Insurtech Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Insurtech Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

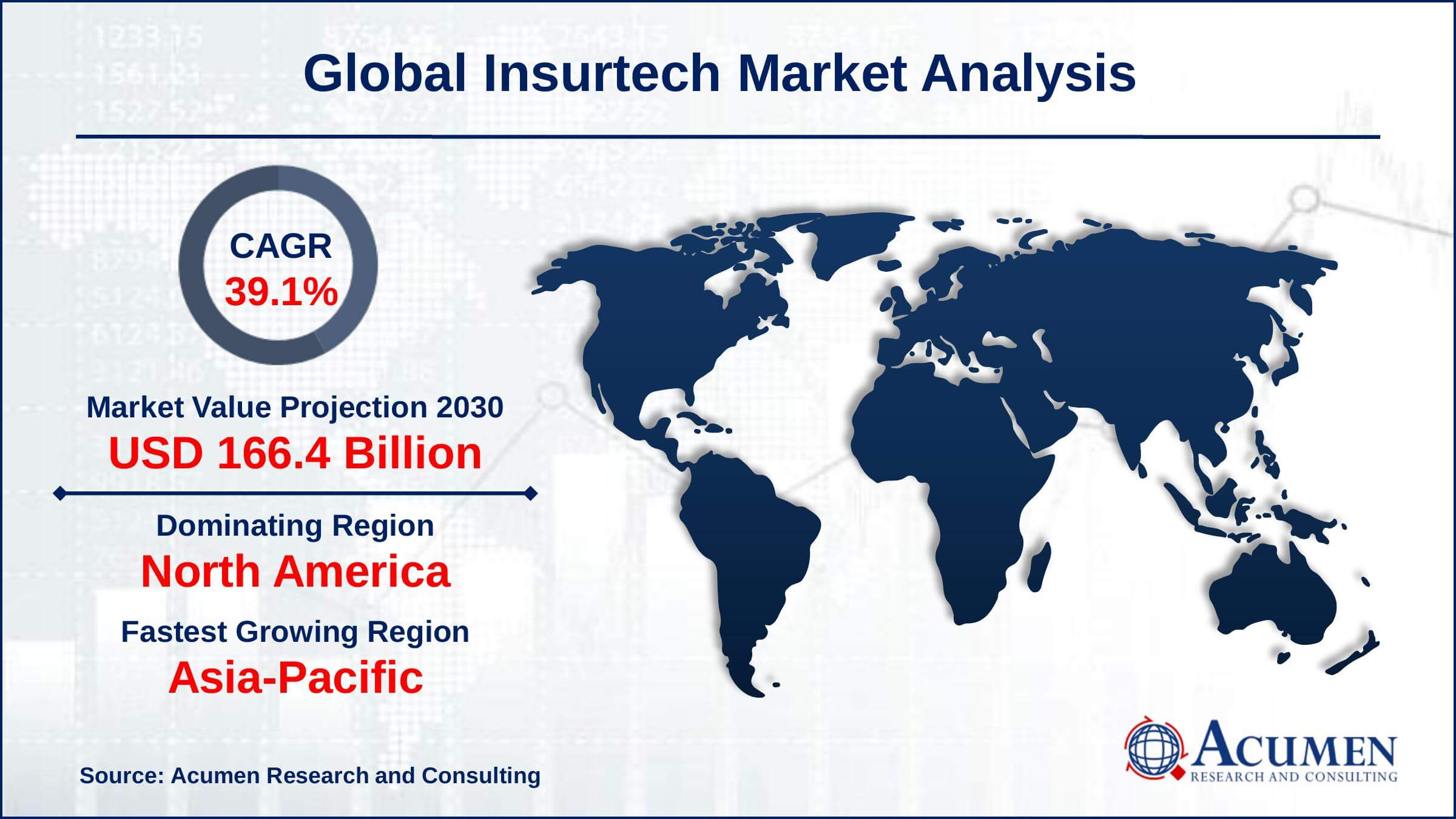

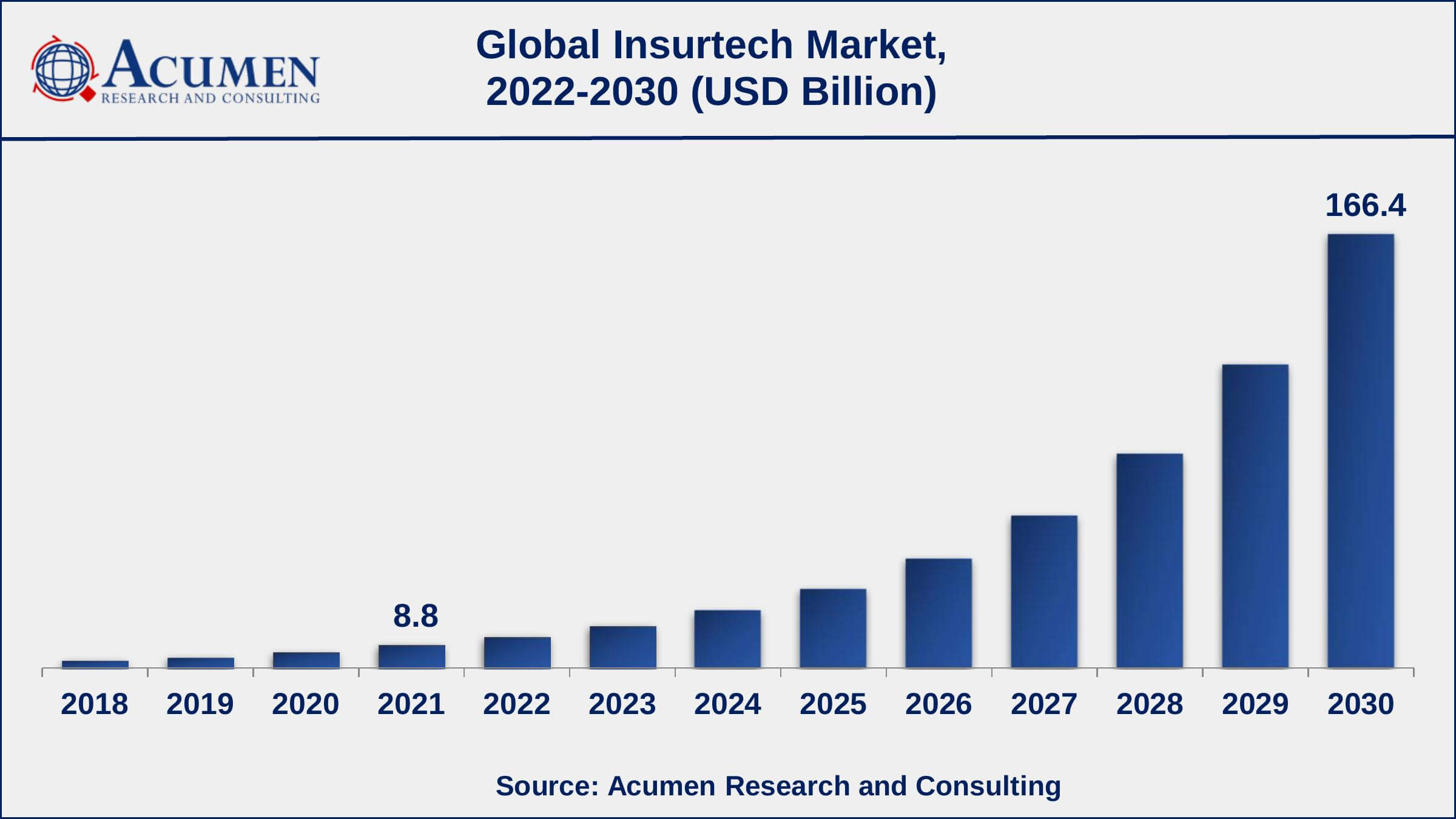

The Global Insurtech Market Size valued for USD 8.8 Billion in 2021 and is projected to occupy a market size of USD 166.4 Billion by 2030 growing at a CAGR of 39.1% from 2022 to 2030.

