Disposable Insulin Pen Market | Acumen Research and Consulting

Disposable Insulin Pen Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

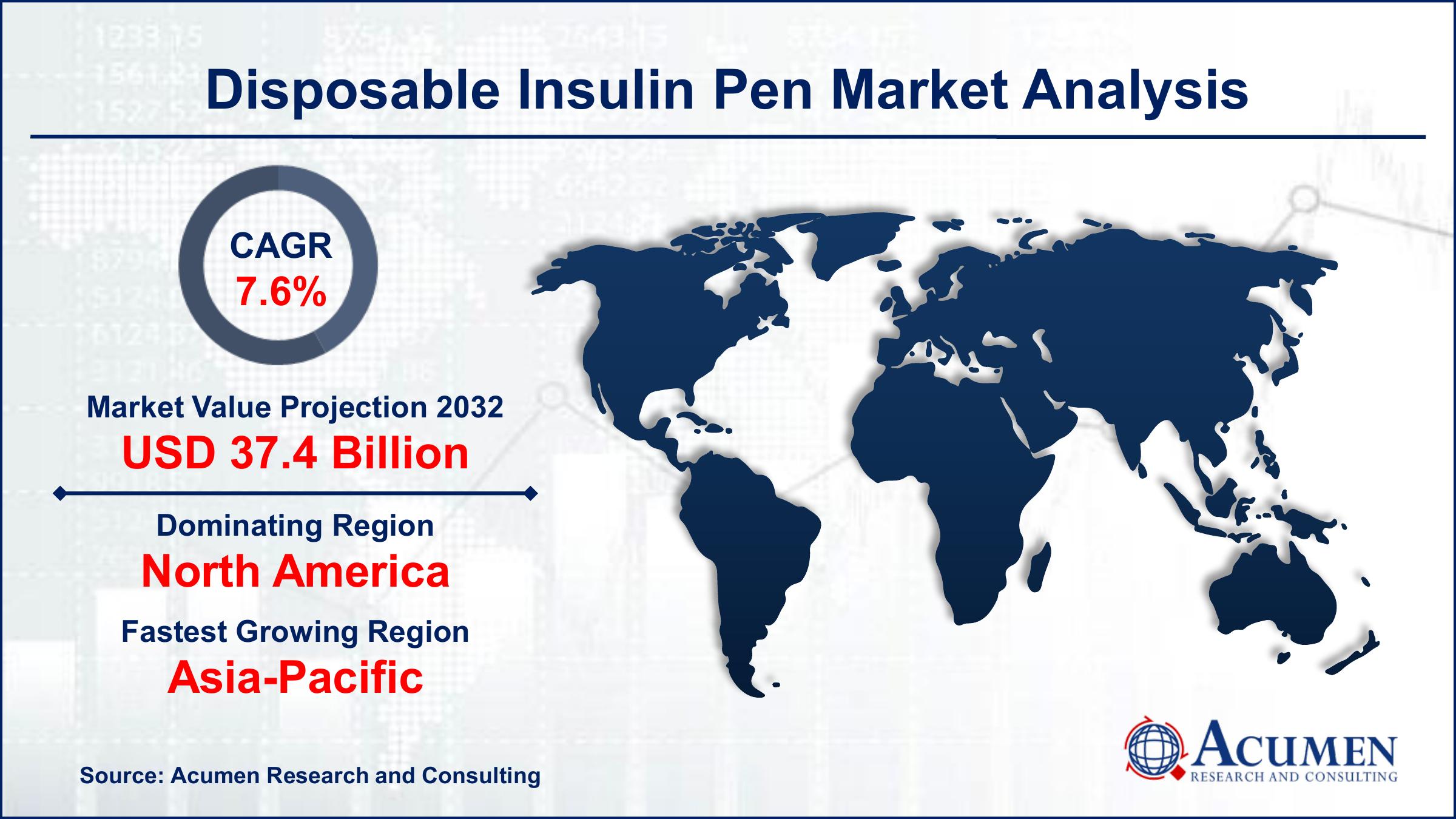

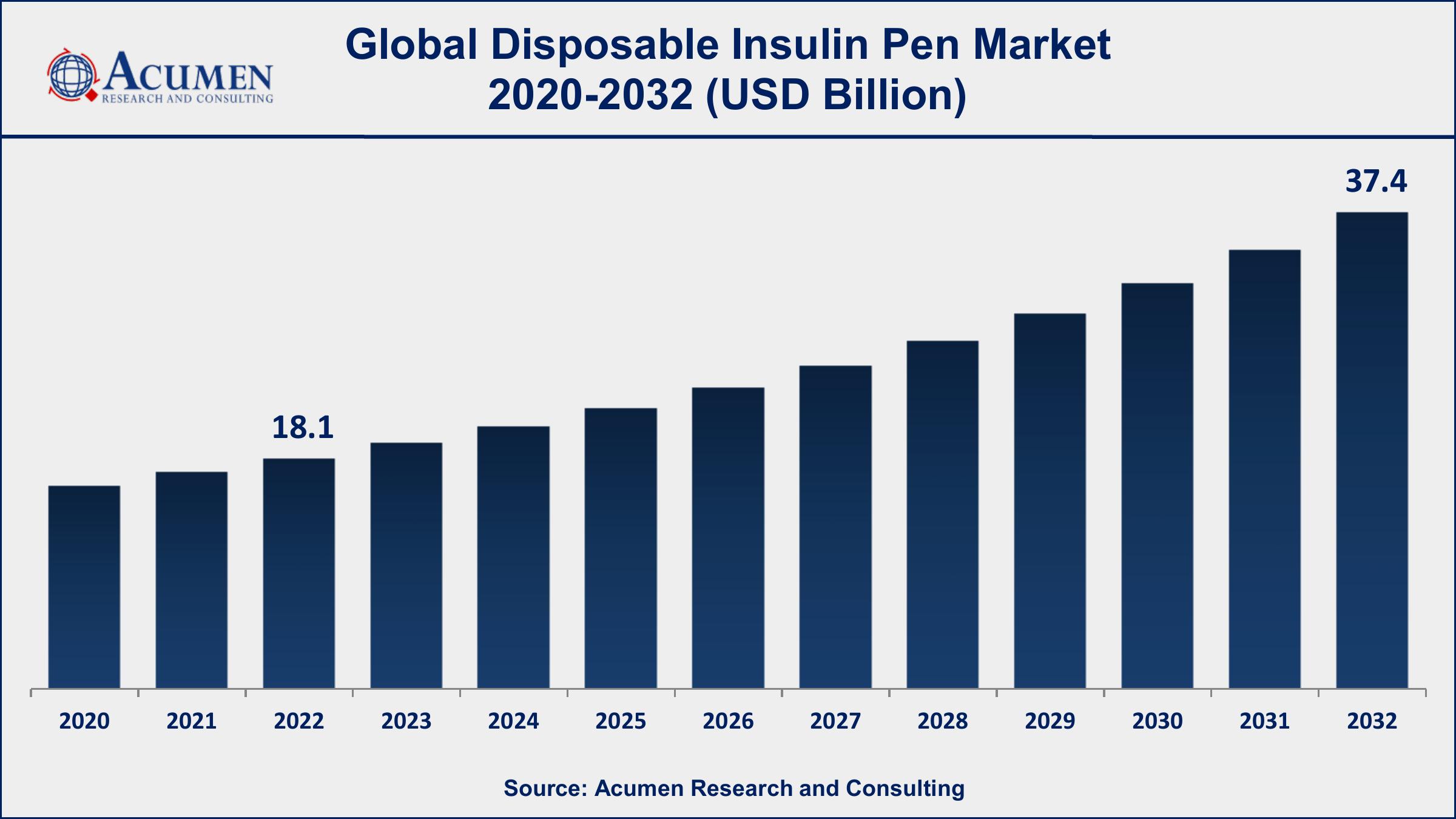

The Global Disposable Insulin Pen Market Size accounted for USD 18.1 Billion in 2022 and is projected to achieve a market size of USD 37.4 Billion by 2032 growing at a CAGR of 7.6% from 2023 to 2032.

