Infant Formula Ingredients Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Infant Formula Ingredients Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

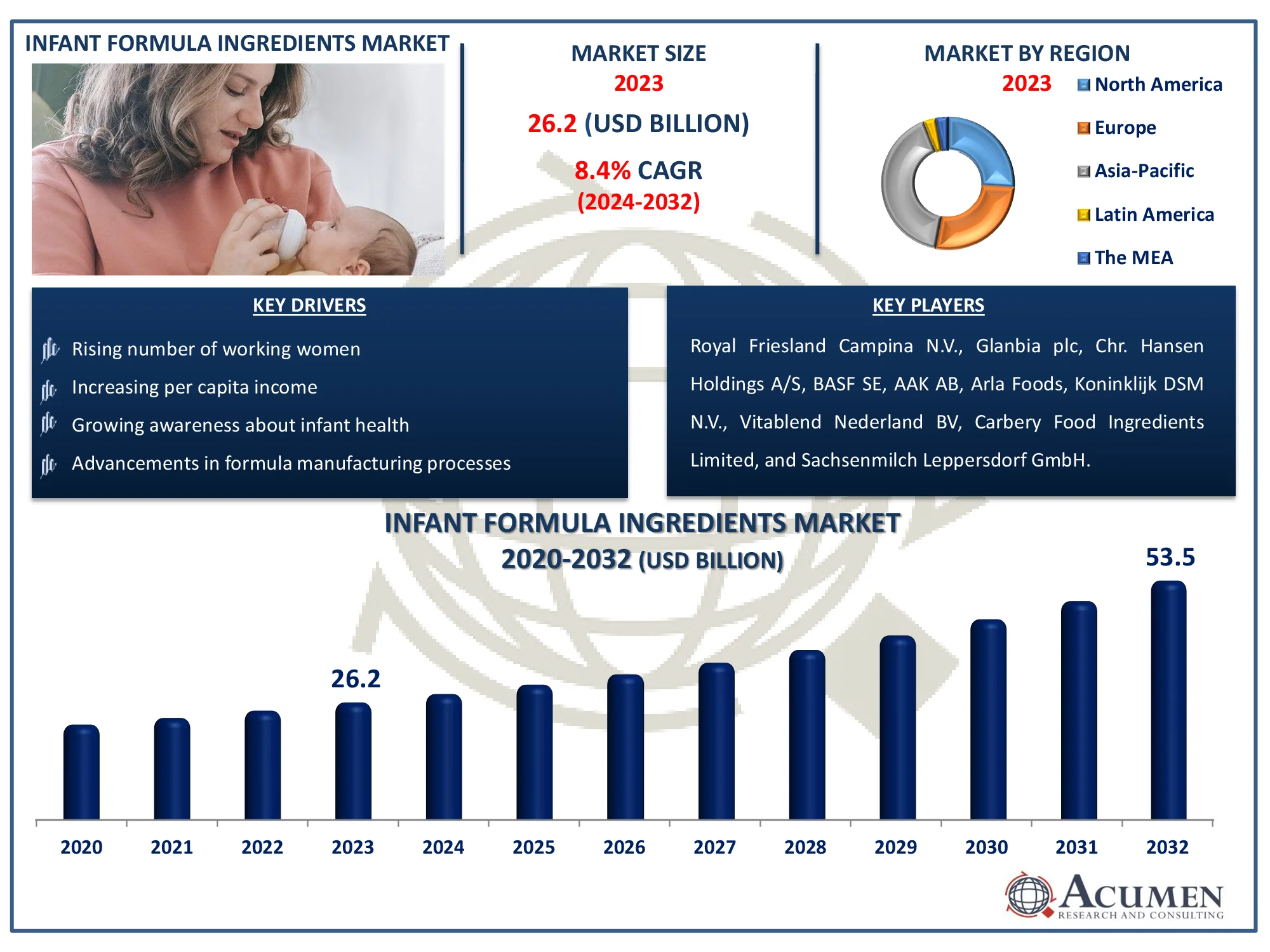

The Global Infant Formula Ingredients Market Size accounted for USD 26.2 Billion in 2023 and is estimated to achieve a market size of USD 53.5 Billion by 2032 growing at a CAGR of 8.4% from 2024 to 2032.

