Medical Display Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

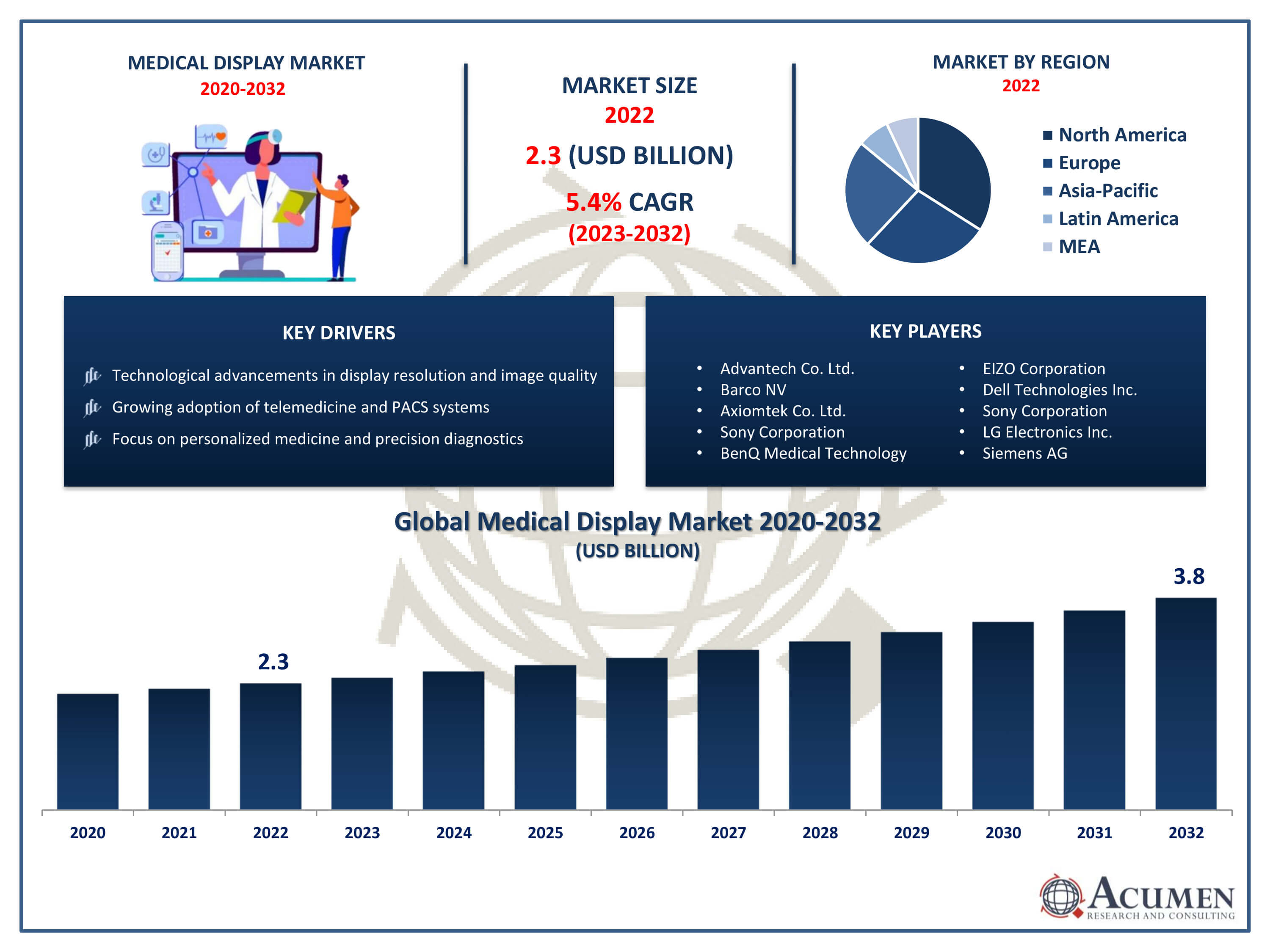

The Medical Display Market Size accounted for USD 2.3 Billion in 2022 and is projected to achieve a market size of USD 3.8 Billion by 2032 growing at a CAGR of 5.4% from 2023 to 2032.

