Ink Additives Market | Acumen Research and Consulting

Ink Additives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

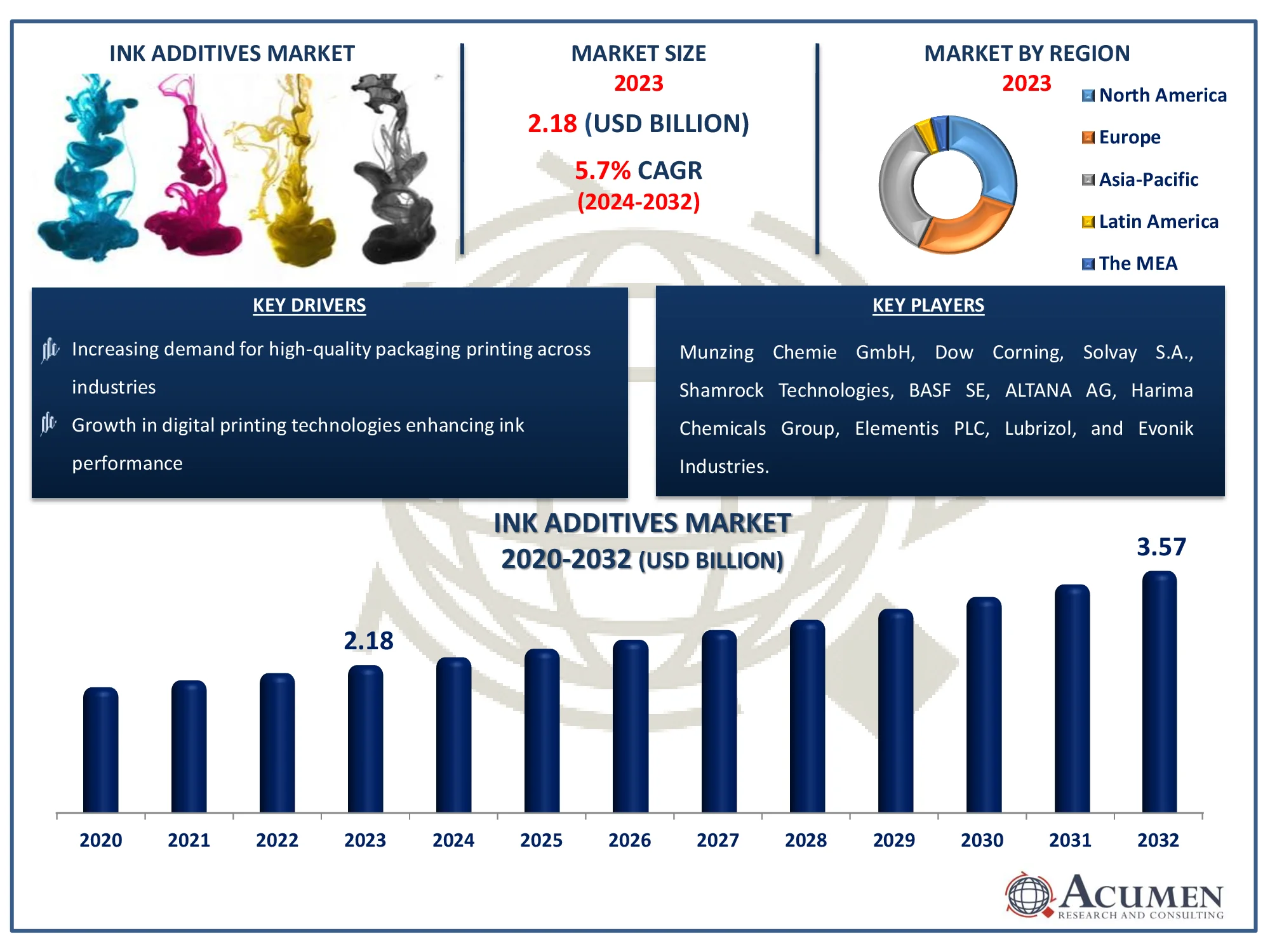

The Global Ink Additives Market Size accounted for USD 2.18 Billion in 2023 and is estimated to achieve a market size of USD 3.57 Billion by 2032 growing at a CAGR of 5.7% from 2024 to 2032.

