Isobutane Market | Acumen Research and Consulting

Isobutane Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

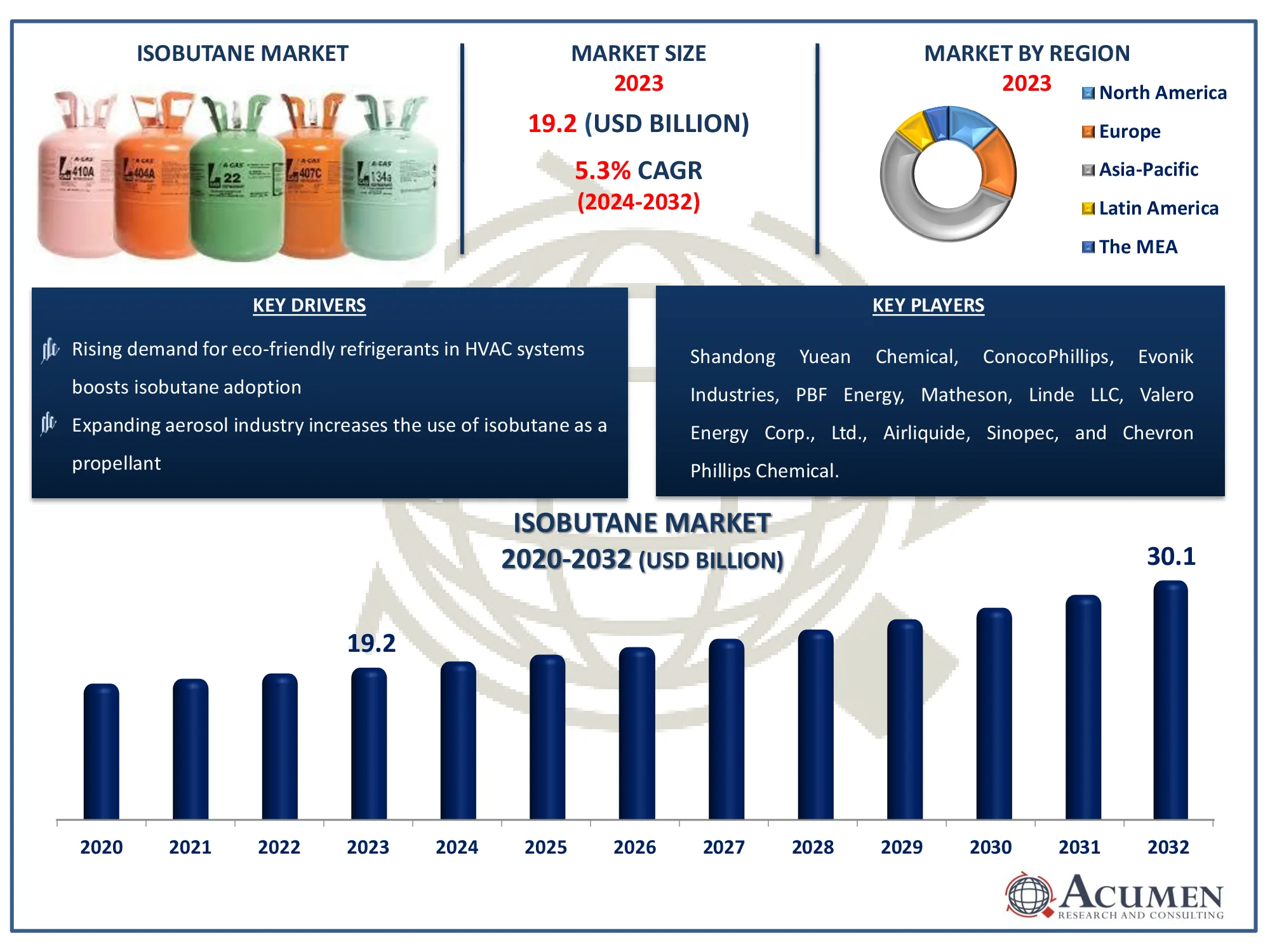

The Global Isobutane Market Size accounted for USD 19.2 Billion in 2023 and is estimated to achieve a market size of USD 30.1 Billion by 2032 growing at a CAGR of 5.3% from 2024 to 2032.

