IoT in Aviation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

IoT in Aviation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

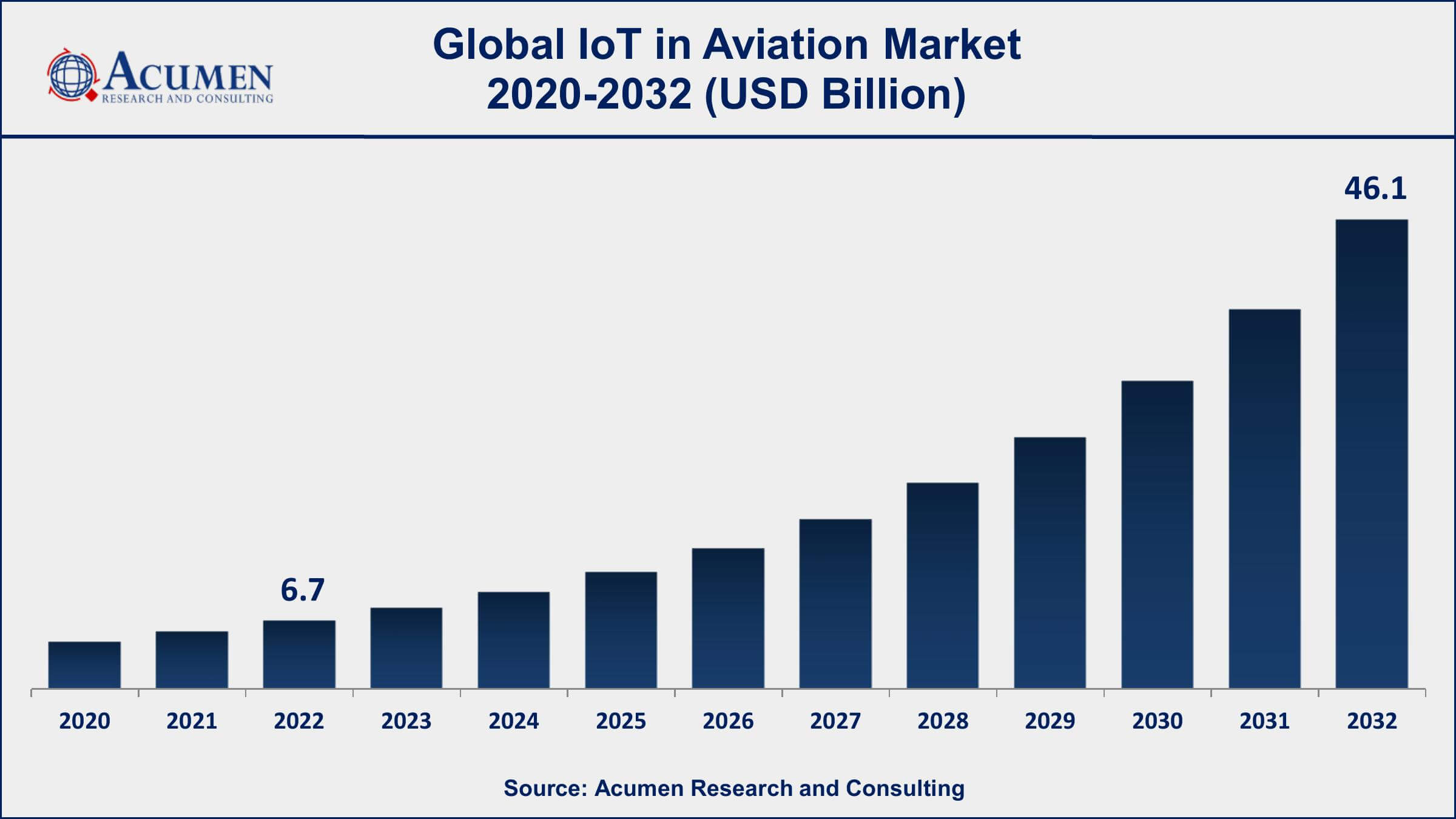

The Global IoT in Aviation Market Size accounted for USD 6.7 Billion in 2022 and is projected to achieve a market size of USD 46.1 Billion by 2032 growing at a CAGR of 21.6% from 2023 to 2032.

