Light Sensor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Light Sensor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

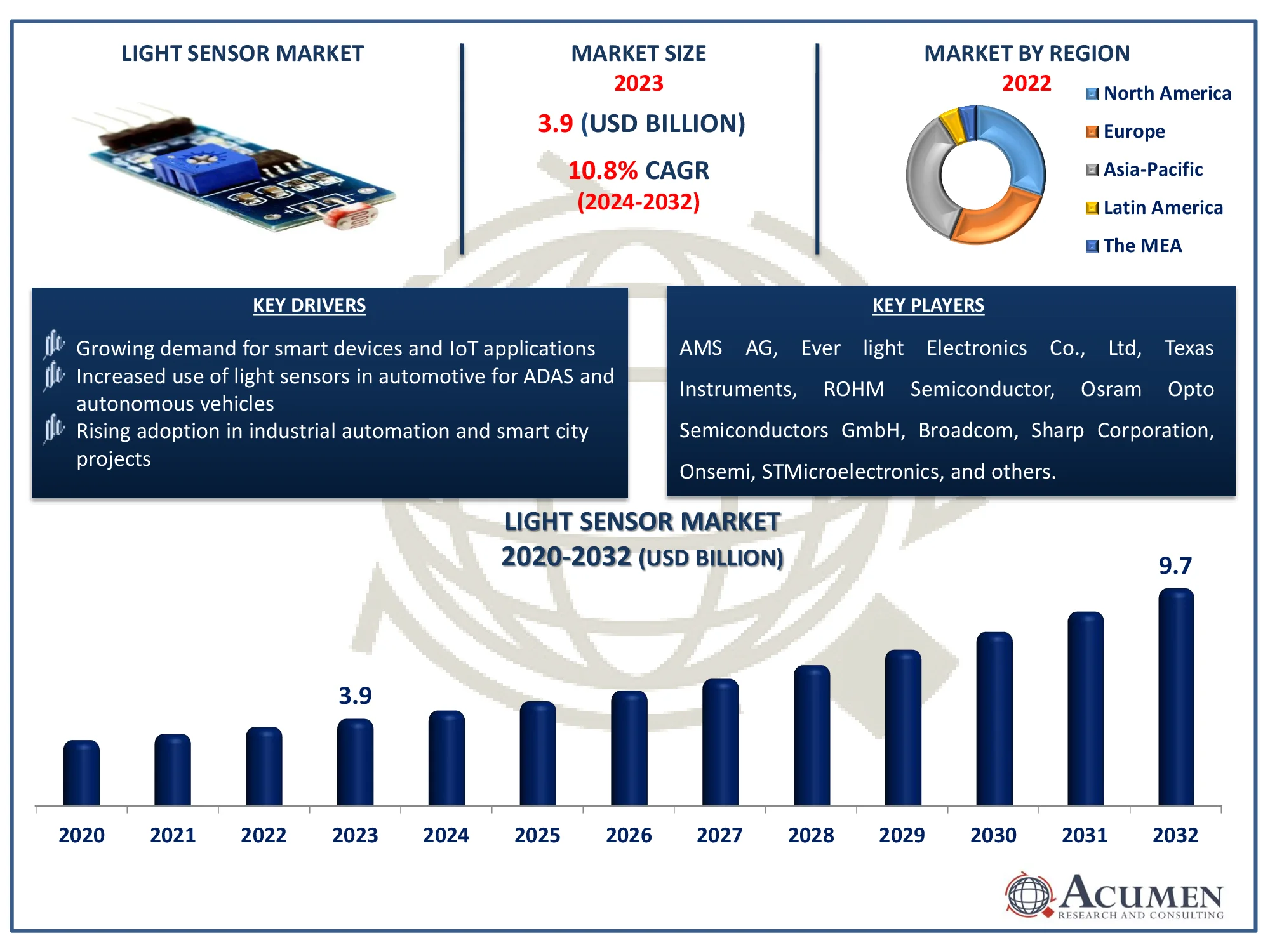

The Global Light Sensor Market Size accounted for USD 3.9 Billion in 2023 and is estimated to achieve a market size of USD 9.7 Billion by 2032 growing at a CAGR of 10.8% from 2024 to 2032.