Infant Formula Ingredients Market Highlights

- Global infant formula ingredients market revenue is poised to garner USD 53.5 billion by 2032 with a CAGR of 8.4% from 2024 to 2032

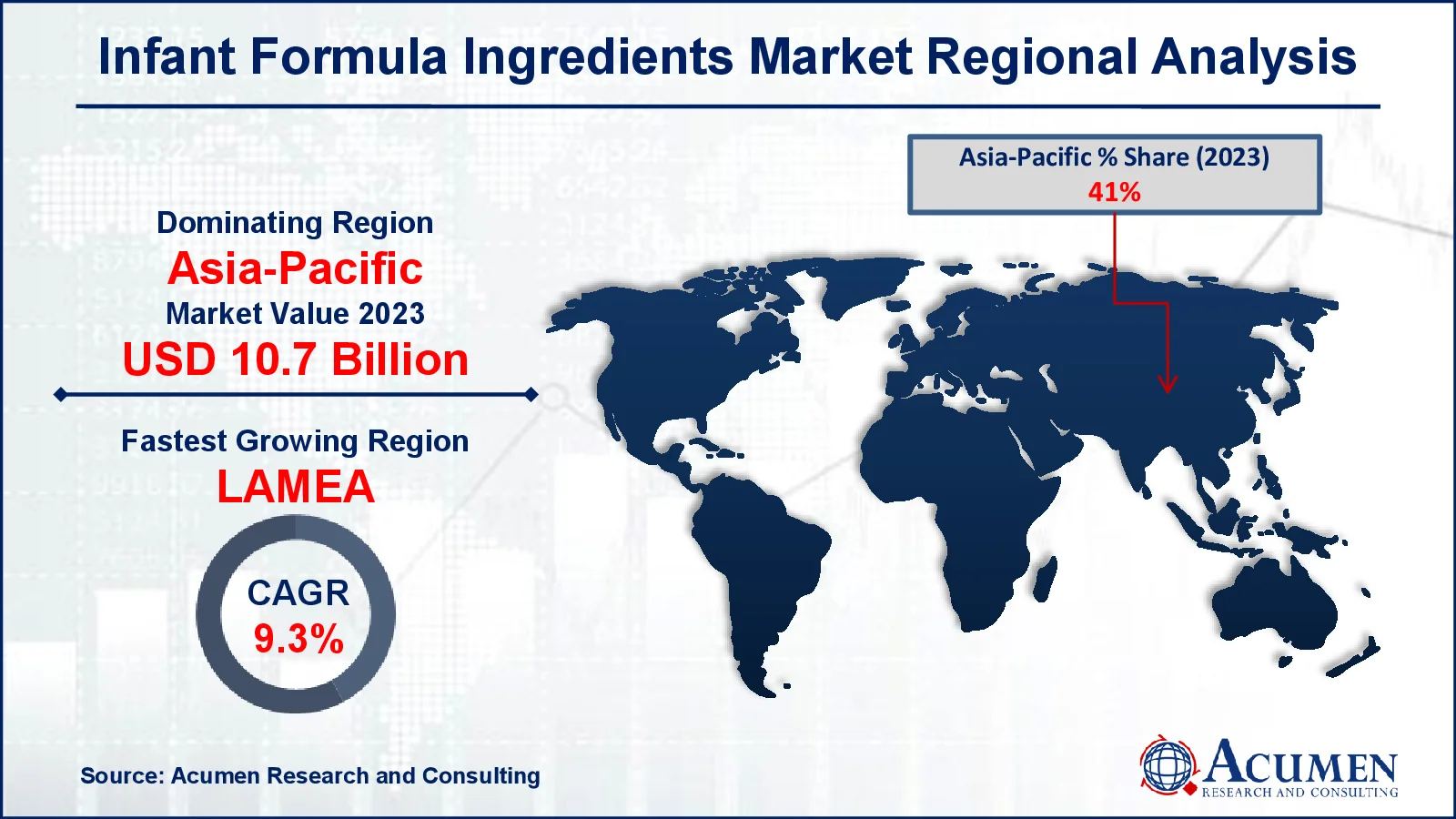

- Asia-Pacific infant formula ingredients market value occupied around USD 10.7 billion in 2023

- LAMEA infant formula ingredients market growth will record a CAGR of more than 9.3% from 2024 to 2032

- Among type, the prebiotics sub-segment generated noteworthy revenue in 2023

- Based on source, the cow milk sub-segment generated significant infant formula ingredients market share in 2023

- Rising demand for hypoallergenic and specialized formulas is a popular infant formula ingredients market trend that fuels the industry demand

A variety of nutritional options for infants are available on the market. Infant formulas typically include purified cow's milk as a protein source, a blend of vegetable oils for fat, a mix of vitamins and minerals, lactose as a carbohydrate source, and other ingredients depending on the manufacturing process. In recent years, the infant formula industry has grown rapidly due to the rising number of working women and increased per capita income. Infant formula ingredients contribute to improving infant health, ultimately helping to reduce hospital costs. Increasing awareness among consumers has led to greater adoption of these nutritional products.

