Medical Device Outsourcing Market | Acumen Research and Consulting

Medical Device Outsourcing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

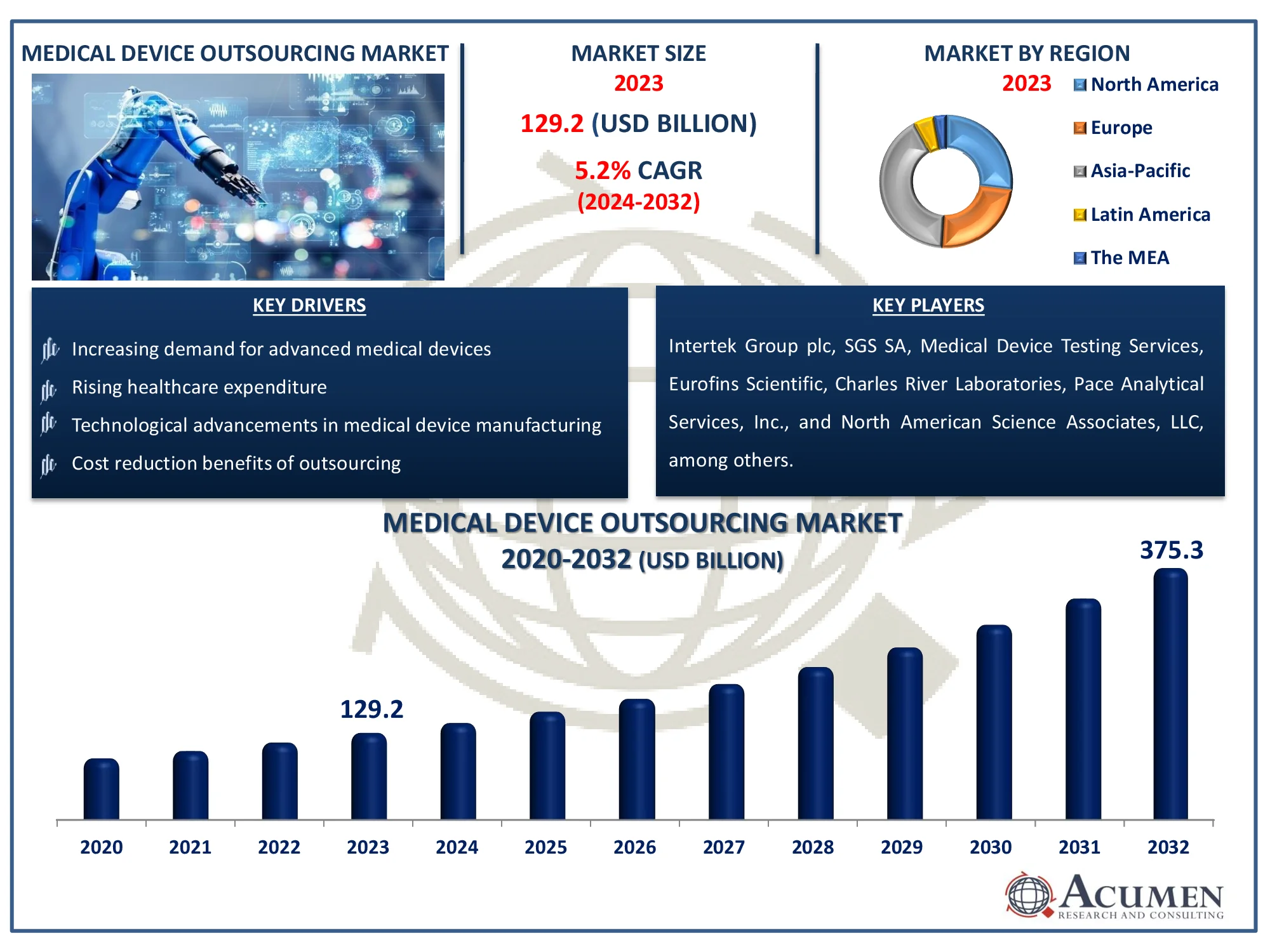

The Medical Device Outsourcing Market Size accounted for USD 129.2 Billion in 2023 and is estimated to achieve a market size of USD 375.3 Billion by 2032 growing at a CAGR of 12.7% from 2024 to 2032.

