Cancer Diagnostics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Cancer Diagnostics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

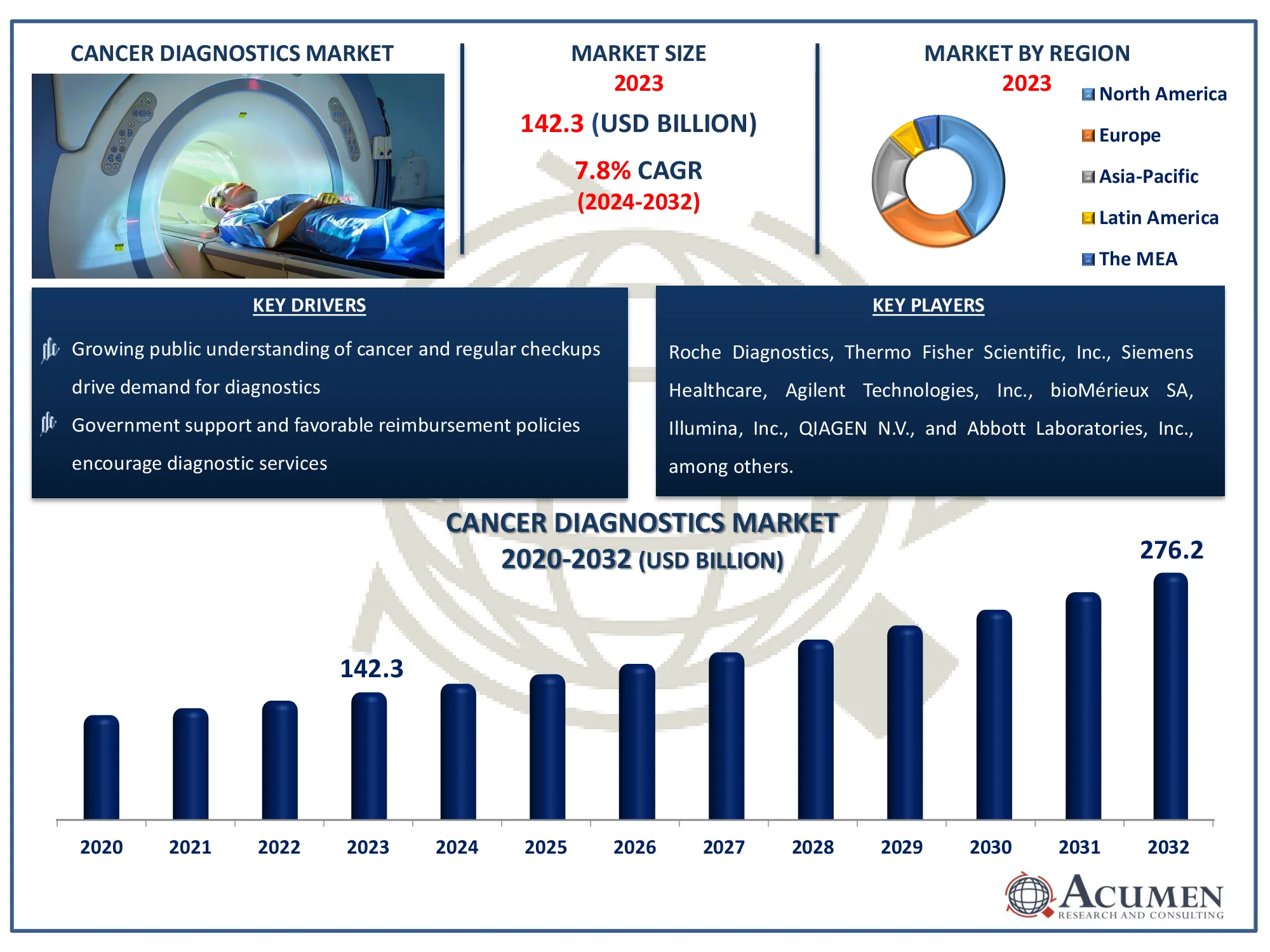

The Global Cancer Diagnostics Market Size accounted for USD 142.3 Billion in 2022 and is estimated to achieve a market size of USD 276.2 Billion by 2032 growing at a CAGR of 7.8% from 2024 to 2032.

