Ketogenic Diet Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Ketogenic Diet Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

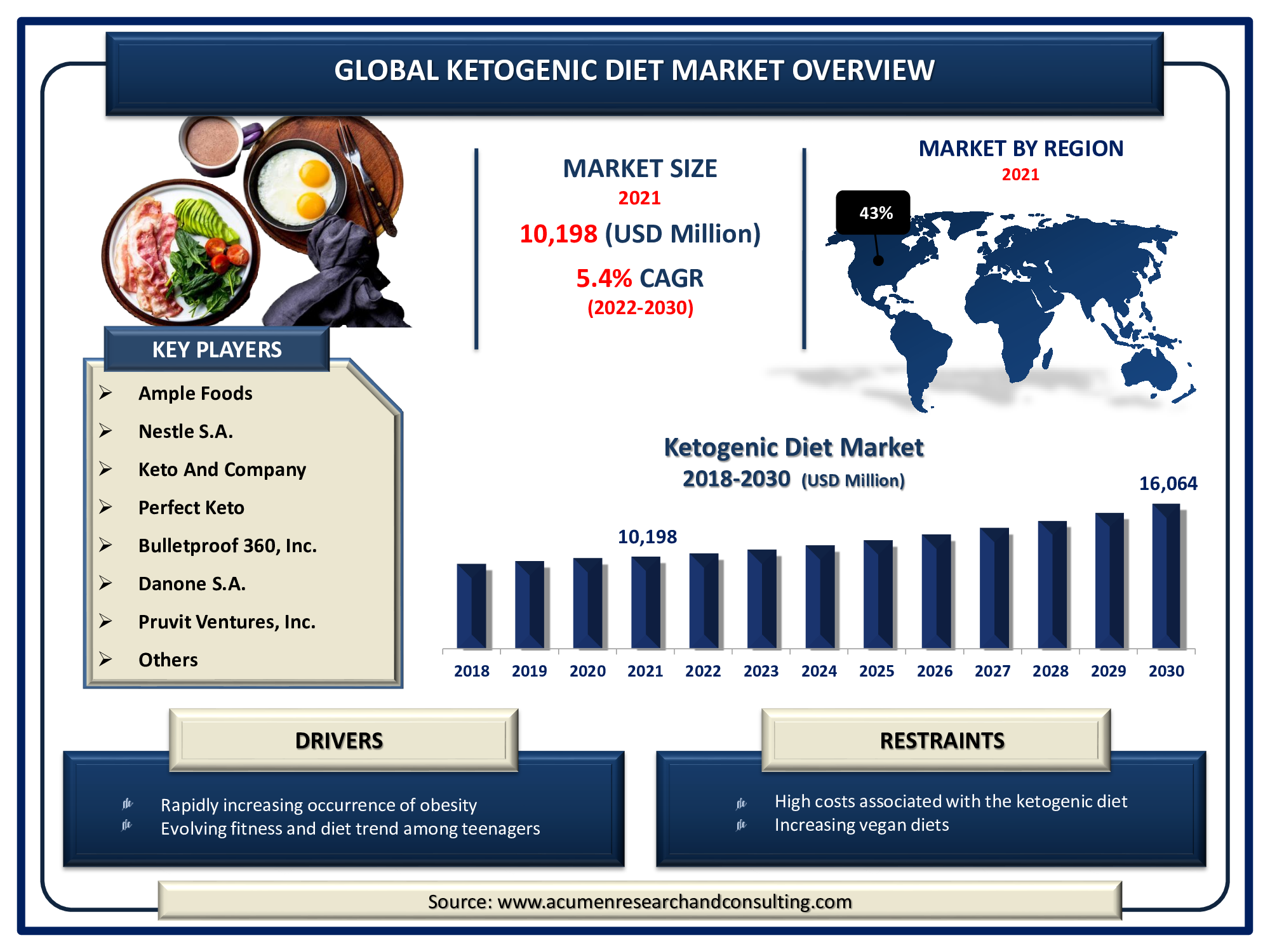

The Global Ketogenic Diet Market Size was valued at USD 10,198 Million in 2021 and is predicted to be worth USD 16,064 Million by 2030, with a CAGR of 5.4% from 2022 to 2030.

The increased prevalence of overweight and obesity conditions among millennials, the younger generation, and the working-class population is propelling the ketogenic diet market growth. Additionally, the growing fitness and health consciousness among individuals all over the globe as a result of the COVID-19 scenario is expected to increase demand for the ketogenic diet market in the coming years.

