Health Insurance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Health Insurance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

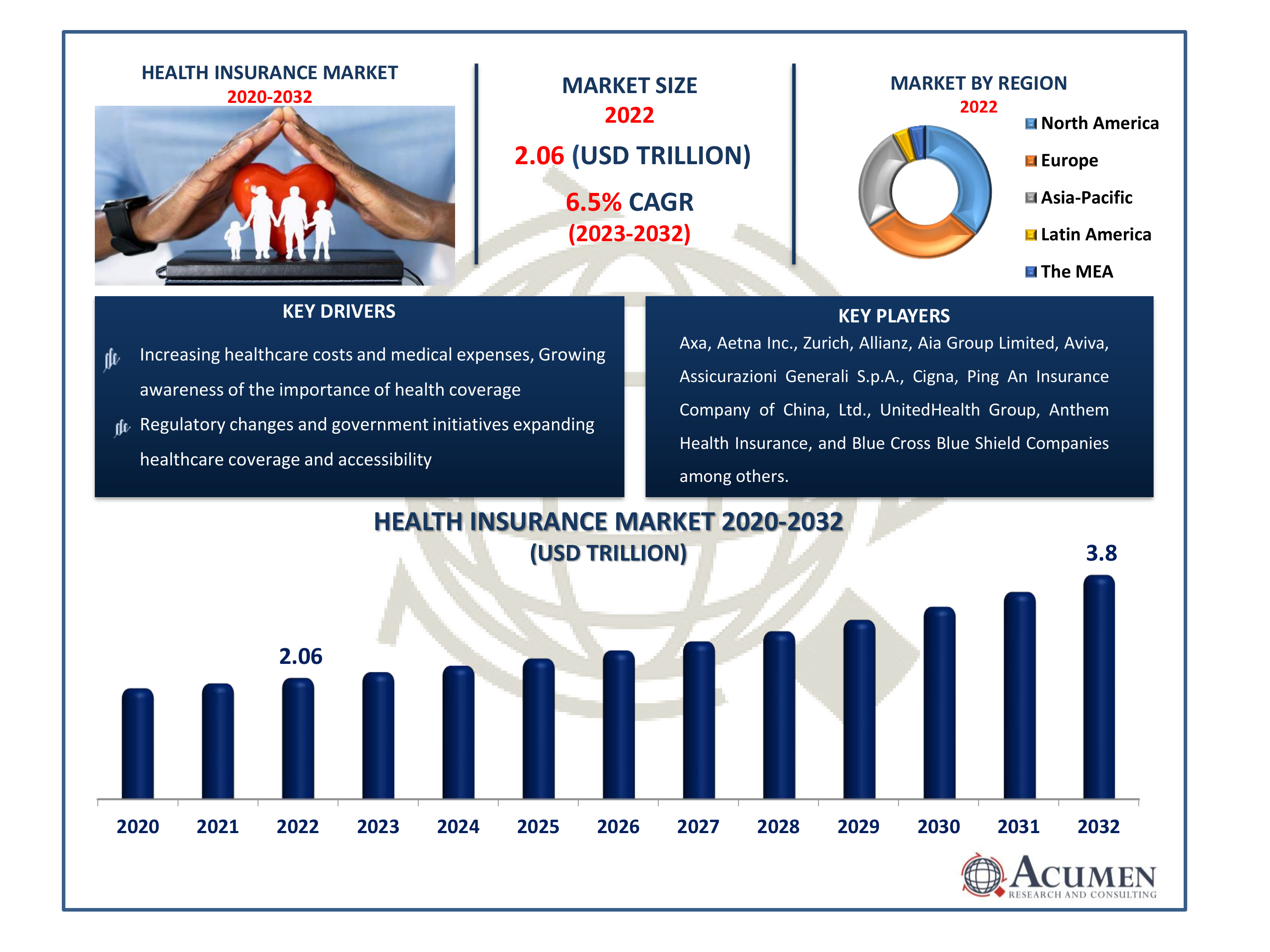

The Health Insurance Market Size accounted for USD 2.06 Trillion in 2022 and is estimated to achieve a market size of USD 3.81 Trillion by 2032 growing at a CAGR of 6.5% from 2023 to 2032.

