Macular Degeneration Treatment Market | Acumen Research and Consulting

Macular Degeneration Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

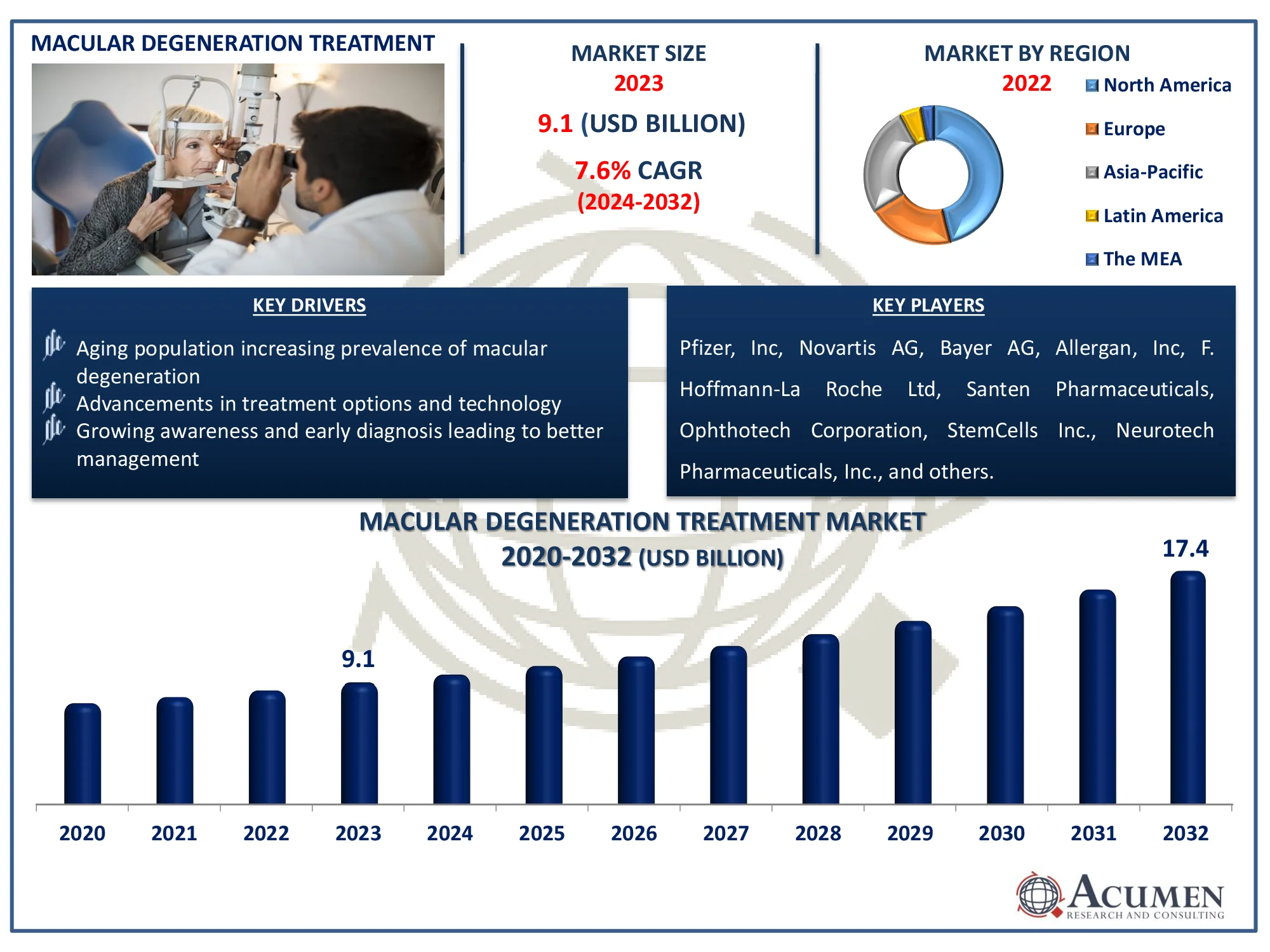

The Global Macular Degeneration Treatment Market Size accounted for USD 9.1 Billion in 2023 and is estimated to achieve a market size of USD 17.4 Billion by 2032 growing at a CAGR of 7.6% from 2024 to 2032.

