In Situ Hybridization Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

In Situ Hybridization Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

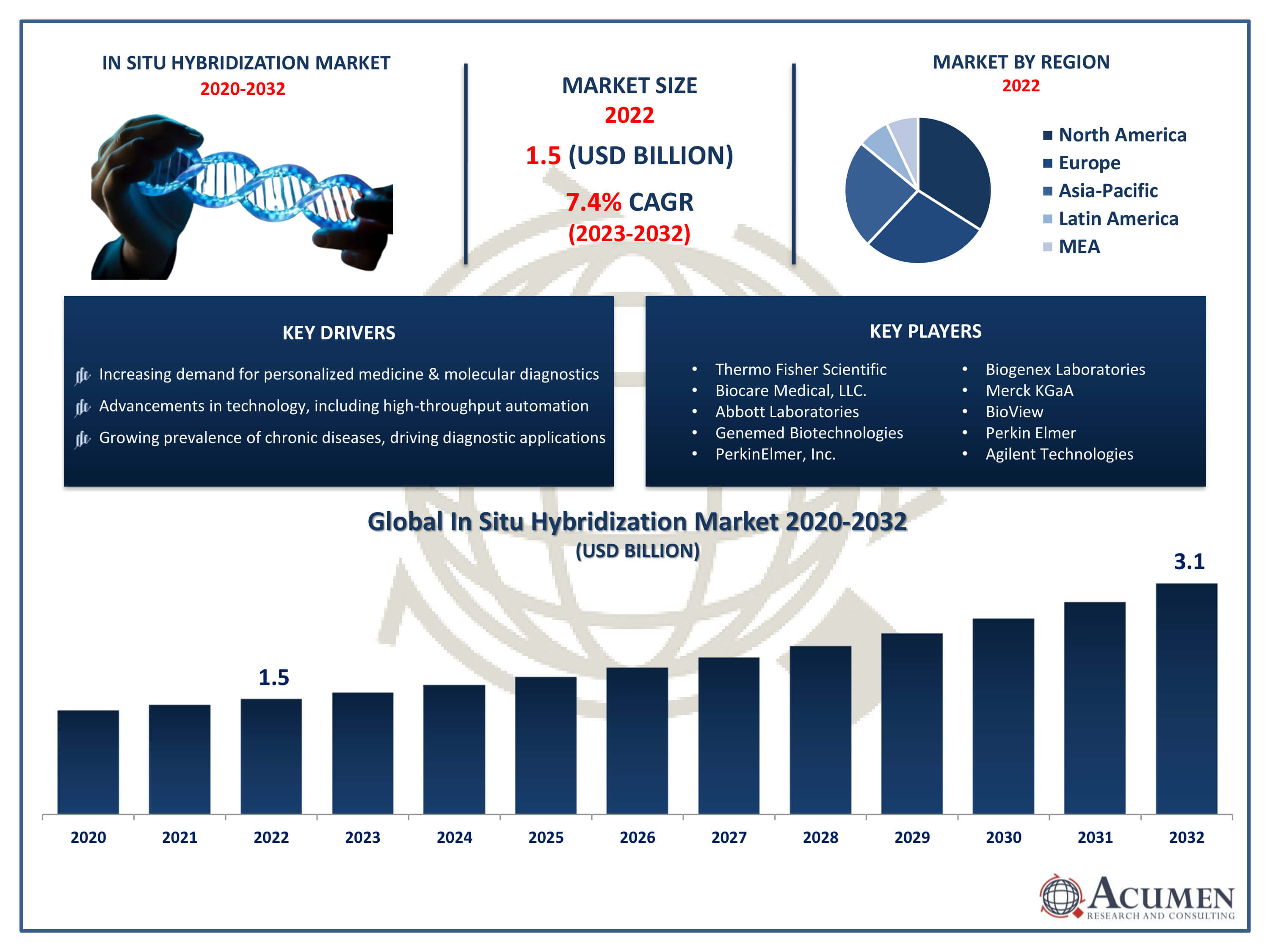

The In Situ Hybridization Market Size accounted for USD 1.5 Billion in 2022 and is projected to achieve a market size of USD 3.1 Billion by 2032 growing at a CAGR of 7.4% from 2023 to 2032.

