Life Science Reagents Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Life Science Reagents Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

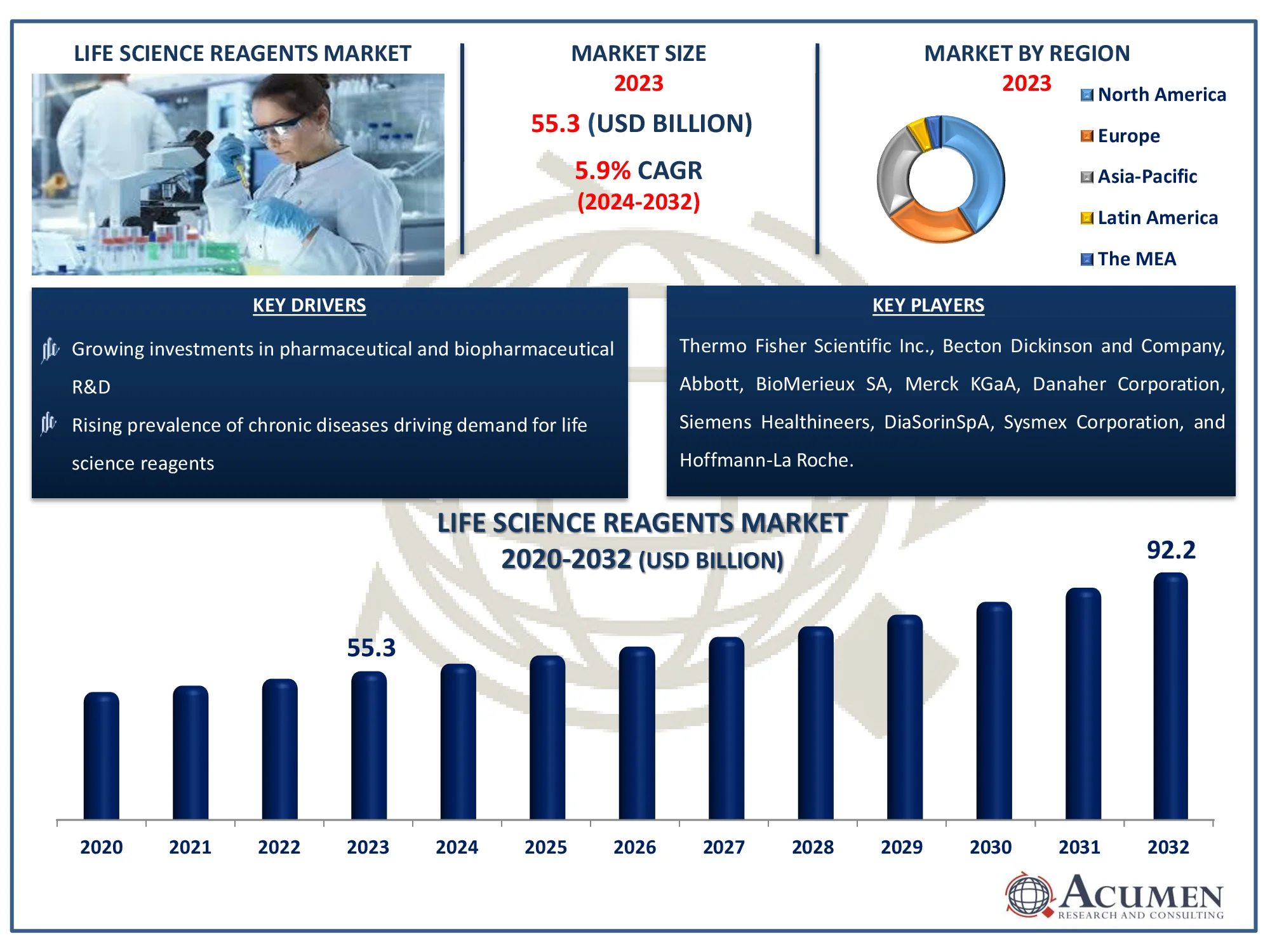

The Global Life Science Reagents Market Size accounted for USD 55.3 Billion in 2023 and is estimated to achieve a market size of USD 92.2 Billion by 2032 growing at a CAGR of 5.9% from 2024 to 2032.

