Insulin Management System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Insulin Management System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

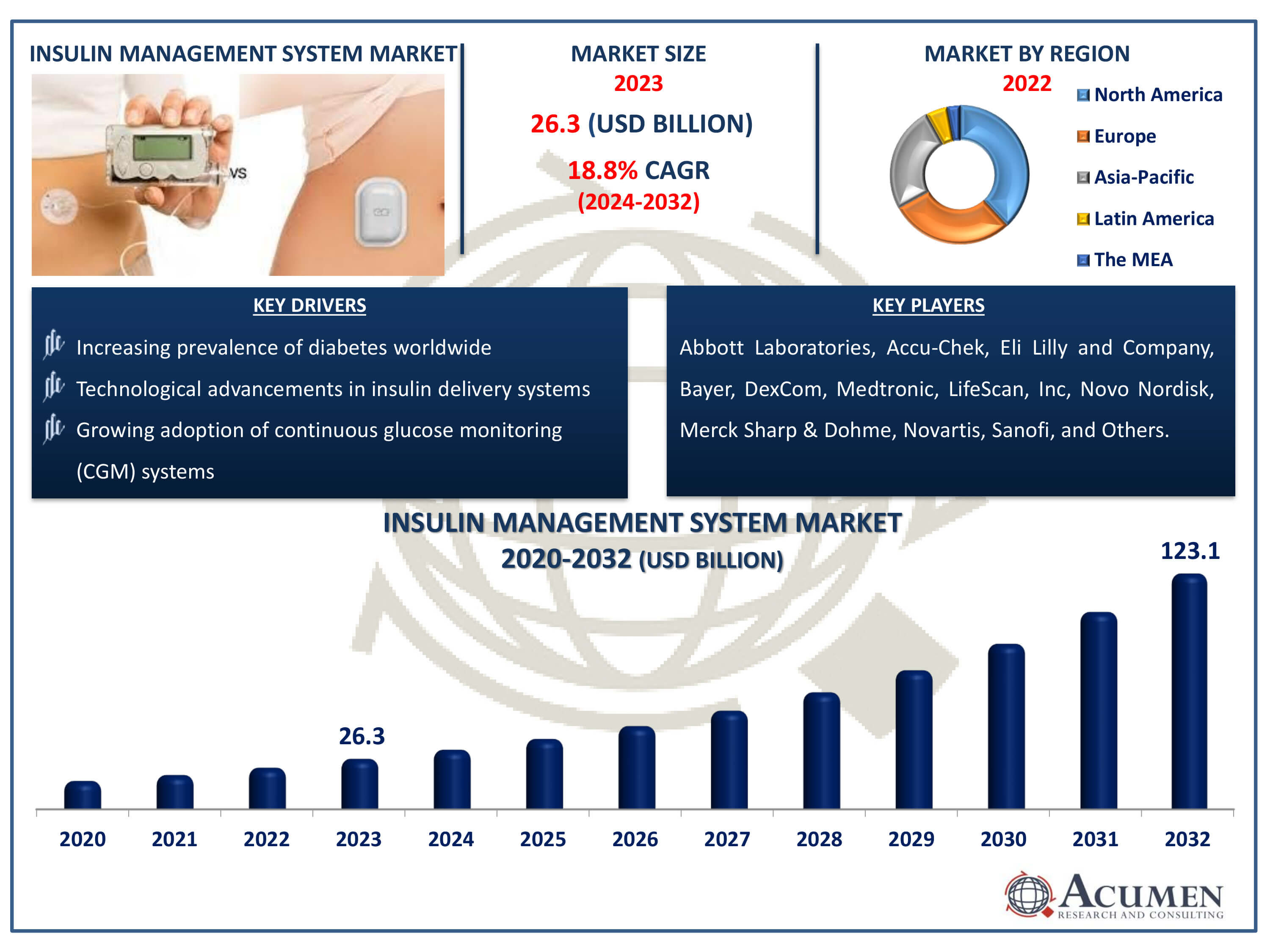

The Insulin Management System Market Size accounted for USD 26.3 Billion in 2023 and is estimated to achieve a market size of USD 123.1 Billion by 2032 growing at a CAGR of 18.8% from 2024 to 2032.