Cancer Diagnostics Market Highlights

- Global cancer diagnostics market revenue is poised to garner USD 276.2 billion by 2032 with a CAGR of 7.8% from 2024 to 2032

- North America cancer diagnostics market value occupied around USD 58.3 billion in 2022

- Asia-Pacific cancer diagnostics market growth will record a CAGR of more than 8.5% from 2024 to 2032

- Among product, the consumables sub-segment generated USD 88.2 billion revenue in 2022

- Based on end-use, the hospitals sub-segment generated 52% cancer diagnostics market share in 2022

- Integration of technology can enhance diagnostic capabilities and remote patient care is a popular cancer diagnostics market trend that fuels the industry demand

Cancer diagnosis is the process of determining the presence of cancer cells in the body. It entails a battery of tests and procedures to establish whether a person has cancer, the type of disease, and its stage of progression. Imaging tests, biopsies, blood tests, and genetic testing are among the most common diagnostic approaches. Imaging tests, such as X-rays, CT scans, MRIs, and ultrasounds, are used to examine the body's internal structures for malignancy. Biopsies are the removal of tissue samples for examination under a microscope to detect cancer cells. Blood tests can detect abnormal amounts of specific compounds in the blood, which may suggest the existence of cancer. Genetic testing examines DNA for mutations linked to cancer.

Early detection through cancer diagnostics is crucial for successful treatment and improved outcomes. Regular screenings and prompt medical attention when symptoms arise can increase the chances of detecting cancer at an early stage, when treatment is often more effective.

Global Cancer Diagnostics Market Dynamics

Market Drivers

- Increasing global population and aging demographic lead to higher cancer cases

- Innovations in imaging techniques, biomarkers, and genetic testing improve accuracy and early detection

- Growing public understanding of cancer and regular checkups drive demand for diagnostics

- Government support and favorable reimbursement policies encourage diagnostic services

Market Restraints

- Diagnostic procedures can be expensive, limiting accessibility, especially in developing countries

- Shortage of skilled healthcare professionals in certain regions can hinder diagnostic services

- Issues related to genetic testing and patient privacy can pose challenges

Market Opportunities

- Advancements in genomics enable tailored diagnostic approaches for individual patients

- Portable diagnostic devices can improve accessibility and speed of diagnosis

- Growing economies in Asia, Africa, and Latin America offer significant market potential for diagnostic services

Cancer Diagnostics Market Report Coverage

| Market | Cancer Diagnostics Market |

| Cancer Diagnostics Market Size 2022 |

USD 142.3 Billion |

| Cancer Diagnostics Market Forecast 2032 | USD 276.2 Billion |

| Cancer Diagnostics Market CAGR During 2023 - 2032 | 7.8% |

| Cancer Diagnostics Market Analysis Period | 2020 - 2032 |

| Cancer Diagnostics Market Base Year |

2022 |

| Cancer Diagnostics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Type, By Test Type, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Roche Diagnostics, Thermo Fisher Scientific, Inc., Illumina, Inc., Siemens Healthcare, Agilent Technologies, Inc., bioMérieux SA, QIAGEN N.V., Abbott Laboratories, Inc., GE Healthcare, Philips Healthcare, Becton, and Dickinson and Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cancer Diagnostics Market Insights

Developing predominance of oncologic cases, steady innovative progressions in diagnostics, and expanding demand for successful screening tests are a portion of the prime factors prodding demand for screening devices and strategies over the world. Rising mindfulness and strong government activities are some extra factors foreseen to support market development amid the forecast period.