Insurtech, or insurance technology, is a growing phenomenon that has allowed the insurance industry to reconnect with a massive customer base comprised of High Net Worth individuals (HNWI), upper-middle-income individuals, and lower-middle-income individuals. Insurtech platforms have the potential to assist insurance companies in improving their relevance to customers and regaining their trust. It will help with customer engagement. COVID-19 positively impacted the insurtech market, as the value of insurance plans among customers has skyrocketed. Customers were able to choose from a wide range of insurance policies, including health and life insurance, personal insurance, home insurance, and more, which increased sales of insurtech solutions significantly.

Insurtech Market Report Statistics

- Global insurtech market revenue is projected to reach USD 166.4 Billion by 2030 with a CAGR of 39.1% from 2022 to 2030

- North America insurtech market share gathered more than USD 3.2 billion in 2021

- Asia-Pacific insurtech market growth will record significant CAGR from 2022 to 2030

- According to the IBEF, India’s overall insurance density stood at US$ 78 in 2021

- As per a recent study, India accounts for 35% of the USD 3.66 billion invested in insurtech ventures nationwide

- Based on type, the health insurance sub-segment achieved approx 24% shares in 2021

- Among services, the managed services sub-segment occupied around 41% of shares in 2021

- The touchless claim process powered by Artificial Intelligence is a prominent Insurtech market trend that drives the industry demand

Global Insurtech Market Dynamics

Market Drivers

- Massive growth in the BFSI sector

- Growing digitization of insurance service models

- Rapidly rising number of insurance claims

- Surging trend of developing more tailored user experiences

Market Restraints

- Dynamic legal and regulatory framework

- Data security and privacy concerns

Market Opportunities

- Increasing shift towards cloud computing

- The growing trend of microinsurance

Insurtech Market Report Coverage

| Market | Insurtech Market |

| Insurtech Market Size 2021 | USD 8.8 Billion |

| Insurtech Market Forecast 2030 | USD 166.4 Billion |

| Insurtech Market CAGR During 2022 - 2030 | 39.1% |

| Insurtech Market Analysis Period | 2018 - 2030 |

| Insurtech Market Base Year | 2021 |

| Insurtech Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Insurance Type, By Technology, By Services, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Damco Group, DXC Technology Company, Insurance Technology Services, InsuerTech Nova, KFin Technologies, Majesco, Oscar Insurance, Quantemplatem, Shift Technology, Trov, Inc., Wipro Limited, and ZhongAn Insurance. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Insurtech Market Growth Factors

The enormous expansion in the banking, finance, and insurance sectors is primarily driving the insurtech market value. The market is growing as a result of increased customer data on insurance claims. The developments of the internet-based business environment, the streamlining of the transaction process, and the increasing importance of customer satisfaction all have a significant impact on the growth of the insurance technology market.

The significant adoption of technologies such as AI, ML, big data analytics, and cloud computing in the insurance industry is increasing market prospects. Integration of these technologies, as well as the large amounts of data processed by insurers via ML, can help underwrite with greater precision and apply it to future models. With technology taking over the entire claim process, businesses can now develop products tailored to individual needs, significantly reduce claim timelines, and so on; experts can devote their expertise to difficult cases. However, rising fraudulent claims and high investment costs may stifle market growth. Furthermore, incorporating big data analytics would provide the market with lucrative opportunities in the coming years.

Insurtech Market Segmentation

The global insurtech market is segmented based on insurance type, technology, services, end-use, and geography.

