Karyotyping Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Karyotyping Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

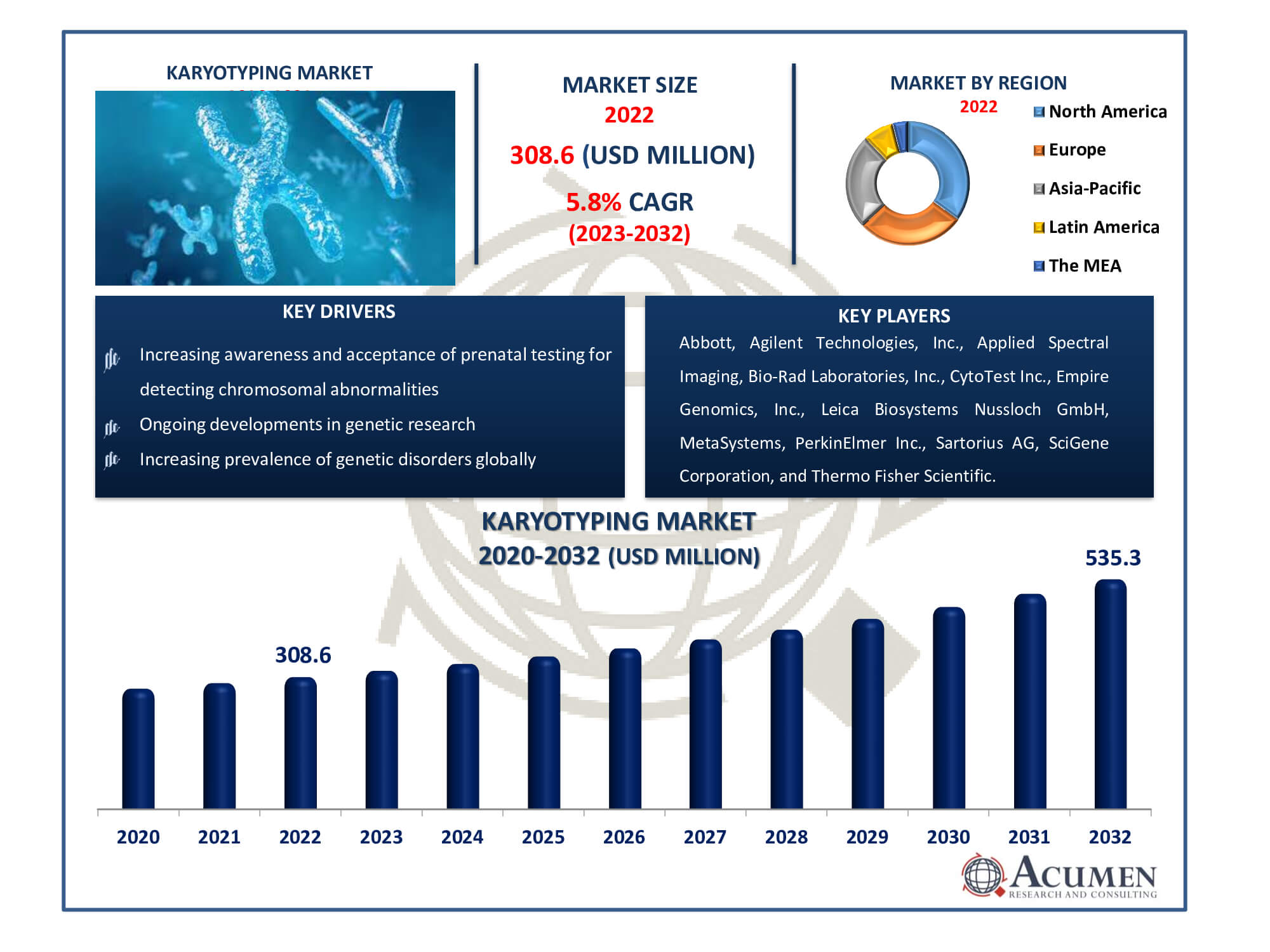

The Karyotyping Market Size accounted for USD 308.6 Million in 2022 and is estimated to achieve a market size of USD 535.3 Million by 2032 growing at a CAGR of 5.8% from 2023 to 2032.

