Insulin Pump Market | Acumen Research and Consulting

Insulin Pump Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

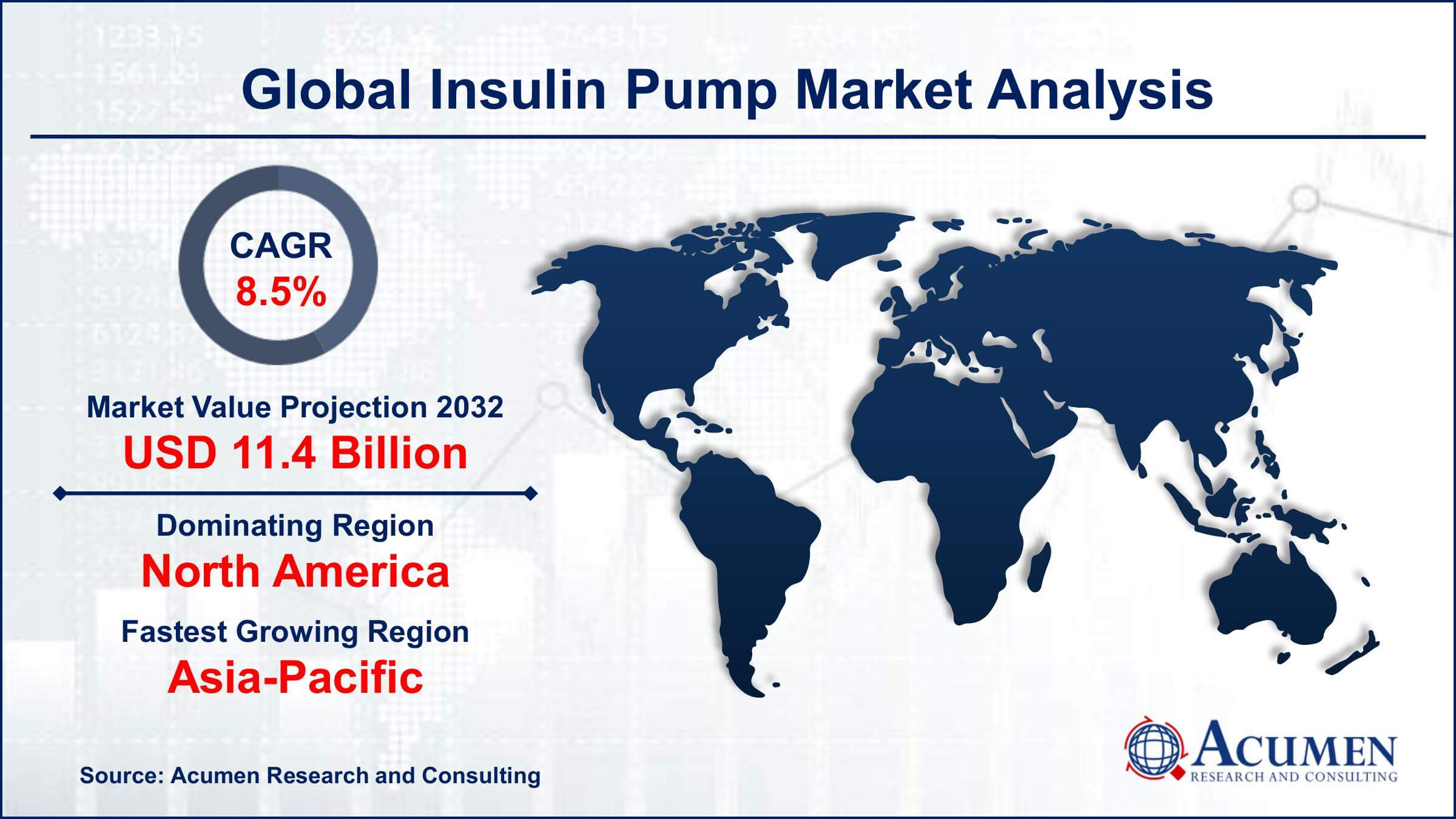

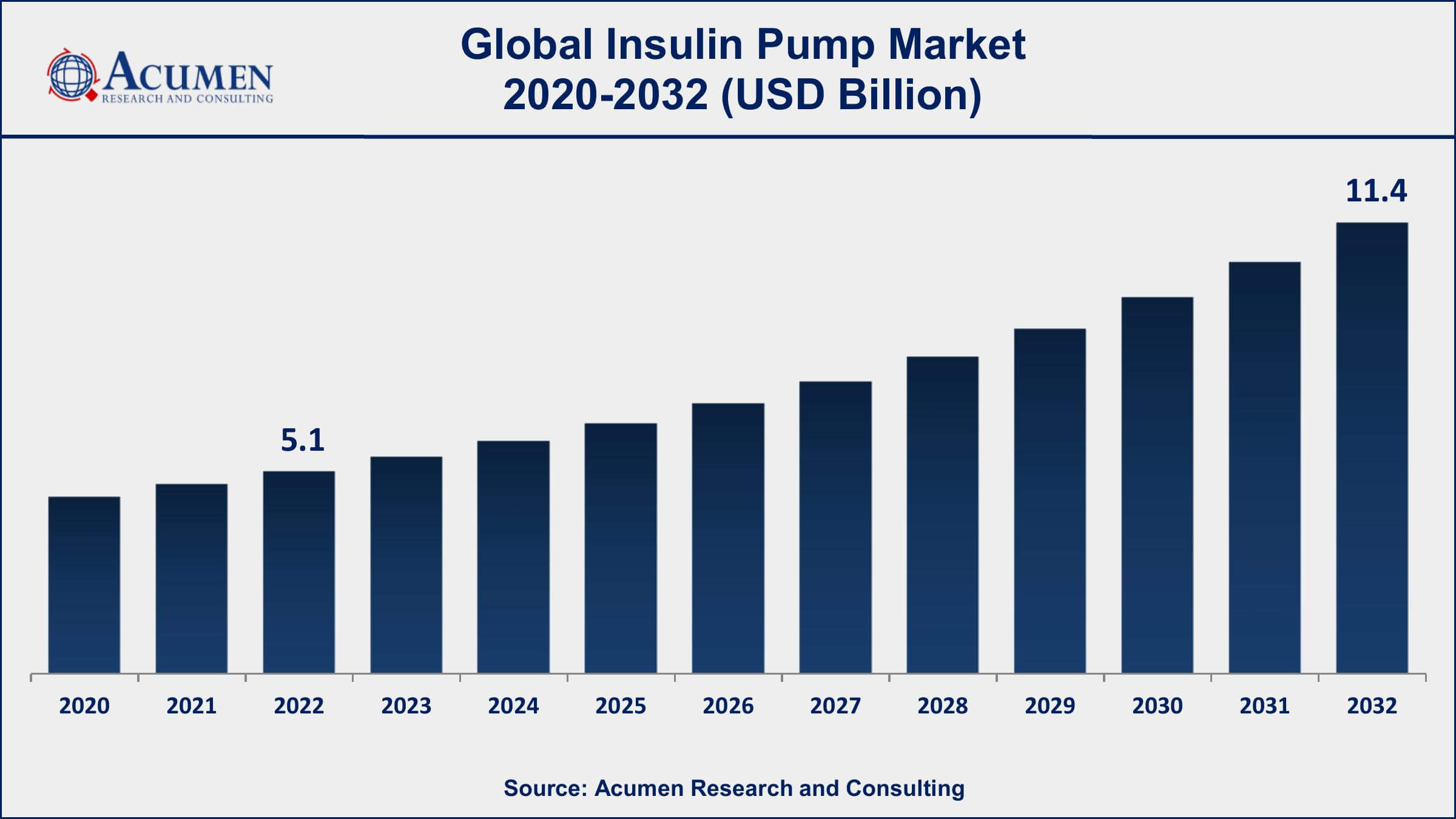

The Global Insulin Pump Market Size accounted for USD 5.1 Billion in 2022 and is projected to achieve a market size of USD 11.4 Billion by 2032 growing at a CAGR of 8.5% from 2023 to 2032.

