Medical Nonwoven Disposables Market | Acumen Research and Consulting

Medical Nonwoven Disposables Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

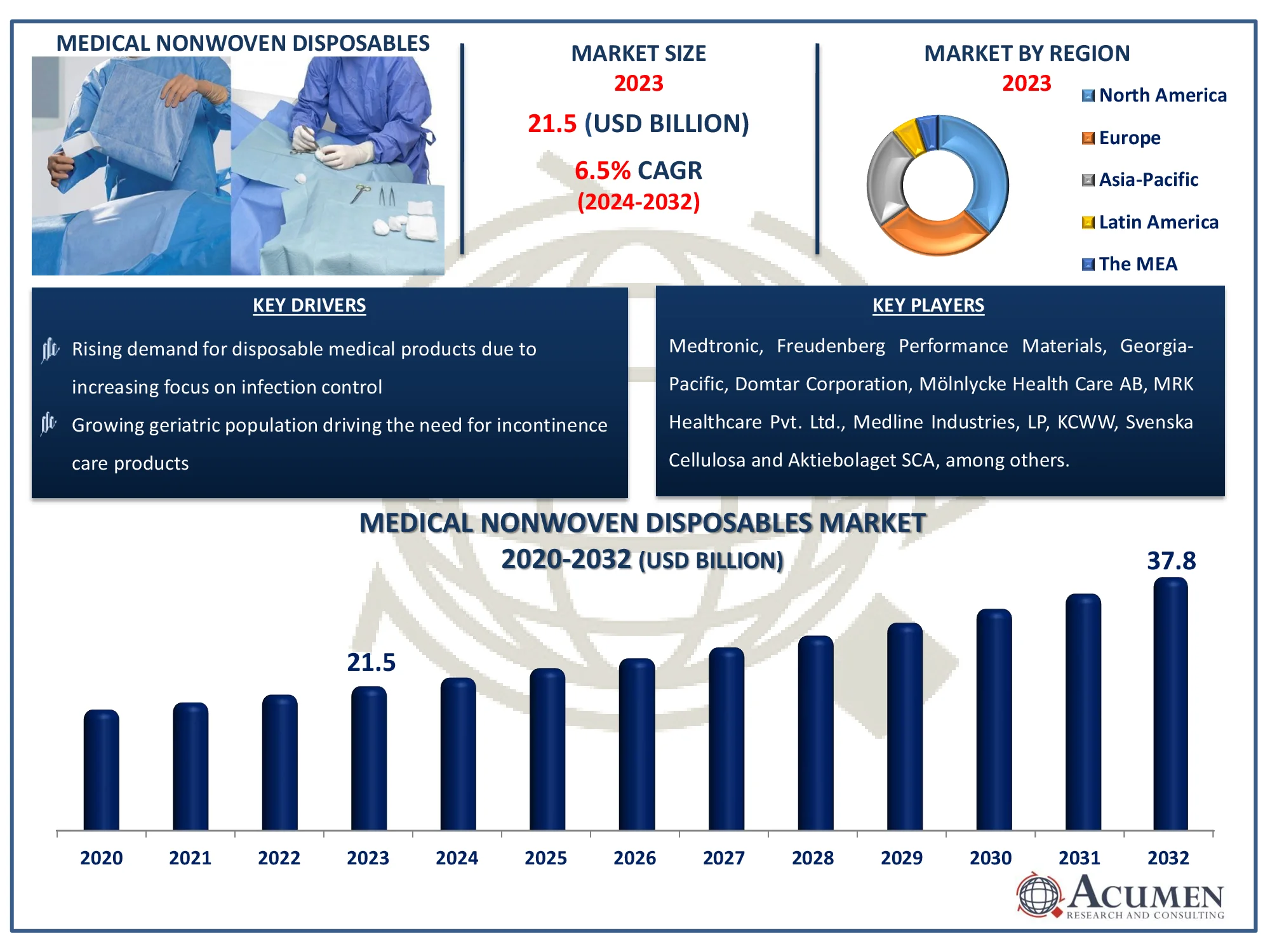

The Global Medical Nonwoven Disposables Market Size accounted for USD 21.5 Billion in 2023 and is estimated to achieve a market size of USD 37.8 Billion by 2032 growing at a CAGR of 6.5% from 2024 to 2032.

