Medical Imaging Workstations Market | Acumen Research and Consulting

Medical Imaging Workstations Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

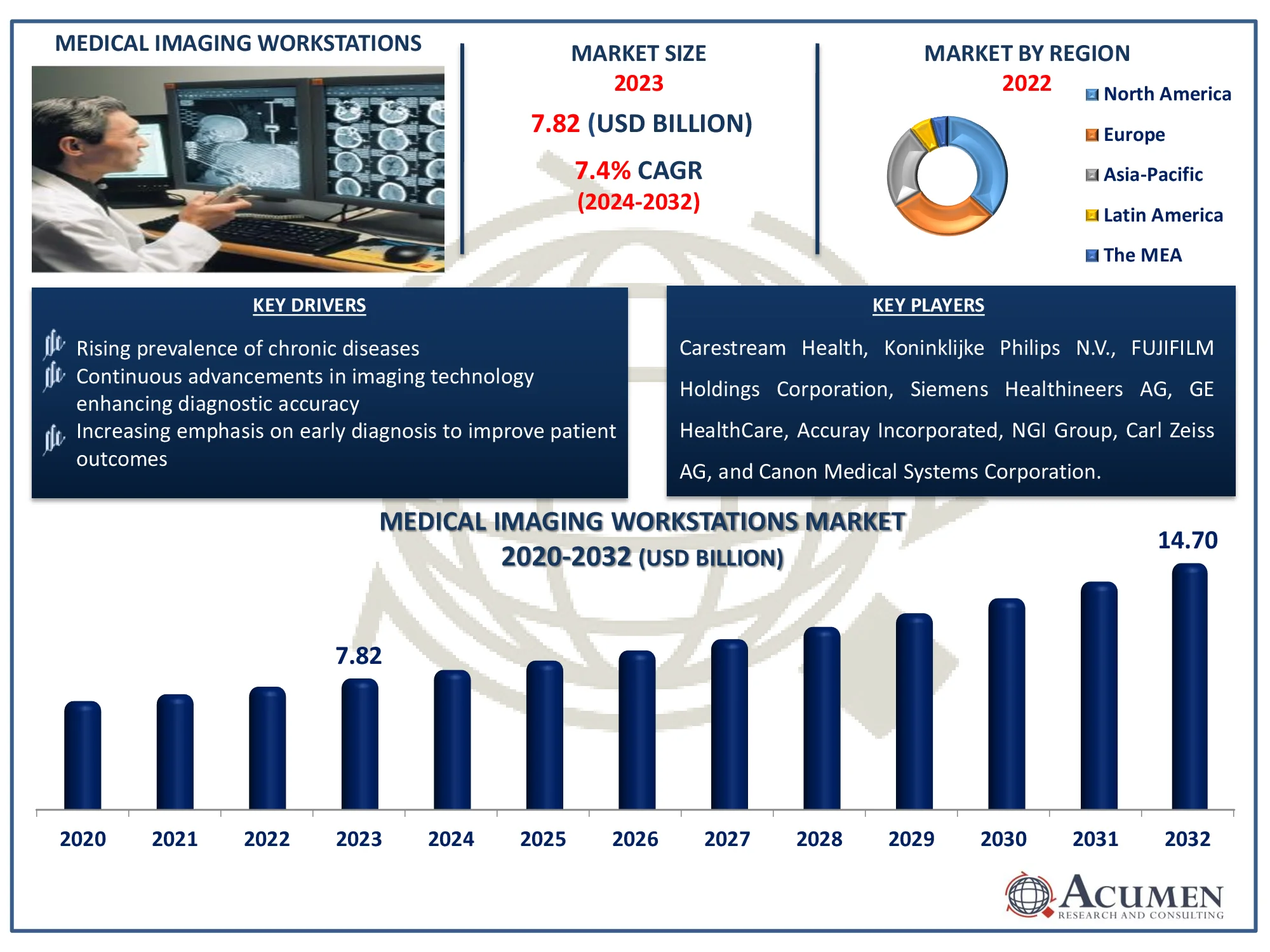

The Global Medical Imaging Workstations Market Size accounted for USD 7.82 Billion in 2023 and is estimated to achieve a market size of USD 14.7 Billion by 2032 growing at a CAGR of 7.4% from 2024 to 2032.

