Melt-Blown Polypropylene Filters Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Melt-Blown Polypropylene Filters Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

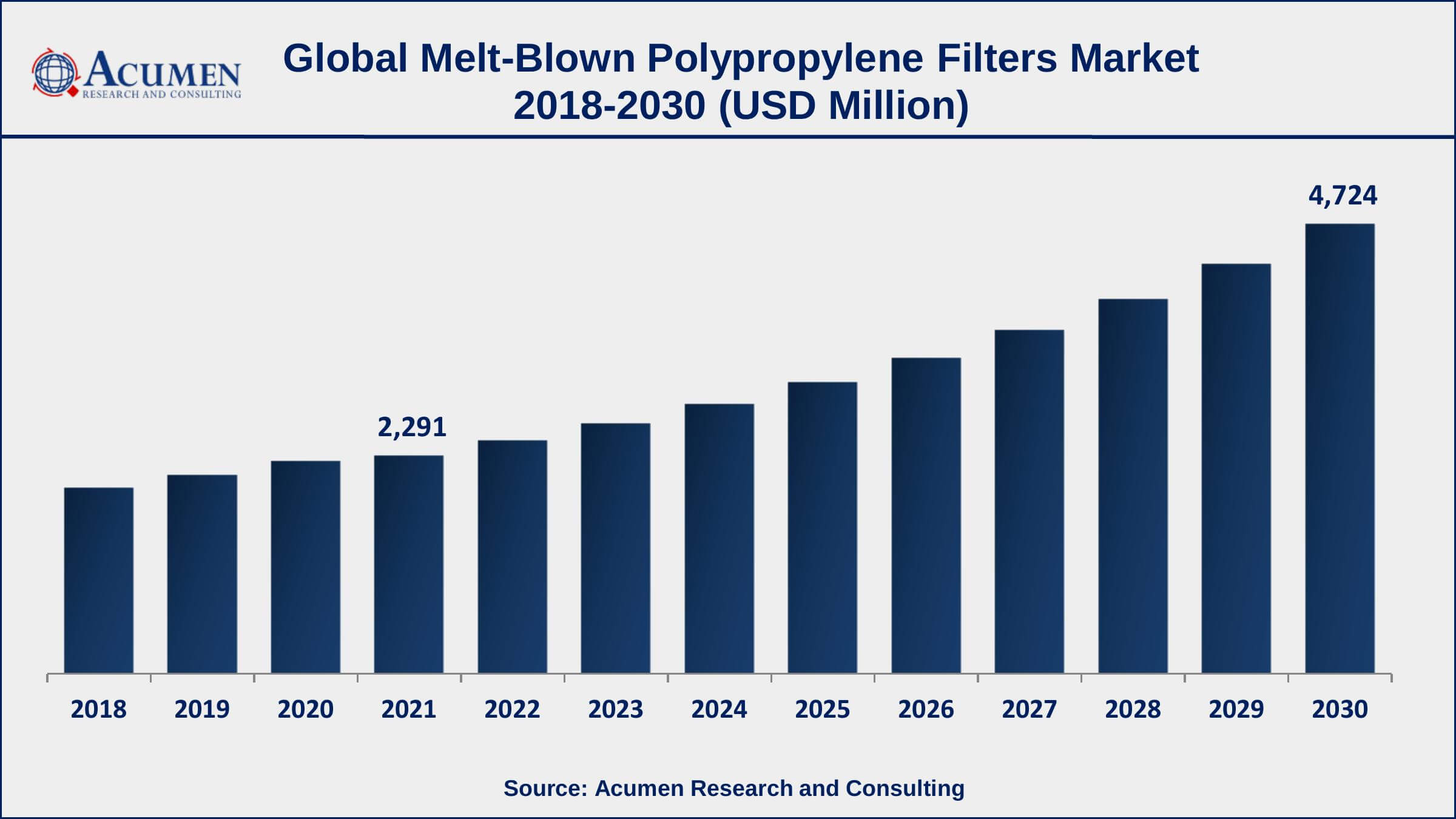

The Global Melt-Blown Polypropylene Filters Market Size accounted for USD 2,291 Million in 2021 and is estimated to achieve a market size of USD 4,724 Million by 2030 growing at a CAGR of 8.6% from 2022 to 2030. Growing product prominence in the wastewater and water treatment industry is anticipated to drive the global melt-blown polypropylene filters market growth. Furthermore, the strong focus of food and beverage firms on increasing production operations would drive melt-blown polypropylene filters market value over 2022 and 2030.

Melt-Blown Polypropylene Filters Market Report Key Highlights

- Global melt-blown polypropylene filters market revenue is estimated to expand by USD 4,724 million by 2030, with a 8.6% CAGR from 2022 to 2030.

- Asia-Pacific melt-blown polypropylene filters market share accounted for over 34.9% of total market shares in 2021

- North America melt blown polypropylene filters market growth will observe fastest CAGR from 2022 to 2030