Medical Nonwoven Disposables Market Highlights

- Global medical nonwoven disposables market revenue is poised to garner USD 37.8 billion by 2032 with a CAGR of 6.5% from 2024 to 2032

- North America medical nonwoven disposables market value occupied around USD 8 billion in 2023

- Asia-Pacific medical nonwoven disposables market growth will record a CAGR of more than 7.8% from 2024 to 2032

- Among product, the incontinence products sub-segment generated notable revenue in 2023

- Based on material type, the polypropylene sub-segment generated significant medical nonwoven disposables market share in 2023

- Technological innovations in antimicrobial and moisture-resistant fabrics is a popular medical nonwoven disposables market trend that fuels the industry demand

Nonwovens are a unique category of textile product engineered from fibers that shape a lucid framework. Medical nonwovens consist of natural fabric, fabric, or artificial products such as polypropylene, polyester, polytetrafluoroethylene (PTFE), and others. Medical nonwoven disposables are widely used in surgical procedures, acting as a obstacle to microorganisms and preventing cross-contamination. Increased public efforts to produce nonwoven medical textiles are expected to drive the wound dressings section. Post-operative wound dressing medicines are also anticipated to propel the wound dressings section. Product demand for incontinence is strong in ambulatory and therapeutic facilities. Increased emphasis on personal hygiene is also probable to boost the incontinence product section during the forecast period. During the medical nonwoven disposables market forecast period, sub-segments under gloves and diapers are anticipated to add to the development of the incontinence product section.

Global Medical Nonwoven Disposables Market Dynamics

Market Drivers

- Rising demand for disposable medical products due to increasing focus on infection control

- Growing geriatric population driving the need for incontinence care products

- Advancements in nonwoven fabric technologies enhancing product efficiency

- Increased surgical procedures worldwide fueling demand for disposable surgical supplies

Market Restraints

- High cost of raw materials impacting production expenses

- Environmental concerns regarding non-biodegradable disposables

- Stringent regulations and approval processes hindering market entry

Market Opportunities

- Rising adoption of biodegradable and eco-friendly nonwoven disposables

- Expanding healthcare infrastructure in emerging economies

- Increasing demand for home healthcare products due to aging populations

Medical Nonwoven Disposables Market Report Coverage

| Market | Medical Nonwoven Disposables Market |

| Medical Nonwoven Disposables Market Size 2022 |

USD 21.5 Billion |

| Medical Nonwoven Disposables Market Forecast 2032 | USD 37.8 Billion |

| Medical Nonwoven Disposables Market CAGR During 2023 - 2032 | 6.5% |

| Medical Nonwoven Disposables Market Analysis Period | 2020 - 2032 |

| Medical Nonwoven Disposables Market Base Year |

2023 |

| Medical Nonwoven Disposables Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product, By Material Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Medtronic, Freudenberg Performance Materials, Georgia-Pacific, Domtar Corporation, Mölnlycke Health Care AB, MRK Healthcare Pvt. Ltd., Medline Industries, LP, KCWW, Svenska Cellulosa Aktiebolaget SCA, First Quality Enterprises, Inc., Unicharm Corporation, and Ahlstrom. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Nonwoven Disposables Market Insights

Growing geriatric population with dementia and other chronic diseases will boost market growth for medical nonwoven disposables. Dementia is a multi-causal syndrome with loss of command and sensory impairment. Incidences of dementia are increasing worldwide, according to WHO, and around 10 million fresh instances are registered annually. These patients need disposable medical non-woven products such as diapers and underwear to minimize disability connected with urinary incontinence. The availability of top-quality products for geriatric population with chronic diseases will fuel market growth. The main variables that increase the development of the worldwide medical nonwoven disposables market include fast advances in nonwovens manufacturing technology, growing concentrate on stopping hospital-acquired infections (HAIs), and improving health infrastructure and facilities across emerging nations.

In addition, increased disposable income, increased wellness consciousness, and important boost in geriatric population complement medical nonwoven disposables market growth. However, the risk of replacements such as woven products and increased popularity of less-invasive surgeries impede this market's development. Conversely, nanotechnology technological developments and their enhanced use in the manufacturing of medical nonwoven disposables are expected to generate profitable possibilities in the near future. The increasing preference of medical nonwoven disposables over traditional textiles, due to their capacity to provide patients and medical practitioners with higher security against diseases, is anticipated to be a high-impact rendering engine for the nonwoven disposables industry.

Increasing public financing for continuing care for nurses in emerging countries will have a substantial beneficial effect on medical nonwoven disposables market growth. In addition, government and private organisations are adopting several projects to teach individuals and promote incontinence products. Such projects improve consciousness of incontinence products in emerging nations like India and China. However, environmental degradation arising from disposal of incontinence products may somehow hamper worldwide medical nonwoven disposables market growth.