Insulin Management System Market Highlights

- Global insulin management system market revenue is poised to garner USD 123.1 billion by 2032 with a CAGR of 18.8% from 2024 to 2032

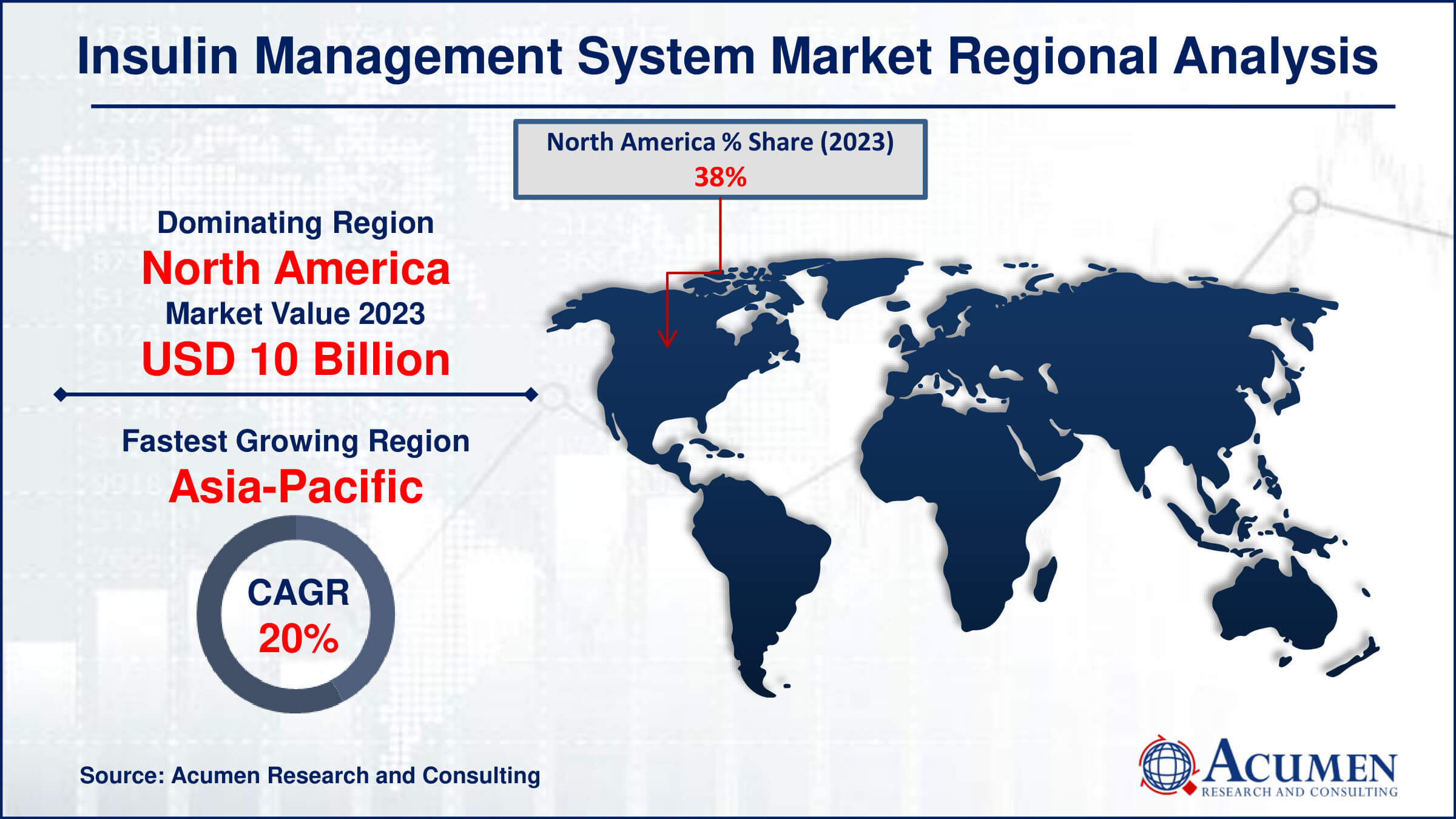

- North America insulin management system market value occupied around USD 10 billion of revenue in 2023

- Asia-Pacific insulin management system market growth will record a CAGR of more than 20% from 2024 to 2032

- Among product type, the external insulin pumps sub-segment generated notable market share in 2023

- Based on mode of action, the rapid acting insulin sub-segment generated noteworthy share in 2023

- Increased adoption of continuous glucose monitoring (CGM) systems integrated with insulin pumps for real-time diabetes management is the insulin management system market trend that fuels the industry demand

An insulin management system is a technological solution designed to assist individuals with diabetes in monitoring and regulating their insulin levels effectively. It typically includes devices such as insulin pumps, continuous glucose monitors (CGMs), and smartphone apps that work together to automate insulin delivery and provide real-time glucose readings. These systems help users achieve better blood sugar control by minimizing manual calculations and injections, thereby reducing the risk of complications like hypoglycemia and hyperglycemia. They also enable personalized insulin dosing based on individual glucose trends, promoting more precise and timely adjustments to insulin therapy. Overall, insulin management systems enhance the quality of life for people with diabetes by offering convenience, accuracy, and improved glycemic control through advanced technology.