Cancer growth is one of the main sources of deaths over the world and predominance of the disease has been heightening at an alarming rate. In this manner, healthcare professional’s experts are concentrating on improvement of compelling demonstrative and treatment answers for check commonness level. Early identification of disease, increases the success rate of treatment regimens. Accordingly, healthcare agencies and market players, through different mindfulness programs, are advancing routine check-ups.

The breast cancer growth portion caught the biggest in the disease diagnostics market forecast period. Mammography is the most well-known and prevalent screening test utilized for breast tumour screening. As per the United States Preventive Services Task Force (USPSTF), ladies aged somewhere in the range of 50 and 74 years are at a higher danger of creating breast malignant growth. Along these lines, USPSTF prescribes ladies over 40 years old to experience mammography every two years.

Also, numerous associations, for example, the National Breast Cancer Foundation, Inc. are embraced activities to spread mindfulness in regards to breast cancer growth, advantages of early location, and accessible treatment alternatives. Increasing cognizance of the populace, combined with campaigns promoting routine mammography, is bringing about extreme demand for imaging arrangements in breast disease screening.

Cancer Diagnostics Market Segmentation

The worldwide market for cancer diagnostics is split based on product, type, test type, application, end-uses, and geography.

Cancer Diagnostics By Product

- Instruments

- Pathology-based Instruments

- Slide Staining Systems

- Tissue Processing Systems

- Cell Processors

- PCR Instruments

- NGS Instruments

- Microarrays

- Other Pathology-based Instruments

- Imaging Instruments

- Others

- Pathology-based Instruments

- Consumables

- Antibodies

- Kits & reagents

- Probes

- Others

- Services

According to cancer diagnostics industry analysis, the market is divided into three segments; instruments, consumables, and services. Consumables make up the majority of this market. Consumables such as reagents, kits, and sample preparation supplies are required for performing diagnostic tests. They are used in conjunction with diagnostic devices to examine biological samples for the presence of cancer cells or biomarkers. The high consumption rate of consumables, driven by rising demand for cancer diagnostics, contributes considerably to the growth of this market sector.

Cancer Diagnostics By Type

- IVD

- By Type

- Diagnosis

- Early Detection

- Therapy Selection

- Monitoring

- By Technology

- Polymerase Chain Reaction (PCR)

- In Situ Hybridization (ISH)

- Immunohistochemistry (IHC)

- Next-generation Sequencing (NGS)

- Microarrays

- Flow Cytometry

- Immunoassays

- Other IVD Testing Technologies

- By Type

- LDT

- Imaging

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Positron Emission Tomography (PET)

- Mammography

- Ultrasound

- Others

The cancer diagnostics market is divided into three major segments; in vitro diagnostics (IVD), laboratory-developed tests (LDT), and imaging. IVD, which includes evaluating biological samples outside the body, now controls the market. This is mostly owing to its widespread availability, standardized processes, and ability to offer prompt and reliable diagnoses. However, LDTs developed and administered in clinical laboratories are gaining popularity due to their flexibility and potential for personalised testing.

Cancer Diagnostics By Test Type

- Biopsy

- Fine-needle Aspiration

- Core Biopsy

- Surgical Biopsy

- Skin Biopsy /Punch Biopsy

- Others

- Others

In the cancer diagnostics market forecast, the biopsy category is expected to be particularly influential. Fine-needle aspiration (FNA) is unique among biopsy subcategories in that it is less invasive, rapid to perform, and can yield a definitive diagnosis with fewer consequences. Core biopsy, while more invasive than FNA, is predicted to develop significantly due to its ability to provide larger tissue samples, which improves diagnostic accuracy. The demand for skin and surgical biopsies remains high due to their importance in specific cancer types, with an increasing emphasis on early-stage cancer detection driving overall market growth.

