IP Camera Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

IP Camera Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

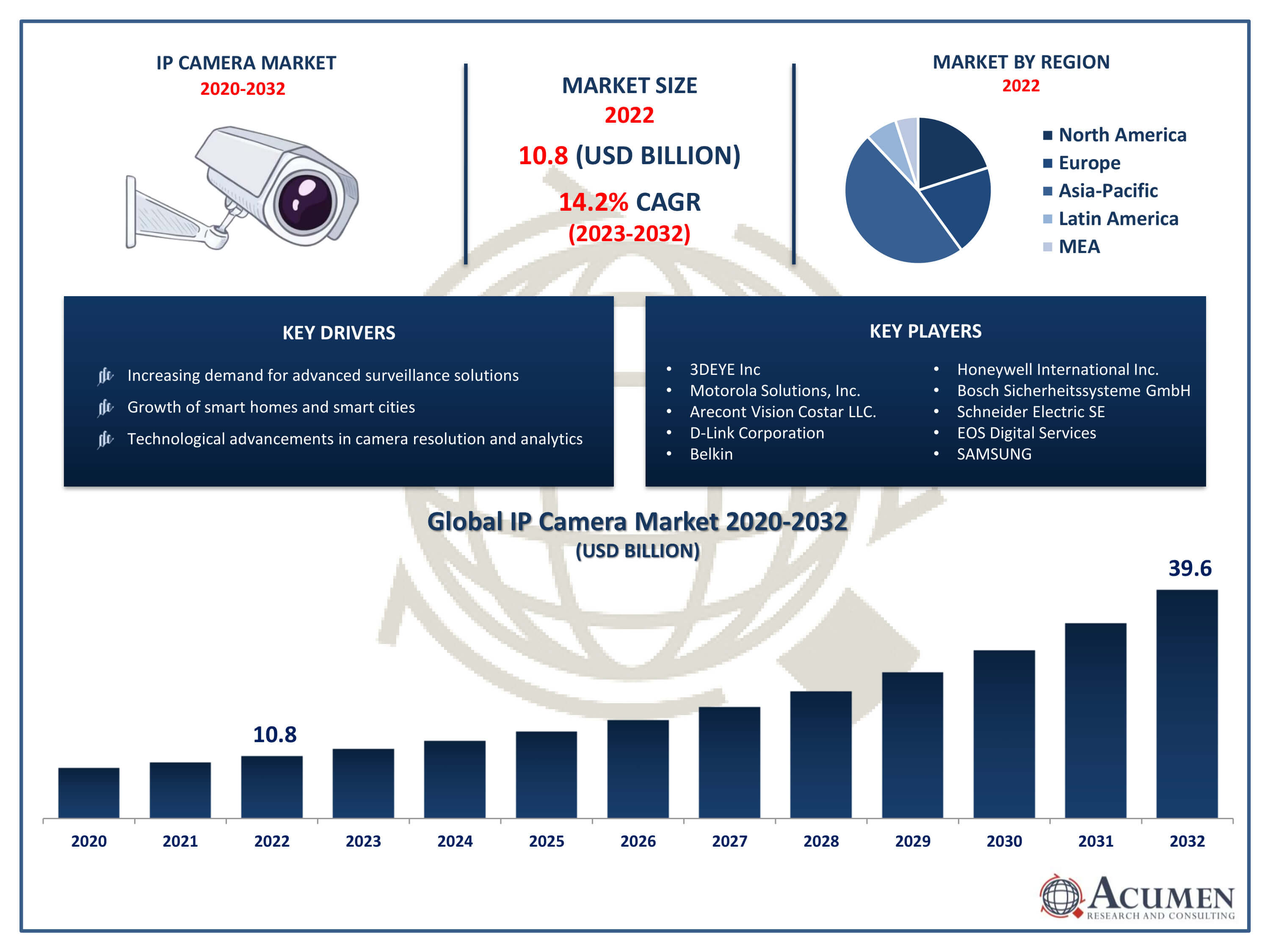

The IP Camera Market Size accounted for USD 10.8 Billion in 2022 and is projected to achieve a market size of USD 39.6 Billion by 2032 growing at a CAGR of 14.2% from 2023 to 2032.

