Immunoassay Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Immunoassay Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

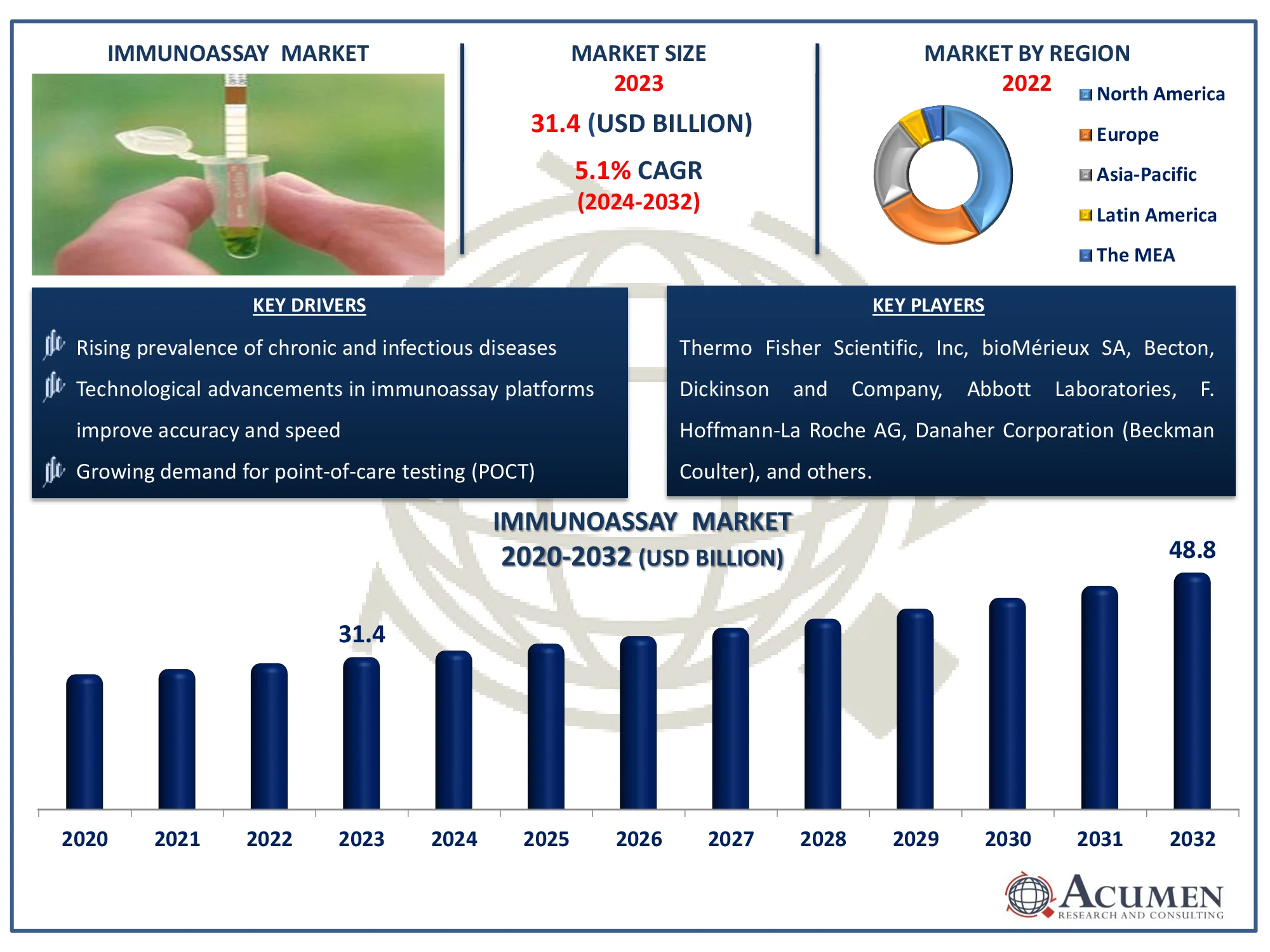

The Global Immunoassay Market Size accounted for USD 31.4 Billion in 2023 and is estimated to achieve a market size of USD 48.8 Billion by 2032 growing at a CAGR of 5.1% from 2024 to 2032.

