Nutritional Supplements Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Nutritional Supplements Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

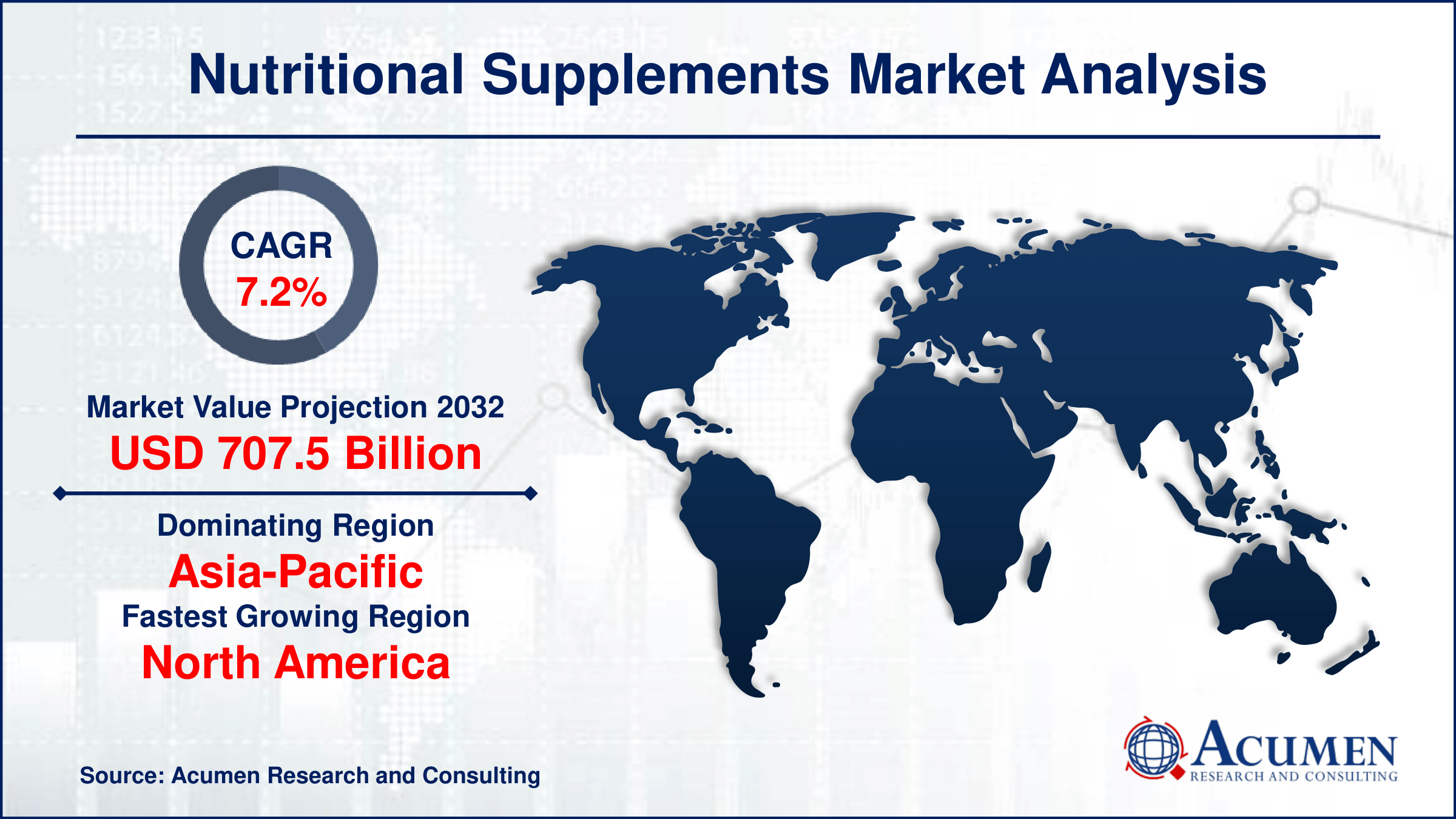

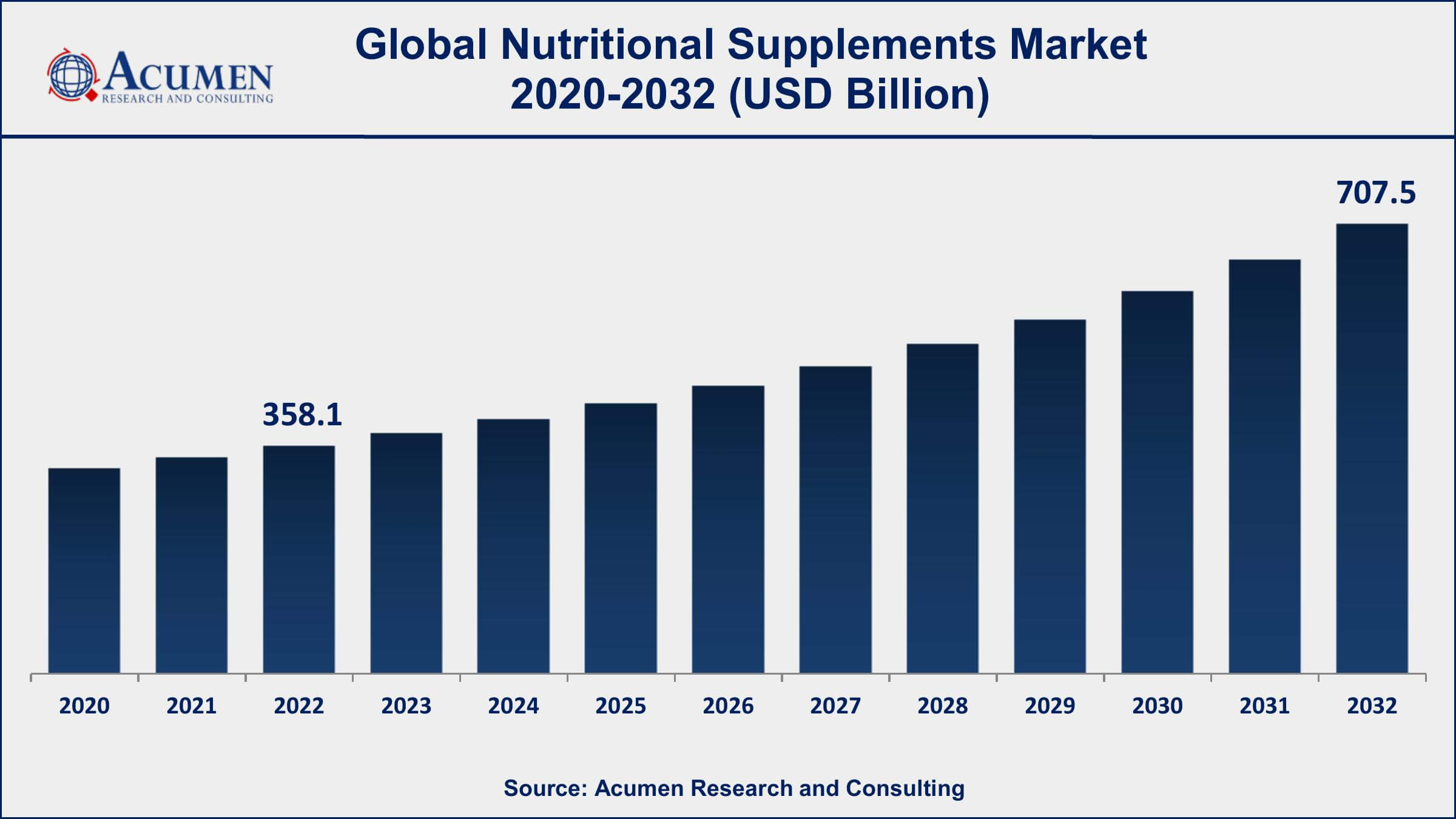

The Global Nutritional Supplements Market Size accounted for USD 358.1 Billion in 2022 and is projected to achieve a market size of USD 707.5 Billion by 2032 growing at a CAGR of 7.2% from 2023 to 2032.

Nutritional Supplements Market Highlights

- Global Nutritional Supplements Market revenue is expected to increase by USD 707.5 Billion by 2032, with a 7.2% CAGR from 2023 to 2032