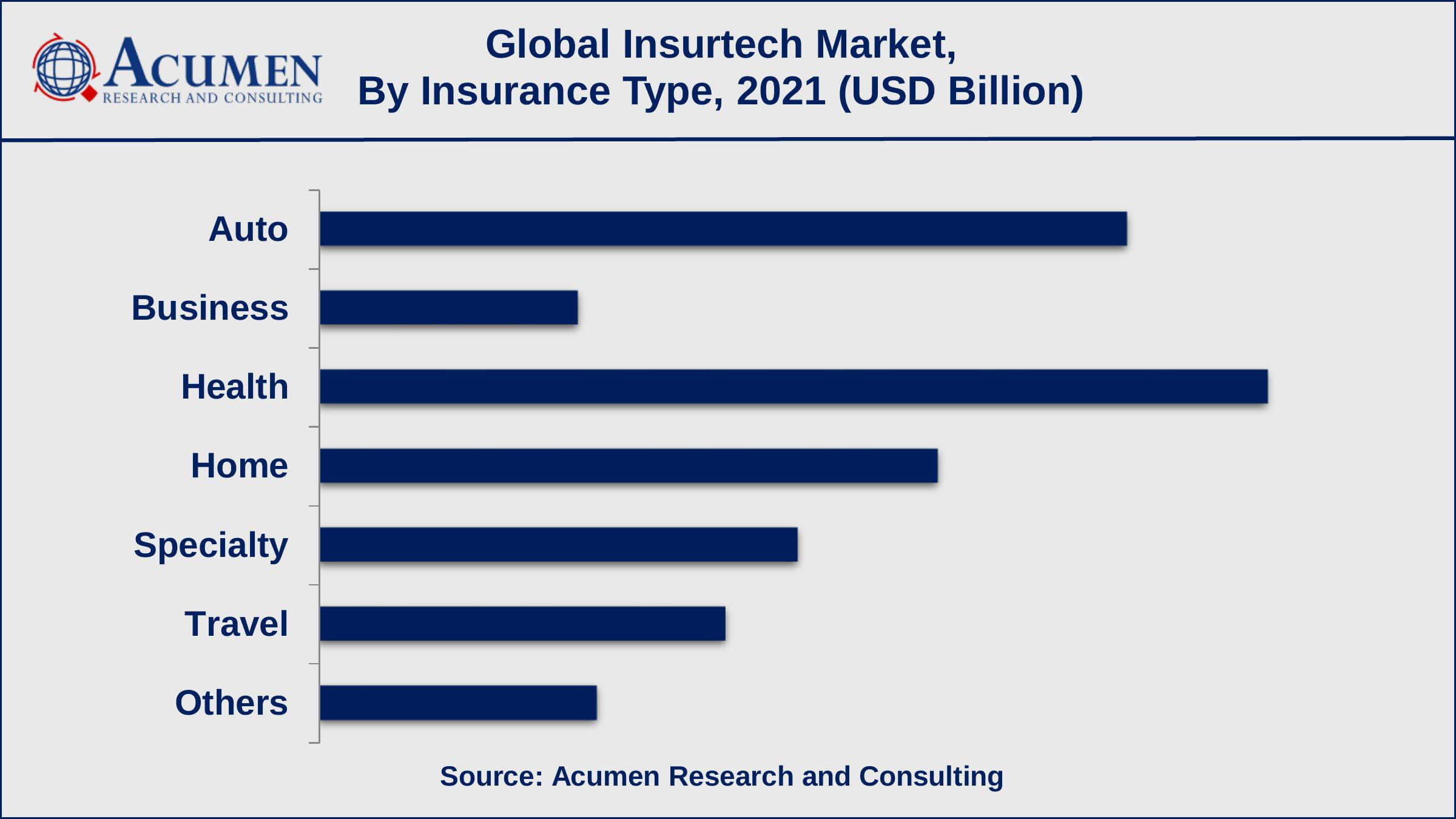

Insurtech Market By Insurance Type

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

According to our insurtech industry analysis, health insurance dominated the market with roughly one-fourth of the market share in 2021 and is expected to grow during the projected timeframe of 2022 to 2030. However, the home insurance type sub-segment is expected to grow at a rapid pace in the coming year, from 2022 to 2030. Wearables and sensors are increasingly being used by businesses to prevent workplace injuries. In addition, organizations are incorporating technologies into worker compensation.

