Health IT Security Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Health IT Security Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

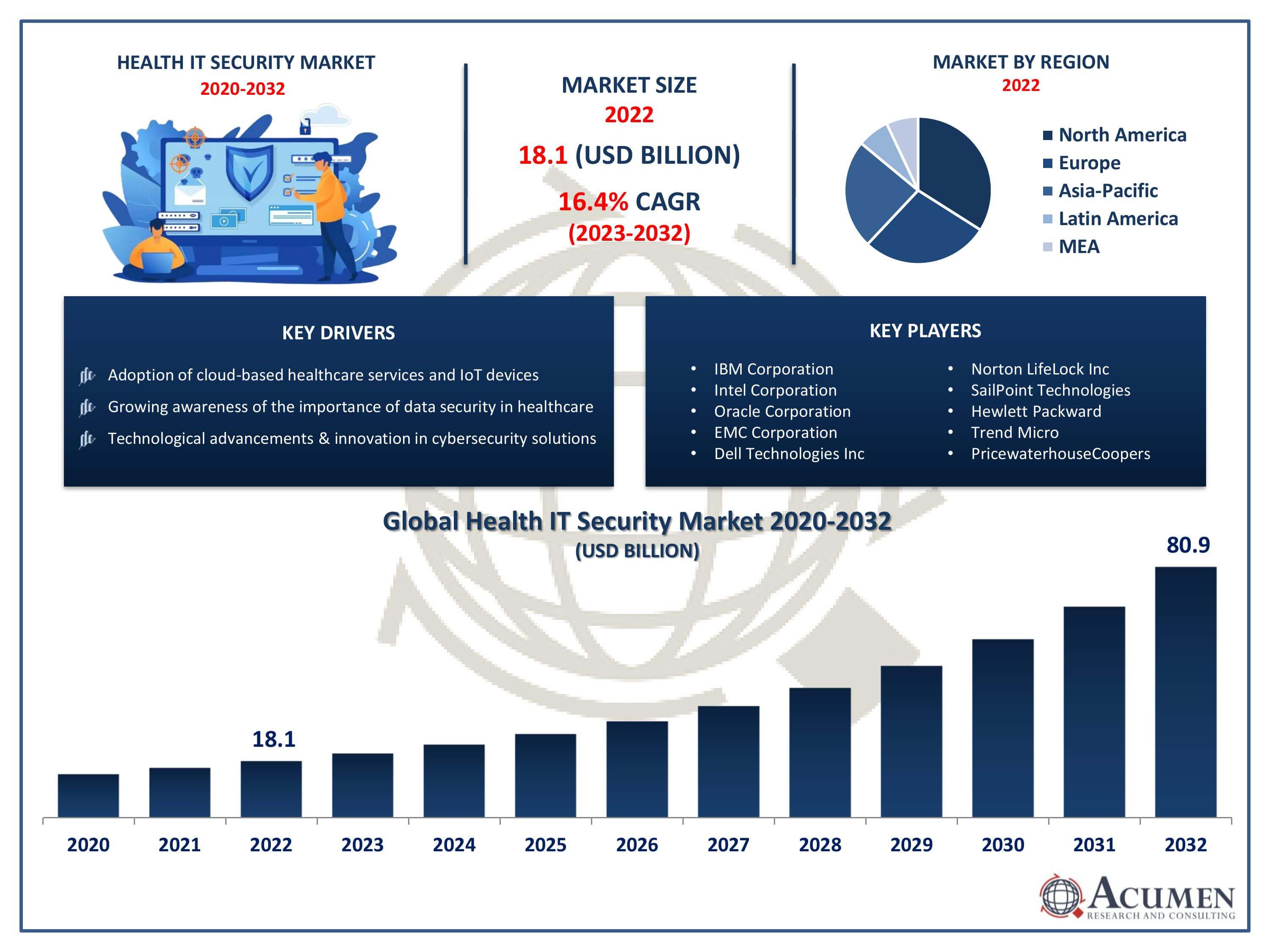

The Health IT Security Market Size accounted for USD 18.1 Billion in 2022 and is projected to achieve a market size of USD 80.9 Billion by 2032 growing at a CAGR of 16.4% from 2023 to 2032.

