HVAC Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

HVAC Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

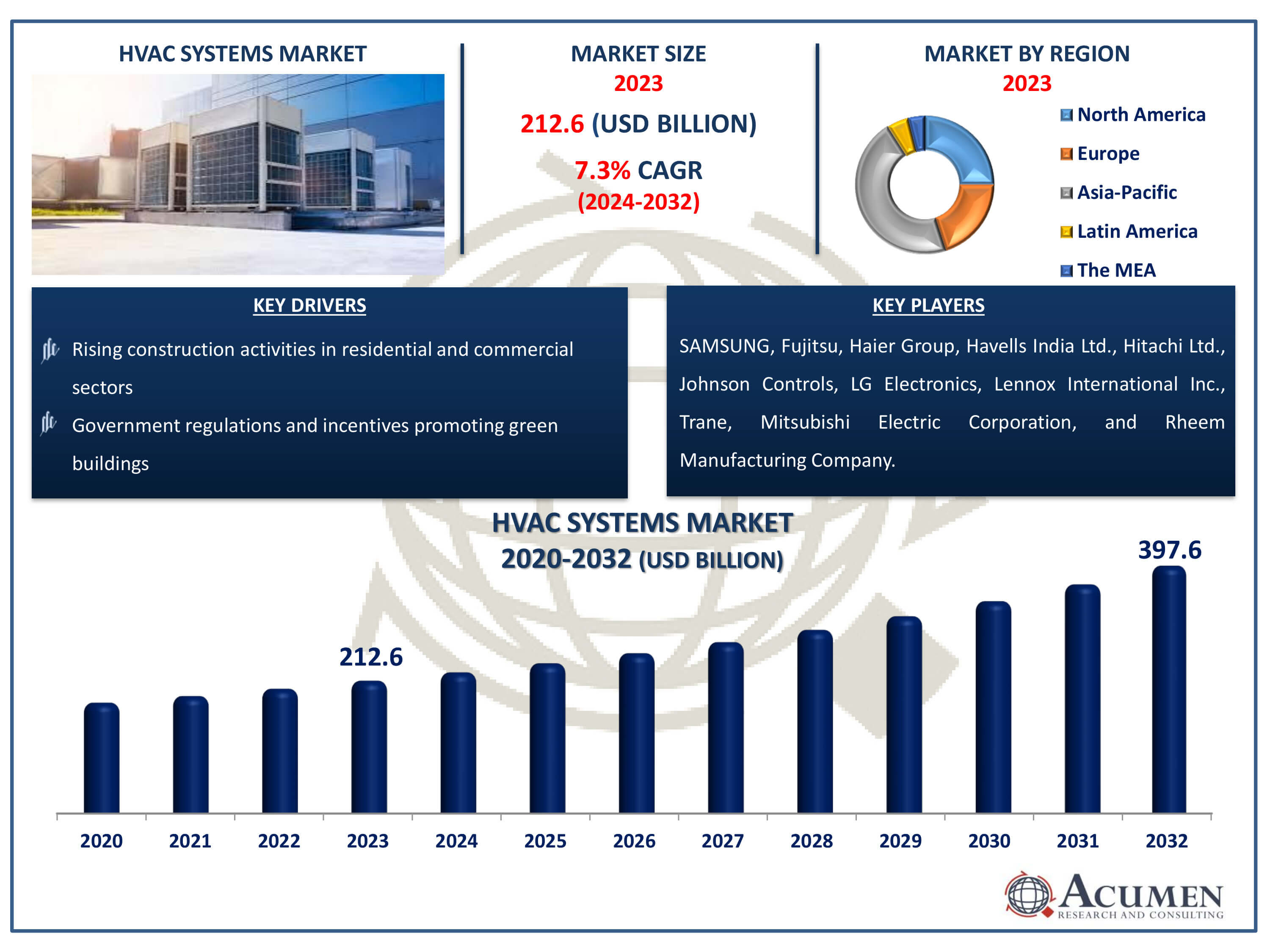

The HVAC Systems Market Size accounted for USD 212.6 Billion in 2023 and is estimated to achieve a market size of USD 397.6 Billion by 2032 growing at a CAGR of 7.3% from 2024 to 2032.