Cancer Diagnostics By Application

- Breast Cancer

- Colorectal Cancer

- Cervical Cancer

- Lung Cancer

- Prostate Cancer

- Skin Cancer

- Blood Cancer

- Kidney Cancer

- Liver Cancer

- Pancreatic Cancer

- Ovarian Cancer

- Others

Breast cancer diagnostics have the highest market share. This can be linked to a variety of causes, including public awareness campaigns and educational activities that have raised knowledge about the need of early breast cancer detection and screening. This has resulted in a greater number of women seeking diagnostic treatments. Early detection programs, such as mammograms, supported by the government and directed by healthcare providers, have been critical in detecting breast cancer in its early stages. These initiatives encourage women to have regular screenings, which adds to the need for breast cancer diagnoses. The development and availability of advanced diagnostic technologies, such as digital mammography, ultrasound, and MRI, have improved the accuracy and sensitivity of breast cancer detection. These technologies provide more precise information about the presence and extent of tumors, enabling earlier diagnosis and more effective treatment.

Cancer Diagnostics By End-Use

- Hospitals

- Laboratories

- Others

Hospitals account for almost 52% of the cancer diagnostics market, reflecting the increased demand for enhanced diagnostic technologies in clinical settings. Hospitals are generally the initial point of contact for patients seeking cancer diagnosis, and they use cutting-edge imaging and biopsy tools to discover and screen disease early. Furthermore, hospitals have interdisciplinary teams, including oncologists and radiologists, who work together to provide comprehensive diagnostic care. Their access to advanced laboratory equipment and competent people assures precise results, which contributes to their market dominance. Furthermore, the increasing global prevalence of cancer cases and the emphasis on early detection to enhance patient outcomes reinforce hospitals' dominant position in this industry.

Cancer Diagnostics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cancer Diagnostics Market Regional Analysis