Life Science Reagents Market Highlights

- Global life science reagents market revenue is poised to garner USD 92.2 billion by 2032 with a CAGR of 5.9% from 2024 to 2032

- North America life science reagents market value occupied around USD 22.7 billion in 2023

- Asia-Pacific life science reagents market growth will record a CAGR of more than 6.5% from 2024 to 2032

- Among product, the immunoassay sub-segment generated noteworthy revenue in 2023

- Based on end user, the hospitals & diagnostic labs sub-segment generated significant life science reagents market share in 2023

- Increasing adoption of life science reagents in academic and research institutions is a popular life science reagents market trend that fuels the industry demand

Life science reagents cover the study of a wide range of species, including bacteria, crops, livestock, and humans. With the completion of the human genome project, a new era of scientific growth has begun in life science research. Biology is at the heart of the life sciences, and technical advances in bioinformatics, genomics, and proteomics have accelerated progress in specialised domains and interdisciplinary research. These advancements have transformed our knowledge of living creatures and their complicated biological processes, paving the door for novel approaches to challenging scientific problems and providing unparalleled opportunities for research and discovery in the life sciences.

Global Life Science Reagents Market Dynamics

Market Drivers

- Advancements in biotechnology and molecular biology research

- Increasing demand for personalized medicine and precision diagnostics

- Growing investments in pharmaceutical and biopharmaceutical R&D

- Rising prevalence of chronic diseases driving demand for life science reagents

Market Restraints

- Stringent regulatory requirements and approval processes

- High cost associated with specialized reagents and equipment

- Limited availability of skilled professionals in life sciences research

Market Opportunities

- Expansion of the biotechnology and pharmaceutical industries

- Emerging markets presenting untapped growth opportunities

- Technological advancements leading to innovative reagent solutions

Life Science Reagents Market Report Coverage

| Market | Life Science Reagents Market |

| Life Science Reagents Market Size 2023 |

USD 55.3 Billion |

| Life Science Reagents Market Forecast 2032 | USD 92.2 Billion |

| Life Science Reagents Market CAGR During 2023 - 2032 | 5.9% |

| Life Science Reagents Market Analysis Period | 2020 - 2032 |

| Life Science Reagents Market Base Year |

2023 |

| Life Science Reagents Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific Inc., Becton Dickinson and Company, Abbott, BioMerieux SA, Merck KGaA, Danaher Corporation, Siemens Healthineers, DiaSorinSpA, Sysmex Corporation, and Hoffmann-La Roche. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Life Science Reagents Market Insights

In recent times, the healthcare sector has seen significant advancements, driven by a shift in patient paradigms from therapy to wellness. With 'early diagnosis' becoming the new standard, the development of efficient cures is crucial for addressing the increasing number and severity of viral epidemics and reducing patient mortality rates. In response to this trend, producers of life science reagents are focusing on developing assessment tools that shorten diagnosis time and enable early detection of various illnesses. Patient diagnostic centers, whether in hospitals or homes, extend beyond traditional laboratory diagnostics when patients have the option to choose their preferred diagnostic centers.

The rise of virus outbreaks and increasing chronic diseases underscores the need for efficient testing in medical specialties and early diagnostic care centers. Medical organizations striving to improve patients' life expectancy are turning to life science reagents and sophisticated testing tools. These companies face pressure to develop timely and cost-effective tests to significantly reduce mortality rates after diagnosis. Sales of life science reagents surged to approximately USD 55.3 Billion revenue in 2023, driven by their expanding applications. The adoption of life science reagents has increased in hospitals and diagnostic laboratories, while rapid growth is anticipated in the biopharmaceutical industry and research institutions in the foreseeable future, sustaining market momentum.

Life Science Reagents Market Segmentation

The worldwide market for life science reagents is split based on product, end user, and geography.

