Long Term Care Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Long Term Care Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

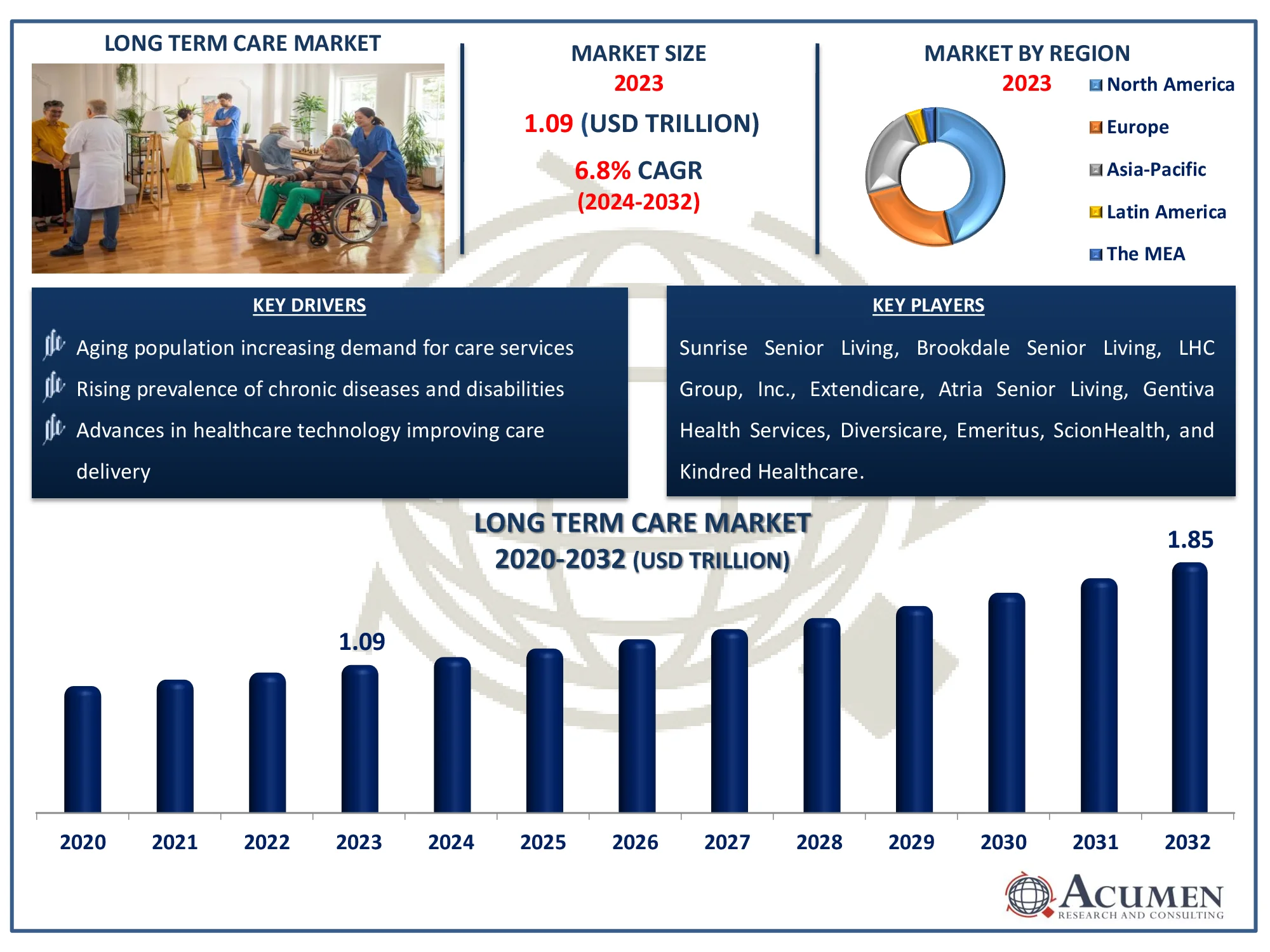

The Global Long Term Care Market Size accounted for USD 1.09 Trillion in 2023 and is estimated to achieve a market size of USD 1.85 Trillion by 2032 growing at a CAGR of 6.1% from 2024 to 2032.