Health IT Security Market Highlights

- Global Health IT Security Market revenue is expected to increase by USD 80.9 Billion by 2032, with a 16.4% CAGR from 2023 to 2032

- North America region led with more than 37% of Health IT Security Market share in 2022

- Asia-Pacific Health IT Security Market growth will record a CAGR of around 17.3% from 2023 to 2032

- By delivery mode, the on-cloud segment is the largest segment in the market, accounting for over 61% of the market share in 2022

- By application, the network security segment has recorded more than 44% of the revenue share in 2022

- Increasing frequency and sophistication of cyberattacks on healthcare organizations, drives the Health IT Security Market value

Health IT security refers to the measures and protocols implemented to protect electronic health information and systems from unauthorized access, disclosure, disruption, modification, or destruction. With the increasing digitization of healthcare records and the widespread use of electronic health systems, ensuring the security of patient data and healthcare infrastructure has become paramount. Health IT security encompasses a range of technologies, practices, and policies designed to safeguard sensitive healthcare information, including electronic health records (EHRs), patient data, and communication networks within the healthcare sector.

The market for health IT security has experienced significant growth in recent years, driven by several factors. One of the main drivers is the growing frequency and sophistication of cyberattacks targeting healthcare organizations. Cybercriminals often target healthcare institutions due to the high value of patient data on the black market. Additionally, regulatory requirements and industry standards, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States, mandate strict data protection measures, compelling healthcare providers to invest in robust IT security solutions. Moreover, the increasing adoption of cloud-based healthcare services, mobile health applications, and Internet of Things (IoT) devices in the healthcare sector has expanded the attack surface, necessitating advanced security solutions to safeguard interconnected systems and data.

Global Health IT Security Market Trends

Market Drivers

- Increasing frequency and sophistication of cyberattacks on healthcare organizations

- Stringent regulatory requirements and compliance standards (e.g., HIPAA)

- Adoption of cloud-based healthcare services and IoT devices

- Growing awareness of the importance of data security in healthcare

- Technological advancements and innovation in cybersecurity solutions

Market Restraints

- High implementation costs associated with advanced security solutions

- Limited awareness and understanding of cybersecurity risks among healthcare professionals

Market Opportunities

- Increasing demand for telehealth and remote patient monitoring solutions

- Emergence of AI and machine learning-based cybersecurity solutions

Health IT Security Market Report Coverage

| Market | Health IT Security Market |

| Health IT Security Market Size 2022 | USD 18.1 Billion |

| Health IT Security Market Forecast 2032 | USD 80.9 Billion |

| Health IT Security Market CAGR During 2023 - 2032 | 16.4% |

| Health IT Security Market Analysis Period | 2020 - 2032 |

| Health IT Security Market Base Year |

2022 |

| Health IT Security Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Delivery Mode, By Application, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | IBM Corporation, Intel Corporation, Oracle Corporation, EMC Corporation, Dell Technologies Inc, Norton LifeLock Inc, SailPoint Technologies, Hewlett Packward, Trend Micro, PricewaterhouseCoopers, CA Technologies, and Wipro |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

With the digitization of healthcare records and the widespread adoption of electronic health systems, health IT security has become paramount in protecting sensitive information and maintaining the trust of patients. The applications of health IT security are vast and diverse, spanning across various aspects of the healthcare sector. One primary application is the protection of electronic health records (EHRs), which contain detailed patient information, including medical history, diagnoses, medications, and treatment plans. Health IT security measures such as encryption, access control, and secure authentication methods help safeguard EHRs from unauthorized access and tampering. Additionally, health IT security is crucial in securing healthcare communication networks, ensuring that sensitive patient data transmitted between healthcare professionals, hospitals, and other stakeholders remain confidential and uncompromised.

The health IT security market has experienced robust growth in recent years, driven by the increasing digitization of healthcare data and rising cybersecurity threats. As healthcare organizations continue to adopt electronic health records (EHRs), telemedicine platforms, and connected medical devices, the need for robust security measures has become paramount. The market growth is fueled by the escalating frequency and sophistication of cyberattacks targeting healthcare institutions. Cybercriminals often seek to exploit vulnerabilities in healthcare IT systems to gain unauthorized access to sensitive patient data, leading to an urgent demand for advanced security solutions. Furthermore, the rapidly expanding telehealth market and telemedicine market are going to propel the health IT security market in the coming years. Additionally, stringent regulatory mandates, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and similar regulations worldwide, require healthcare providers to implement stringent data protection measures, further bolstering market growth.

Health IT Security Market Segmentation

The global Health IT Security Market segmentation is based on component, delivery mode, application, end-user, and geography.