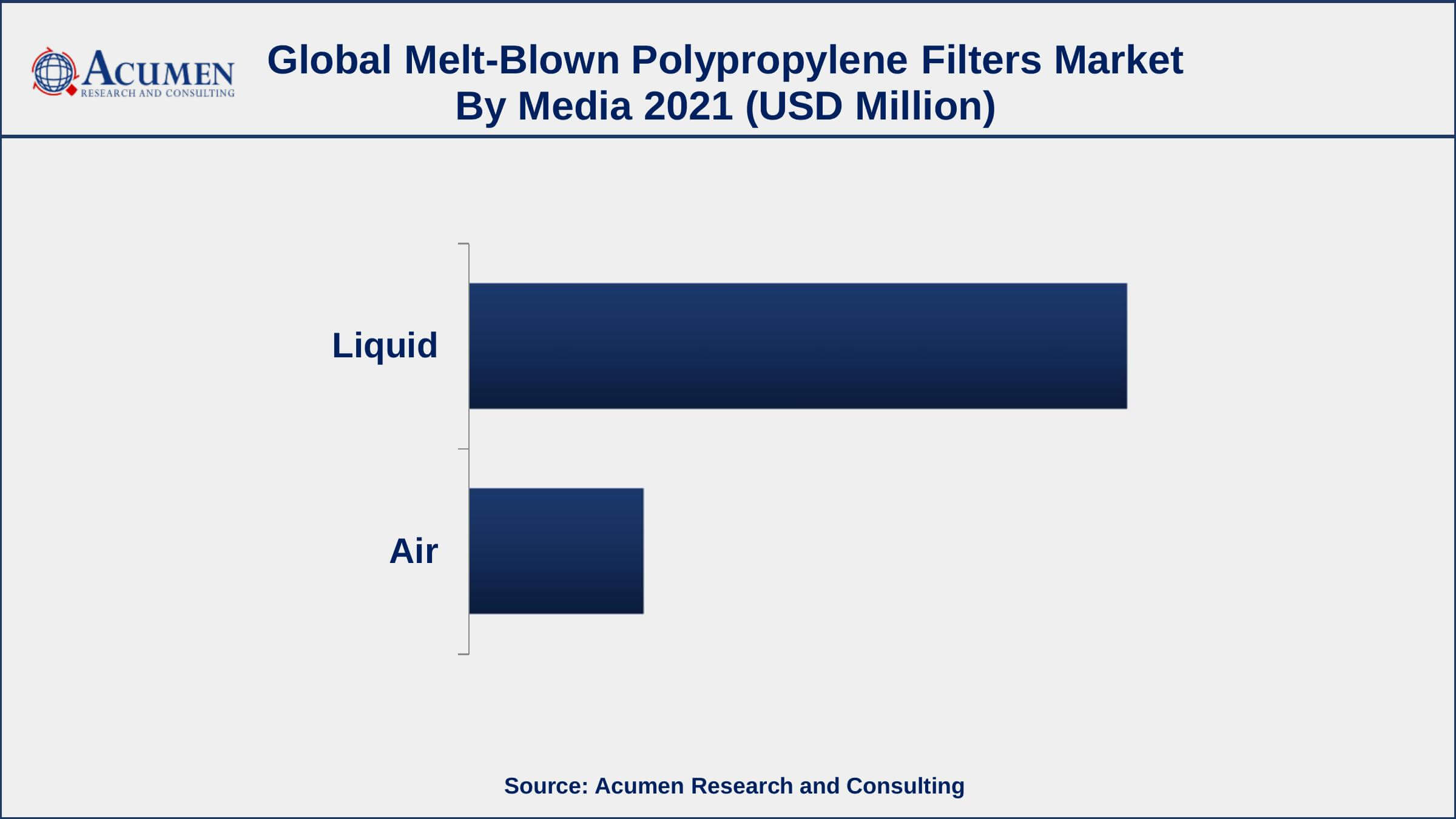

- Based on media, liquid segment accounted for over 78.9% of the overall market share in 2021