IP Camera Market Highlights

- Global IP Camera Market revenue is expected to increase by USD 39.6 Billion by 2032, with a 14.2% CAGR from 2023 to 2032

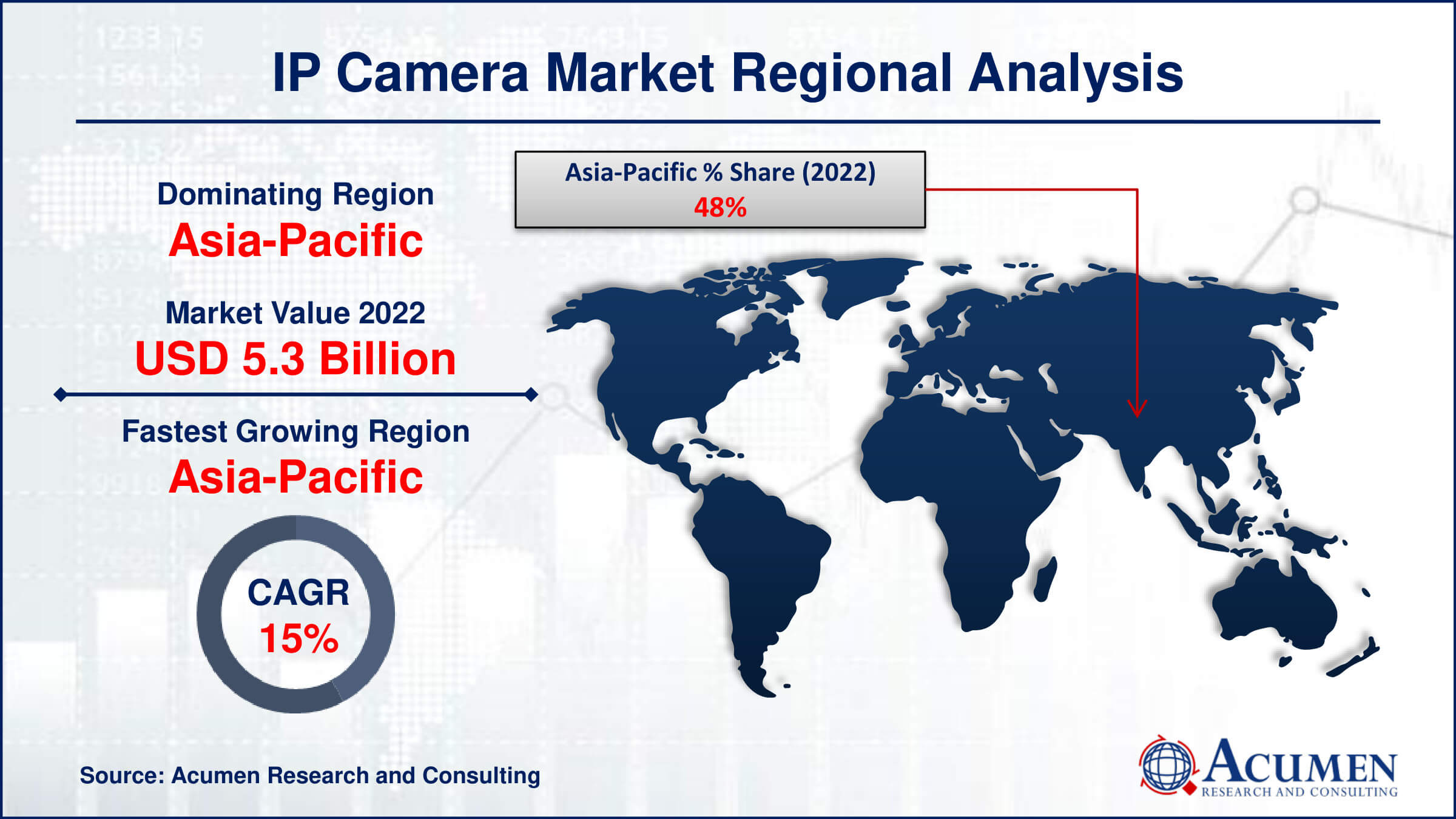

- Asia-Pacific region led with more than 48% of IP Camera Market share in 2022

- Asia-Pacific IP Camera Market growth will record a CAGR of around 14.8% from 2023 to 2032

- By product type, the infrared camera segment is the largest segment in the market, accounting for over 44% of the market share in 2022

- By connection type, the consolidated segment has recorded more than 75% of the revenue share in 2022

- Increasing demand for advanced surveillance solutions, drives the IP Camera Market value

An IP camera, or Internet Protocol camera, is a type of digital video camera that is used for surveillance and can transmit and receive data via the internet or a computer network. Unlike traditional analog cameras, IP cameras can send and receive data over the same network to which they are connected, allowing for remote access and control. They often come equipped with advanced features such as high-resolution video capture, motion detection, and the ability to send alerts or notifications to users.