A keto diet is a unique diet plan that emphasizes meals rich in healthy fats, low in carbohydrates, and full of protein. The main goal of ketogenic diets is to take more calories from fat than carbohydrates. A ketogenic diet is mostly composed of moderate protein, saturated calories, and very low carbohydrates. The macronutrient composition of the diet is broadly distributed as follows: 30% to 35% protein, 55% to 60% fat, with 5% to 10% carbohydrates. The ketogenic diet can lead to weight loss in a variety of ways, including improving metabolism and reducing appetite. Ketogenic diets include meals that are filling and may minimize hunger-stimulating hormones. Adopting a ketogenic diet can reduce appetite and promote weight loss for these reasons. According to a 2013 meta-analysis of 13 different randomized controlled researches, people on ketogenic diets lost 2 pounds (lbs) faster than those on low-fat diets over the duration of a year.

Global Ketogenic Diet Market DRO’s

Market Drivers

- Rising sedentary lifestyles in urban areas

- Rapidly increasing occurrence of obesity

- The rising proportion of health-conscious people across the globe

- Evolving fitness and diet trend among teenagers

Market Restraints

- High costs associated with the ketogenic diet

- Increasing vegan diets

Market Opportunities

- The recent COVID-19 outbreak has resulted in a significant shift in food preferences

- The ketogenic diet is undergoing extensive innovation and R&D

Report Coverage

| Market | Ketogenic Diet Market |

| Market Size 2021 | USD 10,198 Million |

| Market Forecast 2030 | USD 16,064 Million |

| CAGR During 2022 - 2030 | 5.4% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ample Foods, Nestle S.A., Keto And Company, Perfect Keto, Bulletproof 360, Inc., Danone S.A., Pruvit Ventures, Inc., Zenwise Health, Know Brainer Foods, and Ancient Nutrition. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Ketogenic Diet Market Dynamics

The modern lifestyle, hectic schedule, rising spending income, and high proportion of health-conscious people all over the world are all major factors driving up demand for ketogenic diets market. The rapidly growing public knowledge of the benefits of the ketogenic diet is one of the major drivers of the global ketogenic diet market value. The growing wellness and fitness obsession among younger generations worldwide prompts well for the growth of the global ketogenic diet market size. Furthermore, the growing trend of customers endorsing organic and clean label products is expected to boost demand for ketogenic diet products. Rising incidence of chronic health-related problems such as overweight and hypertension are some elements enticing many customers to incorporate the ketogenic diet. This is mainly to the growth of the ketogenic diet market trend throughout time. As a result of increased knowledge, understanding, and acceptability, the global ketogenic diet market is expected to develop significantly in terms of revenue and volume throughout the projected timeframe.

Furthermore, while the ketogenic diet market is quickly developing, various obstacles are limiting its global spread. Since this type of diet is not affordable for everyone, it limits the total market growth. Furthermore, many people are changing their lifestyles and flocking toward vegan products, limiting the ketogenic diet's market growth.

Ketogenic Diet Market Segmentation

The global ketogenic diet market segmentation based on the product, distribution channel and geographical region.