Medical Device Outsourcing Market Highlights

- Global medical device outsourcing market revenue is poised to garner USD 375.3 billion by 2032 with a CAGR of 12.7% from 2024 to 2032

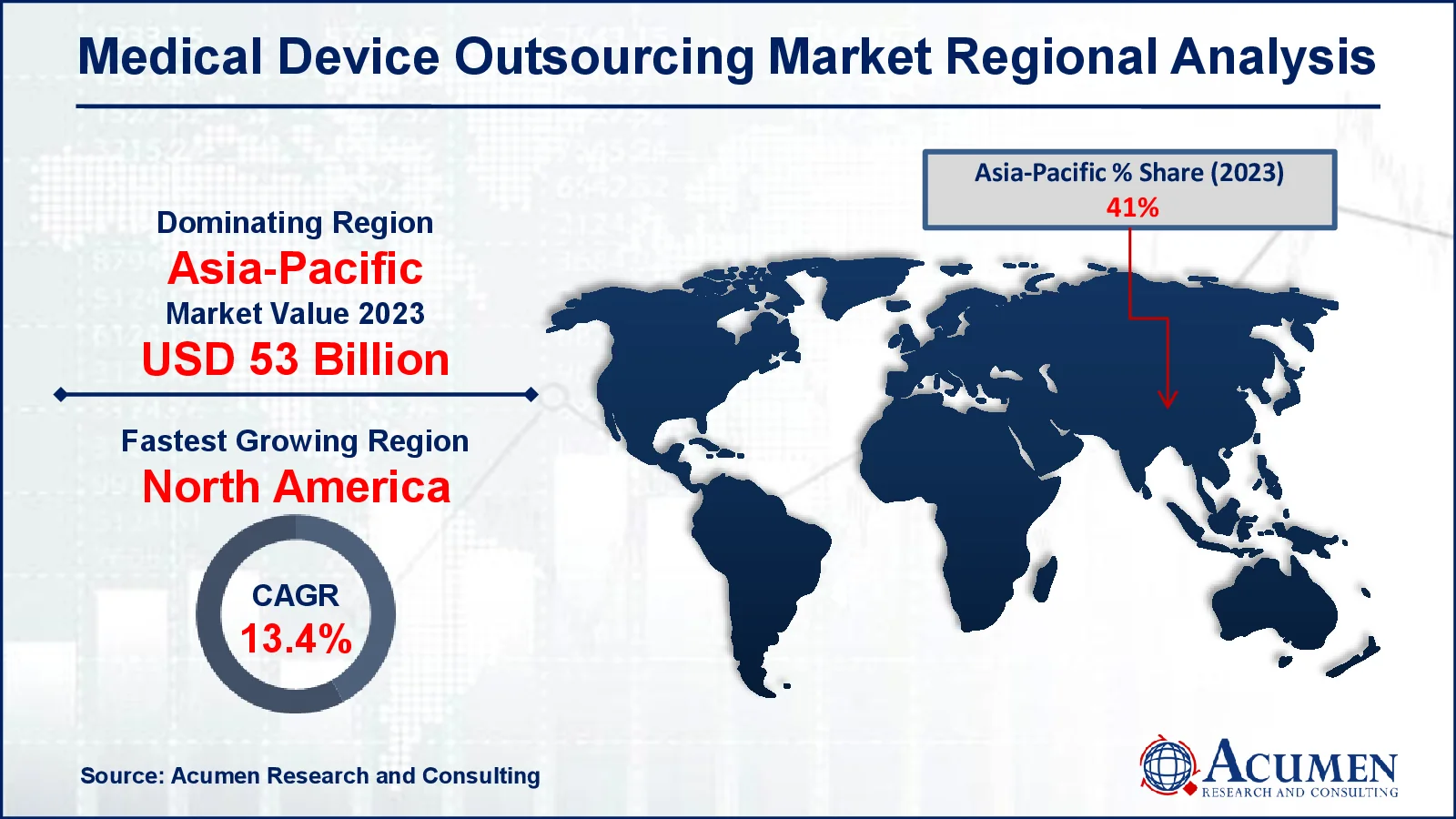

- Asia-Pacific medical device outsourcing market value occupied around USD 53 billion in 2023

- North America medical device outsourcing market growth will record a CAGR of more than 13.4% from 2024 to 2032

- Among service, the contract manufacturing sub-segment USD 69.8 billion revenue in 2023

- Based on application, the cardiology sub-segment generated 22% medical device outsourcing market share in 2023

- Increasing trend of telemedicine and remote monitoring is a popular medical device outsourcing market trend that fuels the industry demand

Medical device outsourcing refers to the practice where medical device companies contract external suppliers to handle various aspects of the production process. This includes design, manufacturing, regulatory compliance, packaging, and distribution. The primary goal is to leverage specialized expertise, reduce costs, and accelerate time-to-market. Outsourcing enables companies to focus on core competencies like innovation and market expansion while benefiting from the capabilities of specialized service providers. Key drivers for Medical Device Outsourcing include the increasing complexity of medical devices, stringent regulatory requirements, and the need for cost-efficient production methods. Outsourcing partners often possess advanced technological capabilities and regulatory knowledge, ensuring high-quality production and compliance with global standards. Additionally, outsourcing helps companies scale operations quickly and respond to market demands without the need for significant capital investments in infrastructure and equipment.