In Situ Hybridization Market Highlights

- Global In Situ Hybridization Market revenue is expected to increase by USD 3.1Billion by 2032, with a 7.4% CAGR from 2023 to 2032

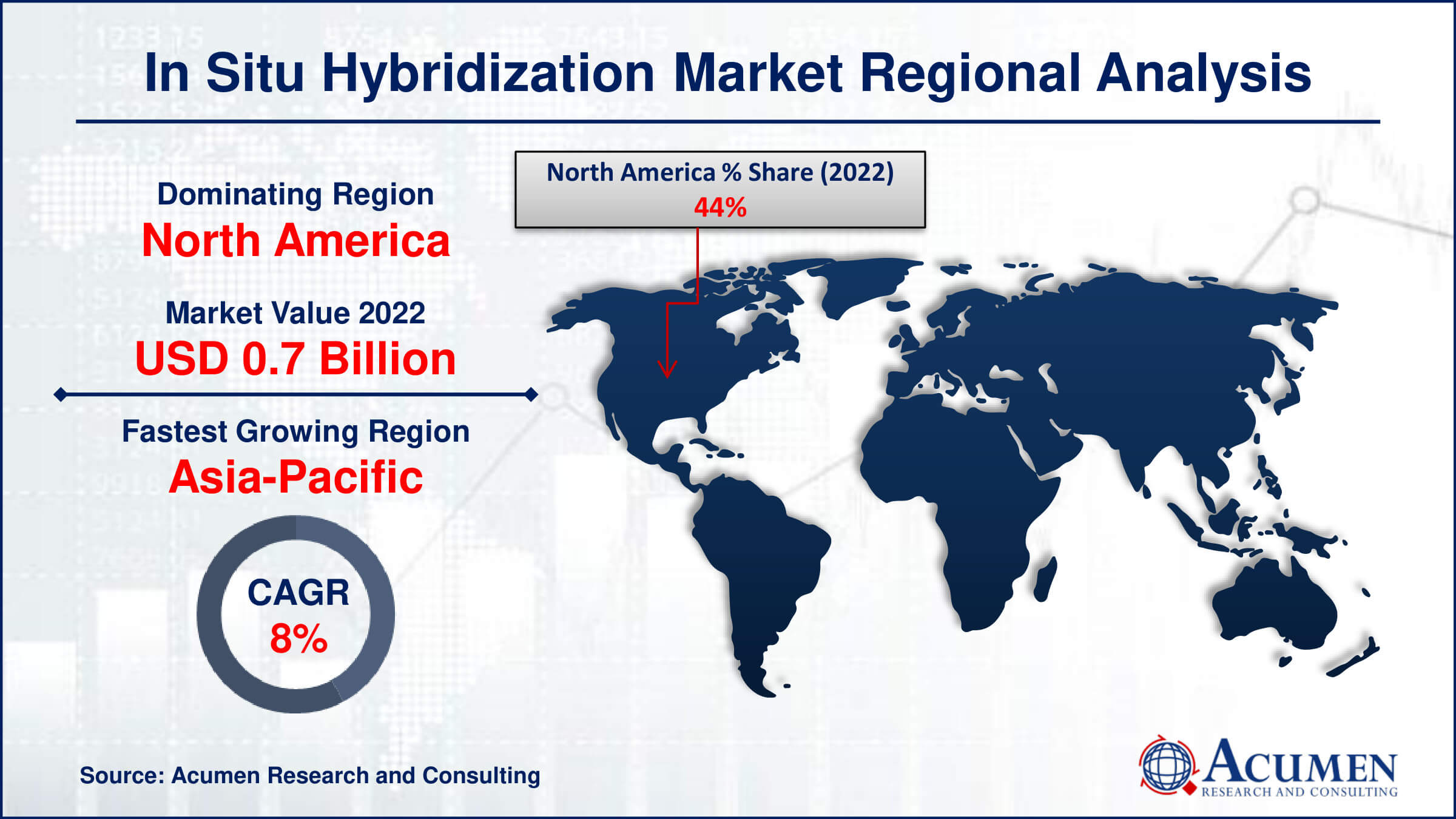

- North America region led with more than 44% of In Situ Hybridization Market share in 2022

- Asia-Pacific In Situ Hybridization Market growth will record a CAGR of around 8.2% from 2023 to 2032

- By technology, the FISH segment is the largest segment in the market, accounting for over 54% of the market share in 2022

- By application, the cancer segment has recorded more than 41% of the revenue share in 2022

- Increasing demand for personalized medicine and molecular diagnostics, drives the In Situ Hybridization Market value

In situ hybridization (ISH) is a powerful molecular biology technique used to visualize and locate specific nucleic acid sequences within a tissue or cell. It enables researchers to study the spatial distribution of RNA or DNA molecules, providing valuable insights into gene expression, chromosomal organization, and cellular function. ISH involves the use of complementary nucleic acid probes that are labeled with a detectable marker, such as a fluorescent dye or radioisotope. These probes hybridize specifically to the target sequences in the biological sample, allowing for their precise localization under a microscope.