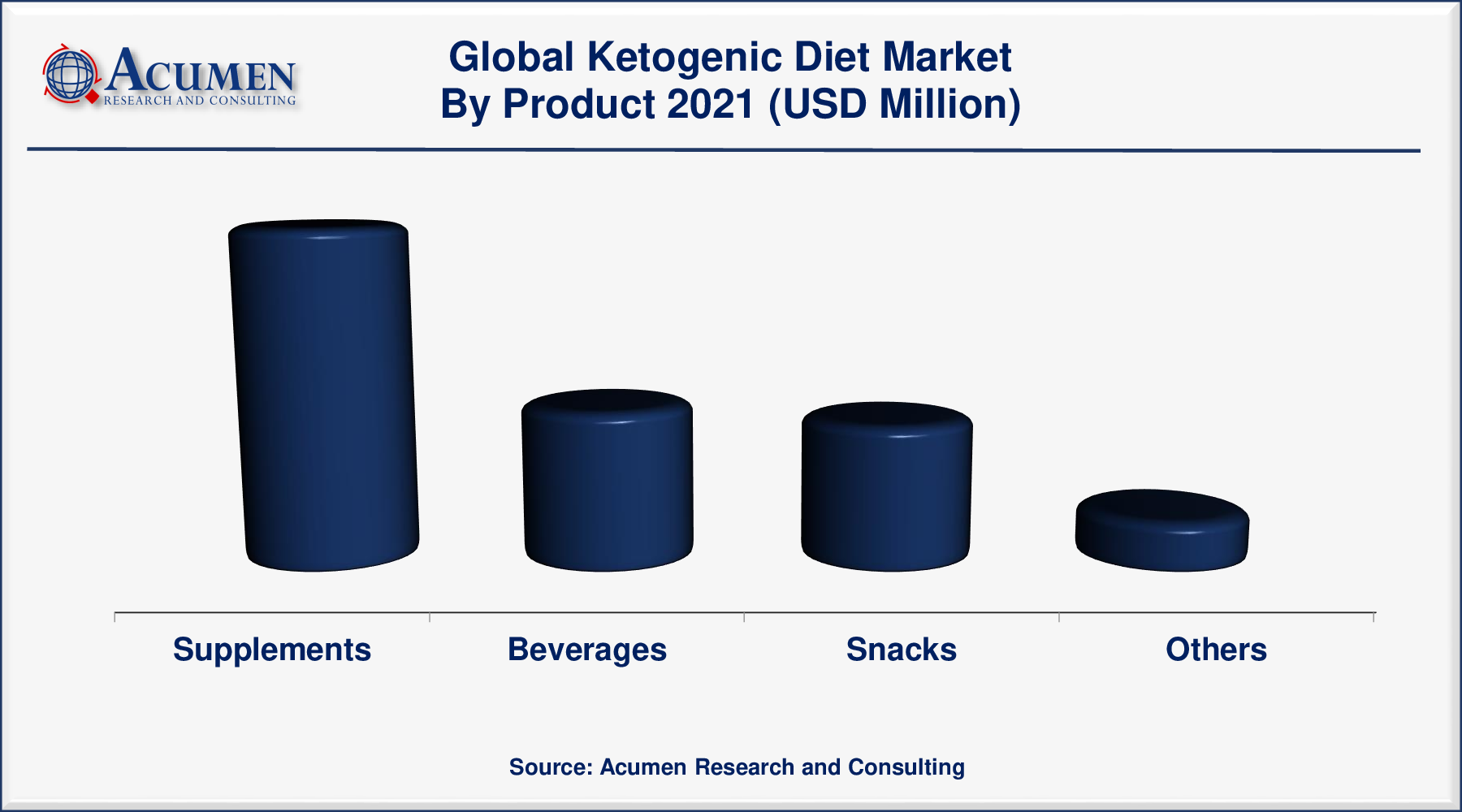

Market by Product

- Supplements

- Beverages

- Snacks

- Others

In terms of product, the supplement segment dominated the market in 2021. The segment is projected to maintain its dominant position over the forecast timeframe due to the wide selection of items accessible in the market. Supplements are classified into three types: capsules, powder, and oil. Such supplements help to achieve micronutrient deficiencies without necessitating large changes to one's regular diet.

Aside from that, the snacks segment is predicted to grow significantly in the market over the forecasted years, according to the ketogenic diets industry analysis. This growth can be attributed to ketogenic snacks, which must be high in protein and low in carbs and sugars. There are various ketogenic snack alternatives that are both nutritious and tasty. There are a variety of ready-to-eat keto-friendly items available. Avocados are the best ketogenic snacks since they are high in protein and fat. As a result of these factors, the snacks segment will gain market share in the coming years.

Market by Distribution Channel

- Supermarket/Hypermarket

- Online

- Specialist Retailers

- Others

Based on distribution channels, the online segment is predicted to grow rapidly in the market over the next few years. With the high penetration of smartphones and the increasing popularity of online shopping among the world's youthful and working-class populations, e-commerce giants such as Alibaba and Amazon, as well as significant brick-and-mortar retailers with large market penetration are edging into the online distribution channel segment. Furthermore, since there are fewer or no intermediates in such an online channel, the operating margins are better than in the offline distribution platform, which boosts sector growth.

