IoT in Oil and Gas Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

IoT in Oil and Gas Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

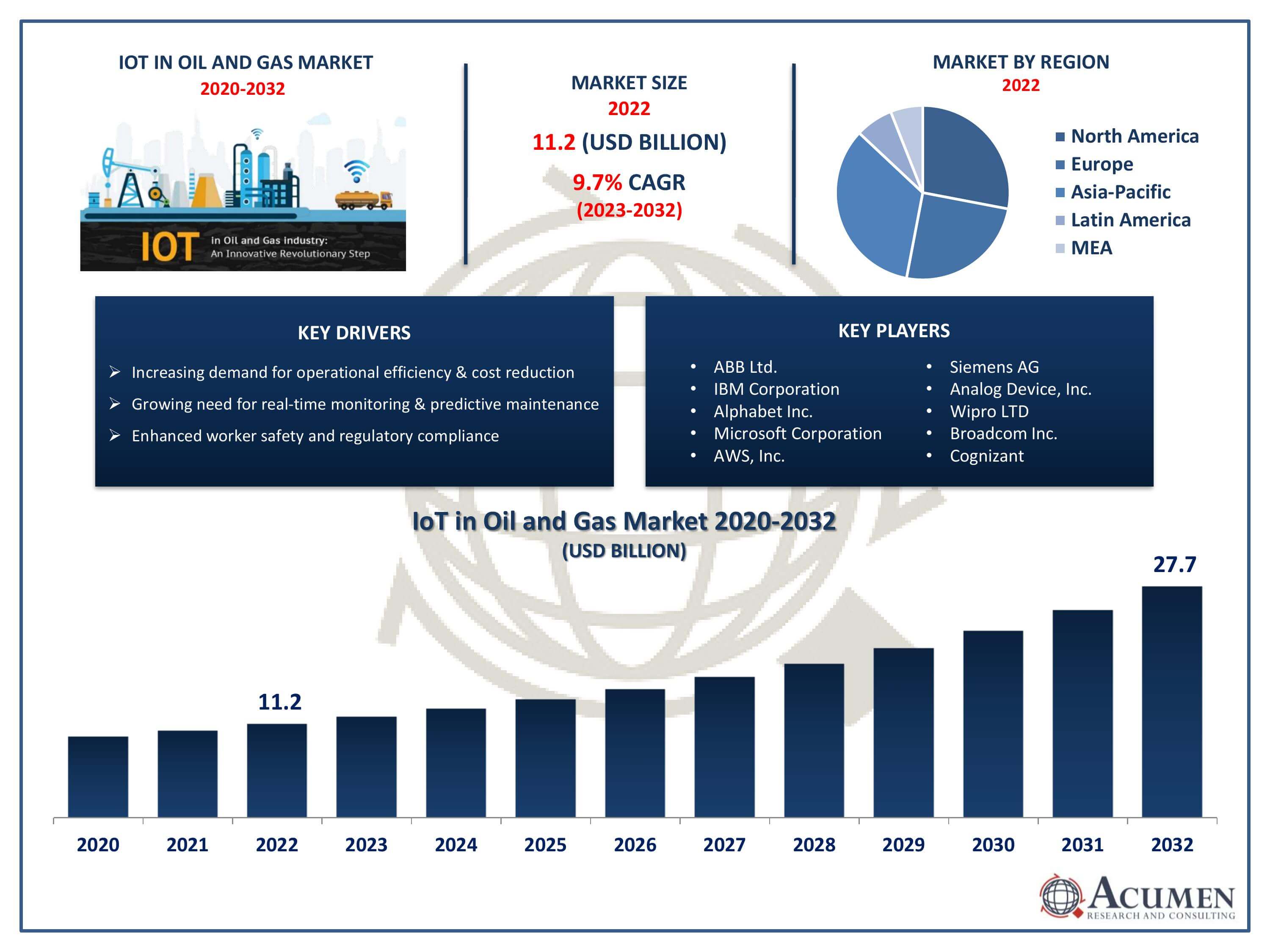

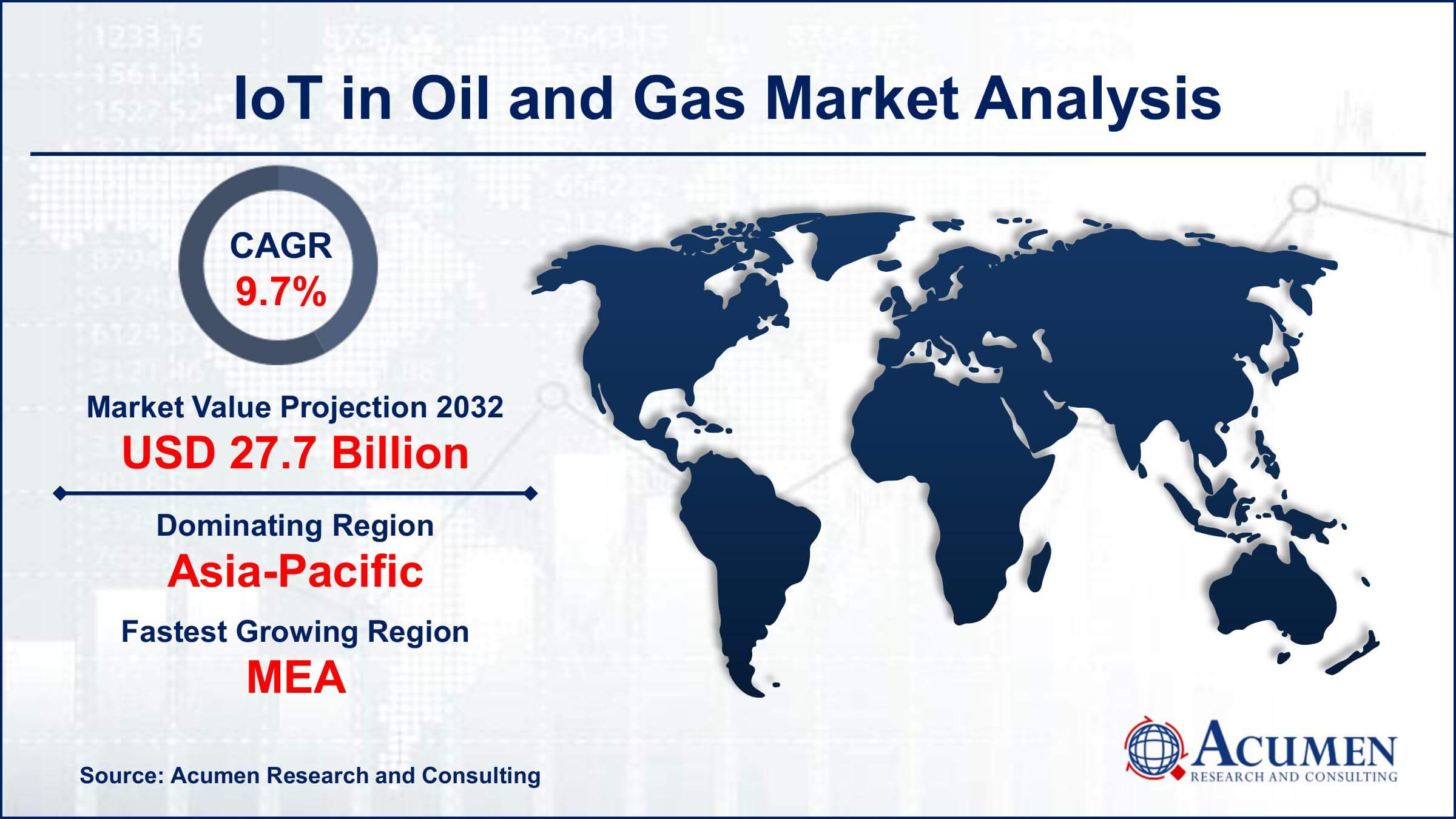

The IoT in Oil and Gas Market Size accounted for USD 11.2 Billion in 2022 and is projected to achieve a market size of USD 27.7 Billion by 2032 growing at a CAGR of 9.7% from 2023 to 2032.

IoT in Oil and Gas Market Highlights

- Global IoT in Oil and Gas Market revenue is expected to increase by USD 27.7 Billion by 2032, with a 9.7% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 38% of IoT in Oil and Gas Market share in 2022

- Middle East and Africa IoT in Oil and Gas Market growth will record a CAGR of more than 10.1% from 2023 to 2032

- By product, the upstream segment captured the largest market share in 2022.