Immunoassay Market (By Technology Enzyme Immunoassay (EIA), Radioimmunoassay (RIA), Rapid test, and Others; By Product: Analyzers/instruments, Reagents & kits, Software & services; By Specimen: Blood, Saliva, Urine, Other Specimens; By Application: Endocrinology, Therapeutic drug monitoring, Autoimmune diseases, Infectious disease testing, Cardiology, Oncology, and Others; By End-Use: Hospitals, Pharmaceutical and biotech companies, Clinical laboratories, Academic research centers, Blood banks, and Others; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Immunoassay Market Highlights

- The global immunoassay market is projected to reach USD 48.8 billion by 2032, with a CAGR of 5.1% from 2024 to 2032

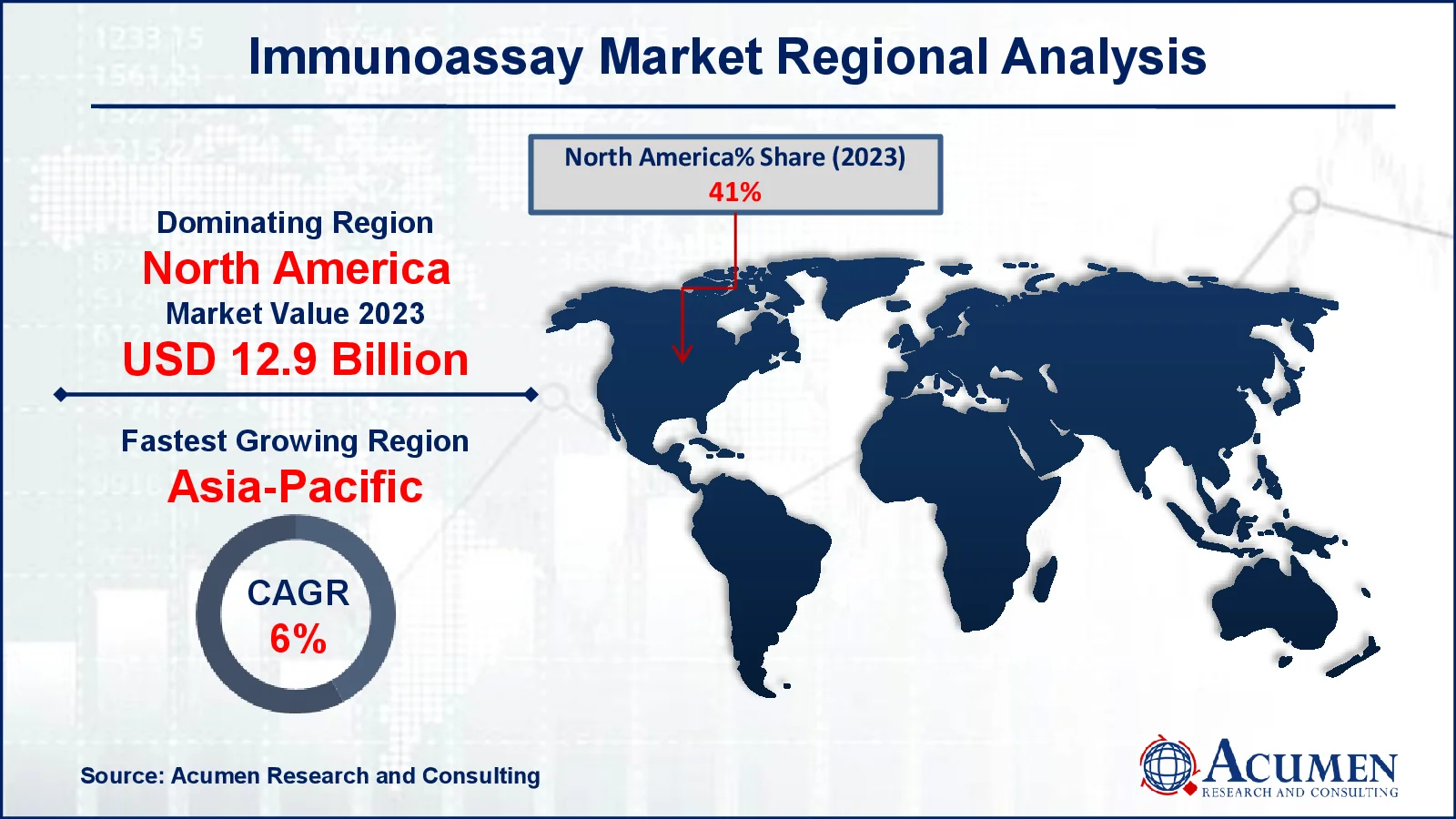

- In 2023, the North American immunoassay market was valued at approximately USD 12.9 billion

- The Asia-Pacific immunoassay market is expected to grow at a CAGR of over 6% from 2024 to 2032

- The enzyme immunoassay (EIA) technology sub-segment accounted for 63% of total revenue in 2023

- The blood specimen segment held a 43% market share in the immunoassay market in 2023

- Infectious disease testing contributed 36% of the immunoassay market share in 2023

- Point-of-care testing (POCT) is rapidly growing, enhancing immunoassay accessibility and speed in diagnostics is a popular Immunoassay market trend that fuels the industry demand

An immunoassay is a biochemical test that detects and quantifies chemicals in a sample based on antibody specificity. It operates by recognizing certain molecules (antigens) and attaching them to antibodies, resulting in a quantifiable signal. Immunoassays are commonly used in clinical diagnostics for detecting infections (e.g., HIV, COVID-19), monitoring hormone levels, and blood screening. They are also used in pharmaceutical research to develop drugs and track therapeutic outcomes. In addition, immunoassays are used in food safety and environmental testing to detect pollutants and poisons. This technology's adaptability and sensitivity make it indispensable in a variety of sectors.