Health Insurance Market Highlights

- Global health insurance market revenue is poised to garner USD 3.81 trillion by 2032 with a CAGR of 6.5% from 2023 to 2032

- North America health insurance market value occupied around USD 0.7 Trillion in 2022

- Asia-Pacific health insurance market growth will record a CAGR of more than 8% from 2023 to 2032

- Among service provider, the public sub-segment generated over US$ 1.2 Trillion revenue in 2022

- Based on demographics, the adults sub-segment generated around 39% share in 2022

- Collaborations and partnerships between insurers and healthcare providers to enhance service delivery and cost-effectiveness is a popular health insurance market trend that fuels the industry demand

Health insurance is a financial tool designed to assist individuals in managing and paying for medical bills. By paying a premium to an insurance company, individuals secure financial protection against healthcare costs. Depending on policy conditions, the insurance company directly covers the expenses or reimburses the insured person. Health insurance typically includes coverage for preventive care, hospital stays, doctor visits, surgeries, prescription drugs, and other services. It significantly alleviates the financial burden associated with healthcare, ensuring access to necessary medical treatments while minimizing out-of-pocket expenses. Additionally, health insurance offers critical illness coverage and tax benefits as major advantages to policyholders.

Global Health Insurance Market Dynamics

Market Drivers

- Increasing healthcare costs and medical expenses

- Growing awareness of the importance of health coverage

- Technological advancements facilitating more efficient insurance processes and customer experience

- Regulatory changes and government initiatives expanding healthcare coverage and accessibility

Market Restraints

- Rising premiums and costs associated with health insurance policies

- Limited coverage options and exclusions in certain policies

- Challenges in managing fraud and abuse within the insurance system

Market Opportunities

- Expansion in emerging markets with rising healthcare needs and growing middle-class populations

- Innovations in digital health technology and telemedicine

- Increasing demand for tailored and specialized health insurance plans for specific demographics (e.g., seniors, chronic illness patients)

Health Insurance Market Report Coverage

| Market | Health Insurance Market |

| Health Insurance Market Size 2022 | USD 2.06 Trillion |

| Health Insurance Market Forecast 2032 | USD 3.81 Trillion |

| Health Insurance Market CAGR During 2023 - 2032 | 6.5% |

| Health Insurance Market Analysis Period | 2020 - 2032 |

| Health Insurance Market Base Year |

2022 |

| Health Insurance Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Service Provider, By Type, By Network Provider, By Demographics, By Time Period, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Axa, Aetna Inc., Zurich, Allianz, Aia Group Limited, Aviva, Assicurazioni Generali S.p.A., Cigna, Ping An Insurance (Group) Company of China, Ltd., UnitedHealth Group, Anthem Health Insurance, Blue Cross Blue Shield Companies, Highmark and HCSC, Humana, and Wellcare. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Health Insurance Market Insights

The anticipated GDP growth is set to drive expansion within the health insurance market during the industry analysis period. Recent reports in the United States revealed a notable GDP surge in the first quarter, boosting GDP alongside escalating healthcare costs. This encourages individuals to allocate ample funds for medical expenses covered by insurance policies, stimulating growth in the health insurance industry. The burgeoning geriatric population is a prime driver of business growth, especially considering the prevalence of chronic illnesses among individuals aged 65 and older. While this demographic often requires critical monitoring and costly surgical procedures, financial constraints may hinder their access to such services. Diverse insurance policies positively impact corporate growth. However, stringent regulatory scenarios could impede industry growth.

Adverse selection remains a significant challenge in the health insurance market. This phenomenon, wherein individuals more prone to health issues seek insurance, disrupts the risk pool balance, leading to increased financial burden and higher rates for insurers. Overcoming this necessitates maintaining a balanced risk pool and offering competitive rates. Moreover, the health insurance market presents a substantial opportunity for technological integration. Innovations like digital health platforms, AI-driven risk assessments, and telemedicine can enhance personalized healthcare services, streamline operations, and improve consumer interaction. These technological advancements offer more accessible healthcare services for a broader population while enhancing customer experience and optimizing cost efficiency for insurers.

Health Insurance Market Segmentation

The worldwide market for health insurance is split based on service provider, type, network provider, demographics, time period, distribution channel, and geography.

Health Insurance Service Providers

- Public

- Private

In the health insurance industry analysis, the public sector emerges as the leading segment, holding approximately 60% of the market share in 2022. The preference for public insurance is rising due to its affordability. Public policies often alleviate out-of-pocket costs for patients, further driving demand and contributing to the growth of this sector. The private sector was estimated to be around USD 0.8 trillion, constituting a substantial segment of revenue in the health insurance industry. The increasing demand for private insurance policies contributes significantly to this segment's size, offering families protection from unforeseen medical expenses. Moreover, private insurance grants individuals the freedom to choose health services and doctors, boosting growth in this segment.