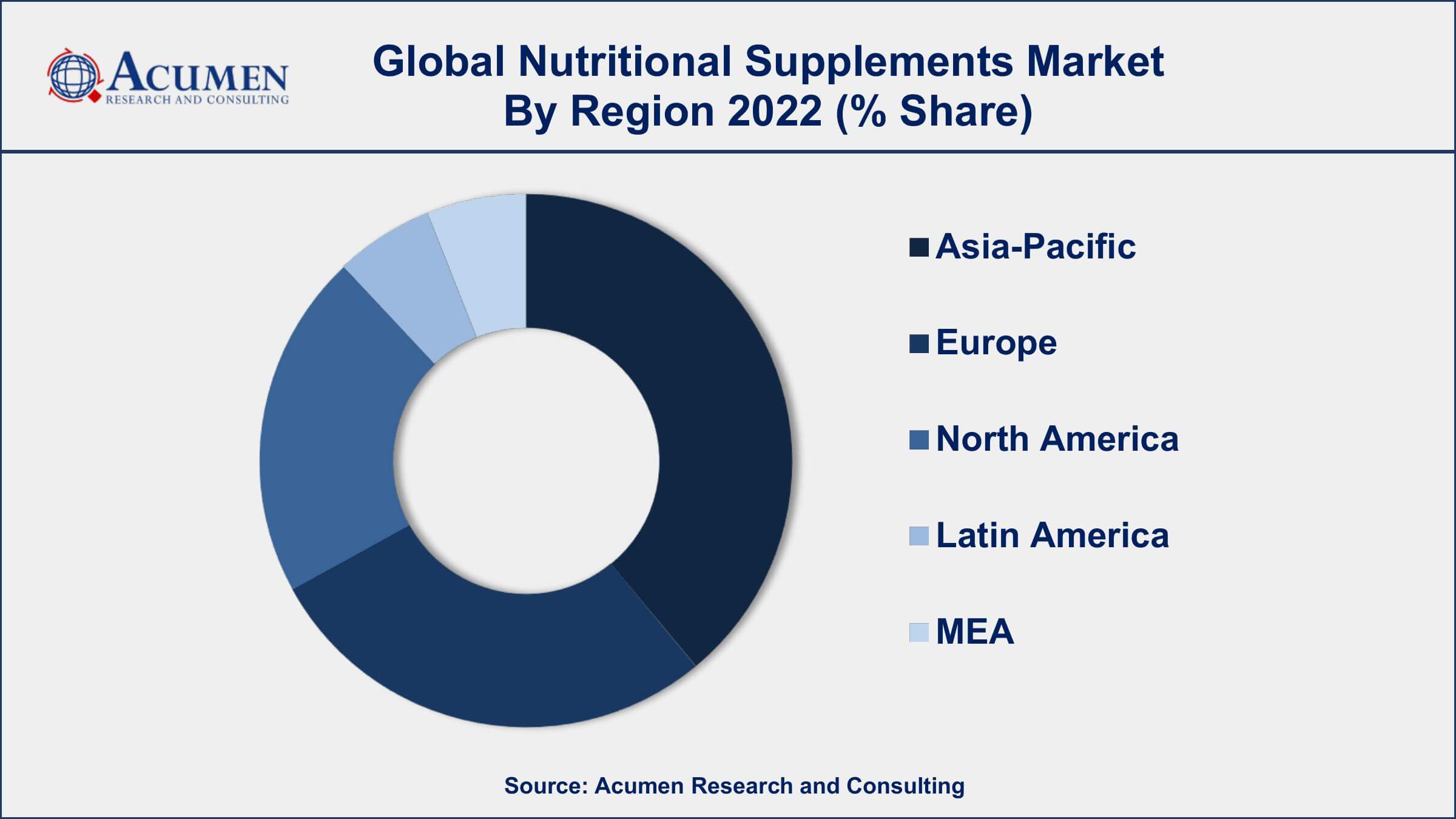

- Asia-Pacific region led with more than 37% of Nutritional Supplements Market share in 2022

- North America Nutritional Supplements Market growth will record a CAGR of around 7.7% from 2023 to 2032

- By product type, the functional food segment has recorded more than 56% of the revenue share in 2022

- By form, the powder segment has accounted more than 36% of the revenue share in 2022

- Increasing health and wellness awareness among consumers, drives the Nutritional Supplements Market value

Nutritional supplements are products designed to provide additional nutrients, such as vitamins, minerals, amino acids, and herbal extracts, to a person's diet. They are typically consumed in the form of pills, capsules, powders, or liquids and are intended to supplement the nutrients individuals obtain from their regular diet. Nutritional supplements can address specific nutrient deficiencies, support overall health and well-being, and even target certain health conditions. They have gained popularity as more people become conscious of their health and seek ways to optimize their nutritional intake.