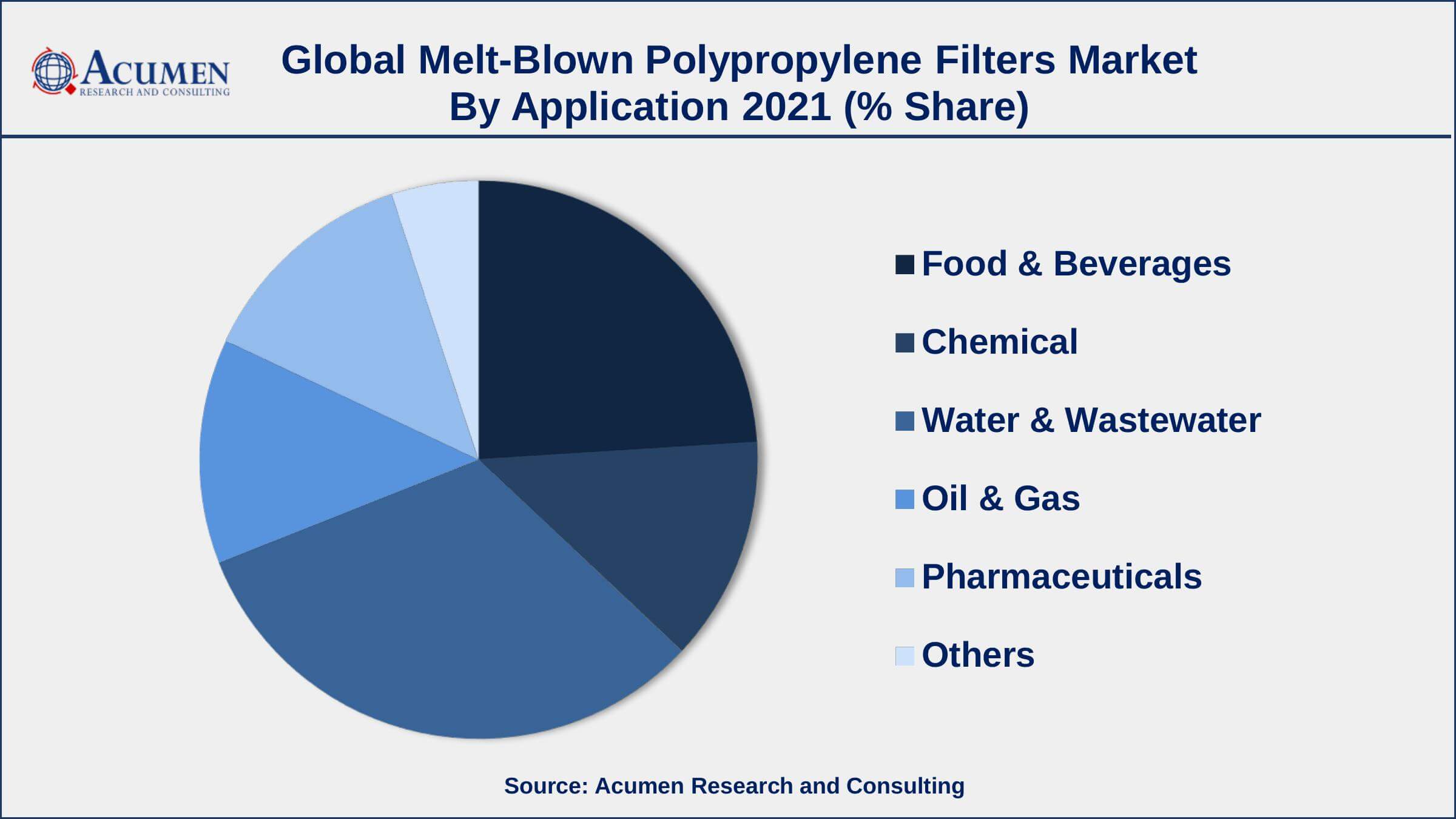

- Among application, water and wastewater treatment segment engaged more than 32.2% of the total market share

- Increasing demand in the pharmaceutical industry, drives the melt-blown polypropylene filters market size

Melt-blown polypropylene filters are spherical cartridges with a set pore structure and a large dirt retention capacity. They provide superior filtration and are utilized in a broad range of industries around the world, such as metal plating, pre-filter for reverse osmosis (RO), desalination, and industrial systems for wastewater treatment. They are widely used in the food and beverage (F&B) sector to assure the purity of the product since they aid in the removal of pollutants, surfactants, as well as residuals.

Global Melt-Blown Polypropylene Filters Market Trends

Market Drivers

- Growth and expansion of the water treatment market

- Increasing demand in the pharmaceutical industry

- Growing demands in the food and beverage industry

- High utilization of melt-blown polypropylene filter due to multiple characteristics

Market Restraints

- Utilization of alternate possibilities

- Increasing popularity of membrane technology

Market Opportunities

- Increasing support for nonwoven filter media in water treatment

- Rising concerns about health risks associated with drinking polluted water

Melt-Blown Polypropylene Filters Market Report Coverage

| Market | Melt-Blown Polypropylene Filters Market |

| Melt-Blown Polypropylene Filters Market Size 2021 | USD 2,291 Million |

| Melt-Blown Polypropylene Filters Market Forecast 2030 | USD 4,724 Million |