Isobutane Market Highlights

- Global isobutane market revenue is poised to garner USD 30.1 billion by 2032 with a CAGR of 5.3% from 2024 to 2032

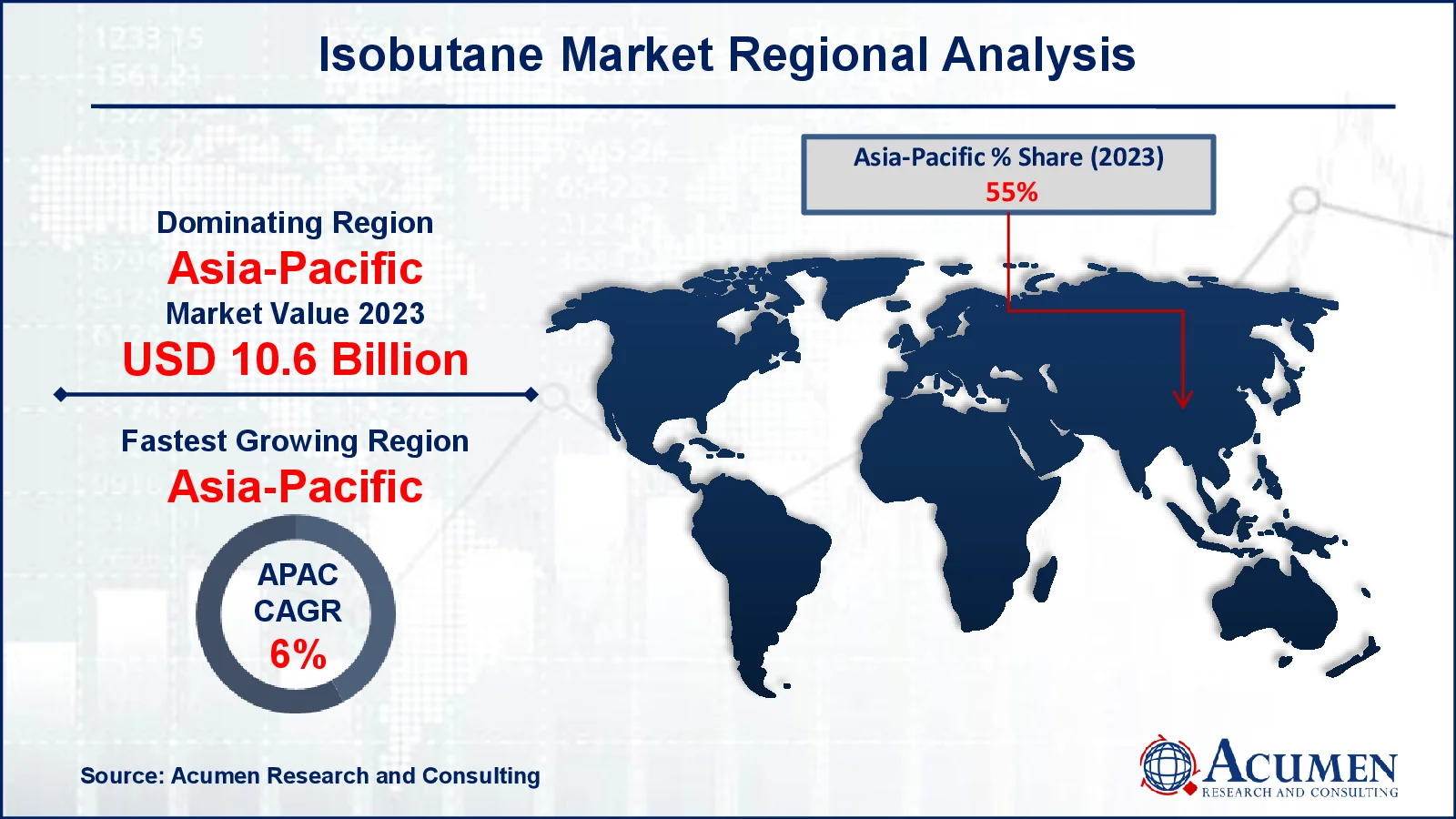

- Asia-Pacific isobutane market value occupied around USD 10.6 billion in 2023

- Asia-Pacific isobutane market growth will record a CAGR of more than 6% from 2024 to 2032

- Among application, the refineries sub-segment generated more than USD 7.7 billion revenue in 2023

- Based on source, the synthetic isobutane sub-segment generated around 62% isobutane market share in 2023

- Rising environmental regulations encourage the use of isobutane as a low-GWP refrigerant is a popular isobutane market trend that fuels the industry demand

Isobutane, a colorless and combustible hydrocarbon gas with the chemical formula C4H1O is a structural isomer of butane. Its low boiling point and high energy content make it largely utilized as a refrigerant (R-600a), an aerosol propellant, and a feedstock in petrochemical operations such as alkylation, which creates high-octane gasoline. Unlike typical refrigerants, isobutane has a low global warming potential, making it an environmentally beneficial choice for refrigeration and air conditioning systems. It is also utilized in many industrial applications, including as the production of plastics, rubber, and other chemicals. Isobutane, which comes in both synthetic and bio-based forms, is widely recognized for its versatility and minimal environmental effect, especially in sustainable manufacturing.