The nutritional supplements market has experienced substantial growth over the past few years, driven by factors such as increasing health awareness, changing dietary patterns, and a growing aging population. Consumers are increasingly seeking ways to enhance their health and prevent chronic diseases through dietary means. Additionally, factors like hectic lifestyles, environmental stressors, and inadequate nutrient content in modern diets have contributed to the demand for supplements that bridge nutritional gaps. The market has expanded to include a wide range of products, from basic multivitamins to specialized formulations targeted at specific health goals, such as immune support, cognitive function, and sports performance. This growth is also fueled by the ease of access to supplements through various distribution channels, including pharmacies, health stores, online retailers, and even subscription services.

Global Nutritional Supplements Market Trends

Market Drivers

- Increasing health and wellness awareness among consumers

- Changing dietary habits and nutrient-deficient modern diets

- Aging population seeking solutions for age-related health concerns

- Growing demand for personalized and targeted health solutions

Market Restraints

- Regulatory challenges and concerns over product safety and efficacy

- Skepticism regarding the benefits of certain supplements

Market Opportunities

- Expansion of online retail platforms and direct-to-consumer models

- Rising demand for natural and organic supplement options

Nutritional Supplements Market Report Coverage

| Market | Nutritional Supplements Market |

| Nutritional Supplements Market Size 2022 | USD 358.1 Billion |

| Nutritional Supplements Market Forecast 2032 | USD 707.5 Billion |

| Nutritional Supplements Market CAGR During 2023 - 2032 | 7.2% |

| Nutritional Supplements Market Analysis Period | 2020 - 2032 |

| Nutritional Supplements Market Base Year | 2022 |

| Nutritional Supplements Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Form, By Product Type, By Age Group, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amway, Herbalife, Abbott Laboratories, Glanbia, Nature's Bounty (formerly NBTY), Nutraceutical International Corporation, GNC Holdings, NOW Foods, USANA Health Sciences, Bayer AG, Pfizer Inc. (Centrum brand), and Nature's Way |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Nutritional supplements are products designed to complement and enhance the nutrient intake of individuals. They contain a variety of vitamins, minerals, amino acids, herbs, and other bioactive compounds that may not be adequately obtained from regular diets alone. These supplements are available in various forms, including pills, capsules, powders, liquids, and gummies, and are consumed to address specific nutrient deficiencies, support overall health, and promote specific wellness goals.

The applications of nutritional supplements are diverse and cater to a wide range of health needs. One of the primary applications is the prevention and management of nutrient deficiencies. For instance, individuals with limited access to certain foods or those following restrictive diets might use supplements to ensure they are meeting their nutritional requirements. Athletes and active individuals often use supplements to support performance, muscle recovery, and endurance. Additionally, supplements are commonly used to promote specific health outcomes, such as immune system support, joint health, cognitive function, and cardiovascular well-being.

The nutritional supplements market has witnessed robust growth in recent years and shows no signs of slowing down. Fueled by increasing health awareness, changing lifestyles, and a desire for preventive healthcare, the market has expanded significantly. Consumers are actively seeking ways to bridge nutritional gaps and support their overall well-being through supplementation. This trend is further driven by the aging population's interest in maintaining vitality and addressing age-related health concerns. Additionally, the accessibility of supplements through various retail channels, including brick-and-mortar stores and online platforms, has contributed to the market's growth by reaching a wide consumer base. The COVID-19 pandemic has also played a role in shaping the market's trajectory. With a heightened focus on immune health, there has been a surge in demand for supplements like vitamins, minerals, and herbal extracts that are believed to support the immune system.

Nutritional Supplements Market Segmentation

The global Nutritional Supplements Market segmentation is based on form, product type, age group, distribution channel, and geography.

Nutritional Supplements Market By Form

- Powder

- Tablets

- Liquid

- Soft gels

- Capsules

- Others

According to the nutritional supplements industry analysis, the powder segment accounted for the largest market share in 2022. Powdered supplements offer versatility and convenience, allowing consumers to easily mix them into beverages, smoothies, or foods, making them a popular choice among health-conscious individuals. This segment's growth is attributed to several factors, including the rising demand for customizable solutions and the preference for alternative dosage forms beyond traditional pills and capsules. One of the key drivers of the powder segment's growth is the demand for personalized nutrition. Furthermore, the expansion of the fitness and sports nutrition market has also contributed to the growth of powdered supplements.