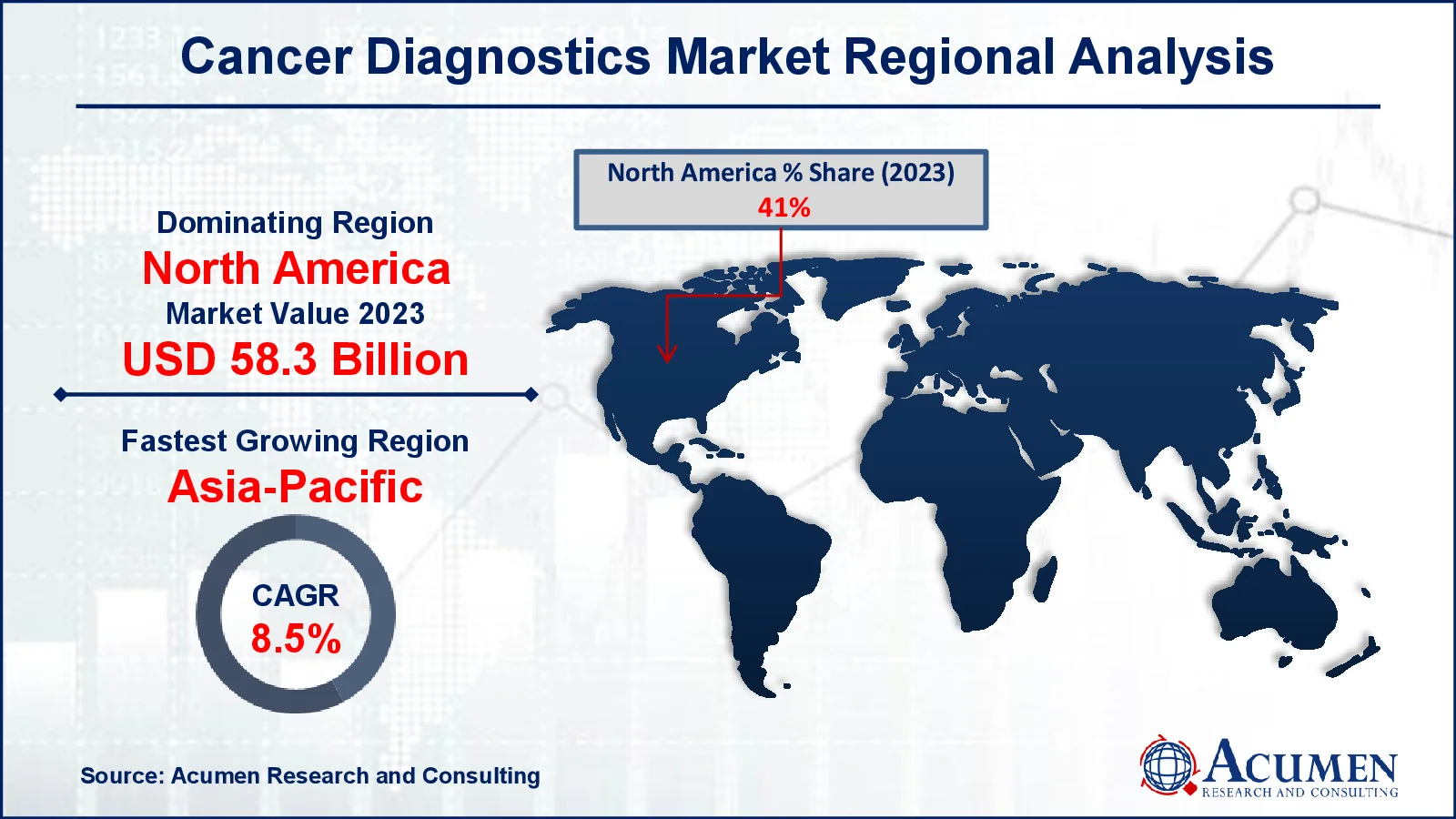

North America ruled the industry by capturing the biggest revenue share offer of 41% in 2023. Nearness of various biotechnologies just as medicinal gadget organizations in the locale is one of the prime elements driving the diagnostics sector in the region. North America is relied upon to proceed with its lead all through the estimate time frame inferable from elements, for example, more prominent subsidizing accessible for research and development projects and high reception of cutting edge innovations.

Asia Pacific is relied upon to show the most astounding development sooner rather than later because of quality of a substantial patient pool, accessibility of skilled experts at a relatively lower cost, and a characterized administrative structure favoring expedited product approvals. Besides, the blasting tourism the travel industry in nations, for example, India, China, and Malaysia are relied upon to help demand for oncological screening.

Cancer Diagnostics Market Players

Some of the top cancer diagnostics companies offered in our report includes Roche Diagnostics, Thermo Fisher Scientific, Inc., Illumina, Inc., Siemens Healthcare, Agilent Technologies, Inc., bioMérieux SA, QIAGEN N.V., Abbott Laboratories, Inc., GE Healthcare, Philips Healthcare, Becton, and Dickinson and Company.

Frequently Asked Questions

How big is the cancer diagnostics market?

The cancer diagnostics market size was valued at USD 142.3 billion in 2022.

What is the CAGR of the global cancer diagnostics market from 2024 to 2032?

The CAGR of cancer diagnostics is 7.8% during the analysis period of 2024 to 2032.

Which are the key players in the cancer diagnostics market?

The key players operating in the global market are including Roche Diagnostics, Thermo Fisher Scientific, Inc., Illumina, Inc., Siemens Healthcare, Agilent Technologies, Inc., bioMérieux SA, QIAGEN N.V., Abbott Laboratories, Inc., GE Healthcare, Philips Healthcare, Becton, and Dickinson and Company.

Which region dominated the global cancer diagnostics market share?

North America held the dominating position in cancer diagnostics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cancer diagnostics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global cancer diagnostics industry?

The current trends and dynamics in the cancer diagnostics industry include increasing global population and aging demographic lead to higher cancer cases, innovations in imaging techniques, biomarkers, and genetic testing improve accuracy and early detection, growing public understanding of cancer and regular checkups drive demand for diagnostics, and government support and favorable reimbursement policies encourage diagnostic service.

Which product held the maximum share in 2022?

The consumables held the maximum share of the cancer diagnostics industry.