Global Medical Device Outsourcing Market Dynamics

Market Drivers

- Increasing demand for advanced medical devices

- Rising healthcare expenditure

- Technological advancements in medical device manufacturing

- Cost reduction benefits of outsourcing

Market Restraints

- Regulatory complexities and compliance issues

- Concerns over intellectual property protection

- Dependence on third-party vendors

Market Opportunities

- Growing need for specialized medical devices

- Expansion in emerging markets

- Development of innovative outsourcing models

Medical Device Outsourcing Market Report Coverage

| Market | Medical Device Outsourcing Market |

| Medical Device Outsourcing Market Size 2022 |

USD 129.2 Billion |

| Medical Device Outsourcing Market Forecast 2032 | USD 375.3 Billion |

| Medical Device Outsourcing Market CAGR During 2023 - 2032 | 12.7% |

| Medical Device Outsourcing Market Analysis Period | 2020 - 2032 |

| Medical Device Outsourcing Market Base Year |

2022 |

| Medical Device Outsourcing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Service, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Intertek Group plc, SGS SA, Medical Device Testing Services, Eurofins Scientific, Charles River Laboratories, Pace Analytical Services, Inc., North American Science Associates, LLC, Laboratory Corporation of America Holdings, WuXiAppTec, RJR Consulting, Inc., Sterigenics U.S., LLC (GTCR, LLC), and TÜV SÜD. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Device Outsourcing Market Insights

The increasing competition among medical device manufacturers is a primary driver for producing products at lower and more reasonable costs. This factor is positively influencing the growth of the global medical device outsourcing market. The continuous changes in the regulatory landscape and the growing awareness and inclination toward outsourcing services, such as quality assurance, product implementation, and regulatory consulting, are also expected to augment during the Medical Device Outsourcing market forecast period. The rising geriatric population is significantly influencing the demand for medical devices. This demographic constitutes a large customer base with limited health resources, prompting manufacturers to subcontract activities such as packaging, assembling, and various other processes. New entrants in the medical device industry, for instance, are likely to outsource device design to stay technologically updated and meet patient demands.

Moreover, increasing complexities in product manufacturing, coupled with the growing number of new entrants globally, are expected to shape the future of the global medical device outsourcing market. As medical devices become more sophisticated, the need for specialized expertise and advanced manufacturing capabilities becomes more pronounced, driving companies to seek external partners for these functions. The rising prevalence of chronic disorders among the global population is further elevating the demand for medical devices. This trend is working in favor of the market, as it necessitates the production of a broader range of devices to meet diverse medical needs. Consequently, manufacturers are increasingly turning to outsourcing to manage the heightened production demands efficiently.

Medical Device Outsourcing Market Segmentation

The worldwide market for medical device outsourcing is split based on service, application, and geography.

Medical Device Outsourcing Market By Services

- Quality Assurance

- Regulatory Affairs Services

- Clinical Trials Applications and Product Registrations

- Regulatory Writing and Publishing

- Legal Representation

- Other

- Product Design and Development Services

- Designing & Engineering

- Machining

- Molding

- Packaging

- Product Testing & Sterilization Services

- Product Implementation Services

- Product Upgrade Services

- Product Maintenance Services

- Contract Manufacturing

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

According to medical device outsourcing industry analysis, the contract manufacturing segment is taking the lead within the service category. This segment encompasses a wide range of activities, including the production of complete medical devices, components, and sub-assemblies. The prominence of contract manufacturing is attributed to its ability to provide cost-effective solutions, allowing medical device companies to focus on core competencies such as research and development, and marketing.

Contract manufacturing offers several benefits, such as access to advanced manufacturing technologies, specialized expertise, and scalability. This enables medical device companies to quickly respond to market demands and regulatory changes without investing heavily in infrastructure and technology. Additionally, outsourcing manufacturing processes helps in reducing production costs, improving product quality, and accelerating time-to-market.