Medical Imaging Workstations Market Highlights

- The global medical imaging workstations market is anticipated to reach USD 14.7 billion by 2032, growing at a CAGR of 7.4% from 2024 to 2032

- North America's medical imaging workstations market was valued at approximately USD 2.9 billion in 2023

- The Asia-Pacific medical imaging workstations market is projected to grow at a CAGR exceeding 8.3% from 2024 to 2032

- Computed tomography (CT) held a 29% share of the market by modality in 2023

- Visualization software dominated with a 58% market share in 2023

- Thin client workstations accounted for 61% of the market share based on usage mode in 2023

- Advanced imaging captured 55% of the market share in 2023

- Rising demand for remote diagnostics and telemedicine capabilities is a popular medical imaging workstations market trend that fuels the industry demand

Medical imaging workstations are used in hospitals to set up the equipment. During the last few years, there has been a significant increase in the prevalence of various diseases and accidents, which has increased the demand for various medical imaging workstations due to an increase in patient influx in the hospital, thereby increasing the market demand. These workstations help oncologists plan radiation therapy with greater precision by seeing tumor boundaries and analyzing treatment progress. They are especially important in cardiology because they provide precise images of the circulatory system, which aids in identifying heart diseases and planning interventions. Furthermore, medical imaging workstations are utilized in orthopedics to test bone integrity and plan procedures, thereby improving patient care through accurate, thorough imaging.

Global Medical Imaging Workstations Market Dynamics

Market Drivers

- Rising prevalence of chronic diseases driving demand for advanced imaging solutions

- Continuous advancements in imaging technology enhancing diagnostic accuracy

- Increasing emphasis on early diagnosis to improve patient outcomes

Market Restraints

- High costs of imaging workstations limiting adoption in cost-sensitive regions

- Complex regulatory hurdles delaying market entry

- Limited access to healthcare infrastructure in developing countries

Market Opportunities

- Growth in telemedicine and remote diagnostics expanding access to imaging services

- Rising adoption of AI and machine learning in imaging for faster, more accurate analyses

- Expanding healthcare infrastructure in emerging markets creating new demand

Medical Imaging Workstations Market Report Coverage

| Market | Medical Imaging Workstations Market |

| Medical Imaging Workstations Market Size 2022 |

USD 7.82 Billion |

| Medical Imaging Workstations Market Forecast 2032 | USD 14.70 Billion |

| Medical Imaging Workstations Market CAGR During 2023 - 2032 | 7.4% |

| Medical Imaging Workstations Market Analysis Period | 2020 - 2032 |

| Medical Imaging Workstations Market Base Year |

2022 |

| Medical Imaging Workstations Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Modality, By Component, By Usage Mode, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Carestream Health, Koninklijke Philips N.V., FUJIFILM Holdings Corporation, Siemens Healthineers AG, GE HealthCare, Accuray Incorporated, NGI Group, Carl Zeiss AG, and Canon Medical Systems Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Imaging Workstations Market Insights

The rising frequency of chronic diseases and a growing senior population are the primary driving forces behind medical imaging workstation development. For instance, according to the US Department of Health and Human Services, approximately 129 million people in the United States have at least one significant chronic condition. (e.g., heart disease, cancer, diabetes, obesity, and hypertension). Five of the top ten main causes of death in the United States are either preventable or closely connected with chronic conditions that can be treated. Over the last two decades, prevalence has steadily climbed, and this trend is likely to continue. An rising proportion of Americans suffer from several chronic illnesses; 42% have two or more, and 12% have at least five. Aside from the personal effects, chronic sickness has a significant effect on the US healthcare system.

The introduction of a hospital-centric business model is promoting long-term collaborations, and the increase in demand for advanced diagnostics equipment for various chronic conditions has had a favorable impact on the growth of the medical imaging workstation market.

The introduction of IT in healthcare has raised the demand for medical imaging workstations. For instance, the U.S. Department of Health and Human Services (HHS), through the Office of the National Coordinator for Health Information Technology (ONC), today made the draft 2024-2030 Federal Health IT Strategic Plan available for public review. Outlines government health IT aims and objectives aimed at increasing access to health data, providing a better, more equal health care experience, and updating our country's public health data infrastructure. Improvements in health information technology (IT), as specified in the Federal Health IT Strategic Plan, contribute to the rising need for medical imaging workstations.

The medical imaging workstations market is expected to rise over the forecast period due to rising consumer spending power and constant technological advancements. For instance, Koelis, SAS, a pioneer and inventor in prostate cancer treatment, will unveil its new product, ProMap Lite, during the prestigious American Urological Association Annual Meeting in New Orleans in May 2022. ProMap Lite is the software-only version of the Koelis MR-Draw biopsy planning workstation.

Medical Imaging Workstations Market Segmentation

The worldwide market for medical imaging workstations is split based on modality, component, usage mode, application, end user, and geography.

Medical Imaging Workstations Modality

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- Mammography

- Others

According to medical imaging workstations industry analysis, computed tomography (CT) dominates market because of its capacity to provide high-resolution, cross-sectional images of the body. The technology's speed and efficacy in detecting a variety of illnesses, including tumors and internal traumas, making it a popular choice among healthcare doctors. Furthermore, advances in CT imaging technology, such as reduced radiation doses and improved image quality, are driving its broad use in clinical settings. For instance, according to Annual Reviews, in recent years, several important improvements in CT technology have had or are projected to have a substantial therapeutic impact, including extreme multidetector CT, iterative reconstruction techniques, dual-energy CT, cone-beam CT, portable CT, and phase-contrast CT.