Macular Degeneration Treatment Market (By Disease Indication: Dry Age-related Macular Degeneration Treatment, Wet Age-related Macular Degeneration Treatment, and Others; By End-user: Ambulatory Surgical Centers, Hospitals, Ophthalmic Clinics, and Others; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Macular Degeneration Treatment Market Highlights

- The global macular degeneration treatment market is projected to reach USD 17.4 billion by 2032, growing at a CAGR of 7.6% from 2024 to 2032

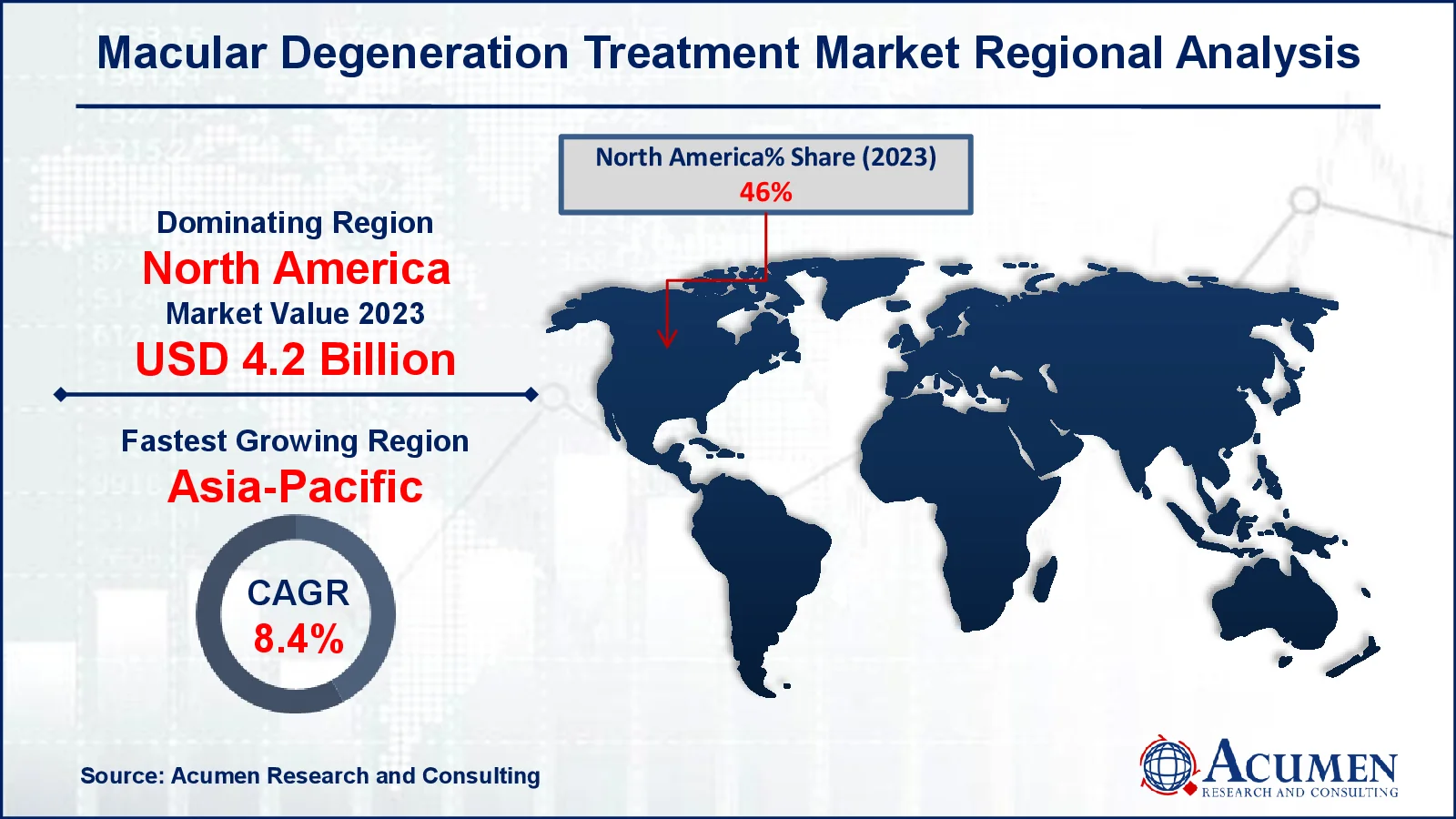

- In 2023, the North America macular degeneration treatment market was valued at approximately USD 4.2 billion

- The Asia-Pacific macular degeneration treatment market is anticipated to grow at a CAGR of over 8.4% from 2024 to 2032

- In 2023, the wet age-related macular degeneration treatment sub-segment accounted for around 80% of the market share based on disease indication

- Gene therapy and stem cell research gaining traction is the macular degeneration treatment market trend that fuels the industry demand

Age-related macular degeneration (AMD), the major cause of vision loss among older persons, is treated by slowing its progression and treating its symptoms. Treatments for AMD differ depending on the type; dry AMD can be controlled with dietary supplements and lifestyle adjustments, whereas wet AMD frequently requires anti-VEGF injections or photodynamic therapy to prevent aberrant blood vessel formation. Additionally, low vision aids and therapy assist patients in adjusting to vision loss. Advances in gene therapy and stem cell research show promise for future treatments. The use of these medicines is critical for increasing quality of life and maintaining vision in affected patients.

Global Macular Degeneration Treatment Market Dynamics

Market Drivers

- Aging population increasing prevalence of macular degeneration

- Advancements in treatment options and technology

- Growing awareness and early diagnosis leading to better management

Market Restraints

- High cost of advanced treatments and therapies

- Limited accessibility to specialized care in rural areas

- Lack of effective treatments for advanced stages of the disease

Market Opportunities

- Development of innovative therapies and drug delivery systems

- Expansion of healthcare infrastructure in emerging markets

- Increased research funding and investment in macular degeneration studies

Macular Degeneration Treatment Market Report Coverage

| Market | Macular Degeneration Treatment Market |