HVAC Systems Market Highlights

- Global HVAC systems market revenue is poised to garner USD 397.6 billion by 2032 with a CAGR of 7.3% from 2024 to 2032

- Asia-Pacific HVAC systems market value occupied around USD 97.8 billion in 2023

- Europe HVAC systems market growth will record a CAGR of more than 8% from 2024 to 2032

- Among product, the cooling equipment sub-segment generated noteworthy revenue in 2023

- Based on application, the residential sub-segment generated around 40% HVAC systems market share in 2023

- Development of eco-friendly and sustainable HVAC technologies is a popular HVAC systems market trend that fuels the industry demand

Heating, ventilation, and air conditioning (HVAC) systems are critical components of residential, commercial, and industrial buildings. They are intended to regulate and sustain indoor environmental comfort by managing temperature, humidity, and air quality. Heating systems, which primarily include furnaces, boilers, and heat pumps, provide warmth throughout the winter months. Ventilation promotes the circulation of fresh air while eliminating stale air and impurities, which is critical for sustaining indoor air quality. During warmer months, air conditioning systems cool and dehumidify the air with equipment like central air conditioners or split systems.

Modern HVAC systems frequently integrate all three functions to provide a comprehensive climate control solution. They can be controlled manually or through automated systems, which improve energy efficiency and comfort. HVAC systems require proper installation and maintenance to ensure their efficiency, lifespan, and the health of building occupants. Advances in technology have resulted in more energy-efficient and ecologically friendly HVAC solutions.

Global HVAC Systems Market Dynamics

Market Drivers

- Increasing demand for energy-efficient HVAC systems

- Rising construction activities in residential and commercial sectors

- Government regulations and incentives promoting green buildings

- Technological advancements in HVAC systems

Market Restraints

- High initial installation and maintenance costs

- Complexity of retrofitting existing systems

- Shortage of skilled labor for HVAC system installation and maintenance

Market Opportunities

- Growing adoption of smart HVAC systems and IoT integration

- Expanding urbanization in emerging markets

- Rising awareness about indoor air quality and health

HVAC Systems Market Report Coverage

| Market | HVAC Systems Market |

| HVAC Systems Market Size 2022 | USD 212.6 Billion |

| HVAC Systems Market Forecast 2032 | USD 397.6 Billion |

| HVAC Systems Market CAGR During 2023 - 2032 | 7.3% |

| HVAC Systems Market Analysis Period | 2020 - 2032 |

| HVAC Systems Market Base Year |

2022 |

| HVAC Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | SAMSUNG, Fujitsu, Haier Group, Havells India Ltd., Hitachi Ltd., Johnson Controls, LG Electronics, Lennox International Inc., Trane, Mitsubishi Electric Corporation, and Rheem Manufacturing Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

HVAC Systems Market Insights

The heating, ventilation, and air conditioning (HVAC) systems market is experiencing significant growth due to increasing urbanization and a rising awareness of energy-efficient products. Governments worldwide are encouraging the adoption of energy-efficient HVAC units by offering various incentives and rebate programs. This support is a key driver of the global HVAC systems market. Technological advancements are playing a crucial role in transforming and revolutionizing HVAC equipment. Innovations such as remote control access, the Internet of Things (IoT), and automated control systems are enhancing the functionality and efficiency of these systems. Automated control systems can detect the surrounding climate and automatically adjust the temperature and fan speeds to provide optimal comfort to the user. This technology ensures that HVAC systems operate efficiently, maintaining a comfortable indoor environment without unnecessary energy consumption.

Remote control access allows users to manage HVAC systems through mobile applications via the internet. This feature offers convenience and flexibility, enabling users to control their systems from anywhere. IoT-enabled HVAC units can connect to the internet and provide real-time information and data about the system's condition. This connectivity allows both users and manufacturers to monitor the performance of the units continuously. By anticipating defects and potential issues, IoT technology helps reduce maintenance costs and improve the longevity of HVAC systems. In summary, the growth of the HVAC systems market is driven by urbanization, increased awareness of energy-efficient products, and government incentives. Technological advancements such as remote control access, IoT, and automated control systems are revolutionizing HVAC equipment, making them more efficient, user-friendly, and cost-effective. These innovations contribute to the overall growth and development of the global HVAC systems market.

HVAC Systems Market Segmentation

The worldwide market for HVAC systems is split based on product, application, and geography.