Global Immunoassay Market Dynamics

Market Drivers

- Rising prevalence of chronic and infectious diseases fuels the demand for immunoassay diagnostics

- Technological advancements in immunoassay platforms improve accuracy and speed

- Growing demand for point-of-care testing (POCT) boosts market adoption

Market Restraints

- High cost of immunoassay systems and consumables limits access in low-income regions

- Stringent regulatory frameworks for diagnostic approvals slow down product launches

- Limited sensitivity in some immunoassays can lead to false negatives, impacting reliability

Market Opportunities

- Expansion of immunoassay applications in personalized medicine and oncology opens new markets

- Increasing adoption of automation and AI-driven immunoassay systems enhances efficiency

- Growing demand in emerging markets due to healthcare infrastructure development presents significant growth potential

Immunoassay Market Report Coverage

| Market | Immunoassay Market |

| Immunoassay Market Size 2022 |

USD 31.4 Billion |

| Immunoassay Market Forecast 2032 | USD 48.8 Billion |

| Immunoassay Market CAGR During 2023 - 2032 | 5.1% |

| Immunoassay Market Analysis Period | 2020 - 2032 |

| Immunoassay Market Base Year |

2022 |

| Immunoassay Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Product, By Specimen, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Inc, Abbott Laboratories, bioMérieux SA, Becton, Dickinson and Company, F. Hoffmann-La Roche AG, Danaher Corporation (Beckman Coulter), Siemens Healthineers, Quidel Corporation; Sysmex Corporation, and Bio-Rad Laboratories, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Immunoassay Market Insights

The primary reasons projected to contribute to market growth in the coming years are a considerable increase in infectious and chronic diseases, as well as an increase in the usage of immunoassays in cancer. The growing elderly population and technical advancements in this field are expected to accelerate overall market growth in the coming years. For instance, in 2023, approximately 28% (16.2 million) of all older individuals in the community lived alone (5.7 million males and 10.5 million women). They accounted for 22% of older men and 33% of older women. Both men and women are more likely to live alone as they get older. The rapid development of the biopharmaceutical and biotechnology industries will also contribute to possible growth prospects in the future.

On the other hand, the unfavorable reimbursement environment is expected to impede the worldwide immunoassay market's growth in the coming years, as are rigorous requirements and regulations governing immunoassay consumable and instrument approvals. Furthermore, increasing complexities are projected to limit total market growth in the coming years when executing diagnostic tests. The expanding opportunities in developing countries are expected to drive market expansion in the coming years.

Rising demand in emerging markets is being driven by rapid expansion of healthcare infrastructure, which is boosting access to modern diagnostic technologies such as immunoassays. For instance, according to Ministry of Health & Family Welfare, as of March 31, 2023, the Indian country has 1,69,615 Sub-Centres (SCs), 31,882 Primary Health Centres (PHCs), 6,359 Community Health Centres (CHCs), 1,340 Sub-Divisional/District Hospitals (SDHs), 714 District Hospitals (DHs), and 362 Medical Colleges (MCs) that served both rural and urban areas. As governments and the business sector engage in modernizing healthcare systems, the demand for reliable and efficient diagnostic technologies grows, especially in areas with high disease loads. Immunoassays provide accurate and affordable testing for infectious diseases, chronic disorders, and blood screening, which is critical for improving patient outcomes.

Immunoassay Market Segmentation

The worldwide market for immunoassay is split based on technology, product, specimen, application, end-use, and geography.

Immunoassay Technologies

- Enzyme Immunoassay (EIA)

- Fluorescence Immunoassays (FIA)

- Chemiluminescence Immunoassays (CLIA)

- Radioimmunoassay (RIA)

- Rapid test

- Others

According to immunoassay industry analysis, enzyme immunoassay (EIA) technology dominates industry due to its high sensitivity, specificity, and adaptability in detecting a diverse spectrum of analytes. EIA, particularly ELISA (Enzyme-Linked Immunosorbent Assay), is widely used in clinical diagnostics for illness detection, hormone monitoring, and drug testing. Its automation and adaptability to high-throughput screening make it ideal for use in laboratories and hospitals. Furthermore, its low cost and durability lead to its extensive use in both established and emerging countries.