Disposable Insulin Pen Market Key Highlights

- Global disposable insulin pen market revenue is expected to increase by USD 37.4 Billion by 2032, with a 7.6% CAGR from 2023 to 2032

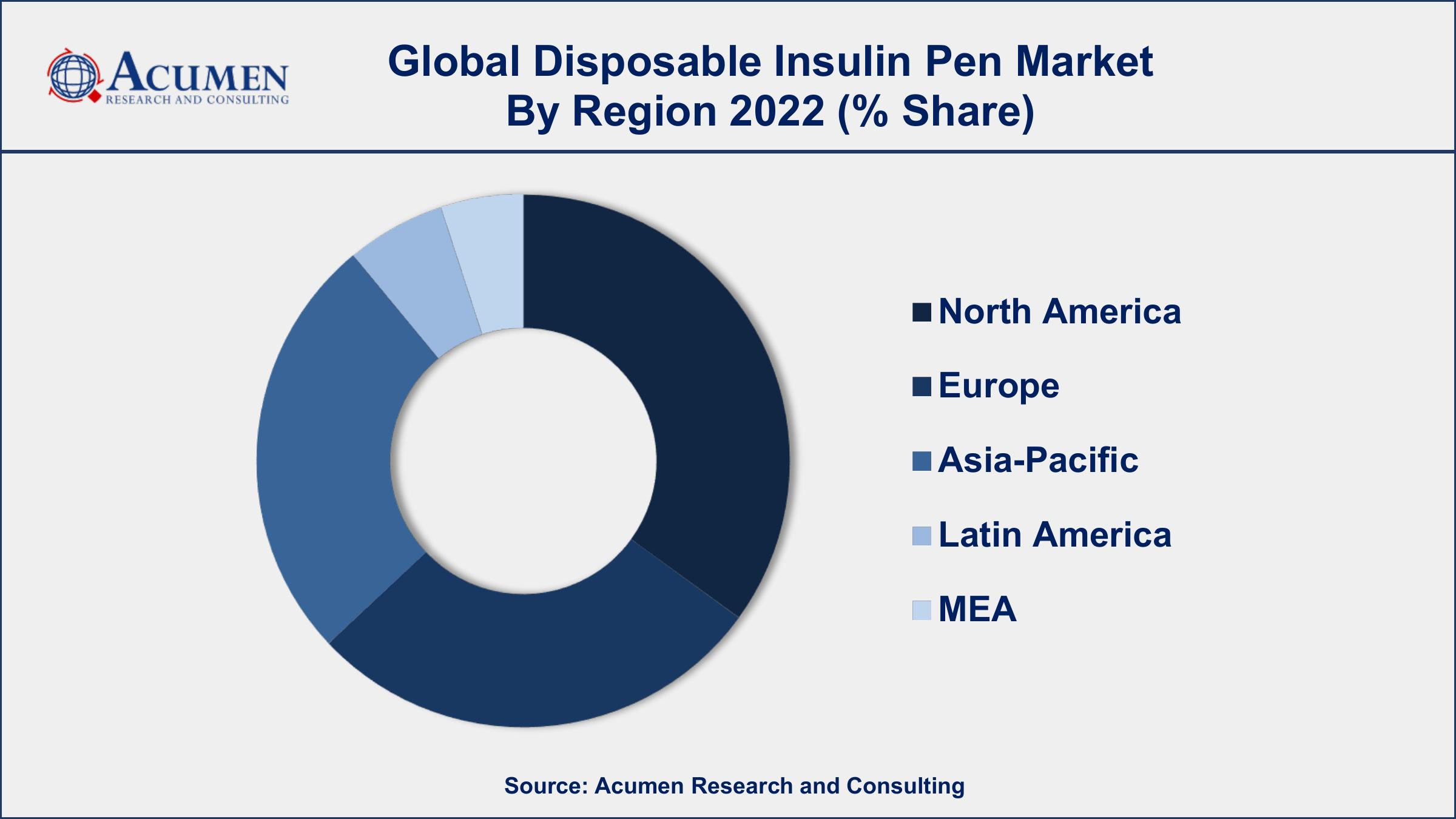

- North America region led with more than 38% of disposable insulin pen market share in 2022