Health Insurance Types

- Hospitalization Insurance

- Income Protection Insurance

- Medical Insurance

- Critical Illness Insurance

The market for health insurance was dominated by the critical illness insurance category the year before. Of the several insurance types, this one had the most market share. Growing public awareness of certain serious illnesses has led to a rise in the popularity of Critical Illness Insurance, which is defined by its emphasis on particular severe illnesses like cancer or heart disorders. Its popularity is a reflection of people's increasing awareness of the financial dangers connected to serious illnesses. This particular insurance kind has been the most popular and sought-after category in the health insurance market since it offers specialised coverage that gives policyholders financial security and assistance during serious health emergencies.

Health Insurance Network Providers

- Preferred Provider Organization

- Health Maintenance Organization

- Exclusive Provider Organization

- Point of Service

The preferred provider organisation (PPO) is the biggest market sector for health insurance policies and it is expected to hold position over the health insurance industry forecast period. A wide range of healthcare providers are included in PPO networks, giving policyholders the freedom to select hospitals or specialists without needing recommendations. Their adaptability, which allows access to both in-network and out-of-network treatment, is the reason for their popularity. Although the out-of-pocket fees for in-network treatments are typically lower, PPOs give you the option to seek medical care outside of the network, although at a greater cost. PPOs are often preferred by customers looking for a balance between choice and coverage because of their broad coverage and freedom in choosing healthcare providers.

Health Insurance Demographics

- Senior Citizens

- Adults

- Minors

The adults sub-segment continues to dominate throughtout the health insurance market forecast period. The prevalence of lifestyle diseases among adults is high, posing an increased health risk in the future. Adults, especially those with heart and other endocrine diseases, exhibit higher sensitivity compared to those requiring hospitalization. The industry's anticipated growth in the coming years is attributed to these factors. Adults often opt for life insurance plans to mitigate financial crises during medical emergencies, thereby stimulating growth within this segment and monitoring healthcare expenditures.

Health Insurance Time Periods

- Term Insurance

- Life Insurance

In 2022, the life insurance segment was significant. Life insurance schemes offer benefits like permanent coverage and life insurance guarantees. Additionally, investing in life insurance can lead to income tax savings for employed professionals. Life insurance investments not only provide financial support during trauma but also indicate that employed professionals are better positioned for tax-deferred growth, enhancing their acceptance.

Over the health insurance market forecast period, the term insurance segment is expected to grow. Compared to permanent life insurance policies, term insurance has lower initial costs, making it a good choice for families facing budget constraints. Term insurance offers high coverage when needed, catering to long-term needs. Consequently, people often rely on term insurance policies to save costs and promote segmental growth.

Health Insurance Distribution Channels

- Direct Sales

- Financial Institutions

- E-Commerce

- Hospitals

- Clinics

- Others

E-commerce is expected to the primary distribution channel in the healthcare insurance market. This digital platform transforms accessibility by enabling customers to easily evaluate policies, comprehend coverage, and buy insurance online. E-commerce provides a smooth, intuitive experience that makes it possible to issue policies quickly and obtain information right away. Its easy-to-use interface and streamlined procedures appeal to the needs of contemporary consumers, drawing in an increasing number of tech-savvy clients who value transparency and convenience of use when choosing health insurance policies.