Insurtech Market By Technology

- Artificial Intelligence

- Big Data and Analytics

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Others

According to technology forecasts, cloud computing will command a sizable market share in 2021. Cloud computing has transformed how businesses operate, and the insurance industry is no exception. There are numerous ways for insurers to use the cloud to improve their operations. Increased efficiency, cost savings, faster platforms, greater scalability, improved customer service, and faster time to market are just a few of them. The Blockchain sub-segment, on the other hand, is expected to grow at the fastest rate in the coming years due to its ability to integrate different insurtech platforms and allow new services to enter the market.

Insurtech Market By Services

- Consulting

- Support & Maintenance

- Managed Services

Managed services generated the most revenue among services in 2021. Managed services give insurers the tools and expertise they need to keep their clients ahead of the competition. Furthermore, managed services assist insurers in lowering IT operating costs while allowing in-house technology teams to be more innovative and strategic. Furthermore, managed services companies provide an easy mechanism for closing the growing skills gap, while also enabling insurers to test cutting-edge technologies against products and services without affecting downstream results.

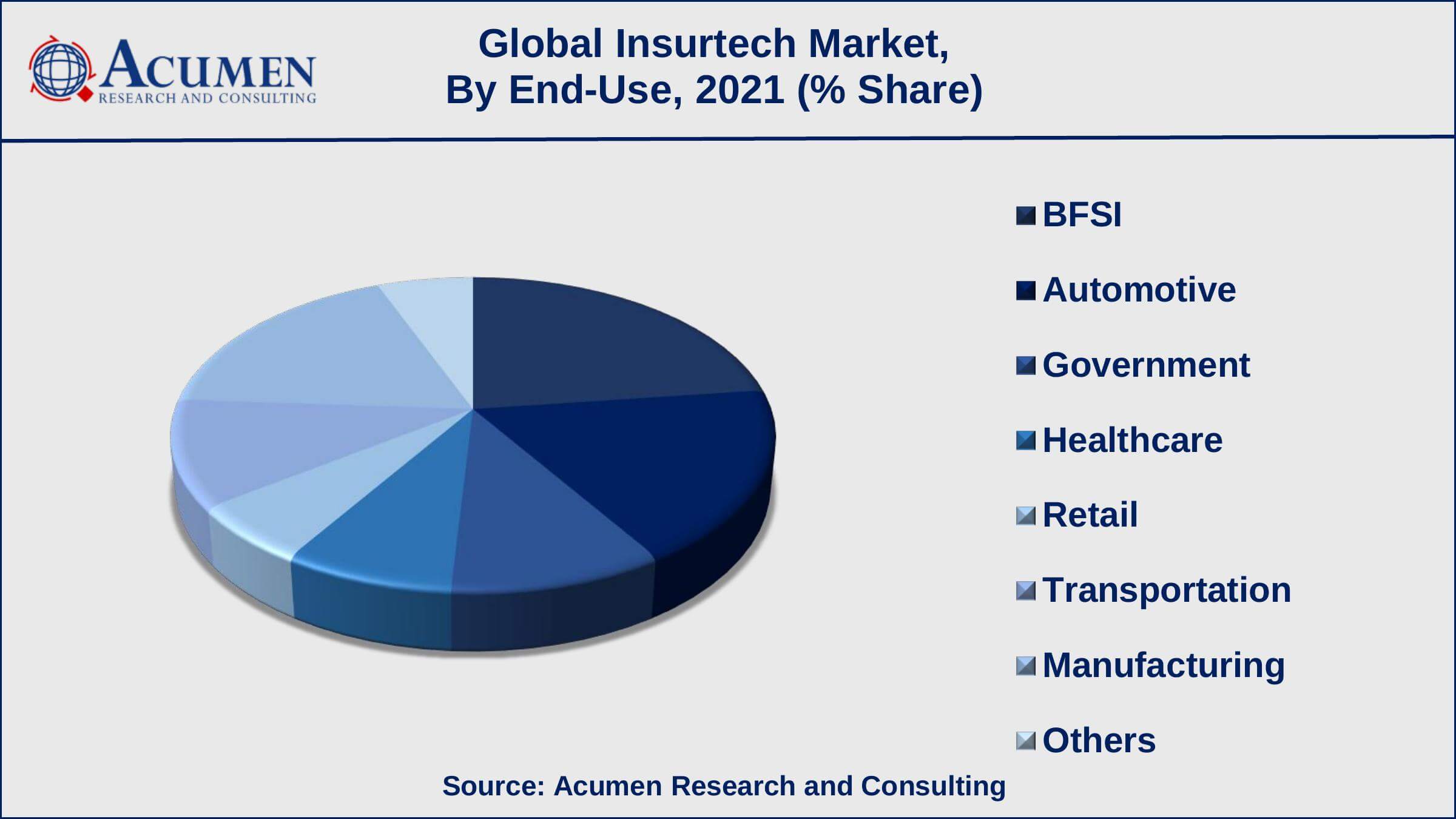

Insurtech Market By End-Use

- BFSI

- Automotive

- Government

- Healthcare

- Retail

- Transportation

- Manufacturing

- Others

According to our insurtech market forecast, the BFSI sector will hold a noteworthy market share between 2022 and 2030. BFSI sector is increasingly implementing Insurtech solutions to improve business proficiency. Advanced analytics and artificial intelligence are being employed for fraud detection and prevention as a result of the substantial growth in data created by banks and financial organizations. The use of mobile devices, smartphones, multimedia content, and click stream data has significantly increased the adoption of the BFSI market.

Insurtech Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Insurtech Market Regional Analysis