The market for in situ hybridization has witnessed significant growth in recent years, driven by increasing demand for advanced molecular diagnostic techniques and the rising focus on personalized medicine. In situ hybridization is widely employed in cancer research, developmental biology, neuroscience, and pathology. The technology's ability to provide spatial information about gene expression has made it indispensable in understanding disease mechanisms and identifying potential therapeutic targets. As the field of genomics continues to advance, with a growing emphasis on single-cell analysis and spatial genomics, the market for in situ hybridization is likely to expand further, offering new opportunities for both research and diagnostic applications.

Global In Situ Hybridization Market Trends

Market Drivers

- Increasing demand for personalized medicine and molecular diagnostics

- Advancements in technology, including high-throughput automation

- Growing prevalence of chronic diseases, driving diagnostic applications

- Expanding applications in research fields like neuroscience and pathology

- Rising emphasis on single-cell analysis and spatial genomics

Market Restraints

- High cost associated with advanced in situ hybridization technologies

- Complexities in standardization and interpretation of results

Market Opportunities

- Continued innovation in probe design and detection methods

- Growing focus on precision medicine and targeted therapeutics

In Situ Hybridization Market Report Coverage

| Market | In Situ Hybridization Market |

| In Situ Hybridization Market Size 2022 | USD 1.5 Billion |

| In Situ Hybridization Market Forecast 2032 | USD 3.1 Billion |

| In Situ Hybridization Market CAGR During 2023 - 2032 | 7.4% |

| In Situ Hybridization Market Analysis Period | 2020 - 2032 |

| In Situ Hybridization Market Base Year |

2022 |

| In Situ Hybridization Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Product, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Inc., Biocare Medical, LLC., Abbott Laboratories, Genemed Biotechnologies, Inc., PerkinElmer, Inc., Biogenex Laboratories, Merck KGaA, BioView, Perkin Elmer, Agilent Technologies, Inc., Qiagen NV, and Bio-Rad Laboratories, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

In situ hybridization (ISH) is a molecular biology technique used to detect and visualize specific nucleic acid sequences within cells or tissues. It involves the use of labeled nucleic acid probes that are complementary to the target sequences of interest. These probes can be designed to bind to either RNA or DNA, and they are typically labeled with a detectable marker, such as a fluorescent dye or a radioactive isotope. The hybridization process allows researchers to precisely locate and identify the distribution of specific genes or nucleic acid sequences within the cellular or tissue context. The applications of in situ hybridization are diverse and crucial for various fields of research and diagnostics. In biomedical research, ISH is widely employed to study gene expression patterns, helping researchers understand the spatial and temporal regulation of genes in tissues and organs.

The in situ hybridization market has experienced robust growth in recent years, driven by a convergence of factors that underscore its expanding applications and relevance in molecular diagnostics and research. The increasing demand for personalized medicine and a deeper understanding of disease mechanisms has fueled the adoption of in situ hybridization techniques. Researchers and clinicians are leveraging the technology to analyze the spatial distribution of nucleic acid sequences, providing critical insights into gene expression patterns and cellular interactions. The market growth is further propelled by advancements in technology, such as automated platforms and high-throughput systems, which enhance efficiency and enable large-scale analysis. As the field of genomics continues to evolve, with a focus on single-cell analysis and spatial genomics, in situ hybridization has become an indispensable tool for studying complex biological processes at the cellular and molecular levels. The market's expansion is evident in its diverse applications, including cancer research, developmental biology, neuroscience, and pathology.

In Situ Hybridization Market Segmentation

The global In Situ Hybridization Market segmentation is based on technology, product, application, end-use, and geography.

In Situ Hybridization Market By Technology

- CISH

- FISH

According to the in situ hybridization industry analysis, the FISH segment accounted for the largest market share in 2022. This growth is due to its unique capabilities in visualizing and mapping specific DNA sequences with high precision. FISH allows for the detection of genetic abnormalities, such as chromosomal rearrangements and gene amplifications, making it an invaluable tool in cancer diagnostics and research. The increasing incidence of cancer and the need for more accurate and detailed genetic information for treatment decisions have been key drivers for the growth of the FISH segment. Furthermore, FISH's ability to provide spatial context to genetic alterations at the single-cell level has positioned it as a preferred method in understanding tumor heterogeneity and aiding in the development of targeted therapies. Technological advancements, particularly in probe design and detection methodologies, have contributed to the expansion of the FISH segment.

In Situ Hybridization Market By Product

- Instruments

- Software

- Consumables & Accessories

- Services

In terms of products, the instruments segment is expected to witness significant growth in the coming years. This growth is driven by technological advancements and the increasing adoption of automated platforms. These instruments play a crucial role in streamlining and enhancing the in situ hybridization workflow, offering improved efficiency, reproducibility, and scalability. The demand for high-throughput solutions in molecular diagnostics and research has spurred the development of sophisticated instruments capable of handling large sample volumes while maintaining the precision required for in situ hybridization techniques. Automated in situ hybridization instruments have become integral to laboratories, reducing manual labor, minimizing errors, and standardizing processes. The automation of steps such as probe hybridization and signal detection not only expedites the analysis but also contributes to the overall cost-effectiveness of in situ hybridization assays.

