Magnetic Sensor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Magnetic Sensor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

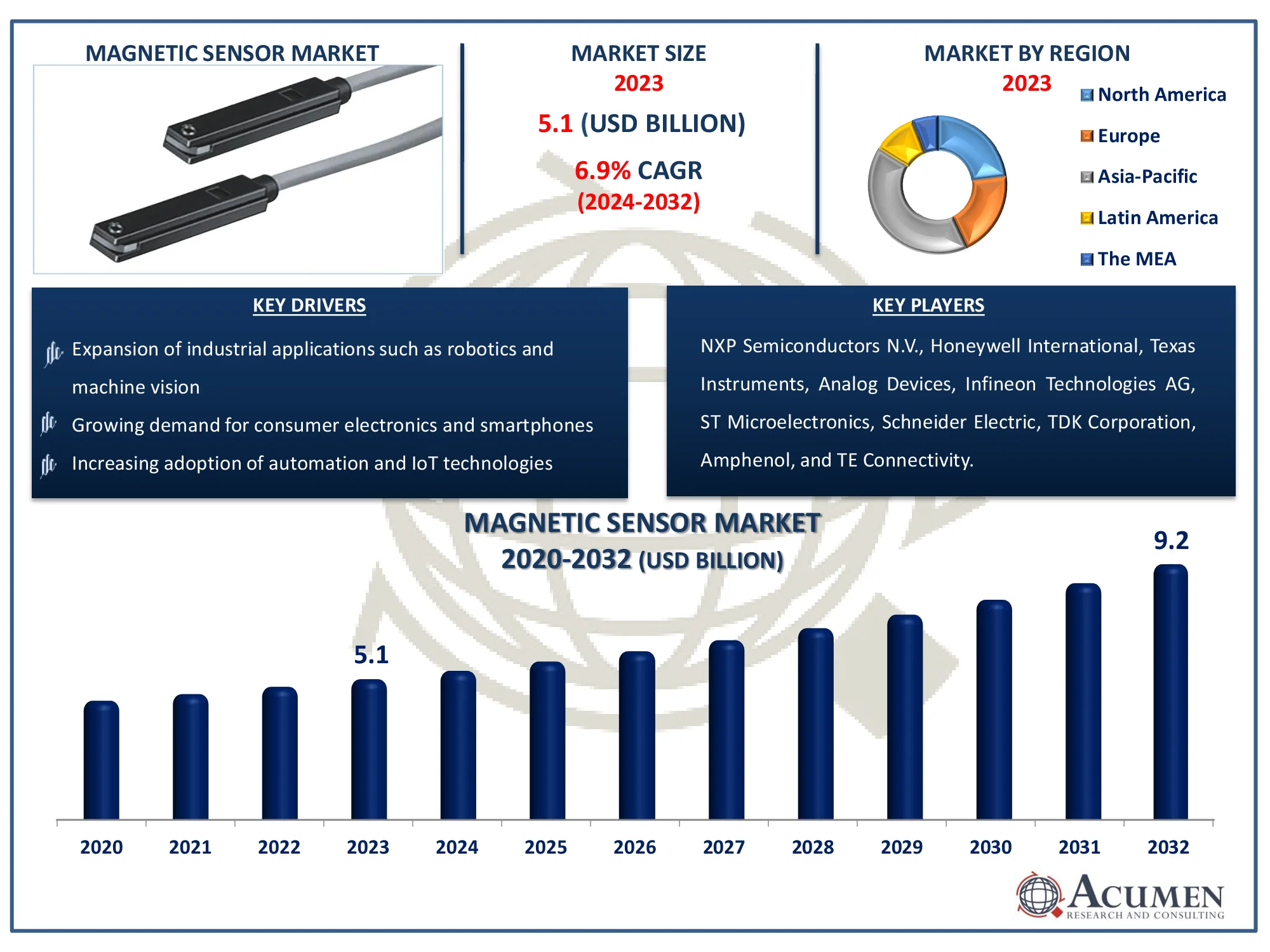

The Global Magnetic Sensor Market Size accounted for USD 5.1 Billion in 2023 and is estimated to achieve a market size of USD 9.2 Billion by 2032 growing at a CAGR of 6.9% from 2024 to 2032.

