5G Chipset Market

Published :

Report ID:

Pages :

Format :

5G Chipset Market

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global 5G Chipset Market accounted for US$ 1,612 Mn in 2021 and is expected to reach US$ 145,288 Mn by 2030 with a considerable CAGR of 66.3% during the forecast timeframe of 2022 to 2030.

As seen in recent years, 5G networks are beginning to emerge and spread out, promising to transfer vast amounts of data 100-200X quicker than 4G LTE Volte. However, in order to realize the true value of 5G, many components of the IoT infrastructure, such as modems, processors, and logic chips at leading-edge nodes and products, would need more memory output and better performance to support next-generation applications. As the market for 5G and IoT devices grows, so does the demand for high-performance, dependable semiconductor chips. A 5G chipset is a specialized component of customer premises equipment and network infrastructure equipment that enables the end-user to set up a wireless network in accordance with 5G network specifications.

Drivers

· Increasing cellular Internet of Things connections

· Rising demand for high-speed internet and extensive network coverage

· Growth in mobile data traffic

· Demand for connected devices and vehicles is on the rise

Restraints

· Concerns about data security and information privacy

· High initial cost for chipsets

Opportunity

· Increased use of automation in the workplace and on the production line in the industry

· Growing Smart city projects in developing economies

Report Coverage

| Market | 5G Chipset Market |

| Market Size 2021 | US$ 1,612 Mn |

| Market Forecast 2030 | US$ 145,288 Mn |

| CAGR | 66.3% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Frequency Type , By Type, By Process Node, By End Use, By Industry Vertical And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Qualcomm Technologies, Inc., Broadcom, Intel Corporation, Nokia Corporation, Samsung Electronics Co., Ltd., Mediatek Inc., Anokiwave, Xilinx Inc., Huawei Technologies Co., Ltd., Unisoc Communications, Inc., Qorvo, and Infineon Technologies AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

5G Chipset Market Dynamics

The primary factors driving market expansion are the growing demand for high-speed internet and widespread network availability, increased cellular IoT interconnection, and an increase in mobile data traffic. Furthermore, the next-generation low-power 5G chipset solution is expected to boost performance and productivity, enabling new consumer experiences and the interconnection of emerging markets. Furthermore, the increase in demand for 5G network infrastructure technologies facilitates the 5G chipset market forecast because it promotes the connecting of new sectors, allowing for increased efficiency and cost reduction, and thus boosting the 5G chipset industry growth.

However, the high cost of 5G chipsets for portable devices will slow the market's growth rate. Other factors, such as concerns about data security and privacy, will stymie market growth. Additionally, technical aspects of RF devices' performance at higher frequencies will present a challenge to the market.

Market Segmentation

Market by Frequency Type

· sub-6GHz

· mmWave

· sub-6GHz + mmWave

Based on the frequency type, the sub-6GHz segment is expected to expand dramatically in the coming years. This is due to major industry partners' early introductions of 5G chipset components that support the sub-6GHz spectrum for connected devices, connected automobiles, and laptops. As the technology for 5G deployment advances, the quantity of testing required for the 5G chipset, hardware, and other devices grows. As a result, the segment will grow as the number of devices using 5g technology increases in the coming years.

Market by Type

· Modem

· RFIC

o RF transceiver

o RF front end

In terms of type, the RFIC sector will account for the majority of the market share in 2021. This component is further subdivided into two parts: radio frequency transceiver and radiofrequency FE. Mobile devices and telecommunications networks are going to be the most important growth drivers for the RFIC segment. The massive increase in the worldwide smartphone population will force consumers to use 5G-enabled services. As a result, increasing adoption of sophisticated applications such as augmented reality, the Internet of Things (IoT), autonomous vehicles, and other technological breakthroughs are likely to support the RFIC segment's growth.

Market by Process Node

· 7 nm

· 10 nm

· Others

In terms of process nodes, the 7nm type is expected to expand the most in the 5G chipset industry over the forecasting years. Currently, 7nm is among the most recent process nodes in production, offering shrinking transistors, increased silicon area utilization, and improved power efficiency, and has been in production for a few months. 7nm is a technology node that is one of the most sophisticated FinFET process nodes used in the design and manufacture of 5G devices. Furthermore, as technology advances, major market competitors are now focusing on designing and producing 7 nm and 10 nm chipset processing nodes to handle high band frequencies.