Insulin Pump Market Highlights

- Global insulin pump market revenue is expected to increase by USD 11.4 Billion by 2032, with a 8.5% CAGR from 2023 to 2032

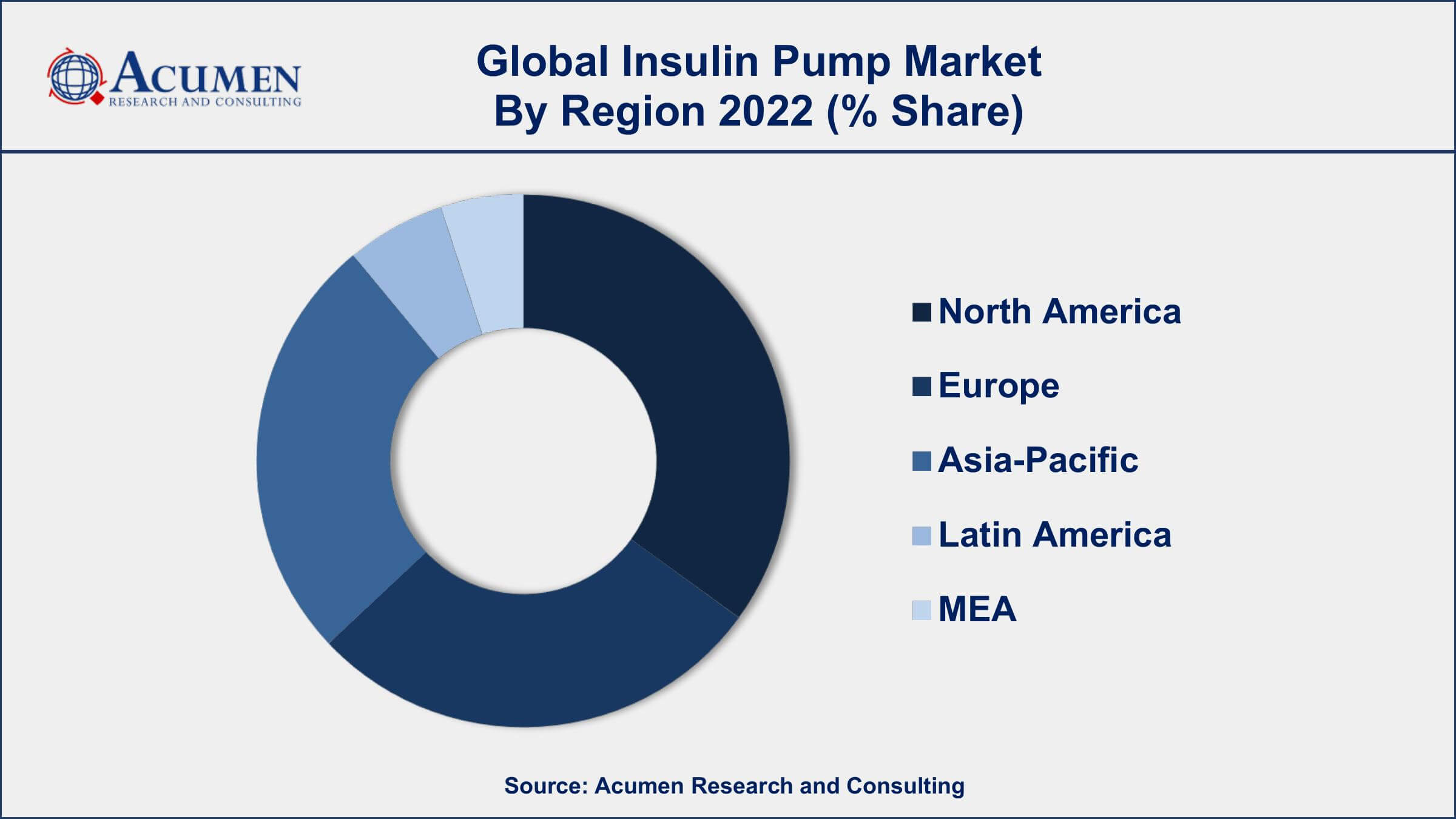

- North America region led with more than 45% of insulin pump market share in 2022

- Asia-Pacific insulin pump market growth will record a CAGR of around 9.4% from 2023 to 2032

- According to the Centers for Disease Control and Prevention, more than 34 million people in the United States have diabetes, and about 1.6 million Americans have type 1 diabetes

