Insulin Delivery Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

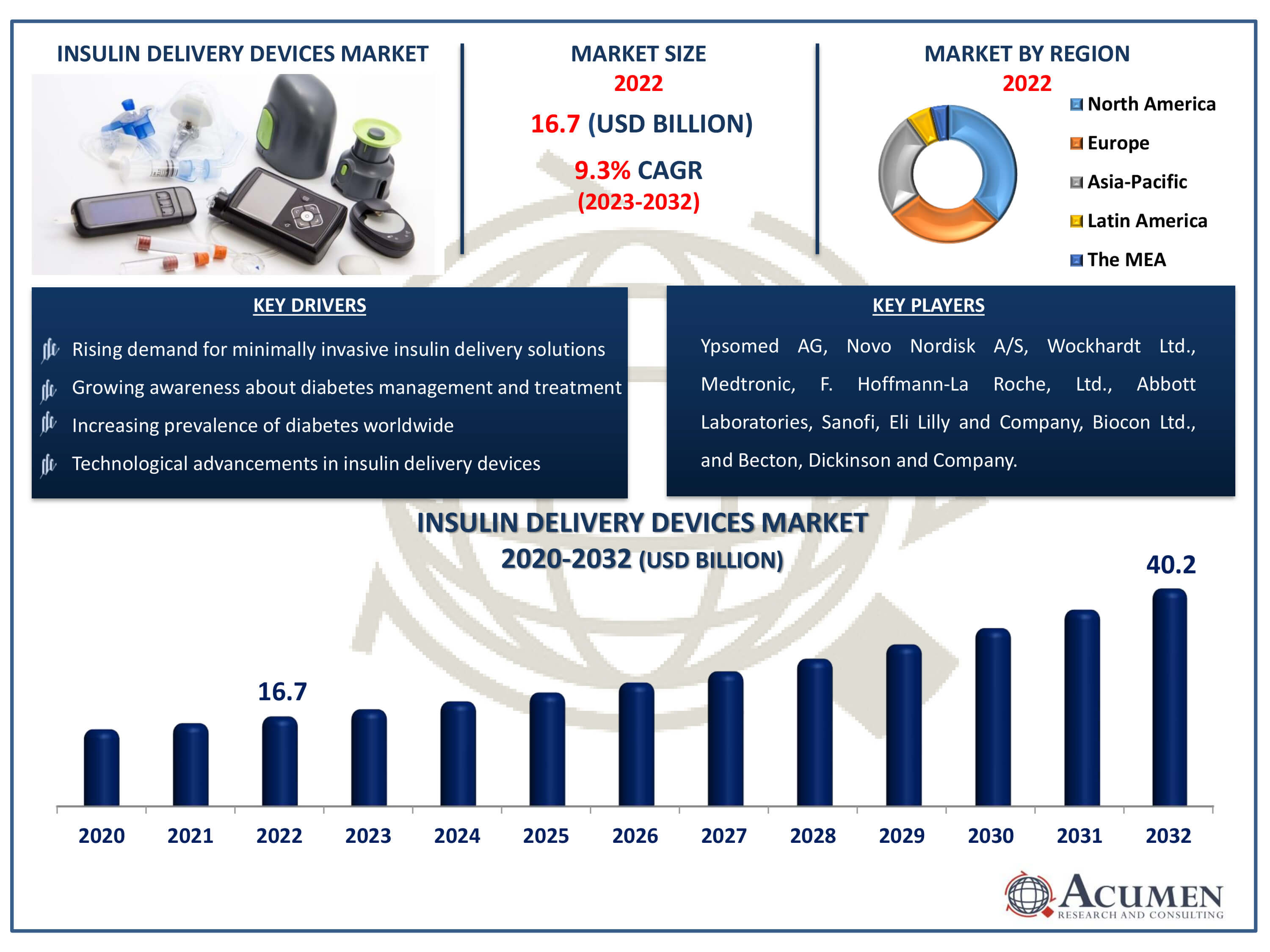

The Insulin Delivery Devices Market Size accounted for USD 16.7 Billion in 2022 and is estimated to achieve a market size of USD 40.2 Billion by 2032 growing at a CAGR of 9.3% from 2023 to 2032.