Immunoassay Products

- Analyzers/instruments

- Closed ended systems

- Open ended systems

- Reagents & kits

- ELISA Reagents & Kits

- Rapid Test Reagents & Kits

- ELISPOT Reagents & Kits

- Western Blot Reagents & Kits

- Other Reagents & Kits

- Software & services

According to immunoassay industry analysis, reagents and kits have long been the market leaders in the immunoassay business, owing to their critical role in providing accurate and efficient diagnostic testing. These consumables are constantly needed for routine testing, making them a high-demand, recurrent item. Their adaptability to multiple immunoassay platforms, such as ELISA and CLIA, makes them indispensable in clinical diagnostics, research, and pharmaceutical applications. The rising prevalence of infectious diseases, combined with the requirement for rapid, dependable diagnostics, drives up demand for reagents and kits.

Immunoassay Specimens

- Blood

- Saliva

- Urine

- Others Specimens

In the immunoassay market, the blood specimen segment has been a dominant force in the industry due to its widespread use in disease detection and monitoring. Blood samples are the most common and readily available biological specimens for immunoassays, which are used to screen for infections, chronic diseases, and biomarkers such as hormones or antibodies. Blood is a favored choice for clinical laboratories and hospitals due to its reliability and capacity to deliver full diagnostic information.

Immunoassay Applications

- Endocrinology

- Therapeutic drug monitoring

- Autoimmune diseases

- Infectious disease testing

- Cardiology

- Oncology

- Others

According to immunoassay market forecast, infectious illness testing has dominated as the global burden of diseases such as HIV, hepatitis, COVID-19, and influenza grows. Immunoassays provide very sensitive and specific diagnostic techniques for detecting infections and tracking illness progression, which is critical for avoiding epidemics and managing public health crises. The growing desire for rapid diagnoses, point-of-care testing, and routine screening has accelerated the use of immunoassays in infectious disease management.

Immunoassay End-Uses

- Hospitals

- Pharmaceutical And Biotech Companies

- Clinical Laboratories

- Academic Research Centers

- Blood Banks

- Others

According to immunoassay industry analysis, because of their large patient populations and vital need for accurate, timely diagnostics, hospitals dominate the immunoassay market as end users. Immunoassays are frequently used in hospitals for routine illness screening, chronic condition monitoring, and infection management, making them valuable instruments in day-to-day operations. The rising use of automated immunoassay technologies improves testing efficiency and enables faster clinical decision-making. With rising healthcare demands, hospitals rely on immunoassays to improve patient outcome.

Immunoassay Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Immunoassay Market Regional Analysis

The North American immunoassay market has a massive market share and is expected to remain so for the foreseeable future. The North American immunoassay market is expected to grow rapidly in the next years due to the large number of research projects and well-established healthcare infrastructures. This region's growth is predicted to accelerate in the next years, as geriatric populations and the biotechnology and pharmaceutical industries rise.

Furthermore, the Asia-Pacific region is experiencing strong growth in the immunoassay market, owing to developing healthcare infrastructure, rising disease prevalence, and increased government diagnostics investments. Rapid urbanization, a growing middle-class population, and an increase in demand for innovative medical technology are all driving market growth. For instance, Getein will introduce the MAGICL 6000 CLIA analyzer at MEDICA 2023 in November 2023. MAGICL 6000 is a compact and innovative CLIA analyzer that is ideal for mid to high-volume laboratories that require a one-step CLIA solution.

Immunoassay Market Players

Some of the top immunoassay companies offered in our report includes Thermo Fisher Scientific, Inc, Abbott Laboratories, bioMérieux SA, Becton, Dickinson and Company, F. Hoffmann-La Roche AG, Danaher Corporation (Beckman Coulter), Siemens Healthineers, Quidel Corporation; Sysmex Corporation, and Bio-Rad Laboratories, Inc.

Frequently Asked Questions

How big is the Immunoassay market?

The immunoassay market size was valued at USD 31.4 Billion in 2023.

What is the CAGR of the global Immunoassay market from 2024 to 2032?

The CAGR of Immunoassay is 5.1% during the analysis period of 2024 to 2032.

Which are the key players in the Immunoassay market?

The key players operating in the global market are including Thermo Fisher Scientific, Inc, Abbott Laboratories, bioMérieux SA, Becton, Dickinson and Company, Thermo Fisher Scientific, Inc, F. Hoffmann-La Roche AG, Danaher Corporation (Beckman Coulter), Siemens Healthineers, Quidel Corporation; Sysmex Corporation, and Bio-Rad Laboratories, Inc.

Which region dominated the global Immunoassay market share?

North America held the dominating position in immunoassay industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of immunoassay during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Immunoassay industry?

The current trends and dynamics in the immunoassay industry include rising prevalence of chronic and infectious diseases fuels the demand for immunoassay diagnostics, technological advancements in immunoassay platforms improve accuracy and speed, and growing demand for point-of-care testing (POCT) boosts market adoption.

Which technology held the maximum share in 2023?

The enzyme immunoassay (EIA) held the maximum share of the Immunoassay industry.