- Asia-Pacific disposable insulin pen market growth will record a CAGR of over 8.3% from 2023 to 2032

- According to the International Diabetes Federation, an estimated 463 million adults (aged 20-79) were living with diabetes in 2019, and this number is projected to increase to 578 million by 2030

- According to a research survey, insulin pens accounted for 58% of the total insulin delivery market in 2022

- Rising focus on patient-centric care and self-management of diabetes, drives the disposable insulin pen market value

A disposable insulin pen is a medical device used by individuals with diabetes to inject insulin. It is a compact and convenient device that contains a prefilled cartridge of insulin and a disposable needle. The pen is designed to be easy to use, with adjustable dosing options, and provides a more discreet and less painful way to administer insulin compared to traditional vials and syringes.

The market for disposable insulin pens has been steadily growing over the past few years due to several factors. Firstly, there has been a rise in the prevalence of diabetes worldwide, which has led to an increased demand for insulin-delivery devices. Additionally, disposable insulin pens offer several advantages over other insulin delivery methods, such as increased convenience, accuracy in dosing, and reduced risk of needle stick injuries. These benefits have made disposable insulin pens a popular choice among patients and healthcare providers alike. Furthermore, advancements in technology have resulted in improved designs of disposable insulin pens, making them more user-friendly, compact, and customizable to individual needs.

Global Disposable Insulin Pen Market Trends

Market Drivers

- Increasing prevalence of diabetes worldwide

- Advancements in technology leading to improved designs of disposable insulin pens

- Convenience and ease of use offered by disposable insulin pens

- Accurate dosing options and reduced risk of needlestick injuries

- Growing demand for more discreet and less painful insulin delivery methods

Market Restraints

- High cost of disposable insulin pens compared to traditional vials and syringes

- Limited availability and accessibility in certain regions

Market Opportunities

- Increasing investment in research and development for innovative features, such as Bluetooth connectivity and smart sensors

- Rising focus on patient-centric care and self-management of diabetes

Disposable Insulin Pen Market Report Coverage

| Market | Disposable Insulin Pen Market |

| Disposable Insulin Pen Market Size 2022 | USD 18.1 Billion |

| Disposable Insulin Pen Market Forecast 2032 | USD 37.4 Billion |

| Disposable Insulin Pen Market CAGR During 2023 - 2032 | 7.6% |

| Disposable Insulin Pen Market Analysis Period | 2020 - 2032 |

| Disposable Insulin Pen Market Base Year | 2022 |

| Disposable Insulin Pen Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Distribution channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, Biocon Ltd., Ypsomed AG, Owen Mumford Ltd., GlaxoSmithKline plc., Wockhardt Ltd., Terumo Corporation, Becton, Dickinson and Company, Haselmeier AG, and Companion Medical Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increasing population suffering from diabetes is one of the major factors resulting in the growing demand for disposable insulin pens. As the amount of insulin in these pens is prefilled to the same levels, the threat of overdose and underdose is avoided. Disposable insulin pens are available in two forms, namely, durable insulin pens and prefilled insulin pens. Durable pens use replaceable insulin cartridges whereas prefilled pens are entirely disposable.

Rising counts of diabetes suffering population globally is the major factor anticipated to drive the market growth of disposable insulin pens. Growing awareness about the advancements evolved in diabetes care devices and their feasible and convenient usage have also raised the demand for disposable insulin pens. However, these disposable insulin pens are expensive when compared to conventional processes. In disposable insulin pens, two separate insulins cannot be combined; such adverse factors could hinder market growth. Disposable insulin pens avoid over/under-dosing of insulin, thus propelling high acceptance among the population. Also, continuous technological advancement and government regulatory support in the field of diabetic devices are augmenting the market growth.

