Industry 5.0 Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Industry 5.0 Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

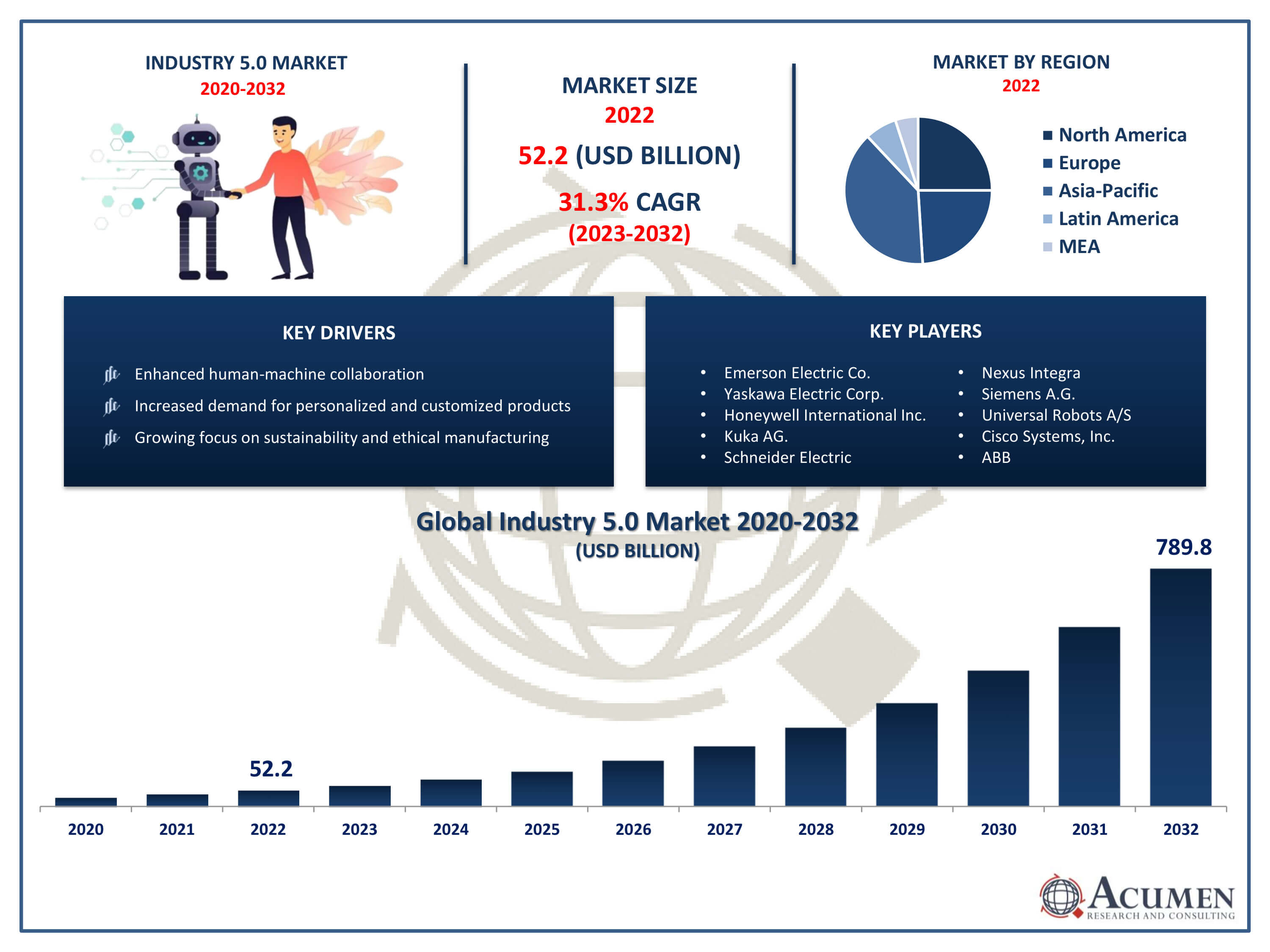

The Industry 5.0 Market Size accounted for USD 52.2 Billion in 2022 and is projected to achieve a market size of USD 789.8 Billion by 2032 growing at a CAGR of 31.3% from 2023 to 2032.