Long Term Care Market Highlights

- The global long term care market is projected to reach USD 1.85 trillion by 2032, with a CAGR of 6.1% from 2024 to 2032

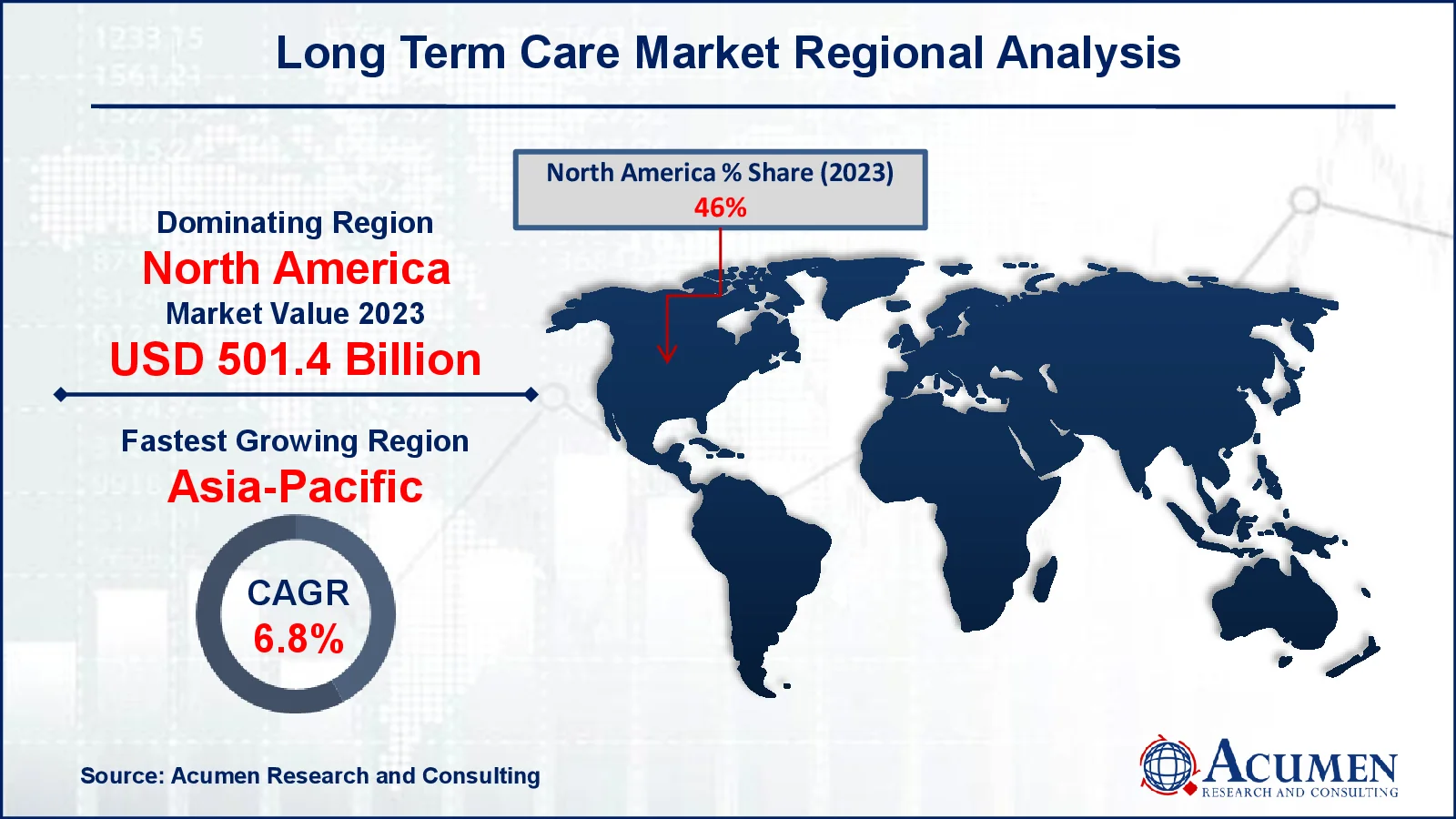

- In 2023, the North American long term care market held a value of approximately USD 501.4 billion