Life Science Reagent Market By Product

- Molecular Diagnostic

- Chromatography

- Flow Cytometry

- Cell & Tissue Culture

- Microbiology

- Immunoassay

- Clinical Chemistry

- Hematology & Hemostasis

- Others

According to life science reagents industry analysis, hospitals and diagnostic labs dominate the market, accounting for roughly three-fifths of the total. Their broad usage of life science reagents in diagnosing various ailments adds greatly to their profitability. Furthermore, in recent years, firms that specialize in commercial and contract studies have increasingly used life science reagents to evaluate the efficacy of biopharmaceuticals, driving up market demand. The use of in-vitro diagnostic procedures in developing nations demonstrates the expanding significance of healthcare infrastructure and research capacity in emerging markets. This suggests that improved diagnostic techniques and reagents are becoming more popular in these areas. The need for skilled goods from hospitals, research institutes, and biopharmaceutical companies demonstrates the essential role that healthcare facilities and research organisations play in generating the demand for life science reagents. These sectors are important market growth drivers, increasing the demand for novel solutions and developments in diagnostic technology.

Life Science Reagent Market By End Users

- Hospitals & Diagnostic Labs

- Academic Research & Institutes

- Contract Research Organizations

- Others

Manufacturers in the life science reagents market are now focused on improving immunoassay reagents. These reagents, recognised for their sensitivity, ease of use, and accuracy, are in great demand in hospitals and pathology laboratories because to their capacity to produce precise and sensitive diagnostic results. Furthermore, the pharmaceutical and biotechnology industries rely significantly on immunoassay reagents for a variety of applications, including clinical research, drug discovery, and the development of novel tests, highlighting their importance in the market. The mention of firms working to produce skilled products capable of identifying viral structural changes illustrates progress in certain product categories of the life sciences reagents industry. This demonstrates a concerted effort to develop diagnostic tests specialized to identify structural changes in viruses, indicating the industry's commitment to providing advanced solutions for early illness detection and control. These advances demonstrate the life sciences reagents market's dedication to innovation and tackling new healthcare concerns with cutting-edge diagnostic technologies.

Life Science Reagents Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Life Science Reagents Market Regional Analysis