Health IT Security Market By Component

- Products

- Encryption and data loss protection solutions

- Antivirus and antimalware

- Risk and compliance management solutions

- Distributed denial of services (DDoS) mitigation

- Intrusion prevention systems

- Identity and access management solutions

- Services

- Managed security services

- Consulting

- Others

According to the health IT security industry analysis, the services segment accounted for the largest market share in 2022. As cyberattacks become more sophisticated, healthcare organizations are seeking specialized expertise to protect their IT infrastructure and sensitive patient data. Security services such as threat intelligence, risk assessment, penetration testing, and incident response are in high demand. These services provide healthcare providers with valuable insights into potential vulnerabilities, enabling them to proactively address security gaps and enhance their overall resilience against cyber threats. Another significant factor fueling the growth of the services segment is the rising adoption of managed security services (MSS) among healthcare organizations. MSS providers offer 24/7 monitoring, threat detection, and response services, allowing healthcare providers to outsource their security operations to experienced professionals.

Health IT Security Market By Delivery Mode

- On-premises

- On-cloud

In terms of delivery modes, the on-cloud segment is expected to witness significant growth in the coming years. This growth is owing to the increasing adoption of cloud-based solutions and services within the healthcare industry. Healthcare organizations are leveraging cloud computing to store and manage vast amounts of patient data, collaborate more efficiently, and streamline their operations. As the industry embraces digital transformation, cloud-based solutions offer scalability, flexibility, and cost-effectiveness, making them an attractive choice for healthcare providers of all sizes. This trend has significantly boosted the demand for cloud-based health IT security solutions, as protecting sensitive patient information stored in the cloud becomes paramount. One of the driving factors behind the growth of the on-cloud segment is the enhanced security features and compliance measures offered by reputable cloud service providers.

Health IT Security Market By Application

- Network Security

- Content Security

- Data/content Security

- Endpoint Security

According to the health IT security market forecast, the network security segment is expected to witness significant growth in the coming years. This growth is propelled by the escalating threats to healthcare networks and the critical nature of safeguarding patient data. Healthcare organizations rely heavily on interconnected systems to share patient records, medical images, and other sensitive information. With the proliferation of cyberattacks and data breaches, securing these networks has become a top priority. Network security solutions, including firewalls, intrusion detection and prevention systems, and secure gateways, play a pivotal role in preventing unauthorized access, detecting malicious activities, and ensuring the integrity and confidentiality of patient data during transmission. One of the main drivers behind the growth of the network security segment is the increasing sophistication of cyber threats targeting healthcare networks.

Health IT Security Market By End-user

- Hospitals and clinics

- Healthcare payers

- Ambulatory care centers

- Others

Based on the end-user, the hospitals and clinics segment is expected to continue its growth trajectory in the coming years. This growth is due to the increasing digitalization of healthcare services and the growing awareness of cybersecurity threats. Hospitals and clinics are at the forefront of patient care, managing vast amounts of sensitive information, including electronic health records (EHRs), billing data, and personal patient details. As these institutions continue to adopt advanced technologies such as telemedicine, wearable devices, and cloud-based solutions, the need for robust IT security measures has become paramount. The rise in cyberattacks targeting healthcare facilities, coupled with stringent regulatory requirements, has compelled hospitals and clinics to invest significantly in health IT security solutions to protect patient data and ensure compliance with industry regulations like HIPAA.