Karyotyping Market Highlights

- Global karyotyping market revenue is poised to garner USD 535.3 million by 2032 with a CAGR of 5.8% from 2023 to 2032

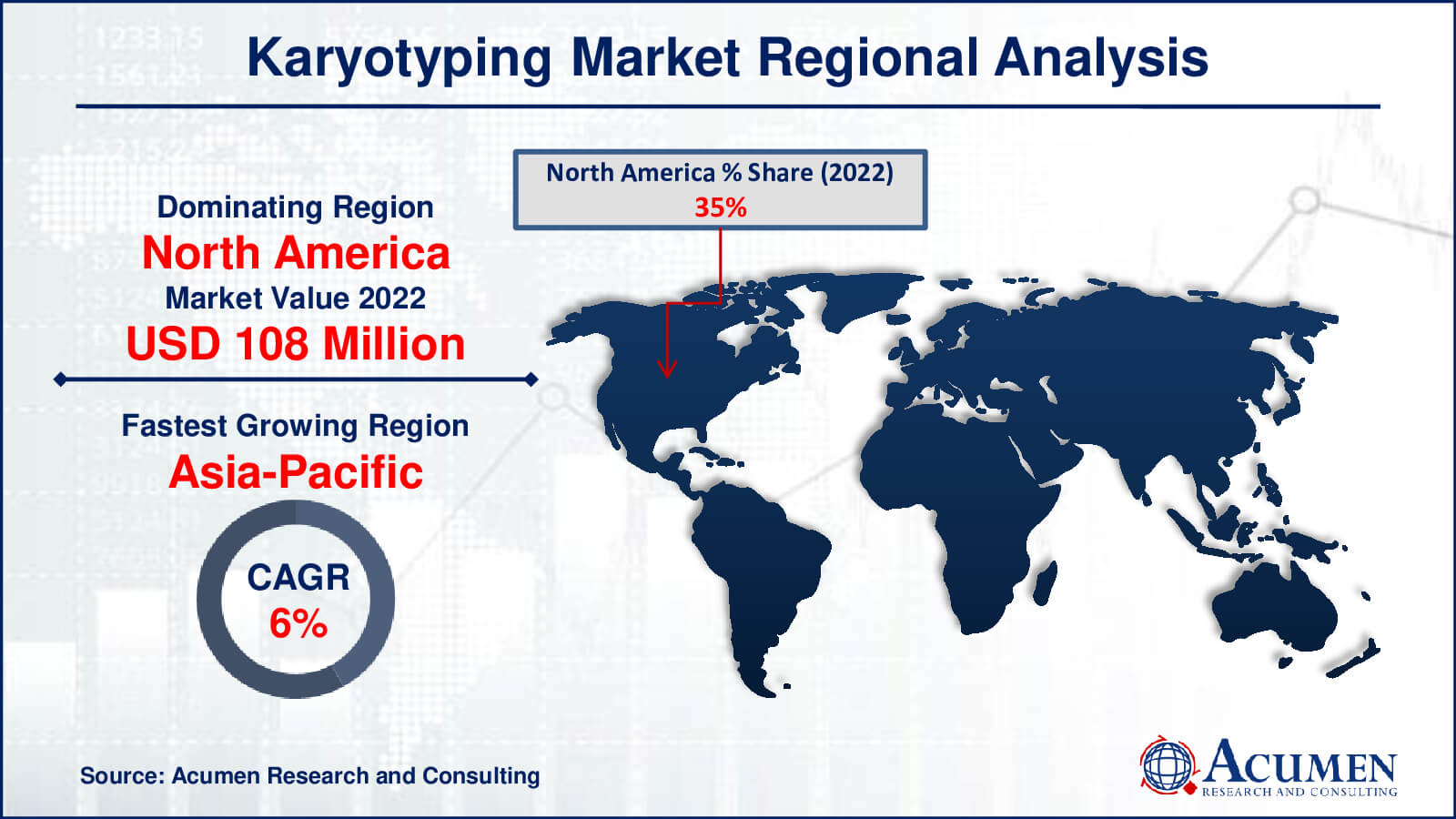

- North America karyotyping market value occupied around USD 108 million in 2022

- Asia-Pacific karyotyping market growth will record a CAGR of more than 6% from 2023 to 2032

- Among product type, the consumables and accessories sub-segment generated noteworthy revenue in 2022

- Based on application, the diagnosis sub-segment generated significant karyotyping market share in 2022

- Integration of artificial intelligence and machine learning algorithms into the analysis of chromosomal data is a popular karyotyping market trend that fuels the industry demand

Karyotyping is a laboratory procedure for seeing and analyzing an individual's chromosomes. Chromosomes are thread-like structures that contain genetic information and are made up of DNA and proteins. Cells from blood or other tissues are cultivated and then treated to stop them in metaphase, a stage of cell division where chromosomes are most compacted and visible. After staining the cells, a picture or computer image of the chromosomes is generated. The resultant karyotype is a visual depiction of an individual's whole set of chromosomes, organized in pairs based on size, banding patterns, and other distinguishing characteristics. Karyotyping is a technique often used in genetic diagnostics to discover chromosomal abnormalities such as trisomies or translocations that might be linked to genetic diseases such as Down syndrome.