- By application, the fleet and asset management segment is predicted to grow at the fastest CAGR between 2023 and 2032

- Increasing demand for operational efficiency and cost reduction, drives the IoT in Oil and Gas Market value

The Internet of Things (IoT) in the oil and gas industry refers to a network of connected devices, sensors, and software applications that collect and exchange data in real time. IoT technology is transforming the way the industry operates by providing valuable insights, improving operational efficiency, and ensuring worker safety. In oil and gas exploration and production, IoT devices are deployed in remote locations and harsh environments to monitor equipment health, detect leaks, optimize drilling processes, and enhance predictive maintenance. Additionally, IoT-enabled sensors are used in pipelines and refineries to monitor the flow of oil and gas, detect anomalies, and prevent accidents, ensuring the integrity of the infrastructure.

The market for IoT in the oil and gas industry has been experiencing significant growth in recent years. The adoption of IoT technology has become crucial for oil and gas companies looking to optimize their operations, reduce costs, and enhance safety. The increasing need for real-time monitoring, predictive maintenance, and efficient resource utilization is driving the demand for IoT solutions in the industry. Moreover, advancements in sensor technologies, data analytics, and communication protocols have made IoT applications more reliable and scalable for the oil and gas sector.

Global IoT in Oil and Gas Market Trends

Market Drivers

- Increasing demand for operational efficiency and cost reduction

- Growing need for real-time monitoring and predictive maintenance

- Enhanced worker safety and regulatory compliance

- Advancements in sensor technology and data analytics

- Rising investments in IoT solutions by oil and gas companies

Market Restraints

- Data security and privacy concerns

- High initial implementation costs

Market Opportunities

- Expansion of IoT applications in upstream, midstream, and downstream activities

- Integration of IoT with artificial intelligence and machine learning for advanced analytics

IoT in Oil and Gas Market Report Coverage

| Market | Green Bio Chemicals Market |

| Green Bio Chemicals Market Size 2022 | USD 11.2 Billion |

| Green Bio Chemicals Market Forecast 2032 | USD 27.7 Billion |

| Green Bio Chemicals Market CAGR During 2023 - 2032 | 9.7% |

| Green Bio Chemicals Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Solution, By Industry Stream, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABB Ltd., IBM Corporation, Alphabet Inc., Microsoft Corporation, Amazon Web Services, Inc., Siemens AG, Analog Device, Inc., Wipro LTD, Broadcom Inc., Cognizant, C3 IoT, Inc., and CISCO Systems Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

IoT in oil and gas is revolutionizing the industry by providing unprecedented insights into operations, enhancing efficiency, and ensuring safety. IoT devices are deployed throughout the oil and gas value chain, from upstream exploration and drilling to midstream transportation and downstream refining processes. These devices can monitor equipment health, detect leaks, optimize drilling techniques, and facilitate predictive maintenance. Moreover, IoT sensors are instrumental in monitoring the structural integrity of pipelines and refineries, ensuring the smooth flow of oil and gas, and detecting potential issues before they escalate into major incidents. By harnessing the power of IoT, the industry can make data-driven decisions, reduce downtime, and ultimately increase productivity.

The Internet of Things (IoT) in the oil and gas industry is experiencing robust growth, driven by the industry's increasing recognition of its potential to enhance operational efficiency, improve safety, and reduce costs. IoT technology enables oil and gas companies to collect and analyze vast amounts of real-time data from sensors placed on equipment, pipelines, and facilities. This data-driven approach facilitates predictive maintenance, allowing companies to identify potential issues before they lead to costly downtime. Moreover, IoT applications enhance the safety of workers by enabling remote monitoring of equipment in hazardous environments, thereby reducing the need for human intervention in potentially dangerous situations. One of the key factors fueling the growth of IoT in the oil and gas sector is the industry's digital transformation initiatives. Companies are increasingly investing in IoT solutions to modernize their operations and gain a competitive edge.

IoT in Oil and Gas Market Segmentation

The global IoT in Oil and Gas Market segmentation is based on solution, industry stream, application, and geography.

IoT in Oil and Gas Market By Solution

- Sensing

- Cloud and Edge Computing

- Communication

- Data Management

According to the IoT in oil and gas industry analysis, the sensing segment accounted for the largest market share in 2022. This growth is due to its pivotal role in providing real-time data and actionable insights. Sensing devices, equipped with various sensors such as pressure sensors, temperature sensors, and flow sensors, are deployed across oil rigs, pipelines, and refineries. These sensors continuously collect data on equipment performance, environmental conditions, and the status of oil and gas reserves. The data generated by these sensors is crucial for predictive maintenance, enabling companies to identify potential issues before they escalate into costly failures. This proactive approach not only minimizes downtime but also enhances the overall operational efficiency of oil and gas facilities. Furthermore, the adoption of advanced sensing technologies in the oil and gas sector is driven by the industry's increasing focus on safety and environmental compliance.