Global Infant Formula Ingredients Market Dynamics

Market Drivers

- Rising number of working women

- Increasing per capita income

- Growing awareness about infant health

- Advancements in formula manufacturing processes

Market Restraints

- High cost of premium formulas

- Stringent regulatory requirements

- Increasing preference for breastfeeding

Market Opportunities

- Expansion into emerging markets

- Development of organic and non-GMO formulas

- Technological innovations in product formulation

Infant Formula Ingredients Market Report Coverage

|

Market |

Infant Formula Ingredients Market |

|

Infant Formula Ingredients Market Size 2023 |

USD 26.2 Billion |

|

Infant Formula Ingredients Market Forecast 2032 |

USD 53.5 Billion |

|

Infant Formula Ingredients Market CAGR During 2024 - 2032 |

8.4% |

|

Infant Formula Ingredients Market Analysis Period |

2020 - 2032 |

|

Infant Formula Ingredients Market Base Year |

2023 |

|

Infant Formula Ingredients Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Source, By Form, By Application, By Distribution Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Royal Friesland Campina N.V., Glanbia plc, Chr. Hansen Holdings A/S, BASF SE, AAK AB, Arla Foods, Koninklijk DSM N.V., Vitablend Nederland BV, Carbery Food Ingredients Limited, and Sachsenmilch Leppersdorf GmbH. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Infant Formula Ingredients Market Insights

The infant formula ingredients market is expanding rapidly due to a number of main reasons. One of the key reasons is the growing middle-class population in the Asia-Pacific region. As more families acquire higher disposable incomes, the demand for high-quality newborn nourishment rises, resulting in increased consumption of infant formula. Another significant contributor is the increasing number of working women. As more women enter the job, the demand for convenient feeding options for their infants grows. Infant formula is a viable option for women who are unable to breastfeed owing to time restrictions or working conditions. Rising awareness of natural newborn feeding is also driving market expansion. Parents are becoming more knowledgeable about their infants' nutritional needs, and they are looking for high-quality formula solutions that closely replicate the benefits of natural nursing. This knowledge is fueling the need for improved and customized formula ingredients.

In recent years, the prevalence of malnutrition and dietary deficits among neonates has risen dramatically. This has increased the emphasis on infant formula ingredients as a critical solution for ensuring adequate nutrition for infants, garnering the attention of parents and healthcare practitioners worldwide. Moreover, a huge population base, rapid economic development, and high birth rates in many regions all contribute to market growth. These causes generate significant demand for infant formula products. The inability of some women to adequately lactate, along with a preference for simple feeding alternatives, drives market expansion. As parents seek trustworthy and nutritionally balanced alternatives to breastfeeding, the need for high-quality infant formula ingredients grows.

Despite promising growth trends, the baby formula ingredients market confronts significant challenges. One big obstacle is the high cost of premium nutrition formulas, which can be too expensive for many families, especially those in low- and middle-income areas. These high costs may hinder market penetration and adoption among economically disadvantaged groups. Furthermore, a lack of awareness and education regarding the benefits and availability of infant formula in developing countries can impede market expansion. Traditional feeding traditions in these communities, as well as restricted access to information about modern nutritional options, can hinder infant formula components from becoming widely used. Addressing these difficulties through focused education and cost-cutting methods is critical for overall market growth.

Infant Formula Ingredients Market Segmentation

The worldwide market for infant formula ingredients market is split based on type, source, form, application, distribution channels, and geography.

Infant Formula Ingredients Market By Type

- Carbohydrates

- Oils & Fats

- Proteins

- Vitamins & Minerals

- Prebiotics

- Others

According to infant formula ingredients industry analysis, prebiotics account for the majority of the global industry. Prebiotics are non-digestible food elements that encourage the growth of healthy bacteria in the stomach, which is essential for an infant's digestive and immune system development. Prebiotics' popularity has increased substantially as parents become more aware of their health benefits. Prebiotics are increasingly being used in infant formulae to mirror the natural qualities of breast milk, which contains prebiotic oligosaccharides. Furthermore, current study and advances in understanding the significance of gut health in overall well-being have increased the appeal of prebiotics. Prebiotics have emerged as a market leader due to their emphasis on giving a more natural alternative to breastfeeding.

Infant Formula Ingredients Market By Source

- Cow Milk

- Soy

- Protein Hydrolysates

- Others

In the infant formula ingredients market, cow milk has the highest share. Cow milk is a popular source because it is readily available, inexpensive, and has a nutritional profile that is similar to that of human milk. It contains the vital proteins, lipids, and carbs required for newborn growth and development. Furthermore, cow's milk-based formulas have been thoroughly investigated and have a long history of safe use, making them a popular choice among parents and healthcare practitioners. The wide selection of products available, each adapted to distinct infant needs and stages, reinforces cow milk's market dominance. Enhanced processing processes also ensure that cow's milk formulas are easy to digest and nutritionally balanced for infants.