- The Asia-Pacific region is expected to grow at a CAGR of over 6.8% from 2024 to 2032

- The public payer accounted for 60% of the market share in 2023

- The nursing care sub-segment captured 33% of the market share in 2023

- Higher prevalence of chronic conditions like alzheimer’s is one of the long term care market trend that fuels the industry demand

Long-term care refers to a range of services tailored to address an individual's short-term and long-term health and personal care needs. This care is often associated with activities of daily living (ADLs), which include tasks such as dressing, bathing, eating, grooming, using the toilet, and moving around. These services are designed to assist individuals who are unable to perform daily activities independently or efficiently. The recipients of long-term care typically include individuals with chronic illnesses, disabilities, injuries, or age-related conditions.

Global Long Term Care Market Dynamics

Market Drivers

- Aging population increasing demand for care services

- Rising prevalence of chronic diseases and disabilities

- Advances in healthcare technology improving care delivery

Market Restraints

- High costs of long-term care services

- Limited availability of skilled healthcare professionals

- Regulatory and policy challenges in long-term care provision

Market Opportunities

- Growth in home-based care and assisted living services

- Expanding adoption of telemedicine and remote monitoring

- Increased government support for long-term care programs

Long Term Care Market Report Coverage

|

Market |

Long Term Care Market |

|

Long Term Care Market Size 2023 |

USD 1.09 Trillion |

|

Long Term Care Market Forecast 2032 |

USD 1.85 Trillion |

|

Long Term Care Market CAGR During 2024 - 2032 |

6.1% |

|

Long Term Care Market Analysis Period |

2020 - 2032 |

|

Long Term Care Market Base Year |

2023 |

|

Long Term Care Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Gender, By Payer, By Service, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Sunrise Senior Living, Brookdale Senior Living, LHC Group, Inc., Extendicare, Atria Senior Living, Diversicare, Gentiva Health Services, Emeritus, ScionHealth, and Kindred Healthcare. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Long Term Care Market Insights

The long-term care market is experiencing growth primarily due to the increasing prevalence of the aging population with chronic illnesses. According to the United Nations Population Fund, by 2050, one in four individuals in Asia and the Pacific will be over the age of 60. The population of older adults (aged 60 and above) in the region is projected to triple from 2010 to 2050, reaching nearly 1.3 billion people.

The rising government funding for improving therapeutic treatments and vaccination programs in LTC facilities is driving market expansion. For instance, The National Institute on Aging (NIA), which spearheads the U.S. government's efforts in aging-related research and the health and well-being of older adults, is a key player in supporting initiatives aimed at improving the lives of the elderly. The President’s FY 2023 Budget reflects the administration's fiscal goals, which include funding for health programs focused on the aging population in the United States.

Additionally, collaborations between private insurers and governments, along with technological advancements in care devices, are enhancing the quality of life for patients. For instance, in May 2023, Omega Healthcare acquired 18 skilled nursing home facilities in West Virginia for USD 233 million. This acquisition enhances Omega Healthcare's capabilities and ensures the continued smooth operation of its services. These devices, paired with internet connectivity, enable easier communication between physicians and caregivers, further boosting market growth. The growing incidence of diseases such as Alzheimer's and dementia is also contributing to market growth.

On the other hand, the market's growth may be hindered by a shortage of skilled healthcare professionals and stringent hiring regulations in certain major economies. Additionally, strict regulations imposed by authorities such as the Centers for Medicare & Medicaid Services (CMS) may limit market expansion. However, ongoing research and development efforts by key manufacturers and the untapped potential of emerging economies are expected to create significant demand during the forecast period. For instance, in 2024, Amedisys, a leading home health provider, is introducing advanced molecular testing across the nation to swiftly and accurately identify pathogens in infections. This enables the prompt initiation of the right treatment, leading to better patient outcomes. The company has teamed up with Patient Choice Laboratories to utilize cutting-edge diagnostic technology, offering results with greater accuracy, sensitivity, and specificity than conventional testing methods. Furthermore, the rising number of working women is supporting the growth of the sector.