Disposable Insulin Pen Market Segmentation

The global disposable insulin pen market segmentation is based on distribution channel, and geography.

Disposable Insulin Pen Market By Distribution channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

In terms of distribution channels, the hospital pharmacies segment holds the largest market share in 2022. This growth as hospital pharmacies is responsible for procuring, storing, and dispensing medications, including insulin pens, to inpatients and outpatients. One key factor driving the growth of the hospital pharmacies segment is the increasing prevalence of diabetes among hospitalized patients. As diabetes is a common comorbidity in many diseases and conditions, including cardiovascular diseases, cancer, and infectious diseases, hospital pharmacies need to stock and dispense disposable insulin pens to meet the insulin therapy needs of diabetic patients during their hospital stay. Moreover, the trend of shifting from vials and syringes to more convenient and user-friendly insulin pens is also driving the demand for disposable insulin pens in hospital pharmacies. Another factor driving the growth of the hospital pharmacies segment is the rising focus on patient-centric care and self-management of diabetes.

Moreover, the online pharmacies segment is witnessing significant growth in the disposable insulin pen market due to several factors. Online pharmacies, also known as e-pharmacies or virtual pharmacies, are gaining popularity among consumers as a convenient and accessible option for purchasing medications, including disposable insulin pens, without the need to visit a physical pharmacy. One of the key drivers of the growth of the online pharmacies segment is the increasing adoption of e-commerce and digitalization in the healthcare industry.

Disposable Insulin Pen Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Disposable Insulin Pen Market Regional Analysis

North America is dominating the disposable insulin pen market due to several factors that have contributed to its growth and market share in the region. These factors include a high prevalence of diabetes, favorable reimbursement policies, advanced healthcare infrastructure, and increasing adoption of technologically advanced insulin delivery devices. North America has a high prevalence of diabetes, which has resulted in a substantial demand for diabetes management products, including disposable insulin pens. According to the International Diabetes Federation, as of 2021, North America has one of the highest prevalence rates of diabetes in the world, with approximately 49 million people living with diabetes. This high prevalence has translated into a large market for disposable insulin pens in the region. Moreover, favorable reimbursement policies in North America have also contributed to the dominance of the disposable insulin pen market. Many countries in North America, including the United States and Canada, have well-established healthcare systems with reimbursement policies that cover the cost of disposable insulin pens. This has made these devices more accessible and affordable for patients, thereby driving their demand in the region.

Disposable Insulin Pen Market Player

Some of the top disposable insulin pen market companies offered in the professional report include Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, Biocon Ltd., Ypsomed AG, Owen Mumford Ltd., GlaxoSmithKline plc., Wockhardt Ltd., Terumo Corporation, Becton, Dickinson and Company, Haselmeier AG, and Companion Medical Inc.

Frequently Asked Questions

What was the market size of the global disposable insulin pen in 2022?

The market size of disposable insulin pen was USD 18.1 Billion in 2022.

What is the CAGR of the global disposable insulin pen market from 2023 to 2032?

The CAGR of disposable insulin pen is 7.6% during the analysis period of 2023 to 2032.

Which are the key players in the disposable insulin pen market?

The key players operating in the global market are including Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, Biocon Ltd., Ypsomed AG, Owen Mumford Ltd., GlaxoSmithKline plc., Wockhardt Ltd., Terumo Corporation, Becton, Dickinson and Company, Haselmeier AG, and Companion Medical Inc.

Which region dominated the global disposable insulin pen market share?

North America held the dominating position in disposable insulin pen industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of disposable insulin pen during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global disposable insulin pen industry?

The current trends and dynamics in the disposable insulin pen industry include growing demand for energy-efficient buildings, increasing adoption of green building materials, and rising demand for ACS in high-temperature industrial Distribution channels.

Which distribution channel held the maximum share in 2022?

The hospital pharmacies distribution channel held the maximum share of the disposable insulin pen industry.