Insulin Delivery Devices Market Highlights

- Global insulin delivery devices market revenue is poised to garner USD 40.2 billion by 2032 with a CAGR of 9.3% from 2023 to 2032

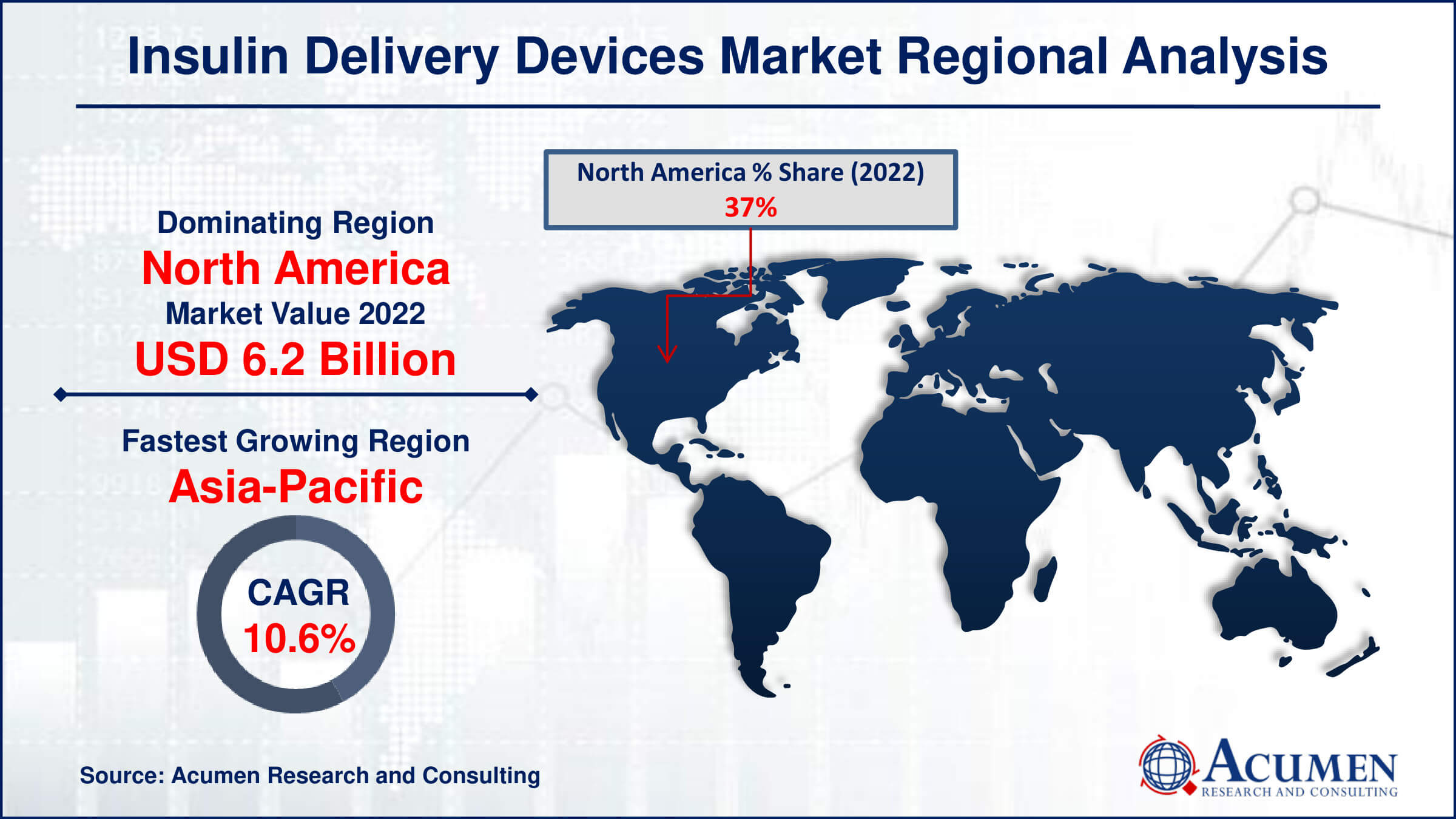

- North America insulin delivery devices market value occupied around USD 6.2 billion in 2022

- Asia-Pacific insulin delivery devices market growth will record a CAGR of more than 10.6% from 2023 to 2032

- Among type, the insulin pens sub-segment generated more than USD 6 billion revenue in 2022

- Based on end use, the homecare sub-segment generated around 48% market share in 2022

- Emerging markets presenting untapped growth potential for insulin delivery device manufacturers is a popular insulin delivery devices market trend that fuels the industry demand