The increasing complexity of medical devices and the stringent regulatory requirements necessitate the use of sophisticated manufacturing processes and quality control measures. Contract manufacturers are well-equipped to handle these challenges, ensuring compliance with global standards. As a result, the contract manufacturing segment is expected to continue its growth trajectory, driven by the ongoing demand for innovative and high-quality medical devices.

Medical Device Outsourcing Market By Applications

- Cardiology

- Diagnostic imaging

- Orthopedic

- IVD

- Ophthalmic

- General and plastic surgery

- Drug delivery

- Dental

- Endoscopy

- Diabetes care

- Others

The cardiology segment holds a dominant position and it is expected to grow over the medical device outsourcing market forecast period. This is largely due to the high prevalence of cardiovascular diseases globally, which drives the demand for a wide range of cardiac devices such as pacemakers, stents, and defibrillators. The growing aging population, coupled with increasing incidences of heart-related conditions, further amplifies this demand.

Cardiology devices require precise manufacturing and stringent quality standards, making outsourcing an attractive option for many medical device companies. By leveraging the expertise and advanced technologies of contract manufacturers, companies can ensure the production of high-quality, reliable devices that meet regulatory requirements. This not only helps in maintaining compliance but also in accelerating the time-to-market for new and innovative products.

Furthermore, continuous advancements in cardiac care technology necessitate specialized knowledge and capabilities, which many outsourcing partners possess. These partners can provide end-to-end services from product design and development to testing and regulatory affairs, ensuring seamless integration and efficiency in the production process. As a result, the cardiology segment remains a key driver of growth within the medical device outsourcing market.

Medical Device Outsourcing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Device Outsourcing Market Regional Analysis

In terms of medical device outsourcing market analysis, the dominance of Asia-Pacific is primarily attributed to several factors, including the presence of a robust manufacturing infrastructure, lower labor costs, and a growing pool of skilled professionals. Countries like China, India, and Japan have emerged as significant hubs for medical device production and outsourcing. These countries offer cost-effective manufacturing solutions without compromising on quality, which appeals to global medical device companies looking to reduce production costs. Additionally, the increasing prevalence of chronic diseases, an expanding middle-class population, and rising healthcare expenditures in the region contribute to the growing demand for medical devices, further boosting the outsourcing during the medical device outsourcing industry forecast period.

North America is experiencing rapid growth in the medical device outsourcing market due to the region's strong focus on innovation, advanced healthcare infrastructure, and the presence of major medical device companies. The United States, in particular, is a leader in medical technology advancements and regulatory standards. The stringent regulatory environment and the high cost of in-house manufacturing push companies to seek outsourcing solutions that can provide high-quality, compliant products more efficiently. Furthermore, the increasing adoption of advanced medical devices and a growing aging population drive the demand for medical devices, propelling the medical device outsourcing market growth in North America.

Medical Device Outsourcing Market Players

Some of the top medical device outsourcing companies offered in our report includes Intertek Group plc, SGS SA, Medical Device Testing Services, Eurofins Scientific, Charles River Laboratories, Pace Analytical Services, Inc., North American Science Associates, LLC, Laboratory Corporation of America Holdings, WuXiAppTec, RJR Consulting, Inc., Sterigenics U.S., LLC (GTCR, LLC), and TÜV SÜD.

Frequently Asked Questions

How big is the medical device outsourcing market?

The medical device outsourcing market size was valued at USD 129.2 billion in 2023.

What is the CAGR of the global medical device outsourcing market from 2024 to 2032?

The CAGR of medical device outsourcing is 12.7% during the analysis period of 2024 to 2032.

The CAGR of medical device outsourcing is 12.7% during the analysis period of 2024 to 2032.

The key players operating in the global market are including Intertek Group plc, SGS SA, Medical Device Testing Services, Eurofins Scientific, Charles River Laboratories, Pace Analytical Services, Inc., North American Science Associates, LLC, Laboratory Corporation of America Holdings, WuXiAppTec, RJR Consulting, Inc., Sterigenics U.S., LLC (GTCR, LLC), and TÃœV SÃœD.

Which region dominated the global medical device outsourcing market share?

Asia-Pacific held the dominating position in medical device outsourcing industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of medical device outsourcing during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global medical device outsourcing industry?

The current trends and dynamics in the medical device outsourcing industry include increasing demand for advanced medical devices, rising healthcare expenditure, technological advancements in medical device manufacturing, and cost reduction benefits of outsourcing.

Which application held the maximum share in 2023?

The cardiology application held the maximum share of the medical device outsourcing industry.