A karyotype study gives essential information on an individual's chromosomal composition, which may be used to help in the diagnosis of genetic diseases and to guide medical interventions or counseling. It is a frequently used method in prenatal diagnostics, where it aids in the detection of chromosomal abnormalities in the fetus. Furthermore, karyotyping is important in cancer research and diagnosis since it can identify chromosomal changes linked to certain forms of cancer. Despite advances in molecular methods, karyotyping remains an important tool in cytogenetics, helping us understand hereditary illnesses and providing tailored medical care.

Global Karyotyping Market Dynamics

Market Drivers

- Increasing awareness and acceptance of prenatal testing for detecting chromosomal abnormalities

- Ongoing developments in genetic research and the identification of novel associations between chromosomal variations and various diseases

- Increasing prevalence of genetic disorders globally

Market Restraints

- High cost of karyotyping procedures

- Emergence of alternative genetic testing technologies

- Ethical concerns and regulatory challenges

Market Opportunities

- Integration of karyotyping in cancer diagnosis

- Ongoing advancements in karyotyping technologies

- Expanding applications in research and drug development

Karyotyping Market Report Coverage

| Market | Karyotyping Market |

| Karyotyping Market Size 2022 | USD 308.6 Billion |

| Karyotyping Market Forecast 2032 | USD 535.3 Billion |

| Karyotyping Market CAGR During 2023 - 2032 | 5.8% |

| Karyotyping Market Analysis Period | 2020 - 2032 |

| Karyotyping Market Base Year |

2022 |

| Karyotyping Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Product Type, By Application, By End-User, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott, Agilent Technologies, Inc., Applied Spectral Imaging, Bio-Rad Laboratories, Inc., CytoTest Inc., Empire Genomics, Inc., Leica Biosystems Nussloch GmbH, MetaSystems, PerkinElmer Inc., Sartorius AG, SciGene Corporation, and Thermo Fisher Scientific Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Karyotyping Market Insights

One of the key reasons is the growing demand for prenatal testing, which is being pushed by increased knowledge and acceptability of genetic screening for chromosomal disorders in babies. This tendency is especially noticeable when pregnant parents seek detailed and early knowledge about probable genetic abnormalities, which contributes to the growing market for karyotyping services. Furthermore, continuous advances in genetic research play an important role, with researchers discovering novel genetic markers linked with various illnesses, increasing the need for comprehensive chromosomal analysis and boosting karyotyping market growth.

Despite these advantages, the karyotyping sector is not without challenges. The high expense of karyotyping techniques, from sample collection to analysis, might limit accessibility, particularly in areas with limited healthcare resources. Furthermore, the introduction of alternative genetic testing technologies, such as next-generation sequencing (NGS), puts established karyotyping procedures under scrutiny. NGS provides quicker findings and improved resolution, shifting some demand away from traditional karyotyping methods.

However, there are several prospects in the karyotyping sector. As detecting chromosomal abnormalities in cancer cells becomes critical for targeted medicines and tailored treatment strategies, the use of karyotyping in cancer diagnostics represents a key avenue for expansion. Furthermore, current technology improvements in karyotyping procedures, such as automation and digital imaging, present prospects for increased efficiency and accuracy, which attracts healthcare providers and researchers. Expanding applications in research, drug development, and disease modeling strengthen karyotyping's position as a vital tool in the pharmaceutical and biotechnology industries, signaling a bright future for the industry.

Karyotyping Market Segmentation

The worldwide market for karyotyping is split based on product type, type, application, end-user, distribution channels, and geography.

Karyotyping Product Types

- Instrument

- Software & Services

- Consumables & Accessories

According to karyotyping industry analysis, consumables and accessories have emerged as the main product type sector in 2022. This category comprises chemicals, culture medium, and staining kits that are required for preparing and studying chromosomes. The recurring nature of karyotyping operations, where laboratories routinely require a stable supply of these consumables, drives the consistent demand for consumables and accessories. Furthermore, developments in staining techniques and the development of specialty consumables targeted to specific applications contribute to this segment's continued dominance. While instruments, software, and services are important components of the overall karyotyping workflow, the ongoing demand for consumables and accessories in routine cytogenetic testing propels this segment to the forefront of market share, reflecting its critical role in supporting chromosomal analysis.

Karyotyping Types

- Spectral Karyotyping

- Virtual Karyotyping

Spectral karyotyping has long been a market leader in the karyotyping industry. Spectral karyotyping, or SKY, is a complex technique that uses fluorescent probes to mark each chromosome with a distinct hue, allowing for thorough imaging and diagnosis of chromosomal abnormalities. The capacity of this approach to give high-resolution pictures and exact detection of structural chromosomal abnormalities has positioned it as a favored alternative for genetic diagnostics and cancer research researchers and doctors. While virtual karyotyping has gained attention for its potential in non-invasive prenatal testing and research, spectral karyotyping's established track record in delivering detailed chromosomal information has contributed to its market dominance.