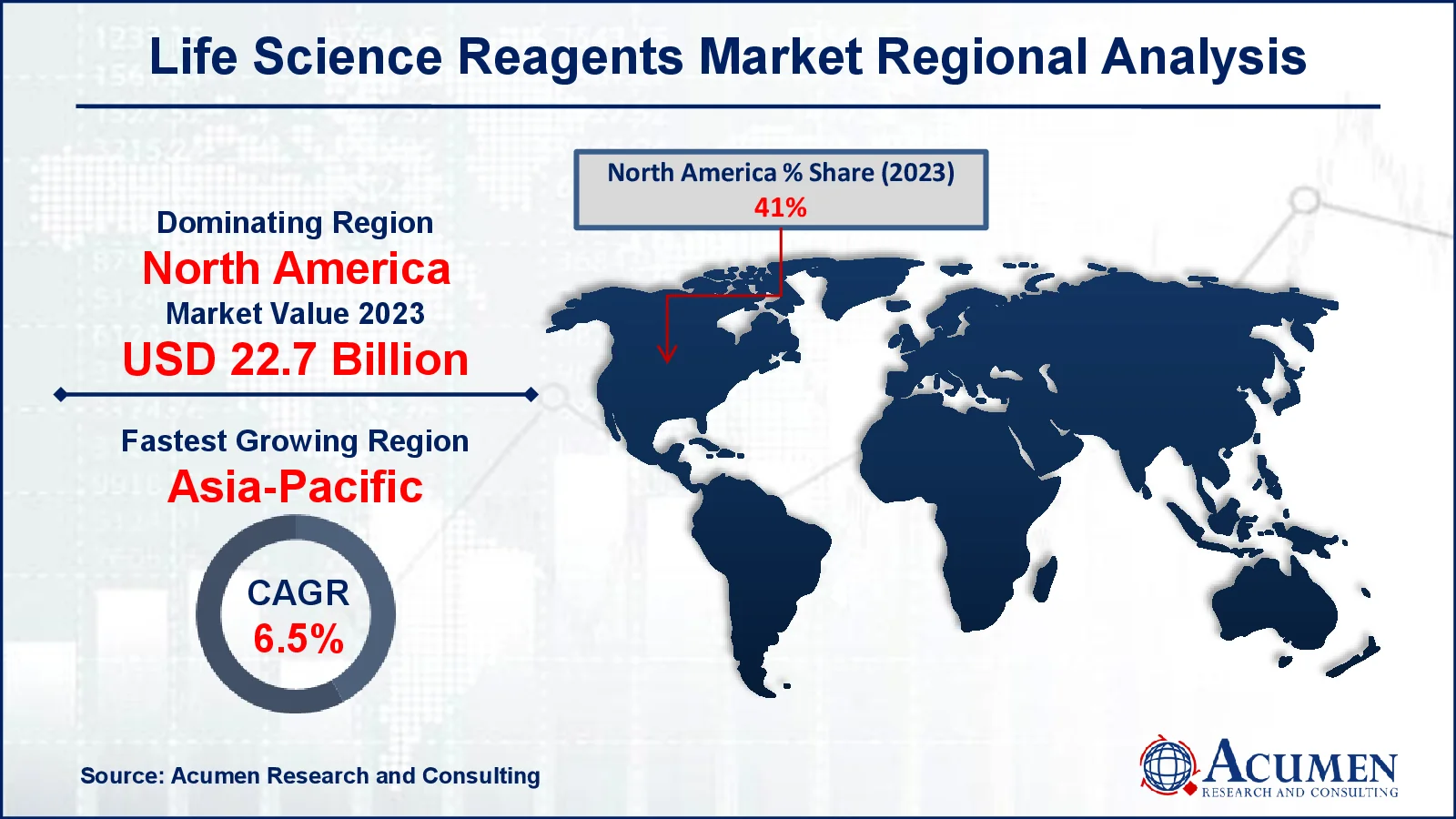

In terms of life science reagents market analysis, in North America, a formidable presence in the market is propelled by substantial investment in cutting-edge biomedical research, bolstered by the established pharmaceutical and biotechnology sectors. The region's thirst for advanced diagnostic tools further solidifies its dominance. Meanwhile, Europe is closely tailing, leveraging robust academic and industrial research landscapes along with regulatory frameworks conducive to innovation. The uptake of personalized medicine within the region is a key driver, fostering market expansion.

Asia-Pacific is growing fastest throughout the life science reagents market forecast period. In the Asia-Pacific, burgeoning opportunities beckon, fueled by escalating healthcare spending and a booming biopharmaceutical industry. Notably, nations like China, India, and Japan are spearheading research endeavors, buoyed by government initiatives aimed at fostering life sciences research and attracting foreign capital. This confluence of factors positions the region as a promising frontier for market growth.

Life Science Reagents Market Players

Some of the top life science reagents companies offered in our report include Thermo Fisher Scientific Inc., Becton Dickinson and Company, Abbott, BioMerieux SA, Merck KGaA, Danaher Corporation, Siemens Healthineers, DiaSorinSpA, Sysmex Corporation, and Hoffmann-La Roche.

Frequently Asked Questions

How big is the life science reagents market?

The life science reagents market size was valued at USD 55.3 billion in 2023.

What is the CAGR of the global life science reagents market from 2024 to 2032?

The CAGR of life science reagents is 5.9% during the analysis period of 2024 to 2032.

Which are the key players in the Life Science Reagents market?

The key players operating in the global market are including Thermo Fisher Scientific Inc., Becton Dickinson and Company, Abbott, BioMerieux SA, Merck KGaA, Danaher Corporation, Siemens Healthineers, DiaSorinSpA, Sysmex Corporation, and Hoffmann-La Roche.

Which region dominated the global life science reagents market share?

North America held the dominating position in life science reagents industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of Life Science Reagents during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global life science reagents industry?

The current trends and dynamics in the life science reagents industry include advancements in biotechnology and molecular biology research, increasing demand for personalized medicine and precision diagnostics, growing investments in pharmaceutical and biopharmaceutical R&D, and rising prevalence of chronic diseases driving demand for life science reagents.

Which end user held the maximum share in 2023?

The hospitals & diagnostic labs end user held the maximum share of the life science reagents industry.