| Macular Degeneration Treatment Market Size 2022 |

USD 9.1 Billion |

| Macular Degeneration Treatment Market Forecast 2032 | USD 17.4 Billion |

| Macular Degeneration Treatment Market CAGR During 2023 - 2032 | 7.6% |

| Macular Degeneration Treatment Market Analysis Period | 2020 - 2032 |

| Macular Degeneration Treatment Market Base Year |

2022 |

| Macular Degeneration Treatment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Disease Indication, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pfizer, Inc., Novartis AG, Bayer AG, Allergan, Inc., F. Hoffmann-La Roche Ltd, Santen Pharmaceuticals, Neurotech Pharmaceuticals, Inc., Ophthotech Corporation, StemCells Inc., Sanofi, and REGENXBIO Inc, etc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Macular Degeneration Treatment Market Insights

The rising patient population and increased awareness of medications for treating AMD are the primary driving reasons behind the expansion of the macular degeneration treatment industry. The anti-VEGF medicines sector is predicted to take the highest share and drive the global market. The leading manufacturers are pursuing possibilities to launch medicines for geographic atrophy, which will have a direct beneficial impact on the growth of the macular degeneration treatment market. Thus, enrollment in clinical trials is projected to increase in the future years.

The increasing prevalence of AMD is likely to enhance the global market; while this may be an evident growth element; other factors are expected to accelerate the market in the near future. For example, increased healthcare spending and patient health awareness are expected to drive market growth. Furthermore, the introduction of innovative pharmaceuticals for age-related macular degeneration therapy is expected to propel the worldwide macular degeneration treatment market.

The macular degeneration market's growth is driven by the continuous introduction of innovative products for atrophy treatment, dry age-related macular degeneration treatment, and wet age-related macular degeneration treatment. Various medications, including anti-VEGF, have been released to the market, which is expected to increase global demand for macular degeneration treatment. Mainly, there is continual innovation in the manufacture of various types of pharmaceuticals to treat dry age-related macular degeneration, which can be one of the primary factors driving the expansion of the macular degeneration treatment industry.