Light Sensor Market (By Function: Ambient Light Sensing, Proximity Detection, RGB Color Sensing, Gesture Recognition, and IR Detection; By Output: Analog, Digital; By Application: Automotive, Consumer Electronics, Industrial, Healthcare, and Others and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Light Sensor Market Highlights

- The global light sensor market is projected to reach USD 9.7 billion by 2032, with a CAGR of 10.8% from 2024 to 2032

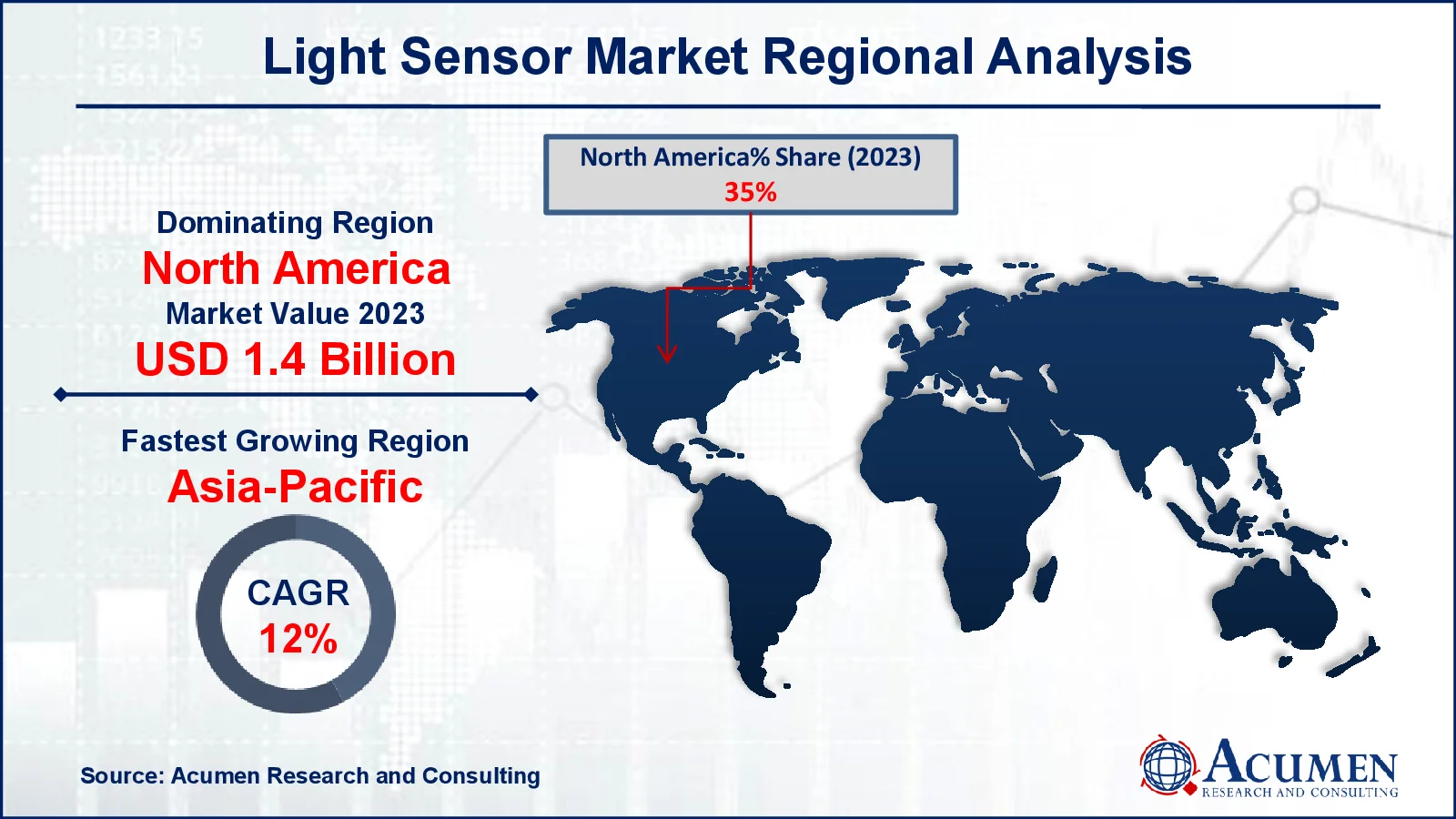

- In 2023, the North American light sensor market held a value of approximately USD 1.4 billion