In Situ Hybridization Market By Application

- Cancer

- Cytogenetics

- Infectious Diseases

- Developmental Biology

- Others

According to the in situ hybridization market forecast, the cancer segment is expected to witness significant growth in the coming years. In situ hybridization techniques, particularly Fluorescence In Situ Hybridization (FISH), have proven instrumental in identifying genetic alterations associated with various cancers. These alterations include chromosomal rearrangements, gene amplifications, and deletions, providing clinicians with critical information for cancer prognosis, treatment planning, and the development of targeted therapies. As the understanding of the genetic basis of cancer continues to deepen, in situ hybridization has become an indispensable tool in characterizing tumor heterogeneity and guiding therapeutic decision-making. The cancer segment's growth is further driven by the rising incidence of cancer globally and the increasing emphasis on early detection and precision medicine. In situ hybridization allows for the visualization of specific genetic markers or oncogenes within tumor tissues, enabling pathologists and oncologists to assess the aggressiveness of tumors and tailor treatment strategies accordingly.

In Situ Hybridization Market By End-Use

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutes

- CROs

- Others

Based on the end-use, the hospitals & diagnostic laboratories segment is expected to continue its growth trajectory in the coming years. In situ hybridization plays a pivotal role in these settings by providing valuable insights into the genetic characteristics of diseases, particularly in cancer diagnostics and personalized medicine. As the demand for more precise and targeted therapies continues to rise, hospitals and diagnostic laboratories are leveraging in situ hybridization to identify specific genetic markers, assess tumor heterogeneity, and make informed treatment decisions. The technology's ability to offer spatial information on gene expression within tissue samples is particularly valuable for pathologists and clinicians, enhancing the diagnostic accuracy and contributing to more effective patient management. The growth of the hospitals and diagnostic laboratories segment is driven by advancements in automation and standardization of in situ hybridization workflows.

In Situ Hybridization Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

In Situ Hybridization Market Regional Analysis

North America stands as a dominating region in the in situ hybridization market, owing to several key factors that contribute to its leadership position. One of the primary drivers is the region's well-established and sophisticated healthcare infrastructure, characterized by advanced diagnostic laboratories, research facilities, and a high level of technological adoption. The presence of leading pharmaceutical and biotechnology companies, as well as academic research institutions, has fueled the demand for cutting-edge molecular diagnostic technologies, including in situ hybridization. The concentration of these entities in North America has created a robust ecosystem that fosters innovation, research collaborations, and the rapid translation of scientific advancements into clinical applications. Moreover, the prevalence of chronic diseases, such as cancer, in North America has heightened the need for accurate and advanced diagnostic tools, driving the adoption of in situ hybridization techniques. The region's proactive regulatory environment and reimbursement policies have facilitated the swift integration of these technologies into routine clinical practice. Additionally, the increasing focus on personalized medicine and the growing awareness of the benefits of molecular diagnostics have further propelled the market's growth in North America.

In Situ Hybridization Market Player

Some of the top in-situ hybridization market companies offered in the professional report include Thermo Fisher Scientific, Inc., Biocare Medical, LLC., Abbott Laboratories, Genemed Biotechnologies, Inc., PerkinElmer, Inc., Biogenex Laboratories, Merck KGaA, BioView, Perkin Elmer, Agilent Technologies, Inc., Qiagen NV, and Bio-Rad Laboratories, Inc.

Frequently Asked Questions

How big is the in-situ hybridization market?

The in-situ hybridization market size was USD 1.5 Billion in 2022.

What is the CAGR of the global in-situ hybridization market from 2023 to 2032?

The CAGR of in-situ hybridization is 7.4% during the analysis period of 2023 to 2032.

Which are the key players in the in-situ hybridization market?

The key players operating in the global market are including Thermo Fisher Scientific, Inc., Biocare Medical, LLC., Abbott Laboratories, Genemed Biotechnologies, Inc., PerkinElmer, Inc., Biogenex Laboratories, Merck KGaA, BioView, Perkin Elmer, Agilent Technologies, Inc., Qiagen NV, and Bio-Rad Laboratories, Inc.

Which region dominated the global in-situ hybridization market share?

North America held the dominating position in in-situ hybridization industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of in-situ hybridization during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global in-situ hybridization industry?

The current trends and dynamics in the in-situ hybridization industry include increasing demand for personalized medicine and molecular diagnostics, advancements in technology, including high-throughput automation, and growing prevalence of chronic diseases.

Which Product held the maximum share in 2022?

The instruments product held the maximum share of the in-situ hybridization industry.