Infant Formula Ingredients Market By Forms

- Powder

- Liquid & Semi-Liquid

Powder is predicted to be the largest sector of the baby formula ingredients market. This dominance is due to a variety of variables. Powdered infant formula is easier to store and transport since it has a longer shelf life and requires less refrigeration than liquid formulations. It also saves money for both manufacturers and customers. Furthermore, powdered recipe provides additional flexibility in preparation, allowing caregivers to change the concentration as needed. These practical advantages, together with widespread consumer preference and a large range of powdered choices in various formulas, help to justify its market leadership.

Infant Formula Ingredients Market By Applications

- Growing-Up Milk (Infants Over 12 Months)

- Standard Infant Formula (0–6-Month-Old Infant)

- Follow-On Formula (6–12 Month-Old Infant)

- Specialty Formula

- Others

The standard infant formula category is projected to be the largest during the infant formula ingredients market forecast period. This segment is designed for newborns aged 0-6 months, a vital growth period in which nutrition is essential. When breastfeeding is impossible or insufficient, parents and caregivers frequently use normal infant formula as a primary or supplementary source of nutrition. The increased birth rate and growing knowledge of newborn nutrition help to drive demand for this market. Furthermore, normal infant formula is meant to closely resemble breast milk, supplying vital nutrients for early development. Its market domination stems from its ubiquitous availability and critical function in early baby care.

Infant Formula Ingredients Distribution Channels

- Pharmacy & Medical Store

- Supermarkets & Hypermarkets

- Online

- Others

Among the distribution channels in the infant formula ingredients market, supermarkets & hypermarkets are expected to emerge as the largest segment. This projection is primarily driven by consumer preferences for one-stop shopping experiences where they can find a wide range of infant formula products alongside other baby care essentials. Supermarkets and hypermarkets offer convenience, competitive pricing, and the assurance of quality through established brands and product variety. Moreover, these retail outlets often provide promotions, discounts, and loyalty programs that attract and retain customers seeking infant nutrition solutions. The accessibility and visibility of infant formula products in these large-scale retail environments further bolster their dominance in reaching a broad consumer base, making supermarkets and hypermarkets the leading distribution channel in the market.

Infant Formula Ingredients Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Infant Formula Ingredients Market Regional Analysis

In terms of infant formula ingredients market analysis, Asia-Pacific is the largest regional market. This supremacy is primarily caused by a number of fundamental causes. To begin, Asia-Pacific has a sizable population base, particularly in countries like as China and India, where rising birth rates and urbanization are driving the demand for infant formula. Economic development and rising disposable incomes in these locations have resulted in increased affordability and demand for premium newborn nourishment products. Moreover, shifting lifestyles and cultural developments, such as the increasing number of working mothers who use formula, help to drive market growth. The presence of established global corporations and local producers catering to varied consumer demands improves the market's position in Asia-Pacific.

In contrast, LAMEA is listed as the fastest-growing region in the infant formula ingredients industry forecast period. This expansion is being driven by improvements in healthcare infrastructure, increased knowledge of the importance of newborn nutrition, and economic progress in several African nations. Urbanization and the gradual transition from traditional feeding techniques to commercially produced infant formulae are also driving market expansion in the region. Furthermore, programs that promote breastfeeding as a viable option to formula feeding are influencing market dynamics in LAMEA. The combination of these characteristics places LAMEA as a prospective and quickly rising market for infant formula components, attracting investments from multinational companies looking to extend their presence in emerging markets.

Infant Formula Ingredients Market Players

Some of the top infant formula ingredients market companies offered in our report includes Royal Friesland Campina N.V., Glanbia plc, Chr. Hansen Holdings A/S, BASF SE, AAK AB, Arla Foods, Koninklijk DSM N.V., Vitablend Nederland BV, Carbery Food Ingredients Limited, and Sachsenmilch Leppersdorf GmbH.

Frequently Asked Questions

How big is the infant formula ingredients market?

The infant formula ingredients market size was valued at USD 26.2 billion in 2023.

What is the CAGR of the global infant formula ingredients market from 2024 to 2032?

The CAGR of infant formula ingredients is 8.4% during the analysis period of 2024 to 2032.

Which are the key players in the infant formula ingredients market?

The key players operating in the global market are including Royal Friesland Campina N.V., Glanbia plc, Chr. Hansen Holdings A/S, BASF SE, AAK AB, Arla Foods, Koninklijk DSM N.V., Vitablend Nederland BV, Carbery Food Ingredients Limited, and Sachsenmilch Leppersdorf GmbH.

Which region dominated the global infant formula ingredients market share?

Asia-Pacific held the dominating position in infant formula ingredients industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

LAMEA region exhibited fastest growing CAGR for market of infant formula ingredients during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global infant formula ingredients industry?

The current trends and dynamics in the infant formula ingredients industry include rising number of working women, increasing per capita income, growing awareness about infant health, and advancements in formula manufacturing processes.

Which type held the maximum share in 2023?

The prebiotics held the maximum share of the infant formula ingredients industry.