- According to a survey conducted by Tandem Diabetes Care, more than 90% of insulin pump users reported that insulin pump therapy had a positive impact on their daily life and quality of life

- Increasing prevalence of diabetes, drives the insulin pump market value

An insulin pump is a medical device used to deliver insulin to individuals with diabetes. It is a small, wearable device that continuously delivers insulin throughout the day, replacing the need for multiple daily injections. The device is programmed to deliver insulin based on the user's insulin needs, which are calculated based on factors such as blood sugar levels, carbohydrate intake, and physical activity. Insulin pumps have become a popular alternative to traditional insulin injections, as they offer greater flexibility and convenience in managing diabetes.

The global insulin pump market has witnessed significant growth in recent years, and this trend is expected to continue in the coming years. The market growth can be attributed to factors such as the increasing prevalence of diabetes, growing awareness about the benefits of insulin pumps, and technological advancements in insulin pump devices. Additionally, the rising demand for personalized diabetes care and the growing adoption of insulin pumps among children and young adults are expected to drive the market growth. The increasing adoption of wearable insulin pumps and the emergence of advanced features such as continuous glucose monitoring and mobile connectivity are expected to create lucrative opportunities for players in the insulin pump industry.

Global Insulin Pump Market Trends

Market Drivers

- Increasing prevalence of diabetes

- Technological advancements in insulin pump devices

- Growing awareness about the benefits of insulin pumps

- Rising demand for personalized diabetes care

- Growing adoption of insulin pumps among children and young adults

Market Restraints

- High cost of insulin pumps

- Limited availability of insulin pumps in developing countries

Market Opportunities

- Growing adoption of wearable insulin pumps

- Emergence of advanced features such as continuous glucose monitoring and mobile connectivity

Insulin Pump Market Report Coverage

| Market | Insulin Pump Market |

| Insulin Pump Market Size 2022 | USD 5.1 Billion |

| Insulin Pump Market Forecast 2032 | USD 11.4 Billion |

| Insulin Pump Market CAGR During 2023 - 2032 | 8.5% |

| Insulin Pump Market Analysis Period | 2020 - 2032 |

| Insulin Pump Market Base Year | 2022 |

| Insulin Pump Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Medtronic plc, Insulet Corporation, Tandem Diabetes Care, Inc., Roche Diabetes Care, Inc., Johnson & Johnson Services, Inc., Ypsomed Group, Valeritas, Inc., Cellnovo Group SA, Sooil Development Co., Ltd., MicroPort Scientific Corporation, and Nipro Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Insulin pumps are used for the administration of insulin in the body to control diabetes. North America is the largest market for global insulin pumps, with the U.S. being the largest market, followed by Europe, Asia-Pacific, and Latin America. Owing to the growing number of diabetic patients, North America and Europe will continue to dominate the market. The increasing awareness of glycemic control and advanced insulin delivery devices is expected to drive the sale of insulin pumps in the Asia-Pacific region during the forecast period.

The increasing incidences of diabetes and rising awareness of diabetes and insulin-delivering devices are the major drivers for this market. Also, the development of home infusion therapy and artificial pancreas is further driving the growth of this market. There have been various concerns associated with insulin delivery devices such as skin infections and the high cost of insulin analogs which acts as restraints to the growth of this market. In addition, the lack of skilled professionals for handling insulin pumps further hampers the growth of this market. Research on aerosolized insulin for inhalation, and insulin-producing stem cell implantation will lead to a decrease in the sale of insulin pumps.

Insulin Pump Market Segmentation

The global insulin pump market segmentation is based on product type, application, end-user, and geography.

Insulin Pump Market By Product Type

- Traditional Insulin Pumps

- Patch Pumps

- Disposable Insulin Pumps

According to the insulin pump industry analysis, the traditional pumps segment accounted for the largest market share in 2022. These pumps are also known as conventional insulin pumps, and they have been in use for several decades. Traditional insulin pumps are battery-powered devices that deliver insulin through a catheter placed under the skin. The device is programmed to deliver insulin at specific times and in specific amounts, based on the user's insulin needs. The traditional insulin pump segment is expected to continue to grow in the coming years, driven by factors such as the increasing prevalence of diabetes, rising demand for personalized diabetes care, and technological advancements in insulin pump devices. Additionally, the growing adoption of traditional insulin pumps among patients with type 1 diabetes and the availability of a wide range of traditional insulin pump devices are expected to further boost the growth of the traditional insulin pump segment.