IoT in Aviation Market Highlights

- Global IoT in Aviation Market revenue is expected to increase by USD 46.1 Billion by 2032, with a 21.6% CAGR from 2023 to 2032

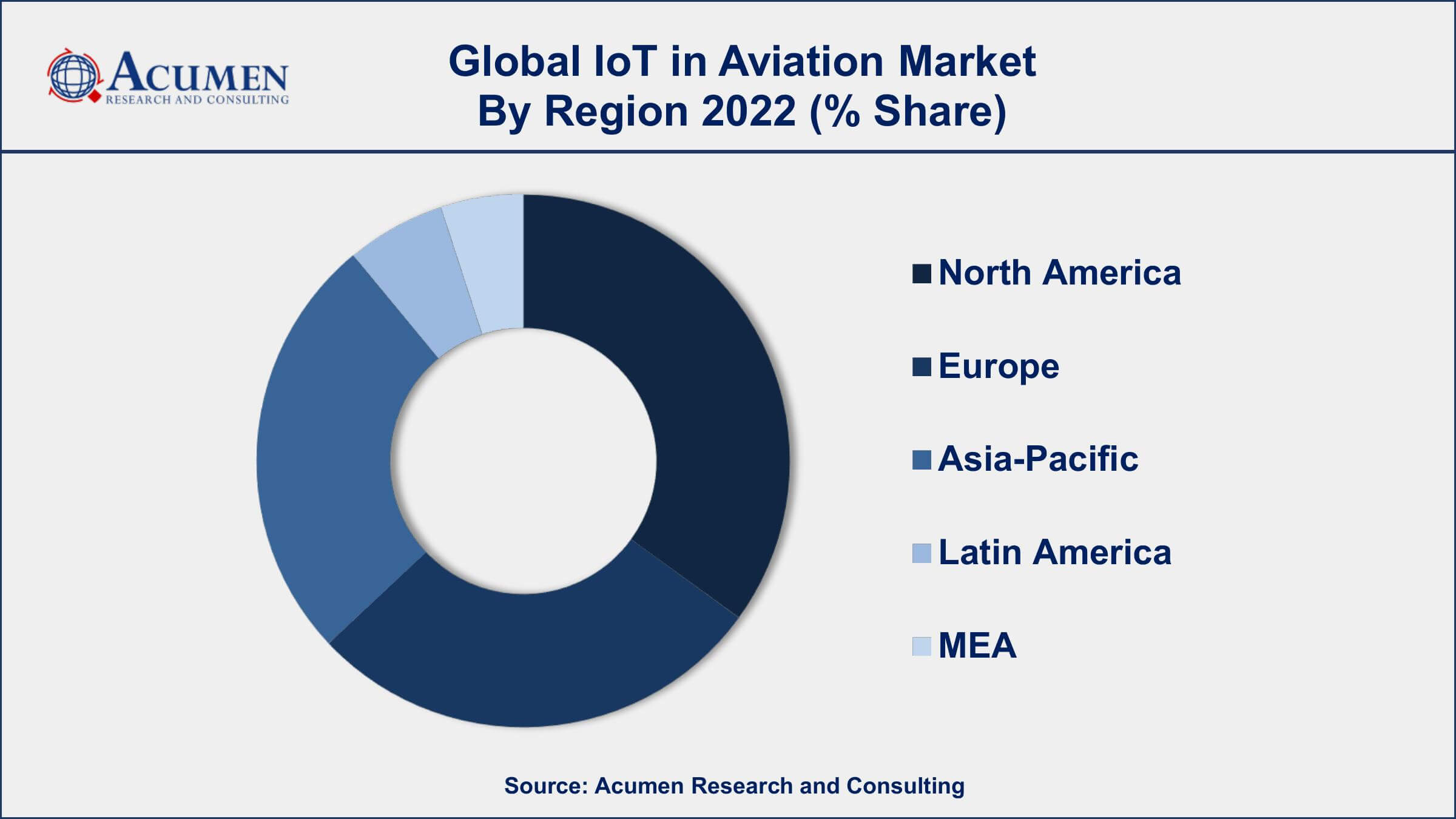

- North America region led with more than 33% of IoT in Aviation Market share in 2022

- Asia-Pacific IoT in aviation market growth will record a CAGR of around 23% from 2023 to 2032

- By application, the asset management segment has accounted more than 31% of the revenue share in 2022

- By end-use, the airport segment has generated of about 36% of the revenue share in 2022

- Increasing demand for real-time data and operational efficiency in the aviation industry, drives the IoT in Aviation Market value

IoT (Internet of Things) in aviation refers to the integration of interconnected devices, sensors, and systems within the aviation industry to enable real-time data collection, analysis, and communication. It involves leveraging IoT technology to connect various components of an aircraft, such as engines, avionics systems, cabin systems, and maintenance systems, as well as ground infrastructure. The aim is to improve operational efficiency, enhance passenger experience, enable predictive maintenance, and optimize overall safety and security.