Long Term Care Market Segmentation

The worldwide market for long term care is split based on gender, payer, service, and geography.

Long Term Care Market By Gender

- Male

- Female

According to the long term care industry analysis, females dominate the market, primarily because they tend to live longer than males and often require more extended care due to age-related conditions. The higher prevalence of chronic illnesses and disability among elderly women further drives this trend. Males also require LTC services but in lesser numbers, generally due to shorter life expectancy. The remaining segment typically focuses on younger individuals who need care due to disabilities or chronic conditions.

Long Term Care Market By Payer

- Public

- Private

- Out-of-Pocket

The public payer, typically government programs such as medicaid, plays a dominant role in the long-term care (LTC) sector due to their significant funding capabilities and the large number of individuals relying on public health assistance. These programs cover a substantial portion of LTC costs, particularly for low-income individuals and those with chronic illnesses or disabilities. Private insurance providers have a limited share, mainly catering to those who can afford additional coverage. As a result, public payers influence the pricing, regulations, and delivery models of LTC services.

Long Term Care Market By Service

- Home Assisted Living Facilities

- Hospice

- Nursing Care

- Assisted Living Facilities

- Others

According to the long term care market forecast, in terms of services, home healthcare led the segment in 2023 and is expected to maintain its dominance throughout the forecast period, driven by the increasing geriatric population and rising disability rates among elderly individuals. This segment is also benefiting from a shift in preference from nursing homes to home care among the aging population. Service providers are focusing on technological advancements and new software to enhance service quality.

Long Term Care Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Long Term Care Market Regional Analysis

For several reasons, North America held the largest market share in the long-term care sector, driven by advanced healthcare services and infrastructure. For instance, in July 2024, America's long-term care (LTC) pharmacies launched the "Save Senior Rx Care" campaign, highlighting the urgent need to protect access to vital medications and services for the millions dependent on long-term care. The campaign seeks to raise awareness about the unexpected yet significant impact that new drug pricing policies could have on their operations and the vulnerable patients they serve. The implementation of the Medicare Prospective Payment System (MPPS), designed to support long-term services, also played a crucial role in regional growth. Additionally, the high percentage of the geriatric population in the region is further fueling demand for long-term care services.

On the other hand, the Asia-Pacific market is anticipated to experience the fastest growth during the forecast period, due to increasing investments by major players in emerging economies like China, Japan, and India. For instance, as per Invest India, the Union Budget 2023-24 prioritized healthcares by allocating substantial funds to the Ayushman Bharat scheme, the world's largest government-funded healthcare initiative, aimed at covering over 500 million people. This initiative is revolutionizing healthcare access for the economically disadvantaged and driving increased demand for medical services and infrastructure. The region's growth is also supported by government investments aimed at enhancing healthcare infrastructure and providing high-quality services to residents. Moreover, the rising disposable income is encouraging individuals to spend more on healthcare services, contributing to the region's market expansion.

Long Term Care Market Players

Some of the top long term care companies offered in our report include Sunrise Senior Living, Brookdale Senior Living, LHC Group, Inc., Extendicare, Atria Senior Living, Diversicare, Gentiva Health Services, Emeritus, ScionHealth, and Kindred Healthcare.

Frequently Asked Questions

How big is the Long Term Care market?

The long term care market size was valued at USD 1.09 trillion in 2023.

What is the CAGR of the global Long Term Care market from 2024 to 2032?

The CAGR of long term care is 6.1% during the analysis period of 2024 to 2032.

Which are the key players in the Long Term Care market?

The key players operating in the global market are including Sunrise Senior Living, Brookdale Senior Living, LHC Group, Inc., Extendicare, Atria Senior Living, Diversicare, Gentiva Health Services, Emeritus, ScionHealth, and Kindred Healthcare.

Which region dominated the global Long Term Care market share?

North America held the dominating position in long term care industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of long term care during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Long Term Care industry?

The current trends and dynamics in the long term care industry include aging population increasing demand for care services, rising prevalence of chronic diseases and disabilities, and advances in healthcare technology improving care delivery.

Which Payer held the maximum share in 2023?

The public payer held the maximum share of the long term care industry.