Industry 5.0 Market Highlights

- Global industry 5.0 market revenue is expected to increase by USD 789.8 Billion by 2032, with a 31.3% CAGR from 2023 to 2032

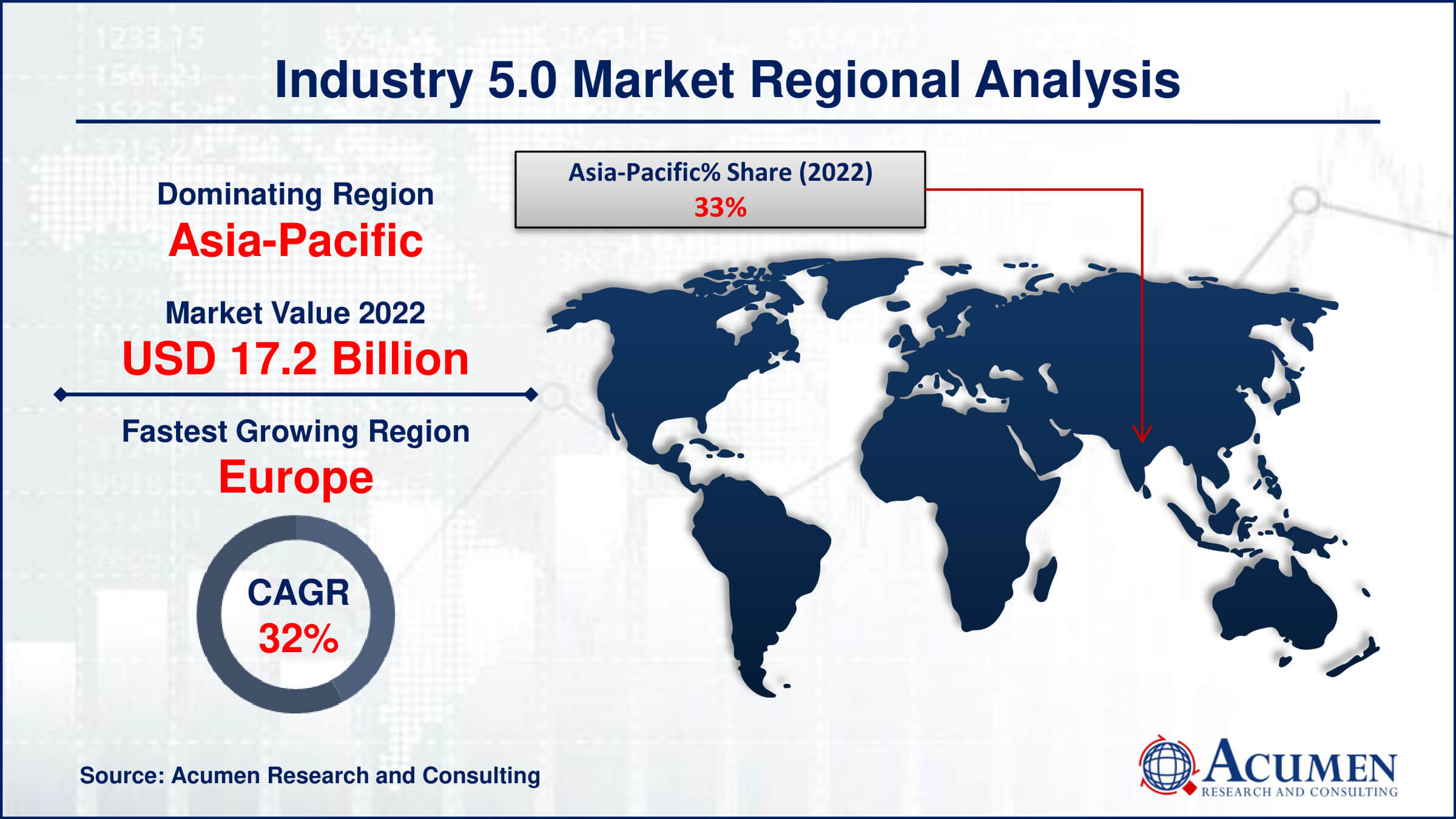

- Asia-Pacific region led with more than 33% of industry 5.0 market share in 2022

- Europe industry 5.0 market growth will record a CAGR of more than 32.4% from 2023 to 2032

- By technology, the digital twin and robots are the largest segment of the market, accounting for over 50% of the global market share

- By industry, the automotive is one of the largest and fastest-growing segments of the industry 5.0 industry

- Growing focus on sustainability and ethical manufacturing, drives the industry 5.0 market value

Industry 5.0 is a conceptual framework that envisions a collaborative relationship between humans and machines in the manufacturing sector. It represents the evolution beyond Industry 4.0, which emphasized automation and digitization. Industry 5.0 focuses on the integration of human skills, creativity, and problem-solving abilities with advanced technologies like artificial intelligence, robotics, and the Internet of Things (IoT). This symbiotic relationship aims to enhance productivity, efficiency, and innovation while ensuring that human workers remain central to the manufacturing process.