Global Insulin Management System Market Dynamics

Market Drivers

- Increasing prevalence of diabetes worldwide

- Technological advancements in insulin delivery systems

- Growing adoption of continuous glucose monitoring (CGM) systems

Market Restraints

- High cost associated with insulin management systems

- Regulatory challenges and approval processes

- Limited awareness and accessibility in developing regions

Market Opportunities

- Expansion of personalized medicine and precision dosing

- Rising focus on minimally invasive insulin delivery methods

- Integration of artificial intelligence and machine learning in diabetes management

Insulin Management System Market Report Coverage

| Market | Insulin Management System Market |

| Insulin Management System Market Size 2022 | USD 26.3 Billion |

| Insulin Management System Market Forecast 2032 | USD 123.1 Billion |

| Insulin Management System Market CAGR During 2023 - 2032 | 18.8% |

| Insulin Management System Market Analysis Period | 2020 - 2032 |

| Insulin Management System Market Base Year |

2022 |

| Insulin Management System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Mode Of Action, By Diabetes Type, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Laboratories, Accu-Chek, Eli Lilly and Company, Bayer, DexCom, Medtronic, Roche Information Solutions India Private Limited, LifeScan, Inc, Novo Nordisk, Merck Sharp & Dohme, Novartis, Sanofi, Takeda Pharmaceuticals, and Bristol-Myers. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Insulin Management System Market Insights

The rising global prevalence of diabetes has spurred significant growth in the insulin management system market. For instance, according to the 2023 ICMR INDIAB (Indian Council of Medical Research – India Diabetes) study, the prevalence of diabetes is 10.1 crore. Insulin management systems, encompassing insulin pumps, continuous glucose monitors, and integrated platforms, cater to the increasing needs of diabetic patients for precise and efficient insulin administration. Advancements in technology, such as automated insulin delivery and smart insulin pens, are further driving market expansion by enhancing treatment efficacy and patient convenience. Additionally, supportive regulatory frameworks and increasing healthcare expenditure contribute to the market's robust growth trajectory, meeting the escalating demand for advanced diabetes management solutions worldwide.

Limited awareness and accessibility in developing regions pose significant restraints for the insulin management system market. Many individuals in these areas lack knowledge about advanced healthcare technologies like insulin pumps and continuous glucose monitors (CGMs), which limits adoption. Moreover, the high cost associated with these systems makes them inaccessible to a large segment of the population in developing regions. As a result, the potential market for insulin management systems remains largely untapped in these areas, hindering overall market growth and innovation tailored to diverse global healthcare needs.

The expansion of personalized medicine and precision dosing presents a significant opportunity for the insulin management system market. For instance, in 2020, Infosys will launch an SAP-based personalized medicine solution tailored for pharmaceutical companies. This technology helps pharma companies create customized medications according to patient needs and precise drug quantities. These advancements allow for tailored insulin therapies that cater to individual patient needs, enhancing treatment efficacy and patient outcomes. Personalized medicine enables healthcare providers to optimize insulin dosing based on genetic, environmental, and lifestyle factors, thereby improving insulin sensitivity and reducing risks of complications. The insulin management system market is poised to benefit from these developments by offering innovative technologies that support precise insulin delivery and monitoring, ultimately transforming diabetes care into a more personalized and effective approach.

Insulin Management System Market Segmentation

The worldwide market for insulin management system is split based on product type, mode of action, diabetes type, end user, and geography.

Insulin Management System Product Types

- Insulin Pen Injectors

- Needle and Syringe

- Insulin Jet Injectors

- Implantable Pumps

- External Insulin Pumps

- Insulin Patches

According to the insulin management system industry forecast, external insulin pumps is expected to dominate the market. These pumps provide precise insulin dosing through continuous subcutaneous infusion, which helps in maintaining stable blood glucose levels. They offer flexibility in insulin delivery schedules, allowing users to adjust basal rates and administer bolus doses as needed. Moreover, external pumps are preferred for their ease of use, programmability, and ability to integrate with glucose monitoring systems, enhancing overall diabetes management efficiency and patient convenience. These factors collectively contribute to their widespread adoption and dominance in the insulin management system market.