Ink Additives Market Highlights

- Global ink additives market revenue is poised to garner USD 3.57 billion by 2032 with a CAGR of 5.7% from 2024 to 2032

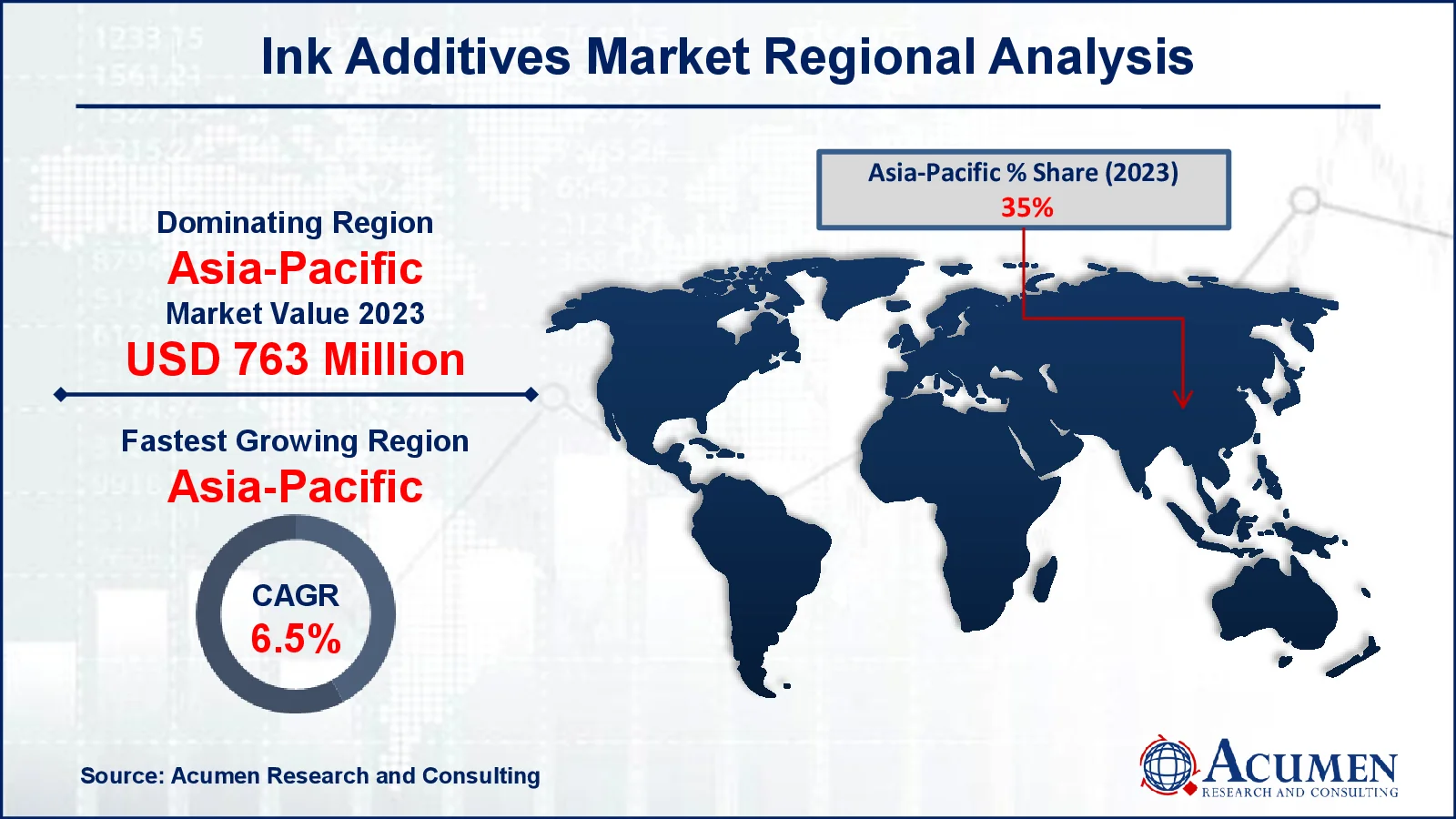

- Asia-Pacific ink additives market value occupied around USD 763 million in 2023

- Asia-Pacific ink additives market growth will record a CAGR of more than 6.5% from 2024 to 2032

- Among application, the packaging sub-segment generated more than USD 828.4 million revenue in 2023

- Based on type, the rheology modifiers sub-segment generated around 35% market share in 2023

- Increasing penetration of additive manufacturing in industrial applications is a popular ink additives market trend that fuels the industry demand

The global market for ink additives is predicted to develop significantly during the forecast period, driven by increased demand from the packaging industry. Additives improve the performance, color, appearance, finish, printability, 3D effects, and ink stickiness. The product and application criteria determine the type of additive used. Defoamers, for example, prevent foaming throughout the manufacturing process and are ideal for water-based flexographic printing and printmaking.