Health Insurance Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

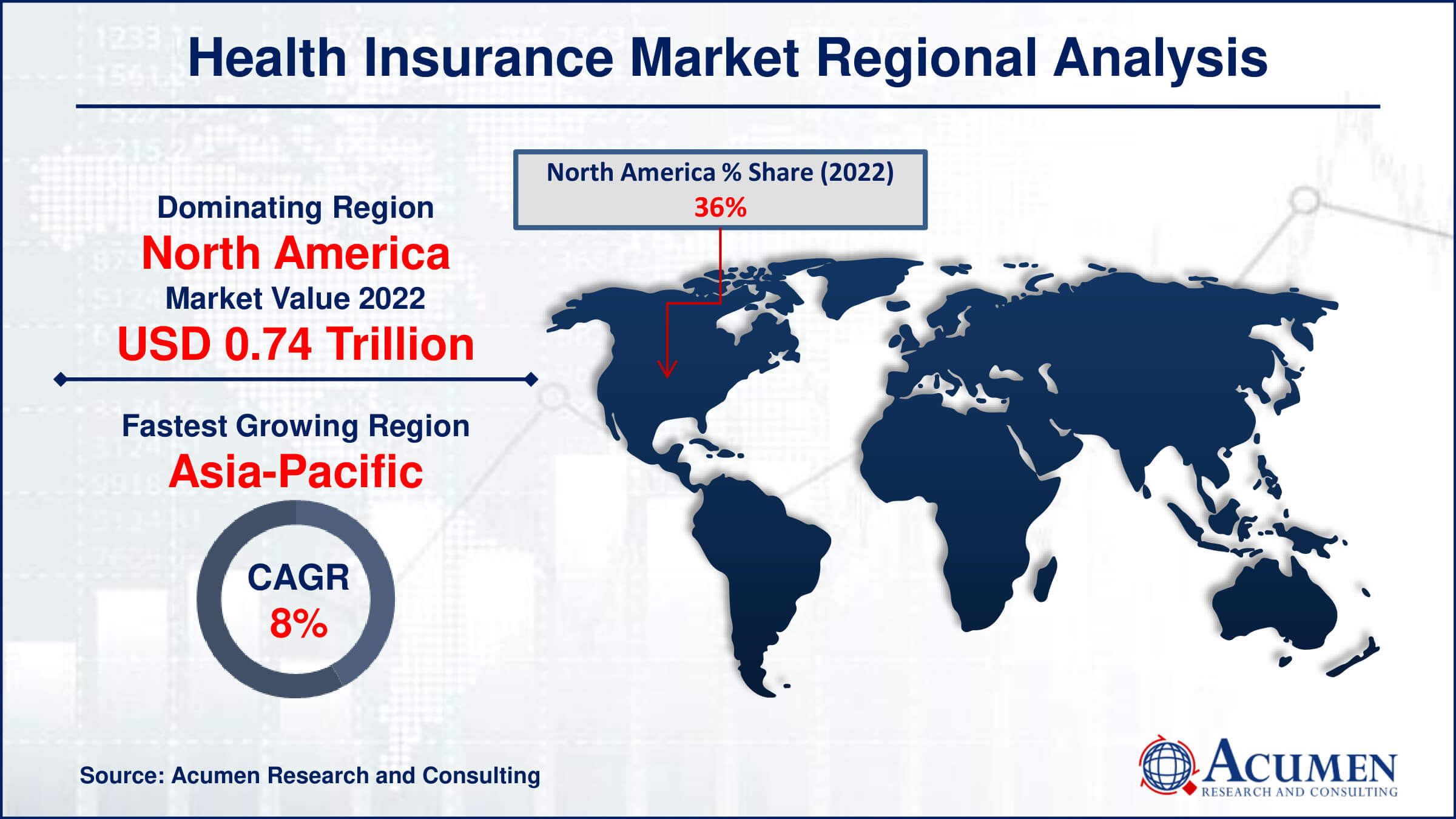

Health Insurance Market Regional Analysis

In 2022, North America's health insurance market was valued at over USD 0.7 trillion. The region's robust growth can be attributed to increased awareness of health insurance policies and its correlation with a high GDP. Additionally, the presence of prominent providers like Medicare in the United States is expected to fuel further growth in the coming years. These insurers design policies offering extensive coverage for various diseases, likely bolstering industry expansion.

The Asia-Pacific health insurance market is projected to grow by more than 8% throughout the forecast period, driven by the escalating prevalence of chronic diseases. This trend augments the demand for healthcare policies, ensuring adequate reimbursements. Moreover, in developing countries across the Asia Pacific, the availability of cost-effective term insurance plans offered by national policy providers is strongly favored, contributing significantly to business growth.

Health Insurance Market Players

Some of the top health insurance companies offered in our report includes Axa, Aetna Inc., Zurich, Allianz, Aia Group Limited, Aviva, Assicurazioni Generali S.p.A., Cigna, Ping An Insurance (Group) Company of China, Ltd., UnitedHealth Group, Anthem Health Insurance, Blue Cross Blue Shield Companies, Highmark and HCSC, Humana, and Wellcare.

Frequently Asked Questions

How big is the health insurance market?

The health insurance market size was USD 2.06 Trillion in 2022.

What is the CAGR of the global health insurance market from 2023 to 2032?

The CAGR of health insurance is 6.5% during the analysis period of 2023 to 2032.

Which are the key players in the health insurance market?

The key players operating in the global market are including Axa, Aetna Inc., Zurich, Allianz, Aia Group Limited, Aviva, Assicurazioni Generali S.p.A., Cigna, Ping An Insurance (Group) Company of China, Ltd., UnitedHealth Group, Anthem Health Insurance, Blue Cross Blue Shield Companies, Highmark and HCSC, Humana, and Wellcare.

Which region dominated the global health insurance market share?

North America held the dominating position in health insurance industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of health insurance during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global health insurance industry?

The current trends and dynamics in the health insurance industry include increasing healthcare costs and medical expenses, growing awareness of the importance of health coverage, technological advancements facilitating more efficient insurance processes and customer experience, and regulatory changes and government initiatives expanding healthcare coverage and accessibility.

Which service provider held the maximum share in 2022?

The public service provider held the maximum share of the health insurance industry.