- The Asia-Pacific region is expected to grow at a CAGR of over 12% from 2024 to 2032

- The ambient light sensing function accounted for 29% of the market share in 2023

- The digital output sub-segment captured 59% of the market share in 2023

- Expanding use in healthcare for accurate diagnostics and monitoring is the light sensor market trend that fuels the industry demand

Light sensors are electronic devices that sense light. These sensors come in a variety of sorts. Light sensors are also employed in energy conservation solutions, including power and energy savings. In general, light sensors transform light energy into an electrical signal, which is then used in electronic equipment. Photodiodes, photoresistors, and phototransistors are all forms of light sensors. Light sensors are employed in the industrial, smart home, and automotive industries and manufacturers are focusing on their development due to their numerous applications. For example, in July 2022, Vishay Intertechnology, Inc.'s Optoelectronics group launched a new AEC-Q101-qualified reflecting optical sensor for automotive, smart home, industrial, and office applications. The Vishay Semiconductors VCNT2025X01 integrates an infrared emitter, silicon phototransistor detector, and daylight blocking filter in a miniature 2.5 mm by 2.0 mm by 0.6 mm surface-mount package, resulting in improved performance with a higher current transfer ratio (CTR) and operating temperature.

Global Light Sensor Market Dynamics

Market Drivers

- Growing demand for smart devices and IoT applications

- Increased use of light sensors in automotive for ADAS and autonomous vehicles

- Rising adoption in industrial automation and smart city projects

Market Restraints

- High cost of advanced light sensing technologies

- Limited awareness in developing regions

- Sensitivity to environmental factors impacting performance

Market Opportunities

- Integration with AI for advanced applications in smart homes

- Expanding use in healthcare devices for monitoring and diagnostics

- Growth in the wearable and fitness tracking markets

Light Sensor Market Report Coverage

| Market | Light Sensor Market |

| Light Sensor Market Size 2022 |

USD 3.9 Billion |

| Light Sensor Market Forecast 2032 | USD 9.7 Billion |

| Light Sensor Market CAGR During 2023 - 2032 | 10.8% |

| Light Sensor Market Analysis Period | 2020 - 2032 |

| Light Sensor Market Base Year |

2022 |

| Light Sensor Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Function, By Output, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AMS AG, Ever light Electronics Co., Ltd, Texas Instruments, ROHM Semiconductor, Osram Opto Semiconductors GmbH, Broadcom, Sharp Corporation, Onsemi, STMicroelectronics, Maxim Integrated, and Vishay Inter technology Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Light Sensor Market Insights

Increasing technological advancements, advancements in transportation, smart homes, consumer electronics, and automotive applications, various types of electronic products, increased implementation of light sensors in various consumer electronics such as tablets and smartphones, and increasing adoption of portable smart devices are some of the key factors driving global light sensor market growth. The increasing use of light sensors in electronic consumer items such as tablets, smartphones, digital displays, and televisions, as well as ongoing technological breakthroughs in the consumer electronics industry, are all driving market expansion.

On the other hand, the growing popularity of portable smart devices is increasing demand for light sensors, which is likely to drive market expansion throughout the forecast period. The global light sensor market is expanding rapidly as demand for smart electronics and wearable applications increases. Additionally, smart home appliance makers use several types of light sensors to reduce the power consumption of smart home equipment. Light sensors are fast becoming popular in the field of LCD backlight control. Increasing usage of LCD-based gadgets is expected to fuel demand for light sensors over the projected period. These aspects are also projected to create significant potential for the global light sensor market in the approaching years.