Medical Display Market Key Highlights

- Global medical display market revenue is expected to increase by USD 3.8 Billion by 2032, with a 5.4% CAGR from 2023 to 2032

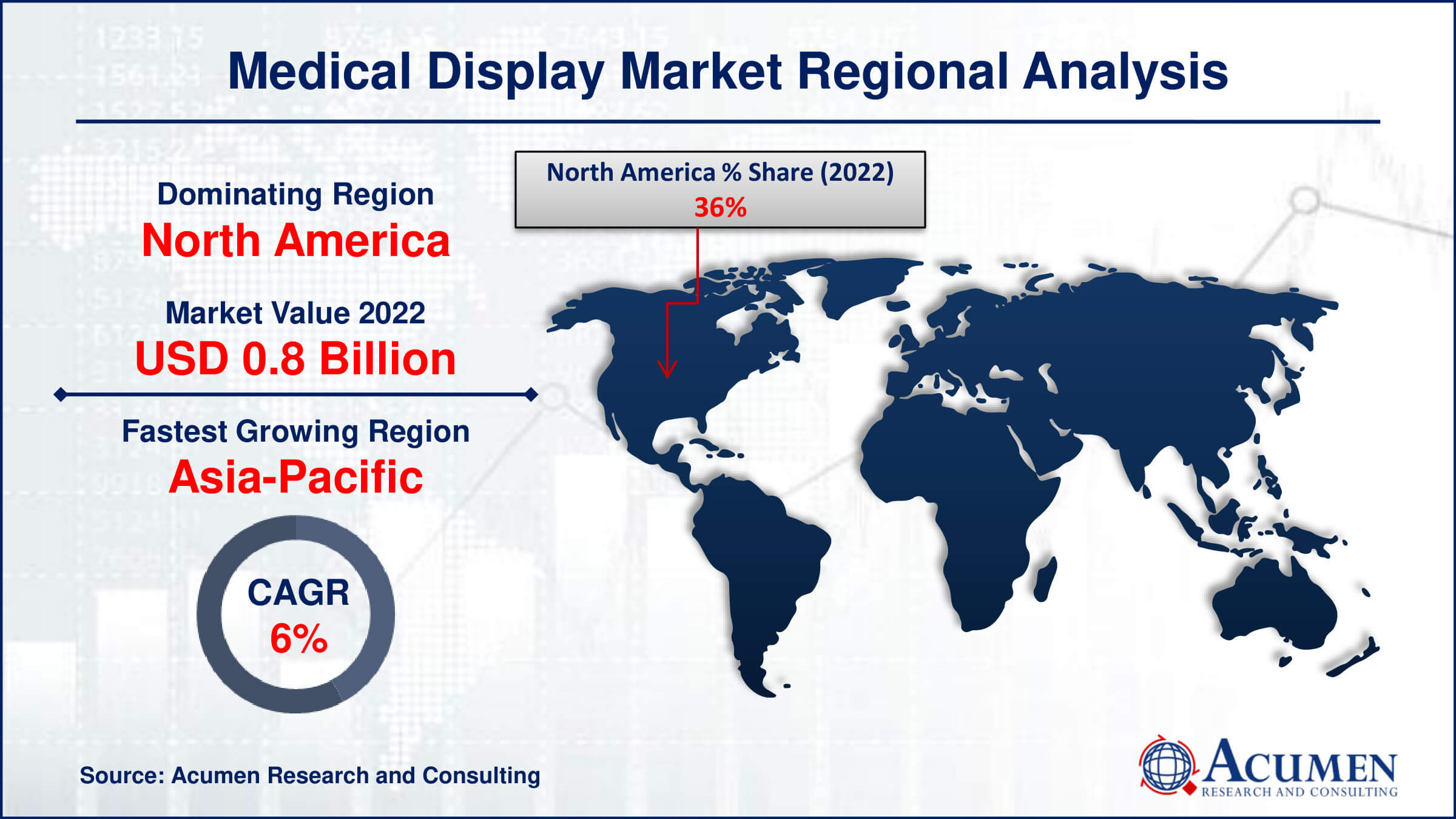

- North America region led with more than 36% of medical display market share in 2022

- Asia-Pacific medical display market growth will record a CAGR of more than 6.2% from 2023 to 2032

- By device, the desktop segment contributed over 81% of revenue share in 2022

- By resolution, the 2.1 to 4MP segment captured more than 35% of revenue share in 2022

- Growing adoption of telemedicine and PACS (Picture Archiving and Communication Systems), drives the medical display market value

A medical display refers to a specialized monitor used in healthcare settings for viewing medical images such as X-rays, MRIs, CT scans, and other diagnostic imaging. These displays are designed to meet stringent quality standards to ensure accurate representation of medical images for diagnostic purposes. They typically have high resolutions, calibrated color accuracy, and often incorporate features like DICOM (Digital Imaging and Communications in Medicine) calibration to ensure consistency and accuracy in displaying medical images. Medical displays are crucial tools for radiologists, physicians, and healthcare professionals to make informed diagnoses and treatment decisions.