Various types of ink additives are available on the market. Topics, waxes, defoamers and dispersants are included. They offer various outcomes. Tensile agents for example improve the wetting of pigments or substrate; waxes promote rubbing resistance; and plasticizers improve film flexibility. Tin additives can be produced in the final printing tin in accordance with the exact requirement. Additives in tin, for example packaging, printing, publishing, commercial or printing procedures, such as lithography, flexography, gravure, and digital printing, can be adapted even for certain applications. However, custom ink additives can only develop by close cooperation between manufacturers of ink printing and manufacturers of ink additives. Such cooperation provides profitable opportunities for manufacturers of ink additives.

Global Ink Additives Market Dynamics

Market Drivers

- Increasing demand for high-quality packaging printing across industries

- Growth in digital printing technologies enhancing ink performance

- Rising use of eco-friendly and sustainable printing solutions

- Expanding demand for UV-curable inks in various applications

Market Restraints

- Volatile raw material prices impacting production costs

- Stringent environmental regulations limiting certain additives

- Shift towards digital media reducing traditional printing demand

Market Opportunities

- Innovations in bio-based ink additives promoting sustainability

- Expanding e-commerce sector boosting packaging requirements

- Growing adoption of 3D printing technologies requiring advanced ink formulations

Ink Additives Market Report Coverage

| Market | Ink Additives Market |

| Ink Additives Market Size 2022 |

USD 2.18 Billion |

| Ink Additives Market Forecast 2032 | USD 3.57 Billion |

| Ink Additives Market CAGR During 2023 - 2032 | 5.7% |

| Ink Additives Market Analysis Period | 2020 - 2032 |

| Ink Additives Market Base Year |

2022 |

| Ink Additives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Printing Process, By Printing Inks, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Munzing Chemie GmbH, Dow Corning, Solvay S.A., Shamrock Technologies, BASF SE, ALTANA AG, Harima Chemicals Group, Elementis PLC, Lubrizol, and Evonik Industries. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ink Additives Market Insights

The packaging of all goods is necessary. Packaging is an important factor in the consumer's buying decision. Goods are protected from improper handling, tough environments and transportation by packaging. An important role in the sale of the goods is attractive packaging. These benefits from packaging have begun to be realized by manufacturers and consumers. This has led to a substantial increase in the global packaging industry over the last few years. During the ink additives industry forecast period, the trend is expected to continue. Printing tints are required for every kind of packaging and all printed tins need one of the raw materials ink additives.

Digitization refers to the digital development of text and images. Digitalization has accelerated the development of computers, smart phones and high-speed internet. There are currently several textbooks, newspapers, illustrative books, etc. on the web. Even marketing campaigns do not require any material to be printed anymore, and can be carried out completely online. The e-commerce trend is increasing rapidly worldwide. Publication and commercial printing have been obstructed with digitizing across a number of sectors, such as e-commerce, books and marketers. In turn, the global industry will likely be restricted during the ink additives market forecast period by substantial declines in paper communications.

Ink Additives Market Segmentation

The worldwide market for ink additives is split based on type, printing process, printing inks, application, and geography.

Ink Additives Market By Type

- Foam Control Additives

- Dispersing & Wetting Agents

- Slip/Rub Materials

- Rheology Modifiers

- Others

According to ink additives industry analysis, rheology modifiers account for the highest proportion of the market due to their critical function in modifying ink flow parameters. These additives regulate the viscosity and stability of ink formulations, resulting in easy application and consistent print quality across multiple substrates. They are commonly used in both water and solvent-based inks, making them useful in industries such as packaging, printing, and textiles. Rheology modifiers also improve overall ink performance by reducing sagging, settling, and poor coverage. Their capacity to fine-tune consistency, improve print precision, and improve adherence renders them crucial in high-performance ink formulations.