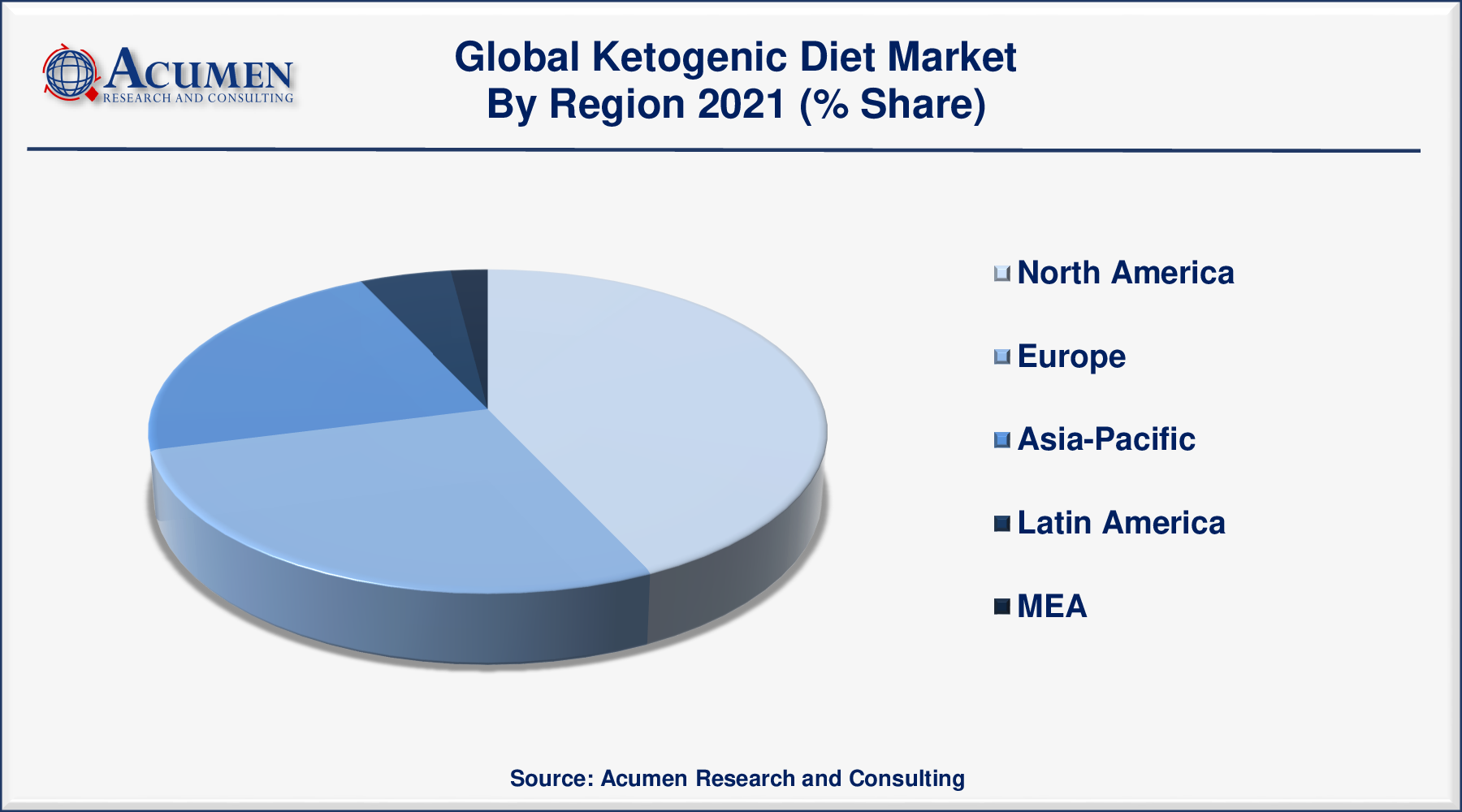

Ketogenic Diet Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Rising Obesity incidents in North America, Drives Regional Market Expansion

North America will dominate the global ketogenic diet market by 2021. The regional market is projected to be driven by increased public awareness of the importance of a nutritious diet and a healthy lifestyle. Furthermore, the United States is expected to have the largest market share in North America. The high level of awareness of a balanced lifestyle among millennials in the United States is expected to increase market penetration in the coming years. Consumption of ketogenic beverages, such as coffee and cold drinks, has been proven to be the healthiest in a number of different ways, including improving instant energy, assisting with weight loss, stimulating the intellect, and helping digestion. The benefits of the ketogenic diet are propelling the North American ketogenic diet market.

Ketogenic Diet Market Players

Some of the prominent global ketogenic diet market companies are Ample Foods, Nestle S.A., Keto And Company, Perfect Keto, Bulletproof 360, Inc., Danone S.A., Pruvit Ventures, Inc., Zenwise Health, Know Brainer Foods, and Ancient Nutrition.

Frequently Asked Questions

How much was the global ketogenic diet market size in 2021?

The global ketogenic diet market size in 2021 was accounted to be USD 10,198 Million.

What will be the projected CAGR for global ketogenic diet market during forecast period of 2022 to 2030?

The projected CAGR of ketogenic diet during the analysis period of 2022 to 2030 is 5.4%.

Which are the prominent competitors operating in the market?

The prominent players of the global ketogenic diet market involve Ample Foods, Nestle S.A., Keto And Company, Perfect Keto, Bulletproof 360, Inc., Danone S.A., Pruvit Ventures, Inc., Zenwise Health, Know Brainer Foods, and Ancient Nutrition.

Which region held the dominating position in the global ketogenic diet market?

North America held the dominating share for ketogenic diet during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for ketogenic diet during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global ketogenic diet market?

Rising sedentary lifestyles in urban areas and rapidly increasing occurrence of obesity are the prominent factors that fuel the growth of global ketogenic diet market.

By segment product, which sub-segment held the maximum share?

Based on product, supplements segment held the maximum share for ketogenic diet market in 2021.