Nutritional Supplements Market By Product Type

- Sports Nutrition

- Functional Food

- Fat Burner

- Dietary Supplements

- Others

In terms of product types, the functional food segment is expected to witness significant growth in the coming years. Functional foods are products that offer additional health benefits beyond basic nutrition, often containing bioactive compounds such as probiotics, prebiotics, antioxidants, and specific vitamins and minerals. This segment's growth can be attributed to several key factors. Firstly, the shift towards preventive healthcare and holistic wellness has led consumers to seek out foods that not only satisfy their nutritional needs but also provide specific health-enhancing properties. Secondly, advancements in food science and technology have enabled the development of functional foods that deliver these health benefits without compromising taste and convenience.

Nutritional Supplements Market By Age Group

- Kids

- Geriatric

- Adults

According to the nutritional supplements market forecast, the adult segment is expected to witness significant growth in the coming years. This growth driven by factors like aging populations, increasing health awareness, and the desire for proactive health management. As adults become more conscious of the need to maintain their well-being as they age, the demand for nutritional supplements tailored to their specific needs has risen substantially. One key driver is the aging population, which is seeking ways to support longevity and address age-related health concerns. As individuals enter their middle and later years, their nutritional requirements can change, and supplementation becomes a way to fill potential gaps in their diets. Supplements that cater to bone health, joint support, cognitive function, and cardiovascular health are especially sought after by this demographic.

Nutritional Supplements Market By Distribution Channel

- Supermarkets/Hypermarkets

- E-commerce

- Pharmacies

- Specialty Stores

- Others

Based on the distribution channel, the e-commerce segment is expected to continue its growth trajectory in the coming years. The rise of e-commerce has been a pivotal factor in the industry's evolution, driven by several key dynamics. Firstly, the convenience and accessibility offered by online platforms have revolutionized the supplement purchasing experience. Consumers can now browse a wide range of products, compare prices, read reviews, and make informed decisions from the comfort of their homes. This convenience has expanded the market's reach, allowing individuals from remote areas or those with limited access to physical stores to explore and purchase supplements with ease. Secondly, the wealth of information available online empowers consumers to research and educate themselves about different supplements and their potential benefits.

Nutritional Supplements Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Nutritional Supplements Market Regional Analysis

The Asia-Pacific region's dominance in the nutritional supplements market can be attributed to a combination of demographic trends, increasing health awareness, and changing consumer preferences. The region's substantial population, with countries like China and India being among the most populous in the world, provides a vast consumer base for nutritional supplements. As disposable incomes rise and urbanization accelerates, more individuals are becoming health-conscious and seeking ways to enhance their well-being. This demographic shift has created a significant demand for nutritional supplements as people look for convenient solutions to meet their dietary needs. Moreover, traditional practices rooted in herbal medicine and holistic wellness have a strong cultural heritage in many Asian countries. This has laid the foundation for a natural integration of nutritional supplements into daily lifestyles. Consumers in Asia-Pacific often prioritize products that align with their traditional beliefs and values, which has led to a surge in demand for supplements derived from natural and herbal sources.

Nutritional Supplements Market Player

Some of the top nutritional supplements market companies offered in the professional report include Amway, Herbalife, Abbott Laboratories, Glanbia, Nature's Bounty (formerly NBTY), Nutraceutical International Corporation, GNC Holdings, NOW Foods, USANA Health Sciences, Bayer AG, Pfizer Inc. (Centrum brand), and Nature's Way.

Frequently Asked Questions

What was the market size of the global nutritional supplements in 2022?

The market size of nutritional supplements was USD 358.1 Billion in 2022.

What is the CAGR of the global nutritional supplements market from 2023 to 2032?

The CAGR of nutritional supplements is 7.2% during the analysis period of 2023 to 2032.

Which are the key players in the nutritional supplements market?

The key players operating in the global market are including Amway, Herbalife, Abbott Laboratories, Glanbia, Nature's Bounty (formerly NBTY), Nutraceutical International Corporation, GNC Holdings, NOW Foods, USANA Health Sciences, Bayer AG, Pfizer Inc. (Centrum brand), and Nature's Way.

Which region dominated the global nutritional supplements market share?

Asia-Pacific held the dominating position in nutritional supplements industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of nutritional supplements during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global nutritional supplements industry?

The current trends and dynamics in the nutritional supplements industry include increasing health and wellness awareness among consumers, and changing dietary habits and nutrient-deficient modern diets.

Which product type held the maximum share in 2022?

The functional food product type held the maximum share of the nutritional supplements industry.