HVAC System Products

- Ventilation Equipment

- Air Filter

- Ventilation Fan

- Humidifier

- Air Purifier

- Others

- Heating Equipment

- Heat pumps

- Furnaces

- Unitary Heaters

- Boilers

- Cooling Equipment

- Room Air-Conditioner

- Unitary Air-Conditioner

- Chiller

- Cooler

- Cooling Tower

- Others

According to HVAC systems industry analysis, the cooling equipment segment is the leader in the market. This segment includes air conditioners, chillers, and other cooling devices that maintain comfortable indoor temperatures in homes, offices, and industrial spaces. The dominance of the cooling equipment segment can be attributed to several factors. First, the demand for air conditioning and cooling systems is particularly high in regions with hot climates, such as Asia, the Middle East, and parts of North America. As urbanization increases and more people move to cities, the need for effective cooling solutions in residential and commercial buildings rises.

Additionally, global warming and rising temperatures are driving the demand for efficient cooling systems to ensure comfort and productivity. Technological advancements in cooling equipment, such as energy-efficient air conditioners and smart cooling systems, also contribute to the segment's growth. Furthermore, increased awareness of energy conservation and the availability of government incentives for energy-efficient cooling systems are encouraging consumers and businesses to invest in modern cooling equipment. As a result, the cooling equipment segment holds the largest market share in the HVAC systems market.

HVAC System Applications

- Residential

- Industrial

- Commercial

The residential sector commands the largest share throughout the HVAC systems market forecast period, driven by several compelling factors. Firstly, rapid urbanization globally fuels a steady increase in residential construction, amplifying the demand for effective heating, ventilation, and air conditioning (HVAC) solutions to ensure optimal indoor comfort. Furthermore, as household incomes rise and living standards improve, homeowners are increasingly investing in HVAC systems to enhance their living environments. This growing consumer inclination is bolstered by a preference for energy-efficient technologies that not only deliver superior comfort but also help reduce operational costs and environmental footprint.

Technological advancements have significantly enriched the appeal of HVAC systems for residential consumers. Innovations such as smart thermostats and Internet of Things (IoT) integration offer enhanced control and automation, catering to the modern homeowner's desire for seamless, efficient home climate management. Government initiatives and incentives further propel market growth by promoting energy-efficient HVAC upgrades in residential settings. These supportive policies encourage homeowners to adopt sustainable solutions, contributing to the dominance of the residential segment in the expanding HVAC systems market.