Karyotyping Applications

- Diagnosis

- Personalized Medicines

- Research

- Others

In the karyotyping market, the diagnostic segment has been a dominant force. Karyotyping is crucial in clinical diagnostics, notably in finding chromosomal anomalies linked to genetic illnesses, developmental difficulties, and different malignancies. Because karyotyping can offer a full examination of an individual's chromosomal composition, it is used to diagnose disorders such as Down syndrome and Turner syndrome. Furthermore, the technique's contribution to preimplantation and prenatal testing strengthens its position in diagnostic applications. While personalized medicine and research applications have shown potential growth, karyotyping's proven significance in illness diagnosis and patient management has been a main driver of its widespread acceptance in the healthcare business.

Karyotyping End-Users

- Academic Research Institutes

- Clinical & Research Laboratories

- Hospitals

- Pharmaceutical & Biotechnology Companies

- Pathology Laboratories

- Others

Historically, clinical and research facilities dominated the karyotyping business. These laboratories are primary consumers of karyotyping technology because they serve as essential hubs for regular diagnostic testing, genetic research, and cytogenetic investigations. Clinical and research laboratories are key users of karyotyping services and products due to the continual need for chromosomal analysis in clinical contexts, such as diagnosing genetic diseases and analyzing cancer-related chromosomal abnormalities. Furthermore, the incorporation of karyotyping into both clinical and research processes contributes to this end-user segment's continued dominance. While hospitals, pathology laboratories, pharmaceutical and biotechnology companies, academic research institutes, and other entities use karyotyping techniques, clinical and research laboratories are the primary drivers of market demand due to their central role in routine genetic analysis.

Karyotyping Distribution Channels

- Direct Tender

- Retail Sales

- Others

In the karyotyping market, distribution channel dynamics include a variety of channels, with direct tender and retail sales being important. Direct bids have been an important conduit for the purchase of karyotyping items and services, frequently including contracts or agreements between producers and healthcare organizations or laboratories. This technique allows for bulk purchasing and long-term commitments, which is especially advantageous for big clinical and research institutions. In contrast, retail sales entail the direct selling of karyotyping products to end-users such as labs, hospitals, and research organizations. Companies often reach a larger consumer base through retail sales, catering to the different demands of laboratories and research centers of varying sizes. Partnerships with distributors, internet platforms, and cooperation with specialist suppliers are examples of additional distribution channels. The efficiency of various distribution channels can be impacted by factors such as the market's geographical reach and end-user preferences.

Karyotyping Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Karyotyping Market Regional Analysis

The market in North America has always been healthy, supported by well-established healthcare institutions, substantial R&D spending, and a growing demand for genetic testing services. Europe also plays an important role in market expansion, with superior healthcare facilities and a strong emphasis on genetic research.

The Asia-Pacific area has emerged as one with significant development potential. Rising awareness of genetic abnormalities, improved healthcare infrastructure, and increased research activity in countries like as China and India all contribute to the market's expansion. Furthermore, the Asia-Pacific region's increased emphasis on personalized treatment and advances in genomic technology encourage the usage of karyotyping procedures.

Factors such as healthcare accessibility and the incidence of genetic abnormalities impact market dynamics in Latin America and the Middle East. While these regions have lesser market shares than North America and Europe, there is room for development as healthcare infrastructure improves and knowledge of genetic testing grows.

Karyotyping Market Players

Some of the top karyotyping companies offered in our report includes Abbott, Agilent Technologies, Inc., Applied Spectral Imaging, Bio-Rad Laboratories, Inc., CytoTest Inc., Empire Genomics, Inc., Leica Biosystems Nussloch GmbH, MetaSystems, PerkinElmer Inc., Sartorius AG, SciGene Corporation, and Thermo Fisher Scientific Inc.

Frequently Asked Questions

How big is the Karyotyping market?

The karyotyping market size was USD 308.6 Million in 2022.

What is the CAGR of the global Karyotyping market from 2023 to 2032?

The CAGR of karyotyping is 5.8% during the analysis period of 2023 to 2032.

Which are the key players in the Karyotyping market?

The key players operating in the global market are including Abbott, Agilent Technologies, Inc., Applied Spectral Imaging, Bio-Rad Laboratories, Inc., CytoTest Inc., Empire Genomics, Inc., Leica Biosystems Nussloch GmbH, MetaSystems, PerkinElmer Inc., Sartorius AG, SciGene Corporation, and Thermo Fisher Scientific Inc.

Which region dominated the global Karyotyping market share?

North America held the dominating position in karyotyping industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of karyotyping during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global Karyotyping industry?

The current trends and dynamics in the karyotyping industry include increasing awareness and acceptance of prenatal testing for detecting chromosomal abnormalities, ongoing developments in genetic research, and increasing prevalence of genetic disorders globally.

Which product type held the maximum share in 2022?

The consumables & accessories held the maximum share of the karyotyping industry.