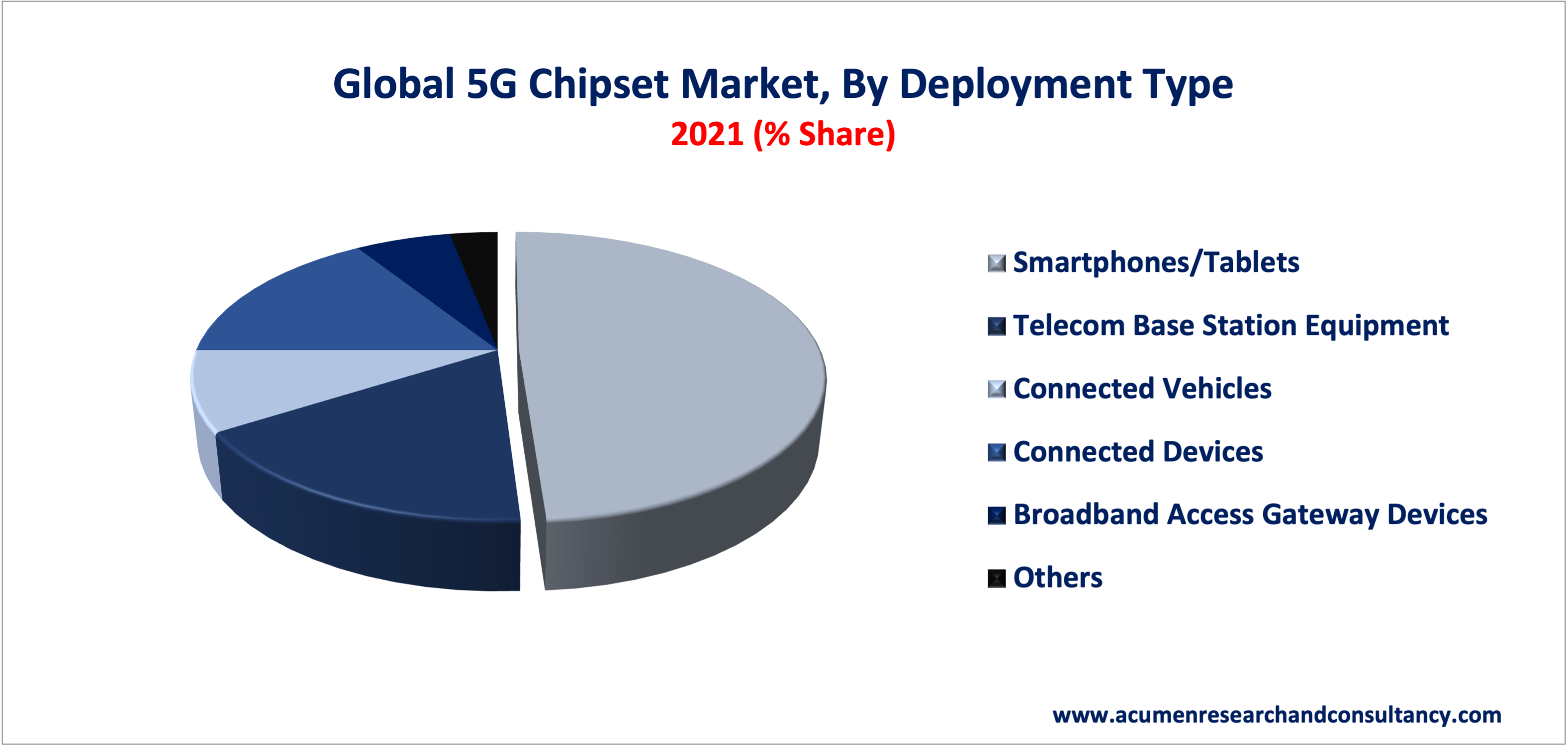

Market by End Use

· Smartphones/Tablets

· Telecom Base Station Equipment

· Connected Vehicles

· Connected Devices

· Broadband Access Gateway Devices

· Others

In terms of End Use, the smartphone segment will account for more than half of the market in 2021. This growth can be attributed to the growing demand for 5G-enabled technology in smartphones, which is used to play online games, watch high-resolution 4K videos, and use voice conferencing and mobile applications.