HVAC Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

HVAC Systems Market Regional Analysis

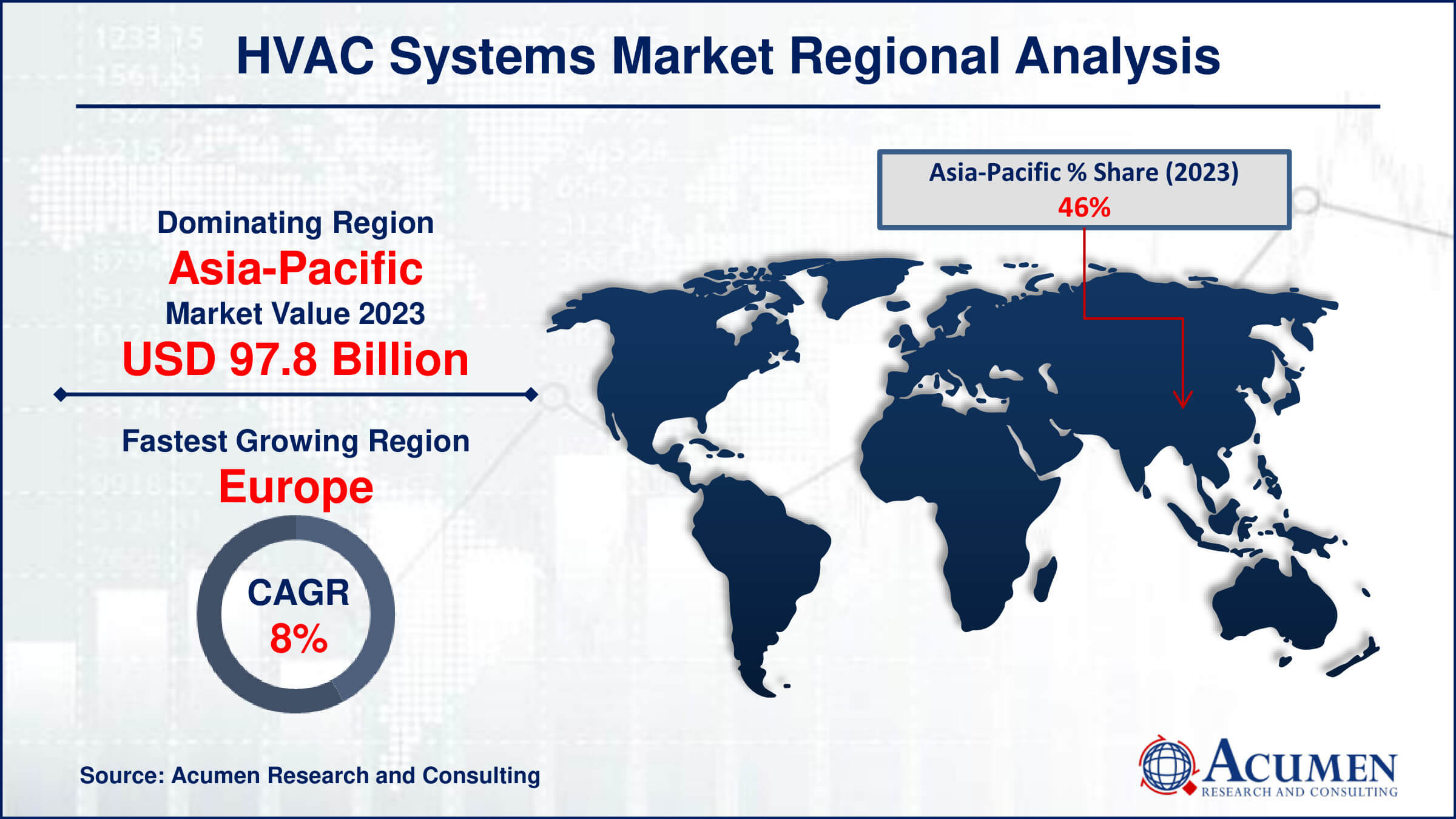

In terms of HVAC systems market analysis, Asia-Pacific emerges as the largest region, driven by changing climatic conditions, a growing population, rising disposable incomes, and rapid urbanization in emerging economies. Countries like Japan, India, and China collectively contribute over 60% to the region's total sales. APAC's dominance is further supported by favorable government initiatives promoting advanced energy-efficient HVAC units in buildings, which enhances market growth prospects.

Conversely, Europe is recognized as the fastest-growing region during the commercial HVAC system industry forecast period. This growth is primarily attributed to the significant presence of the real estate and tourism sectors. The well-established service sector, along with stringent government regulations promoting energy efficiency and driving construction activities, further propels market expansion in Europe.

North America and Europe jointly lead the commercial HVAC system market, leveraging their robust industrial bases and mature service sectors. The implementation of stringent government regulations and the increasing adoption of advanced HVAC technologies contribute significantly to market growth in these regions.

HVAC Systems Market Players

Some of the top HVAC systems companies offered in our report includes SAMSUNG, Fujitsu, Haier Group, Havells India Ltd., Hitachi Ltd., Johnson Controls, LG Electronics, Lennox International Inc., Trane, Mitsubishi Electric Corporation, and Rheem Manufacturing Company.

Frequently Asked Questions

How big is the HVAC systems market?

The HVAC systems market size was valued at USD 212.6 billion in 2023.

What is the CAGR of the global HVAC systems market from 2024 to 2032?

What is the CAGR of the global HVAC systems market from 2024 to 2032?

Which are the key players in the HVAC Systems market?

The key players operating in the global market are including SAMSUNG, Fujitsu, Haier Group, Havells India Ltd., Hitachi Ltd., Johnson Controls, LG Electronics, Lennox International Inc., Trane, Mitsubishi Electric Corporation, and Rheem Manufacturing Company.

Which region dominated the global HVAC systems market share?

North America held the dominating position in HVAC systems industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of HVAC Systems during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global HVAC systems industry?

The current trends and dynamics in the HVAC systems industry include increasing demand for energy-efficient HVAC systems, rising construction activities in residential and commercial sectors, government regulations and incentives promoting green buildings, and technological advancements in HVAC systems.

Which application held the maximum share in 2023?

The residential application held the maximum share of the HVAC systems industry.