Magnetic Sensor Market Highlights

- Global magnetic sensor market revenue is poised to garner USD 9.2 billion by 2032 with a CAGR of 6.9% from 2024 to 2032

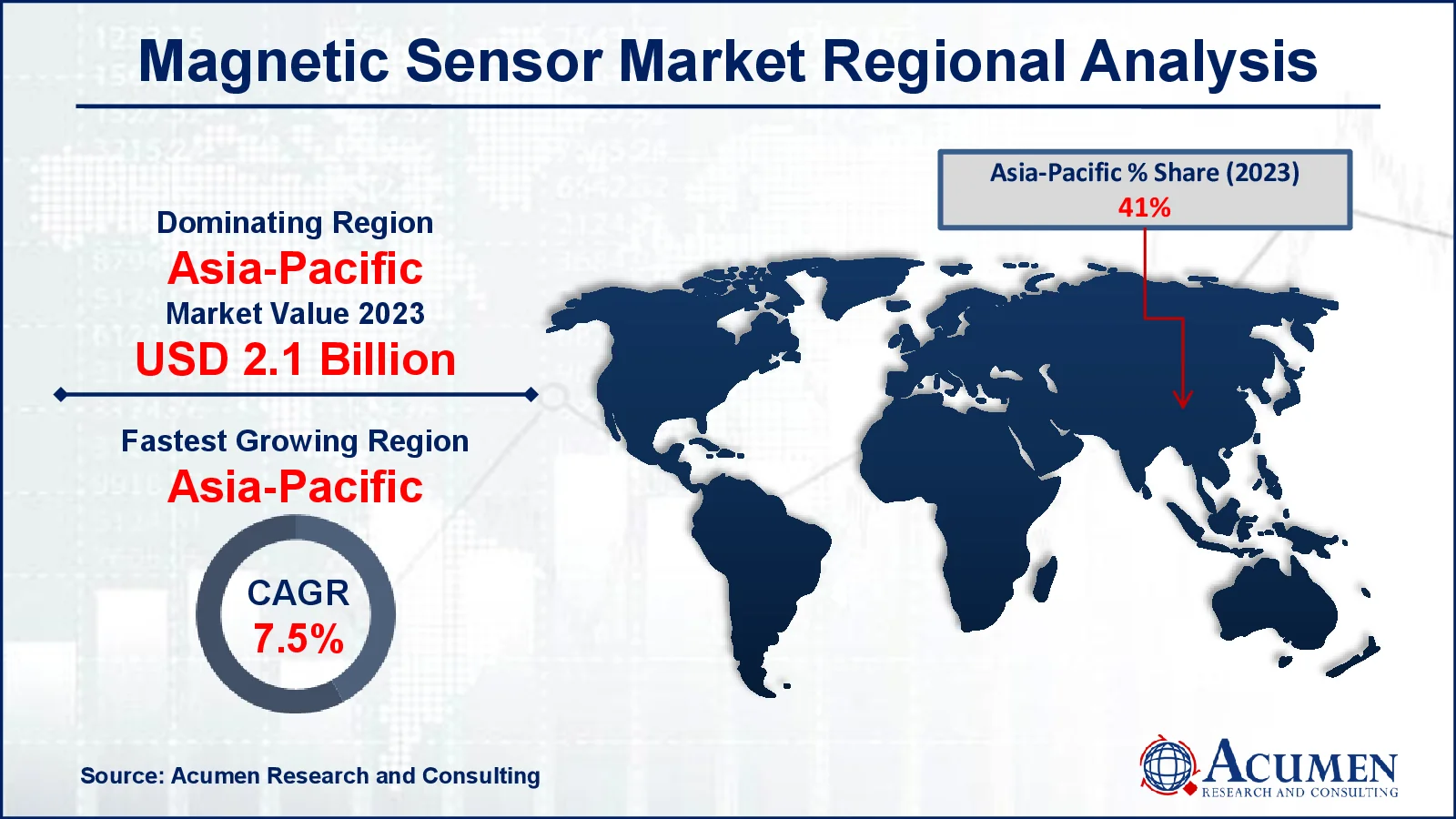

- Asia-Pacific magnetic sensor market value occupied around USD 2.1 billion in 2023

- Asia-Pacific magnetic sensor market growth will record a CAGR of more than 7.5% from 2024 to 2032

- Among application, the position sensing sub-segment generated more than USD 1.7 billion revenue in 2023

- Based on end user, the automotive sub-segment generated around 36% market share in 2023

- Advancements in nanotechnology enabling miniaturization and improved sensor performance is a popular magnetic sensor market trend that fuels the industry demand

Magnetic sensors serve an important role in a variety of applications, which may be classified as whole magnetic field measurements or magnetic field vector components. These sensors need permanent magnets, such as neodymium magnets, to work. The fundamental function of magnetic sensors is to determine the magnitude and direction of magnetic fields in their proximity. A magnetic sensor typically has a revolving sensor tip that allows for the detection of transversal and longitudinal magnetic fields. This rotating mechanism enables a thorough examination of the magnetic environment, as well as the exact detection and characterization of magnetic events. These sensors, which precisely capture magnetic field fluctuations, find use in a variety of sectors, including automotive, industrial automation, consumer electronics, and medical devices.