| Melt-Blown Polypropylene Filters Market CAGR During 2022 - 2030 | 8.6% |

| Melt-Blown Polypropylene Filters Market Analysis Period | 2018 - 2030 |

| Melt-Blown Polypropylene Filters Market Base Year | 2021 |

| Melt-Blown Polypropylene Filters Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Media, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Trinity Filtration Technologies Pvt. Ltd., Clack Corp., Parker Hannifin Corporation, Brother Filtration Equipment Co. Ltd., The 3M Company, United Filters International (UFI), Pall Corp., Suez SA, Eaton Corp., Borealis AG., and Lenntech B.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Growing demand for nonwoven filter media in water purification, in emerging nations, for example, China and India, is relied upon to be the main consideration driving the worldwide melt blown polypropylene filters market size. Both nations are relied upon to build their desalination limit by around 10 million liters for every day in the coming decade. Increasing concerns about health risks related to drinking polluted water are anticipated to profit the worldwide market. Expanding shortage of water is driving the demand for water desalination ventures. According to a report distributed in 2016 by the International Desalination Association, there were around 17,000 desalination plants situated crosswise over 150 nations, which give safe drinking water to more than 300 million individuals around the world. In the food & beverages segment, melt-blown polypropylene filters are utilized for the preparation of organic product juices and sodas to guarantee the immaculateness of the product.