Macular Degeneration Treatment Market Segmentation

The worldwide market for macular degeneration treatment is split based on disease indication, end-user, and geography.

Macular Degeneration Treatment Disease Indication

- Dry Age-related Macular Degeneration Treatment

- Wet Age-related Macular Degeneration Treatment

According to the macular degeneration treatment industry analysis, the wet age-related macular degeneration (AMD) treatment dominates the market because it is more severe and progresses faster than the dry variety. Wet AMD accounts for the vast majority of vision loss cases, creating a greater demand for medicines such as anti-VEGF injections that delay disease development. Advances in drug delivery techniques and new biologics have expanded the industry even further. Furthermore, the growing worldwide geriatric population adds to the rise in prevalence of wet AMD.

Macular Degeneration Treatment End-User

- Ambulatory Surgical Centers

- Hospitals

- Ophthalmic Clinics

- Others

According to the macular degeneration treatment market forecast, the hospital segment is expected to dominate the worldwide market. Furthermore, the hospital category is expected to maintain its leadership position during the projection period. Furthermore, because treatment costs are lower in hospitals than in ophthalmology clinics, the majority of the populace prefers to seek AMD treatment there. Ambulatory surgery centers are a less popular alternative for treating AMD.

Macular Degeneration Treatment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Macular Degeneration Treatment Market Regional Analysis

For several reasons, North America dominates the global macular degeneration therapy market. The growing number of FDA-approved medications, as well as the rising adoption of age-related macular degeneration illnesses, has contributed to this region's domination. This will boost the growth of the macular degeneration treatment industry. Presence of key players and their innovations and advancements further boosts market growth in forecast year. For instance, in October 2021, Roche received FDA approval for Susvimo (ranibizumab injection) 100 mg/mL for intravitreal use via ocular implant for wet age-related macular degeneration (nAMD) in patients who have previously responded to at least two anti-vascular endothelial growth factor (VEGF) injections.

Asia-Pacific is predicted to develop rapidly as the region's patient population grows and healthcare expenditure rises. For instance, according to PRSIndia organization, the Department of Health and Family Welfare's expected budget in 2023-24 is Rs 86,175 crore, accounting for nearly 2% of total central government expenditure. This is a 13% increase over the updated predictions for 2022–23.

Macular Degeneration Treatment Market Players

Some of the top macular degeneration treatment companies offered in our report include, Pfizer, Inc, Novartis AG, Bayer AG, Allergan, Inc, F. Hoffmann-La Roche Ltd, Santen Pharmaceuticals, Neurotech Pharmaceuticals, Inc., Ophthotech Corporation, StemCells Inc., Sanofi, and REGENXBIO Inc, etc.

Frequently Asked Questions

How big is the macular degeneration treatment market?

The macular degeneration treatment market size was valued at USD 9.1 billion in 2023.

What is the CAGR of the global macular degeneration treatment market from 2024 to 2032?

The CAGR of macular degeneration treatment is 7.6% during the analysis period of 2024 to 2032.

Which are the key players in the macular degeneration treatment market?

The key players operating in the global market are including Pfizer, Inc, Novartis AG, Bayer AG, Allergan, Inc, F. Hoffmann-La Roche Ltd, Santen Pharmaceuticals, Neurotech Pharmaceuticals, Inc., Ophthotech Corporation, StemCells Inc., Sanofi, and REGENXBIO Inc, etc

Which region dominated the global macular degeneration treatment market share?

North America held the dominating position in macular degeneration treatment industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of macular degeneration treatment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global macular degeneration treatment industry?

The current trends and dynamics in the macular degeneration treatment industry include aging population increasing prevalence of macular degeneration, advancements in treatment options and technology, and growing awareness and early diagnosis leading to better management.

Which disease indication held the maximum share in 2023?

The wet age-related macular degeneration treatment expected to hold the maximum share of the macular degeneration treatment industry.