Insulin delivery devices are essential for administering insulin to patients with Type 1 and Type 2 diabetes. Insulin plays a crucial role in diabetes treatment by facilitating the transfer of glucose from the bloodstream into the muscles. Unlike pills or liquids, insulin cannot be ingested orally as it would be digested and not reach the bloodstream. Instead, it is typically injected or infused into the fatty tissues under the skin. Various types of devices are used for insulin delivery, including insulin syringes, insulin pens, insulin jet injectors, insulin pumps, and insulin inhalers. Insulin syringes allow for direct injection of insulin using a needle. Insulin pens come in disposable and reusable forms, featuring short and thin designs. Insulin pumps are available in tethered and patch forms; tethered pumps are attached to the body with a small tube, while patch pumps have no or very short tubes. Additionally, insulin can be inhaled using insulin inhalers, with the dose entering the lungs and subsequently being absorbed into the bloodstream. Both external and implantable insulin options are available in the market.

Global Insulin Delivery Devices Market Dynamics

Market Drivers

- Increasing prevalence of diabetes worldwide

- Technological advancements in insulin delivery devices

- Growing awareness about diabetes management and treatment

- Rising demand for minimally invasive insulin delivery solutions

Market Restraints

- Stringent regulatory requirements for insulin delivery devices

- High cost associated with advanced insulin delivery technologies

- Limited accessibility to insulin delivery devices in developing regions

Market Opportunities

- Expanding market penetration through strategic collaborations and partnerships

- Development of personalized insulin delivery solutions

- Rising adoption of insulin pumps and continuous glucose monitoring systems

Insulin Delivery Devices Market Report Coverage

| Market | Insulin Delivery Devices Market |

| Insulin Delivery Devices Market Size 2022 | USD 16.7 Billion |

| Insulin Delivery Devices Market Forecast 2032 |

USD 40.2 Billion |

| Insulin Delivery Devices Market CAGR During 2023 - 2032 | 9.3% |

| Insulin Delivery Devices Market Analysis Period | 2020 - 2032 |

| Insulin Delivery Devices Market Base Year |

2022 |

| Insulin Delivery Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Distribution Channel, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ypsomed AG, Novo Nordisk A/S, Wockhardt Ltd., Medtronic, F. Hoffmann-La Roche, Ltd., Abbott Laboratories, Sanofi, Eli Lilly and Company, Biocon Ltd., and Becton, Dickinson and Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Insulin Delivery Devices Market Insights

The tremendous increase in the worldwide diabetes population in recent years has been the key driver of the insulin device industry. This increase is supported by a number of variables, including rising discretionary income and the availability of favourable reimbursement rules, which all contribute to market expansion. Moreover, increased consumer knowledge of the availability of various insulin delivery devices plays a vital role in the market's rising demand. Furthermore, the continuous lack of a definite and effective diabetes treatment highlights the critical need for insulin therapy improvement, which will drive market expansion even further. Despite continuing medical advancements, diabetes remains a chronic disorder that requires long-term treatment, emphasising the need of insulin delivery systems. As a result, the industry is still expanding as healthcare practitioners and consumers look for new ways to improve diabetes control and quality of life.

The availability of oral insulin has a substantial impact on the insulin delivery device business. Despite its potential appeal to patients because to its non-invasive nature, oral insulin confronts obstacles that prevent widespread adoption. These issues include lower bioavailability and efficacy as a result of enzymatic breakdown in the digestive system, as well as varying absorption rates. Furthermore, greater dosages are required to elicit therapeutic benefits, which complicates its utilisation. As a result, conventional insulin administration methods such as syringes, pens, pumps, and inhalers remain popular among both healthcare practitioners and patients. However, technical improvements in insulin delivery devices provide promising answers to these difficulties, potentially minimising the influence of oral insulin on market growth and generating demand for novel delivery methods.

Insulin Delivery Devices Market Segmentation

The worldwide market for insulin delivery devices is split based on type, distribution channel, end use, and geography.

Insulin Delivery Device Market By Type

- Insulin Syringe

- Insulin Pens

- Insulin Jet Injectors

- Insulin Pumps

- Insulin Needles

- Insulin Inhalers

According to insulin delivery devices industry analysis, the insulin pen segment dominates the market by type, holding the maximum share. This segment has been experiencing significant growth primarily due to its presence in the market since the late 1980s. The availability of pens in both disposable and reusable forms further supports this growth. According to the ADA, diabetes patients express greater satisfaction with insulin pens compared to the vial and syringe technique, particularly with prefilled disposable pens. Other benefits associated with insulin pen usage include ease of use for both children and the elderly, portability, and convenience, as well as the presence of small needles to minimize fear and pain.