The market for medical displays has experienced steady growth in recent years due to several factors. Technological advancements have led to the development of displays with higher resolutions, better image quality, and enhanced features, driving demand from healthcare facilities seeking to upgrade their imaging systems. Additionally, the increasing prevalence of chronic diseases and age-related conditions necessitates greater utilization of diagnostic imaging procedures, further fueling the demand for medical displays. Moreover, stringent regulations and guidelines regarding image quality and patient safety drive healthcare providers to invest in high-quality medical displays to ensure accurate diagnoses and compliance with standards.

Global Medical Display Market Trends

Market Drivers

- Technological advancements in display resolution and image quality

- Increasing prevalence of chronic diseases driving demand for diagnostic imaging

- Stringent regulations driving adoption of high-quality displays for accurate diagnoses

- Growing adoption of telemedicine and PACS systems

- Focus on personalized medicine and precision diagnostics

Market Restraints

- High initial investment costs for advanced medical displays

- Limited healthcare budgets in certain regions

Market Opportunities

- Integration of artificial intelligence (AI) for enhanced image analysis

- Development of portable and point-of-care medical display solutions

Medical Display Market Report Coverage

| Market | Medical Display Market |

| Medical Display Market Size 2022 | USD 2.3 Billion |

| Medical Display Market Forecast 2032 | USD 3.8 Billion |

| Medical Display Market CAGR During 2023 - 2032 | 5.4% |

| Medical Display Market Analysis Period | 2020 - 2032 |

| Medical Display Market Base Year |

2022 |

| Medical Display Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Device, By Resolution, By Panel Size, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Advantech Co. Ltd., Barco NV, Axiomtek Co. Ltd., Sony Corporation, BenQ Medical Technology, EIZO Corporation, Dell Technologies Inc., Sony Corporation, LG Electronics Inc., Siemens AG, Novanta Inc., and Steris Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Unlike conventional computer monitors or television screens, medical displays are designed to meet stringent standards for image quality, accuracy, and consistency. They often feature high resolutions, calibrated color accuracy, and compliance with standards such as DICOM (Digital Imaging and Communications in Medicine) to ensure precise representation of medical images. Medical displays are essential tools for radiologists, physicians, surgeons, and other healthcare professionals involved in diagnostic imaging, treatment planning, and patient care. The applications of medical displays span various medical specialties and healthcare settings. In radiology departments, medical displays are used for interpreting diagnostic images, detecting abnormalities, and monitoring disease progression. They also play a crucial role in surgical suites, where surgeons rely on real-time imaging for guidance during minimally invasive procedures. Beyond radiology and surgery, medical displays are utilized in specialties like cardiology, oncology, orthopedics, and obstetrics for diagnosing and monitoring various conditions.

The medical display market has been experiencing robust growth globally, driven by various factors such as technological advancements, increasing healthcare expenditure, and the growing adoption of diagnostic imaging procedures. With the continuous evolution of medical imaging technologies, there's a growing demand for high-resolution and accurate displays to facilitate precise diagnoses and treatment planning. Additionally, the rising prevalence of chronic diseases and the aging population contribute to the escalating need for medical imaging services, further propelling the demand for advanced medical displays. Moreover, the COVID-19 pandemic has accelerated the adoption of telemedicine and remote healthcare services, leading to an increased reliance on medical displays for remote viewing and interpretation of medical images. This shift towards telehealth solutions has created new opportunities for medical display manufacturers to develop innovative products tailored to meet the demands of virtual healthcare delivery.

Medical Display Market Segmentation

The global medical display market segmentation is based on device, resolution, panel size, technology, application, and geography.

Medical Display Market By Device

- All-in-one

- Mobile

- Desktop

According to medical display industry analysis, the desktop segment held the largest market share in 2022. One of the key drivers is the increasing adoption of desktop medical displays in healthcare facilities due to their versatility and cost-effectiveness. Desktop displays offer healthcare professionals the flexibility to integrate them into various medical imaging workflows, from radiology departments to outpatient clinics, facilitating efficient image interpretation and diagnosis. Additionally, desktop displays typically offer high resolutions and calibrated color accuracy, meeting the stringent requirements for medical imaging applications. Furthermore, the proliferation of Picture Archiving and Communication Systems (PACS) and electronic health records (EHR) has fueled the demand for desktop medical displays.

Medical Display Market By Resolution

- Up to 2MP

- 2.1 to 4MP

- 4.1 to 8MP

- Above 8MP

In terms of resolution, the 2.1 to 4MP segment is dominate the market in 2022. This growth is primarily due to advancements in imaging technology and increasing demand for higher resolution displays in healthcare settings. Medical displays within this resolution range are particularly well-suited for applications such as general radiology, mammography, and other diagnostic imaging procedures where detailed visualization is crucial for accurate diagnosis. The shift towards digital imaging modalities has driven the need for higher resolution displays to ensure clear and precise visualization of medical images. Moreover, the rising prevalence of chronic diseases and the aging population have contributed to the growing demand for diagnostic imaging procedures, further fueling the adoption of 2.1 to 4MP medical displays.