Medical Nonwoven Disposables Market Segmentation

The worldwide market for medical nonwoven disposables is split based on product, material type, distribution channel, and geography.

Medical Nonwoven Disposables Market By Product

- Incontinence Products

- Surgical Products

- Wound Care Products

- Others

According to medical nonwoven disposables industry analysis, incontinence hygiene products section of the medical nonwoven disposables industry is expected to grow by around 7% over time frame analysis. Incontinence has important consequences for private dignity and quality of life. Older people are also prone to urinary incontinence, resulting in social stigma, anxiety, and hygienic problems. To solve these problems, older individuals are progressively adopting incontinence health goods such as pads, clothing disposable ostomy liners and diapers that will favourably boost segment development.

Medical Nonwoven Disposables Market By Material Type

- Polypropylene

- Polyethylene

- Polyester

- Others

Polypropylene is predicted to lead the medical nonwoven disposables market because to its versatility and low price. Polypropylene is commonly used in the production of nonwoven medical disposables such as surgical gowns, masks, and drapes because of its lightweight, resilient, and breathable properties. It also offers excellent moisture and pollutant resistance, which allows it to meet the stringent cleanliness standards required in healthcare applications. The rising need for disposable medical items, notably in surgical and incontinence care, is driving the use of polypropylene materials. Its recyclability and compatibility with high-speed manufacturing processes add to its widespread use. As a result, polypropylene remains the most popular material, comprising the great majority of the market.

Medical Nonwoven Disposables Market By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Platform

Online internet segment is expected to grow significantly over the prediction era. Older population base with chronic diseases such as urinary incontinence and dementia often involve disposable medical non-woven. These nurses tend to order large-scale, low-price medical non-woven disposables through internet systems. As a consequence, improving customer preference over online pharmacies, owing to the comfort and comfort connected with it, will increase segment development over timeframe prediction.

Medical Nonwoven Disposables Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Nonwoven Disposables Market Regional Analysis

North America was the biggest national market for medical nonwoven disposables in 2023 as incontinence in this region increased. Statistics indicate that significant North American populations presently demand disposable adult incontinence goods, with 10% of males and 33% of females over the era of 50. Another significant factor contributing to elevated demand for incontinence products is the existence of a big geriatric population base in this region, which prefers disposable medical nonwovens over other accessible options due to their comfort and safety.

Asia-Pacific is the most profitable medical nonwoven disposables business region. Growing geriatric population base in China and Japan contributes to the development of this global economy. Such a big presence of a geriatric population is anticipated to result in demand for adult diapers exceeding baby diapers. In addition, rising patient sensitivity in this region and reducing the incidence of hospital-acquired infections are anticipated to increase medical nonwoven disposables utilization levels.

Medical Nonwoven Disposables Market Players

Some of the top medical nonwoven disposables companies offered in our report includes Medtronic, Freudenberg Performance Materials, Georgia-Pacific, Domtar Corporation, Mölnlycke Health Care AB, MRK Healthcare Pvt. Ltd., Medline Industries, LP, KCWW, Svenska Cellulosa Aktiebolaget SCA, First Quality Enterprises, Inc., Unicharm Corporation, and Ahlstrom.

Frequently Asked Questions

How big is the medical nonwoven disposables market?

The medical nonwoven disposables market size was valued at USD 21.5 billion in 2023.

What is the CAGR of the global medical nonwoven disposables market from 2024 to 2032?

The CAGR of medical nonwoven disposables is 6.5% during the analysis period of 2024 to 2032.

Which are the key players in the medical nonwoven disposables market?

The key players operating in the global market are including Medtronic, Freudenberg Performance Materials, Georgia-Pacific, Domtar Corporation, Mölnlycke Health Care AB, MRK Healthcare Pvt. Ltd., Medline Industries, LP, KCWW, Svenska Cellulosa Aktiebolaget SCA, First Quality Enterprises, Inc., Unicharm Corporation, and Ahlstrom.

Which region dominated the global medical nonwoven disposables market share?

North America held the dominating position in medical nonwoven disposables industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical nonwoven disposables during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global medical nonwoven disposables industry?

The current trends and dynamics in the medical nonwoven disposables industry include rising demand for disposable medical products due to increasing focus on infection control, and growing geriatric population driving the need for incontinence care products.

Which product held the maximum share in 2023?

The incontinence product held the maximum share of the medical nonwoven disposables industry.