Insulin Management System Mode of Action

- Short Acting Insulin

- Intermediate Acting Insulin

- Rapid Acting Insulin

- Pre-Mixed Insulin

According to the insulin management system industry analysis, rapid-acting insulin shows remarkable growth due to its quick onset and short duration of action, which closely mimics the body's natural insulin response after meals. This type of insulin is crucial for managing postprandial glucose levels effectively, offering flexibility in timing meals and injections. Moreover, advancements in insulin delivery devices, such as insulin pumps and pens, have further boosted the popularity of rapid-acting insulin among healthcare providers and patients alike. For instance, in March 2022, Novo Nordisk announced that two smart connected insulin pens, the NovoPen 6 and NovoPen Echo Plus, became available on prescription for individuals in the United Kingdom who are treated with Novo Nordisk insulin. Overall, rapid acting insulin’s ability to provide precise control over blood sugar levels with reduced risk of hypoglycemia makes it a preferred choice in modern insulin therapy strategies.

Insulin Management System Diabetes Type

- Diabetes I

- Diabetes II

According to the insulin management system industry analysis, diabetes type II shows notable growth due to its higher prevalence worldwide compared to type I diabetes. Type II diabetes typically develops later in life and is often associated with lifestyle factors such as obesity and sedentary habits, which are prevalent in many societies today. The larger patient population of type II diabetes necessitates a greater demand for insulin management systems that cater to the diverse needs of these individuals, including various insulin delivery methods and continuous glucose monitoring systems. As a result, healthcare providers and manufacturers focus more resources on developing and improving technologies tailored to type II diabetes management, driving its adoption in the insulin management system market.

Insulin Management System End User

- Hospital & Clinics

- Ambulatory canters

- Others

According to the insulin management system industry analysis, hospitals and clinics anticipated to dominate as the primary end users. Firstly, hospitals typically treat a wide range of patients with diabetes, requiring efficient insulin management solutions. Secondly, hospitals have the infrastructure and resources to support advanced technologies needed for insulin delivery and monitoring. Thirdly, clinics, while smaller in scale compared to hospitals, also play a significant role, particularly in outpatient care and diabetes management programs. Together, hospitals and clinics drive demand for insulin management systems due to their pivotal role in providing comprehensive healthcare services to diabetic patients across varied settings.

Insulin Management System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Insulin Management System Market Regional Analysis

For several reasons, North America leads the insulin management system market due to several factors. First, the region boasts advanced healthcare infrastructure and high healthcare spending, facilitating widespread adoption of cutting-edge medical technologies like insulin management systems. Second, a significant prevalence of diabetes in North America drives demand for effective insulin delivery and monitoring solutions. Third, robust research and development in the pharmaceutical and medical device sectors contribute to innovation and product advancements. For instance, in January 2022, Boston-based Insulet Corp. announced that the FDA had approved the new Omnipod 5 system, signifying the company's debut in the automated insulin delivery (AID) market. Fourth, favorable reimbursement policies and healthcare regulations support market growth by encouraging investment and adoption. Lastly, strong collaboration between healthcare providers, technology developers, and research institutions enhances market penetration and technological integration in the region.

Asia-Pacific is fastest-growing region in insulin management system market, due to technological advancements, and a substantial diabetic population. For instance, according to the International Diabetes Federation (IDF), more than 60% of the world's diabetic population resides in the Asia-Pacific region, with over 114 Million people in China alone. Moreover, healthcare expenditures, along with growing government support and a large number of market participants, the market are poised for growth.

Insulin Management System Market Players

Some of the top insulin management system companies offered in our report include Abbott Laboratories, Accu-Chek, Eli Lilly and Company, Bayer, DexCom, Medtronic, Roche Information Solutions India Private Limited, LifeScan, Inc, Novo Nordisk, Merck Sharp & Dohme, Novartis, Sanofi, Takeda Pharmaceuticals, and Bristol-Myers.

Frequently Asked Questions

How big is the insulin management system market?

The insulin management system market size was valued at USD 26.3 billion in 2023.

What is the CAGR of the global insulin management system market from 2024 to 2032?

The CAGR of insulin management system is 18.8% during the analysis period of 2024 to 2032.

Which are the key players in the insulin management system market?

The key players operating in the global market are including Abbott Laboratories, Accu-Chek, Eli Lilly and Company, Bayer, DexCom, Medtronic, Roche Information Solutions India Private Limited, LifeScan, Inc, Novo Nordisk, Merck Sharp & Dohme, Novartis, Sanofi, Takeda Pharmaceuticals, and Bristol-Myers.

Which region dominated the global insulin management system market share?

North America held the dominating position in insulin management system industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of insulin management system during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global insulin management system industry?

The current trends and dynamics in the insulin management system industry include increasing prevalence of diabetes worldwide, technological advancements in insulin delivery systems, and growing adoption of continuous glucose monitoring (CGM) systems.

Which product type held the maximum share in 2023?

The external insulin pumps held the maximum share of the insulin management system industry.