Insulin Pump Market By Application

- Type 1 Diabetes

- Type 2 Diabetes

In terms of applications, the type 1 diabetes segment is expected to witness significant growth in the coming years. Type 1 diabetes is an autoimmune disease that affects the body's ability to produce insulin, and people with type 1 diabetes require insulin therapy to manage their condition. Insulin pumps have become an increasingly popular treatment option for people with type 1 diabetes, as they offer greater flexibility and convenience in managing insulin therapy. The type 1 diabetes segment is expected to continue to grow in the coming years, driven by factors such as the increasing prevalence of type 1 diabetes, rising awareness about the benefits of insulin pumps, and growing demand for personalized diabetes care. Additionally, the availability of advanced insulin pump devices with features such as continuous glucose monitoring and remote control is expected to further boost the growth of the type 1 diabetes segment.

Insulin Pump Market By End-User

- Hospitals

- Clinics

- Homecare Settings

- Others

According to the insulin pump market forecast, the homecare settings segment is expected to witness significant growth in the coming years. Homecare settings refer to the use of insulin pumps by patients in their homes, rather than in healthcare facilities. Insulin pumps have become increasingly popular in homecare settings, as they offer greater convenience and flexibility in managing diabetes. Homecare settings are particularly beneficial for patients who require frequent insulin injections or have difficulty managing their condition. The homecare settings segment is expected to continue to grow in the coming years, driven by factors such as the increasing prevalence of diabetes, rising demand for personalized diabetes care, and growing adoption of insulin pumps among patients.

Insulin Pump Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Insulin Pump Market Regional Analysis

North America is currently dominating the insulin pump market, accounting for a significant share of the global market. One of the key factors driving the growth of the insulin pump market in North America is the high prevalence of diabetes in the region. According to the International Diabetes Federation, North America has one of the highest prevalence rates of diabetes in the world, with an estimated 48 million people living with diabetes in the region. In addition to the high prevalence of diabetes, the availability of advanced healthcare infrastructure and a well-established reimbursement framework for insulin pumps are also driving the market growth. The region has a highly developed healthcare system with access to the latest medical technologies and treatment options. Moreover, the favorable reimbursement policies offered by governments and private insurance providers in North America have made insulin pumps more affordable and accessible for patients. Furthermore, the presence of key market players and their focus on research and development activities is also contributing to the dominance of North America in the insulin pump market.

Insulin Pump Market Player

Some of the top insulin pump market companies offered in the professional report include Medtronic plc, Insulet Corporation, Tandem Diabetes Care, Inc., Roche Diabetes Care, Inc., Johnson & Johnson Services, Inc., Ypsomed Group, Valeritas, Inc., Cellnovo Group SA, Sooil Development Co., Ltd., MicroPort Scientific Corporation, and Nipro Corporation.

Frequently Asked Questions

What was the market size of the global insulin pump in 2022?

The market size of insulin pump was USD 5.1 Billion in 2022.

What is the CAGR of the global insulin pump market from 2023 to 2032?

The CAGR of insulin pump is 8.5% during the analysis period of 2023 to 2032.

Which are the key players in the insulin pump market?

The key players operating in the global market are including Medtronic plc, Insulet Corporation, Tandem Diabetes Care, Inc., Roche Diabetes Care, Inc., Johnson & Johnson Services, Inc., Ypsomed Group, Valeritas, Inc., Cellnovo Group SA, Sooil Development Co., Ltd., MicroPort Scientific Corporation, and Nipro Corporation.

Which region dominated the global insulin pump market share?

North America held the dominating position in insulin pump industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of insulin pump during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global insulin pump industry?

The current trends and dynamics in the insulin pump industry include increasing prevalence of diabetes, technological advancements in insulin pump devices, growing awareness about the benefits of insulin pumps, and rising demand for personalized diabetes care.

Which application held the maximum share in 2022?

The type 1 diabetes application held the maximum share of the insulin pump industry.