Health IT Security Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

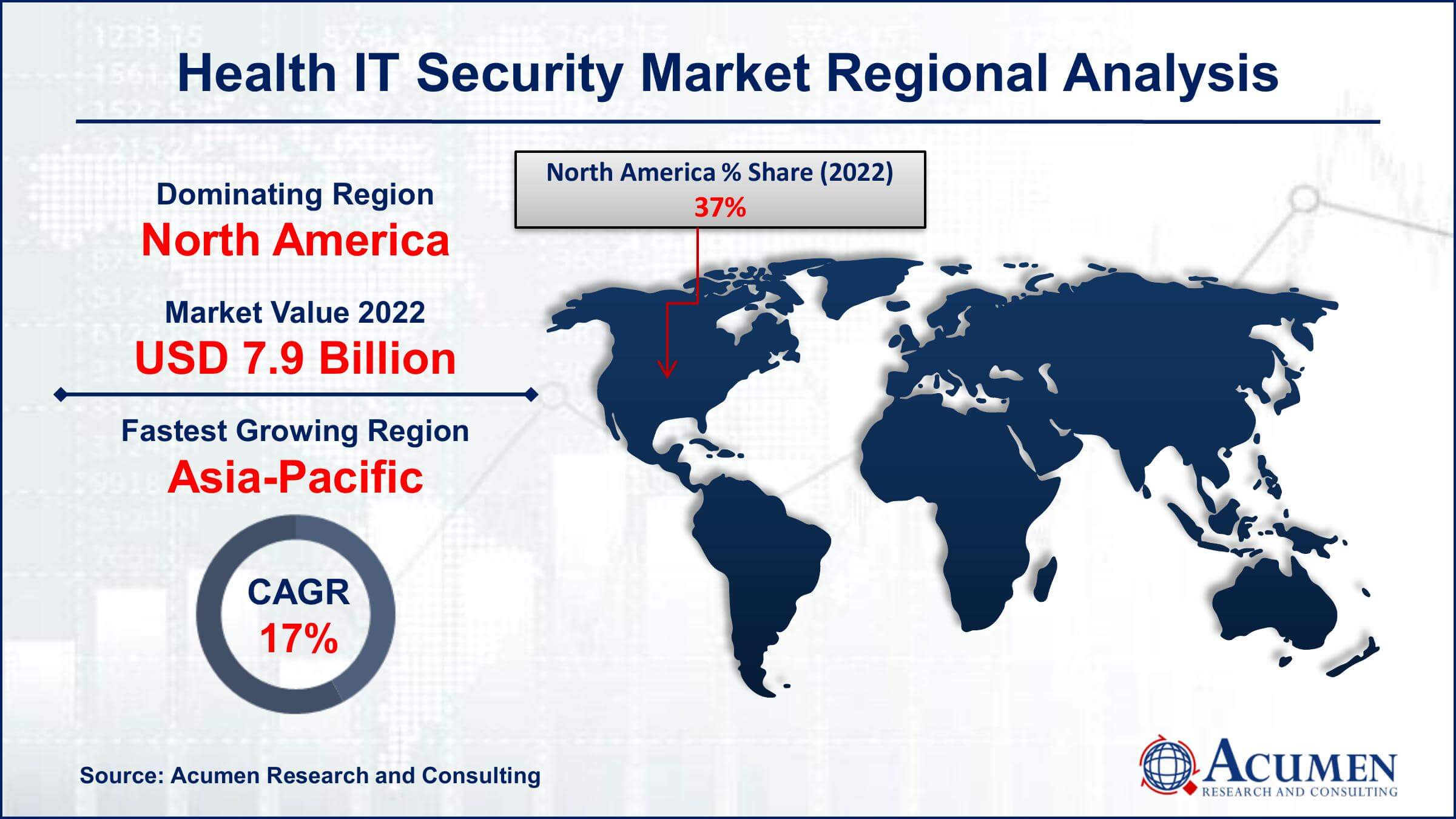

Health IT Security Market Regional Analysis

Geographically, North America has emerged as a dominating region in the health IT security market. One of the primary drivers is the early and widespread adoption of healthcare information technology in the United States and Canada. These countries have heavily invested in digitalizing healthcare systems, including electronic health records (EHRs), telemedicine, and mobile health applications, creating a vast digital infrastructure that requires robust security measures. The presence of well-established healthcare institutions, research centers, and technology companies in North America has further accelerated the integration of advanced IT solutions, fostering a fertile ground for the growth of the health IT security market. Stringent regulatory frameworks, particularly in the United States, such as the Health Insurance Portability and Accountability Act (HIPAA) and the HITECH Act, mandate stringent security standards and data protection protocols in healthcare. These regulations have compelled healthcare providers to invest significantly in health IT security solutions to avoid legal consequences and maintain patient trust. Moreover, the region has witnessed a surge in cyber threats targeting healthcare organizations, leading to a heightened awareness of the importance of cybersecurity.

Health IT Security Market Player

Some of the top health IT security market companies offered in the professional report include IBM Corporation, Intel Corporation, Oracle Corporation, EMC Corporation, Dell Technologies Inc, Norton LifeLock Inc, SailPoint Technologies, Hewlett Packward, Trend Micro, PricewaterhouseCoopers, CA Technologies, and Wipro.

Frequently Asked Questions

How big is the health IT security market?

The market size of health IT security was USD 18.1 Billion in 2022.

What is the CAGR of the global health IT security market from 2023 to 2032?

The CAGR of health IT security is 16.4% during the analysis period of 2023 to 2032.

Which are the key players in the health IT security market?

The key players operating in the global market are including IBM Corporation, Intel Corporation, Oracle Corporation, EMC Corporation, Dell Technologies Inc, Norton LifeLock Inc, SailPoint Technologies, Hewlett Packward, Trend Micro, PricewaterhouseCoopers, CA Technologies, and Wipro.

Which region dominated the global health IT security market share?

North America held the dominating position in health IT security industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of health IT security during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global health IT security industry?

The current trends and dynamics in the health IT security industry include increasing frequency and sophistication of cyberattacks on healthcare organizations, stringent regulatory requirements and compliance standards, and adoption of cloud-based healthcare services and IoT devices.

Which Delivery Mode held the maximum share in 2022?

The on-cloud delivery mode held the maximum share of the health IT security industry.