, military applications like thermal imaging, and continuous advancements in display tech.

Which technology held the maximum share in 2023?

The LCD technology held the maximum share of the microdisplays industry.