Global Magnetic Sensor Market Dynamics

Market Drivers

- Increasing adoption of automation and IoT technologies

- Growing demand for consumer electronics and smartphones

- Rising use of magnetic sensors in automotive safety systems

- Expansion of industrial applications such as robotics and machine vision

Market Restraints

- Price volatility of rare earth materials used in magnet production

- Concerns regarding accuracy and reliability in extreme environments

- Regulatory challenges related to privacy and data security in IoT applications

Market Opportunities

- Emerging applications in healthcare and medical devices

- Expansion of smart home and building automation systems

- Integration of magnetic sensors in emerging renewable energy technologies

Magnetic Sensor Market Report Coverage

| Market | Magnetic Sensor Market |

| Magnetic Sensor Market Size 2022 |

USD 5.1 Billion |

| Magnetic Sensor Market Forecast 2032 | USD 9.2 Billion |

| Magnetic Sensor Market CAGR During 2023 - 2032 | 6.9% |

| Magnetic Sensor Market Analysis Period | 2020 - 2032 |

| Magnetic Sensor Market Base Year |

2022 |

| Magnetic Sensor Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | NXP Semiconductors N.V., Texas Instruments, Analog Devices, Infineon Technologies AG, ST Microelectronics, Honeywell International, Schneider Electric, TDK Corporation, Amphenol, and TE Connectivity. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Magnetic Sensor Market Insights

The increased integration of motors across different vertical industries is anticipated to drive market growth, supported by major technological advances in sensing technology. Market development is expected to benefit from government regulations requiring the incorporation of magnetic sensors into cars. Magnetic sensors are essential components of automotive and smartphone navigation systems, which is likely to boost their demand in both industries. Due to increased demand for automotive magnetic detectors, a good growth rate is projected for the market throughout the magnetic sensor market forecast period. Sensor companies have emphasized that effective devices can be incorporated into many applications. These instruments support contactless operations and wear-free angular velocity and rotational angle measurements. Another approach taken by producers is aggressive investment in R&D to develop sophisticated sensory elements aimed at creating sensors with characteristics like motion detection, velocity, and proximity to meet the requirements of various vertical end-use applications.

Magnetic sensors serve as the building blocks of electronic control systems in both commercial and passenger cars. These systems ensure greater safety and enhance driver comfort, leading to increased acceptance. Such sophisticated sensing components ensure high economic reliability and effectiveness. The high penetration of advanced sensing components, which will have a positive effect on the market in the following years, is the result of the high level of sophistication in smartphones and tablets. Magnetic detectors are also widely used in non-destructive testing (NDT) and medical R&D sectors. Average magnetic sensor sales prices (ASPs) are steadily decreasing due to intense market competition. As a consequence, producers are compelled to reduce their margins to secure long-term agreements with businesses across various markets. Although ASPs are expected to continue decreasing, the market will continue to benefit from the increased application ranges of magnetic detectors in the magnetic sensor industry forecast year.

Magnetic Sensor Market Segmentation

The worldwide market for magnetic sensor is split based on technology, application, end user, and geography.

Magnetic Sensor Technologies

- Hall Effect

- Tunnel Magnetoresistance (TMR)

- Giant Magnetoresistance (GMR)

- Anisotropic Magnetoresistance (AMR)

- Others

According to magnetic sensor industry analysis, the hall effect segment accounted for a significant share in sales, and its dominance is expected to continue throughout the forecast period. This is attributed to the fact that Hall Effect sensors are simple to implement, compact in design, and offer a variety of working voltages and power choices.

In the TMR segment, the most volume-oriented compound annual growth rate (CAGR) over the forecast period is projected to be noteworthy share. TMR devices are suitable for a broad spectrum of industrial applications, including bio-sensing and MRAM. The technology is gaining popularity in the anti-lock braking (ABS) sector due to its capacity to deliver high performance, sensitivity, and sensing performance similar to Wheel Speed Sensors (WSS).

Additionally, AMR sensors are expected to be common during the forecast period due to their intrinsic characteristics such as increased magnetoresistance, reduced cost, and higher flexibility.