Insulin Delivery Device Market By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Sales

- Diabetes Clinics & Centers

Hospital pharmacies are the main distribution route and it will grow throughout the insulin delivery devices industry forecast period. This dominance is due to a variety of variables. For starters, hospital pharmacies act as important centres for healthcare services, providing patients with a wide choice of medicinal supplies, including insulin delivery devices, while under expert supervision. Furthermore, hospitals frequently serve a broad patient population, including individuals with acute and chronic illnesses like diabetes, necessitating the availability of a variety of insulin administration methods. Moreover, hospital pharmacists maintain close ties with healthcare practitioners, which allows for easy communication and collaboration when prescribing and distributing insulin devices. Overall, hospital pharmacies are the preferred distribution channel for insulin delivery devices due to their extensive services, accessibility, and competence, which contributes greatly to their market dominance.

Insulin Delivery Device Market By End-Use

- Hospitals

- Clinics

- Ambulatory Care Centers

- Homecare

Several significant factors contribute to the homecare sector becoming the largest end-use category in the insulin delivery devices market. To begin, there is an increasing tendency towards patient-centered treatment, which encourages diabetics to control their illness from the comfort of their own homes. Homecare settings provide patients with greater convenience, autonomy, and flexibility in managing their insulin administration, leading to increased usage of insulin delivery devices. On other hand, technical improvements have made equipment more user-friendly and accessible for self-administration, boosting demand in the homecare sector. Furthermore, with the global prevalence of diabetes increasing, homecare offers a cost-effective approach for long-term disease treatment, lessening the strain on healthcare institutions. Overall, the homecare sector's emphasis on patient empowerment and convenience makes it the largest and fastest-growing category in the insulin delivery device market.

Insulin Delivery Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Insulin Delivery Devices Market Regional Analysis

In 2022, North America accounted for the major shares in the regional market and it is also expected to continue with the dominance over the insulin delivery devices market forecast period from 2023 to 2032 owing to the increasing number of diabetes patients. The changing lifestyle and unhealthy eating habits are contributing to the growing number of diabetes cases in the region. In addition, favorable government policies, programs, and actions are further supporting the regional market growth.

Asia-Pacific has emerged as the fastest-growing region in the insulin delivery devices market, owing to a number of factors. To begin, the region is rapidly urbanizing and industrializing, resulting in substantial lifestyle changes such as sedentary lifestyles and bad food habits, all of which contribute to the increased incidence of diabetes. Furthermore, the Asia-Pacific region's demand for insulin delivery devices is being driven by improvements in healthcare infrastructure, higher disposable incomes, and increased access to healthcare services. Furthermore, aggressive government activities, such as awareness campaigns and subsidized healthcare programs, are fueling market expansion. As a result, Asia-Pacific has significant development prospects for insulin delivery device makers, ranking as the market's fastest-growing region.

Insulin Delivery Devices Market Players

Some of the top insulin delivery devices companies offered in our report include Ypsomed AG, Novo Nordisk A/S, Wockhardt Ltd., Medtronic, F. Hoffmann-La Roche, Ltd., Abbott Laboratories, Sanofi, Eli Lilly and Company, Biocon Ltd., and Becton, Dickinson and Company.

Frequently Asked Questions

How big is the insulin delivery devices market?

The insulin delivery devices market size was valued at USD 16.7 billion in 2022.

What is the CAGR of the global insulin delivery devices market from 2023 to 2032?

The CAGR of insulin delivery devices is 9.3% during the analysis period of 2023 to 2032.

Which are the key players in the insulin delivery devices market?

The key players operating in the global market are including Ypsomed AG, Novo Nordisk A/S, Wockhardt Ltd., Medtronic, F. Hoffmann-La Roche, Ltd., Abbott Laboratories, Sanofi, Eli Lilly and Company, Biocon Ltd., and Becton, Dickinson and Company.

Which region dominated the global insulin delivery devices market share?

North America held the dominating position in insulin delivery devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of insulin delivery devices during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global insulin delivery devices industry?

The current trends and dynamics in the insulin delivery devices industry include increasing prevalence of diabetes worldwide, technological advancements in insulin delivery devices, growing awareness about diabetes management and treatment, and rising demand for minimally invasive insulin delivery solutions.

Which distribution channel held the maximum share in 2022?

The homecare end use held the maximum share of the insulin delivery devices industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date