Furthermore, the demand for connected vehicles is expected to expand significantly over time, owing to the rising demand for autonomous vehicles and increased sales of electric vehicles. Due to 5G technology, system and application developers in the automotive sector can create a wide range of applications for better customer performance, such as vehicle-to-infrastructure, vehicle-to-vehicle, vehicle-to-pedestrian, and vehicle-to-network.

Market by Industry Vertical

· Manufacturing

· Energy & Utilities

· Media & Entertainment

· IT & Telecom

· Transportation & Logistics

· Healthcare

· Others

In terms of industry verticals, the IT and telecom industries will lead the market in 2021. As more industry verticals express interest in private networks and financial projections become available, 5G technology is poised to expand the IT and telecom sector beyond the traditional sphere of service providers. With 5G, IT and telecom companies may rewrite business as usual and increase market share, specifically by supporting 5G-relivant service providers and end-users.

Furthermore, due to its continued advancement in advancing societies, transforming industries, and vastly improving day-to-day experiences, 5G technology is becoming increasingly important around the world. Similarly, as technology advances, there is a greater demand for next generation 5G chipsets in a variety of industries, including IT and telecommunications, power and energy, manufacturing, entertainment and media, transportation, and healthcare, for faster connectivity, ultra-low latency, and increased bandwidth.

5G Chipset Market Regional Overview

North America

· U.S.

· Canada

Europe

· U.K.

· France

· Germany

· Spain

· Rest of Europe

Latin America

· Mexico

· Brazil

· Rest of Latin America

Asia-Pacific

· India

· China

· Japan

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· South Africa

· GCC

· Rest of Middle East & Africa

In 2020, Asia-Pacific dominated the 5G chipset market with the largest share. This is due to a significant increase in investments in the development of 5G-enabled devices and base stations that support 5G New Radio frequencies. Increased R&D efforts, investments, and collaborations among firms interested in 5G in countries such as India, China, and South Korea are driving the Asia-Pacific market's expansion. Major regional firms like Samsung Electronics, Ltd. and Huawei Co., Ltd. are making significant investments in the development of 5G chipset modules. China has made significant contributions to the development of 5G network infrastructure. Furthermore, 5G has been launched in 9 countries, with 12 more in Asia-Pacific set to follow suit in the coming years.

Competitive Landscape

Some of the prominent players in global 5G chipsetmarket are Qualcomm Technologies, Inc., Broadcom, Intel Corporation, Nokia Corporation, Samsung Electronics Co., Ltd., Mediatek Inc., Anokiwave, Xilinx Inc., Huawei Technologies Co., Ltd., Unisoc Communications, Inc., Qorvo, and Infineon Technologies AG.

Frequently Asked Questions

How much was the estimated value of the global 5G chipset market in 2021?

The estimated value of global 5G chipset market in 2021 was accounted to be US$1,612 Mn.

What will be the projected CAGR for global 5G chipset market during forecast period of 2022 to 2030?

The projected CAGR of 5G chipset during the analysis period of 2022 to 2030 is 66.3%.

Which are the prominent competitors operating in the market?

The prominent players of the global 5G chipset market involve Qualcomm Technologies, Inc., Broadcom, Intel Corporation, Nokia Corporation, Samsung Electronics Co., Ltd., Mediatek Inc., Anokiwave, Xilinx Inc., Huawei Technologies Co., Ltd., Unisoc Communications, Inc., Qorvo, and Infineon Technologies AG.

Which region held the dominating position in the global 5G chipset market?

Asia-Pacific held the dominating share for 5G chipset during the analysis period of 2022 to 2030

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for 5G chipset during the analysis period of 2022 to 2030

What are the current trends and dynamics in the global 5G chipset market?

Increasing cellular Internet of Things connections, high-speed internet, extensive network coverage, and growing demand for connected devices and vehicles are the prominent factors that fuel the growth of global 5G chipset market

By segment End Use, which sub-segment held the maximum share?

Based on End Use, smartphone segment held the maximum share for 5G chipset market in 2021