Global Isobutane Market Dynamics

Market Drivers

- Rising demand for eco-friendly refrigerants in HVAC systems boosts isobutane adoption

- Expanding aerosol industry increases the use of isobutane as a propellant

- Growth in petrochemical refineries drives demand for isobutane as a feedstock

- Increasing preference for bio-based isobutane supports sustainable market growth

Market Restraints

- Flammability concerns and strict safety regulations limit isobutane usage in certain applications

- Volatile raw material prices impact isobutane production costs and profitability

- Competition from alternative refrigerants affects isobutane's market share in the HVAC sector

Market Opportunities

- Technological advancements in bio-based isobutane production open new avenues

- Growing adoption in automotive air conditioning systems presents a significant market opportunity

- Expanding markets in emerging economies drive demand for industrial-grade isobutane

Isobutane Market Report Coverage

| Market | Isobutane Market |

| Isobutane Market Size 2022 |

USD 19.2 Billion |

| Isobutane Market Forecast 2032 | USD 30.1 Billion |

| Isobutane Market CAGR During 2023 - 2032 | 5.3% |

| Isobutane Market Analysis Period | 2020 - 2032 |

| Isobutane Market Base Year |

2022 |

| Isobutane Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Purity, By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Shandong Yuean Chemical, ConocoPhillips, Evonik Industries, PBF Energy, Matheson, Linde LLC, Valero Energy Corp., Ltd., Airliquide, Sinopec, and Chevron Phillips Chemical. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Isobutane Market Insights

The isobutane market is expanding rapidly due to increased demand in a variety of applications. The increased demand for isobutane as a refrigerant, aerosol propellant, and feedstock for high-octane gasoline are key drivers of this growth. Furthermore, growing environmental concerns and supportive government laws promoting the usage of natural refrigerants such as isobutane are driving market growth.

The demand for isobutane as a refrigerant is continuously increasing because of its superior thermodynamic properties and environmental friendliness,. It delivers efficient cooling with low global warming potential, making it a viable alternative to traditional refrigerants. Furthermore, the growing use of isobutane in the automobile industry to create high-octane gasoline is propelling market growth. Isobutane's high octane number and clean combustion qualities help to improve engine performance and reduce pollutants.

The market is also benefiting from the rising use of isobutane as an aerosol propellant. Its non-flammability and non-ozone depleting qualities make it an appropriate choice for a wide range of aerosol products, including personal care items, cleaning products, and medical devices. Furthermore, growing awareness of the detrimental impacts of old propellants is encouraging the transition to more sustainable alternatives like as isobutane.

However, the market is not free of challenges. Crude oil price fluctuations can affect isobutane production costs, influencing overall market dynamics. Furthermore, the availability of alternative refrigerants and propellants could pose a competitive challenge to the isobutane market's expansion. Nonetheless, the market forecast for isobutane remains bright due to its various applications, environmental benefits, and high demand from a variety of industries.

Isobutane Market Segmentation

The worldwide market for isobutane is split based on type, purity, source, application, and geography.

Isobutane Types

- Industrial Grade

- Reagent Grade

According to isobutane industry analysis, industrial grade is widely used in a variety of industries due to its versatility and low cost. It is a vital component of refrigeration systems, acting as a sustainable and efficient refrigerant. It also plays an important function in the automotive sector as a high-octane gasoline additive that improves engine performance and reduces emissions. It is also a useful feedstock in the petrochemical industry, where it is used to make a variety of chemicals and polymers.

In contrast, reagent grade isobutane is commonly used in labs and for research. It is renowned for its high purity and precise chemical composition, making it useful for analytical and synthesis purposes. While there is a high need for reagent grade isobutane, it is somewhat specialized in comparison to industrial grade isobutane, which has several applications. Therefore, due to its diverse applications and growing demand across various industries, the industrial grade isobutane segment is expected to be the largest and fastest-growing segment in the market.