The market growth of IoT in aviation has been significant in recent years and is expected to continue expanding in the coming years. The aviation industry recognizes the immense potential of IoT in improving various aspects of operations. The adoption of IoT solutions in aviation can lead to substantial cost savings, streamlined processes, and enhanced decision-making capabilities. Airlines are leveraging IoT to monitor and optimize fuel consumption, track and maintain aircraft components, improve maintenance processes, and enhance passenger services through personalized experiences. Furthermore, the increasing demand for connected aircraft and the rise of smart airports are driving the growth of IoT in aviation.

Global IoT in Aviation Market Trends

Market Drivers

- Increasing demand for real-time data and operational efficiency in the aviation industry

- Growing emphasis on passenger safety and security

- Advancements in connectivity technologies, such as 5G, enabling seamless communication and data exchange

- Rise in the adoption of predictive maintenance and condition monitoring to reduce downtime and improve aircraft performance

Market Restraints

- Concerns regarding data security and privacy, as IoT devices collect and transmit sensitive information

- High implementation costs and complexities associated with integrating IoT technologies into existing aviation infrastructure

Market Opportunities

- Growing focus on digitalization and automation in the aviation industry

- Emergence of innovative use cases, such as remote monitoring of aircraft systems and components

IoT in Aviation Market Report Coverage

| Market | IoT in Aviation Market |

| IoT in Aviation Market Size 2022 | USD 6.7 Billion |

| IoT in Aviation Market Forecast 2032 | USD 46.1 Billion |

| IoT in Aviation Market CAGR During 2023 - 2032 | 21.6% |

| IoT in Aviation Market Analysis Period | 2020 - 2032 |

| IoT in Aviation Market Base Year | 2022 |

| IoT in Aviation Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cisco Systems, Inc., IBM Corporation, Honeywell International Inc., Siemens AG, Microsoft Corporation, General Electric Company, Rockwell Collins, Inc., Thales Group, Bosch.IO, Oracle Corporation, Intel Corporation, and SAP SE. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

IoT (Internet of Things) in aviation is a implementation of interconnected devices, sensors, and systems within the aviation industry to enable seamless communication, data collection, and analysis. It involves integrating various components, such as aircraft systems, ground infrastructure, and passenger devices, to create a networked ecosystem that enhances operational efficiency, safety, and passenger experience. By harnessing IoT technology, aviation stakeholders can leverage real-time data and insights to optimize processes, monitor critical systems, and make informed decisions.

The applications of IoT in aviation are diverse and have the potential to transform various aspects of the industry. One significant application is predictive maintenance. IoT sensors can continuously monitor the health and performance of aircraft components, such as engines, avionics systems, and landing gear. By collecting real-time data and applying advanced analytics, maintenance teams can identify potential issues or failures in advance, allowing for proactive maintenance and minimizing aircraft downtime.

The aviation IoT market has witnessed robust growth in recent years and is expected to continue expanding at a significant pace. The aviation industry recognizes the potential of IoT in improving operational efficiency, enhancing passenger experience, and optimizing safety measures. The increasing adoption of connected aircraft, smart airports, and advanced IoT solutions is driving market growth. One of the key factors fueling the growth of the aviation IoT market is the pursuit of operational efficiency. Airlines are leveraging IoT technology to optimize fuel consumption, streamline maintenance processes, and enhance flight operations. Real-time data collection and analysis enable proactive maintenance, minimizing downtime and reducing operational costs. Additionally, IoT solutions enable airlines to optimize fleet management, improve route planning, and enhance resource allocation, leading to increased operational efficiency.

IoT in Aviation Market Segmentation

The global IoT in Aviation Market segmentation is based on component, application, end-use, and geography.