Ink Additives Market By Printing Process

- Flexography

- Lithography

- Digital

- Gravure

- Others

Flexography dominates the ink additives market because of its broad use in packaging and labeling applications. This printing technology is highly efficient for large-scale production and versatile across a variety of substrates, including paper, plastic, and metallic films. Flexography necessitates unique ink additives to enhance ink flow, adhesion, and drying time, resulting in brilliant colors and sharp details on flexible materials. Its dominance is further fueled by the increased need for environmentally friendly packaging, where flexo printing thrives with water-based inks. As customer preferences shift toward sustainable products, flexography's versatility and cost-effectiveness strengthen its market position.

Ink Additives Market By Printing Inks

- Solvent-based

- Water-based

- UV-cured

Water-based inks are predicted to be the largest category in the ink additives market due to its environmental friendliness and low VOC (Volatile Organic Compound) emissions. As industry and consumers move toward more sustainable practices, water-based inks provide a safer alternative without sacrificing print quality or performance. These inks are frequently used in packaging, textiles, and labels, where regulatory pressure for greener alternatives is high. The increased demand for environmentally friendly products, notably in the food packaging industry, has accelerated the use of water-based inks. Furthermore, advances in additive technology have increased their drying time and printability, making them a better option than solvent-based alternatives.

Ink Additives Market By Application

- Publishing

- Packaging

- Commercial Printing

- Others

Packaging is a marketing aspect of great importance that influences the purchasing decision of consumers. A major consumer of printing inks is the packaging industry. In the next few years the demand for ink additives are estimated to increase in the food-and beverages industry and the demand for flexible packaging in the health care industry. The global ink additive market for the forecast period will be driven by increasing demand in the global packaging industry. The worldwide packaging industry in 2023 was estimated at around USD 828.4 billion and is expected to expand fast over the ink additives market forecast period.

Ink Additives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ink Additives Market Regional Analysis

Asia-Pacific leads the ink additives market due to its strong industrial base and expanding industries such as packaging, printing, and textiles. China, India, and Japan are major manufacturers and users of inks and additives, thanks to their expanding economies and rising industrial output. The region's supremacy is reinforced by the rapid growth of e-commerce and the packaging industry, all of which require high-quality printing solutions. The presence of a large number of ink makers, along with cheaper manufacturing costs, strengthens Asia-Pacific's leadership position. Furthermore, increased consumer demand for printed goods, particularly in packaging and advertising, is driving the market for ink additives in the region.

Asia-Pacific is also predicted to be the fastest-growing region in the ink additives market, owing to rising urbanization, industrialization, and increased e-commerce. The growing demand for packaged goods, combined with the expansion of flexible packaging, drives the need for sophisticated printing methods that rely largely on ink additives. Governments across the region are pushing environmentally friendly practices, which encourages the use of water-based inks and increases demand for specialist additives. Emerging economies such as India, Vietnam, and Indonesia are seeing an increase in the use of printing inks as their retail and advertising sectors thrive. This rapid rise has established Asia-Pacific as a major market for future expansion.

Ink Additives Market Players

Some of the top ink additives companies offered in our report includes Munzing Chemie GmbH, Dow Corning, Solvay S.A., Shamrock Technologies, BASF SE, ALTANA AG, Harima Chemicals Group, Elementis PLC, Lubrizol, and Evonik Industries.

Frequently Asked Questions

How big is the ink additives market?

The ink additives market size was valued at USD 2.18 Billion in 2023.

What is the CAGR of the global ink additives market from 2024 to 2032?

The CAGR of Ink Additives is 5.7% during the analysis period of 2024 to 2032.

Which are the key players in the ink additives market?

The key players operating in the global market are including Munzing Chemie GmbH, Dow Corning, Solvay S.A., Shamrock Technologies, BASF SE, ALTANA AG, Harima Chemicals Group, Elementis PLC, Lubrizol, and Evonik Industries.

Which region dominated the global ink additives market share?

Asia-Pacific held the dominating position in ink additives industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ink additives during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global ink additives industry?

The current trends and dynamics in the ink additives industry include increasing demand for high-quality packaging printing across industries, growth in digital printing technologies enhancing ink performance, rising use of eco-friendly and sustainable printing solutions, and expanding demand for UV-curable inks in various applications.

Which type held the maximum share in 2023?

The rheology type held the maximum share of the ink additives industry.