The market growth of Industry 5.0 is poised to be significant as industries worldwide increasingly recognize the value of combining human ingenuity with technological advancements. With the rise of smart factories and the adoption of advanced manufacturing techniques, the demand for solutions that facilitate human-machine collaboration is expected to soar. Companies investing in Industry 5.0 technologies can benefit from improved flexibility, customization, and agility in their production processes, leading to better product quality and customer satisfaction. Additionally, as concerns about job displacement due to automation persist, Industry 5.0 presents an opportunity to create new roles that leverage human capabilities alongside machines, potentially leading to more sustainable and inclusive growth.

Global Industry 5.0 Market Trends

Market Drivers

- Enhanced human-machine collaboration

- Increased demand for personalized and customized products

- Growing focus on sustainability and ethical manufacturing

- Advancements in artificial intelligence and robotics

- Emphasis on agility and responsiveness in manufacturing processes

Market Restraints

- Concerns over job displacement and workforce reskilling

- High initial investment costs for implementing Industry 5.0 technologies

Market Opportunities

- Expansion of smart factory concepts and adoption of digital twins

- Development of innovative human-centric automation solutions

Industry 5.0 Market Report Coverage

| Market | Industry 5.0 Market |

| Industry 5.0 Market Size 2022 | USD 52.2 Billion |

| Industry 5.0 Market Forecast 2032 |

USD 789.8 Billion |

| Industry 5.0 Market CAGR During 2023 - 2032 | 31.3% |

| Industry 5.0 Market Analysis Period | 2020 - 2032 |

| Industry 5.0 Market Base Year |

2022 |

| Industry 5.0 Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Emerson Electric Co., Yaskawa Electric Corp., Honeywell International Inc., Kuka AG., Schneider Electric, Nexus Integra, Siemens A.G., Universal Robots A/S, Cisco Systems, Inc., ABB, FANUC CORPORATION, and Rockwell Automation, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Industry 5.0 represents the evolution of industrial manufacturing, emphasizing the harmonious integration of humans and advanced technologies like artificial intelligence, robotics, and automation. Unlike its predecessors, which primarily focused on automating processes and reducing human involvement, Industry 5.0 seeks to leverage human creativity, problem-solving skills, and emotional intelligence alongside technological advancements. This approach aims to create more flexible, responsive, and efficient manufacturing systems that capitalize on the strengths of both humans and machines.

Applications of Industry 5.0 span various sectors, including manufacturing, healthcare, logistics, and beyond. In manufacturing, Industry 5.0 could revolutionize production processes by enabling human workers to collaborate seamlessly with robots and AI systems. This could lead to the creation of highly adaptable factories capable of producing customized products at scale, while also ensuring quality control through human oversight. In healthcare, Industry 5.0 could enhance patient care by integrating advanced medical technologies with human expertise, leading to more personalized treatment plans and improved outcomes. Similarly, in logistics, Industry 5.0 could optimize supply chain management by combining AI-driven predictive analytics with human decision-making to streamline operations and reduce costs. Overall, Industry 5.0 holds the promise of transforming industries across the board by unlocking new levels of efficiency, innovation, and collaboration between humans and machines.

Industry 5.0 Market Segmentation

The global industry 5.0 market segmentation is based on technology, industry, and geography.

Industry 5.0 Market By Technology

- Digital Twin

- AI In Manufacturing

- Industrial 3D Printing

- AR/VR

- Robots

- Industrial Sensors

In terms of technology, the robots and digital twin segment accounted for the largest market share in 2022. Robots are becoming increasingly sophisticated, capable of handling complex tasks and interacting safely with humans in shared workspaces. In Industry 5.0, robots serve as valuable teammates to human workers, augmenting their capabilities and enhancing overall productivity. This collaborative approach enables companies to achieve greater flexibility and efficiency in manufacturing processes, as robots can perform repetitive or physically demanding tasks while humans focus on more strategic activities.