The market for IP cameras has experienced significant growth in recent years due to the increasing demand for advanced surveillance solutions in various sectors, including residential, commercial, and industrial. The rise of smart homes and smart cities, coupled with the need for enhanced security measures, has fueled the adoption of IP cameras. Additionally, advancements in technology, such as the development of higher resolution cameras, improved video analytics, and the integration of artificial intelligence, have contributed to the growing popularity of IP cameras. As the world becomes more interconnected and the importance of security continues to rise, the IP camera market is expected to see sustained growth in the coming years.

Global IP Camera Market Trends

Market Drivers

- Increasing demand for advanced surveillance solutions

- Growth of smart homes and smart cities

- Technological advancements in camera resolution and analytics

- Rising awareness of the benefits of IP-based surveillance

Market Restraints

- High initial costs and installation complexities

- Concerns over data privacy and security

Market Opportunities

- Expanding applications beyond traditional security and video surveillance

- Decreasing costs of IP camera technology

- Integration of artificial intelligence in surveillance

IP Camera Market Report Coverage

| Market | IP Camera Market |

| IP Camera Market Size 2022 | USD 10.8 Billion |

| IP Camera Market Forecast 2032 | USD 39.6 Billion |

| IP Camera Market CAGR During 2023 - 2032 | 14.2% |

| IP Camera Market Analysis Period | 2020 - 2032 |

| IP Camera Market Base Year |

2022 |

| IP Camera Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Product Type, By Connection Type, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3DEYE Inc, Motorola Solutions, Inc., Arecont Vision Costar LLC., D-Link Corporation, Belkin, Honeywell International Inc., Bosch Sicherheitssysteme GmbH, Schneider Electric SE, EOS Digital Services, SAMSUNG, Hangzhou Hikvision Digital Technology Co. Ltd., Sony Corporation, Johnson Controls, and Panasonic. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Unlike traditional analog cameras that require a separate recording device, IP cameras have built-in processors and connectivity, enabling them to transmit video footage directly to networked storage devices, computers, or the cloud. They offer high-resolution video quality, remote access capabilities, and advanced features like motion detection and night vision, making them a popular choice for surveillance and security applications. The applications of IP cameras are diverse and extend across various sectors. In the realm of home security, IP cameras are commonly used to monitor and safeguard residential properties. They allow homeowners to remotely view live footage, receive alerts for suspicious activities, and even communicate with visitors through integrated audio features. In commercial and industrial settings, IP cameras play a crucial role in ensuring the safety of premises, monitoring operations, and preventing unauthorized access. Additionally, IP cameras are employed in public spaces, transportation systems, and smart city initiatives to enhance overall security and provide real-time surveillance.

The IP camera market has witnessed robust growth in recent years, driven by a surge in demand for sophisticated surveillance solutions across various sectors. The increasing need for high-resolution video capture, remote access capabilities, and advanced analytics has fueled the adoption of IP cameras in residential, commercial, and industrial settings. The shift towards smart homes and smart cities has been a major catalyst, propelling the market forward as consumers and businesses seek more intelligent and connected security systems. Moreover, technological advancements, including the integration of artificial intelligence and improvements in camera resolution, have further boosted the appeal of IP cameras, making them a preferred choice for modern security applications. The market's trajectory is also shaped by factors such as decreasing costs of IP camera technology and the expanding scope of applications beyond traditional security.

IP Camera Market Segmentation

The global IP Camera Market segmentation is based on component, product type, connection type, end-use, and geography.

IP Camera Market By Component

- Services

- Hardware

According to the IP camera industry analysis, the hardware segment accounted for the largest market share in 2022. This growth is propelled by continuous advancements in technology and a rising demand for more sophisticated surveillance solutions. One key driver is the constant evolution of camera hardware, including improvements in sensor technology, lens quality, and image processing capabilities. Higher resolution cameras have become increasingly prevalent, enabling clearer and more detailed video capture, which is crucial for applications such as facial recognition and license plate identification. Additionally, the integration of cutting-edge features like infrared sensors for low-light conditions and advanced zoom capabilities has contributed to the expanding capabilities of IP camera hardware, enhancing overall surveillance effectiveness.