Isobutane Purity

- 99.5%

- 95%

- 99%

- Others

The 99.5% purity segment is crucial in the isobutane market due to its wide range of applications in sectors that require low impurities. This high-purity grade is very important in applications such as medicines, fine chemicals, and petrochemical processes that require product uniformity and quality. Because of its stable chemical qualities, 99.5% pure isobutane is beneficial to sectors such as refrigeration and air conditioning by increasing equipment efficiency and safety. Furthermore, the growing global emphasis on environmental sustainability has increased demand for high-purity isobutane in eco-friendly refrigerants and aerosol propellants. The 99.5% purity grade stands out as a significant category, meeting the stringent requirements of current industrial applications while simultaneously encouraging growth in environmentally sensitive areas.

Isobutane Source

- Synthetic Isobutane

- Bio-based Isobutane

The synthetic isobutane segment is important in the isobutane market since it is widely available and inexpensive. Synthetic isobutane, which is produced using typical petrochemical methods, is widely utilized as a refrigerant, propellant, and feedstock in a variety of industries such as refrigeration, cosmetics, and petrochemicals.Its accessibility and existing manufacturing infrastructure make it a good alternative for large-scale industrial applications that demand consistency and volume. Furthermore, synthetic isobutane is frequently utilized in refinery alkylation units to generate high-octane gasoline, increasing demand in the automotive fuel market. While bio-based alternatives are emerging, synthetic isobutane remains the favored choice because to its low cost, wide range of applications, and regular supply, making it crucial for meeting current industrial demands.

Isobutane Application

- Refrigerant

- Refineries

- Propellants

- Solvents

- Feed Stock (Plastics)

- Others

The refineries segment is critical to the isobutane market since it produces high-octane gasoline. In refineries, isobutane is necessary for alkylation, which involves mixing it with olefins to produce alkylate—a high-value blending component that improves gasoline quality and removes engine knocking. This application is consistent with expanding worldwide fuel requirements and the demand for cleaner-burning fuels, as high-octane gasoline reduces pollutants. Furthermore, the rising automobile industry drives demand for refined goods, making isobutane a key resource for improving fuel economy. The broad and ongoing need for high-performance fuel additives keeps the refineries segment at the heart of the isobutane market's growth trajectory.

Isobutane Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Isobutane Market Regional Analysis

Asia-Pacific is the world's largest and fastest-growing in the isobutane market forecast period, driven by rising industrial sectors in China, India, and Japan. Rising automotive and industry activity drives up demand for isobutane in refining and as a feedstock in plastic synthesis. Furthermore, the expansion of the consumer goods sector, particularly aerosols and refrigeration, promotes greater isobutane use in this region.

North America is a key isobutane market for isobutane due to its established petrochemical sector and use of ecologically friendly refrigerants. Isobutane is in high demand in the United States refining industry, where it is utilized in alkylation operations to generate gasoline. Furthermore, strict environmental regulations promote isobutane as an alternative refrigerant in refrigeration and HVAC systems, driving isobutane market growth.

Europe is a rising market for isobutane, owing to strict environmental legislation and the phase-out of high-GWP refrigerants. Isobutane is supported by European Union rules as a low-impact refrigerant, which is increasing its use in air conditioning and refrigeration systems. The region's thriving cosmetic and personal care sectors also boost demand for isobutane as an aerosol propellant in consumer goods.

Isobutane Market Players

Some of the top isobutane companies offered in our report include Shandong Yuean Chemical, ConocoPhillips, Evonik Industries, PBF Energy, Matheson, Linde LLC, Valero Energy Corp., Ltd., Airliquide, Sinopec, and Chevron Phillips Chemical.

Frequently Asked Questions

How big is the isobutane market?

The isobutane market size was valued at USD 19.2 billion in 2023.

What is the CAGR of the global isobutane market from 2024 to 2032?

The CAGR of isobutane is 5.3% during the analysis period of 2024 to 2032.

Which are the key players in the isobutane market?

The key players operating in the global market are including Shandong Yuean Chemical, ConocoPhillips, Evonik Industries, PBF Energy, Matheson, Linde LLC, Valero Energy Corp., Ltd., Airliquide, Sinopec, and Chevron Phillips Chemical.

Which region dominated the global isobutane market share?

Asia-Pacific held the dominating position in isobutane industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of isobutane during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global isobutane industry?

The current trends and dynamics in the isobutane industry include rising demand for eco-friendly refrigerants in hvac systems boosts isobutane adoption, expanding aerosol industry increases the use of isobutane as a propellant, growth in petrochemical refineries drives demand for isobutane as a feedstock, and increasing preference for bio-based isobutane supports sustainable market growth.

Which purity held the maximum share in 2023?

The AC motors purity the maximum share of the isobutane industry.