IoT in Aviation Market By Component

- Hardware

- Service

- Software

According to the IoT in aviation industry analysis, the hardware segment accounted for the largest market share in 2022. Hardware components play a crucial role in enabling connectivity, data collection, and communication within the aviation ecosystem. The increasing adoption of IoT solutions in aviation has fueled the demand for specialized hardware devices and sensors. One of the key drivers for the growth of the hardware segment is the deployment of IoT-enabled devices in aircraft systems. These devices include sensors, actuators, and communication modules that enable the collection and transmission of real-time data. For example, IoT sensors can monitor engine performance, temperature, fuel levels, and other critical parameters, providing insights for predictive maintenance and optimizing operational efficiency. As airlines seek to leverage IoT capabilities for data-driven decision-making, the demand for specialized hardware components is expected to grow.

IoT in Aviation Market By Application

- Ground Operations

- Aircraft Operations

- Passenger Experience

- Asset Management

- Others

In terms of applications, the asset management segment is expected to witness significant growth in the coming years. Asset management in aviation refers to the monitoring, tracking, and optimization of various assets such as aircraft, engines, components, and ground support equipment. IoT solutions play a crucial role in enabling real-time asset monitoring, predictive maintenance, and efficient utilization of resources. One of the key drivers for the growth of the asset management segment is the need for proactive maintenance and cost optimization. IoT-enabled asset management systems allow airlines and maintenance providers to monitor the health and performance of critical assets in real-time. By leveraging sensors, data analytics, and machine learning algorithms, potential issues can be identified in advance, enabling predictive maintenance. This helps in reducing unscheduled downtime, optimizing maintenance schedules, and improving the overall operational efficiency of the aviation industry.

IoT in Aviation Market By End-Use

- Airport

- MRO

- Airline Operators

- Aircraft OEM

According to the IoT in aviation market forecast, the airport segment is expected to witness significant growth in the coming years. IoT solutions are transforming airports into smart, connected ecosystems that enhance operational efficiency, passenger experience, and overall safety and security. One of the key drivers for the growth of the airport segment is the increasing focus on enhancing operational efficiency. IoT technology enables airports to automate and optimize various processes, such as baggage handling, security screening, and passenger flow management. By integrating IoT devices, sensors, and data analytics, airports can gather real-time insights and make informed decisions to streamline operations, reduce delays, and improve resource allocation. Smart airport solutions powered by IoT enable seamless coordination between different airport stakeholders, resulting in enhanced efficiency and productivity.

IoT in Aviation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

IoT in Aviation Market Regional Analysis

Geographically, North America dominates the IoT in the aviation market in 2022. North America boasts a robust aviation sector with a significant number of airlines, airports, and aviation service providers. The region has a highly developed infrastructure and a strong emphasis on technological advancements. This foundation provides a conducive environment for the adoption of IoT solutions in aviation. The presence of major aircraft manufacturers, technology providers, and industry leaders in North America drives innovation and accelerates the implementation of IoT technologies across the aviation ecosystem. Moreover, North America is home to several prominent technology companies specializing in IoT solutions and services. These companies have played a pivotal role in driving the growth of the IoT in aviation market by developing and deploying innovative IoT platforms, hardware components, and software applications. The expertise and resources available in the region foster the development and deployment of cutting-edge IoT solutions tailored specifically for the aviation industry.

IoT in Aviation Market Player

Some of the top IoT in aviation market companies offered in the professional report include Cisco Systems, Inc., IBM Corporation, Honeywell International Inc., Siemens AG, Microsoft Corporation, General Electric Company, Rockwell Collins, Inc., Thales Group, Bosch.IO, Oracle Corporation, Intel Corporation, and SAP SE.

Frequently Asked Questions

What was the market size of the global IoT in aviation in 2022?

The market size of IoT in aviation was USD 6.7 Billion in 2022.

What is the CAGR of the global IoT in aviation market from 2023 to 2032?

The CAGR of IoT in aviation is 21.6% during the analysis period of 2023 to 2032.

Which are the key players in the IoT in aviation market?

The key players operating in the global market are including Cisco Systems, Inc., IBM Corporation, Honeywell International Inc., Siemens AG, Microsoft Corporation, General Electric Company, Rockwell Collins, Inc., Thales Group, Bosch.IO, Oracle Corporation, Intel Corporation, and SAP SE.

Which region dominated the global IoT in aviation market share?

North America held the dominating position in IoT in aviation industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of IoT in aviation during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global IoT in aviation industry?

The current trends and dynamics in the IoT in aviation industry include increasing demand for real-time data and operational efficiency in the aviation industry, and growing emphasis on passenger safety and security.

Which application held the maximum share in 2022?

The asset management application held the maximum share of the IoT in aviation industry.