Medical Display Market By Panel Size

- Up to-22.9-inch

- 23.0-26.9-inch

- 27.0-41.9-inch

- Above-42-inch

According to the medical display market forecast, the 27.0–41.9-inch segment is expected to witness significant growth in the coming years. This growth is propelled by various factors driving demand for larger display sizes in healthcare environments. One significant driver is the increasing adoption of PACS (Picture Archiving and Communication Systems) and other digital imaging solutions in healthcare facilities. These systems require larger displays to accommodate the viewing of multiple medical images simultaneously and facilitate comprehensive analysis by healthcare professionals. Additionally, larger displays offer greater screen real estate, allowing for enhanced visualization of intricate medical images such as MRIs, CT scans, and 3D reconstructions.

Medical Display Market By Technology

- Light Emitting Diode (LED)

- Cold Cathode Fluorescent Light (CCFL)

- Organic Light Emitting Diode (OLED) Display

- Backlit Liquid Crystal Display

- Others

Based on the technology, the light emitting diode (LED) segment is expected to witness significant growth in the coming years. LED displays offer several benefits over traditional LCD (liquid crystal display) technology, including higher energy efficiency, longer lifespan, and superior image quality. Healthcare facilities are increasingly adopting LED medical displays to replace older LCD monitors, as they offer improved brightness, contrast, and color reproduction, ensuring accurate visualization of medical images for diagnostic purposes. Furthermore, LED technology allows for thinner and lighter display designs, making LED medical displays more space-efficient and easier to integrate into various healthcare environments such as radiology departments, operating rooms, and outpatient clinics.

Medical Display Market By Application

- Digital Pathology

- Surgical

- Multi-modality

- Mammography

- Radiology

- Others

In terms of application, the radiology segment has been experiencing significant growth in recent years. This growth is driven by several factors contributing to the increasing demand for specialized displays tailored to the unique needs of radiologists and imaging professionals. Radiology is a cornerstone of modern healthcare, with diagnostic imaging playing a crucial role in the accurate diagnosis and treatment of various medical conditions. As radiologists rely heavily on medical displays for interpreting a wide range of imaging studies, there is a growing emphasis on investing in high-quality displays optimized for radiology workflows. One key driver of growth in the radiology segment is the ongoing technological advancements in medical imaging modalities, such as computed tomography (CT), magnetic resonance imaging (MRI), and digital mammography.

Medical Display Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Display Market Regional Analysis

North America dominates the medical display market for several reasons, primarily attributed to the region's advanced healthcare infrastructure, technological innovation, and high healthcare expenditure. The United States, in particular, boasts a robust healthcare system with a strong emphasis on adopting cutting-edge medical technologies. As a result, North America has been at the forefront of the adoption of digital imaging solutions, including medical displays, across various healthcare settings such as hospitals, diagnostic imaging centers, and ambulatory surgical centers. Moreover, the presence of key market players and leading technology companies in North America further contributes to the region's dominance in the medical display market. Several prominent manufacturers of medical displays are headquartered or have a significant presence in the United States and Canada, driving innovation and driving the adoption of advanced display technologies. These companies continually invest in research and development to develop state-of-the-art medical display solutions tailored to meet the specific needs of healthcare providers in the region, further solidifying North America's position as a leader in the global medical display market.

Medical Display Market Player

Some of the top medical display market companies offered in the professional report include Advantech Co. Ltd., Barco NV, Axiomtek Co. Ltd., Sony Corporation, BenQ Medical Technology, EIZO Corporation, Dell Technologies Inc., Sony Corporation, LG Electronics Inc., Siemens AG, Novanta Inc., and Steris Corporation.

Frequently Asked Questions

How big is the medical display market?

The medical display market size was USD 2.3 Billion in 2022.

What is the CAGR of the global medical display market from 2023 to 2032?

The CAGR of medical display is 5.4% during the analysis period of 2023 to 2032.

Which are the key players in the medical display market?

The key players operating in the global market are including Advantech Co. Ltd., Barco NV, Axiomtek Co. Ltd., Sony Corporation, BenQ Medical Technology, EIZO Corporation, Dell Technologies Inc., Sony Corporation, LG Electronics Inc., Siemens AG, Novanta Inc., and Steris Corporation.

Which region dominated the global medical display market share?

North America held the dominating position in medical display industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical display during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global medical display industry?

The current trends and dynamics in the medical display industry include technological advancements in display resolution and image quality, and increasing prevalence of chronic diseases driving demand for diagnostic imaging.

Which device held the maximum share in 2022?

The desktop device held the maximum share of the medical display industry.