IoT in Oil and Gas Market By Industry Stream

- Upstream

- Downstream

- Midstream

In terms of industry streams, the upstream segment is expected to witness significant growth in the coming years. IoT solutions are transforming the upstream operations by providing real-time monitoring and data analytics capabilities. In exploration, IoT sensors are deployed to gather geological data, analyze seismic activities, and assess reservoir conditions. This data-driven approach enhances the accuracy of exploration efforts, enabling companies to identify potential oil and gas reserves more efficiently. In drilling operations, IoT-enabled equipment and sensors are used to optimize the drilling process. These sensors provide valuable data on drill bit performance, downhole conditions, and formation properties. By analyzing this data in real time, drilling engineers can make informed decisions, leading to increased drilling efficiency and reduced operational costs.

IoT in Oil and Gas Market By Application

- Fleet and Asset Management

- Pipeline Monitoring

- Security Management

- Preventive Maintenance

- Others

According to the IoT in oil and gas market forecast, the fleet and asset management segment is expected to witness significant growth in the coming years. IoT technology is playing a crucial role in tracking, monitoring, and optimizing the utilization of fleets and assets in this industry. For oil and gas companies, managing a vast array of vehicles, drilling equipment, pipelines, and other assets spread across remote and often challenging environments is a complex task. IoT-enabled sensors and devices provide real-time data on the location, condition, and performance of these assets, ensuring they are utilized to their maximum potential. In fleet management, IoT solutions enable real-time tracking of vehicles and equipment, allowing companies to optimize routes, reduce fuel consumption, and enhance driver safety. Advanced IoT applications also facilitate predictive maintenance, where sensors monitor the health of vehicles and alert operators about potential issues before they escalate, reducing downtime and maintenance costs.

IoT in Oil and Gas Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

IoT in Oil and Gas Market Regional Analysis

Asia-Pacific is emerging as a dominant force in the IoT market for oil and gas due to a combination of factors that uniquely position the region for significant growth. One of the primary drivers is the rapid industrialization and urbanization occurring in countries across the Asia-Pacific region, leading to a surge in energy demand. As a result, oil and gas companies in these countries are increasingly embracing IoT technologies to enhance operational efficiency, reduce costs, and ensure a stable energy supply. The need to meet the growing energy demands efficiently has accelerated the adoption of IoT solutions, making Asia-Pacific a hub for innovation and implementation in the oil and gas sector. Moreover, Asia-Pacific countries are investing heavily in digital transformation initiatives. Governments and private enterprises in countries like China, India, Japan, and South Korea are supporting IoT research, development, and deployment through strategic investments and favorable policies. This support creates a conducive environment for the proliferation of IoT technologies in the oil and gas industry. Additionally, the presence of established technology providers and a robust ecosystem of IoT startups further fuels the growth of the IoT market in the region.

IoT in Oil and Gas Market Player

Some of the top IoT in oil and gas market companies offered in the professional report include ABB Ltd., IBM Corporation, Alphabet Inc., Microsoft Corporation, Amazon Web Services, Inc., Siemens AG, Analog Device, Inc., Wipro LTD, Broadcom Inc., Cognizant, C3 IoT, Inc., and CISCO Systems Inc.

Frequently Asked Questions

How big is the IoT in oil and gas market?

The market size of IoT in oil and gas was USD 11.2 Billion in 2022.

What is the CAGR of the global IoT in oil and gas market from 2023 to 2032?

The CAGR of IoT in oil and gas is 9.7% during the analysis period of 2023 to 2032.

Which are the key players in the IoT in oil and gas market?

The key players operating in the global market are including ABB Ltd., IBM Corporation, Alphabet Inc., Microsoft Corporation, Amazon Web Services, Inc., Siemens AG, Analog Device, Inc., Wipro LTD, Broadcom Inc., Cognizant, C3 IoT, Inc., and CISCO Systems Inc.

Which region dominated the global IoT in oil and gas market share?

Asia-Pacific held the dominating position in IoT in oil and gas industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

MEA region exhibited fastest growing CAGR for market of IoT in oil and gas during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global IoT in oil and gas industry?

The current trends and dynamics in the IoT in oil and gas industry include increasing demand for operational efficiency and cost reduction, growing need for real-time monitoring and predictive maintenance, and enhanced worker safety and regulatory compliance.

Which industry stream held the maximum share in 2022?

The downstream industry stream held the maximum share of the IoT in oil and gas industry.