Medical Imaging Workstations Component

- Visualization Software

- Display Units

- Display Controller Cards

- Central Processing Units

- Others

According to medical imaging workstations industry analysis, the visualization software component dominates market by offering sophisticated tools for understanding and analyzing complex medical images. This program improves diagnosis accuracy with capabilities such as 3D reconstruction, picture segmentation, and quantitative analysis, allowing radiologists and clinicians to make better decisions. As healthcare relies more on precise imaging for treatment planning and monitoring, the demand for advanced visualization software grows.

Medical Imaging Workstations Usage Mode

- Thin Client Workstations

- Thick Client Workstations

According to medical imaging workstations industry analysis, thin client workstations dominate market because they are efficient and flexible in terms of imaging data access and management. These workstations employ centralized servers to run applications, allowing several users to access advanced imaging software without requiring high-performance hardware on each device. This concept not only saves money and maintenance for healthcare facilities, but it also improves data security and compliance.

Medical Imaging Workstations Application

- Diagnostic Imaging

- Clinical Review

- Advanced Imaging

According to medical imaging workstations market forecast, advanced imaging technologies dominate market because they provide greater diagnostic and treatment capabilities for complex medical problems. Techniques like MRI, PET, and 3D ultrasound provide precise information that improves clinical decision-making and patient outcomes. As healthcare professionals look for new ways to increase diagnostic accuracy and efficiency, demand for workstations with advanced imaging modalities is increasing, driving growth in this market sector.

Medical Imaging Workstations End User

- Hospital and Clinics

- Diagnostics Centers

- Others

According to medical imaging workstations market forecast, hospitals and clinics indicates highest growth in industry. These healthcare institutions require sophisticated imaging systems to support a wide range of medical disorders, allowing for rapid and accurate diagnosis, which are essential for effective treatment. The growing patient volume and need for advanced imaging technologies in these settings drive the expansion of medical imaging workstations designed specifically for hospital and clinical use, underscoring their importance in the healthcare ecosystem.

Medical Imaging Workstations Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Imaging Workstations Market Regional Analysis

Regional analysis of medical imaging workstations market, North America has the largest medical imaging workstation market. The presence of a large patient population suffering from various ailments, increasing healthcare spending, and rising investment in the healthcare sector have all contributed to the growth of the Americas medical imaging workstations market. The United States dominates the North American medical imaging workstations business due to its well-developed economy and large consumer spending power. Mexico and Canada are projected to have significant market growth in the foreseeable future. For instance, in June 2024, GE Healthcare and the Heart Hospital of New Mexico at Lovelace Medical Center worked together to establish the first Allia IGS Pulse lab, which provides higher picture quality and enhanced diagnostics for precision cardiovascular disease treatment and management.

Europe is the second-largest market, followed by Asia-Pacific. Medical imaging workstations have advanced in a variety of sectors, including emergency medicine and pediatrics, for all patients, regardless of weight, age, or overall health. Asia-Pacific is an emerging market. The presence of rapidly rising economies, a large population base, and positive government policies are driving the growth of the medical imaging workstation market. The number of healthcare organizations has grown dramatically in recent years, increasing demand for medical imaging workstations.

Latin America, the Middle East, and Africa are seeing slow market expansion due to weak healthcare infrastructure, limited funding availability, and low healthcare spending. However, the region anticipates strong growth in the foreseeable future as a result of numerous unexplored opportunities.

Medical Imaging Workstations Market Players

Some of the top medical imaging workstations companies offered in our report includes Carestream Health, Koninklijke Philips N.V., FUJIFILM Holdings Corporation, Siemens Healthineers AG, GE HealthCare, Accuray Incorporated, NGI Group, Carl Zeiss AG, and Canon Medical Systems Corporation.

Frequently Asked Questions

How big is the medical imaging workstations market?

The medical imaging workstations market size was valued at USD 7.82 billion in 2023.

What is the CAGR of the global medical imaging workstations market from 2024 to 2032?

The CAGR of medical imaging workstations is 7.4% during the analysis period of 2024 to 2032.

Which are the key players in the medical imaging workstations market?

The key players operating in the global market are including Carestream Health, Koninklijke Philips N.V., FUJIFILM Holdings Corporation, Siemens Healthineers AG, GE HealthCare, Accuray Incorporated, NGI Group, Carl Zeiss AG, and Canon Medical Systems Corporation.

Which region dominated the global medical imaging workstations market share?

North America held the dominating position in medical imaging workstations industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical imaging workstations during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global medical imaging workstations industry?

The current trends and dynamics in the medical imaging workstations industry include rising prevalence of chronic diseases driving demand for advanced imaging solutions, continuous advancements in imaging technology enhancing diagnostic accuracy, and increasing emphasis on early diagnosis to improve patient outcomes.

Which component held the maximum share in 2023?

The visualization software held the maximum share of the medical imaging workstations industry