Digital twin technology, on the other hand, facilitates the creation of virtual replicas of physical assets, systems, or processes. These digital twins enable real-time monitoring, simulation, and optimization of industrial operations. In the context of Industry 5.0, digital twins serve as powerful tools for decision-making and problem-solving, providing insights into the performance of both human and machine elements within manufacturing environments. By leveraging digital twins, companies can visualize and analyze the interactions between humans, robots, and other components of their operations, leading to continuous improvement and innovation.

Industry 5.0 Market By Industry

- Automotive

- Medical

- Energy

- Semiconductor & Electronics

- Oil & Gas

- Food & Beverage

- Aerospace

- Chemicals

- Metals & Mining

- Others

According to the Industry 5.0 market forecast, the automotive segment is expected to witness significant growth in the coming years. One of the key drivers of growth in this segment is the integration of human expertise with advanced robotics and automation systems. Automotive manufacturers are increasingly adopting Industry 5.0 principles to optimize production lines, improve product quality, and enhance customization capabilities. By leveraging human creativity and problem-solving skills alongside robotic precision and efficiency, companies can streamline assembly processes and adapt more quickly to changing consumer preferences. Furthermore, Industry 5.0 is enabling the development of smart factories in the automotive sector, where interconnected systems and real-time data analytics drive greater operational efficiency and flexibility. These smart factories leverage technologies such as the Internet of Things (IoT), artificial intelligence (AI), and digital twins to monitor equipment performance, predict maintenance needs, and optimize production schedules. As a result, automotive manufacturers can reduce downtime, minimize waste, and achieve higher overall equipment effectiveness (OEE), leading to improved profitability and competitiveness in the market.

Industry 5.0 Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Industry 5.0 Market Regional Analysis

The Asia-Pacific region is emerging as a dominant force in the Industry 5.0 market due to several key factors. One significant factor is the region's strong manufacturing base, particularly in countries like China, Japan, South Korea, and Taiwan. These countries have long been leaders in industrial production and have been quick to adopt advanced technologies and automation systems. With the rise of Industry 5.0, companies in the Asia-Pacific region are leveraging their manufacturing expertise to integrate human intelligence with cutting-edge technologies, driving innovation and efficiency in production processes. Moreover, the Asia-Pacific region is home to a large and rapidly growing consumer market, which creates significant demand for advanced manufacturing solutions. As consumer preferences evolve and become more personalized, companies in industries such as automotive, electronics, and consumer goods are seeking ways to adapt quickly and efficiently to changing market demands. Industry 5.0 offers the flexibility and agility needed to meet these demands, making it an attractive proposition for businesses operating in the region. Furthermore, governments in the Asia-Pacific region are actively supporting the adoption of Industry 5.0 technologies through various initiatives and policies. These include investment incentives, research and development grants, and the development of supportive regulatory frameworks.

Industry 5.0 Market Player

Some of the top industry 5.0 market companies offered in the professional report include Emerson Electric Co., Yaskawa Electric Corp., Honeywell International Inc., Kuka AG., Schneider Electric, Nexus Integra, Siemens A.G., Universal Robots A/S, Cisco Systems, Inc., ABB, FANUC CORPORATION, and Rockwell Automation, Inc.

Frequently Asked Questions

How big is the industry 5.0 market?

The industry 5.0 market size was USD 52.2 Billion in 2022.

What is the CAGR of the global industry 5.0 market from 2023 to 2032?

The CAGR of industry 5.0 is 31.3% during the analysis period of 2023 to 2032.

Which are the key players in the industry 5.0 market?

The key players operating in the global market are including Emerson Electric Co., Yaskawa Electric Corp., Honeywell International Inc., Kuka AG., Schneider Electric, Nexus Integra, Siemens A.G., Universal Robots A/S, Cisco Systems, Inc., ABB, FANUC CORPORATION, and Rockwell Automation, Inc.

Which region dominated the global industry 5.0 market share?

Asia-Pacific held the dominating position in industry 5.0 industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of industry 5.0 during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global industry 5.0 industry?

The current trends and dynamics in the industry 5.0 market growth include increasing consumer awareness about personal grooming, rising disposable income and urbanization, and advancements in cosmetic technology and formulations.

Which technology held the maximum share in 2022?

The digital twin technology held the maximum share of the industry 5.0 industry.