According to the insurtech regional analysis, North America commanded the utmost market share in 2021. The massive market share in the region is driven by the increasing adoption of insurance technology solutions by the insurance service sector to increase its customer base and the presence of prominent solution providers in the region. In terms of growth, Asia-Pacific will lead the market from 2022 to 2030. The high growth in APAC is ascribed to the growing population, increasing health insurance, rapidly growing automotive industry, and presence of emerging economies such as China, India, and Hong Kong. Furthermore, the growing penetration of smartphones and wearable devices is also favoring the Asia-Pacific insurtech market growth.

Insurtech Market Players

Some of the leading Insurtech companies include Damco Group, InsuerTech Nova, DXC Technology Company, Insurance Technology Services, KFin Technologies, Oscar Insurance, Majesco, Quantemplatem, Trov, Inc., Wipro Limited, Shift Technology, and ZhongAn Insurance.

Frequently Asked Questions

What is the size of global Insurtech market in 2021?

The market size of Insurtech market in 2021 was accounted to be USD 8.8 Billion.

What is the CAGR of global Insurtech market during forecast period of 2022 to 2030?

The projected CAGR of Insurtech market during the analysis period of 2022 to 2030 is 39.1%.

Which are the key players operating in the market?

The prominent players of the global Insurtech market include Damco Group, DXC Technology Company, InsuerTech Nova, Insurance Technology Services, KFin Technologies, Oscar Insurance, Majesco, Quantemplatem, Trov, Inc., Shift Technology, Wipro Limited, and ZhongAn Insurance.

Which region held the dominating position in the global Insurtech market?

North America held the dominating Insurtech during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for Insurtech during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global Insurtech market?

Massive growth in the BFSI sector, growing digitization of insurance service models, rapidly rising number of insurance claims, and surging trend of developing more tailored user experiences drives the growth of global Insurtech market.

Which services held the maximum share in 2021?

Based on services, managed services segment is expected to hold the maximum share of the Insurtech market.