Filters likewise discover applications in the oil and gas division. They are utilized for the refining techniques of unrefined petroleum or crude oil. According to the information distributed by International Energy Agency (IEA) in 2017, oil production around the world is probably going to increment in the following couple of years. The information likewise expressed that the Middle East region is relied upon to watch a huge increase in its raw petroleum refining limit.

Almost 7 million barrels every day of additional refining limit is probably going to come online by 2023. The Organization of the Petroleum Exporting Countries (OPEC) is additionally expected to include a limit of about 750,000 barrels every day by 2023. In this way, escalating need for refining forms in the oil and gas segment because of the increasing production of crude oil is probably going to remain a key factor in enlarging the market development.

Melt-Blown Polypropylene Filters Market Segmentation

The worldwide melt blown polypropylene filters market segmentation is based on the media, application, and geography.

Melt-Blown Polypropylene Filters Market By Media

- Liquid

- Air

According to a melt-blown polypropylene filters industry analysis, the liquid media segment can hold a significant market share in 2021. The product's unique capability to retain fine particles is likely to stimulate demand in the F&B sector.

Melt-Blown Polypropylene Filters Market By Application

- Food & Beverages

- Chemical

- Water & Wastewater

- Oil & Gas

- Pharmaceuticals

- Others

According to the melt-blown polypropylene filters market forecast, the food and beverage industry is predicted to increase significantly in the market during the predicted years. Rising consumer knowledge of processes such as High-Pressure Processing (HPP) is propelling the industry forward. HPP is a method of food processing that uses filters as well as other media to enhance the overall quality of liquid or solid food items.

Melt-Blown Polypropylene Filters Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Holds Largest Share Of Global Melt-Blown Polypropylene Filters Market

As far as revenue, Asia-Pacific was the biggest regional market and represented 35% of the worldwide industry revenue in 2021. Growing investments in the regional wastewater and water treatment industry because of the rising need for new water are probably going to help product demand.

North America is probably going to watch moderate development over the coming years. The region is relied upon to represent about 27.0% of the worldwide revenue by 2025. The oil and gas division of the region is probably going to carter consistent demand for the product over the estimated time frame. In this manner, the area's development is to a great extent reliant on the key nations, for example, U.K. and Germany.

Melt-Blown Polypropylene Filters Market Players

Some of the top melt-blown polypropylene filters market companies offered in the professional report includes Trinity Filtration Technologies Pvt. Ltd., Clack Corp., Parker Hannifin Corporation, Brother Filtration Equipment Co. Ltd., The 3M Company, United Filters International (UFI), Pall Corp., Suez SA, Eaton Corp., Borealis AG., and Lenntech B.V.

Frequently Asked Questions

What is the size of global melt-blown polypropylene filters market in 2021?

The estimated value of global melt-blown polypropylene filters market in 2021 was accounted to be USD 2,291 Million.

What is the CAGR of global melt-blown polypropylene filters market during forecast period of 2022 to 2030?

The projected CAGR melt-blown polypropylene filters market during the analysis period of 2022 to 2030 is 8.6%.

Which are the key players operating in the market?

The prominent players of the global melt-blown polypropylene filters market are Trinity Filtration Technologies Pvt. Ltd., Clack Corp., Parker Hannifin Corporation, Brother Filtration Equipment Co. Ltd., The 3M Company, United Filters International (UFI), Pall Corp., Suez SA, Eaton Corp., Borealis AG., and Lenntech B.V.

Which region held the dominating position in the global melt-blown polypropylene filters market?

Asia-Pacific held the dominating melt-blown polypropylene filters during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for melt-blown polypropylene filters during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global melt-blown polypropylene filters market?

Growth and expansion of the water treatment market and increasing demand in the pharmaceutical industry drives the growth of global melt-blown polypropylene filters market.

By media segment, which sub-segment held the maximum share?

Based on media, commodity chemical segment is expected to hold the maximum share of the melt-blown polypropylene filters market.