IP Camera Market By Product Type

- Fixed

- Infrared

- Pan-Tilt-Zoom (PTZ)

In terms of product types, the infrared camera segment is expected to witness significant growth in the coming years. Infrared cameras utilize infrared radiation to capture images, making them essential for nighttime surveillance and scenarios with limited visibility. As the demand for around-the-clock security solutions continues to rise, the adoption of IR cameras within the IP camera market has become increasingly prevalent across various sectors, including residential, commercial, and industrial applications. One of the key drivers for the growth of the IR camera segment is the constant improvement in IR technology, leading to enhanced performance and increased range. Modern IR cameras can capture high-quality images in complete darkness, offering a crucial advantage in maintaining comprehensive security coverage.

IP Camera Market By Connection Type

- Distributed

- Consolidated

According to the IP camera market forecast, the consolidated segment is expected to witness significant growth in the coming years. A key contributor to this growth is the increasing demand for high-resolution cameras with advanced analytics capabilities. As businesses and consumers seek more intelligent surveillance solutions, IP cameras that offer features like facial recognition, object detection, and behavior analysis are gaining prominence. This consolidation of features within the IP camera segment enables users to deploy more sophisticated and proactive security measures. Furthermore, the market's consolidation is evident in the integration of Internet of Things (IoT) technologies, where IP cameras are becoming integral components of interconnected ecosystems.

IP Camera Market By End-Use

- Residential

- Industrial

- Commercial

- BFSI

- Healthcare

- Education

- Retail

- Real estate

- Transportation & logistics

Based on the end-use, the residential segment is expected to continue its growth trajectory in the coming years. The advent of smart home technologies and the growing awareness of the benefits of IP-based cameras have been key drivers in this trend. IP cameras offer homeowners the ability to remotely monitor their residences through smartphones or other connected devices, providing a sense of control and peace of mind. The ease of installation and user-friendly interfaces have also contributed to the widespread adoption of IP cameras in residential settings. The growth in the residential segment is further fueled by the diversification of IP camera offerings tailored specifically for home use. Manufacturers are producing compact, aesthetically pleasing designs that blend seamlessly with home décor, addressing concerns about the intrusion of surveillance technology into personal spaces. Additionally, features like motion detection, two-way audio communication, and integration with other smart home devices contribute to the appeal of IP cameras for residential users.

IP Camera Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

IP Camera Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the IP camera market, propelled by rapid urbanization, robust economic growth, and an increasing emphasis on security infrastructure. Countries such as China, Japan, South Korea, and India have been at the forefront of this surge, with a growing demand for advanced surveillance solutions across various sectors. The expansion of smart city initiatives, rising concerns about public safety, and the need for efficient monitoring systems in densely populated urban areas have been key factors driving the adoption of IP cameras in the region. The Asia-Pacific market dominance can also be attributed to the presence of major technology manufacturers and a proactive approach to adopting cutting-edge innovations. Chinese companies, in particular, have played a pivotal role in shaping the IP camera market, leveraging their manufacturing capabilities and technological expertise. Additionally, favorable government initiatives and policies supporting the implementation of advanced security systems have further accelerated the growth of the IP camera market in the region.

IP Camera Market Player

Some of the top IP camera market companies offered in the professional report include 3DEYE Inc, Motorola Solutions, Inc., Arecont Vision Costar LLC., D-Link Corporation, Belkin, Honeywell International Inc., Bosch Sicherheitssysteme GmbH, Schneider Electric SE, EOS Digital Services, SAMSUNG, Hangzhou Hikvision Digital Technology Co. Ltd., Sony Corporation, Johnson Controls, and Panasonic.

Frequently Asked Questions

How big is the IP camera market?

The IP camera market size was USD 10.8 Billion in 2022.

What is the CAGR of the global IP camera market from 2023 to 2032?

The CAGR of IP camera is 14.2% during the analysis period of 2023 to 2032.

Which are the key players in the IP camera market?

The key players operating in the global market are including 3DEYE Inc, Motorola Solutions, Inc., Arecont Vision Costar LLC., D-Link Corporation, Belkin, Honeywell International Inc., Bosch Sicherheitssysteme GmbH, Schneider Electric SE, EOS Digital Services, SAMSUNG, Hangzhou Hikvision Digital Technology Co. Ltd., Sony Corporation, Johnson Controls, and Panasonic.

Which region dominated the global IP camera market share?

Asia-Pacific held the dominating position in IP camera industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of IP camera during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global IP camera industry?

The current trends and dynamics in the IP camera industry include increasing demand for advanced surveillance solutions, growth of smart homes and smart cities, and technological advancements in camera resolution and analytics.

Which Product Type held the maximum share in 2022?

The infrared product type held the maximum share of the IP camera industry.