Magnetic Sensor Applications

- Speed Sensing

- Detection

- Position Sensing

- Navigation

- Others

The position sensing category is the largest in the magnetic sensor Market due to its broad applications in a variety of sectors. Position sensing is vital in several industries, including automotive, industrial automation, robotics, and aerospace. Magnetic sensors precisely detect the location of moving objects or components, giving critical information for accurate control, monitoring, and feedback systems. These sensors are used in a variety of applications, including throttle position sensing in automobile engines and accurate positioning of robotic arms in industrial operations. Magnetic sensors' flexibility and dependability in identifying location make them indispensable in current technology. With rising need for automation and precise control systems, the position sensing category continues to dominate the magnetic sensor market, providing significant revenue and development potential.

Magnetic Sensor End User

- Industrial

- Healthcare

- Consumer Electronics

- Aerospace & Defense

- Automotive

- Others

As per the magnetic sensor market forecast, automotive industry is anticipated to emerge as the most demand-producing segment throughout 2024 to 2032. In various automotive applications, approximately 1.6 billion magnetic sensors were used in 2023. This segment was also responsible for the dominant share in the magnetic sensor industry this year. The development of the segment is shaped by key legislative bodies around the globe, aiming to address increasing concerns about environmental pollution by emphasizing the use of electric and hybrid cars. The increased use of magnetic sensors will positively impact market growth in consumer electronics. These sensors are integral components of appliances such as tablets, smartphones, scanners, printers, laptops, flat panels, and cameras. They are also integrated into game controllers and other intelligent devices.

In recent years, the use of robots in plant automation has become more prominent. For precise linear and angular position sensing in engine movement, factory automation solutions require greater precision, repeatability, and accuracy. Magnetic sensors are increasingly being utilized for angular and linear sensing, security switches, and proximity detection to enhance the efficiency of manufacturing lines in response to the growing need for optimization.

Magnetic Sensor Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Magnetic Sensor Market Regional Analysis

In terms of magnetic sensor market analysis, in 2023, Asia-Pacific emerged as the leader in both revenues and quantity in the market due to the thriving car and consumer electronics sectors in the region, as well as the presence of leading sensor producers in China and Japan. The demand for cars and high-tech smartphones in the region has driven the demand for magnetic sensors.

In North America, connected automobiles have become significantly more prominent, with consumer purchasing behavior increasingly dependent on the communication capabilities offered by various vehicle manufacturers. Miniature magnetic sensors facilitate the transmission of these capabilities while maintaining essential automotive functionality. These sensing elements are also gaining traction in the region across multiple applications, including position sensing, flow rate detection, and velocity sensing.

The European market is expected to continue growing steadily over the forecast period. Hybrid cars integrated with Hall Effect energy systems are gaining traction in Europe, significantly contributing to industry growth.

Market players are increasing investments in the Middle East & Africa (MEA) to expand their physical presence. The market in GCC nations is anticipated to grow significantly during the forecast period, as many semiconductor suppliers in the region offer miniaturized magnetic detectors to improve operational efficiency. In Brazil, the national magnetic sensors market has been driven by rising IT expenditure and increased adoption of sophisticated techniques in South America. Brazil is expected to maintain a significant share of its market revenue in the region during the forecast period.

Magnetic Sensor Market Players

Some of the top Magnetic Sensor companies offered in our report include NXP Semiconductors N.V., Texas Instruments, Analog Devices, Infineon Technologies AG, ST Microelectronics, Honeywell International, Schneider Electric, TDK Corporation, Amphenol, and TE Connectivity.

Frequently Asked Questions

How big is the magnetic sensor market?

The magnetic sensor market size was valued at USD 5.1 billion in 2023.

What is the CAGR of the global magnetic sensor market from 2024 to 2032?

The CAGR of magnetic sensor is 6.9% during the analysis period of 2024 to 2032.

Which are the key players in the magnetic sensor market?

The key players operating in the global market are including NXP Semiconductors N.V., Texas Instruments, Analog Devices, Infineon Technologies AG, ST Microelectronics, Honeywell International, Schneider Electric, TDK Corporation, Amphenol, and TE Connectivity.

Which region dominated the global magnetic sensor market share?

Asia-Pacific held the dominating position in magnetic sensor industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of magnetic sensor during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global magnetic sensor industry?

The current trends and dynamics in the magnetic sensor industry include increasing adoption of automation and iot technologies, growing demand for consumer electronics and smartphones, rising use of magnetic sensors in automotive safety systems, and expansion of industrial applications such as robotics and machine vision.

Which application held the maximum share in 2023?

The position sensing application held the maximum share of the magnetic sensor industry.