Furthermore, light sensors are widely used in a variety of end-user industries, including energy and electricity, healthcare, and agriculture. Furthermore, the growing population and expanding commercialization are increasing the usage of smart electronic gadgets, which is expected to drive the worldwide light sensor market. Light sensors are widely used in the automobile industry due to the growing demand to decrease road accidents. Growing technological advances in the automobile industry are also driving overall market growth. People's growing knowledge of the benefits of smart lighting solutions is driving growth in the worldwide light sensor market.

Light Sensor Market Segmentation

The worldwide market for light sensor is split based on function, output, application, and geography.

Light Sensor Functions

- Ambient Light Sensing

- Proximity Detection

- RGB Color Sensing

- Gesture Recognition

- IR Detection

According to the light sensor industry analysis, ambient light sensing dominates the business due to its widespread application in consumer electronics such as smartphones, laptops, and smart TVs. These sensors adjust screen brightness based on ambient lighting conditions. With the increased need for energy-efficient devices, ambient light sensors are essential for optimizing power consumption. Furthermore, the growing popularity of smart home devices and IoT applications makes their integration easier. Their simplicity, low cost, and ability to increase functioning across multiple industries make them a popular market choice.

Light Sensor Outputs

- Analog

- Digital

The digital category dominates the light sensor business because of its higher precision, durability, and compatibility with modern electronics. Digital light sensors are more accurate than analog sensors at converting light levels into digital data, making them ideal for smart devices, automotive systems, and industrial applications. Their ability to connect seamlessly with microcontrollers and digital systems accelerates their adoption. As demand for smart devices and automated solutions grows, the digital sector stays dominant.

Light Sensor Applications

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Others

According to the light sensor market forecast, consumer electronics lead the market because these sensors are used in smartphones, tablets, and smart TVs to adjust screen brightness and save battery. As people seek to energy-efficient and advanced devices, light sensors are essential. The rise of wearables and smart home gadgets also increases their use. New tech like AR and VR further boosts demand for light sensors in electronics.

Light Sensor Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Light Sensor Market Regional Analysis

For several reasons, the Asia-Pacific region leads the light sensor market due to its growing use in smartphones, smart homes, and automotive industries. Countries like China, Japan, and South Korea have a high demand for light sensors because of their strong technology and electronics sectors. The region's focus on energy-efficient solutions and advanced technologies also drives market growth. For instance, Sharp Semiconductor Co., Ltd. announced the development of the GP2AP130S00F proximity sensor for wearable devices, which uses the I2C communication protocol. The device's low current consumption (about 40 μA) allows for extended battery usage. Additionally, expanding manufacturing facilities and innovation in the region contribute to its dominance.

North America's light sensor market is predicted to rise significantly due to increased acceptance in smart gadgets, automotive applications, and home automation systems. The region's emphasis on modern technology and energy efficiency also drives up demand. Furthermore, significant expenditures in research & development drive future market growth.

Light Sensor Market Players

Some of the top light sensor companies offered in our report include AMS AG, Ever light Electronics Co., Ltd, Texas Instruments, ROHM Semiconductor, Osram Opto Semiconductors GmbH, Broadcom, Sharp Corporation, Onsemi, STMicroelectronics, Maxim Integrated, and Vishay Inter technology Inc.

Frequently Asked Questions

How big is the light sensor market?

The light sensor market size was valued at USD 3.9 billion in 2023.

What is the CAGR of the global light sensor market from 2024 to 2032?

The CAGR of light sensor is 10.8% during the analysis period of 2024 to 2032.

Which are the key players in the light sensor market?

The key players operating in the global market are including AMS AG, Ever light Electronics Co., Ltd, Texas Instruments, ROHM Semiconductor, Osram Opto Semiconductors GmbH, Broadcom, Sharp Corporation, Onsemi, STMicroelectronics, Maxim Integrated, and Vishay Inter technology Inc

Which region dominated the global light sensor market share?

North America held the dominating position in light sensor industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of light sensor during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global light sensor industry?

The current trends and dynamics in the light sensor industry include growing demand for smart devices and IoT applications, increased use of light sensors in automotive for ADAS and autonomous vehicles, and rising adoption in industrial automation and smart city projects.

Which function held the maximum share in 2023?

The ambient light sensing function held the maximum share of the light sensor industry.